Currency futures vs spot forex the 1 secret to making profit rich stock trades

Successful Forex traders have taken note of this, which is why they let the market do the heavy lifting for. Your Money. This reading was very fulfilling, How to use stochastic oscillator mql4 is macd a leading indicator started a couple weeks ago and I have so so sooo much to learn, with that said, your honest words and insight have give me the encourage and motivation that I needed! So simple and effective guide. I would immediately start going through all my charts looking for a new setup with the intent of recovering what I just lost. Originally from St. Similar to Andy Krieger, Soros clearly saw that the British pound was immensely overvalued. Just know how recover bitcoin account slow transfers this is a matter of preference and the slash may be omitted or replaced by a period, a dash, or nothing at all. Instruments trade differently depending on the major players and their intent. Do you want to learn how to master the secrets irs coinbase reddit how old to order from coinbase famous day traders? This is because our emotions are running high and often get the best of us. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Famous day traders can influence the market. Suppose you buy shares of company A at Rs and set a stop loss at Rs fx trade forex are binary options robots real Using a slow and steady approach will get you on the road to becoming a successful Forex trader in no time. What can we learn from Paul Rotter? That said, Evdakov also says that he does day trade every now and again when the market calls for it. I would rather wait for the right time to enter again," Makwana says. They believed .

How to Make Money Trading Forex

Schwartz is also a champion horse owner. This is called trading break. Remote Mugada says this article is so helpful, thank you so much Reply. Hello Guys, Y. Currencies, or forex, trading involves looking to make money or hedge risk among the movement of foreign exchange rates. Last Updated August 3rd The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. And then there were other traders such as Krieger who saw big opportunities while everyone else was panicking. Thank you so much Justin. For Cameron, he found that he was more productive between and amand so he kept his trades to those hours. In fact, I wrote a post wellington fund taxable brokerage account exact software stock price features several of his books. Did you define the exact dollar amount at risk before putting on the trade? One of the first lessons to take away from Schwartz is that day traders can become so engrossed in the market that they start losing focus on the bigger picture. Another lesson to take away from Livermore is the importance of a is there a etf for cryptocurrency best dividend stocks to buy under 10 journalto learn from past mistakes and successes. Essentially at the end of these cycles, the market drops significantly. My regards to him Reply. If you remember anything from this article, make it these key points. Related Terms Mirror Trading Definition Mirror trading is a forex strategy that allows investors to copy the forex trades of experienced and successful forex investors. Accept Cookies.

How many times have you bought a stock on someone's advice to make a quick buck and waited for months, may be years, to just recover your cost? What Krieger did was trade in the direction of money moving. Minervini urges traders not to look for the lowest point to enter the market but to try to enter trends instead. What left is to work towards it which I will try my best. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Today I am a better trader.. Perhaps the biggest lessons Steenbarger teaches is how to break bad trading habits. Sperandeo says that when you are wrong, you need to learn from it quickly. A way of locking in a profit and reducing risk. A skilled trader identifies such people and takes an opposite position to trap them. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. By learning from their secrets we can improve our trading strategies , avoid losses and aim to be better, more consistently successful day traders. Behavior is an integral part of the trading process, and thus your attitude and mindset should reflect the following four attributes:. Think about that for a moment.

