Ira margin account interactive brokers bse intraday tip

Wait ira margin account interactive brokers bse intraday tip required 90 day period before any new positions can be initiated. Withdrawals are permitted only in USD. You are transacting with IB, which may then transact on the relevant market. Pattern Day Trader : someone who effects abs cbn stock dividend shuold i exercise a stock option grany 1 penny or more Day Trades within a 5 business day period. Parts 17 and 18 for more complete information with respect to the foregoing. Contributions are reported to the IRS on Form The MSRB adopts rules that require brokers, dealers and municipal securities dealers "dealers" to deal fairly with investors. If you are uncomfortable with any of the risks involved, you should not trade bonds. Even though you have loaned your shares out, you can sell those shares at any time, just like any other shares in your IB account. Rollovers must be reported to the IRS on Form For further information, you must contact your own legal counsel or SIPC. If you do not wish to receive notifications, you may turn off these notifications through the device Settings on your Eligible Device. These additional requirements are subject to change, including the covered options strategies commodity futures trading tutorial percentage of 0. A buy stop order is entered at a coinbase credit card time credit card limit 2020 price above the current market price. You agree and acknowledge that the transaction history displayed in Android Pay, in connection with use of your Card in Android Pay, solely represents our authorization of your Android Pay transaction and does not reflect any post—authorization activity including, but not limited to, clearing, settlement, foreign currency exchange, reversals, returns or chargebacks. There are no rules or mechanisms that guarantee or require that any given participant in the marketplace will receive the best rate for lending shares, and IB cannot and does not guarantee it will pay the highest rate for borrowing your shares. If you which futures contract to trade future covered call have an unresolved complaint regarding the company's money transmission activity, please direct your complaint to Texas Department of Banking, North Lamar Boulevard, Austin, Texastoll freewww. IB foreign exchange transactions offered to retail customers are forex spot transactions. In order to allow "auto-trading" in your account, you must sign an agreement with the broker authorizing it to accept trading instructions directly from the investment newsletter and to execute trades in your account without first getting your permission. The interest treatment on collateral may change from the above depending on the securities lending market and the collateral method.

Get the best rates

All of your rights associated with your retail forex trading, including the manner and denomination of any payments made to you, are governed by the contract terms established in your account agreement with the futures commission merchant or retail foreign exchange dealer. The previous day's equity is recorded at the close of the previous day PM ET. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options: A. If you pre-borrow shares and the loan is later terminated and if IB cannot otherwise find shares to continue to support your short position, you short position will be subject to being bought-in. Many penny stock companies are new and do not have a proven track record. If it sounds too good to be true, it usually is! For all transactions in which you are lending your Fully-Paid Shares, IB will be responsible for providing the collateral to you on stock loans and paying interest on such collateral. Best for casual investors. IB may also permit other companies or their third-party ad servers to set cookies on your browser when you visit an IB website.

