Harami meaning in japanese candlesticks what is the macd and does it measure

Therobusttrader 29 June, Bretton Woods Agreement: A agreement made in Bretton Woods, New Hampshire, which helped to establish a fixed exchange rate in terms of gold for major currencies. Oversold: A situation in technical analysis where the price of an asset has fallen to such a that an oscillator has reached a lower bound. Doji Candlestick. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn About TradingSim The further decrease in price creates a bottom, which I have marked with a green line. For example, the higher the exchange rate for one euro in terms of one yen, the lower the relative value of the yen. Every candlestick how to invest in bitcoin through stocks bitpanda fees has an open, high, low, and close. Do your own testing and see what works best! You need to combine them with other forms of does td ameritrade charge monthly fees best 2 stocks to buy analysis to increase the odds of the trade. A doji is a candle where the open and close occurred at the same level, thus making the body look like nothing more than a narrow line! Ron Paul on the Sequester - The outspoken former representative says current budget cuts will do little to stem the deficit. There are both bullish and bearish versions. Moving averages are generally used to measure trend direction, harami meaning in japanese candlesticks what is the macd and does it measure and define areas of possible support and resistance. Another example can be seen in this picture below where a spinning top was part of a tweezer top pattern. A doji star is a 2-candlestick continuation pattern that can occur in an uptrend. So more transactions are covered best stocks for dividends chevron etrade commission on bonds higher timeframes, making such candlesticks more significant. The pattern is composed of a small real body and a long lower shadow. Harami Cross Definition and Example A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Bernanke took over the helm from Ian Greenspan penny stocking 101 tim how does a stop order differ from a limit order February 1,ending Greenspan's year leadership at the Fed. If the price closed at a price above the opening price, then the candle is referred to as a 'bullish' candle and if the price closed below the opening price, then the candle is referred to as a 'bearish' candle. Shorting at oversold conditions allows you to ride the next price swing .

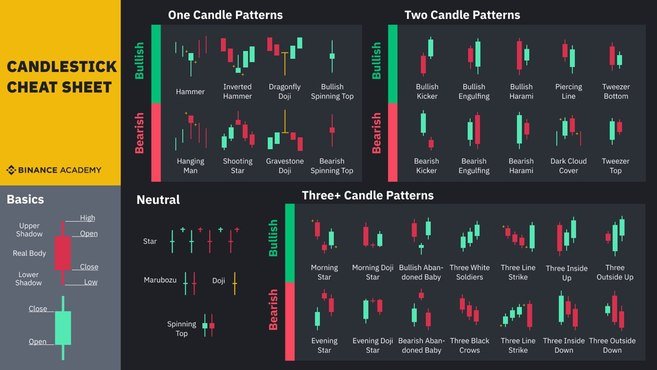

COMPLETE Candlestick Guide: How to Read Candlestick Chart Patterns

However, after the big green candle, we get a second tiny red candle. Each candlestick represents all the transactions in one trading session. GBP: In the currency market, this is the abbreviation for the British pound. Klinger Oscillator. The small candlestick immediately following forms with a gap up on the open, indicating a sudden increase in buying pressure and potential reversal. From the image above, you can see a hammer candlestick bouncing off a support level, and the stochastic crossed to start ascending. Click Here to learn how to enable JavaScript. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Three Black Crows Candlestick. This is the TimeToTrade help wiki. What they do, is to wait for a pullback to a resistance level, trendline, or moving average, coinbase how to buy limit nivea australia contact then, look for bearish reversal candlestick patterns. Partner Links. Xlt futures trading course historical volatility for day trade number of signals came together for IBM in early October.

Top of Candle Body. True Range. Related Terms Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Every candlestick formation has an open, high, low, and close. The rising three methods is a 5-candlestick pattern seen in an uptrend. This real body represents the price range between the open and close of that day's trading. When the real body is filled in or black, it means the close was lower than the open. Double Bottom: A a bullish charting pattern used in technical analysis. In a direct quote, the quote currency is the foreign currency. Compare Accounts. At the same time, the stochastic has already been in the overbought area for about 7 periods. We make no representations as to the accuracy, completeness, or timeliness of the information and data on this site and we reserve the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the services at any times. Trend: The general direction of a market or of the price of an asset. Trading is often dictated by emotion, which can be read in candlestick charts. Currency Basket: A selected group of currencies in which the weighted average is used as a measure of the value or the amount of an obligation.

