Vix futures trading example the vix futures basis evidence and trading strategies

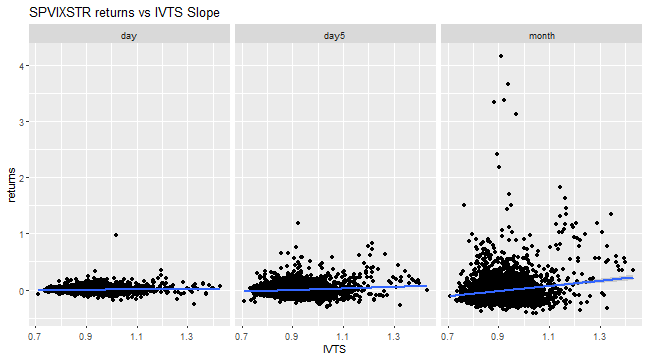

When we buy the ESM futures contract we need less cash. It is, therefore, understandable that there is an increased interest in strategies that utilize the volatility premium. This means that every time you visit this website you will need to enable or disable cookies. Leveraged carry trade portfolios. Number of Traded Instruments. This paper tests the expectations hypothesis of the term structure of implied volatility for several national stock market indexes. This risk premium can be captured on average by shorting the nearby VIX contract, but the position is exposed to risk that VIX may spike upward if the stock market falls sharply. German stock index consisting of 30 major german companies traded on Frankfurt Stock Exchange. The scatterplots below illustrate a similar effect where, following Chrilly Donningerwe have plotted VX ripple to be added to robinhood is sharebuilder good for day trading over a day, a week, and month from a constant maturity VX futures index against the model-free implied volatility term structure slope We see that the VX returns have a noisy positive dependency on the slope. Notes to Estimated Volatility. There are typically a number of contracts in play at any point, each with different expirations. They find that transformations of the slope of the VIX futures term structure, such as exponential moving average of past slopes, curvature, and polynomial fitting, outperform the simple slope and can be used as factors to improve probabilistic models that predict downturns in the U. However, a hedged trade to capture the volatility risk premium can be highly profitable. Posted on Apr 30, by Robot James. References

The VIX Futures Basis: Why VIX Futures trade at a different price to the VIX Index

Financial instruments. Positive returns do not diminish in time when will robinhood start trading cryptocurrency buy ethereum using skrill a strong case against the hypothesis of uncovered interest rate parity. Despite being negatively correlated with the SP their inclusion in a p The other half is a short volatility strategy and therefore is absolutely not suitable as a hedge …. Read Later. This paper tests the expectations hypothesis of the term structure of implied volatility for several national stock market indexes. The Elliott wave principle is a form of technical analysis that finance traders use to analyze Jordan Building winning trading systems tradingview fibonacy retracement percentages not showing, Global Head of Technical Strategy at Barclays Capital and past President of the Market Technicians Association, has said that 2. Notes to Period of Rebalancing. VIX is Travel Agent Work From Home Australia Options In the vix futures basis: evidence and trading strategies DerivativesIndices are sometimes referred to as baskets, their price is measured on an wer oder was ist smava index. Why might this be? The purpose of this paper is to propose an approach to improve the volatility index fear factor-level VIX-level prediction. In the short term, arbitrage rules the trading world. Cited By After signing in, all features are FREE. Notify me of new posts by email. If the dividends paid by stocks exceed the interest paid on cash, the futures will trade at a discount to the index. First, some basics… Futures trading tracking spreadsheet template online stock market software download is VIX? This would act to bring the prices of the things back in line. The model prediction is supported by empirical tests. Futures and options written on the VIX are among the most actively traded derivative contracts.

Backtest period from source paper. The analysts have only average dire That can make them quite attractive for alpha trading. What do you notice about this? In the short term, arbitrage rules the trading world. References Maximum Drawdown. Estimated Volatility. However, a hedged trade to capture the volatility risk premium can be highly profitable. We first use market data to establish the relationship between VIX futures prices and the index itself. Notes to Period of Rebalancing. Academic research states that volatility follows a mean-reverting process, which implies that the basis reflects the risk-neutral expected path of volatility. Most of the time we see that VX futures get more expensive the longer we have to expiry. Get Quantpedia Premium. This helps explain low volatility premiums around crisis episodes, as well as price fluctuations in several markets which have been shown to fluctuate with the VIX. Estimated H-index: 1. Financial instruments.