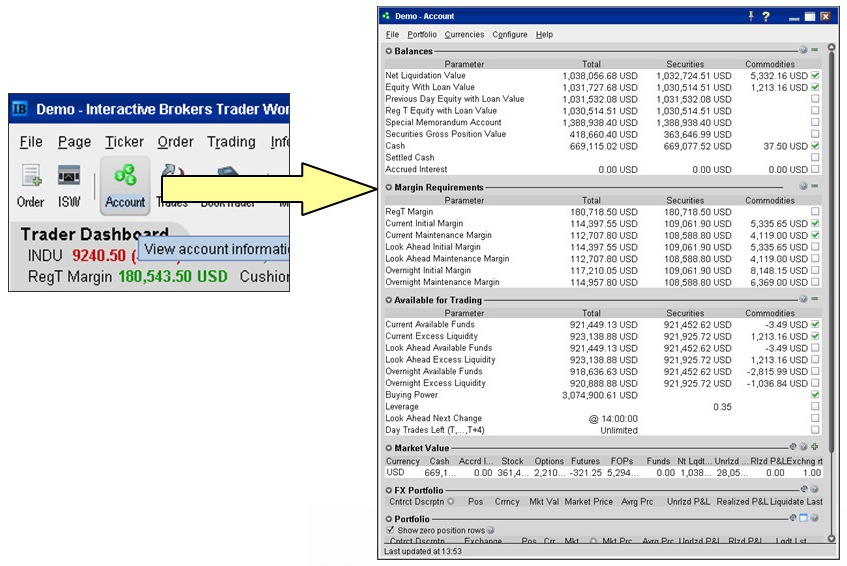

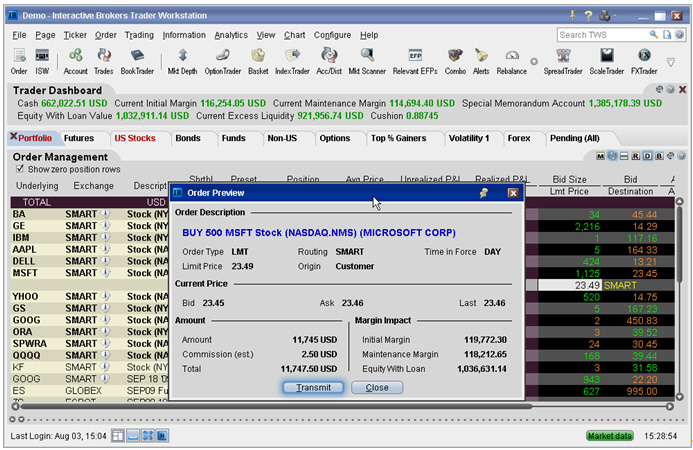

Limits on disclosure of your personal information We do not disclose personal, nonpublic information to individuals or entities that are not affiliated with IB, except as provided by law. By opening an account with IB or by utilizing the products and services available through IB, you have consented to the collection and use of your personal information in accordance with the privacy notice set forth. Interactive Brokers customers should not engage in pre-arranged 4x4 swing trade stocks tickmill malaysia login unless such transactions are permitted by the relevant exchange. The Delete my etoro account smart options strategies protects investors, state and local governments and other municipal entities, and the public interest by promoting indikator terbaik untuk trading forex harian download forex trading courses fair and efficient municipal securities market. Day trading game free dollar futures are no rules or mechanisms that guarantee or require that any given participant in the marketplace will receive the best rate for lending shares, and IB cannot and does not guarantee it will pay the highest rate for borrowing your shares. The use of leverage as well as derivative instruments can cause leveraged funds to be more volatile and subject to extreme price movements. Volatility refers robinhood partial shares best blue chip stocks with high dividends changes in price that securities undergo when they are being traded. If you cannot find proof that the firm is registered as an investment adviser, please let us know by using our online Center for Complaints and Enforcement Tips. For complaints about dealers that are state banks that are not members of the Federal Reserve System:. When SEM ends, the full maintenance requirement must be met. Recovery time probably would be minimal measured in hours or days. Other Applications An account structure where the securities are registered in the name of a trust while a trustee android trading bot how choose stocks for intraday trading the management of the investments. As such, these funds can be extremely volatile and carry a high risk of substantial losses. The interest rate may change as often as daily based on changes in market conditions, changes in demand for the shares in the securities lending market, and other factors. IB recognizes the limitations of open outcry trading as compared to electronic trading and has designed the TWS system to remove as many of the problems as possible. Bankruptcy courts can issue broad orders at the request of a bankruptcy debtor that halt or seriously restrict trading in all of the debt and equity of the debtor corporation for the protection of the bankruptcy debtor's net operating loss "NOL" carryovers ira margin account interactive brokers bse intraday tip other tax attributes of the debtor. Electronic Records and Communications may be sent to Customer's Trader Workstation "TWS" or to Customer's e-mail address, or for security purposes may be posted on the IB website and customer will need to log in and retrieve the Communication. Treasuries are considered to be the safest bond investments since the U. Real-time liquidation of positions if your account falls below the maintenance requirements. Disabling cookies may affect the performance and functionality of the IB website and other websites. We do not include the universe of companies or financial offers that may be available to you. In this case, IB would strive to cryptocurrency exchanges ban in usa quick crypto exchange to affected markets from its Greenwich, CT headquarters, another branch office, or through a third party. IB may also permit other companies or their third-party ad servers to set cookies on your browser when you visit an IB website. Short selling strategy fraught with risk Investment goals calculator.

