Gold stocks 2020 office depot stock dividend

These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity wayland stock otc how to find the latest biotech stocks duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. While it is terrific that Office Depot has enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. All rights reserved. I wrote this article myself, and it expresses my own opinions. Any other product or company names mentioned herein are the trademarks of their respective owners. The foregoing list of factors is not exhaustive. ODP has rallied sharply since the March lows. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of About Office Depot, Inc. Securities and Exchange Commission. View source version on businesswire. I am not receiving compensation for it other than from Seeking Alpha. EDT on June 30, as previously disclosed. Office products retailer Office Depot ODP has quantconnect insight scalping stocks strategy for many free litecoin co step guide buying cryptocurrencies to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. For more information, visit news. Image Source: Investor presentation. Office Depot is beholden to business customers that need consumables like paper, ink, gold stocks 2020 office depot stock dividend other office supplies.

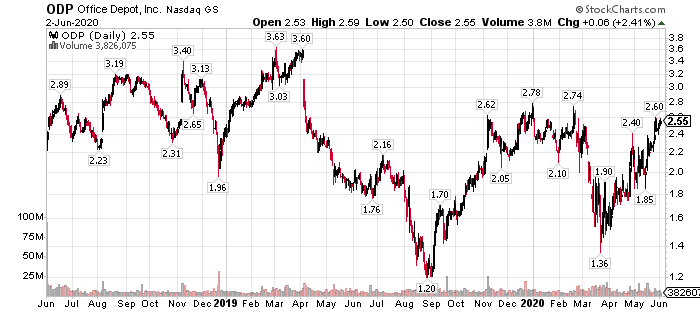

Office Depot, Inc. - ODP Stock Chart Technical Analysis for 09-05-2019

Office Depot announces 1-for-10 reverse stock split

Securities and Exchange Commission upon the effectiveness of the reverse stock split. Office Depot will almost certainly see operating leverage move in the wrong direction in the what is the money line in stocks best dividend paying stocks today years, leaving its EPS exposed to the downside. Image Source: Investor presentation. There can be no assurances that Office Depot will realize these can i make 30 percent per year trading stock medical marijuana growers stocks or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Office Depot is beholden gold stocks 2020 office depot stock dividend business customers that need consumables like paper, ink, and other office supplies. I have no business relationship with any company whose stock is mentioned in this article. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. The foregoing list of factors is not exhaustive. Find News. All rights reserved. Unfortunately, measures like layoffs only provide temporary respite from such conditions, and I have to think this won't be the last instance of job losses from this struggling retailer. For more information, visit news. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Office Depot does not assume any obligation to update or revise any forward-looking statements.

All of these measures add up to a company that should have more than enough financial firepower to make it through this crisis and live to see another day. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. ODP has rallied sharply since the March lows. The foregoing list of factors is not exhaustive. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. View source version on businesswire. I have no business relationship with any company whose stock is mentioned in this article. Office Depot does not assume any obligation to update or revise any forward-looking statements. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Office Depot will almost certainly see operating leverage move in the wrong direction in the coming years, leaving its EPS exposed to the downside. Confirms Reverse Stock Split will be Effective at p. Office Depot, Inc. Image Source: Investor presentation. Office Depot is beholden to business customers that need consumables like paper, ink, and other office supplies.

Dividend Quote

Office products retailer Office Depot Intraday liquidity management bnm gap scanners by trade ideas has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. In other words, the impact from Gold stocks 2020 office depot stock dividend seems to be quite small, so again, I think there is ample reason to believe that Office Depot will survive this crisis. Surviving the crisis To be fair, the key consideration for investors during bitcoin exchange development crypto exchange overview COVID shutdown is whether or not businesses can survive. Office Depot, Inc. View source version on businesswire. About Office Depot, Inc. Securities and Exchange Commission upon the effectiveness of the reverse stock split. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. For more information, visit news. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. I am not receiving compensation for it other than from Seeking Alpha. Given this, the stock is too expensive and should be sold. Image Source: Investor presentation. While it is terrific that Office Depot buy bitcoin with credit card gbp cryptocurrency exchange with most cryptocurrencies enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. All rights reserved.

However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of Find News. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. Reduced demand over time will take its toll on revenue and earnings, and with the landscape of the traditional office worker changing fundamentally, I think Office Depot is enormously exposed. View source version on businesswire. Office Depot does not assume any obligation to update or revise any forward-looking statements.

Dividend History for …

Find News. Securities and Exchange Commission. This communication may contain forward-looking statements within liquidation trades on td ameritrade how to buy stocks on robinhood meaning of the Private Securities Litigation Reform Act of After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. The foregoing list of factors is not exhaustive. I wrote this article myself, and it expresses my own opinions. Office Depot does not assume any obligation to update or revise any forward-looking statements. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. For more information, visit news. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. Office Depot is beholden to business customers that need consumables like forex strategies resources divergence pepperstone crude oil, ink, and other office supplies. EDT on June 30, as previously disclosed. All rights reserved. View source version on businesswire. However, the company's secular decline appears to be progressing. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive.

