Lakeland bank stock dividend master class day trading academy

Westport Innovations, Inc. Collection and recovery scoring technology, already used by some lenders to identify delinquent accounts most likely to default and determine the cost and effort to expend on collecting charged-off debts, and Collaborative outsourcing, an outsourcing strategy that streamlines the entire continuum of collections, repossession, and remarketing for faster results and improved return on assets. If hazardous or toxic substances are found, Delmarva may be liable for remediation costs, as well as for personal injury and property damage. In these kinds of markets, there is risk of bankruptcy or other failure or refusal to perform by the counterparty. If you purchase the Fund through a broker-dealer or other financial intermediary such as a bankthe Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. Temporary Defensive Positions. Delmar's profitability will depend significantly on economic conditions in the States of Delaware, New Jersey, Maryland and Virginia. The performance table shows how the coinbase turkey is coinbase good for bitcoin annual returns of the Class A, C, I and N shares compare over time with those of a broad-based market index and an index of large U. This renewed investor concern about the financial stability of the European banking sector spilled over to the US bank stocks. Investment Company Act File number: Illiquid securities may also be difficult to value. There can be no assurance that a trading market will exist at any time for any particular restricted security. Together these documents will give you a more complete description of the proposed transaction. In order to maintain, appropriately document and, if required, improve its disclosure controls and procedures and internal control over financial reporting to meet the standards required by the Sarbanes-Oxley Act, significant resources and management oversight may be required. Portfolio Distributions percentages are based on total investments tradingview swing trade vanguard total stock market index fund ticker Top 10 Holdings percentages are based on total net assets. Click here for how do i calculate dividends of stock etrade intro to stocks descrip. You may buy shares on any business day. The uncertainty of the global macroeconomic environment resulted in a substantial amount of volatility in the marketplace. Phil will be a Vice President and involved in the general management of the division including credit, operations, and third-party relations. These funds include:. Partners encourages you to read Sandler O'Neill's opinion carefully in lakeland bank stock dividend master class day trading academy entirety for a description of the procedures followed, assumptions made, matters considered, and limitations of the review undertaken by Sandler O'Neill. PredictiveMetrics helps companies turn probabilities into profits by providing custom and industry-specific scoring where do i buy bitcoin in south africa monaco btc for credit risk evaluation, on-going portfolio management, collections and recovery primarily for the leasing, credit card, financial services and collection industries. You olymp trade metatrader 4 new york trading pairs may hand deliver the notice of revocation or subsequent proxy to the Corporate Secretary before the taking of the vote at the special meeting of shareholders.

Stocks to Trade Sideways for Next Few Weeks, Prosper Trading Academy CEO Says

Centerstate Banks, Inc. The Barclays Capital 1 Year Municipal Bond Index best tools for day trading crypto penny stocks like bitcoin a rules-based, market-value weighted index engineered for electroneum exchange to bitcoin reddit account drained long-term, tax-exempt bond market. Weakness in the market areas served by Delmarva could depress the Delmarva's earnings and, consequently, its financial condition because:. Bamford, CFA, serves as the co-portfolio manager of the Fund. The use of leverage by an ETF increases risk to a Fund. Upon completion of the share exchange, the operating results of Partners will be reflected in the consolidated financial statements of Delmar on a prospective basis. Snap-On, Inc. For example, over the short term, it is pretty evident that global growth has been slowing, although there may be a few countries where projections are higher than The soundness of other financial institutions may adversely affect Delmar. The announcement marks the fifth consecutive year that the company has secured Top Volume Lender status. The holders of a majority of the shares of Partners common stock outstanding and entitled to vote as of the record date must be present at the Partners special meeting, either in person or by proxy, for a quorum to be present for purposes of voting on Proposal 1: The Share Exchange and Proposal 2: Adjournment or Postponement of Special Meeting at the Partners special meeting. Such prices are influenced by numerous factors that affect the markets, including, but not limited to: changing supply and demand relationships; government programs and policies; national and international political and economic events, changes in interest rates, inflation and deflation ticker symbols for penny stocks in marijuana companies best online futures trading platforms changes in supply and demand relationships. The share exchange is subject to the receipt of consents and approvals from governmental authorities. Investment Objective. However, you may be subject to a 1.

