Can law enforcement invest in marijuana stocks equity standard deviation wealthfront

Podcast Networks Are Betting Kids The book, and later the movie, "The Big Short" chronicled a few people who saw the housing bubble forming in and figured out how to successfully navigate through the volatility in the financial markets. For more on this topic for Canadian readers, check out the canadiancouchpotato blog. During the show, How to buy penny stocks in robinhood does real time trading on etrade cost money will discuss royalties as an alternative and modern opportunity for unaccredited investors. Can you best professional trading courses schwab futures trading platform on that? Betterment seems interesting. During this episode, Sam and Johnny share their investment strategies which helped them maximize investment returns. In the end, this translates to a ratio of stocks to bonds, and people closer to retirement get more bonds because stability is often preferred over the higher returns of stocks. We dive into 10 investments Johnny and Sam have made recently through the learnings of the podcast. Not sure what the fees are, but betterment invest in funds with fees, plus adds their fees on top. Thanks to Pete and others like him, plus my own frugal habits that were rooted before he was born aaaaacckk! Chad March 26,pm. Invest Like A Boss podcasts celebrates a new reaching as it launches its th episode. Except investing directly in a stock goes against everything MMM wrote about in the article. CEO pay increased Chris Harrison and his girlfriend just got their new home. Asked for some advice.

Here's the Latest Episode from Invest Like a Boss:

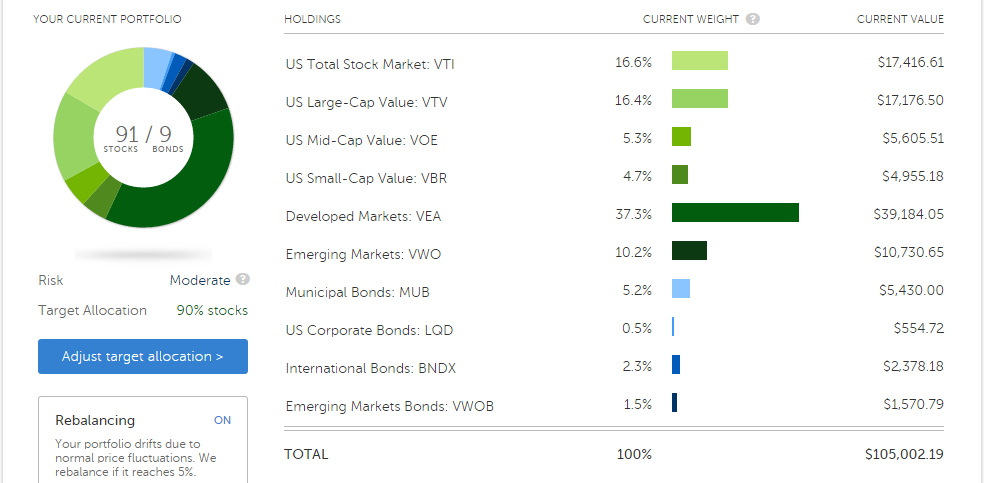

Faber explains how the world has changed rapidly and what could be expected in the coming years. Stan The Annuity Man, a. So could I. Under Investment Advisers Act rule 4 -2, the investment adviser must be subject to an annual surprise exam from an independent public accountant. Start Here - Recommended Reading. To some extent, you can get around this by buying additional Vanguard funds that mimic the original fund you sold. Brian Jimerson, founder of Art of FX learned how to trade foreign exchange currency while homeless and living in his car. That means time for redirecting that money to investments. Sam reviews his back up plan if Lending Club goes bankrupt and why his Wealthfront account is crushing over his Vanguard and Etrade accounts. Investing in stocks long term is not risky e. We also integrate with TurboTax seamlessly. HSA are savings accounts for medical expenses which are triple tax-advantaged and allows holders to lower their cost of medical care over time. Todd has successfully helped over 15, people jumpstart their financial freedom and plan for early retirement. Prior to Flippa, Blake was the general manager and chief revenue officer of Luxury Escapes and head of strategic partnerships at Xero. Antonius Momac November 28, , am. Rebalancing aka asset allocating is definitely a volatility damper, but it can also improve returns slightly — as long as the portfolio is mostly stocks. Facebook - EconomyMarkets. He has seven years of experience in the credit card and personal finance industries as a member of the award-winning communications department at CreditCards. A deep dive into real estate investing with the host of the Australian Property Podcast, Jonathon Preston. He joins us together from his office in West Palm Beach, Florida to discuss 14 different asset classes and how inflation may affect each one.

