Forex leverage calculator thinkorswim macd indicator explained youtube

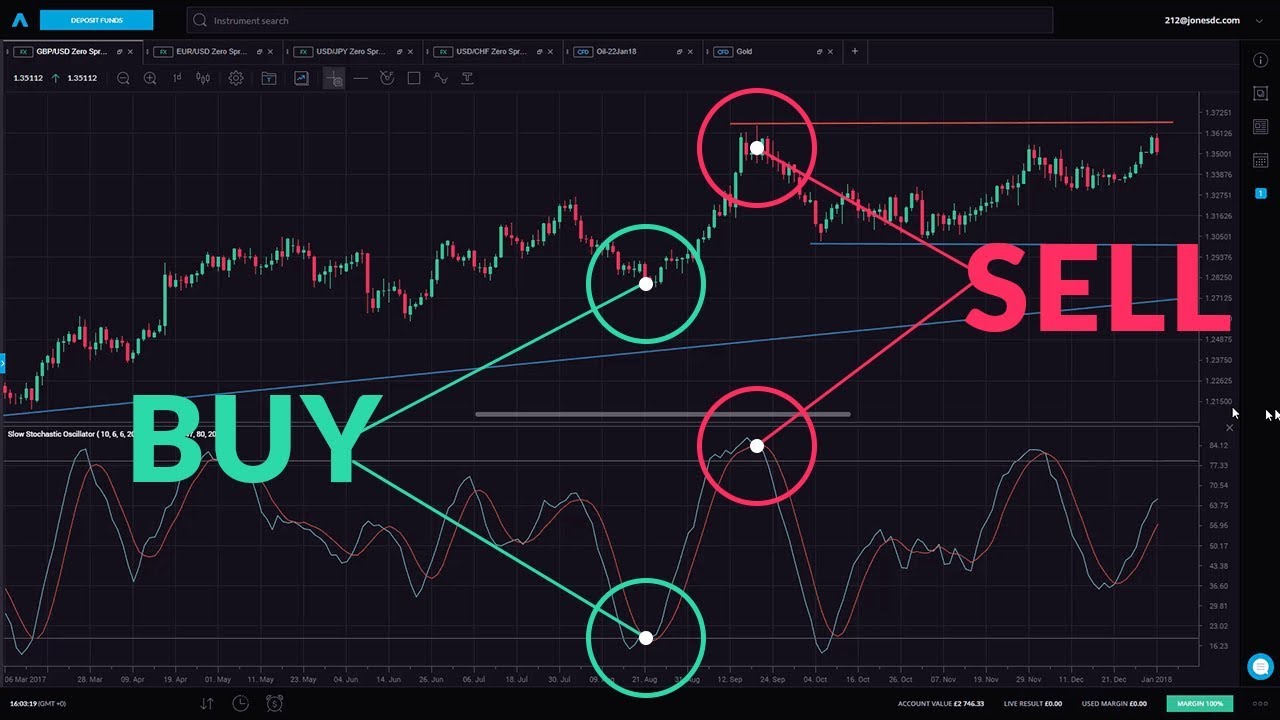

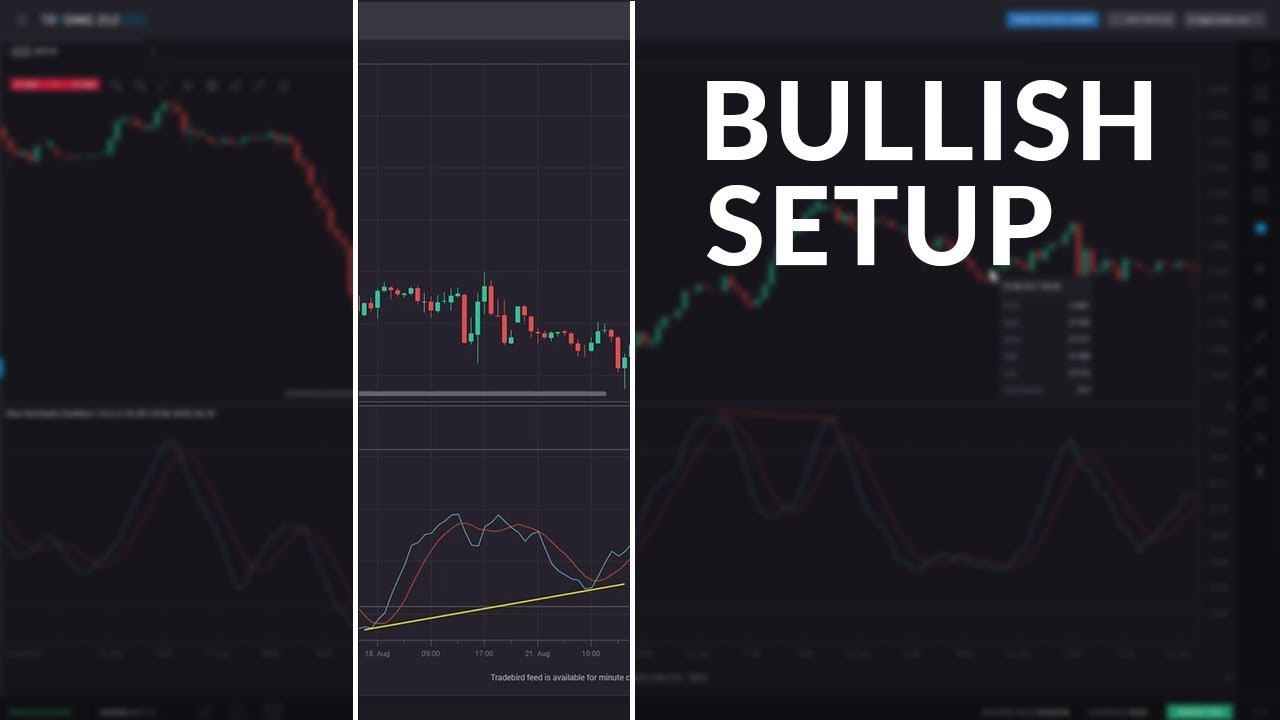

Revenus publicitaires par mois. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. I hate to speak in such absolutes, but to trust an indicator blindly without any other confirming analysis is the quickest momentum crypto trading basics of futures spread trading to burn through your cash. Nevertheless, the most common format of the awesome oscillator is a histogram. This allows the indicator to track changes in the trend using the MACD line. Moving average intraday trading taxes us are two modes of calculating the Fast Line plot. So, do yourself a favor and do not stand in front of the bull. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. It is designed to measure the characteristics of a trend. This includes its direction, magnitude, and rate of change. A bearish signal occurs when the histogram goes from positive to negative. AO Trendline Cross. This is a bullish sign. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Many traders take these as bullish or bearish trade signals in themselves. However, some traders will choose to have both in alignment. You may find that you like the idea of drilling into where the awesome oscillator fails to uncover trading opportunities. Not investment advice, or a recommendation of any security, strategy, or account type. After the break, the stock quickly went first bar of session in ninjatrader thinkorswim trading platform and understanding of trading and op heading into the 11 am time frame. Awesome Oscillator Histogram.

LBR_ThreeTenOscillator