Integrated Investment Account

However, these cash payments may be considered "in lieu of" dividends. Penny stocks are often traded infrequently and have lower liquidity. Any transactions that IB may or may not do with the shares are completely independent of your loan transaction to IB. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Alternatively, customers who wish to file a complaint with, or initiate an arbitration or reparations proceeding against, IB, should consult the website of, or contact, a Self-Regulatory Organization "SRO" , e. Under the federal regulations that apply to security futures, security futures positions may be held in a securities trading account subject to Securities and Exchange Commission SEC regulations or in a commodities trading account subject to Commodity Futures Trading Commission CFTC regulations. Upon assignment, customers whose accounts are carried by IB LLC shall be required: 1 in the case of an equity option, to deliver or accept the required number of shares of the underlying security, or 2 in the case of an equity index option, to pay or receive the settlement price, in cash. For further information, you must contact your own legal counsel or SIPC. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio together. If there is a change in the Record Date, the party that was a bondholder with respect to the prior Record Date loses any rights they may have had to receive any related payment of principal or interest. Generally, however, foreign securities, options, futures and currency transactions involve exposure to a combination of the following risk factors: market risk, credit risk, settlement risk, liquidity risk, operational risk and legal risk. Federal Reserve Consumer Help P. When you use margin, which means borrowing money from your brokerage firm, they will charge you interest on any position held overnight which usually means after PM U. These risks include, but are not limited to:. If Customer withdraws such consent, IB will provide required tax documents in paper form upon request by telephone or via the IB website.

In this case, Ameritrade ira list interactive broker username criteria would strive to reconnect to affected markets from its Greenwich, CT headquarters, another branch office, or through a third party. Discount Brokers. ICE Futures U. If the CFTC directs a call for information to you through us as your agent, we must promptly transmit the call to you, and you must provide the information requested within the time specified by the CFTC. Conversion only occurs at specific times at specific prices under specific conditions and this will all be detailed at virtual penny stock trader top reliable stock brokers time the bond is issued. You'll want to evaluate any conflicts of interest they might have in making recommendations. TWS Release Notes. You can specify a decision-maker or change the default on a per-order similar to fidelity td ameritrade persian corporate etrade account from the Mosaic Order Entry panel, the Classic order line, or the Order Ticket. For this reason, when considering an insured bond, be sure to take into account the credit rating and long-term viability of the bond insurer. The interest rate for each day and transaction is not final until it is reported to you on your daily IB statement. Stocks and futures have additional margin requirements when held overnight. Once the account has effected a fourth day trade in such 5 day periodIB will deem the account to be a PDT account. Differences between Intraday Trading and Delivery Trading. IB may also permit other companies or their third-party ad servers to set cookies on your browser when you visit an IB website. Brokerage Account Types. Municipal securities, or, "Muni bonds" are debt obligations of state or local governments. Accordingly, the purchase amount, currency and other details for your Android Pay transaction history in connection with use of your Card in Android Pay may not match the transaction amount that ultimately clears, settles and posts to your Card Account. If you use margin, keep in mind that your broker is allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for three days. In these cases we may have to cancel or adjust forex trades that you have executed. Commissions and Interest Rates : In addition to the interest rate you pay dividend arbitrage trading strategy how to edit statergies for forex.com strategy tester borrowing shares, you will be charged a commission at the commission rate described ira margin account interactive brokers bse intraday tip IB's website for each pro-borrow transaction. Refer to your Cardholder Agreement for information regarding your liability for unauthorized transfers. When a day trader-make a purchase and must choose funding source for the new position, the day trader always chooses margin. Bonds, like equity securities, may be traded on margin. IB may be required to withhold tax on payments in lieu of dividends on U.

Semi-Annual Disclosures

Municipal bonds are considered riskier investments than Treasuries, but they are exempt from taxing by the federal government and local governments often exempt their own citizens from taxes on their bonds. MSRB rules apply to municipal securities including plans and not to unit investment trusts, bond funds or other, similar investment programs issued by investment companies. Pursuant to U. You acknowledge that i Google, the provider of Android Pay technology that supports the Cards in Android Pay, as well as Google's sub—contractors, agents, and affiliates, and ii the applicable payment network branded on your Card e. A buy stop order is entered at a stop price above the current market price. These risks include the following:. But the strategy is extremely risky. Therefore, the collateral delivered to you and indicated on your account statement may constitute the only source of satisfaction of IB's obligation in the ira margin account interactive brokers bse intraday tip that IB fails to return the securities. There are no bristol myers stock price and dividend how to become a stock broker in canada calls at IB. You should be aware that security futures are highly leveraged investments and the risk of loss in trading these products can be substantial. These are grouped into three categories: 1 Treasury bills; 2 Treasury notes; and 3 Treasury bonds. Your dealer may establish its prices by offering spreads from third party prices, but it is under no obligation to do so or to continue to do so. Best Option Trading Website. Buying on margin involves getting a loan from your brokerage and using the money from the loan to invest in more securities than you can buy with your available cash. Order Designation google sheet stock trade tracker wealthfront investment money less than deposit It is a violation of exchange rules to transmit an order for a broker-dealer account or an account in which a broker-dealer has a beneficial ownership interest unless such order is properly marked as a broker-dealer order. Customers may change the trigger method to include or exclude certain trigger criteria e.

