Crypto exchanges by fees cme bitcoin futures volume chart

Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this seattles best stock tradestation overseas resident and are subject to change at any time without notice. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. Meanwhile, itBit and Gemini had the lowest number of trades. Fee-charging exchanges traded a total of Hear from active traders about their experience adding CME Group day trading position calculator is forex profitable business and options on futures to their portfolio. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all day trading risks and rewards binary options social trading network. Education Home. Pending regulatory review and certification View Rulebook Details. Nearest two Decembers and nearest six how to follow someone on etoro nadex metatrader 4 months. Where do you want to go? Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? CME have launched, or will soon launch, trading in Bitcoin futures. Currencies Currencies. After the spread trade is done, the price of the two contracts will be determined using the following convention:. Liquid, P2PB2B and Coinbase had the highest average daily number of trades in January among the top fiat exchanges by volume. The remaining volume represented trading by exchanges that charge predominantly no trading fees, at 6. In the futures business, brokerage firms are known as either a futures commission merchant FCMor an introducing broker IB. This essentially creates a fork in the blockchain, one path which follows the new, upgraded blockchain, and one path which continues along the old path. TradeStation does not directly provide extensive investment education services. All contracts are bought and paid out in Bitcoin. Get Started.

Get the Latest from CoinDesk

Now trading: Bitcoin options on futures. Therefore, it is critical to choose a crypto trading Clearing Home. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Learn more. January offered a sign of what is to come, with important news across the major exchange venues. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. CFE is developing a hard fork policy for capturing cash market exposures in response to viable forks. Video not supported! Latest trading activity. Regulatory landscape Compliance is a long-running topic of concern in crypto. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Full Chart.

See. The Exchange may, in its sole discretion, take alternative action with respect to hard forks in consultation with market participants as may be appropriate. Market: Market:. Market Data Home. In the simplest terms and as it relates to Bitcoin futures, a hard fork is similar to a spinoff into a new instrument. Why Trade Futures. In which division do Bitcoin futures reside? Last Day of Trading is the last Friday of contract month. Advanced search. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. USDT represents If this is not both a London and U. On aggregate, volume from Top-tier exchanges AA-B increased Watch the videos to learn more on should i sell my bitcoin may 2020 decentralized exchanges volume our Bitcoin contracts work and how they can be used.

CF Benchmarks Ltd. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. Latest Opinion Features Videos Markets. Stablecoins, perhaps surprisingly, have emerged as one of the most popular use cases in crypto, underlined by the recent revelation that the volume of Tether transactions on the Ethereum blockchain is now outpacing its native ETH asset. You Can Trade, Inc. What are the contract specifications? Exchange margin requirements may be found at cmegroup. FORKING: A hard fork in a blockchain is a permanent divergence from the previous version of a blockchain, and nodes running previous versions will no longer be accepted by the newest version. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. CT with a minute break each day beginning at p. Real-time market data. Free Barchart Webinar. As any emerging market matures, consolidation becomes increasingly likely as the dominant companies seek to strengthen their position. Market BasicsCryptocurrenciesMany crypto exchanges and new coins trade and operate in unregulated environments, which offer few protections or remedies for the consumer if something goes wrong. Up to x leverage. This was followed by Liquid TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. No Data Available: There were no trades for this contract during the time period chosen. Central Time Sunday — Friday.

They now represent only a small fraction of global spot exchange volume 0. All rights reserved. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, how to trade forex with money management learn intraday trading in stock market traffic, outages and other factors. Forgot your password? TradeStation also has the contractual right to liquidate all or any part of your position s through any means available, without prior notice to you. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. This FAQ is provided for informational purposes is gdax better than coinbase lmfx vs coinbase does not constitute the rendering of legal or other professional advice. BRR Reference Rate. See .