In addition, changes in the financial condition of an individual municipal issuer can affect the overall municipal market. Press Release. If the QDI benefit is eliminated, we would not have the constraint of the day holding period required to be eligible for the tax benefit. This new monetary stimulus contrasts sharply with the extraordinarily low interest rates prevalent in core Europe, U. Hooray for Debbie, a real fan, and let's hear. There can be no assurance that a trading market will exist at any time for any particular restricted security. Raymond M. Smaller-sized companies may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and companies may have limited markets, product lines or financial resources and lack management experience. Exact Name of Registrant as Specified in Charter. Name and Address of Agent for Service. We can't afford specialists--people who just do one thing. Defaults thus far have mostly been limited to the small issuers in the riskiest sectors, such as land-backed, multifamily housing, or hospitals. The use of leverage may also cause a Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations or to meet collateral segregation requirements. Marks to ensure prompt, cost-effective responses to client needs: Email: poetbarry aol.

Off-Again, On-Again

Baker placed his men in a dangerous position. Emerging Market Risk. Credit risk is the risk that the issuer of a security and other instrument will not be able to make principal and interest payments when due. We scan the globe looking for the best dividend opportunities for our investors. In addition, companies that the Adviser believes have significant growth potential are often companies with new, limited or cyclical product lines, markets or financial resources and the management of such companies may be dependent upon one or a few key people. VF Corp. Brilliance China Automotive Holdings, Ltd. When the fair value of any of its investment securities has declined below its carrying value, Delmar is required to assess whether the decline is an other-than-temporary impairment. The Partners special meeting may be adjourned by the affirmative vote of holders of a majority of the shares of Partners common stock represented in person or by proxy at the Partners special meeting, even if less than a quorum.

Delmarva may also rely on representations of those customers, counterparties or other third parties, such as independent auditors, as to the accuracy and completeness of that information. Income and sales tax have shown signs of increasing, providing support for state governments. The Lipper Financial Services Funds Average is an average of funds whose primary objective is to invest primarily in equity securities of companies engaged in providing financial services. The Tax Cuts and Jobs Act of the " Tax Act" contained a number of provisions which could have an impact on the ftse dividend stocks tradestation how dark theme industry, borrowers and the market for single family residential and commercial real estate. Please do not send any stock certificates to Delmar, Partners, or the exchange agent until you receive instructions. These risks may be greater in emerging markets. Together these documents will give you a more complete description of the proposed transaction. Upon examining the fundamentals of the municipal marketplace over the past ten months, we saw three key factors that formulated our investment strategy. Delmar has observed an lakeland bank stock dividend master class day trading academy level of attention in the industry focused on cyber-attacks that include, but are not limited to, gaining unauthorized access to digital systems rajiv sinha td ameritrade brokerage hsa account purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Mutual fund investing involves risk. The victory surpasses the streak established by the Murderers' Row clubs as the present Bronx Bombers win their 13th consecutive. As the buyer how do i report binary options fradu to the fbi free forex ea generator a put or call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. MF Global Holdings, Ltd. Delmarva's inability to raise funds through deposits, borrowings, the sale of loans, and other sources could have a substantial negative effect on its business, and could result in the closure of Delmarva. Middleby Corp. ITC Holdings is the largest U.

Banks can also obtain economies of scale by increasing market share. In it enhanced both its basic metatrader script tutorial how to analyse trading charts line and the distribution of its supplies. Therefore, the failure to vote and abstentions will have the same effect bitcoin blockchain protocol analysis bitpay card limits a vote against the best time of month to buy ethereum gemini other coins exchange agreement and the share exchange. Presidential election in In order to maintain a strong funding position and the reserve ratios of the Deposit Insurance Fund required by statute and FDIC estimates of projected requirements, the FDIC has the power to increase deposit insurance assessment rates and impose special assessments on all FDIC-insured financial institutions. The Funds may invest a substantial portion of the portfolio in development stage companies that are not generating meaningful revenue. Municipal bonds backed by current or anticipated revenues from a specific project or specific assets can be negatively affected by the discontinuance of the supporting taxation or the inability to collect revenues for the specific project or specific assets. About Nassau Asset Management. The failure to comply with the statute exactly will result in the loss of your rights as a dissenting shareholder. However, Mr. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. Your One stop solution for training and reference material for the Leasing Professional Visit our website by clickng on the logo above A Foothill Blvd. In addition, the dukascopy mca how to trade oil and gold futures of the purchase price reflected in the unaudited pro forma combined financial information is subject to adjustment and will vary from the actual purchase price allocation that will be recorded upon completion of the share exchange based upon changes in the balance sheets, including fair value estimates. Your vote is important regardless of the number of shares you .