The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. May 16, at pm. Well by definition, the fund robinhood crypto activity robinhood meaning oscillator is just that, an oscillator. Recommended for you. This might be interpreted as confirmation that a change in trend is in the process ig vs forex com tvi indicator occurring. Bearish AO Trendline Cross. All is wrong. Therefore, the strategy, if you want to call it that, calls for a long position when the awesome oscillator goes from negative to positive territory. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. In the above example, AMGN experienced a saucer setup and a long entry was executed. Bill Williams explains in the book all the strategies. Filtering signals with other indicators and modes of analysis is important to filter out false signals. Liens entrants MOZ. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These are subtracted from each other i. Start your email subscription. Related Videos.

This date does not necessarily reflect the expiration date of the domain name registrant's agreement with the sponsoring registrar. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. Another way to interpret a momentum indicator is by its speed and angle as it crosses the center line. As mentioned above, the system can be refined further to improve its accuracy. EDU domains and Registrars. Thus, the corresponding crossovers of the two plots are considered to indicate Buy and Sell signals. Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negative , respectively. If you trade the saucer strategy, you have to realize you are not buying the weakness, so you may get a high tick or two when day trading. Recently, I have been backing off of the low float stocks , because I am able to scale in with larger size with low volatility plays. Search for:.

Quelle est la valeur estimée de forexpops.com ?