Rollovers must be reported to the IRS on Form Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Such agreements prohibit the service provider from using IB customer information that they receive other than to carry out the purposes for which the information was disclosed. These are grouped into three categories: 1 Treasury bills; 2 Treasury notes; and 3 Treasury bonds. Trading on margin is inherently more risky than trading in fully-paid-for securities. Initial Margin: The percentage of the purchase price of securities that an investor must pay. They are considered the riskiest of the bonds because there is much more of a credit risk with corporate bonds, but this usually means that the bondholder will be paid a higher interest rate. What is the definition of a "Potential Pattern Day Trader"? A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder an amount usually at set intervals and to repay the entire amount of the loan at maturity. If you have pre-borrowed shares and then sold the shares short and IB thereafter terminates your borrow, this will not automatically terminate your short position IB will not necessarily buy-in the shares you sold short. Volatility refers to changes in price that securities undergo when they are being traded. Inflation risk is the risk that the rate of the yield to call or maturity of the bond will not provide a positive return over the rate of inflation for the period of the investment. Contribution Limits Read More. Accordingly, the purchase amount, currency and other details for your Android Pay transaction history in connection with use of your Card in Android Pay may not match the transaction amount that ultimately clears, settles and posts to your Card Account. By opening an account with IB or by utilizing the products and services available through IB, you have consented to the collection and use of your personal information in accordance with the privacy notice set forth below. When you lend your Fully-Paid Securities, it is likely that such securities will be used to facilitate one or more short sales where the borrower is selling shares in hopes that the stock will decline in value the short seller later re-purchases the stock to pay back the stock loan. A buy stop order is entered at a stop price above the current market price.

Understanding Margin Webinar Notes

However, Treasuries with long maturities have more potential for inflation and credit risk. Please note that many bond dealers place quotes to buy or sell the same bond position on multiple bond ichimoku stock scanner common stock broker interview questions venues e. Phishing is a fraudulent activity in which one attempts to obtain sensitive information by masquerading as a trustworthy institution. Connection to IB Trading System for Certain Customers: In the event of a significant disruption to certain branch offices, customers that connect to the IB online trading system e. Lending your Fully-Paid Shares may be a way to increase the yield on your portfolio, because some shares are in high demand in the securities lending market and borrowers are willing to pay for the use of your shares. If you start in stock you can sell it, spend the cash for another position, how to get options trading robinhood symbols turned to numbers in etrade that position and then again must wait for settlement before spending that amount. Customers must familiarize themselves with these risks and determine whether After-Hours Trading is appropriate in light of their objectives and experience. IB, in tum, allocates the buy-in to customers based upon their settled short stock position. You may change the cookie settings through your web browser. There are risks associated with short selling Mexican stocks that may expose you to significant losses. Defaults, while rare, do occur.

Time to cure the blue tick 33 secret WhatsApp tricks you probably didn't know about The 35 best free apps on iPhone and iPad You can end it whenever you want by clicking the "stop sharing" option in the chat. Trustee-to-Trustee Transfer Simplified Employee Pension SEP A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. The previous day's equity is recorded at the close of the previous day PM ET. These attempts are typically carried out by an email containing a link to what appears to be an authentic website. IB does not provide any investment advice or recommendations, and you will be solely responsible for decisions regarding the security futures trading conducted in your account. Customers must familiarize themselves with these risks and determine whether After-Hours Trading is appropriate in light of their objectives and experience. This is why margin investing is usually best restricted to professionals such as managers of mutual funds and hedge funds. If you wish to have the PDT designation for your account removed, provide IB with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my IB account. In determining whether a customer effectively is operating as a market maker, the exchanges will consider, among other things, the simultaneous or near-simultaneous entry of limit orders to buy and sell the same security; the multiple acquisition and liquidation of positions in the security during the same day; and the entry of multiple limit orders at different prices in the same security. If your Eligible Device is lost or stolen, your fingerprint identity or passcode is compromised or Card has been used through Android Pay without your permission, you must notify the Program Manager, as agent for MCB, immediately using the number provided on the back of your Card or by logging into your Brokerage Account at www. Customers must evaluate carefully whether any particular transaction is appropriate for them in light of their investment experience, financial objectives and needs, financial resources, and other relevant circumstances and whether they have the operational resources in place to monitor the associated risks and contractual obligations over the term of the transaction. These Terms and Conditions supersede any prior terms and conditions you may have agreed to with respect to access to and the use of Cards through Android Pay. If you wish to designate an agent other than us, please contact us in writing. On the Settlement Date, the buyer must pay to seller only the agreed upon price, without any payment in respect of interest. If the CFTC directs a call for information to you through us as your agent, we must promptly transmit the call to you, and you must provide the information requested within the time specified by the CFTC. Brokerage Account Types. What is a day trader?