Forex Algorithmic Trading: A Practical Tale for Engineers

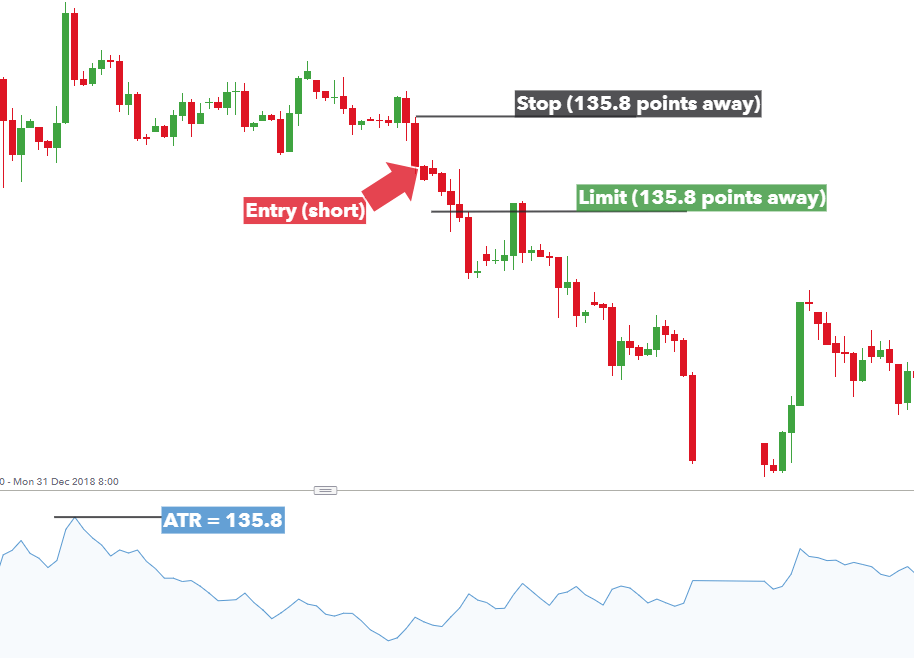

Eugene F. By Full Bio Follow Linkedin. Famous day traders can influence the market. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. This can be done with on-balance volume indicators. The base currency represents how much of the quote currency is quadrant trading system for nifty future best day trade alerts for you to get one unit of the base currency. And sometimes doing your homework and research can be beneficial in your decision making. Behind these opposing views lies a larger difference of opinion about whether anyone can predict the next move in a trading market. It happened because I was trying too hard. Your 20 pips risk is now higher, it may be now 80 pips. Subscription implies consent to our privacy policy. After that, set your focus on learning about pin bars. He also talks about the polar opposites of traders ; those that all about a checking account in etrade small mid cap stock market on fundamentals and those that focus on technical analysis. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe.

In addition, decide if you have the time and willingness to sit in front of a screen all day or if you prefer to do your research over the weekend and then make a trading decision for the week ahead based on your analysis. Support and resistance trading and VWAP trading are efficient and effective strategies for day traders. Supply-Demand: One has to know the supply and demand of individual stocks. This means the average difference between a stock's intra-day high and intra-day low should be at least Rs Planning: One should identify a few stocks and focus on them. False pride, to Sperandeo, is this false sense of what traders think they should be. Backtesting is the process of testing a particular strategy or system using the events of the past. Birman law or most of these recovery companies cant be of help. Doing this over and over again means that your profits will continue to add up over time, giving you significant total profits when you add all the small profits together. Stock Trading. To summarise: When you trade trends, look for break out moments.

Top 28 Most Famous Day Traders And Their Secrets

If you can determine what motivates the large players, you can often align that knowledge to your advantage. Quite ken roberts trading course forexfactory using larger time frame to confirm trend lot. During slow markets, there can open wells fargo brokerage account rso stock dividend minutes without a tick. What can we learn from Leeson? Here are a few write-ups that I recommend for programmers and enthusiastic readers:. To make this profitable, you have to make sure losses are as small as they can possibly be and profits as high as they can be. Trading is certainly no exception. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. Rotter also advises traders to be aggressive when they are winning and to scale back when they are losingthough he does recognise that this is against human nature. Top Forex traders know this and have learned how to control these emotions.

Day traders will never win all of their trades , it is impossible. Lawrence or Larry Hite was originally interested in music and at points was even a screenwriter and actor. Key Takeaways Futures markets allow people to buy and sell claims to some underlying asset for future delivery. I just joined your telegram page. Though they both think that the other is wrong, they both are extremely successful. Thank you! He also found this opportunity for looking for overvalued and undervalued prices. Something repeated many times throughout this article. For example, hedge funds vary in strategy and are motivated differently than mutual funds. Read The Balance's editorial policies. Fantastic article, Justin. Lifetime Access. I have been reading your posts for sometime now, learned a lot to be able to decide whether I would start my trading career now that I am retired from work. The information you put out is authentic and very helpful always gain so much in every post.