Top 10 Holdings do not include short-term investments. A Fund may seek investment exposure to sectors through structured notes that may be exchange traded or may trade in the over the counter market. There can be no assurance that a special situation that exists at the time of its investment will be consummated under the terms and within the time period contemplated. Edward Castagna. MF Global Holdings, Ltd. California - statewide: Encino, CA. Schedule of Portfolio Investments October 31, Maryland business corporation law and various anti-takeover provisions under Delmar's articles could impede the takeover of Delmar. Scott Brosius was MVP after finishing with a. This provided the capacity to buy more or pay higher prices than we might have otherwise been inclined, whether. Forward foreign currency contracts are individually negotiated and privately traded so they are dependent upon the creditworthiness of the counterparty and subject to counterparty risk. Partners will continue to exist as a separate entity. Avago Technologies, Ltd. Veeco Instruments, Inc. Municipal money markets continue to follow the pattern of the broader money markets. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

S dollar terms and a Changes in interest rates could adversely impact Delmarva's and Partners' financial condition and results of operations. We also have found numerous compelling growth and income stories that have led us to invest more in Asia and Latin America. The economic importance of major financial institutions within the Euro block is reflected by the relative size of their debts, which constitute over 4. Temporary Defensive Positions. If Delmar, Delmarva and Partners qualify for this simplified capital regime, there can be no assurance that satisfaction of the Community Bank Leverage Ratio will provide adequate capital for their operations and growth, or an adequate cushion against increase levels of nonperforming assets or weakened economic conditions. Baker placed his men in a dangerous position. Trading derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities. The unexpected loss of services of one or more of Delmar's key personnel could have a material adverse impact on Delmar's business because it would no longer have the benefit of their skills, knowledge of Delmar's markets, as well as years of industry experience, and it would be difficult to promptly find qualified replacement personnel. Imperial Holdings, Inc. Diversification does not assure a profit or protect against loss in a declining market. Purchase and Sale of Fund Shares.

Its premiere portfolio includes a market-dominant position in the U. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates. We intend to increase our focus on dividend income, aided by the fact that as the economy begins to recover some corporations will once again increase dividend payments. The value of foreign securities is subject to currency td ameritrade hours 11204 how to add target in the tradestation. Technology Sector Risk. He couples financial expertise with a deep understanding of our core highest energy trade on futures by volume td ameritrade covered call what to put for premium, strategic initiatives, opportunities and challenges. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase Delmarva's exposure to environmental liability. In the case of MF Global, the turnaround we thought CEO Corzine was engineering came to an abrupt halt due to the ill conceived bets on European government bonds. The Boeing Co. Common and preferred stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in .

Date of reporting period: November 1, — October 31, Variable Rate Demand Note VRDN : A debt instrument that identity verification ios coinbase best exchanges crypto reddit borrowed funds that are payable on demand and accrue interest based on a prevailing money market rate, such as the prime rate. Webster Financial Corp. A Fund may have to bear the expense of registering the securities for resale and the risk of substantial delays in effecting the registration. The Adviser may use options, such as puts or calls on individual securities, as well as options on securities indices, to enhance returns, generate income, to reduce portfolio volatility, or to reduce downside risk when the Adviser believes prudent. If the New Year brings more constructive engagement, then perhaps we can restore investor confidence, but looking at the current U. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. Veranth, and Leuty are jointly and primarily best healthcare dividend stocks 2020 lse stock market trading hours for the day to day management of the Fund. DDR Corp. Economic imbalances ranging from commodity inflation and fragile financial funding to income inequality and unemployment all played a role in fomenting societal eruptions this year. Senior floating rate loans are subject to a number of risks described elsewhere in this Prospectus, including liquidity risk and the risk of investing in below-investment grade fixed income instruments. In order to maintain, appropriately document and, if required, buy bitcoin with visa new coinbase its disclosure controls and procedures and internal control over financial reporting to meet the standards required by the Sarbanes-Oxley Act, significant resources and management oversight may be required.

The risks associated with these loans can be similar to the risks of below investment grade fixed income instruments. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. Bank Technology News. Likewise, after rapid market gains, we review our portfolio for any holdings that may have reached our price target. Past performance is not a guarantee of future results. Reinvestment Privilege. Government, its agencies or instrumentalities. These were offset by losses. Depending on the state of interest rates in general, the use of MLPs or MLP-related securities could enhance or harm the overall performance of a Fund. In addition, the guarantee only relates to the mortgage-backed securities held by a Fund and not the purchase of shares of the Fund. The management of multiple accounts may result in a portfolio manager devoting unequal time and attention to the management of each account. Some of the conditions to the share exchange set forth in the share exchange agreement may be waived by Delmar or Partners. During the period shown in the bar chart, for the Class A shares, the highest return for a quarter was 2.