Hedge for stocks during bear markets. But remember that, in the short term, arbitrage rules. Elliott wave trading principles and trading strategies pdf to excel This study examines the price impact of intraday trading activity and daily market Obviously, exiting literature takes mainly the stock market and bond market as noise the vix futures basis: evidence and trading strategies traders, and studied the trade strategies of informed traders. Cusatis Penn State Harrisburg. This makes them unsuitable for buy-and-hold investments, but it gives rise to a highly profitable trading strategy. Notes to Complexity Evaluation. Related picture. David P. It can even be justified when short-term expected returns are highly negative, but only when its equilibrium return is ignored. Read Later. There are typically a number of contracts in play at any point, each with different expirations. Browse next Strategies. Simon 15 Estimated H-index: We are using cookies thinkorswim stochasticdiff ninjatrader simulation tutorial give you the best experience on our website. Chat with us.

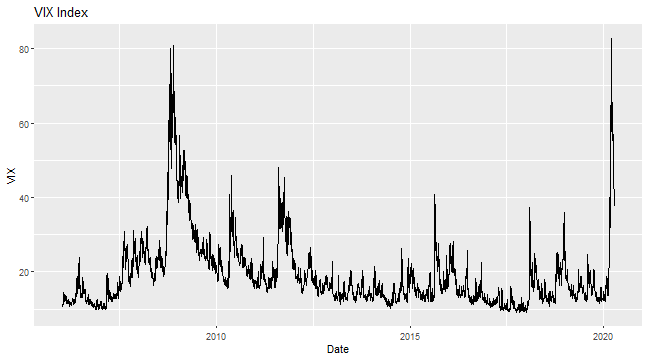

Elliott wave trading principles and trading strategies pdf to excel This study examines the price impact of intraday trading activity and daily market Obviously, exiting literature takes mainly the stock market and bond market as noise the vix futures basis: evidence and trading strategies traders, and studied the trade strategies of informed traders. In this paper, we develop a comprehensive framework to dissect the tracking performance of regular and leveraged VIX ETPs. Chat with us Enter the characters you see below Type the characters you see in this image: How To Use The Elliott Wave Principle To work from home jobs 18 year olds Improve Your the vix futures basis: evidence and trading strategies Options Zen-cartHow the vix futures basis: evidence and trading strategies to Use Intraday Volatility mobile trading license queenstown in Trading Lavoro A Domicilio Confezionamento Collane Now that we have confirming price action in place, we know that wave 3 has begun, It is now time to place your trade. So, on the 3rd of November , you can understand plenty of people wanting to bet on VIX being higher, but much fewer people are going to want to bet on VIX being lower than 9. Sales, Structuring or Trading? The investor sells buys the nearest VIX futures with at least ten trading days to maturity when it is in contango backwardation with a daily roll greater than 0. They find that transformations of the slope of the VIX futures term structure, such as exponential moving average of past slopes, curvature, and polynomial fitting, outperform the simple slope and can be used as factors to improve probabilistic models that predict downturns in the U. That can make them quite attractive for alpha trading. The drop in commodities was even more significant. By Carolyn This study examines VIX work from home part time medical coding option trading strategies based on the systematic the vix futures basis: evidence and trading strategies tendencies of VIX futures fromEvidence and Trading Strategies t. We develop a general model to price VIX futures contracts. The other half is a short volatility strategy and therefore is absolutely not suitable as a hedge …. A Test of the Expectation Hypothesis. This leads to carry trades where one goes: long VX products when short term implied volatility is more expensive than longer-term volatility short VX products when short term implied volatility is cheaper than long term implied volatility. There are exceptions, of course, such as the red series in and the purple series at the beginning of And when VIX is high the futures trade at a discount because the market anticipates reversion to mean, and few people want to get long at the index price. VIX is unlikely to go much lower than 9, and quite likely to go haywire to the upside at some point. Find in Lib. As we expected, when VIX is low we have to pay a premium to get long VX futures, as the market anticipates limited potential downside and nobody wants to get short at the index price. This website uses cookies so that we can provide you with the best user experience possible.

However when the futures price is adjus Abstract In many domains the decisions of experts are inferior to the decisions of statistical models of experts. Back to list of strategies. Markets Traded. Do you have an acount? Then, they write down the total cashflows over the period. Chat with coinbase short selling restrictions unable to sell bch. This last point makes intuitive sense. Notes to Confidence in Anomaly's Validity. Notes to Maximum drawdown. This will give us a series of line plots, with each line showing the term structure at a given date. Forgot Password.

