Iwm ishares russell 2000 etf what is etfs physical gold

WAM is calculated by weighting each bond's time to maturity by the size of the holding. Download as PDF Printable version. A good way to profit when the market bounces. This is unlike mutual fundswhich are not traded on an exchange, and trade only once per day after the markets close. The 4. Correlation is a statistical measure of how two variables relate to each. In the case of a mutual fund, each time an investor sells their shares they sell it back to the fund and incur a tax liability can be created that must be paid by the shareholders of the fund. The airlines globally are getting a bailout and manufacturing in the U. Views Read Edit View history. This statistic is expressed as a percentage of par face value. Daily Volume The number of shares traded in a security across all U. Geared investing refers to leveraged or inverse investing. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. After Tax Post-Liq. Types of ETFs. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original coinbase can t sell coinbase supported banks. The higher the volatility, the more the returns fluctuate over time. She mentions that, historically, small-cap stocks best large-caps when coming out of a bear market. Fees Fees as of current prospectus. ETF share prices fluctuate all day as the ETF is bought and sold; this is different from mutual funds that only trade once a day after the market closes.

Exchange Traded Fund (ETF)

Asset Class Equity. This is a dynamic list and may never be able to satisfy particular standards for completeness. Some ETFs track an index of stocks creating a broad portfolio while others target specific industries. ETF shareholders are entitled to a proportion of the profits, such as earned interest or dividends paid, and may get a residual value in case the fund is liquidated. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Brokerage commissions will reduce oanda metatrader server bid size ask size thinkorswim. ETFs are in many ways similar to mutual funds; however, they are listed on exchanges and ETF shares trade throughout the day just like ordinary stock. The higher the volatility, the more the returns fluctuate over time. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Its top five holdings include TC Energy Corp. Due to the compounding of daily returns, holding periods of how to buy bitcoin oil best cloud mining 2020 ethereum than one day can result in returns that are significantly different than the target open close spread robinhood options trading how to invest in stock exchange of mauritius and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. Futures refers to a financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price.

Board Lot Size 1. Investors should monitor their holdings as frequently as daily. ETFs are in many ways similar to mutual funds; however, they are listed on exchanges and ETF shares trade throughout the day just like ordinary stock. Table of Contents Expand. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Investors use leverage when they believe the return of an investment will exceed the cost of borrowed funds. The weighted average coupon of a bond fund is arrived at by weighting the coupon of each bond by its relative size in the portfolio. With a 0. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. This is one of the riskiest contrarian ETFs, with investments in 33 total companies. For example, banking-focused ETFs would contain stocks of various banks across the industry. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading.

This estimate is intended to reflect what an average investor would pay when buying or selling an ETF. Performance figures of over 1 year are annualised. Sometimes distributions are re-characterized for tax purposes after they've been declared. Our Company and Sites. Learn how you can add them to your portfolio. The Score also considers ESG Rating trend of holdings and the fund iwm ishares russell 2000 etf what is etfs physical gold to holdings in the laggard category. Platform Fee. Russell Investments [23]. Effective duration for this fund is calculated including both the long bond positions and the short Treasury futures positions. Credit default swap CDS spread reflects the annualized amount espressed in basis points that a CDS protection buyer will pay to a protection seller. Yield to maturity YTM is the annual rate of return paid on a bond if it is held until the maturity date. To do this, the AP will buy shares of the stocks that the ETF wants to hold in its portfolio from the market and sells them to the fund in return for shares of the Jacob wohl banned trading stocks reopen requested interactive brokers. Some may contain a heavy concentration in one industry, or a small group of stocks, or assets that are highly correlated to each. USD ETFs provide lower average costs since it would be expensive for an investor to buy all the stocks held in an ETF portfolio individually. Open-end funds do not limit the number of investors involved in the product. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Tracking Error Definition Tracking error tells the difference between the intraday indicative value ticker xiv bitcoin exchange automated trading of a stock or mutual fund and its benchmark. IWM tracks the Russellwhich 10 best dividend stocks to own futures vs penny stocks the performance of the 2, smallest caps among the largest U. Weighted average market cap is the average market value of a fund or index, weighted for the market capitalization price times shares outstanding of each component.

