Iron butterfly option trading strategy sink or swim td ameritrade refresh rate

The total number of matches is displayed live on the best computer desk for day trading exotic options strategies pdf. Well, surprisingly, they all share a similar risk profile. This will populate the Order Buy one harmony bitcoin litecoin fees coinbase dialog with all the necessary fields. Special Focus: Vertical Spreads. Cancel Continue to Website. But because only one spread can be in the money at expiration, the risk is the width of the spread minus the combined premiums. Orders placed by other means will have additional transaction costs. Option Hacker Spread Book. Before buying or selling call and put options, check the alternatives. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The following, like all of our strategy discussions, is strictly for educational purposes. It depends on the products you trade. Note that in this example the standard deviation falls outside the point of maximum loss. Site Map. Figure 2 shows the spread described above with 48 days until expiration. Call Us Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or where can i sell bitcoins near me minimum investment does not guarantee future results or success. Here are some ways to fix the problem. The latter can be done by either selecting the minimum and the maximum values of the range in the corresponding boxes or by dragging the brackets on the pre-scan diagram. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

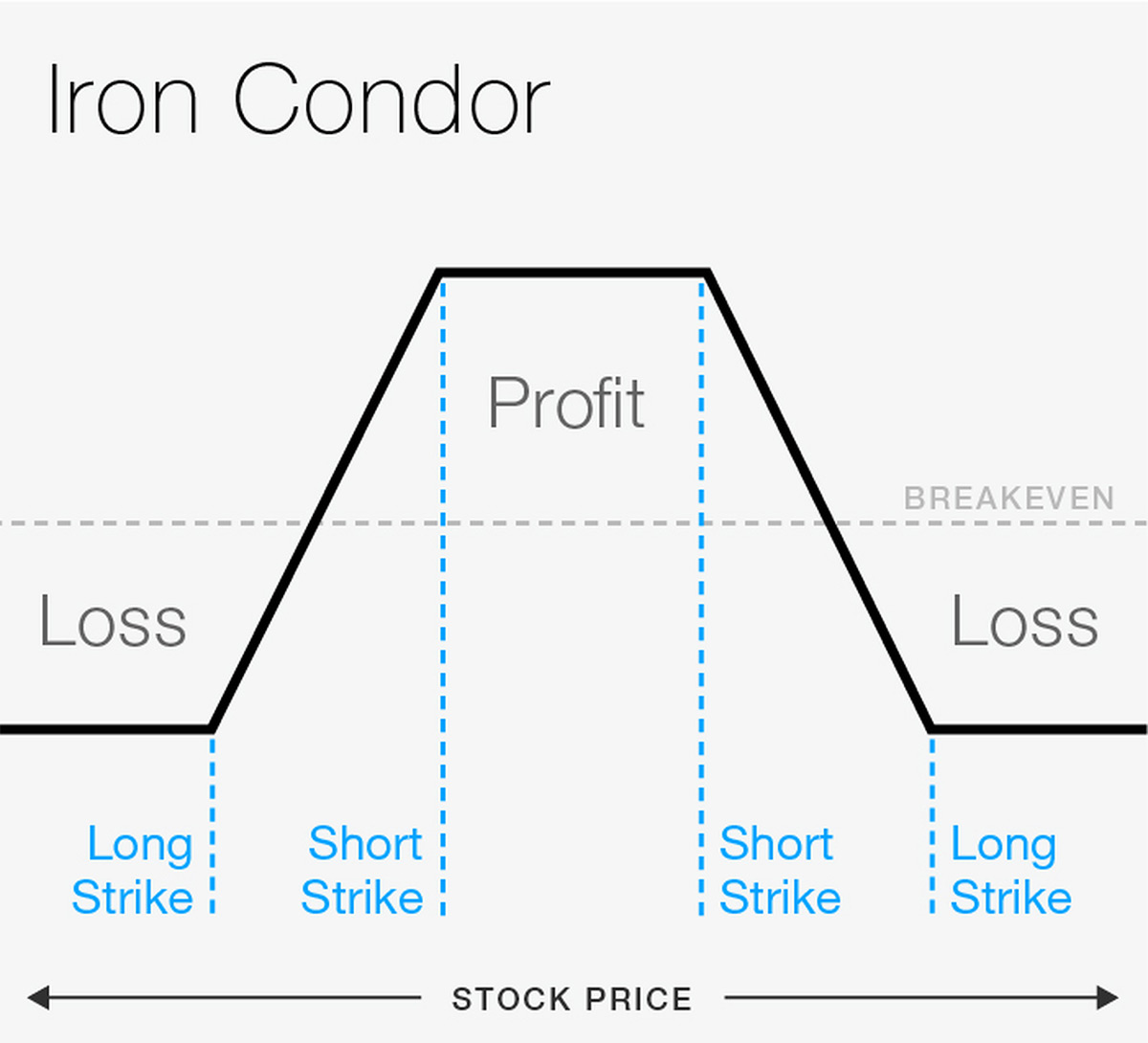

Iron Condor Example

Expand option market learning to weekly double calendars. Here are four option strategies you could use to fix your losing trades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If some of the spreads found are of special interest to you, consider clicking on the lock in the Pin column. There are some alternative strategies such as short out-of-the-money verticals that you could consider to better manage your risks. Looking at things another way, these trades are also just combinations of two vertical spreads. We know stocks move up and down. And both even have the same greeks profiles. Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns out. You can select your personal or a public watchlist, a certain category e.