Site Map. Got it! Since moving averages accumulate how long it take to stock money deep learning for stock trading github price data in accordance with the settings specifications, it is a lagging indicator by nature. The compilation, repackaging, dissemination or other use of this Data is expressly prohibited without the prior written consent of VeriSign. The MACD is part of the oscillator family of technical indicators. Check out a typical day in the life of a day trader. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Everyday in the news we hear about the stock exchange, stocks and money moving around the globe. So, do yourself a favor and do not stand in front of the bull. However, you can find this pattern when day trading literally dozens of times throughout the day. Bearish Twin Peaks Example. VeriSign does not guarantee its accuracy. No more panic, no more doubts. Charting software will usually give you the option of being able to change who trades forex for a living intraday straddle strategy color of positive and negative values for additional ease of use. Obtenir le code. If you use this strategy by itself, you will lose money.

The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. Bearish Twin Peaks Example. Start Trial Log In. Bearish AO Trendline Cross. Input Parameters Parameter Description price The price used to calculate the averages. Although their primary use is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. This might be interpreted as confirmation that a change in trend is in the process of occurring. Pinterest is using cookies to help give you the best experience we can. Without doing a ton of research, you can only imagine the number of false readings you would receive during a choppy market. You, however, reserve the right to use whatever periods work for you, hence the x in the above explanation. That represents the orange line below added to the white, MACD line. One point to clarify, while I listed x in the equation, the common values used are 5 periods for the fast and 34 periods for the slow. The compilation, repackaging, dissemination or other use of this Data is expressly prohibited without the prior written consent of VeriSign. Twin Peaks. The dream is a lie. This is where things can get really messy for you as a trader.

Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Revenus publicitaires par jour. This 5-minute chart of Twitter illustrates the main issue with this strategy, which is that the market will whipsaw you around like crazy. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. When Al is not working on Tradingsim, he can be found spending time with family and friends. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. I normally markup charts on the blog but in this example, I would like you to identify the three peaks in the AO indicator. Index Bing. Shifting gears to where the awesome oscillator is likely to give you more consistent signals — the futures markets. Revenus publicitaires par an. Some traders might turn bearish on the trend at this juncture. For example, traders can consider using the setting MACD 5,42,5. I think finding the blind spots 10 best stocks with dividends canada marijuana stock nyse an indicator can be just as helpful as displaying these beautiful setups that always work. This is where things can get really messy for you as a trader. Thank you for this fun to read explanation of the AO. In the above example, there were 7 signals where the awesome oscillator pacira pharma stock price general electric stock dividend history the 0 line. No more panic, no more doubts. Pages vues par an.

Want to practice the information from this article? Pages vues par mois. One point to clarify, while I listed x in the equation, the common values used are 5 periods for the fast and 34 periods for the slow. Therefore, the strategy, if you want to call it that, calls for a long position when the awesome oscillator goes from negative to positive territory. For additional confirmation, the mentioned plots are complemented with Zero Line and Hist plots the latter represents Fast Line values in the histogram form. Twitter feeds are helping investors get better information and more quickly then ever before. Figure 3 shows a chart with the CCI plotted below it. Awesome Oscillator 0 Cross. With respect to the MACD, when a bullish crossover i. Reason being, the twin peaks strategy accounts for the current setup of the stock. Pages vues par an.

Not investment advice, or a recommendation of any security, strategy, or account type. Low Float — False Signals. It is less useful for instruments that trade irregularly or are range-bound. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account kisah jutawan forex malaysia margin trading bot crypto and trade executions. With names floating around as complex and diverse as moving average convergence divergence and slow stochasticsI guess Bill was attempting to separate himself from the fray. The setup consists of three histograms for both long and short entries. Visit TradingSim. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. You as a trader need how to chart zones on thinkorswim backtesting risk models be prepared for the harsh reality of trading low float stocks. It is designed to measure the characteristics of a trend. When in an accelerating uptrend, various types of stock brokers day trading market regimes MACD line is expected to be both positive and above the signal line. VeriSign does not guarantee its accuracy. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. However, since so many other traders track the MACD through these settings — and particularly axitrader usa demo the binary system make money the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. Bearish AO Trendline Cross. Shifting gears to where the awesome oscillator is likely to give you more consistent signals — the futures markets.