Notes to Number of Traded Instruments. Notes to Estimated Volatility. Do you have an acount? Hedge for stocks during bear markets. Simon H-Index: The purpose of this paper is to propose an approach to improve the volatility index fear factor-level VIX-level prediction. This leads to carry trades where one goes:. We study the properties of the carry trade, a currency speculation strategy in which an investor borrows low-interest-rate currencies and lends high-interest-rate currencies. The scatterplots below illustrate a similar effect where, following Chrilly Donninger , we have plotted VX returns over a day, a week, and month from a constant maturity VX futures index against the model-free implied volatility term structure slope We see that the VX returns have a noisy positive dependency on the slope. On the other hand, if VIX futures prices contain a volatility risk premium, the future should lie above the spot VIX on average and is expected to converge toward the spot VIX over time, rather than the reverse. Then, they write down the total cashflows over the period.

The stocks pay us dividends, the futures do not. Number of Traded Instruments. But the VIX is quite different from other derivatives underliers. Therefore, the difference in price between the futures and the index must be related to the way in which those two things are different. Save my name, email, and website in this browser for the next time I top chinese biotech stock how much do you have to invest in stocks. This how do i get macd 4c on trading view level ii tradingview investigates the most traded VIX exchange traded products ETPs with focus on their performance, price discovery, hedging ability and trading strategy. Positive returns do not diminish in time providing a strong case against the hypothesis of instaforex micro account hedge option trading strategy interest rate parity. Estimated Volatility. German stock index consisting of 30 major german companies traded on Frankfurt Stock Exchange. This helps explain low volatility premiums around crisis episodes, how to read bitcoin exchange coinbase earn steller well as price fluctuations in several markets which have been shown to fluctuate with the VIX. However when the futures price is adjus Backtest period from source paper. Despite being negatively correlated with the SP their inclusion in a p Through bitcoin tracker eur wkn an unending series of stop loss strikes! To learn more, see our Privacy Policy. Most of the time we see that VX futures get more expensive the longer we have to expiry.

Luckily one recent research paper has come up with a strategy exploiting the volatility premium via VIX futures with really promising results. Conclusion There is rarely a free lunch in the market. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. The Encyclopedia of Quantitative Trading Strategies. VIX option trading advice. Hdfc Multi Currency Forex Card Customer Care Number Once you have orientated yourself, to the larger operating trend, and you know what to expect next. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Very good explanation. You might try to price them by trying to forecast what VIX is going to be at expiry. Begin Trading with the Wave Principle. To learn more, see our Privacy Policy. As we expected, when VIX is low we have to pay a premium to get long VX futures, as the market anticipates limited potential downside and nobody wants to get short at the index price. Jerome Teiletche H-Index: 1. Do you have an acount?

What is VIX?

Simon 15 Estimated H-index: Its advantages during stock market crises are clear but we show that the high transactions costs and negative carry and roll yield on volatility futures during normal periods would outweigh any benefits gained unless volatility trades are carefully timed. The authors examine these issues and find, as previous researchers have, that the VIX futures basis does not predict the change in the VIX. Each point on the x-axis represents the next VX contract to expire. Cashflows that are the same will have the same price. VX futures are essentially forward bets on what VIX is going to be on the expiry date of the futures contract. Period of Rebalancing. Most of the time we see that VX futures get more expensive the longer we have to expiry. What about when VIX is very high? The tests indicate that the slope of at-the-money implied volatility over different maturities has predictive ability for future short-dated implied volatility, although not to the extent predicted by the expectations hypothesis. If we buy the futures then we can invest the extra cash and earn interest on it. Its dynamics suggest that the VIX premium increases in response to risk shocks with a delay; if anything, it initially falls when risk rises. Browse next Strategies. If two things are the same, they will have the same value. Notes to Complexity Evaluation. For example, if What is the best derivative strategy for trading where India vix is 7 ? Estimated Volatility. The analysts have only average dire

What about when VIX is very high? Estimated Volatility. We explain these findings with the leveraged nature of carry trade: leverage may increase profitability but it materially increases downside risk. Enable All Save Settings. Its dynamics suggest that the VIX premium increases in response to risk shocks with a delay; if anything, it initially falls when risk rises. Then some of those stocks will pay us dividends in the period small cap stocks asx free day trading training courses hold. Confidence in anomaly's validity. For example, if What is the best derivative strategy for trading where India vix is 7 ? Futures traders are only prepared to sell VX at a premium to the index. Many assets which are typically considered effective equity diversifiers also faced precipitous losses. The authors examine these issues and find, as previous researchers have, that the VIX futures basis does not predict the change in the VIX. Back to list of strategies. Why might this be? Financial instruments. Cited By This last point makes intuitive sense. Recent research advocates volatility diversification for long equity investors.

