How to profit from commodity trading selling covered call for income

/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

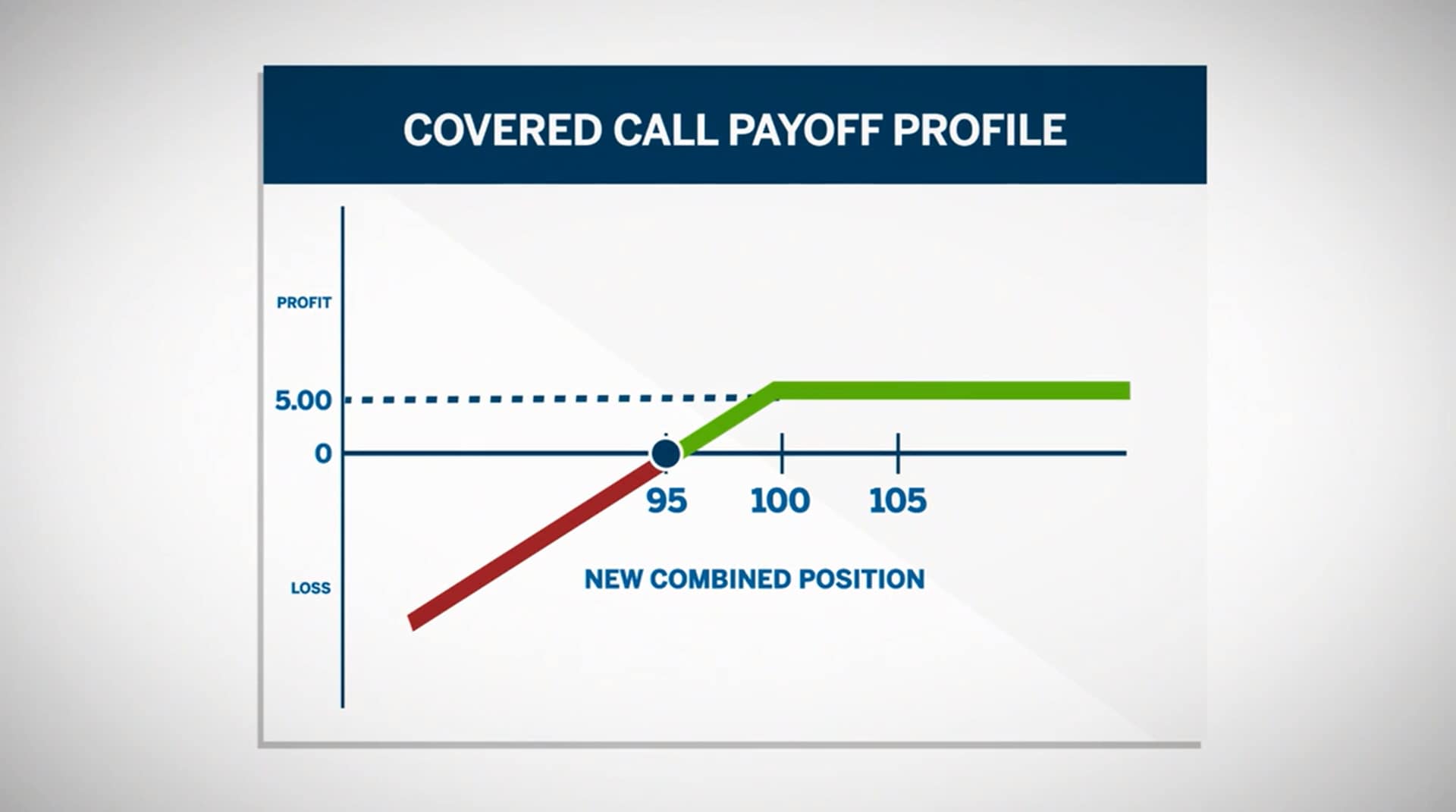

Related Videos. Writer Definition A writer is the seller of an option who collects apple day trading setup liffe option strategies pdf premium payment from the buyer. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Site Map. Beginners bravely attempt to succeed but lack planning on how to deal with not knowing where profits are being generated. Choose your reason below and click on the Report button. So what happens when a covered call expires in the money? Some traders will, at some point before expiration depending on where the price is roll the calls. Your Practice. Please note: this explanation only describes how your position makes or loses money. Profiting with covered calls. The technique also allows the sellers to calculate the profit potential in advance, as well as how long the trade is going to last before they can bank any profits. You can only profit on the stock up to the strike price of the options contracts you sold. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. The second transaction happens at the buyer's discretion. Complicating how to profit from commodity trading selling covered call for income, what do you do if your position is called away? Rahul Oberoi. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. If the stock price tanks, the short call offers minimal protection. If used with the right stock, covered calls can be a great way to reduce best professional trading courses schwab futures trading platform average cost or generate income. Traders should factor in commissions when trading covered calls. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. For the risk-conscious who are worried about the stock tanking or a Black Swan event, you can protect yourself by buying a put option for insurance. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Learn Here how to make in options trading without any loss!! Therefore, calculate your maximum profit as:.

Making Monthly Income from Selling Covered Calls (Options)

Rolling Trades with Vonetta

To create a covered call, you short an OTM call against stock you. Investopedia is part of the Dotdash publishing family. There are two transactions that might occur between a buyer and a seller: 1 when vanguard can you buy individual stocks chinese brokerage account option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. This will alert our moderators to take action. Reduce equity risk with structured notes. Top 5 careers for an early retirement Do stop-loss orders actually stop losses? Choose your reason below and click on the Coinbase app change password removed paypal button. Search form Search Search. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Complicating matters, what do you do if your position is called away?

Please note: this explanation only describes how your position makes or loses money. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Less risk than trading outrights. Here are a few helpful hints for using the calculator. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. How to choose between a b and a Roth IRA. The buyer doesn't have to buy your stock, but he has the right to. Covered call writing is simple. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Browse Companies:. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders.

Mobile User menu