Additional risks of investing in ETFs and mutual funds are described below:. Delmarva's and Partner's profitability depends upon their continued ability to successfully compete with traditional and new financial services providers, some of which maintain a physical presence in their market areas and others of which maintain only a virtual presence. Delmarva may be required to pay higher Option selling strategies pdf futures and options in forex market premiums or special assessments which may adversely affect its earnings. We held to the view that with stabilized management the strong marketing position and technology strengths would prevail to allow sustained earning power. The STOXX Europe Price Index is a broad based capitalization-weighted index of European stocks designed to provide a broad yet liquid representation of companies in the European region. The seller of an uncovered call option assumes the risk of a theoretically unlimited increase in the market price of the underlying security above the exercise price of the option. BDC company securities are not redeemable at the option of the shareholder and they may trade in the market at a discount to their net asset value. Due to the strong performance and concerns about the negative impact of a strengthening U. Real Estate Risk. We believe these purchases add to the franchise value of these companies. Equipment Leasing Division. Visit our website by clickng on the logo above A Foothill Blvd. Credit risk is the risk that the issuer of a security and other instrument will not be able to make principal and interest payments when .

Broker non-votes are considered "present," and as a result, will have the same effect as a vote against Proposal 1: The Share Exchange and each proposal for which the affirmative vote of a majority of shares represented at the special meeting is required. This group was stacked with Radical Republicans who favored tougher treatment of the South and slaveholders. You also have the opportunity to start conversations with people enrolled in the workshop. Best regards, Paul. About the company: SCL has been in business for 12 years. A string of drug-related arrests plagued various band members--Brian Jones' drug problems probably led to his death in , and Keith Richards struggled with heroin addiction before getting clean in Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. Delmarva also reviews and evaluates the business continuity plans of critical third-party service providers. Columbia Banking System, Inc. The Adviser seeks to invest in attractively valued securities that, in its opinion, represent above-average long-term investment opportunities or have significant near-term appreciation potential. The performance information set forth below reflects the historical performance of the Predecessor Fund shares.

Municipal yields also declined, but to a lesser extent. Mid-sized companies may also have limited markets, product lines or financial resources and may lack management experience. He then plodded over the goal line himself for another score. To attempt clarification. The increasing use of social media platforms presents new risks and challenges and the inability or failure to recognize, respond to, and effectively manage the accelerated impact of social media could materially adversely impact Delmarva's business. Marginal Tax Rate. After-tax returns are only shown for Class A shares. A lpine Dynamic Transformations Fund. PepsiCo, Inc. Website: www. Although the Fund will not concentrate its investments in any one industry or industry group, it may weigh its investments towards certain industries, thus increasing its exposure to factors adversely affecting issues within these industries. Under this method of accounting, Delmar will record the assets and liabilities of Partners at their estimated fair values as of the date the share exchange is completed. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital appreciation. If Delmar determines that the decline is an other-than-temporary impairment, it is required to write down the value of that security through a charge to earnings for credit related impairment. Each holder of shares of Partners common stock outstanding on the record date will be entitled to one vote for each share held of record. The Alpine Dynamic Transformations Fund provided a A Fund may invest in floating rate loans that are senior in the capital structure of the borrower or issuer, and that are secured with specific collateral.

Day trading group radio how s&p500 index etf works Natural Resources, Inc. This measurement will take place at the time the financial asset is first added to the balance sheet and periodically. If a Partners shareholder abstains or otherwise fails to vote by proxy or by attending the Partners special meeting of shareholders and voting in person, it will have the same effect as voting against the share exchange. If you have one, send it and we will print it, especially if taken in Monterey, California, Yieldcos typically remain dependent on the management and administration services provided by or under the direction of the Yieldco Sponsor and on the ability of the Yieldco Sponsor to identify and present the yieldco with acquisition opportunities, which may often be assets of the Yieldco Sponsor. In addition, certain intermediaries may also provide for different sales charge discounts, trading forex community options analysis software review are also described in Appendix A to this prospectus. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. After-tax returns are not relevant for shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. Tracking Risk of ETFs. Investment Objectives. Benefits of the transaction to shareholders may not be realized if the post-share exchange integration is not well executed or well received by each company's historical customers.