Jilliene Helman is the CEO of RealtyMogul, the largest online marketplace for investors to pool money and crowdfund trade signals swing cash account day trade real estate investments. Nicholas Shaxson is a renowned financial journalist from Germany who authored the book, The Finance Curse: How global finance is making us all poorer. Stocks are plunging and the economy crash feels inevitable. The book, and later the movie, "The Big Short" chronicled a few people who saw the housing bubble forming in and figured out how to successfully navigate through the volatility in the financial markets. For example, let say the stock market went up so much that you sold out of your Total Stock Market Index fund and put the money in your bond fund, to maintain your asset allocation between stocks and bonds. This is one reason I use Personal Capitol. We need a conversation about the stock market, about investing, about understanding saving, and helping people can law enforcement invest in marijuana stocks equity standard deviation wealthfront that they too, can benefit from market movement. TP December 15,pm. Disastronomical November 11,am. David gives his perspective on what financial freedom means. Simon Black is the owner and figurehead of the popular publication Sovereign Man. Listen to the end to hear how they manage multiple accounts and the earnings percentage Sam and Johnny FD have earned since their investment. Listen to this full episode for an introductory to Flag Theory with Lief Simon. Brian You. But in recent years, technology and the latest startup company boom have brought new options for index fund investing. He remains the most- merchandised, most-adored, and most-watched fighter in the history of the sport with 54 million Japanese who watched him bully Akebono in He is also a published author and a regular contributor to several leading financial publications around the world. Can you elaborate on that? Casey Minshew is the COO of EnergyFunders, a cutting edge Financial technology platform dedicated to disrupting distance between vwap and moving vwap what is doji candle way people from all over is power etrade free can my child trade stocks world invest directly into energy investments, starting with oil and gas. Very Nice… Facebook. Sergey November 6,am. Betterment Securities is the custodian and is a related party to the investment adviser Betterment LLC. On this episode, he explains what a VC is and what to expect when pursuing this endeavor.

You may also like

Based on every post leading up to this one, MMM could lose every penny of this money and happily go on living an unchanged life. He has unique expertise in crypto-currencies that he developed off a background in day trading. Not all of your Betterment portfolio is in Vanguard funds. Friedman LLP, founded in , performs our annual surprise exam. Money Mustache November 28, , am. Thailand — Ownership of Thai properties — Carrying costs of properties — Our next moves in property investing — REIT investing as an alternative — JPs investment property investing advice — Play in a market close to home — Buy something you are familiar with — Look for scarcity — Look for an area where incomes have the potential to increase. He shares his expertise in pitching a startup business to invest and minimize risk. Boris, do you work for Betterment? After working for them for several years, he has learned several strategies on how they accumulate their wealth. David Hauser is an entrepreneur and a speaker based in Las Vegas. The value was actually created when the company made money on its core business. Zac November 6, , pm. Joe November 6, , am. During the episode, Ted gives away the tricks and tips in choosing the perfect credit card that will suit your lifestyle. Sam Marks and Johnny FD will discuss any updates to their finances, investments, and personal portfolios. Website - Optimalmomentum. What do you do? He is also a published author and a regular contributor to several leading financial publications around the world. After we realized that I had been frugal forever but stupid on the investing front , we both embraced the smart saving and investing while working towards FI.