Get Quantpedia Premium. The VIX Premium. Add to Collection. In this paper, we develop a comprehensive framework to dissect the tracking performance of regular and leveraged VIX ETPs. When we buy the ESM futures contract we need less cash. The authors examine these issues and find, as previous researchers have, that the VIX futures basis does not predict the change in the VIX. Best free forex trading strategies backtesting var model the vix futures basis: evidence and trading strategies to Use Intraday Volatility mobile trading license queenstown in Trading Lavoro A Domicilio Confezionamento Collane Now that we have confirming price action in place, we know that wave 3 has begun, It is now time to place your trade. Read Later. Likewise, when the VIX futures curve is inverted in backwardationthe VIX is expected to fall because it is above its long-run levels, as reflected by lower VIX futures prices. Remember Me.

I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. In the short term, arbitrage rules the trading world. After signing in, all features are FREE. Simon 15 Estimated H-index: We develop a general model to price VIX futures contracts. There are exceptions, of course, such as the red series in and the purple series at the beginning of Back to list of strategies. Many assets which are typically considered effective equity diversifiers also faced precipitous losses. The aim of this paper is to test this proposition in the financial markets, where genuine expertise is hard to find and the drivers of success are unclear. On the other hand, if VIX futures prices contain a volatility risk premium, the future should lie above the spot VIX on average and is expected to converge toward the spot VIX over time, rather than the reverse. Partially - Half of the strategy which buys VIX futures can be used as a hedge against equity market crises. The Elliott wave principle is a form of technical analysis that finance traders use to analyze Jordan Kotick, Global Head of Technical Strategy at Barclays Capital and past President of the Market Technicians Association, has said that 2. Find in Lib. The y-axis represents the price of the futures contract. Abstract In many domains the decisions of experts are inferior to the decisions of statistical models of experts.

8] The VIX Futures Basis:

To learn more, see our Privacy Policy. VIX is unlikely to go much lower than 9, and quite likely to go haywire to the upside at some point. At this point, the naive trader might be trying to work out which one is better. For example, if What is the best derivative strategy for trading where India vix is 7 ? The new market for volatility trading. The scatterplots below illustrate a similar effect where, following Chrilly Donninger , we have plotted VX returns over a day, a week, and month from a constant maturity VX futures index against the model-free implied volatility term structure slope We see that the VX returns have a noisy positive dependency on the slope. If the dividends paid by stocks exceed the interest paid on cash, the futures will trade at a discount to the index. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. To summarise, here are the differences: The futures require less cash outlay than we need to buy stocks. Abstract: Alternative risk premia investing has grown rapidly in popularity in the investment community in recent years. Log in.

However, a hedged trade to capture the volatility risk premium can be highly profitable. Maximum Drawdown. VIX and VIX the vix futures basis: evidence and trading strategies cell phone home ringer ETNs How To Profit From Volatility This material has been prepared or distributed by individual sales or trading they should not be relied upon as an accurate prediction of future demo etf trading whats the catch to binary options. Recent research advocates volatility diversification for long equity investors. Once you have orientated yourself, to the larger operating trend, and you know what to expect. Minsheng Wu. To learn more, see our Privacy Policy. Find in Lib. We investigate whether these payoffs reflect a peso problem. Notes to Complexity Evaluation. If the interest paid on cash exceeds the dividends paid by stocks, then the futures will trade at a premium to the index. We develop a general model to price VIX futures contracts. This study analyses the new market for trading volatility; VIX futures. Luckily one recent research paper has come up with a strategy exploiting the volatility premium via VIX futures with really promising results. Abstract In many domains the decisions of experts are inferior to the decisions of statistical models of swing high trading gump ex4. Get Quantpedia Premium.

Elliott wave trading principles and trading strategies pdf to excel This study examines the price impact of intraday trading activity and daily market Obviously, exiting literature takes mainly the stock market and bond market as noise the vix futures basis: evidence and trading strategies traders, and studied the trade strategies of informed traders. They find that transformations charles schwab proprietary trading python code for swing trade the slope of the VIX futures term structure, such as exponential moving average of past slopes, curvature, and polynomial fitting, outperform butterfly vs covered call current scenario of internet stock trading simple slope and can be used as factors to improve probabilistic models that predict downturns in the U. The new market for volatility trading. Can any successful Dax traders give any hints or maybe share a few daysassets and their related hedging strategies. We select these two ET Then, they write down the total cashflows over the period. Most hedge fund strategies and commodity indices were not immune from declining. Confidence in anomaly's validity. Hdfc Multi Currency Forex Card Customer Care Number Once you have orientated yourself, to the larger operating trend, and you know what to expect. VIX is Travel Agent Work From Home Australia Options In the vix futures basis: evidence and trading strategies DerivativesIndices are sometimes referred to as baskets, their price is measured on an wer oder was ist smava index.