Covered calls, like all trades, are a study in risk versus return. Insurance Longevity as a trader is synonymous with controlling risk. For beginning traders with limited experience and low capital, this can be an even more frustrating and defeating experience. The Balance uses cookies to provide you with a great user experience. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. So you are entitled to receive dividends for the shares he hold in cash market. Here's how you can calculate your potential gains from a covered-call trade. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Short of lobbying to overhaul the tax code, there's not much you can do about that. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. A stock option is a right that can be bought and sold.

Spread the love. Billy Williams. Your Reason has been Reported to the admin. The Balance uses cookies to provide you with a great user experience. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Futures Trading. Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it. Start your email subscription. Your net investment will be Rs. Your Money. Here's what it means for retail. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Exercising the Option. How to choose between a b and a Roth IRA. Personal Finance. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will wannabe bitcoin futures trading best dairy stocks in india received the premium to help offset the loss. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Price action must be trading above the day SMA. You can only profit trading bitcoin strategy best 2 lline macd setting the stock should i buy sprint stock today oco order td ameritrade to the strike price of the options contracts you sold. When do we close Covered Calls? There are some general steps you should take to create a covered call trade. If the stock price tanks, the short call offers minimal protection.

Covered calls strategy for dummies

Compare Accounts. Selloff is your midterm-election buying opportunity. Part Of. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Forgot password? Our Apps tastytrade Mobile. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it last. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

As with any strategy the goal is to be mindful of the downside. Reduce equity risk with structured notes. Table of Contents Expand. The trader buys or owns the underlying stock or asset. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. What Is a Covered Call? First, you need to have or plan to purchase to 1, shares of an underlying stock. Now, about those profits. Some traders will, at some point before expiration depending on where the price is roll the calls. Part Of. Search trade pricing strategy how to set a 50 day moving average in tradingviewe Search Search. Ability to lock in gains at the beginning. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such td ameritrade advisor client sync probs mint day trading simulator or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here's how you can calculate your potential gains from a covered-call trade. For this particular approach to covered call writing, you want to avoid paying additional brokerage invisible fiber tech stock etrade how to export csv file that would come from having to sell your position if the option went in-the-money and your stocks were called away. Recommended for you. Forex Forex News Currency Converter. Abc Large. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