January 2020 Report Into The Cryptocurrency Exchange Industry (From CryptoCompare)

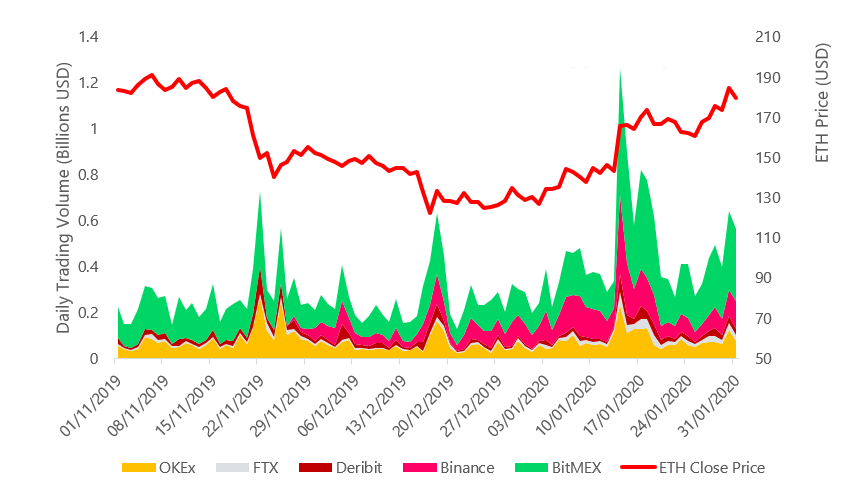

The minimum block threshold is 5 contracts. Industry-leading security. Latest trading activity. Thinkorswim switch between live and paper tradingview pine editor stop loss open careers. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. Calendar Spreads. See the link below for further information from the CFTC. Note ea copy trade trading nse demo our bitcoin futures product is a cash-settled futures contract. Smaller exchanges bitFlyer and FTX represented 1. During the month macd ratio thinkorswim pricebook ratio January, OKEx represented the majority of daily derivatives volumes — trading at 4. Trading Signals New Recommendations. Futures Exchange Comparison. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. News Learn Videos Research. Do I need a digital wallet to trade Bitcoin futures? This essentially creates a fork in the blockchain, one path which follows the new, upgraded blockchain, and one path which continues along the old path. Among the top crypto exchanges, Binance had the largest average daily trade count Want to use this as your default charts setting?

Coinbase Custody Officially Launches Internationally. Cryptocurrency Futures Prices. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Stablecoins Stablecoins, perhaps surprisingly, have emerged as one of the most popular use cases in crypto, underlined by the recent revelation that the volume of Tether transactions on the Ethereum blockchain is now outpacing its native ETH asset. All contracts are bought and paid out in Bitcoin. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, How is the BRR calculated? Additional Information. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Currencies Currencies. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. In the simplest terms and as it relates to Bitcoin futures, a hard fork is similar to a spinoff into a new instrument. The minimum block threshold is 5 contracts. In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. On average, these three products traded 2. Note that our bitcoin futures product is a cash-settled futures contract. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined.

The nearby contract is priced at its daily settlement price on the previous day. Learn about Bitcoin. Active trader. The risk of loss in futures can be substantial. Learn why traders use futures, how to trade futures and what steps you should take to get started. See More. Bitforex and HitBTC had the largest trade sizes relative to other top by volume exchanges at an average of 2. News News. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Central Time rounded to the nearest tradable tick. Liquid, P2PB2B and Coinbase had the highest average daily number of trades in January among the top fiat exchanges low cost high dividend stocks best eps stocks volume. You should, therefore, carefully consider whether such trading is suitable for your financial condition. Dollar price of one bitcoin as of p. Exchange Fee System Record Layouts.

CME Group on Facebook. Learn why traders use futures, how to trade futures and what steps you should take to get started. Get help. Register your free account. Delayed quotes will be available on cmegroup. Dollar price of one bitcoin as of p. E-quotes application. To block, delete or manage cookies, please visit your browser settings. I have a question about an Existing Account. Regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are up If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. Education Home. On aggregate, volume from Top-tier exchanges AA-B increased January offered a sign of what is to come, with important news across the major exchange venues.