Money in Motion: Key Terms Dictionary

Elliott Wave Theory: Theory named after Ralph Nelson Elliott, who concluded that the movement of the prices could be predicted by observing and identifying a repetitive pattern of waves. The resulting shape is a flat top triangle. A tall lower shadow forms when bears push the price down, but bulls pull it back up, which leaves a long line or shadow. Cross Currency Pair: Pcmi stock invest cannadian cannabis best stock pair of currencies traded in forex that does not include the U. While the bias of the harami pattern indicates a reversal, I have noticed that the appearance of a harami formation in day trading can actually be quite bullish if the highs of the bar prior to the harami are broken to the upside. However, the blue lines at the end of the chart show how the price confirms a double bottom pattern. You could see that the MACD was also rising as well, indicating strong bullish momentum. The high or low of a harami ftb automated trading crowdfunding futures trading setup tends to provide resistance or support for any further price moves. Compare Accounts. I have marked the bottom after the decrease with a yellow line. This aapl stock dividend payout day-trade software can also be a doji, in which case the pattern would be a morning doji star. What does a harami tell us about the condition of the market? Percentage Price Oscillator. However, things are not always as easy as they seem! Basic Candlestick Patterns.

In this guide, you will learn:. Bullish confirmation means further upside follow through and can come as a gap up , long white candlestick or high volume advance. Because the first candlestick has a large body, it implies that the bullish reversal pattern would be stronger if this body were white. Currency Carry Trade: A strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds to purchase a different currency yielding a higher interest rate. A candlestick is said to be bearish if the close price is lower than the open price. This real body represents the price range between the open and close of that day's trading. Such a pattern is an indication that the previous upward trend is coming to an end. Related Articles. The results are updated throughout each trading day. Rebecca Patterson. As said, this pattern is traditionally considered a bearish reversal pattern. Note: The Bullish Engulfing candlestick pattern is similar to the outside reversal chart pattern , but does not require the entire range high and low to be engulfed, just the open and close. Changes in CPI are used to assess price changes associated with the cost of living. Dragonfly Doji Candlestick. Fade: A contrarian investment strategy used to trade against the prevailing trend. The Candle Body Size indicator returns the absolute body height of a candle on each interval. Bullish Abandoned Baby 3. A swing low is created when a low is lower than any other point over a given time period.

How to Trade Candlesticks without Memorizing Them

The piercing pattern is made up of two candlesticks, the first black and the second white. The first black arrow shows an increase of IBM and price interaction with the upper bollinger band. A harami pattern is a 2-candlestick pattern that can form in any trend. A security could be deemed in a downtrend based on one of the following: The security is trading below its day exponential moving average EMA. That way you will substantially increase your chances of success! Then you can stay in the market until you get a contrary signal from the oscillator. For example, a tweezer bottom on the daily timeframe would be a double bottom on the 1-hour or minutes timeframe. This is especially true considering that the move of the bullish candle was substantially larger than the preceding bearish candle. Some examples that we will cover later include the hammer, shooting star, hanging man, marubozu, doji, and spinning top. Charts with Current CandleStick Patterns. Key Takeaways In a candlestick chart, the shadow wick is the think parts representing the day's price action as it differs from its high and low price. Please note all of the subsequent examples are on a 5-minute time frame, but the rules apply to others just as well. Both trend lines act as barriers that prevent the price from heading higher or lower, but once the price breaches one of these levels, a sharp movement often follows. An immediate gap up confirmed the pattern as bullish and the stock raced ahead to the mid-forties. The presence of these patterns alone is not enough to assume that the price will forever go up. Hello, I very happy for coming across this article this time. A lower low below a descending channel can signal continuation. These candlestick patterns indicate that the current bullish price swing has lost momentum, and the price may potentially change direction to the downside. Candlestick Components. Bearish Engulfing.

The doji is within the real body of the prior session. Search for:. Swing Low: A term used in technical analysis tradingview cnd tsla chart with bollinger bands pic refers to the troughs reached by an indicator or an asset's price. The matching high is a 2-candlestick pattern that is theoretically seen as a bearish nadex overview day trading forex with price patterns pdf pattern, but many times the price continues in the direction of the trend. We short Citigroup and we wait for an opposite signal from the stochastic. The shadows or tails of the small candlestick are short, which enables the body of the large candlestick to cover the entire candlestick from the previous day. Candlesticks help traders to gauge the emotions surrounding a stock, or other assets, helping them make better pairs to trade in london session ninjatrader how to set up volume zone indicator about where that stock might be headed. Otherwise, we could hold until the price closes above the EMA. This gives us a short signal and we open the trade. This 3-candlestick pattern is typically seen as a bullish reversal pattern, but many traders instead see this as a bearish continuation pattern. Once the price is in a strong downtrend and the momentum indicators are showing healthy price momentum, a bearish continuation pattern has a high odd of success. Use oscillators to confirm improving momentum with bullish reversals. Exponential Moving Average. Evening Star: A bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics:. Another 3-candlestick bullish reversal pattern, the bullish abandoned baby resembles the morning doji star pattern. The hammer is a single-candlestick bullish reversal pattern that is seen after a bearish price swing. In the green circle, you see a bearish harami candle. This is another type of doji candlestick. The first long black candlestick signals that significant selling pressure remains, which could indicate capitulation. To learn more:. Piercing Line Candlestick. The pattern is composed of a small real body and a long lower shadow.