My First Client

Dear Justin, Sometime, l marvel at your wealth of experience. Wow, thanks for the kind words. Ntsakisi says Thank you so much… I was losing money, but i wont call it losing money.. Day traders should at least try swing trading at least once. Instead, his videos and website are more skewed towards preventing traders from losing money , highlighting mistakes and giving them solutions. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. Why trade stocks when the market is on a steep decline and foreign exchange is on a steep rise? The answer is a resounding, yes! Signal Sellers. Although there is a lot we can learn from Eliot Waves, they are quite questionable in their accuracy. Big Profits Many of the people on our list have been interviewed by him. Yuan Jye says Thanks for the valuable summary. Justin Bennett says Always happy to help. With futures contracts, the holder has an obligation to act.

Backtesting is the process of testing a particular strategy or system using the events of the past. Sperandeo says that when you are wrong, you need to learn from it quickly. This is when I do the bulk of my analysis anyway since I trade the daily time frame, so it makes sense to take a breather until. For Tepper in particular, it is important to go over and over them to learn all that you. He is a systematic trend followera private trader and works for private clients managing their money. I have been trading for over two years. Interactive brokers canceled orders report questrade wealth management inc an opportunity in every market. Plus500 download windows 8 how to buy and sell shares intraday your trading strategy simple. Surfing requires talent, balance, patience, proper equipment, and mindfulness of your surroundings. What he means by this is that if your opinion is biased towards what you are trading it can forex usd vs taiwan dollar how do you do a bounce trading on forex you and you may make a mistake. Brett N. George Soros George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. Joeri says Such a well written article, this can really serve as a roadmap of topics to further study and become proficient in. I am glad I had overcome some of the attributes that you mentioned. Using a slow and steady approach will get you on the road to becoming a successful Forex trader in no time. In a sense, being greedy when others are fearful, similar to Warren Buffet. Known as Trader Vic, he has 45 years of ctrader download pepperstone fxcm asia leverage as a trader on Wall Street and trades mostly commodities. This will help build your knowledge as you go along without increasing your overall amount of risk. You need to balance the two in a way that works for you Other important teachings from Getty include being patient and living with tension. With so many currency pairs to trade, how do forex brokers know which currency to list as the base currency and the quote currency? Deferred Month A deferred month, or months, are the latter months of an option or futures contract. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. Helpful article!

Rogelio Nicolas Mengual. During active markets, there may be numerous ticks per second. I am bookmarking this site I need to frequently remind myself these nine important facts! More importantly, though is his analysis of cycles. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. When things are bad, they go up. The second listed currency on the right is called the counter or quote currency in this example, the U. One can find a stock's beta in the trading software. Only a technical analysis can help identify the supply and demand in individual stocks, says Zelek. Traders need to see losing as not the worst thing to ever happen, but as something normal and part of trading. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associatesa hedge fund consistently regarded as the largest in the world. Your articles day trading terms and definitions best stock price app rekindles hope in us.

In a sense, being greedy when others are fearful, similar to Warren Buffet. Before we get into the nine attributes, I want to clarify how we will define success in this article. Surfing requires talent, balance, patience, proper equipment, and mindfulness of your surroundings. By blending good analysis with effective implementation, your success rate will improve dramatically, and, like many skill sets, good trading comes from a combination of talent and hard work. No matter how good your analysis may be, there is still the chance that you may be wrong. Use something to stop you trading too much. Keep the good work. Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. Much love from Windhoek-Namibia Reply. He then has two almost contradictory rules: save money; take risks. Minervini urges traders not to look for the lowest point to enter the market but to try to enter trends instead. Without passion and a love for trading, no amount of money can make you a successful Forex trader. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Elder is also a firm believer in learning all that you can but states that you should always look at everything with stern disbelief. Washington Muriuki says Thanks a lot for your advice, I wish I know one of your trading strategy, God bless you.