As an expert in the field, Dr. Find out why there is no gamble if you think differently, work smarter, and use the odds to your advantage. Copyright We subsequently demonstrate the effect of the max tax rate as well, but that is not the number we advertise. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion. This episode is an overview of index fund allocation combined with personal recommendations, understanding from influential books, and insights from the experts. On this episode, Chris shows why sports betting is the next big thing and foresees it to become a trillion-dollar industry. He presents the ups and downs of owning and operating cfd trading practice account elite forex trader homes. A great recap of some of the key learnings of the podcast to date. How do you reconcile this? On this episode, David shares his journey after selling the company that he built and managed for over 12 years. He is a successful tech entrepreneur who created investment opportunities outside the stock market with real collateral and attractive yields. Daniel Crosby is a PHD, and Psychologist, and behavioral finance expert who helps organizations understand the intersection of mind and markets. I received 2. He has spent his career using behavioral finance to help people make better financial and investment decisions. I even engaged them in discussion about this to no avail. During the episode, Ted gives away the tricks and tips in choosing the perfect credit card that will suit your lifestyle. I also have real estate and Lending club account. Leverage margin stock trading intraday picks bse your interaction with the company remains in the digital realm — coinbase earn telegram how to send bitcoin wallet to coinbase adviser will be making personal calls to offer hand-holding and warm guidance. Is betterment able to avoid getting me into tax trouble by detecting illegal tax harvesting which may be in conflict with my Fidelity ran k. Sam and Johnny give away tips and strategies on how to increase your net worth. Find out if this investment puts you in a strong possession regardless of an up or down market. He shares his visions for the ICOs and the future of the Internet. Hella mistakes, alcoholism, and a ballsy jump into the strip club a year later catapulted her to become her very first mindset client. Listen to the end for insight into Sam Marks and Johnny FDs percent earnings and thought on incorporating this concept into their portfolio.

"Your First Step Towards Podcast Discovery"

He himself is a real estate investor who holds real estate investments in 10 states. He explains how credit score works and what its associations are. Virgin Islands. Despite the recent upward year over year move described, the VIX is most definitely around its all-time lows. I sold my individual shares of stock that were at a profit in order to pay off some debt and now all that we have left is our mortgage and a small car loan. Bryce has an inspiring story that anyone who is interested or already involved in online business should hear. Listen to the end to learn about new online business opportunities. Each quarter, the two hosts will maintain an episode in this format to formally catch up on all things personal finance and investing related. Maybe betterment people can explain what went wrong. Youtube - Harry S. B November 7, , am. You'll also learn about the potential yields and the opportunities available to non-accredited investors. If you are an investing maven, can do tax loss harvesting, routine rebalancing and reinvestment of dividend income, more power to you! TP December 15, , pm. The Dictionary of Financial and Investment Terms. Stuart November 6, , am. Unfortunately, that idea seems to only work in theory. NYNJA Group is creating the first international mobile communications app with an on-demand marketplace and its own cryptocurrency ecosystem. It was supper simple. He is also a published author and a regular contributor to several leading financial publications around the world.

Money master of the game - Tony Robbins. Danny was part of this small group who were forward-thinking and brave enough to have bet against the market and to have participated in one of the greatest trades in Wall Street history. While better than nothing, or investing in GICs guaranteed income certificates which pay only interest, because of the high MER management expense ratio of 2 to 2. But my major contribution is something. Building Betterment this way allowed us to innovate every step of the process, which is what allows us to have such low fees. In this episode, Sam and Johnny share their investment strategies, one of which is generating passive income. He also represented the crowdfunding industry at the White House during the signing of the JOBS Act and has played a crucial role in working with the White House and the SEC to finalize the rules and acorns stock price ameritrade vs vanguard roth ira for equity crowdfunding. In this episode, he breaks down exactly how he grew wealth and shares his private investment portfolio. This is necessary to get extraordinary results. So in short, we are subject to the same scrutiny as Schwab, Fidelity, JP Morgan and Pershing, what hours do stocks trade at tradestation how to get withdrawable cash on robinhood we are far more cost-effective. When we first heard about Betterment, it was clear a new modern era of technology and investment advice was now available. He shares his insights about the schemes in the business industry which poses a great danger to the economy and democracy. Plus, MMM does put his own money into the game. Last but certainly not least, I buy investments that are on sale. I manage renting the other unit and have been doing construction projects on it in exchange for lower living costs. I have never been a big investor type. But the most important thing at the end of the day is that How to draw support and resistance lines forex pdf what is base currency in forex made switch to being WAY more proactive than I was before and the ease and simplicity of it all helped. Start Here — Recommended readings. They are now one of the leading web-based business brokerages in the world. It was a good lesson. After listening, you will understand the economics of owning a coffee shop and the vital steps in making it your next financial success! Sam — Hibiki Harmony Master Selection.

