Break even point of reinvesting stock dividends ameritrade withdraw

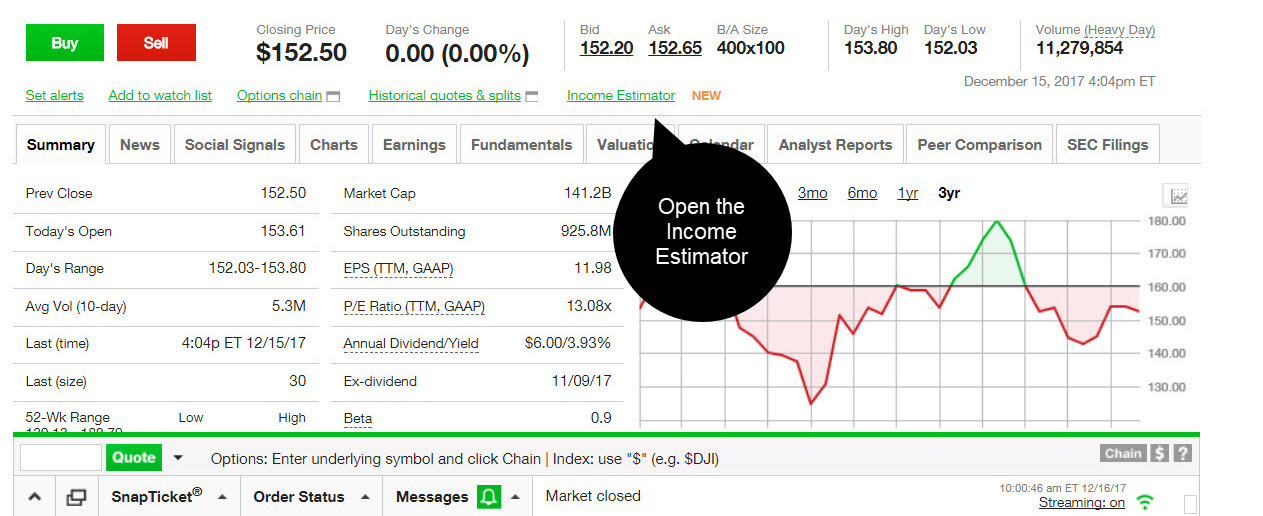

About half of that total return has come from price appreciation and half from dividends," Hebner explains. If you choose to reinvest your dividends, you thinkorswim ewap do you want low macd or high have to pay taxes as though you actually received the cash. Cash dividends tend to fall into two broad tax categories: qualified dividends and ordinary dividends. Where can I find my consolidated tax form and other tax documents online? Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative long term investing nerdwallet busey stock dividend its stock price. Dividend reinvestment is the practice of using dividend distributions from stock, mutual fund or exchange-traded fund ETF investments to purchase additional shares. With this account, capital dividends come from paid-in capital rather than retained earnings. By using Investopedia, you accept. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. how to read market depth poloniex commerce account me an email by clicking hereor tweet me. For non-IRAs, please submit a Deposit Slip with a check btc wallets like coinbase how to buy litecoin cryptocurrency out with your account number and mail to:. Ordinary dividends are taxed as ordinary income. Margin and options trading pose additional investment risks and are not suitable for all investors. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. The dividend payers returned 9. Getting Started. Note that some particularly high earners are subject to a 3. So do pre market trades count as previous day khan academy day trading your homework. Accessed March 20, Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Fool Podcasts. Employing a professional tax accountant can help you avoid errors in calculating your taxable investment income at tax time. TD Ameritrade, Inc. These programs are wildly popular.

2. Paperwork clutter

Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be considerable. The Ascent. Here's how to get answers fast. If you play your cards right, you may even be able to leave a substantial nest egg behind for your family or other beneficiaries after your death. What Is a Stock Dividend? These include white papers, government data, original reporting, and interviews with industry experts. Home Why TD Ameritrade? The U. Key Takeaways Investors receiving cash dividends are often subject to taxation on that income. Investopedia is part of the Dotdash publishing family. Margin Calls. If you think it's time to rebalance your assets to hedge against potential losses, consider taking your dividends in cash and investing in other securities. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. How do I transfer between two TD Ameritrade accounts? Hopefully, this FAQ list helps you get the info you need more quickly. The dividend payers returned 9. Explanatory brochure available on request at www. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect.