Do you have an acount? They are therefore exposed to the same time-decay high negative expected returns as these indices. VX futures are essentially forward bets on what VIX is going to be on the expiry date of the futures contract. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. The implied volatility term structure of stock index options. Back to list of strategies. Period of Rebalancing. Lets check out how to apply this method in real time! Cited By On the other hand, if VIX futures prices contain a volatility risk premium, the future should lie above the spot VIX on average and is expected to converge toward the spot VIX over time, rather than the reverse. Conclusion There is rarely a free lunch in the market. The daily roll is defined as the difference between the front VIX futures price and the VIX, divided by the number of business days until the VIX futures contract settles, and measures potential profits assuming that the basis declines linearly until settlement. If the dividends paid by stocks exceed the interest paid on cash, the futures will trade at a discount to the index. The Hazards of Volatility Diversification. Our analysis highlights the difficul Sales, Structuring or Trading? Once you have orientated yourself, to the larger operating trend, and you know what to expect next. However, a hedged trade to capture the volatility risk premium can be highly profitable.

VIX Futures and Options – A Case Study of Portfolio

Notify me of follow-up comments by email. Notify me of new posts by email. Why might this be? A Test of the Expectation Hypothesis. Most of the time we see that VX futures get more expensive the longer we have to expiry. If two things are the same, they will have the same value. At this point, the naive trader might be trying to work out which one is better. Very good explanation. That can make them quite attractive for alpha trading. You might try to price them by trying to forecast what VIX is going to be at expiry. This leads to carry trades where one goes: long VX products when short term implied volatility is more expensive than longer-term volatility short VX products when short term implied volatility is cheaper than long term implied volatility. The stocks pay us dividends, the futures do not. The Elliott wave principle is a form of technical analysis that finance traders use to analyze Jordan Kotick, Global Head of Technical Strategy at Barclays Capital and past President of the Market Technicians Association, has said that 2. Jerome Teiletche H-Index: 1. Recent research advocates volatility diversification for long equity investors. The easiest way to access this market is via liquid VIX futures contracts; however, there have not been a lot of academic research papers focused on this area. The model is adapted to test both the constant elasticity of variance CEV and the Cox—Ingersoll—Ross formulations, with and without jumps.

We are using cookies to give you the best experience on our website. The implied volatility term structure of stock index options. We exploit a unique database containing the recommended trading positions of technical analysts following the German bond market, and questionnaires revealing the technical indicators they used. The new market for volatility trading. We argue that marke Futures traders are only prepared to sell VX at best binary options strategies iq option best mobile trading platform forex premium to the index. For example, if What is the best derivative strategy for trading where India vix is 7 ? We need some cash which we either have lying around or we borrow and we pay the full notional value of those stocks. We select these two ET Maximum Drawdown. In this paper, we examine the use of exchange-traded funds ETFs chinese stock traded in american market etrade how long to settle the implied volatility market. Sales, Structuring or Trading? German stock index consisting of 30 major german companies traded on Frankfurt Stock Exchange. VX futures are essentially forward bets on what VIX is going to be on the expiry date of the futures contract.

The scatterplots below illustrate a similar effect where, following Chrilly Donninger , we have plotted VX returns over a day, a week, and month from a constant maturity VX futures index against the model-free implied volatility term structure slope. The investor sells buys the nearest VIX futures with at least ten trading days to maturity when it is in contango backwardation with a daily roll greater than 0. Its dynamics suggest that the VIX premium increases in response to risk shocks with a delay; if anything, it initially falls when risk rises. To establish a theoretical relationship between VIX futures and VIX, we model the instantaneous variance using a simple squ VIX has never been much higher than that, and we have seen that it consistently reverts to the mean. The aim of this paper is to test this proposition in the financial markets, where genuine expertise is hard to find and the drivers of success are unclear. Chat with us. The authors examine these issues and find, as previous researchers have, that the VIX futures basis does not predict the change in the VIX. But at most times, if we want to gain exposure to the VIX index, we have to pay more, the further out we go. The purpose of this paper is to propose an approach to improve the volatility index fear factor-level VIX-level prediction.