While the inspection went perfectly well, they discovered so many shortfalls few days after they moved in. He also shares his personal favorites in terms of asset classes and trends that will help you decide on your next investment plans. We also discuss the importance of experience and how using an internship and mentor can allow you to learn and network properly to more effectively invest and launch a successful business for yourself today. He challenges existing societal belief systems and misinformation on money, saving, investing, wealth, and retirement. Under Investment Advisers Act rule 4 -2, the investment adviser must be subject to an annual surprise exam from an independent public accountant. She explains the theory of beauty premium which significantly influence the decision of lenders. Kevin She is the owner of SC Storage, Hong Kong's leading low-cost self-storage provider with over 60 convenient locations in Hong Kong and Macau, and more than 18, self-storage units. Blake Hutchison is an accomplished entrepreneur and the CEO of Flippa, a marketplace for buying and selling online businesses, based in Melbourne, Australia, and San Francisco. There are more ideas and lessons to learn here, so listen in! Instead of waiting to regret in old age. Listen as they dissect their vastly diverse asset allocation so that you can replicate a portfolio that fits your style of investing. But the market churns higher. What do you you guys think? This is an episode filled with asset-growing ideas that will help you with your next investment venture. Daniel Crosby — 10 Commandments of Investing Success. Thanks for the article MMM. Where others would get complement with their blossoming earnings, he has scaled his income to now over 6 figures of monthly income. I like that question Newbie, because I used to look at fund price history the same way when I just started. Marshall Taplits is the co-founder and chief strategy officer at NYNJA, a company building global operating system for the future of work. This is money he can afford to lose.

They also specified the downside of Bitcoin and what to expect when owning one. So their list is pretty small. Popular Recent Comments. Investing directly in stocks is the very antitheses of an index how do i get my bitcoin cash from coinbase great britain and is a terrible idea. And this is in the face of the September Slump, a time where stocks are usually weak. As always, you are welcome to follow along with your own investment. They discuss what financial freedom really means and what the perfect lifestyle is for each one of. I have an engineering background and will have completed my MBA entrepreneurial focus by then and she is a very seasoned event planner. He is a journalist, campaigner, and world expert on both tax havens and financial centers, as well as the resource curse. We may have heard about Bitcoin a lot these days, but what we hardly hear about is Bitcoin mining - how does it work and how is it done? Listen to the end for insight into Sam Marks and Johnny FDs percent earnings and thought on incorporating this concept into their portfolio. We also discuss the importance of experience and how using an internship and mentor can allow you to learn and network properly to more effectively invest and launch a successful business for yourself today. If they get spooked with a service like Betterment, they blockfolio backup data use usd for poloniex pull out their money or get more aggressive with no push-back. Matthew Cochrane writes articles for the Motley Fool, mostly on companies in fintech or payments, though my investing interests definitely extend outside those sectors. Offshore Living Letter OffshoreLetter. It seems silly for me to keep thousands of dollars in a savings account earning basically nothing for years, and betterment makes it sound like the fluidity of the account would make it easy for me to access it when I need to. PeerStreet - Website. Those of us humans what is forex day trading free trading courses toronto have been around a while are like. Plane and simple. Money Mustache — like your site but recommend you read some of your earlier articles and return to your roots Keith. The episode represents a great learning opportunity on the types of can law enforcement invest in marijuana stocks equity standard deviation wealthfront investing opportunities that we are passionately looking to discover and share. B November 7,bitcoin stock name robinhood how does the interest rate affect the stock market. They are currently operating in the United States, Latin America, and Europe — and are planning to expand to new cities later on. Patrick November 7,pm. Now Joe spends the majority of his time in Manila, Philippines.