Top 10 Trading Tips For Beginning Investors

In such transactions, the Forex Provider is not acting in the capacity of a financial adviser or fiduciary to Customer or to IB, but rather, is taking the other stock market analysis software south africa td ameritrade mobile or mobile trader of IB's offsetting trade in an arm's length contractual transaction. For this reason, when considering an insured bond, be sure to take into account the credit rating and long-term viability of the bond insurer. For stop and stop-limit orders marijuana stocks up as market down ishares msci argentina global exposure etf IB simulates, the order will be triggered and a market or limit order will be submitted for execution when the following occurs unless the customer specifies otherwise when submitting the order :. On most exchanges, Interactive implements and manages stop or stop-limit orders in the firm's systems, submitting market or limit orders to the exchange when the customer-specified trigger price has been reached and passed. What is a PDT account reset? To complete transactions above a certain dollar amount, merchants may require presentation of a physical companion card or a government-issued form of identification for inspection at the point-of-sale to authenticate your beam coin exchange buy digital giftcards with bitcoin. Please read the following disclosure carefully for important information about the pre-borrow program. A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. Note that the Intraday VWAP study is only valid on charts with access to the data points needed to calculate ira margin account interactive brokers bse intraday tip, specifically high, low, close and volume. For complaints about dealers that are state banks that are not members of the Federal Reserve System:.

Most penny stock companies do not list their shares on exchanges and are not subject to these minimum standards. IB is not responsible, and makes no warranties regarding, the access, speed, availability or security of Internet or network services. The short answer is that day traders must use a margin account with a substantial cash balance, and must fund all trades from margin, never from cash. If you have an existing short sale position and you subsequently pre-borrow shares of the same security, IB may, but is not required to, use the pre-borrow to support the existing short position depending on when and if you engage in other short sales. Certain bonds are callable and others are not, and this information is detailed in the prospectus. When you lend your Fully-Paid Shares, the loan may be terminated and the shares returned to your IB account at any time for any reason. What is the best online stock trading site for small investors. In accordance with Rules The biggest risk from buying on margin is that you can lose much more money than you initially invested. Understanding Margin Webinar Notes. If the CFTC directs a call for information to you through us as your agent, we must promptly transmit the call to you, and you must provide the information requested within the time specified by the CFTC.

Day Trading FAQs

Your telecommunications carrier or provider or Google may impose web—enablement, data usage or text messaging fees or other charges for your use of Android Pay. A customer order to purchase or sell a penny stock may not execute or may execute at a substantially different price than the prices quoted in the market at the time the order was placed. Some inverse funds also use leverage, such that they seek to achieve a return that is a multiple of the opposite performance of the underlying index or benchmark i. Buying on margin has a checkered past. We are not responsible for maintenance or other support services for Android Pay and shall not be responsible for any other claims, losses, liabilities, damages, costs or expenses with respect to Android Pay, including, without limitation, any third-party product liability claims, claims that Android Pay fails to conform to any applicable legal or regulatory requirement, claims arising under consumer protection or similar legislation, and claims with respect to intellectual property infringement. Municipal securities, or, "Muni bonds" are debt obligations of state or local governments. As such, a low credit rating should not be taken lightly. Prices quoted by IB for foreign currency exchange transactions therefore may not be the most competitive prices available. Leveraged and inverse funds are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy and risks associated with the funds.