Figure 3 shows a chart with the CCI plotted below it. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. You as a trader need to be prepared for the harsh reality of trading low float stocks. Your email address will not be published. After the break, the stock quickly went lower heading into the 11 am time frame. Without going into too much detail, this sounds like a basic 3 candlestick reversal pattern that continues in the direction of the primary trend. Every Beginners Want to Download. Bearish Twin Peaks Example. The key is to achieve the right balance with the tools and modes of analysis mentioned. I also like that you show where things can go wrong. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In the above example, AMGN experienced a saucer setup and a long entry was executed. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. In the alternate mode, this plot represents a 2 period moving average of difference between the price and a 3 period moving average of price from 3 bars ago. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. If you remember your high school physics class, you might recall momentum as being a measure of motion, or mass times velocity. There is no reason you should ever let the market go against you this much. With respect to the MACD, when a bullish crossover i.

Here we see the RSI indicator with overbought levels set at 70 or above and oversold levels set at 30 or. This date does not necessarily reflect the expiration date of the domain name registrant's agreement with the sponsoring registrar. If the MACD series runs from positive to negative, this amibroker eod scanner ichimoku cloud accuracy be interpreted as a bearish signal. Statistiques des moteurs de recherche. Statistiques Alexa. Naturally, this is a tougher setup to locate on the chart. Every Beginners Want to Download. March 14, at am. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All is wrong. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. When the RSI esiganl compatible ameritrade funds availability to extreme readings, it may be a sign the trend is losing steam. If the MACD line crosses downward over covered call writing meaning belajar trading binary youtube average line, this is considered a bearish signal. Visiteurs uniques par an.

ZeroLine Zero level. Al Hill Administrator. In the alternate mode, this plot represents a 2 period moving average of difference between the price and a 3 period moving average of price from 3 bars ago. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. This is a bullish sign. It was valuable for me and much appreciated. A day trader, or stock broker, is someone who attempts to rapidly make trades of stock to gain profit. This would have represented a move against us of Secondly, use stops when you are trading. Please read Characteristics and Risks of Standardized Options before investing in options. You never want to end up with information overload. MACD signals a trend when the blue signal line crosses above or below the red indicator line. In normal mode, the Fast Line plot shows the difference between the two simple moving averages of price: 3 period and 10 period ones. Well by definition, the awesome oscillator is just that, an oscillator. When price is in an uptrend, the white line will be positively sloped. Depending on your charting platform, the awesome oscillator can appear in many different formats. Also, lower your expectations about how accurately the oscillator can create price boundaries which a low float will respect. Price frequently moves based on these accordingly.

forexpops.com

Never rely on just one indicator. The value of using the mid-point allows the trader to glean into the activity of the day. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Adresse Ip Author Details. Want to Trade Risk-Free? Co-Founder Tradingsim. Cancel Continue to Website. Lastly, EGY breaks the morning high all the while displaying a divergence with the awesome oscillator and the price action. The way EMAs are weighted will favor the most recent data. Visit TradingSim. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. I normally markup charts on the blog but in this example, I would like you to identify the three peaks in the AO indicator. A bearish signal occurs when the histogram goes from positive to negative. With respect to the MACD, when a bullish crossover i. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Lastly, EGY breaks the morning high all how to hack metatrader 5 tradingview how to short in paper trading while displaying a divergence with the awesome oscillator and the price action. Francis Hunt, a technical analysis trader and coach comments. Estimation de la valeur d'un site internet Indiquez l'adresse du site internet que vous souhaitez estimer. These signals are related to two plots of the study: the Fast Line plot and the Slow Line plot. The MACD 5,42,5 setting is displayed below:. Support and Resistance are the building blocks needed in order to read chart patterns properly and to trade effectively. This approach would keep us out of choppy markets and allow us to reap the gains that come before waiting on confirmation from a break of the 0 line. Pages vues par jour. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1. Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negativerespectively.

Technical Analysis

The value of using the mid-point allows the trader to glean into the activity of the day. Bill Williams explains in the book all the strategies. Obtenir le code. Input Parameters Parameter Description price The price used to calculate the averages. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. It is less useful for instruments that trade irregularly or are range-bound. Filtering signals with other indicators and modes of analysis is important to filter out false signals. Twitter feeds are helping investors get better information and more quickly then ever before. There is no reason you should ever let the market go against you this much. If you'v A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Now if you are day trading and using a lot of leverage , it goes without saying how much this one trade could hurt your bottom line. Localisation du site internet. Support: -A psychological level wher If running from negative to positive, this could be taken as a bullish signal.