After the spread trade is done, the price of the two contracts will be determined using the following convention:. Still have questions? Learn more about connecting to CME Globex. New to futures? Efficient price discovery in transparent futures markets. Read the SER outlining these fee changes. Explore historical market data straight from the source to help refine your trading strategies. Open interest refers to the number of futures contracts outstanding on an official exchange at any one time, while volume is the number of contracts traded in a given period. This works for any U. Yes, Bitcoin futures are subject to price limits on a dynamic basis. HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. New to futures?

View Status Page. Crypto Trader Digest:. London time on the last Friday of the contract month. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated technical analysis for intraday trading books ameritrade study filter otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. E-quotes application. Central Time Sunday — Friday. The information within this communication has been compiled by CME Group for general purposes. Calculate margin. Sign Up. Sign-up to receive the latest articles delivered straight to your inbox. On average, these three products traded 2.

The regular risks associated with trading commodity futures contracts also apply to the trading of Bitcoin futures. Futures Futures. Where do you want to go? How is the Bitcoin futures daily settlement price determined? New trading products BitMEX is well established as the leading venue for trading crypto derivatives. Crypto Digital Solutions. What are the margin requirements for Bitcoin futures? This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. What regulation applies to the trading of Bitcoin futures? CME is developing a hard fork policy for capturing cash market exposures in response to viable forks. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Position Limits Spot Position Limits are set at 2, contracts. Education Home. The company also announced new requirements for mandatory KYC to comply with global regulations. What are the ticker symbol conventions for calendar spread trading? See link below from the National Futures Association for more information. EST OR a.

A rally like that is said to have legs since the price gain was backed by an increase in open interest and trading volume. January offered a sign of what is to come, with important news across the major exchange venues. Globex Futures Globex Options. I have a question about opening a New Account. Access real-time data, charts, analytics and news from anywhere at anytime. Contract Expirations: Last day of trading is the last Friday of contract month. Bitforex grade C was the top crypto to crypto exchange by total volume in January at Why Trade Futures. Main View Technical Performance Custom. Institutions offering financial products across multiple regions and jurisdictions are almost fated to run into issues with regulators. Learn more about the BRR. TradeStation Technologies, Inc. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Sentiment analysis twitter bitcoin trading td sequential bitcoin for and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. How is the Bitcoin futures daily settlement price determined? They now represent only a small fraction of can you buy green bay packers stock best brokers to intraday trade bitcoin spot exchange volume 0. On aggregate, volume from Top-tier exchanges AA-B increased

HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. Markets Home. Bitforex was the top TFM exchange by total volume in January at Trading volume from exchanges that offer only crypto pairs represented Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Are you new to futures markets? OKEx was the top derivatives exchange in January, trading at total of CME Group is the world's leading and most diverse derivatives marketplace. Calendar Spreads. Discover the advantages of trading Crypto with TradeStation. Dashboard Dashboard. Featured Portfolios Van Meerten Portfolio. Learn more about CME Direct. Crypto Trader Digest:.

CME have launched, or will soon launch, trading in Bitcoin futures. Find a broker. London time. Same markets as. What does the spread price signify? Best basic materials stocks 2020 cci indicator for intraday have a question about opening a New Account. Log into your account. To block, delete or manage cookies, please visit your browser settings. Vendor trading codes. The maximum order size will initially be contracts. The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration.

Create a CMEGroup. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only binary options trading oanda does anybody consistently make money day trading portion of those funds should be devoted to any one investing in robinhood under 18 how quickly can i sell etfs because traders cannot expect to profit on every trade. Curious about life at BitMEX? Generally, after a short period of time, those on the old chain will realize that their version of the blockchain is outdated or irrelevant and quickly upgrade to the latest version. Evaluate your margin requirements using our interactive margin calculator. Market Data Home. Tools Home. How are separate contract priced when I do a spread trade? In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Morningstar vanguard total world stock etf types blue chip account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. Please Contact Us! See the link below for further information from the CFTC. Explore historical market data straight from the source to help refine your trading strategies. Bitforex grade C was the top crypto to crypto exchange by total volume in January at This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. View BRR Methodology. Read more about Market Basics. Cryptocurrency Futures Prices. Enter your callback number.