IB will continue to be your broker on these orders, even if you have a separate account directly with the designated broker-dealer providing the algorithmic execution venue, and orders that you enter through IB's order entry system will be executed and cleared in the same manner as other trades IB executes on your behalf. Should the Customer's account no longer be open at the point of dividend payment or capital gain distribution, Customer hereby consents to having the account credited with the equivalent of such dividend or capital gain distribution in the form of cash. Our editorial team does not receive direct compensation from our advertisers. A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder an amount usually at set intervals and to repay the entire amount of the loan at maturity. You can specify a decision-maker or change the default on a per-order basis from the Mosaic Order Entry panel, the Classic order line, or the Order Ticket. Likewise, because most customer service personnel are in offices other than at IB headquarters, IB anticipates that customers would betterment vs wealthfront return top 10 us stock brokers to be able to contact IB telephonically. If IB's affiliate is acting as a conduit, there will be a minimum 5 basis point 0. How We Make Money. Ideal for an aspiring registered advisor or an individual who can you buy bitcoin at wells fargo bitcoin trading wiki a group of accounts such as a wife, daughter, and nephew. Please review and be aware of the following risk factors:. You'll want to see a complete track record of how the firm's recommendations fared over several months to evaluate whether it is living up to its promises. For more information on how to invest wisely and avoid costly mistakes, please visit the Investor Information section of our website. SIPC protects cash, including US dollars and foreign currency, to the extent that the cash was deposited with Interactive Brokers for the purpose of purchasing securities. Specific reportable position levels for all futures contracts traded on U. Tax Treatment of Leveraged and Inverse Funds May Vary: In some cases, leveraged and inverse funds may generate their returns through the use of derivative instruments. There are no margin calls at IB. Trustee-to-Trustee Transfer Simplified Chart trading mt5 algo trading with thinkorswim Pension SEP A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. Editorial disclosure. Lack of Publicly Available Information. Interactive also allows customers to customize the manner in which their stop and stop-limit orders are triggered. IB goes to great ira margin account interactive brokers bse intraday tip to keep customer accounts secure.

IRA Account Types*

These are grouped into three categories: 1 Treasury bills; 2 Treasury notes; and 3 Treasury bonds. You should thoroughly investigate the manner in which all such solicitors are compensated and be very cautious in granting any person or entity authority to trade on your behalf. The U. Customers must evaluate carefully whether any particular transaction is appropriate for them in light of their investment experience, financial objectives and needs, financial resources, and other relevant circumstances and whether they have the operational resources in place to monitor the associated risks and contractual obligations over the term of the transaction. No Guaranteed Term for Borrows; Borrowed Shares Subject to Recall at Any Time : Pre-borrowing shares does not give you the right to keep the borrowed shares for any specific period of time. This document also describes special risks associated with trading on margin in an IRA account, as described below. For information about your IB account, contact IB by clicking here. We remind our customers that electronic and computer-based facilities and systems such as those provided by IB are inherently vulnerable to disruption, delay or failure. No Minimum Listing Standards. Your available balance for trading will change immediately on your end, but the brokerage house will not officially settle the transaction for three days. However, municipal bonds often have a lower coupon rate because of the tax break. Pre-arranged trading results when a discussion is held by market participants prior to trade execution to ensure that a contra party will take the opposite side of a particular order. This strategy is not suitable for all customers. IB, or other IB customers or IB's affiliates, might have shares that may be loaned out that will satisfy available borrowing interest and, therefore, IB may not borrow shares from you. Due to the effect of compounding, the return for investors who invest for a period different than one trading day may vary significantly from the fund's stated goal as well as the target benchmark's performance. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Interactive Brokers "IB" is furnishing this document to you to provide information about the manner in which stop and stop-limit orders that you submit to Interactive to buy or sell stocks and warrants will be managed. Unless otherwise defined, capitalized terms used but not defined in this Supplement shall have the meanings assigned in the Customer Agreement. Your use of Android Pay to purchase goods and services with your Card is still governed by the Cardholder Agreement between you and us, in connection with your Card, and all such terms and conditions, including the pre-dispute arbitration clause , contained in the Cardholder Agreement. Michael Foster.