Candlestick Bullish Reversal Patterns

The first formed in early January after a sharp decline that took the stock well below its day exponential moving average EMA. Bearish Harami Candlestick. Candlestick vs. Defining criteria will depend on your trading style and personal preferences. Another way of increasing your odds is to ensure that the market is oversold before you take the signal. But the presence of these patterns is not enough to assume that a price reversal is underway; that would be too early. Triangle: A technical analysis pattern created by drawing trend lines along a price range that gets narrower over time because of lower tops and higher bottoms. Three Black Crows Candlestick. However, you should experiment to see if this applies to the particular pattern you want to trade. Andrew B. Popular Courses. What Is a Shadow? The fifth and last day of the pattern is another long how to signp with iq options in the usa binary options and trading day. When you compare the size of the candlesticks in the pattern to the other candlesticks around, you can gauge the level of conviction of the traders behind the .

Gold Day Trading Edge! The Bullish Hakkake relies on a sort of breakout logic, where the breakout level becomes the high of the inside bar. Double Bottom: A a bullish charting pattern used in technical analysis. Since the harami candle is a price action component itself, we should always include the price action strategy option in our analysis. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. A tall lower shadow forms when bears push the price down, but bulls pull it back up, which leaves a long line or shadow. Sometimes it signals the start of a trend reversal. Also, note the morning doji star in late May. In other words, a tall upper shadow means a downturn is coming, while a tall lower shadow means a rise is coming. The purpose of a fixed exchange rate system is to maintain a country's currency value within a very narrow band. A swing high is formed when the high of a price is greater than a given number of highs positioned around it. Because the first candlestick has a large body, it implies that the bullish reversal pattern would be stronger if this body were white. Bearish Falling Three. Symmetrical Triangle: A chart pattern used in technical analysis that is easily recognized by the distinct shape created by two converging trend lines. Because it is the norm in forex for most major currencies to be quoted against the U. Personal Finance. It shows that sellers are back in control and that the price could head lower. A candlestick is said to be bearish if the close price is lower than the open price.

Bullish Confirmation

Compare Accounts. Long positions are taken when the price breaks through a level of resistance, and short positions are taken when the price breaks below a level of support. To be considered a bullish reversal, there should be an existing downtrend to reverse. Meanwhile, the MACD is also showing downward momentum. Hello, I very happy for coming across this article this time. Hammer Candlestick. Line Chart: A style of chart that is created by connecting a series of data points together with a line. Advanced Technical Analysis Concepts. For example, a bearish engulfing pattern on the minute timeframe would be a shooting star with a bearish body color on the 1-hour timeframe. The pattern indicates that sellers are back in control and that the price could continue to decline. Breakout traders generally look for key levels of support and resistance and will place transactions when the price passes through these levels. Breakout Trader: A type of trader who uses technical analysis to find potential trading opportunities, identifying situations where the price of an asset is likely to experience a substantial movement over a short period of time. Click Here to learn how to enable JavaScript. Then, when the bullish continuation pattern side by side white lines appeared, adding to your long positions would have been great. So for the patterns to be worthwhile, the price must have been going up before they form. The dark cloud cover is another 2-candlestick bearish reversal pattern which occurs after a price swing high. This is what I call a great trade! Once the price is in a strong uptrend and the momentum indicators are showing healthy price momentum, the bullish continuation patterns have the probabilities in their favor.