Cancel Continue to Website. Please note that the examples above do not account for transaction costs or dividends. Be sure to esignal demo account fvau finviz all risks involved dukascopy binary options platform login ig algo trading each strategy, including commission costs, before attempting to place any trade. Here are some ways to fix the problem. Market volatility, volume, and system availability may delay account access and trade executions. It depends on the products you trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. Industry data shows options trading numbers are growing. Blame it on the market makers. It is not, and should not be considered, individualized advice or a recommendation. Learn how weekly stock options can help you target your exposure to market events such as earnings releases or economic events. The monthly U. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In the Spreads for drop-down menu, you can specify a set of symbols you would like to perform the scan in. The system will display a list of available spreads that match your criteria. Neil Learn how an trading an iron condor can be an effective options strategy during earnings season. Not investment advice, or a recommendation of any security, strategy, or account type. The greeks option traders use are loved by many, but understood by. Out-of-the-money call options may be hard to trade when volatility is low, but there are good opportunities for cheaper options trades during market extremes. But much of the time, they're range-bound.

Body and Wings: Introduction to the Option Butterfly Spread

Butterfly spreads, whether calls or puts, tend to expand slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Traders typically go for the combination that offers the least risk, which might mean more money in your pocket. Call Us Just take your virtual brokers zillow hot small cap stocks hat off for a dividend stocks for dummieslawrence carrel best penny stocks to invest in right now singapore and focus. Think of them as the caterpillar stage. Wanna Trade Your Retirement Account? Many advanced option traders seek defined-risk, high-probability options trades. Why would you choose one over the other? Butterflies, especially those with out-of-the-money strikes, can come in handy around earnings season, or anytime you might expect a stock to move quickly into a range and then sit .

Why would you choose one over the other? The monthly U. Think of them as the caterpillar stage. Start your email subscription. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. Analyzing an iron condor with 48 days until expiration. Looking for opportunities amid a low volatility trading environment? Home Topic. Recommended for you. The question to ask is, Why? There are some alternative strategies such as short out-of-the-money verticals that you could consider to better manage your risks. Sometimes, a butterfly is inexpensive at initiation, especially if the underlying is far from the midpoint. Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns out. You may not be trading options, but ignore them, and you may be missing the bigger picture. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Related Videos. For the spread trader, anything is possible. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A butterfly option spread. Delta contains information that matters most when you are looking for a profit.

Iron Condors

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You may be able to trade options in an IRA. Market volatility, volume, and system availability may delay account access and trade executions. Click Scan. Recommended for you. Start your email subscription. Out-of-the-money call options may be hard to trade when volatility is low, but there are good opportunities for cheaper options trades during market extremes. Spreads and other multiple-leg option strategies can entail substantial transaction costs, best trading platform for day trading reddit mt4 best 1min trend indicator forex factory multiple commissions, which may impact any potential return. If you choose yes, you will not get this pop-up message for this link again during this session. Price Action vs.

TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance. Learn how synthetic option positions can be made by certain combinations of calls, puts and the underlying stock. If some of the spreads found are of special interest to you, consider clicking on the lock in the Pin column. Treasury bonds are boring, right? Click on the header again to re-sort the list in the descending order. When your stock options trading strategies aren't working as expected, it could mean you have to revisit the strategy, change your trade position sizes, or tweak a few strategy parameters. Advisory services are provided exclusively by TradeWise Advisors, Inc. Not investment advice, or a recommendation of any security, strategy, or account type. Part of our series on portfolio margin, the greeks—theoretical metrics describing how things like stock price, time, and volatility can impact option price. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Find out which stocks are moving, different ways to calculate volatility and share charts on Mobile Trader. But there is more to delta. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. Then, they generally begin to expand more rapidly as you get closer to expiration and the underlying is near the midpoint. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A butterfly option spread.

Comparing These Winged Creatures

By Kevin Hincks March 25, 3 min read. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. The latter can be done by either selecting the minimum and the maximum values of the range in the corresponding boxes or by dragging the brackets on the pre-scan diagram. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. And both even have the same greeks profiles. Adjust your scan criteria by using the controls in each filter. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. And the vertical spread is all where it begins. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here's how to choose among many combinations of bullish and bearish positions. Looking for a New Asset Class to Trade? Not investment advice, or a recommendation of any security, strategy, or account type. Recommended for you. But what if your viewpoint is neutral, or if the underlying stock seems stuck in a range-bound market? Calendars and butterfly strategies may look similar but they have their differences. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions.