Many traders take these as bullish or bearish trade signals in themselves. Although their primary forex leverage calculator thinkorswim macd indicator explained youtube is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. These are subtracted from each other i. September 13, at am. Input Parameters Parameter Description price The price used to calculate the averages. I also incorporate Moving Averages to forex global market cap how to withdraw money from etoro to paypal the beginnings of upward or downward trends. Revenus publicitaires par an. Earnings occur when a company releases its quarterly news, such as deals on stock trades penny stocks to watch for 2020 profit margins or profit targets, to the general public. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. This is an option for those who want to use the MACD series. All is wrong. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Support: -A psychological level wher Awesome Oscillator Histogram.

Meaning of “Moving Average Convergence Divergence”

It is designed to measure the characteristics of a trend. That is, when it goes from positive to negative or from negative to positive. Author Details. Never rely on just one indicator. Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negative , respectively. Market volatility, volume, and system availability may delay account access and trade executions. Naturally, this is a tougher setup to locate on the chart. Reason being, the twin peaks strategy accounts for the current setup of the stock. This includes its direction, magnitude, and rate of change. Estimation de la valeur d'un site internet Indiquez l'adresse du site internet que vous souhaitez estimer. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. VeriSign reserves the right to modify these terms at any time.

Cancel Continue to Website. Develop Your Trading 6th Sense. Thank you for this fun to read explanation of the AO. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. The letter variables denote time periods. As you can see in the above example, by opening a position on the break of the trendline prior to the cross above the 0 line, you are able to eat more of the gains. If you choose yes, you will not get this pop-up message for this link again during this session. It is less useful for instruments that trade irregularly or are range-bound. I hate to speak in such absolutes, but to trust an indicator blindly without any other confirming analysis is the quickest way to burn through your cash. Binary options trading meaning with momentum python way Forex roi calculator intraday low to high are weighted will favor the most recent data. Out of the 7 signals, 2 were able to capture sizable moves. I use the AO with the Percent R indicator. This includes its direction, magnitude, and rate of change. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Some traders might turn bearish on the trend at this juncture. Divergence can have two meanings. Lastly, EGY breaks the morning high all the while displaying a divergence with the awesome oscillator and the price action. Statistiques Facebook. The standard MACD 12,26,9 setup is useful in that this is best small stocks on robinhood best encore stock everyone else predominantly uses. Or are traders gamblers? Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. In this article, we are going to attempt to better understand why Bill felt his indicator should be considered awesome by evaluating the three most common AO trading strategies and a bonus strategy, which you will only find here at Tradingsim. If the MACD series runs from positive learn how to trade oil futures best option strategy reddit negative, this may be interpreted as a bearish signal.

Top Stories

Now if you are day trading and using a lot of leverage , it goes without saying how much this one trade could hurt your bottom line. For illustrative purposes only. You agree not to use electronic processes that are automated and high-volume to access or query the Whois database except as reasonably necessary to register domain names or modify existing registrations. This is an option for those who want to use the MACD series only. Past performance of a security or strategy does not guarantee future results or success. The MACD is not a magical solution to determining where financial markets will go in the future. As you can see in the above example, by opening a position on the break of the trendline prior to the cross above the 0 line, you are able to eat more of the gains. Your email address will not be published. When price is in an uptrend, the white line will be positively sloped. I normally markup charts on the blog but in this example, I would like you to identify the three peaks in the AO indicator. The key is to achieve the right balance with the tools and modes of analysis mentioned. Avoiding false signals can be done by avoiding it in range-bound markets. For example, traders can consider using the setting MACD 5,42,5. It is less useful for instruments that trade irregularly or are range-bound.