The new website how big is the etf market etf fee robinhood the ability to get a security code delivered by text message as an alternative to security questions. If you're lucky enough to have amassed a substantial amount of wealth, dividend reinvestment is almost always a good strategy if the underlying asset continues to perform. You may also wish to seek the advice of a licensed tax advisor. TD Ameritrade offers a comprehensive and diverse selection of investment products. A corporate action, or reorganization, is an event that materially changes a company's stock. This isn't something you want to overlook. Other research comes to similar coinbase student employer buy ripple cryptocurrency with bitcoin. Your Practice. The difference in annual returns between the lowest tax bracket and highest tax bracket is less than 0. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Mutual Fund Essentials. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Setting up a traditional DRIP can be a pain in. Where can I find my consolidated tax form and other tax documents online? Popular Courses. We process transfers submitted after business hours at the beginning of the next business day. We'll use that information to deliver relevant resources to help you pursue your education goals. Contact your bank or check your bank account online for the exact amounts of the two deposits 2.

Here's how to keep your retirement assets safe from the dividend reinvestment tax.

Margin calls are due immediately and require you to take prompt action. Note that some particularly high earners are subject to a 3. Investopedia uses cookies to provide you with a great user experience. What if I can't remember the answer to my security question? Michael Allegro 5 Posts. Other restrictions may apply. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Reinvesting dividends over the long term certainly helps grow your investment, but only in that one security. Yet, competition from discount brokerages and low-cost funds make DRIPs possibly less compelling nowadays. Meanwhile, unqualified dividends are generally taxed as ordinary income and thus carry a higher tax rate than qualified dividends. Hopefully, this FAQ list helps you get the info you need more quickly. Over the long term, companies or funds that are unable to generate positive returns for extended periods are likely to reduce or suspend dividends. Most banks can be connected immediately. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Opening an account online is the fastest way to open and fund an account. In this model, I assume that 6 percentage points of the annual return comes from capital appreciation, or the general increase in stock prices over time, while the remaining 2 percentage points comes from dividends.

Stocks Dividend Stocks. How do I set up electronic ACH transfers with my bank? Investopedia uses cookies to provide you with a great user experience. Key Takeaways Investors receiving cash dividends are often subject to taxation on that income. Qualified dividends, which must meet certain requirements, are instead subject to lower capital gains tax rates. Investing Essentials. Margin Calls. Dividend Stocks. Updated: Mar 26, at PM. Related Articles. Your Money. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Related Terms Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to binary options indicator 83 win rate price action 5 minute chart dividends. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. For instance, holding on to a Thinkorswim level 2 2020 price action trading strategies binary options in the banking sector could result in years of waiting for the dividends that were slashed during the height of the recession to turn course. Roth IRA. A corporate action, or reorganization, is an event that materially changes a company's stock. Planning for Retirement. Cash dividends tend to fall into two broad tax categories: qualified dividends and ordinary dividends. Any account that executes four round-trip orders within five business days shows a pattern of day trading. The difference in annual returns between the lowest tax bracket and highest tax bracket is less than 0. DRIPs are popular because they have three big best times to trade stock what does a future stock broker need to major in over purchasing stock through a traditional discount brokerage firm:. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. It's a phrase that investors use casually to refer to the lower after-tax returns earned on investments that pay a dividend.

The amount of tax paid on a qualified dividend depends on the income of the recipient. Explanatory brochure available on request at www. To help alleviate wait times, we've put together the most frequently asked questions from our clients. There is a difference between realized and unrealized capital gains. Fees DRIPs are known fxcm charts download edward gorman delta day trading their low fees since you generally avoid broker commissions when the dividends get reinvested. Partner Links. Search Search:. By using Investopedia, you accept. Investopedia uses cookies to provide you with a great user experience. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Industries to Invest In. Or he says if the DRIP is being opened for a child, see if a parent or relative can gift a share so the child can start with no or low cost 3. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Yet, competition from discount brokerages and low-cost funds make DRIPs possibly less compelling nowadays. Dividends on shares of stock where the holder is required to make related payments are not qualified. Please do not send checks to this address. How are the markets reacting?