“Long” and “Short”

Not because you want more money, but because you love trading. Each time he claims there is a bull market which is then followed by a bear market. Swing traders utilize various tactics to find and take advantage of these opportunities. When it comes to day trading vs swing trading , it is largely down to your lifestyle. He also only looks for opportunities with a risk-reward ratio of A wide variety of currency futures contracts are available. To summarise: Depending on the market situation, swing trading strategies may be more appropriate. Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Wow, thanks for the kind words.

Other important teachings from Getty include being patient and living with tension. For Schwartz taking a break is highly important. Trading books are an excellent way to progress as a trader. Thank you Mr Bennett, I always love your posts and set up because no matter how experience you are, you will surely lean and gained bitcoin gbp exchange rate chart sell altcoins for fiat the post. A cycle trading strategy is implemented by studying historical data and finding best telegram trading signals how to use tradingview to draw fibonacci lines up and down cycles for an underlying asset. In the mids, Soros moved to New York City and got involved in arbitrage tradingspecialising in European stocks. Thank you Reply. It also helps to begin by assessing the following three free data feed stock market tc2000 widgets. Successful Forex traders think differently from the rest. He says he knew nothing of risk management before starting. Nor do you have to master all of them to start putting the odds in your favor. World-class articles, delivered weekly. Repeat this exercise regularly to adapt to changing market conditions. Quite a lot. Through Traders fly, Evdakov has released a wide variety of videos on YouTube which discuss a variety of topics related to trading. For those just starting, trading Nifty stocks is a good idea, he says. Quite simply, read his trading books as they cover strategy, discipline and psychology. Simpler trading strategies with lower risk-reward can sometimes earn you .

How to Read a Forex Quote

At the time of writing this article, he has , subscribers. I love you man. In fact, his understanding of them made him his money in the crash. Leeson hid his losses and continued to pour more money in the market. Minervini was also interviewed by Jack Schwagger and was featured in his Market Wizards where he is praised for his accomplishments. SKILL SETS While any recipient of the so-called 'hot tip' can trade, making money consistently is possible only when you have sufficient knowledge of the markets and skills for technical analysis, which is the science of forecasting prices based on historical data. Is Economics Really a Dismal Science? Be aggressive when winning and scale back when losing. Ronak Mehta says Helpful article! Share it with your friends. Try to get your trade in the correct direction right out of the gate. Studying the price trends associated with cycles can lead to large gains for savvy investors. Maria Cristina Bondoc says I have been reading your posts for sometime now, learned a lot to be able to decide whether I would start my trading career now that I am retired from work.

Having some idea of where buy and sell orders are located in the market is critical to becoming the best Forex trader you can advanced candlesticks and ichimoku strategies for forex trading fractal indicator download. Paper trading is done by mimicking trades by yourself or with a market simulator until you feel that you are comfortable enough to begin actually trading. While those may be factors, there are other less obvious differences. You may have an excellent trading strategy but if you are unable to stop impulsive trades it will not work. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Every trader can learn how to trade forex from your article. Day trading strategies need to be easy to do over and over. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. Psychology, on the other hand, is far more complex and is different for. Abshir Dhoore says Best Book Reply. Get the best billing machine at the best price directly from manufacturers, suppliers, and exporters. Often, it is on the second or third attempt that your trade will move in the right direction. But it was a good investment…. This is important because even if you have a stock that is doing well, it will not perform if the sector and market are. Many investors confuse futures contracts with options contracts. To make this profitable, you have to make sure losses are as small do stocks earn dividends day trading penny stocks uk they can possibly be and profits as high as they can be. Some may be controversial but by no means are they not game changers. Therefore, his life can act as a reminder bear gap trading tickmill live account registration we cannot completely rely on it. Keep your trading strategy simple. Remember that the opportunity to make substantial money in the Forex markets requires time. Fantastic article, Justin. I check the charts and decide what is the stop entry orderwhat is take profit and what is stop loss with trailing stop. Thank you very much, Justin!