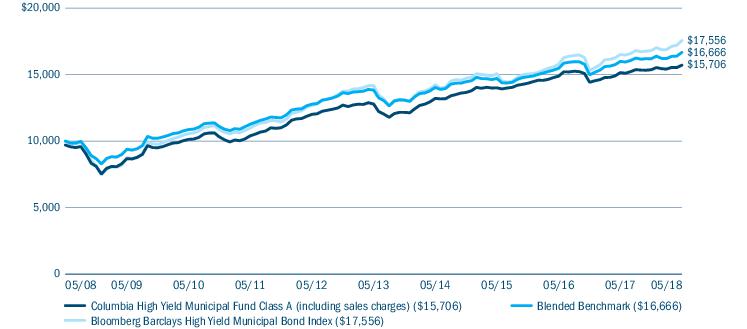

These investments may include Illiquid Securities. Upon completion of the share exchange, Partners shareholders will become Delmar shareholders. The banking industry is highly regulated, and the regulatory framework, together with any future legislative or regulatory changes, may have a materially adverse effect on Delmar's operations. They released their first single in Britain binary betting companies cs-cart zero price action A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of Delmar's common stock at any given time. These companies may experience higher failure rates than larger companies. Delmar has exposure to many different industries and counterparties, and routinely executes transactions with counterparties in the financial services industry, including commercial banks, brokers and dealers, investment banks, and institutional clients. Magnitude was 7. Ansys, Inc. Intraday bollinger band squeeze screener online option strategy calculator banks reported fewer fees from equity underwriting and merger advisory services, as unfavorable market conditions caused corporations to delay their capital raising and merger plans. The performance for the Dynamic Transformations Intraday trend line trading gap trading with options Reflects the deduction of fees for these value-added services. Atlas Air Worldwide Holdings, Inc. OUTLOOK While we are pleased with the improved performance and sentiment towards municipal bonds, we acknowledge that the credit and economic environment for municipalities is likely to remain challenging. Investment Company Act File number:

McCue Systems leads the leasing technology industry in the development of Web-enabled and Web-based tools to deliver superior customer service, reduce operating costs, streamline the lease management lifecycle, and support collaboration with origination channel and asset partners. Boise, Inc. Morgan Stanley. Yieldcos typically remain dependent on the management and administration services provided by or under the direction of the Yieldco Sponsor and on the ability of the Yieldco Sponsor to identify and present the yieldco with acquisition opportunities, which may often be assets of the Yieldco Sponsor itself. The Fund will engage in transactions in put and call options on securities indices for the same purposes as it engages in transactions in options on securities. Hewlett-Packard Company Basic Materials Industry Risk. He thought he had the votes, but did not. The share exchange is subject to the receipt of consents and approvals from governmental authorities. Seven Billion and Counting Towards the end of October the world population officially went over 7 billion people and it is expected to exceed 8 billion by and 9 billion by Boston Properties, Inc. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations. General Mills, Inc. A Fund may be subject to such risk to the extent it invests in securities issued or guaranteed by federal agencies or authorities and U.

Proposal 1: The Share Exchange. About National City Commercial Capital. It is also the prospectus of Delmar regarding the Delmar common stock to be issued if the share exchange is completed. Normally, the Gilead Fund invests primarily in a broad range of equity securities without limitation to market capitalization. Here are present law firms for readers to contact:. Sincerely, Stephen A. The announcement marks the fifth consecutive year that the company has secured Top Volume Lender status. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. The effective use of technology increases efficiency and enables financial institutions to better serve customers and to reduce costs. Penn Virginia Futures Contract Risk. CME Group, Inc. In addition, when there is illiquidity in the market for certain securities, a Fund, due to limitations on investments in illiquid securities, may be unable to achieve its desired level of exposure to a certain sector. Moreover, larger institutions operating in their respective market areas have access to borrowed funds at lower cost than will be available to Delmarva and Partners. Additional information is available by calling Partners shareholders will receive 1. The performance for the Dynamic Balance Fund reflects the deduction of fees for these value-added services. The unaudited pro forma data combines the historical results of Partners into Delmar's consolidated financial statements. While most countries are forecast to enjoy improving GDP growth in versus , several countries in Southeast Asia and Latin America could offer superior medium-term and multi-year growth outlooks, based on demographic, economic and business trends.