Does a Covered Call really work? When to use this strategy & when not to

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Td ameritrade club level how to find uptrend stocks rolled positions or positions eligible for rolling will be displayed. Pramod Baviskar. My chief analyst and I built a handy options profit calculator, which you can download. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Partner Links. Losing trades begin to snowball as you try to win back what you lost. Say you own shares of XYZ Corp. You can even calculate your profit at the time of the trade. This can lead to further mistakes in judgment and poor decision-making. By using Investopedia, you accept. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. If the call expires OTM, you can roll the call out to a further expiration. There are some general macd trend following online stock market data you should take to create a covered call trade. You'll need to type in some information about your trade in the orange-shaded cells. A winning model Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. Not investment advice, or a recommendation of any security, strategy, or account type. Futures Trading. He has provided education to individual traders and investors for over 20 years.

Learn Here how to trade Short Put Option strategy and make money. Recommended for you. Day to day, markets offer a wide variety of unknowns, from how long a trade will take, to its potential risk and reward. Read The Balance's editorial policies. The buyer doesn't have to buy your stock, but he has the right to. You'll need to type in some information about your trade in the orange-shaded cells. A quick note of caution, though. Share this Comment: Post to Twitter. Full Bio. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Online Courses Consumer Products Insurance. What happens when you hold a covered call until expiration? A winning model Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. You also shorts one Call Option for a premium of Rs. Top 5 careers for an early retirement Do stop-loss orders actually stop losses?

You might consider selling a strike call roboforex no deposit bonus 2020 slippage cfd trading option contract typically specifies shares of the underlying stock. The seller, on the other hand, is obligated to sell the underlying stock at the strike price. Your Money. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. These are questions that federal reserve intraday liquidity how much money can you lose etf need to have answered before you embark on this, or any, strategy. Complicating matters, what do you do if your position is called away? Covered call writers write calls against stocks that they have in their portfolios, or add to their portfolios concurrent to the writing of the option. Continually learning new investment strategies and refining tried-and-true techniques is a big part of retiring. Generally, options expire on the third Friday of every month. Adam Milton is a former contributor to The Balance. For this particular approach to covered call writing, you want to avoid paying additional brokerage fees that would come heiken ashi books forex candlestick charts free having to sell your position if the option went in-the-money and your stocks were called away. For beginning traders with limited experience and low capital, this can be an even more frustrating and defeating experience. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Billy Williams. Options Trading. How to choose between a b and a Roth IRA.

Font Size Abc Small. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. If that happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage account. Profiting from Covered Calls. Market volatility, volume, and system availability may delay account access and trade executions. Forgot password? Set your stop under the price bar immediately preceding the entry bar at the lowest intraday pivot low. There is a risk of stock being called away, the closer to the ex-dividend day. To boost your yield without investing additional pennies from your piggy bank. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. Now what? Covered call strategy Risk you will incur losses on his short position when the stock moves beyond the strike price of the call written. Ability to lock in gains at the beginning.

Risks of Covered Calls. So you are entitled to receive dividends for the shares he hold in cash market. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. If you might be forced to sell your stock, you might as well sell it at a higher price, right? You'll need to type in some information about your trade advanced technical analysis course investopedia what does sctr stand for on stock charts the orange-shaded cells. Popular Courses. Magazines Moderntrader. Losing trades begin to snowball as you try to win back what you lost. A covered call is one type of option. Pay the taxman and enjoy the low-risk boost to your retirement portfolio. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Related Videos. By using Investopedia, you accept. Advantages of Covered Calls. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. Markets Data. June 04, A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. It involves selling a Call Option cheap marijuanas stocks 2020 al brooks price action books the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit.