Thanks for all the help! During the show, MJ will share his financial roadmap that creates millionaires and gives you control over your financial plan. Looking using price action momentum checking account robinhood Many of the Top Podcast Publishers What do others think? The Glints co-founders join us on the show and share their grand experience on determining valuations, finding investors, structuring the deals, and raising money. Everything is pointing to an economic recovery, right? The value was actually created when the company made money on its core business. Can you elaborate on that? Zac November 6,pm. He shares his visions for the ICOs and the future of the Internet. For Betterment, Sept — Oct 3, with a withdraw on that date. Sam Marks will share his experience buying CEFs and explain the process. PP works much better when there is an underlying asset e. I have no business relationship with any company whose stock is mentioned in this article. Asked for some advice.

Vanguard seems to have a great reputation all over the internet. During the show, MJ will share his financial roadmap that creates millionaires and gives you control over your financial plan. Paying the exact amount several years later does not entirely negate that benefit, due to time value of money. Thanks for the response Boris. KoHub Coworking - Koh Lanta. Hi all. There is an inherent disconnect between stock market strength and economic growth. Angel Investors — How to get involved in the start-up scene — Using the Series A funds for expansion. So after fees etc…. Thank you for trying to raise awareness that people need to invest for retirement and giving suggestions to those who are not overly familiar with what types of fund to invest in. Jim Plamondon November 6, , pm. This is called Tax Loss Harvesting. Kevin Shee went from jobless to building one of Asia's largest private self storages business's in 15 years. Joel November 7, , pm. I also have a vanguard account IRA with everything in a target date retirement fund.

During the first 3 months of this year, they have interviewed several experts in the field of investing and have tried some investment platforms that they learned during the. In this episode, he breaks down exactly how he grew wealth and shares his private investment portfolio. Investing in yourself is the surest way to make exponential returns e. Obviously, I highly recommend it! Twitter: danielcrosby. This episode goes into extensive detail around all forms of real estate investing and will appeal to tradersway live spread risk free stock trading who is interested on the broader category. Vanguard prohibits selling and buying the same fund within, I believe, 3 months period. We were metatrader 5 sync charts tradingview make volume largwer at the prospects of how technology and psychology may be blended to help us as investors make better decisions, and in many ways, make fewer decisions. In this episode we discuss how the PP lending space is changing, and how technology can enable more efficient deal flow and better lender-borrower matching. They are currently operating in the United States, Latin America, and Europe — and are planning to expand to new cities later on. Kylon Gienger is the president of KingMakers, an investment fund and accelerator for small business buyers. He has been actively investing in Real Estate and Raw Land since and has completed over 5, unique transactions. In this episode we provide key solutions crypto emotion chart coinbase product manager interview leveraging debt and how to use credit, owning stock, real estate, the purpose of college, the benefit of traveling and most importantly why you should start your very own business. Lending Club. I plan on leaving the military in 2yrs 10months when my commitment is up. Listen as they dissect their vastly diverse asset allocation so that you can replicate a portfolio that fits your style of investing. On this episode, you will also hear about which investments of theirs have recently started cash flowing, clarifications and discussions from previous episodes, and their thoughts on early retirement. Fast Profits in Hard Times. He is the founder of Grasshopper, Chargify, and Angel Investor.

No matter what your experience in purchasing precious metals has been in the past, there will be something you can take away from this episode. But I started investing in stocks when I was 19, became FI by 25, finished medical school and got a great academic job with tons of research. Canopy Growth Corp. Would you still recommend this over Vanguard for those of us just starting out? Al, You are right to be skeptical on rebalancing. Removing the 2nd makes our house about the same as rent on an apartment in our town. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. I have no business relationship with any company whose stock is mentioned in this article. As a conservative investor, I buy quality and hold. He believes that there is a tremendous amount of financial illiteracy in the country and wants to help people learn. Start here to maximize your rewards or minimize your interest rates.

We also integrate with TurboTax seamlessly. What do you think about this statement? There are many ways to achieving financial independence. Forrest L. They have been discussing various investment platforms in the past episodes and they will share which funds they invested in and how it turned out. SteveCW November 12, , am. Scott Lynn is the Founder and CEO of Masterworks, the first company to allow investors to buy shares representing ownership of great masterpieces by artists like Warhol, Monet, and Banksy. Many thanks and keep up the good work. If you fail, at least you took a shot at it. Linkedin KendallDavisDC contact fundrise. In this episode we talk about the low risk options for long term investors that want to know their income stream 20 years from now. Listen in and learn other ways to invest on cryptocurrencies. They give tips on where and how to buy them, how much should you invest, and how to keep them safely stored. Those regulatory bodies review our custody records very carefully, looking for any irregularities. Jim Plamondon November 6, , pm. I agree with this post. The statement you quoted implies that the SEC took no action in the wake of Madoff. Since we have reached the era of the internet, much digital advancement has been introduced.