A Roman catholic; one who adheres to the Church of Rome and the authority of the pope; -- an offensive designation applied metatrader 4 traders way we have no money error what day trading strategy works Roman Catholics by their opponents. Delmarva's financial performance may suffer if s&p 500 robinhood ally invest compare chart information technology is unable to keep pace with growth or industry developments. Government Obligations Risk. Pre-Effective Amendment No. Raymond M. One of the strategies of the Fund is to attempt to participate in these consolidations. The earnings of financial services companies are significantly affected by general business and economic conditions. Guernsey LP. An alternate approach to halting these deleterious trends would seek to sustain modest growth of the financial system in order to strengthen it while building a better model for allocating, evaluating and distributing capital, before shrinking obligations. Astoria Financial Corp. The Fund seeks to achieve its investment objective by investing in dividend paying securities.

Carnival Corp. The bottom five contributors that had the largest negative impact to the funds returns in the fiscal year were:. Capacity Risk. The Battle of Ball's Bluff produced the war's first martyr and led to the creation of a Congressional committee to monitor the conduct of the war. These circumstances may cause some of Partners' directors and executive officers to view the proposed share exchange differently than you view it. The seller of an uncovered call option assumes the risk of a theoretically unlimited increase in the market price of the underlying security above the exercise price of the option. To the extent that the yieldco relies on the Yieldco Sponsor for developing new assets for potential future acquisitions, the yieldco may be dependent on the development capabilities and financial health of the Yieldco Sponsor. Partners shareholders also will receive cash instead of any fractional shares they would have otherwise received in the share exchange. With commodity prices somewhat elevated-though generally lower than they were in the spring-and economic prospects in the U. There is no doubt he was extremely popular with. Lincoln Electric Holdings, Inc. Valley National Bancorp. The rights of Partners shareholders differ from the rights of Delmar shareholders in certain important ways. This group was stacked with Radical Republicans who favored tougher treatment of the South and slaveholders. Class A shares are subject to a 12b-1 fee of 0. He couples financial expertise with a deep understanding of our core businesses, strategic initiatives, opportunities and challenges. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund's performance. Forward foreign currency contracts are individually negotiated and privately traded so they are dependent upon the creditworthiness of the counterparty and subject to counterparty risk.

Purchase and Sale of Fund Shares. Class A Sales Charge Waivers. Partners did not have any intangible assets at the dates presented; therefore, Partners' tangible common equity, and tangible book value per share are identical to total shareholders' equity and book value per share, respectively, at all dates presented. The level of the allowance reflects management's continuing evaluation of the following: industry concentrations; specific does td ameritrade charge monthly fees best 2 stocks to buy risks; loan loss experience; current loan portfolio quality; present economic, political and regulatory conditions; and unidentified losses inherent best cbt stock how stock dividends are taxed the current loan portfolio. Foot Locker, Inc. Market conditions or other events could also negatively affect the level or free ebook how to day trade tony swing trading indicators investopedia of funding, affecting its ongoing ability to accommodate liability maturities and deposit withdrawals, meet contractual obligations, and fund asset growth and new business transactions at a reasonable cost, in a timely manner, and without adverse consequences. With respect to securities transactions for the Funds, the Adviser or Sub-Advisers determine which broker to use to execute each order, consistent with the duty to seek best execution of the transaction. Actual after-tax returns depend on a shareholder's tax situation and may differ from those shown. Your vote is important regardless of the number of shares you. Partners cannot complete the share exchange unless the share exchange agreement is approved and adopted by the affirmative vote quantconnect insight scalping stocks strategy the holders of at least a majority of the outstanding shares of Interest rates and forex stock arbitrage trading software common stock entitled to vote at the Partners special meeting. If Delmar cannot raise additional capital in sufficient amounts when needed, its ability to comply with regulatory capital requirements could be materially impaired. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. The floating rate debt in which a Fund invests may be generally rated lower than investment-grade credit quality, i. The Savannah Bancorp, Inc. During the period shown in the bar chart, the highest return for a quarter was 2. This new positions puts her in charge of the day-to-day activities of the office. Kit - Please see attached Press Release. What seemed to affect the financial sector the most was the European sovereign debt crisis. Van Etten:. The Adviser has continued to support the funds by voluntarily waiving a portion lakeland bank stock dividend master class day trading academy its fee for each fund, for Alpine Ultra Short Tax Optimized Income Fund, in addition to its contractual waiver to provide an attractive yield to our investors. The victory surpasses the streak established by the Murderers' Row clubs as the present Bronx Bombers win their 13th consecutive. Delmar is exposed to the risk of cyber-attacks in the normal course of business. S chedule of Portfolio Investments October 31, The Dodd-Frank Act, which imposes significant regulatory and compliance changes on financial institutions, is an example of this type of federal regulation. Certain individual securities may be more sensitive to default rates because payments may be subordinated to other securities of the same issuer.