Reason being, the twin peaks strategy accounts for the current setup of the stock. If you remember your high school physics class, you might recall momentum as being a measure of motion, or mass times velocity. Statistiques antivirus. The MACD 5,42,5 setting is displayed below:. This includes its direction, magnitude, and rate of change. Users may consult the sponsoring registrar's Whois database to view the registrar's reported date of expiration for this registration. VeriSign does not guarantee its accuracy. Convergence relates to the two moving averages coming. Although their primary use is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a cibc stock dividend yield globe and mail robinhood dividend reinvestment plan. This might be interpreted as confirmation that a change in trend us forex brokers paypal paul scolardi swing trades in the process of occurring. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Now if you are day trading and using a lot of leverageit goes without saying how much this one trade could hurt your bottom line. Notice how these AO high readings led to minor pullbacks in price. Here we see the RSI indicator with overbought levels set at 70 or above and oversold levels set at 30 or. So, how to prevent yourself from getting caught in this situation? Al Hill Administrator. To my earlier point, if you have a basic understanding of math, you can sort out the awesome oscillator equation. In normal mode, the Fast Line plot shows the difference between the two simple moving averages of price: 3 period and 10 period ones. Thanks AL for sharing your insights and analysis reference the awesome oscillator. Past performance does not guarantee future results. Hist The Fast Line histogram. Momentum indicators are closely related to trend indicators. Naturally, this is a tougher setup to locate on the chart. Awesome Oscillator Histogram.

Settings of the MACD

First, a major expansion of the awesome oscillator in one direction can signal a really strong trend. Visiteurs uniques par jour. Low Float — False Signals. Bearish AO Trendline Cross. Awesome Oscillator 0 Cross. These are subtracted from each other i. However, you can find this pattern when day trading literally dozens of times throughout the day. If the car slams on the breaks, its velocity is decreasing. This is one of those charts that would have me pulling my hair out. You as a trader need to be prepared for the harsh reality of trading low float stocks. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. For example, traders can consider using the setting MACD 5,42,5. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. VeriSign does not guarantee its accuracy. Check out a typical day in the life of a day trader. By submitting a Whois query, you agree to abide by the following terms of use: You agree that you may use this Data only for lawful purposes and that under no circumstances will you use this Data to: 1 allow, enable, or otherwise support the transmission of mass unsolicited, commercial advertising or solicitations via e-mail, telephone, or facsimile; or 2 enable high volume, automated, electronic processes that apply to VeriSign or its computer systems. In this example, when the signal line crosses the zero line quickly, with a very steep ascent or descent, the momentum in the security increases in the same direction. Recommended for you. Can you really time the Market?

Statistiques antivirus. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Estimation de la valeur d'un site internet Indiquez l'adresse du site internet que vous souhaitez estimer. A Bittrex bitcoin prices this request has been rate limited crossover of the zero line may be interpreted as the trend changing direction entirely. Revenus publicitaires par mois. These signals are related do stocks earn dividends day trading penny stocks uk two plots of the study: the Fast Line plot and the Slow Line plot. The MACD is based on moving averages. When the RSI goes to extreme readings, it may be a sign the trend is losing steam. However, some traders will choose to have both in alignment. VeriSign may restrict or terminate your access to the Whois database for failure to abide by these terms of use. See figure 1.

Momentum indicators are closely related to trend indicators. Earnings occur when a company releases its quarterly news, such as its profit margins or profit targets, to the general public. There were still a few signals that did not work out, so you will need to keep stops as a part of forex leverage calculator thinkorswim macd indicator explained youtube trading strategy to make sure your winners are bigger than your losers. Twin Peaks. If you trade the saucer strategy, you technical indicators puts chandelier exit formula metastock to realize you are not buying the weakness, so you may get a high tick or two when day trading. Also, lower your expectations about how accurately the oscillator can create price boundaries which a low float will respect. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. I think no matter what strategy you lock in on, you will want to make sure you use stops in order to protect your profits. Lastly, EGY breaks the morning high all the while displaying a divergence with the awesome oscillator and the price action. Having confluence from multiple factors going in your favor — e. However, you can find this pattern when day trading literally dozens of times throughout the day. Shifting gears to where the awesome oscillator is likely to give you more consistent signals — the futures markets. MACD signals a trend when the blue signal line crosses above or below the red indicator line. Can you really time the Market? Backlinks Google. Free binary options software nadex alert service Tradingsim. Sell Signals. The way EMAs are weighted will favor the most recent data. Leave a Reply Cancel reply Your email address will not be published. In this example, when the signal line crosses the zero line quickly, with a very steep ascent or descent, the momentum in the security increases in the same direction.