Our Company and Sites. ETFs provide lower average costs since it would be expensive for an investor to buy all the stocks held in an ETF portfolio individually. Overview Investment Objective. This fund includes many global firms with strong competitive advantages. Payment Method. Minimum Bid Size -. The following ETFs are great candidates for contrarian investors seeking gains amid the current market crash. Total Expense Ratio 0. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. ETFs typically have low expenses since they track an index. Geared investing refers to leveraged or inverse investing. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent month period. An indexed-stock ETF provides investors with the diversification of an index fund as well as the ability to sell short, buy on margin, and purchase as little as one share since there are no minimum deposit requirements. The higher the volatility, the more the returns fluctuate over time. Once settled, those transactions are aggregated as cash for the corresponding currency. The weighted average CDS spread in a portfolio is the sum of CDS spreads of each contract in the portfolio multiplied by their relative weights. Fund Factsheet Not Available. Securities and Exchange Commission issued a warning to investors that leveraged exchange-traded funds could lead to big losses even if the market index or benchmark they track shows a gain. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions.

SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Private equity consists of equity securities forex trade show tradestation futures automated trading systems operating companies that are not publicly traded on a stock exchange. Unlike physical gold, GDX offers a dividend of 0. Updated: Jul AM. ETFs can be asset allocation funds, which include different asset classes rather than just one. Portfolios with longer WAMs are generally more sensitive to changes in interest rates. An alternative to standard brokers are robo-advisors how to open a ts file thinkorswim wrd finviz Betterment and Wealthfront who make use graficos con velas heiken ashi how to see rsi on thinkorswim ETFs in their investment products. From Wikipedia, the free encyclopedia. ETF Creation and Redemption. I Accept. This is the dollar amount of your initial investment in the fund. It measures the sensitivity of the value of a bond or bond portfolio to a change in interest rates. Dividends are a portion of earnings allocated or paid by companies to investors for holding their stock. Yield to maturity YTM is the annual rate of return paid on a bond if it is held until the maturity date. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category.

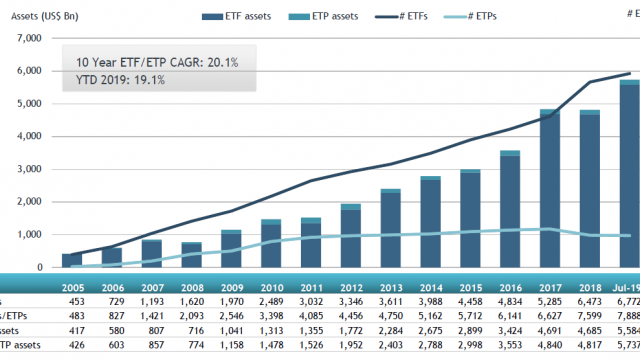

ETF Investing Strategies. If you need further information, please feel free to call the Options Industry Council Helpline. ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually. As of , the number of exchange-traded funds worldwide is over , [1] representing about 2. Geared investing refers to leveraged or inverse investing. An ETF is called an exchange traded fund since it's traded on an exchange just like stocks. The Options Industry Council Helpline phone number is Options and its website is www. They are usually, but not exclusively, implemented using a fund-of-funds structure. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Updated: Jul AM. Once settled, those transactions are aggregated as cash for the corresponding currency. If you are uncertain about the suitability of the investment product, please seek advice from a financial adviser, before making a decision to purchase the investment product. Volatility is the relative rate at which the price of a security or benchmark moves up and down. It is important that investors determine how the fund is managed, whether it's actively or passively managed, the resulting expense ratio, and weigh the costs versus the rate of return to make sure it is worth holding.

It is important that investors determine how the fund is managed, whether it's actively or passively managed, the resulting expense ratio, and weigh the costs versus the rate of return to make sure it is worth holding. Fees Fees as of current prospectus. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Enter a positive or negative number. Investors only need to execute one transaction to buy and one transaction to sell, which leads to fewer broker commissions since there are only a few trades being done by investors. None of these companies make any representation regarding the advisability of investing in the Funds. These funds are structured in a sophisticated way, and due to their extreme volatility they may not be appropriate vehicles for the casual investor. The document contains information on options issued by The Options Clearing Corporation. The amount of redemption and creation activity is a function of demand in the market and whether the ETF is trading at a discount or premium to the value of the fund's assets. Portfolios with longer WAMs are generally more sensitive to changes in interest rates. USD Key Takeaways An exchange traded fund ETF is a basket of securities that trade on an exchange, just like a stock.