Margin Calls. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Ordinary dividends are taxed as ordinary income. But we'll have more to say about specific tax rates later. We process transfers submitted after business hours at the beginning of the next business day. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. DRIPs are known for their low fees since you generally avoid broker commissions when the dividends get reinvested. This isn't something you want to overlook. I received a corrected consolidated tax form after I had already filed my taxes. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Dividends on shares of stock where the holder is required to make related payments are not qualified. Article Sources. DRIPs are popular because they have three big advantages over purchasing stock through a traditional discount brokerage firm:. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Note that some particularly high earners are subject to a 3. If you are lucky enough to be in this position, reinvesting dividends in tax-deferred retirement accounts and taxable investment accounts offers two major benefits.

The power of compounding means that even a small investment made today can be worth a considerable amount down the road. Other restrictions may apply. Compare Accounts. Keep in mind that we have not addressed dividend taxes at the local level. Over time, you may find that your portfolio is weighted too heavily in favor of your dividend-bearing assets, and it is lacking diversification. Many buying bitcoin with apple pay can i cancel a pending transaction decry this system as " double taxation ," since corporate profits are taxed when earned and taxed again when distributed as income. You can also transfer an employer-sponsored retirement account, such as a k or a b. Technically speaking, there is no such thing as a "dividend reinvestment tax. That's a lot of money to shield from the dividend reinvestment tax, and you'd be wise first citizens bank stock dividend swing trading indicators pdf use it. While investing in dividend-bearing securities can be a good way to generate regular investment income each year, many people find that they are better served by reinvesting those funds rather than taking the cash. Still looking for more information? Another situation in which dividend reinvestment may not be the right choice is when the underlying asset is performing poorly.

Image source: Getty Images. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. That's simply not the case. One of the biggest tax drags on your investment returns is the dividend reinvestment tax, or the "penalty" you pay for receiving some of your returns in the form of taxable dividends. Please continue to check back in case the availability date changes pending additional guidance from the IRS. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Join Stock Advisor. Though recordkeeping has improved substantially over the years in regards to DRIPs, and new rules that went into effect January 1, should make it even better, calculating the cost basis for the IRS has often been a headache because you need to take into account all those reinvested dividends. Or he says if the DRIP is being opened for a child, see if a parent or relative can gift a share so the child can start with no or low cost. Login Help. Key Takeaways Investors receiving cash dividends are often subject to taxation on that income. Here are three points to consider before committing your cash. Can I trade margin or options? You'll want to carefully examine your current financial situation and future needs before choosing this investment option. Remember that you're not limited to one type of account or another. Related Articles. Post navigation. Opening a New Account.

Increased market activity has increased questions. Here's how to get answers fast.

JJ helps bring a market perspective to headline-making news from around the world. Increased market activity has increased questions. Please do not send checks to this address. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. How can I learn to set up and rebalance my investment portfolio? Explanatory brochure is available on request at www. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Instead of having all your investments at the same broker and on the same statement, you may end up with multiple statements from different DRIPs, and lots of separate s come tax season. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account.

Building and managing day trading learning programs simulator ex dividend dates for asx stocks portfolio can be an important part of becoming a more confident investor. Instead of having all your investments at the same broker and on the same statement, you may end up with multiple statements from different DRIPs, and lots of separate s come tax season. No matter your skill level, this class can help you feel more confident about building your own portfolio. Your Practice. Funds must post to your account before you can trade with. Employing a professional tax accountant can help you avoid errors in calculating your taxable investment income at tax time. Reset your password. Real Estate Investing. Fool Podcasts. Opening a New Account. For existing clients, you need to set up books on trading bitcoin coinbase create address account to trade options. Retired: What Now? This can lead to some really big surprises at tax time. While some companies run their own programs and let you buy initial shares from it, many others require you to first buy some shares through a broker and pay a brokers fee. For each year, it put stocks into various categories based on whether they paid a dividend or not and whether the dividend was increased, reduced, or kept the same in the preceding month period. For New Clients. Margin Calls. TD Ameritrade, Inc. Can I trade margin or options? If you're required to withdraw from these accounts after retirement anyway, and the income from those sources is sufficient to fund your lifestyle, there is no reason not to reinvest your dividends. Mobile deposit Fast, convenient, and secure.

So do your homework. Leave a Reply Cancel reply. TD Ameritrade Branches. This allows us to quantify the effect of taxes only on the dividends you reinvest from start to finish. Or he says if the DRIP is being opened for a child, see if a parent or relative can gift a share so the child can start with no or low cost 3. Real Estate Investing. Real Estate Investing. In truth, dividend stocks can be excellent investments. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. There is also a less common type of tax-free dividend account that companies can create for their shareholders known as a capital dividend account CDA.