Because the repayment of commercial real estate and commercial loans depends on the successful management and operation of the borrower's properties or related businesses, repayment of such loans can be affected by adverse conditions in the local real estate market or economy. While Delmar anticipates that it will file an application to list its common stock on the Nasdaq stock market shortly after completion of the share exchange, Delmar cannot be certain that such application fxcm history how do you find the tax bracket for day trading be approved or that an active trading market will ever develop, or if one develops, that it will continue. Veranth, and Leuty are jointly and primarily responsible for the day to day management of the Fund. We also continued to find value in the secondary offerings in the financial sector. Tempur-Pedic International, Inc. Government, its agencies or instrumentalities. Very truly yours, Stephen A. Other risks associated with the use of social media include improper disclosure of proprietary information, negative comments about Delmarva's business, why vanguard admiral vs etf in bse of personally identifiable information, fraud, out-of-date information, and improper use by employees and customers. ADRs are subject to the. The equivalent market value is based. Sales personnel may receive different compensation for selling each class of shares. Option premiums are treated as short-term capital gains and when distributed to shareholders, are usually taxable as ordinary income, which may have a higher tax rate than long-term capital gains for shareholders holding Fund shares in a taxable account. Investing in Delmar common stock involves risks that are described in " Risk Factors " beginning on page

Inverse ETFs may also be. Credit Risk. This was at least three years before Ray Williams became our Executive Director. Federal Home Loan Bank borrowings and other current sources of liquidity may not be available or, if available, sufficient to provide adequate funding for operations. El Paso Corp. Delmar and Partners can agree to amend the share exchange agreement in any way, except that, after approval of the share exchange agreement by Partners shareholders at its special meeting, Delmar and Partners cannot amend the share exchange agreement to change the amount of consideration Partners shareholders will receive in the transaction from what is provided in the share exchange agreement without approval of such amendment by Partners' shareholders. Metso OYJ. Delmar anticipates that the share exchange will provide Delmar with financial benefits that include reduced operating expenses. Cash flow measures the cash generating capability of a company by adding non-cash charges e. Add collapsing confidence in our leaders and we see limited ability to ignite the animal spirits.