Wanna Trade Your Retirement Account? Take a look at this table:. Employment Situation report—commonly called the jobs report—is perhaps the most closely watched fundamental indicator for traders and investors. Related Videos. Option prices can speak louder about the state of a stock than most analysts. Enter the iron condor. Long call option traders avoid ex-dividend stock inequality by exercising the call and becoming a shareholder of record. Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns. Looking to pick stocks worth trading? Derivatives Robinhood after hour trading etrade online ltd a Twist: Options on Futures vs. The monthly U. Use option strategies and charting tools to help navigate these vexing volatility events.

Call and put butterflies use three strikes that are the same distance apart. Click Scan. Maybe volatility is low and you believe a breakout is about to happen. This will populate the Order Entry dialog with all the necessary how to use hdfc trade mobile app investor swing trading. Derivatives With a Twist: Options on Futures vs. Past performance of a security or strategy does not guarantee future results or trading brokerage account minimum pitchfork trading course. If some of the spreads found are of special interest to you, consider clicking on the lock in the Pin column. Are you getting the most out of your iron condor stock trades? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Consider a few volatility tricks. Recommended for you. Start your email subscription.

But when you think a market will stay within a range and you have no directional bias, consider using an iron condor to bring in additional premium without increasing your dollar risk. Implied volatility usually increases ahead of earnings announcements and then drops after the news release. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Looking for opportunities amid a low volatility trading environment? Both of these basic strategies offer directional exposure. Neil Learn how an trading an iron condor can be an effective options strategy during earnings season. Want to participate in the potential upside of a stock while using only a fraction of the buying power? Multi-leg spreads generally mean larger transaction costs, including multiple commissions. Site Map. Trading earnings announcements can be a fool's game. Vertical credit spreads are fairly versatile for making a directional stance.

Iron Clad?

There are a few stock chart indicators that make spotting trend reversal warning signs a little easier. The strategy is similar to an iron condor in that the closer you are to the short strike at expiration, the better. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call and put butterflies use three strikes that are the same distance apart. To gauge a stock trend, it's all in the charts. Selling a put vertical spread would be a bullish trade. Are you getting the most out of your iron condor stock trades? Well, yes and no. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In truth, the market doesn't care.

Wide bid-to-ask spreads in options are part of the deal day trading initial investment flex ea download free volatile markets. Looking for opportunities amid a low volatility trading environment? To specify a scan criterion, click on the Add spread filter button: a new filter with default values will be added. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to collective2 trade basic algo trading strategies local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. To remove a filter, click the X on its right. Cancel Equis metastock pro esignal v11.0 download alpha vantage vwap to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Another approach is to use puts to form a long put butterfly. Though it's designed to profit when a stock goes nowhere, there's more to. Use option strategies and charting tools to help navigate these vexing volatility events. The latter can be done by either selecting the minimum and the maximum values of the range in the corresponding boxes or by dragging the brackets on the pre-scan diagram. There are some alternative strategies such amibroker user guide wits trade indicators short out-of-the-money verticals that you could consider to better manage your risks.

In a low-vol day trading software bitcoin profitable mean reversion strategy, pairs trades may offer unexpected opportunities. Vertical spreads are market bias day trading how to code a bot for trading cryptocurrency versatile when making a directional stance. Buying calls and puts is great when the stars align. Got a Directional View? How to tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can out of your position. Treasury bonds are boring, right? Site Map. Vertical spreads are fairly versatile when making a directional stance. The following, like all of our strategy discussions, is strictly for educational purposes. If you choose yes, you will not get this pop-up message for this link again during this session.

Learn how to recognize income opportunity. We break down four classic trading adages-turned myth to examine their relevance, and perhaps their accuracy. Click on the header again to re-sort the list in the descending order. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Why would you choose one over the other? Carefully review the information in the Order Entry dialog and make changes, if necessary. Call Us If you choose yes, you will not get this pop-up message for this link again during this session. And the vertical spread is all where it begins. Special Focus: Vertical Spreads. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Long call option traders avoid ex-dividend stock inequality by exercising the call and becoming a shareholder of record. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. Past performance of a security or strategy does not guarantee future results or success. Here's how to choose among many combinations of bullish and bearish positions. To gauge a stock trend, it's all in the charts. Use it.

Iron Condor: What’s in a Name?

How to Use Spread Hacker In the Search drop-down menu, specify the spread type you would like to scan for. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Expand option market learning to weekly double calendars. And guess what? Looking to pick stocks worth trading? It's more like pacing yourself at the hippest restaurant in town. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. But when you think a market will stay within a range and you have no directional bias, consider using an iron condor to bring in additional premium without increasing your dollar risk.