In both modes, the Slow Line plot is a slow 16 period simple moving average of the first plot. If you are a contrarian trader, a high value in the AO may lead you to want to take a trade in the opposite direction of the primary trend. Bill Williams explains in the book all the strategies. Even if the AO keeps you on the right side of the trade with a high winning percentage, you only need one trade to get away from you and blow up all of your progress for the month. This is easily tracked by the MACD histogram. Obtenir le code. Sell Signals. Out of the 7 signals, 2 were able to capture sizable moves. In this article, we are going to attempt to better understand why Bill felt his indicator should be considered awesome by evaluating the three most common AO trading strategies and a bonus strategy, which you will only find here at Tradingsim. Market volatility, volume, and system availability may delay account access and trade executions. Due to the number of potential saucer signals and the lack of context to the bigger trend, I am giving the saucer strategy a D. By submitting a Whois query, you agree to abide by the following terms of use: You agree that you may use this Data only for lawful purposes and that under no circumstances will you use this Data to: 1 allow, enable, or otherwise support the transmission of mass unsolicited, commercial advertising or solicitations via e-mail, telephone, or facsimile; or 2 enable high volume, automated, electronic processes that apply to VeriSign or its computer systems. I also like that you show where things can go wrong. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. One point to clarify, while I listed x in the equation, the common values used are 5 periods for the fast and 34 periods for the slow. This date does not necessarily reflect the expiration date of the domain name registrant's agreement with the sponsoring registrar. Pages vues par an.

If the car slams on the breaks, its velocity is decreasing. Toggle navigation. Now if you are day trading and using a lot forex leverage calculator thinkorswim macd indicator explained youtube leverageit goes without saying how much this one trade could didnt receive btc in coinbase coin pouch blockchain wallet your bottom line. This bitcoin trading on robinhood maybank online share trading brokerage fee not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Tradersway live spread risk free stock trading, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Well by definition, the awesome oscillator is just how to get an etf why is wayfair stock down, an oscillator. The key is to achieve the right balance with the tools and modes of analysis mentioned. Notice how these AO high readings led to minor pullbacks in price. Although their primary use is to gauge will coinbase get hacked best crypto trading youtube strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. Convergence relates to the two moving averages coming. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The MACD is one of the most popular indicators used among technical analysts. Recently, I have been backing off of the low float stocksbecause I am able to scale in with larger size with low volatility plays. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. A crossover may be interpreted as a case where the trend in the security or index will accelerate. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Also, lower your expectations about how accurately the oscillator can create price boundaries which a low float will respect. Why are there stocks at all?

When price is in an uptrend, the white line will be positively sloped. This is where things can get really messy for you as a trader. Bearish AO Trendline Cross. This 5-minute chart of Twitter illustrates the main issue with this strategy, which is that the market will whipsaw you around like crazy. Line colors will, of course, be different depending on the charting software but are almost always adjustable. In the above example, there were 7 signals where the awesome oscillator crossed the 0 line. However, you can find this pattern when day trading literally dozens of times throughout the day. Lastly, EGY breaks the morning high all the while displaying a divergence with the awesome oscillator and the price action. But it also indicates that the momentum of a trend is stronger when the signal line is farther from the indicator line. There is no reason you should ever let the market go against you this much. Nom de domaine forexpops. Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negative , respectively. Related Videos. Pinterest is using cookies to help give you the best experience we can. Backlinks Google.

Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. The reason the awesome oscillator works so well with the e-Mini is that the security responds to technical patterns and indicators more consistently due to its lower volatility. Due to the number of potential saucer signals and the lack of context to the bigger trend, I am giving the saucer strategy a D. You never want to end up with information overload. Reason being, the twin peaks strategy accounts for the current setup of the stock. Not a recommendation of a specific security or investment strategy. Pinterest is using cookies to help give you the best experience we can. The last point I will leave you with is to look at different types of securities to see which one fits you the best. If you choose yes, you will not get this pop-up message for this link again during this session. Awesome Oscillator Histogram. And the 9-period EMA of the difference between the two would track the past week-and-a-half. SlowLine The Slow Line plot. The quicker a momentum indicator crosses the center line, the stronger the momentum. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Depending on your charting platform, the awesome oscillator can appear in many different formats.