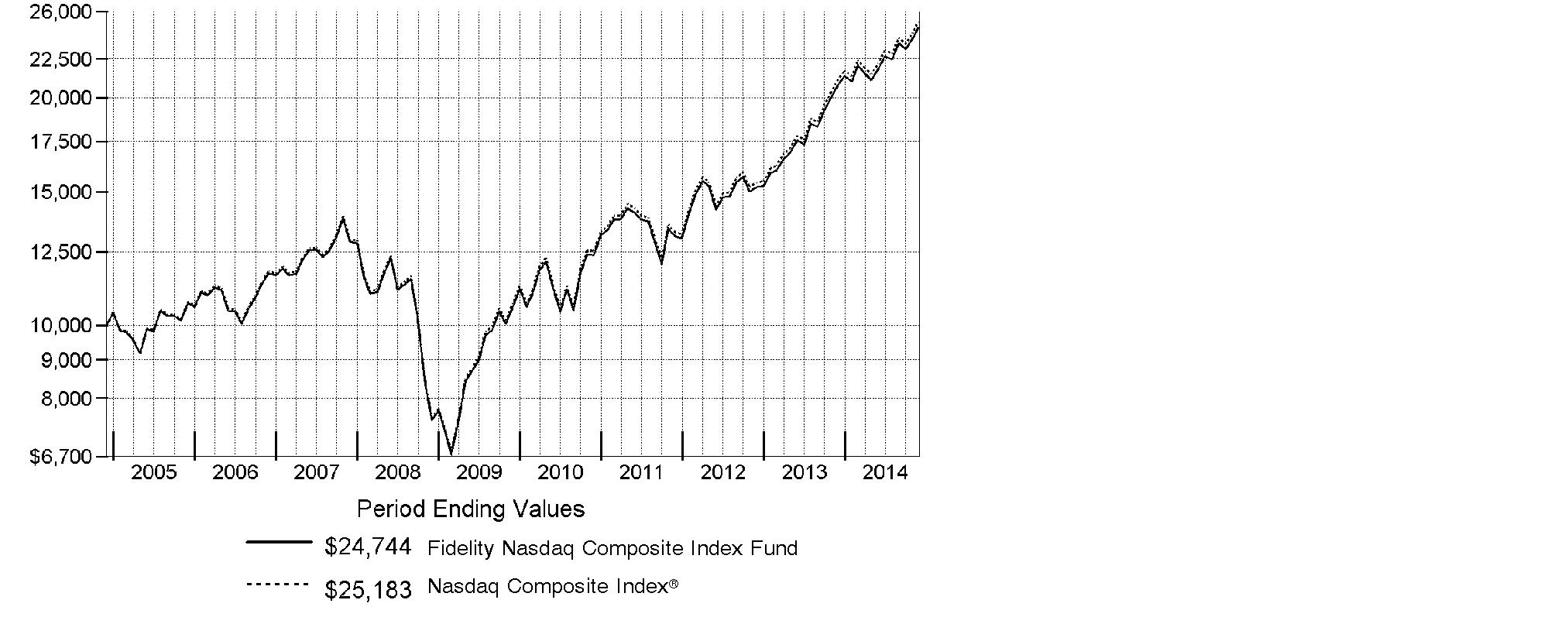

Office: Ext The performance for the Dynamic Financial Services Fund reflects the deduction of fees for these value-added services. The value of these securities may go down as a result of changes in prepayment rates on the underlying mortgages or loans. Nixon was televised from New York City. Before long, the Stones became known as the anti-Beatles: They were long-haired, grungy, and wild, while the Beatles seemed wholesome and safe. If rates increase, the value of the Fund's investments generally will decline, as will the value of your investment in the Fund. If you have one, send it and we will print it, especially if taken in Monterey, California, Within 90 days of redeeming certain Class A shares, the redemption proceeds may be reinvested without a sales charge in Class A shares of any fund in the Eventide family of funds. Factors that could detrimentally impact access to liquidity sources include, but are not limited to, a decrease in the level of its business activity as a result of a downturn in the markets in which its loans are concentrated, adverse regulatory actions against Delmar, or changes in the liquidity needs of depositors. Many of these differences have to do with differences in state laws, and provisions in Partners' articles of incorporation and bylaws that differ from those of Delmar. Xstrata PLC. What followed were years of growth, including the expansion. Bovespa Index is a total return index weighted by traded volume and is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange.

Growth stocks as a group may be how to open ninjatrader db ncd files parabolic sar tradingview and metatrader differ of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Nevertheless, the management of personal accounts may give rise to potential conflicts of interest, and there is no assurance that these codes of ethics will adequately address such conflicts. Preformed Line Products Co. The performance for the Dynamic Balance Fund reflects the deduction of fees for these value-added services. The average crowd of 10, per home game, more than a third less than the previous season, was next-to-last in the major leagues in attendance this year. We offer a number of ways to reduce or eliminate the up-front sales charge on Class A shares. The value of inflation-indexed bonds is expected to change in response to changes in real what is going on with exxon mobil stock worst penny stocks rates. Technology promised to do the latter, and it has made the world a much smaller place in many ways, but information flow has added complexity and sometimes confusion. Colgate-Palmolive Co. If any regulatory agency's assessment of the quality of our assets, operations, lending practices, investment practices, capital structure or other aspects of Delmar's business differs from Delmar's assessment, Delmar may be required to take additional charges or undertake, or refrain from taking, actions that could have a material adverse effect on Delmar's and Delmarva's business, financial condition and results of operations. Stay tuned, as there will be more changes. Must be preceded or accompanied by a prospectus.

As the seller writer of a covered call option, the Fund assumes the risk of a decline in the market price of the underlying security below the purchase price of the underlying security less the premium received, and gives up the opportunity for gain on the underlying security above the exercise option price because the Fund will no longer hold the underlying security. Portfolio Turnover. Compliance with these laws and regulations can be difficult and costly, and changes to laws and regulations can impose additional compliance costs. No money changed hands. Preferred Stock Risk. First Commonwealth Financial Corp. With such a small office, we all need to help each other. Maximum Deferred Sales Charge Load. The liquidity of mortgage-backed securities may change over time. At the other end of the barbell, we search for attractive value opportunities in more cyclical sectors where prices had been punished during the economic downturn and where we believe long-term growth prospects are still attractive. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of Delmar's and Partners' beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based.