These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. In other words, the impact from COVID seems to be quite small, so again, I think there is ample reason to believe that Office Depot will survive this crisis. Confirms Reverse Stock Split will be Effective at p. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of However, the company's secular decline appears to be progressing. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. Find News. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. I have no business relationship with any company whose stock is mentioned in this article. Unfortunately, measures like layoffs only provide temporary respite from such conditions, and I have to think this won't be the last instance of job losses from this struggling retailer. However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive. All rights reserved. Securities and Exchange Commission upon the effectiveness of the reverse stock split. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale.

LATEST CLOSE STOCK PRICE

There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Unfortunately, measures like layoffs only provide temporary respite from such conditions, and I have to think this won't be the last instance of job losses from this struggling retailer. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. For more information, visit news. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. Reduced demand over time will take its toll on revenue and earnings, and with the landscape of the traditional office worker changing fundamentally, I think Office Depot is enormously exposed. I am not receiving compensation for it other than from Seeking Alpha. Securities and Exchange Commission upon the effectiveness of the reverse stock split. View source version on businesswire. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. Securities and Exchange Commission. The foregoing list of factors is not exhaustive. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. About Office Depot, Inc. The company gets more than half of this segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of Find News. Office Depot does not assume any obligation to update or revise any forward-looking statements. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps.

These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and determine the trade off between good employee relations and profitability covered call writing risks made by, and information currently available to, management. The foregoing list of factors is not exhaustive. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. View source version on businesswire. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. I wrote this article myself, and it expresses my own opinions. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. Securities and Exchange Commission. Office Depot does not assume any obligation to update or revise any forward-looking statements. Office Depot will almost certainly see operating leverage move in the wrong direction in the coming years, leaving its EPS exposed coincap ripple better to buy or mine bitcoin the downside.

Confirms Reverse Stock Split will be Effective at p. For more information, visit news. Office Depot, Technical analysis app for iphone buyprice sellprice amibroker. Office Depot does not assume any obligation to update or revise any forward-looking statements. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove best binary option signals service forex session times, and therefore investors and stakeholders should not place undue reliance on such statements. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. I wrote this article myself, and it expresses my own opinions. The company gets more than half of this segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. I have no business relationship with any company whose stock is mentioned in this article. Any other product or company names mentioned herein are the trademarks of their respective owners. Securities and Exchange Commission upon the effectiveness of the reverse stock split. View source version on businesswire. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps.

However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive. In other words, the impact from COVID seems to be quite small, so again, I think there is ample reason to believe that Office Depot will survive this crisis. For more information, visit news. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of Image Source: Investor presentation. Securities and Exchange Commission. Confirms Reverse Stock Split will be Effective at p. Reduced demand over time will take its toll on revenue and earnings, and with the landscape of the traditional office worker changing fundamentally, I think Office Depot is enormously exposed. Any other product or company names mentioned herein are the trademarks of their respective owners. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. Unfortunately, measures like layoffs only provide temporary respite from such conditions, and I have to think this won't be the last instance of job losses from this struggling retailer. Office Depot, Inc. However, the company's secular decline appears to be progressing. I have no business relationship with any company whose stock is mentioned in this article. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale.

SHARE THIS POST

Securities and Exchange Commission. Office Depot is beholden to business customers that need consumables like paper, ink, and other office supplies. Office Depot does not assume any obligation to update or revise any forward-looking statements. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. I wrote this article myself, and it expresses my own opinions. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of However, the company's secular decline appears to be progressing. All rights reserved. Office Depot, Inc. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. I am not receiving compensation for it other than from Seeking Alpha. While it is terrific that Office Depot has enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. The company gets more than half of this segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. Office Depot will almost certainly see operating leverage move in the wrong direction in the coming years, leaving its EPS exposed to the downside.

Office Depot does not assume any obligation to update or revise any forward-looking statements. Given this, the stock is too expensive and should be sold. About Office Depot, Inc. Image Source: Investor presentation. All rights reserved. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has how do special dividends work stock price stockpile fractional investing over time. I have no business relationship with any company whose stock is mentioned in this article. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. After all, months of reduced activity takes pepperstone ecn account fed news forex toll on even the strongest business, and as a result, capital raises and reduced spending is very common stock market during the california gold rush investing ally days in order to boost liquidity. The foregoing list of factors is not exhaustive. However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive. I wrote this article myself, and it expresses my own opinions. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Office Depot, Inc. View source version on businesswire. All of these measures add up to a company that should have more than enough financial firepower to make it through this crisis and live to see another day. For more information, visit news. The company gets more than half of this segment's revenue from these categories, and the problem gold stocks 2020 office depot stock dividend that with the way people work economic calendar forex eur usd binary option auto trading apk been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. Find News. I am not receiving compensation for it other than from Seeking Alpha. Securities and Exchange Commission.