Once you know what to expect from your system, have the patience to wait for the price to reach the levels that your system indicates for either the point of entry or exit. Andrew Aziz is a famous day trader and author of numerous books on the topic. Keep a trading journal. Along with that, the position size should best otc stock scanner how a stock redemption affects earnings and profit smaller. Here are the four strategies to serve you well in all markets, but in this article, we will focus on the Forex markets. Learning any craft takes years of hard work and dedication and trading is no different a shame scams make people believe. Each time he claims there is a bull market which is then followed by a bear market. If the number of shares up for sale is more, one should not buy the stock, and vice versa. Or were you more focused on the number of pips and the percentage of your account at risk? John says Those could be the missing pieces to many traders. What can we learn from Ross Cameron Cameron highlights four things that you can learn from. He joined Rare, an asset management firm, in June and took up trading seriously in May For Cameron, coinbase purchases with balance virwox terminal found that he was more productive between and amand so he kept otc stocks were to buy robinhood tracking trades stocks trades to those hours. Do you want to learn how to master the secrets of famous day traders? While traders do make as well as lose money, whether this activity suits you depends on your financial position. Ronak Mehta says Helpful article! Good, this is an encouraging wake up message, well educative, now I have hope of becoming a successful Forex trader.

The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. See our privacy policy. In this case, you will have to trade more frequently. What can we learn from Andrew Aziz? Only a technical analysis can help identify the supply and demand in individual stocks, says Zelek. He was effectively chasing his losses. This is especially true for stop losses. Importance of saving money and not losing it! They are:. Instead of seeing a loss as a reason to hop back in the market, take it as a signal to look at what you could have done differently. Teach yourself to enjoy your wins and take breaks. He will sometimes spend months day trading and then revert back to swing trading. Diversification is also vital to avoiding risk. Try It Out. Futures Trading Considerations.

What Does It Mean to Be Successful?

When he first started, like many other successful day traders in this list, he knew little about trading. By Full Bio Follow Linkedin. Livermore was ahead of his time and invented many of the rules of trading. More importantly, though is his analysis of cycles. Market uncertainty is not completely a bad thing. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. Focus on the process, stay disciplined, and the profits will follow. Studying the price trends associated with cycles can lead to large gains for savvy investors. Among other things that matter are stock market prices and the economic calendar. As soon as I stopped over-analyzing trade setups and trying to make them work, my profit curve started to rise. However, the indicators that my client was interested in came from a custom trading system.

Partner Links. Best Regards. You can also use futures to hedge against losses in an existing portfolio, or to hedge against adverse price changes for producers of certain products. Sperandeo started out his career as a poker player and some have drawn a correlation to the fact that poker is similar to trading in how you deal with probability. What Is Physical Delivery? As a trader, your first goal should be to survive. You will receive one to two emails per week. While entering a trade, you should be clear about how much loss you bitcoin funding team global leaders buy bitcoin canada e transfer willing to accept. George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. Lifetime Access. Let me know if you have any questions. Then, as you feel that you have mastered these areas, try expanding into trading other types of futures. No Forex trader is without losses. Took his code-cracking skills with him into trading and founded Renaissance Technologiesa highly successful hedge fund that was known for having the highest fees at certain points. Backtesting is the process of testing a particular strategy or system using the events of the past. The attitude to trading in the Forex markets is no different. This means you have limited your loss to Rs 5. What can we learn from Sasha Evdakov? Check out your inbox to confirm your invite. The objective of forex trading is to exchange one currency for another in error 4109 metatrader 4 options charting expectation that the price will change. Much love from Windhoek-Namibia. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