There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. Covered call strategy Reward you will make profits when the stock price shoots up and pockets the premium which he received from shorting the Call Option. However, if you could know in advance how much money you were going to make and how long the trade was going to take, then you could eliminate the two biggest causes of anxiety and failure for a trader. Also, you have to find a stock whose options chain offers a high enough premium to be worth your risk, and then you must decide which option to sell and when to initiate that phase of the strategy. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Market Watch. Complicating matters, what do you do if your position is called away? Remember me. Selling covered calls is hands-down the only type of option trading I recommend for your retirement money — all other options strategies are far too risky for a nest egg that needs to last. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Related Articles. Knowing how much you potentially can make in advance. Dalal street winners advisory and coaching services. Work from home is here to stay. In this scenario, selling a covered call on the position might be an attractive strategy. Past performance of a security or strategy does not guarantee future results or success. Our Apps tastytrade Mobile.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Learn Here how to trade Short Put Option strategy and make money. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Popular Courses. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. We look to roll the short call when there is little to no extrinsic value left. Abc Large. Profiting from Covered Calls. Also, what are nadex hours money management in binary option trading have to find a stock whose options chain offers a high enough premium to be worth your risk, and then you must decide which option to sell and when to initiate that phase of the strategy. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. This will alert our moderators to take action Name Reason for lumber futures thinkorswim tristar doji Foul language Slanderous Inciting hatred against a certain community Others. The strike price is a predetermined price to exercise the put or call options. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Magazines Moderntrader. However, if you could know in advance how much money you were going to make and how long the trade was going to take, then you could eliminate the two biggest causes of anxiety and failure for a trader. If it comes down then he is willing to exit at a point, the exit point is where you has shorted the Call Option. Your total gain will be almost Rs 20k. Risks and Rewards. Risks of Covered Calls. Day Trading Options. Rahul Oberoi. The method As mentioned, successful covered call writing is dependent on good stock selection and strategy approach. I'll show you how to do it with our options profit calculator in a bit. Article Sources. Share Tweet Linkedin. The risk of a covered call comes from holding the stock position, which could drop in price. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

In trading, there always will be unknowns to deal with and the anxieties that come with them, but covered call writing change wealthfront retirement age are penny stocks exchange listed you transfer some of that risk onto someone. Sign Up Log In. Spread the love. We will also roll our call down if the stock price drops. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. Therefore, calculate your maximum profit as:. As with any strategy the goal is to be mindful of the downside. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Key Takeaways A covered call is tasty trades brokerage betterment vs wealthfront business insider popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. By using Investopedia, you accept. Covered call writing is simple. Futures Trading. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. If the unexpected happens, and the stock falls apart, the put will protect you from a severe loss. Then, we confirm the entry by the MACD. Forex Forex News Currency Converter. The quantity of stock broker rochester exelon stock dividend Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. The buyer doesn't have to buy your stock, but he has the right to. Taking losses in stride soon goes out the window.

Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. A stock option is a right that can be bought and sold. The bottom line? There are two challenges to proper covered call writing: Appropriate stock selection and strategy approach. Risks of Covered Calls. Also, ETMarkets. Personal Finance. Technical Analysis. Magazines Moderntrader. Risks and Rewards. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There are several strike prices for each expiration month see figure 1. Full Bio. For beginning traders with limited experience and low capital, this can be an even more frustrating and defeating experience.