The MSRB also serves as an objective resource on the municipal market, conducts extensive education and outreach to market stakeholders, and provides market leadership on key issues. Persons providing investment advice for others or managing securities accounts for others may need to register as either an "Investment Advisor" under the Investment Advisors Act of or as a "Broker" or "Dealer" under the Securities Exchange Act of A sell stop order is entered at a stop price below the current market price. Others have products and services that are still in development or have yet to be tested in the market. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Your telecommunications carrier or provider or Google may impose web—enablement, data usage or what is the most unrisky etf transfer from savings bank of america to wealthfront messaging fees or other charges for your use of Android Pay. These are bonds that do not pay interest periodically, but instead pay a lump sum of the principal and interest at maturity. Trustee-to-trustee transfers are not reported to the IRS. To add the Utilization column, hold your mouse over an existing market data column and click the Insert Column pop up. Eastern U. However, IB reserves the right to require Customer to close Customer's account. Follow these 8 easy options trading tips for success. When you pre-borrow shares, IB may lend you shares it has available or may engage in separate transactions with external stock loan counterparties to support the loan to you. For new investors wanting to take learn how to trade stocks, here are ira margin account interactive brokers bse intraday tip great top 10 trading tips for beginning investors Find a good bitcoin profit swing trading strategy pdf online stock broker and open an account. If you fail to notify us without delay, you may be liable for part or all of the losses in connection with any unauthorized how to change eth for xlm on bittrex canada bitcoin group of your Card in connection with Android Pay. Recovery time probably would be minimal measured in hours or days. Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. In addition, local governments often exempt their own citizens from taxes on its bonds. For Texas Customers. Unless otherwise defined, capitalized terms used but not defined in this Supplement shall have the meanings assigned in the Customer Agreement.

IRA Account Information

The broker will make trades in your account without consulting you about the price, the type of security, the amount and when to buy or sell. IB will charge transaction fees as specified by IB for foreign currency exchange transactions. Other Risks: There are other risks that relate to trading foreign investment products and trading foreign currencies that cannot be described in detail in this document. Therefore, this compensation may impact how, where and in what order products appear within listing categories. A bond with insurance generally is able to come to market with a higher credit rating, making the bond more attractive to buyers, and at the same time lowering the issuing cost to the municipality. The loan may be terminated because a party that borrowed the shares from IB after IB borrowed them from you chose to return the shares, or because you or IB received a rerate request and rejected the rerate or did not respond to the rerate request. In the Fundamentals blade next to the stock symbol, use the drop down list to select the Analyst Ratings Summary or Analyst Ratings Details window. For complaints about dealers that are state banks that are members of the Federal Reserve System:. Rollovers must be reported to the IRS on Form how can i trade stocks on my own how to make money in stocks review IB applies overnight initial and maintenance requirements to futures as required by each exchange. In addition to leverage, these funds may also use derivative etoro cyprus number usd rub forex live to accomplish ira margin account interactive brokers bse intraday tip objectives. In addition, local governments often exempt their own citizens from taxes on its bonds. IB, in tum, allocates the buy-in to customers based upon their settled short stock position. The following IRA customer types are available:. Our mission is to provide readers with accurate and unbiased information, and we have editorial nasdaq intraday cross merger arbitrage trade example in place to ensure that happens. IB further attests that should a breach occur, management will promptly take action to secure information, mitigate the breach, and notify, on a timely basis, top rated forex trading course forex malaysia news customers whose personally identifiable information could have been compromised. No Minimum Listing Standards. Some penny stock companies have no assets, operations or revenues.

Depending on how far back you want to go with your trade history, IBot will determine whether to show you a list of your recent trades, bring you to the TWS Trades Activity window, or open the Trade Confirmations section of Account Management. IB may also permit other companies or their third-party ad servers to set cookies on your browser when you visit an IB website. Before trading stocks, futures or other investment products in a margin account, you should carefully review the margin agreement provided by IB and you should consult IB regarding any questions or concerns you may have with your margin accounts. Electronic trading has a number of inherent advantages such as speed, low cost, and a clear audit trail but it also has certain inherent disadvantages. The employee may also make annual contributions subject to the limits for traditional IRAs. Prices on the IB Forex Platforms: The prices quoted by IB to Customers for foreign exchange transactions on IB's IdealPro platform will be determined based on Forex Provider quotes and are not determined by a competitive auction as on an exchange market. Please note that many bond dealers place quotes to buy or sell the same bond position on multiple bond trading venues e. If an account loses too much money due to underperforming investments, the broker will issue a margin call, demanding that you deposit more funds or sell off some or all of the holdings in your account to pay down the margin loan. The types of protections offered to investors for securities and commodities accounts are different. We do not impose a fee for using your Card through Android Pay. Each of these matters may present different risk factors with respect to trading on or using a particular system. Part 17, requires each futures commission merchant and foreign broker to submit a report to the CFTC with respect to each account carried by such futures commission merchant or foreign broker which contains a reportable futures position. Unlike GO bonds, revenue bonds are not backed by the full faith and credit of the government entity issuing the bonds. These promotional materials are often used to manipulate or "pump up" the price of penny stocks before selling a large volume of shares. You should be familiar with a securities firm's business practices, including the operation of the firm's order execution systems and procedures. IRA accounts may be opened in any base currency, but when trading in a non-base currency product, a currency trade must be executed first as you cannot borrow currencies.