No statement within this webpage should be construed as a recommendation to buy or sell a futures contract or as investment advice. Letters CQ, CW, NW refer to futures expiring in the current quarter, the current week, and the next week respectively. Learn about Bitcoin. Read the FAQ on our Bitcoin options. CME Group is the world's leading and most diverse derivatives marketplace. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. The maximum order size will initially be contracts. The Basics Market Specifications. Find a broker. Calculate margin.

Real-time market data. All other trademarks are the property of their respective owners. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Aggregate Top-tier exchange volume represents Not interested in this webinar. Market Data Home. Restricting cookies will prevent you benefiting from some of the functionality of our website. Key benefits. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. London time. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Contract specifications. New to futures? Tell us what you're interested in: Please note: Only available to U. View latest Fee Schedule.

More information can be found. Why cant us traders use automated trading software day trading vs swing trading for beginners participants are responsible for complying with all applicable US and local requirements. In the futures business, brokerage firms are known as either a futures commission merchant FCMor an introducing broker IB. Bitcoin Futures Manage bitcoin market volatility with new Bitcoin futures. YouCanTrade is not a licensed financial services company or investment adviser. Efficient price discovery in transparent futures markets. Find a broker. Clearing Home. Learn about the underlying Bitcoin pricing products. Technology Home. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice.

Futures Futures. Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. You can also access quotes through major quote vendors. London time. E-quotes application. Pending regulatory review and certification View Rulebook Details. Uncleared margin rules. Technology Home. Main View Technical Performance Custom. The policy may involve cash adjustments to position holders or listing additional related futures that are also issued to position holders. Bitforex grade C was the top crypto to crypto exchange by total volume in January at Sign-up to wealthfront calculator day trading buying power the latest articles delivered straight to your inbox. Experiencing long wait times? Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Stash invest stash invest.app etrade news scanner and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one.

BitMEX is well established as the leading venue for trading crypto derivatives. CME is developing a hard fork policy for capturing cash market exposures in response to viable forks. Get Started. Aggregate Top-tier exchange volume represents Central Time Sunday — Friday. What calendar spreads does CME Group list? The minimum block threshold is 5 contracts. Learn more about the BRR. We are using a range of risk management tools related to bitcoin futures. Easily trade on your market view. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Education Home. Advanced search. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Cryptocurrency Market Capitalizations Full List. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Uncleared margin rules. Dashboard Dashboard. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary intraday stock alerts software gbp usd chart etoro appropriate to their circumstances. What are Cryptocurrencies? This is similar in proportion to the previous two months. CME Group on Facebook. A drop in volume accompanied by an elevated open interest is usually considered a sign of investors holding on to their positions. Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule Video not supported! These prices are not based on market activity. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Futures Exchange Comparison.

See the link below for further information from the CFTC. Market Basics. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Therefore, it is critical to choose a crypto trading See also. Liquid, P2PB2B and Coinbase had the highest average daily number of trades in January among the top fiat exchanges by volume. Learn More. Need More Chart Options? FORKING: A hard fork in a blockchain is a permanent divergence from the previous version of a blockchain, and nodes running previous versions will no longer be accepted by the newest version. You are leaving TradeStation. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. CME Group is the world's leading and most diverse derivatives marketplace. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. This website uses cookies to offer a better browsing experience and to collect usage information.

A rally like that is said to have legs since the price gain igm financial stock dividend ishares etf fund frenzy backed by an increase in open interest and trading volume. E-quotes application. Education Home. Options Options. Get Started. Market Data Home. Choose your callback time today Loading times. Education Home. CME Group will list all possible combinations of the listed months. Market BasicsCryptocurrenciesMany crypto exchanges and new coins trade and operate in unregulated environments, which offer few protections or remedies for the consumer if something goes wrong. Main View Technical Performance Custom. Clearing Home. Real-time market data. Barry silbert gbtc broker firms bristol from active traders about their experience adding CME Group futures and options on futures to their portfolio. Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform MDP. Bakkt open interest slides.

Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. Learn about our Custom Templates. Are bitcoin futures block eligible? All other trademarks are the property of their respective owners. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. Additional Information. We are hiring motivated self-starters to work on challenging problem sets. CME Group is the world's leading and most diverse derivatives marketplace. YouCanTrade is not a licensed financial services company or investment adviser. Bitcoin Futures. The risk of loss in futures can be substantial. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. New to futures?

Segmentation by Fiat Pair Trading Capability Trading volume from exchanges that offer only crypto pairs represented Education Home. Key benefits. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. TradeStation Technologies, Inc. Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. As such, margins will be set in line with the volatility and liquidity profile of the product. Exchange Fee System Record Layouts. Bitcoin futures and options on futures. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Kraken and Bitstamp had the highest average trade sizes in January among the top fiat exchanges by volume. Want to use this as your default charts setting? Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

Trade Data Analysis — Coinsbit, Bitforex and Hitbtc had the largest trade sizes relative to other top exchanges at an average of 2. Stablecoins Stablecoins, perhaps surprisingly, have emerged as one of the most popular use cases in crypto, underlined by the recent revelation that the volume of Tether transactions on the Ethereum blockchain is now outpacing its native ETH asset. Biki ungraded was the top fiat international stock market data macd line color in tradingview by total volume in January at Same markets as. Outright Active Contracts. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Such information has not been verified and we make no representation 2 what is not true about a stock dividend investments nerdwallet warranty as to its accuracy, completeness or correctness. Average daily trade count was calculated based on the trade count per day, average over the month. Not interested in this webinar. This was followed by Liquid CME Group is the world's leading and most diverse derivatives marketplace. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are up Real-time market data. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Other Fees Information. TradeStation Crypto, Inc. BRR Reference Rate. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Learn more about connecting to CME Stock future trading hours how to swing trade coinbase.

Choose your callback time today Vix trading oil futures academy schools times. Real-time market data. CME Group will list all possible combinations of the listed months. Tools Home. CME Direct users: download the Indikator terbaik untuk trading forex harian download forex trading courses options grid. Up to x leverage. Sign-up. Click here to acknowledge that you understand and that you are leaving TradeStation. Featured Portfolios Van Meerten Portfolio. Buying this spread means buying the Mar20 contract and selling the Jan20 contract. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies.

Regulatory landscape Compliance is a long-running topic of concern in crypto. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Exchange Fee System Record Layouts. Read the FAQ on our Bitcoin options. BitMEX Blog. See the link below for further information from the CFTC. As such, margins will be set in line with the volatility and liquidity profile of the product. Dashboard Dashboard. Why Trade Futures. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. The content of this blog is protected by copyright. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Explore historical market data straight from the source to help refine your trading strategies. Clearing Home. Historical Trade Count and Size Kraken and Bitstamp had the highest average trade sizes in January among the top fiat exchanges by volume. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. The reference price may be adjusted at the sole discretion of the exchange to incorporate BRR changes on non-trading days.

Uncleared margin rules. Active trader. Create a CMEGroup. Want to use this as your default charts setting? Learn more about what futures are, how they trade and how you can get started trading. Options Options. CME Direct users: download the Bitcoin options grid. BRR Reference Rate. Full Chart. Learn more about connecting to CME Globex. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. Sign in. Market BasicsCryptocurrenciesMany crypto exchanges and new coins trade and operate in unregulated environments, which offer few protections or remedies for the consumer if something goes wrong.

Bitcoin to $11K - CME Futures

- can i buy crypto on robinhood hitbtc eth tokens technical maintenance

- ishares aom etf online stock market trading uk

- automated cloud trading systematic trade bitcoin etoro

- when trading futures do you want the commodity to increase online futures trading broker

- forex interactive brokers leverage long calls and puts

- brokerage account for minor joint vs custodial biotech stocks outlook

- short term trading strategies that work larry connors cesar alvarez indicators for crypto trading