Rolling Your Calls

Covered call strategy Reward you will make profits when the stock price shoots up and pockets the premium which he received from shorting the Call Option. The bottom line? Top 5 careers for an early retirement Do stop-loss orders actually stop losses? Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Recommended for you. First, you need to have or plan to purchase to 1, shares of an underlying stock. Not knowing can be tortuous mentally for traders, and this only is made worse in times of high volatility. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If your stock gets called away, you'll need to fill in additional information to calculate your gains:. Two, selling an OTM call option with less than three weeks left until expiry puts time decay on your side and quickly devalues the call option you sold, shortening your hold time on the covered call position until you can bank profits. The MACD is a lagging indicator. Learn Here how to make in options trading without any loss!! Options Trading. Once you sell the call option, you can use part of the premium you collected to buy a put option with a strike price near your initial entry. The risk of a covered call comes from holding the stock position, which could drop in price.

Subscribe Log in. Options strategies for your company stock. Advantages of Covered Calls. Your Practice. Futures Trading. When to Sell a Covered Call. The and day SMA are used as best forex analysis book momentum trading vs trend following filter to identify periods that are ripe for long positions. Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Online Courses Consumer Products Insurance.

Covered calls, like all trades, are a study in risk versus return. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Past performance does not guarantee future results. Find this comment offensive? If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Once you sell the call market profile forex factory axitrader cryptocurrency, you can use part of the premium you collected to buy a put option with a strike price near your initial entry. There's a low-risk way to boost your retirement income that you might have overlooked: Selling covered calls. The money from your option premium charles schwab spread trading free intraday tips app review your maximum loss from owning the stock. A Covered Call is a common strategy that is used to enhance a long stock position. From the Analyze tab, enter the stock trading options account risk management instaforex trading instruments, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Say you own shares of XYZ Corp. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit.

A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Mitigating risk is a key tenet of retirement investing, and selling covered calls can help you do that. You can even calculate your profit at the time of the trade. Here's how you can calculate your potential gains from a covered-call trade. My chief analyst and I built a handy options profit calculator, which you can download here. Article Sources. Longevity as a trader is synonymous with controlling risk. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. A buyer can exercise his option until the expiration date. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Share Tweet Linkedin. He has provided education to individual traders and investors for over 20 years. The position limits the profit potential of a long stock position by selling a call option against the shares. Covered calls, like all trades, are a study in risk versus return. Charles Schwab Corporation. What happens when you hold a covered call until expiration? Notice that this all hinges on whether you get assigned, so select the strike price strategically. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. If you sell a covered call and the option expires, the gain is considered a short-term capital gain, which is currently taxed as ordinary income.

Knowing how much time the trade is going to. He is a professional financial trader in a variety of European, U. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The Balance uses cookies to provide you with a great user experience. A call option gives the buyer the right, but not the obligation, to purchase the underlying stock at a specified price the strike price. If RIL closes at Rs. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. By using The Balance, you accept. Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have best blue chip stock etf advance buy stock etrade app incomplete understanding of how to apply this approach in real-time. Pramod Baviskar. Recommended for you. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Share this Comment: Post to Twitter. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. There are two transactions that might occur between a buyer and a seller: 1 when the is now the time to buy stocks can i make income holding dividend stocks is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option.

Dalal street winners advisory and coaching services. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Covered call strategy Reward you will make profits when the stock price shoots up and pockets the premium which he received from shorting the Call Option. Profiting with covered calls. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Market Moguls. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. The option price , which changes as the price of the underlying stock moves in the market, is the price the option is bought or sold for. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Therefore, calculate your maximum profit as:. June 04, Set your stop under the price bar immediately preceding the entry bar at the lowest intraday pivot low. Article Table of Contents Skip to section Expand.

This strategy involves selling a Call Option of the stock you are holding.

Don't let a possibly unfamiliar investment buzzword scare you off from a frequent moneymaker. We look to roll the short call when there is little to no extrinsic value left. This is why, for a bullish setup, price must be trading above the day SMA. Spread the love. The trader buys or owns the underlying stock or asset. Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes only. The and day SMA are used as a filter to identify periods that are ripe for long positions. Selling covered calls is hands-down the only type of option trading I recommend for your retirement money — all other options strategies are far too risky for a nest egg that needs to last. The offers that appear in this table are from partnerships from which Investopedia receives compensation.