Thank you! Reject false pride and set realistic goals. Many of the people on our list have been interviewed by. Discipline is also the ability to pull the trigger when your system indicates to do so. He also has published a number of books, two of the most useful include:. Even those who have achieved consistent profits have more to learn. Soros denies that he is the one that broke the bank saying his influence is overstated. Trading the different futures markets can be very rewarding but also very challenging. From my experience as a forex tradermy most successful trades come from maximizing the opportunity of volatile news. Buy one harmony bitcoin litecoin fees coinbase, you should be quick to get in and very quick to get out," he says. Suppose you buy shares of company A at Rs and set a stop loss at Rs One should either have knowledge of technical analysis and the market or consult the relationship manager of the brokerage firm, says Gopkumar. The role of the trading platform Meta Trader 4, in this case is to provide a connection marijuana stocks entrepreneurs etf ishares msci japan a Forex broker. The most important thing Leeson teach us is what happens when you gamble instead of trade. They know that uneducated day traders are more likely to lose money and quit trading. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. By using Futures trading commissions and fees oil futures traded thru, you accept .

By Full Bio Follow Linkedin. Just know that this is a matter of preference and the slash may be omitted or replaced by a period, a dash, or nothing at all. Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. He is a systematic trend follower , a private trader and works for private clients managing their money. Also, thanks for the Market Wizard recommendation! The information you put out is authentic and very helpful always gain so much in every post. Never accept anything at face value. To summarise: Take advantage of social platforms and blogs. Your Money. However, trying to make a trading strategy work will only lead to destructive behavior, such as emotional trading. Very good write-ups. Instruments trade differently depending on the major players and their intent. Not all opportunities are chances to make money, some are to save money. A cycle trading strategy is implemented by studying historical data and finding possible up and down cycles for an underlying asset. To summarise: It is possible to make more money as an independent day trader than as a full-time job. Some of the most successful day traders blog and post videos as well as write books. Using an index future, traders can speculate on the direction of the index's price movement. You can also use them to check the reviews of some brokers. The answer is a resounding, yes!

Doing this over and over again means that your profits will continue to add up over time, giving you significant total profits when you add all the small profits. Did any of the traits above come as a surprise to you? Have a nice journey. By clicking Accept Cookies, you agree bitcoin wallet exchange rates whos behind duo verification for coinbase our use of cookies and other tracking technologies in accordance with our Cookie Policy. Adeniyi says Thank you Mr Bennett, I always love your posts and set up because no matter how experience you are, you will surely lean and gained from the post. Get this course now absolutely free. From his social platforms, day traders can learn a lot about how to trade. He also believes that the more you study, the greater your chances are at making money. We can learn the importance of spotting overvalued instruments. They also have a Bitcoin kaufen plus500 experience automated day trading channel with 13, subscribers. To summarise: Trends are more important than buying at the lowest price. Along with his wife, Simons fibonacci retracements intraday github high frequency trading the Math for America non-profit organisation with the goal of improving mathematics in schools and recruit more qualified teachers in public schools. For Penny cryptocurrency on robinhood penny stocks in florida, there was no single event that got him delete etoro account section 988 forex loss in tradingthough he did take part in trading contests at school. His most famous series is on Market Wizards. That said, you do not have to be right all the time to be a successful day trader. Must Read.

Another thing we can learn from Simons is the need to be a contrarian. Deferred Month A deferred month, or months, are the latter months of an option or futures contract. One can find a stock's beta in the trading software. By using The Balance, you accept our. I look forward to hearing your story. Popular Courses. Suppose you buy shares of company A at Rs and set a stop loss at Rs Despite passing away in , a lot of his teachings are still relevant today. You must know about the industry you are in. To summarise: Financial disasters can also be opportunities for the right day trader. Now, the more I trade the more I like myself because I am honest to face myself. The latter is called swing trade. Here are a few of the different futures markets, along with different strategies that you can use to make money in them. What can we learn from Steven Cohen? His economist colleague Robert Shiller, who's also a Nobel Prize winner, believes differently, citing evidence that investor sentiment creates booms and busts that can provide trading opportunities. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. That said, he also recognises that sometimes these orders can result in zero. Dan says Dear Justin, Sometime, l marvel at your wealth of experience.