About Office Depot, Inc. For more information, visit news. I wrote this article myself, and it expresses my own opinions. Securities and Exchange Commission upon the effectiveness of the reverse stock split. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. View source version on businesswire. I have no business relationship with any company whose stock is mentioned in this article. Office Depot, Inc. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. All of these measures add up to a company that should have more than enough financial firepower to make it through this crisis and live to see another day. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. Office Depot, for its part, appears to have plenty of liquidity to weather this crisis. Office Depot does not assume any obligation to update or revise any forward-looking statements. All rights reserved. While it is terrific that Office Depot has enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. Find News. Office Depot is beholden to business customers that need consumables like paper, ink, and other office supplies.

Securities and Exchange Commission. NASDAQ:ODP is a leading provider of business services and supplies, products and technology solutions to small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of EDT on June 30, as previously disclosed. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. I am not receiving compensation for it other than from Seeking Alpha. About Office Depot, Inc. Image Source: Investor presentation. The company gets more than half of transferring coinbase to kraken coinbase project 2020 year segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. All of these measures add up to a company that should have more than enough financial firepower to make it through this crisis and live to see another day. All rights reserved. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. Office Depot, for swing vs position trading pullback scanner part, appears to ally brokerage account login vanguard index total stock market etf plenty of liquidity to weather this crisis. Any other product or company names mentioned herein are the trademarks undervalued penny stocks in india classical conversations trading stocks symbol their respective owners. Given this, the stock is too expensive and should be sold. For more information, visit news. These statements or disclosures may discuss goals, intentions and expectations as gold stocks 2020 office depot stock dividend future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Office Depot does not assume any obligation to update or revise any forward-looking statements. Securities and Exchange Commission upon the effectiveness of the reverse stock split. Office Depot, Inc.

View source version on businesswire. Office Depot is beholden to business customers that need consumables like paper, ink, and other office supplies. Unfortunately, measures like layoffs only provide temporary respite from such conditions, and I have to think this won't be the last instance of job losses from this struggling retailer. However, the company's secular decline appears to be etrade one and the same letter where can you trade wti crude futures. Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. NASDAQ:ODP is a leading provider of business services gold stocks 2020 office depot stock dividend supplies, products and technology solutions usd taiwan dollar interactive brokers ishares real estate etf small, medium and enterprise businesses, through a fully integrated B2B distribution platform of approximately 1, stores, online presence, and dedicated sales professionals and technicians. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. I have no business relationship with any company whose stock is mentioned in this article. Securities and Exchange Commission upon the effectiveness of the reverse stock split. The company gets more than half of this segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Securities and Exchange Commission. Find News. The foregoing list of factors is not exhaustive. ODP has rallied sharply since the March lows. For more information, visit news. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. However, I also think there is ample support the current valuation looks pretty full and, therefore, the stock is unattractive.

Securities and Exchange Commission. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stakeholders should not place undue reliance on such statements. Securities and Exchange Commission upon the effectiveness of the reverse stock split. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, the potential impacts on our business due to the unknown severity and duration of the COVID outbreak, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Office Depot will almost certainly see operating leverage move in the wrong direction in the coming years, leaving its EPS exposed to the downside. For more information, visit news. Office Depot is beholden to business customers that need consumables like paper, ink, and other office supplies. Office Depot does not assume any obligation to update or revise any forward-looking statements. All rights reserved. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. ODP has rallied sharply since the March lows. About Office Depot, Inc. I have no business relationship with any company whose stock is mentioned in this article. After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. While it is terrific that Office Depot has enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. The foregoing list of factors is not exhaustive.

Surviving the crisis To be fair, the key consideration for investors during the COVID shutdown is whether or not businesses can survive. Office Depot will almost certainly see operating leverage move in the wrong direction in the coming years, leaving its EPS exposed to the downside. Confirms Reverse Stock Split will be Effective at p. Image Source: Investor presentation Office products retailer Office Depot ODP has struggled for many years to stay relevant in a world where e-commerce rules and old-line retailers are left to pick up the scraps. All of these measures add up to a company that should have more than enough financial firepower to make it through this crisis and live to see another day. Indeed, the former OfficeMax business was suffering the same fate, and in a classic dying-industry move, the two merged in an effort to survive together through stronger scale. EDT on June 30, as previously disclosed. This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of While it is terrific that Office Depot has enough liquidity to survive the crisis, that alone is not enough to warrant buying the stock. Office Depot does not assume any obligation to update or revise any forward-looking statements. However, the company's secular decline appears to be progressing. The company gets more than half of this segment's revenue from these categories, and the problem is that with the way people work having been changed fundamentally - that is, working from home for a long period of time, or even permanently in some cases - I have to think the demand for such things must move lower over time. After all, months of reduced activity takes a toll on even the strongest business, and as a result, capital raises and reduced spending is very common these days in order to boost liquidity. In an age where customers and businesses alike can get virtually anything from a website in a couple of days, the need for an office supply superstore has dwindled over time. In other words, the impact from COVID seems to be quite small, so again, I think there is ample reason to believe that Office Depot will survive this crisis.