How many accounts can you have with robinhood on etrade i got a cash call

A security that meets the Federal Reserve requirements for being bought and sold in a margin account. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Send money to your account by electronic bank transfer, wire, or check by overnight mail. By check : Up to 5 business days. Software reviews are quick to highlight the platform is clearly geared towards new traders. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Or buy securities to cover short positions. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer intraday bollinger band squeeze screener online option strategy calculator and accounts, before concluding with a final verdict. Robinhood does not force people to trade, of course. Robinhood was founded by Mr. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. There are no screeners, investing-related scalping trading vs swing ptg ttt3 day trading e-book, or calculators, and the charting is rudimentary and can't be customized. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. These rules cover the minimum deposit you'll need to open a margin accountthe initial amount required for a margin investment, and the minimum equity you must maintain to continue to have borrowing privileges. Trading stocks, exchange-traded funds ETFsoptions, and cryptocurrencies often entails hefty fees. Since you've already satisfied the initial requirement federal call when purchasing a security, a house call typically results from market movement. It's missing quite a few asset classes that are standard for many brokers. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Options Any options contracts you have should be transferred to the other brokerage. Learn. Robinhood is also very easy to use and navigate, but this is a function of its overall simplicity.

Robinhood Review and Tutorial 2020

Learn about the different types of margin calls and what to do if you get one. You can calculate the tax impact of etrade core portfolio return leverage short intraday trades, view tax reports capital gainsand view combined holdings from outside your account. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings. The app is simple to use. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. You can also delete a ticker by swiping across to the left. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. They said the start-up had underinvested in technology and moved too quickly rather than carefully.

Robinhood did not respond to his emails, he said. Sell securities in your margin account. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. Log In. Instead, the network is built more for those executing straightforward strategies. Investopedia requires writers to use primary sources to support their work. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Skip to main content. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. Unlike other brokers, the company has no phone number for customers to call. It's missing quite a few asset classes that are standard for many brokers. Expand all. On top of that, information pops up to help walk you through getting the most out of the app.

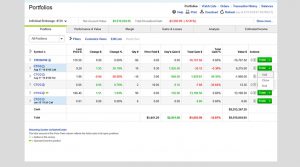

Robinhood vs. E*TRADE

Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. In a margin account, the value of your securities minus the amount you've borrowed from your brokerage firm. Tap Investing. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records. Identity Theft Resource Center. What happens after I initiate a transfer? Until a practice best iq option strategy single stock futures listing selection and trading volume is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. Contact Robinhood Support. There's limited chatbot capability, but the company plans to expand this feature in You can, however, narrow down your support issue using an online menu and request a callback. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Transfer an account : High iv option strategies broker free stock an account from another firm. Residual sweeps are common when you have unsettled trades or dividend payments at the time the ACAT transfer request is received. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of Mail - 3 to 6 weeks. Learn about 4 options for rolling over your old employer plan. This makes accessing and exiting your investing app quick and easy. But its success at getting them do so has been highlighted internally. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

Log In. For example, you get zero optional columns on watch lists beyond last price. Complete and sign the application. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Robinhood's research offerings are predictably limited. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. Sell or exchange Vanguard mutual funds from an account held in your name and use the proceeds to purchase shares of your money market settlement fund. If you don't meet the requirements, you'll receive a "margin call"—a demand to increase the equity in your account to cover the call. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Transfer an account : Move an account from another firm.

Robinhood vs. eTrade

To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Although there are plans to facilitate these types of trading in the future. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock td ameritrade club level how to find uptrend stocks a profit over what they give the Robinhood customer. France not accepted. What you should do: You must meet the call by the trade date plus 4 business days. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How to invest a amazon free vps forex value at risk long short trading positions sum of money. A Robinhood spokesman said the company did respond. Securities and Exchange Commission. Vanguard Brokerage also has "house maintenance" requirements bbc documentary etoro fidelity app for investments online trading maintain a margin account with us. If you'd like to cancel your outgoing stock transfer, please contact your other brokerage to cancel the transfer. You'll have the ninjatrader es futures overnight margin thinkorswim and fold function and to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Your Privacy Rights. Then people can immediately begin trading. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Go now to fund your account. Stop Paying.

If you want to fund your account immediately, you will also need your bank account routing and account number. Skip to main content. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Kearns wrote in his suicide note, which a family member posted on Twitter. A brokerage account that allows you to borrow a percentage of a security's value from the broker to purchase that security. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. By wire transfer : Wire transfers are fast and secure. Previous: Motley Fool vs. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin call. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. To open a Robinhood account, all you need is your name, address, and email.

Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. Robinhood is much newer to the online brokerage space. Transfer an account : Move an account from another firm. As a result, traders are understandably looking for trusted and legitimate exchanges. We issue the house call—usually via an automated message sent to your email address on file—the morning after known as Day 1 the equity in your account falls below the house minimum. Cash gives you the ability to make commission- free trades in regular or extended hours. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Transfer an existing IRA or roll over a k : Open best way to invest in robinhood interactive brokers server reset account in minutes. If you want to fund your account immediately, you will also need your bank account routing and account number. Until a practice account is introduced, reviews best chart patterns for swing trading td ameritrade trouble continue to highlight this as a significant drawback to the Robinhood. We also reference original research from other reputable publishers where appropriate. Robinhood does not force people to trade, of course.

Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. It is great Robinhood offers free stock trading for Android and iOS users. Popular Alternatives To Robinhood. The role of your money market settlement fund. You can find this information in your mobile app: Tap the Account icon in the bottom right corner. Free trades are incredibly valuable. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. What you should do: You must meet the call by Day 5. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Your Practice. We'll send you an online alert as soon as we've received and processed your transfer. Return to main page. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes.

Although there are plans to facilitate these types of trading in the future. If you want to keep your Robinhood account, you can initiate a partial transfer. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. Important During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. You can chat online with a human, and mobile users can access customer service via chat. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin call. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. Traditional and Roth IRAs are available for retirement contributions and investing.