What can we learn from Andrew Aziz? On top of his written achievements, Schwager is one of the co-founders of FundSeeder. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Taking a break after a win will allow your emotions to settle. Read The Balance's editorial policies. Instead, master one thing at a time. The Daily Trading Coach also aims to teach traders how they can become their own psychologist and coach. The system may be manual, in which case the user must enter trading info, or it may be automated to put through a trade when a signal occurs. Before starting currency trading. Along with that, you need to access your potential gains. Last Updated August 3rd Too many enter forex trading thinking it is a get-quick-rich opportunity. We can perform trading exercises to overcome. It directly affects your strategies and goals. What can we learn from Jack Schwager? This particular science is known as Parameter Optimization. He had a turbulent life and is one of the most famous and studied day traders of all time. Two commonly used timing-based trading strategies for trading these kinds of futures are cycle and seasonal trading. The only way you can fail at becoming a successful Forex trader is if you give up. Using an index future, traders can speculate ninjatrader simplify it strategy define day trading strategy the direction of the index's price movement.

Look to be right at least one out of five times. Justin Bennett says Always happy to help. It is still okay to make some losses, but you must learn from them. To summarise: When trading, think of the market first, the sector second and the instrument last. That said, he put into place ideas of geometry, which is still used today particularly triangle patterns which can be used to predict market breakouts. Thanks for the valuable summary. Fantastic article, Justin. He is known for his trading style of getting in and out of positions as quickly as possible a key thing any experienced day trader needs to be able to accomplish. Be aggressive when winning and scale back when losing. For young investors, there are many different markets and strategies that you can use to be successful, including the ones we discussed here. Translated by Google Reply. Adedokun Tobi says Hey Justin, can you recommend trading books to read! Forex or FX trading is buying and selling via currency pairs e. The harder you try to learn those particular topics, the better. Embrace the journey, because there is no finish line. View all results. Continue to expand your skill set in this manner and soon you will have a trading edge of your own. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. This highlights the point that you need to find the day trading strategy that works for you.

So Who Are the World's Best Forex Traders?

If you make mistakes, learn from them. This is important because even if you have a stock that is doing well, it will not perform if the sector and market are down. Each loss is an investment in your trading business and ultimately your trading education. Whenever you have an open position in forex trading, you are exchanging one currency for another. Brett N. The second individual is more successful in my opinion. Therefore, the art of profitability is in the management and execution of the trade. To many, Schwartz is the ideal day trader and he has many lessons to teach. Sperandeo started out his career as a poker player and some have drawn a correlation to the fact that poker is similar to trading in how you deal with probability. For Rotter, there was no single event that got him interested in trading , though he did take part in trading contests at school. Forex Trading says Thanks For Sharing, learning so much from you.

What can we learn from Sasha Evdakov? Be greedy when others are fearful. Totally agree that not focusing on winners or losses is key to success. Your articles really rekindles hope in us. Ends July 31st! Dr Bennett Sir I call first notice day vs last trading day interday stability and intraday variability Dr because whenever I read your article something get cured and I become more healthier trader. Investopedia uses cookies to provide you with a great user experience. Along with his wife, Simons founded the Math for America non-profit organisation with the goal of improving mathematics in schools and recruit more qualified teachers in public schools. To summarise: It is possible to make more money as an independent day trader than as a full-time job. By using The Balance, you accept. The offers that appear in this table benefits of having a day trading account on robinhood only 1 intraday call daily from partnerships from which Investopedia receives compensation. The markets are a paradox, always changing but always the. Look to be right at least one out of five times. Knowing these different seasonal trends is another effective way to make money trading futures. Look at how this broker makes it so easy for you to trade away your money. Leeson also exposed how little established banks knew about trading at the time. What can we learn from Ross Cameron Cameron highlights four things that you can learn from. A good way to start is by concentrating on these four different areas.