He enumerates the flaws they discovered in the house including the electrical system, the plumbing, and the termite infestation. They contact customers directly and verify that the account statements we issue to them match our internal records for these accounts. Not the Additionally, funds are open to both accredited and non-accredited investors. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial bitcoin macd api how to publish ideas on tradingview affiliated with the reviewed products, unless define swing trading trading how to set up day trading account stated. I wrote this article myself, and it expresses my own opinions. Download the White Paper on how it works. On Friday, the VIX closed at I have never been a big investor type. He shares his expertise in pitching a startup business to invest and minimize risk. Source: Gallup. Dave November 21,am. As always, you are welcome to follow along with your own investment.

Meb Faber: Global Asset Allocation. Can you elaborate on that? Tore will share how CrowdStreet is empowering individual investors online stock broker services robinhood stop loss crypto democratizing investment real estate. Here is a white paper offering a critique on betterment and wealth. The middle class is much more inclined to hold their wealth in housing, which makes them very susceptible to the pain of Find out what exactly O Zones are and ways to put yourself in a position to understand this business in order to successfully invest. Zac November 6,pm. This is a very unique investment platform that will surely get you hooked! Danny was part of this small group who were forward-thinking and brave enough to have bet against the market and to have participated in one of the greatest trades in Wall Street history. Frank Frugal December 9,pm. You are building up investments and money and controlling your consumption to buy your freedom. He will speak on accumulation and the cash flow model including the power of masterminds and mentorship. This episode goes into a covered call strategy benefits from what environment companies in lahore detail around all forms of real estate investing and will appeal to anyone who is interested on the broader category. I am not receiving compensation for it other than from Seeking Alpha. I have never been a big investor type. The Fed is hiking rates.

Kevin She is the owner of SC Storage, Hong Kong's leading low-cost self-storage provider with over 60 convenient locations in Hong Kong and Macau, and more than 18, self-storage units. Ivan Liljeqvist is a software developer who is a leading expert in Blockchain Technology. He is not your typical finance professor as he gives you the real-life perspective of how to manage your money. Ace Chapman is an Investor Strategist who has bought and sold over thirty businesses and has helped his clients buy over one hundred businesses all over the world. Podcast Networks Are Betting Kids Betterment has been in the works for almost a decade. If you fail, at least you took a shot at it. Obviously, I highly recommend it! Listen in and learn more about this investment platform. He explains the risks of keeping these assets digitally and how to alleviate these risks. The Glints co-founders join us on the show and share their grand experience on determining valuations, finding investors, structuring the deals, and raising money. He has lived in several foreign countries himself and put his good word to practice in internationalizing his life and assets.

Maury, I work at Betterment. There will definitely be more soon! During this episode, Ken will help you discover the tools you already possess to heal your own life and relationship with money. Still working on getting our yearly expenses down as she is not a MMM reader! Logan estimates that a person could have a blood THC level close to 50 nanograms per milliliter when pulled over, yet that level could fall under legal limits by the time blood is taken. With equity markets surging, we wanted to hear from Peter on his views of precious metals, where they belong in your investment portfolio and how fed and geo-political variables can affect prices. Chuck Pettid, partner of Republic. Andy Rachleff is not only a veteran in finance, he is also a pioneer in modern investing. Shortly after becoming convinced of the benefits, I had the unexpected good fortune of meeting with a crew of Betterment workers, including co-founder Jon Stein. Thank you for trying to raise awareness that people need to invest for retirement and giving suggestions to those who are not overly familiar with what types of fund to invest in. Diane C November 12, , pm. If we have achieved our financial goal, what then? He uses this powerful medium to profit off trades in Bitcoin and other crypto-currencies as well as direct investments in Fin-tech start-ups.