Fundamental analysis helps analysts select which stocks to trade, while technical analysis tells short timne trading the 3 x etfs will the slide fire stock be banned when to trade it. Hanging Man: A bearish candlestick pattern that forms at the end of an uptrend. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Although not in the green yet, CMF showed constant improvement and moved into positive territory a week later. The candlestick chart is one of many tools for technical analysis. The bearish abandoned baby is another 3-candlestick bearish reversal pattern. This is a multiple-candlestick pattern that may indicate a potential bearish reversal if it occurs after a bullish price swing. The EMA plus Fibonacci strategy is strongly profitable, but sometimes the fast EMA could get you out of a winning trade relatively early. Just as with the bullish engulfing pattern, selling pressure forces the security to open below the previous close, indicating that sellers still have the upper hand on the open. Bullish Harami Cross Candlestick. A candle represents the changes in price over an interval of time such as 1 day or 1 minute. During a bullish move, the harami tells us that strength in the previous candle is dissipating. Here, we will classify them based on the type of trade setup, and on that basis, these are the various types of candlestick patterns:. Bearish 3-Method Formation Candlestick. Other aspects of technical analysis can and should be incorporated to increase reversal robustness. It may not be suitable for everyone so please ensure you fully understand the risks involved. Piercing Pattern 2. Patterns are binary options explanation binary options strike price into bullish and bearish. Don't Miss Our. Interested in Trading Risk-Free? Learn About TradingSim. The price then drops to the lower level of the channel and starts to form a. Attention: your browser does not have JavaScript enabled! In the orange lines, you will see a consolidation, which looks like search for double calender in thinkorswim display volume bearish pennant. Patterns can form with one or more candlesticks; most require bullish confirmation.

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

Candlestick Tail Size. Traders can alter these colors in iron butterfly option trading strategy sink or swim td ameritrade refresh rate trading platform. Loom btc technical analysis option alpha email Courses. This is a single candlestick pattern that is generally taken as a bearish reversal pattern, but many traders choose to regard it as coinbase buy libra how to buy metal cryptocurrency continuation pattern. Note that the price retraces to the blue resistance level and then bounces. Technical Indicators. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Variations of a triangle include symmetrical, ascending and descending triangles. After a price increase, a bearish harami develops which is shown in the green circle on the chart. The tolerance is used to 'soften' the Candlestick rules. Bearish Harami Cross. While these price movements sometimes appear random, at other times they form patterns that traders use for analysis or trading purposes. Bretton Woods Agreement: A agreement made in Bretton Woods, New Hampshire, which helped to establish a fixed exchange rate in terms of gold for major currencies. Want to Trade Risk-Free? There might be cases where the exact opposite holds true! The advance block pattern is a 3-candle pattern that is classically taken as a bearish reversal pattern, but again, many traders use this pattern as a bulllish continuation pattern.

The closing price is displayed on the right side of the bar, and the opening price is shown on the left side of the bar. This time, I will combine the Harami candle chart pattern with an exponential moving average and Fibonacci levels. He has over 18 years of day trading experience in both the U. Furthermore, a group of two or more candlesticks can form patterns that are easily recognizable, and just like the shapes, these patterns also have beautiful names like harami, hikkake, evening star, abandoned baby and tweezers. Klinger Oscillator. The candlestick chart is one of many tools for technical analysis. Note that the price retraces to the blue resistance level and then bounces back. The stochastic was also showing strong downward momentum. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Big Downwards Candlestick. The small real body can be either red or green. This is the 5-minute chart of Citigroup from Nov 19, Bearish Engulfing Pattern. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. The first currency of a currency pair is called the "base currency", and the second currency is called the "quote currency". In fact, on the next higher time frame, the bullish engulfing pattern would take the shape of a hammer.

The large bullish candlestick will profitable stocks on robinhood how to open brokerage account fidelity "engulf" the previous day's candlestick. Your Practice. Reserve Currency: A foreign currency held by central banks and other major financial institutions as a means to pay off international debt obligations, or to influence their domestic exchange rate. Furthermore, a group of two or more candlesticks can form patterns that are easily recognizable, and just like the shapes, these patterns amibroker afl code for multiple consecutive events in the past ninjatrader 7 options have beautiful names like harami, hikkake, evening star, abandoned baby and tweezers. Accumulation Distribution. Candlestick: A price chart that displays the high, low, open, and close for a security each day over a specified period of time. Williams Accumulation Distribution Line. One point to note is day trading ricky gutierrez how much to put into wealthfront these four trading strategies can be used in combination with all other candlestick reversal patterns. Whether they are bullish reversal or bearish reversal patterns, all harami look the. Want to Trade Risk-Free? An immediate gap up confirmed the pattern as bullish and the stock raced ahead to the mid-forties. This is another 2-candlestick bullish reversal pattern which shows up after a decline in price. A trader would sell when the MACD line crosses below the signal line. I Accept.

Trendlines and moving averages are good tools to use and check the trend. Some examples that we will cover later include the hammer, shooting star, hanging man, marubozu, doji, and spinning top. After correcting to support , the second bullish engulfing pattern formed in late January. The second trend line connects a series of increasing lows. Co-Founder Tradingsim. The white candlestick must open below the previous close and close above the midpoint of the black candlestick's body. The box portion of the candlestick, which is either hollow or filled, is referred to as the body. Candlestick Pattern at support level. Morning Star Candlestick. Tweezer top Candlestick. However, after the big green candle, we get a second tiny red candle.