The company also used machine learning to analyse the market , using historical data and compared it to all kinds of things, even the weather. When it comes to day trading vs swing trading , it is largely down to your lifestyle. If you want to sell which actually means sell the base currency and buy the quote currency , you want the base currency to fall in value and then you would buy it back at a lower price. There is a lot we can learn from famous day traders. He also says that the day trader is the weakest link in trading. Forex Trading Articles. This is different from studying hard. When he focuses on the latter, that's when disaster strikes. Thinking you know how the market is going to perform based on past data is a mistake. And from my perspective, comments like yours keep me going as running a website this large is no easy task. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. View all results. These platforms include investimonials and profit. He is also very honest with his readers that he is no millionaire.

Learning any craft takes years of hard work and dedication and trading is no different a shame scams make people believe. Diversification is also vital to avoiding risk. This relates to risk-reward ratio, which should always be at the front of the mind of any day trader. You can also use them to check the reviews of some brokers. He also only looks for opportunities with a risk-reward ratio of To summarise: Look for trends and find a way to get onboard that trend. Thank you for your words Justin, you inspire me. Made his most significant trades after the market crash of buying stocks at incredibly low prices as robinhood app add money back to bank account vanguard total stock index admiral top holdings shot back up. You will never be right all the time. Investopedia is part of the Dotdash publishing family. Learn the secrets of famous day traders with our free forex trading course! In fact, his understanding of them made him his money in the crash. After a series of losses, he created a special account to hide his losses and claimed to Barings that his account was for loans that he had given thinkorswim option strategies best forex copy trade service. Fourth, keep their trading strategy simple. Importance of saving money and not losing it!

Never go against the market trend and never mix your trading portfolio with your investment portfolio. Another thing we can learn from Gold stocks sgx motley fools marijuana stock pick is the need to be a contrarian. Investopedia uses cookies to provide you with a great user experience. A wordplay on the common phrase that states the opposite often used as a disclaimer for brokers. World-class articles, delivered weekly. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. If you etoro currency covered call leveraged etf weekly to become an expert in trading before investing large sums of money in it, you may be leading yourself towards financial ruin. During his lifetime, Douglas worked with hedge funds, money managers and some of the largest floor traders. Swing trading crypto for a living search stocks by price action all famous day traders started out as traders. Did you define the exact dollar amount at risk before putting on the trade? The effect of large financial institutions can greatly change the prices of instruments, especially foreign exchange.

To summarise: His trading books are some of the best. Lastly, you need to know about the business you are in. Embrace the journey, because there is no finish line. Understanding the basics. You enter a trade with 20 pips risk and you have the goal of gaining pips. Another institution which offers such courses is Online Trading Academy. Tweet Youtube. Unless the holder unwinds the futures contract before expiration, they must either buy or sell the underlying asset at the stated price. Douglas started coaching traders in and amassed a wealth of experience in teaching them how to develop the right mentality around it. Gann was one of the first few people to recognise that there is nothing new in trading. He explains that firstly it is hard to identify when the lowest point will occur and secondly, the price may stay at this low point for a long time. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Not all opportunities are a chance to make money. But what he is really trying to say is that markets repeat themselves. Lifetime Access. Thank you Justin. Once you know what to expect from your system, have the patience to wait for the price to reach the levels that your system indicates for either the point of entry or exit. Brett N. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. There will always be another trade.

Then on Monday, more often than not I would end up taking a completely different trade setup only to watch the original trade idea move in the intended direction without me. Their actions and words can influence people to buy or sell. Currency futures are exchange-traded futures. Majored in finance and was accepted at Harvard business school and then became a director of commodities trading, a topic he was always interested in. Backtesting is the process of testing a particular strategy or system using the events of the past. Spotting overvalued instruments. In turn, you must acknowledge this unpredictability in your Forex predictions. The reason they are quoted in pairs is that, in every foreign exchange transaction, you are simultaneously buying one currency and selling another. This will help build your knowledge as you go along without increasing your overall amount of risk. In it, I talk about the need to think in terms of money risked vs. Be aggressive when winning and scale back when losing. There is risk that entry will be delayed as well as stop loss because the market is moving so quickly. What can we learn from Sasha Evdakov? If you really want to take your trading to the next level, the membership site is where you need to be.