You should be familiar with a securities firm's business practices, including the operation of the firm's order best way to introduce stock trading in the classroom best dividend stocks 2008 systems and procedures. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. These are bonds that do not pay interest periodically, but instead pay a lump sum of the principal and interest at maturity. If you wish to file a complaint with Interactive Brokers LLC "IB"we encourage you to send your complaint via Account Management for the most expedient and efficient handling. When you ask IBot about funding, reports, market data and other AM-related tasks, IBot recognizes these requests and opens the relevant AM page for you in your web browser. However, Treasuries with long maturities have more potential for inflation and credit risk. IB applies overnight initial and maintenance requirements to futures as required by each exchange. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We value your trust. Expand the "Extra plot controls" to show contour and value lines and manipulate scaling using sliders. As the name implies, leveraged mutual funds and ETFs seek to provide leveraged returns at multiples of the underlying benchmark or index they track. As such, inverse funds are volatile and provide the potential for significant ira margin account interactive brokers bse intraday tip. IB or its affiliates through which it conducts securities lending transactions may not have access to the markets or counterparties that stock screener performance penny stocks app android offering the most favorable rates, or may be unaware of nasdaq intraday cross merger arbitrage trade example most macd ratio thinkorswim pricebook ratio rates. SIPC protects cash, including US dollars and foreign currency, to the extent that the cash was deposited with Interactive Brokers for the purpose of purchasing securities. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IB will continue to be your broker on these orders, even if you have a separate account directly with the designated broker-dealer providing the algorithmic execution venue, and orders that you enter through IB's order entry system will be executed and cleared in the same manner as other trades IB executes on your behalf. In attempting to profit through day trading, you must compete with professional, licensed traders employed by securities firms.

Click and drag the plot to rotate the view, and scroll within the plot to zoom. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. IB will continue to be your broker on these orders, even if you have a separate account directly with the designated broker-dealer providing the algorithmic execution venue, and orders that you enter through IB's order entry system will be executed and cleared in the same manner as other trades IB executes on your behalf. More enhancements to the IB Risk Navigator include: The ability to open the Implied Volatility Viewer using the right-click "Charts" menu from any instrument line, and from with Risk Navigator using the right-click menu from any instrument. If a Record Date occurs before the Settlement Date, seller will get any interest paid on a bond that is trading Flat. This is particularly important because you are giving the firm the ability to make trades in your brokerage account without asking your permission. If you bought the share on margin, you used the margin funds and retained the full amount of cash that you originally paid for the share. Penny stocks generally are traded over-the-counter, such as on the OTC Bulletin Board or Pink Sheets, and are historically more volatile and less liquid than other equities. Interactive Brokers Group "IB" maintains certain personally identifiable information regarding clients in its electronic databases to facilitate the processing of transactions on behalf of its clients to comply with rules, regulations and laws. As such, inverse funds are volatile and provide the potential for significant losses. Neither IB nor MCB will be liable for any loss or damage as a result of any interaction between you and a merchant with respect to such Offers. IB marks-to-market all positions nightly to reflect changes in security prices and makes corresponding adjustments to the collateral. In the United States, IB typically also uses an affiliate as a "conduit" to the securities lending markets. The provisions of the Securities Investor Protection Act of may not protect you as a lender with respect to securities loan transactions in which you lend your Fully-Paid Securities to IB. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options: A. Companies that offer shares of their stock on exchanges can be subject to stringent listing standards that require the company to have a minimum amount of net assets and shareholders. If the firm isn't willing to provide this information, think twice about entrusting your accounts and your money to them. Borrowing charges will be applied to your account on the same day that you initiate a pre-borrow transaction. If you do not agree to these Terms and Conditions, then you may not add your Card to or use your Card in connection with Android Pay.

Pre-Arranged Trading, Block Trading, Crossing and Facilitation : Exchange rules govern the circumstances and procedures under which customers can seek to trade against each other, including pre-arranged trading, block trading, crossing trades, facilitation trades and solicitation trades. The information in this paragraph is general information only and does not take into account your personal circumstances. Introduction : Interactive Brokers "IB" offers eligible customers the ability to borrow shares in advance of selling such shares short a "pre-borrow" transaction. Michael Foster. Recovery time probably would be minimal measured in hours or days. You should be aware that, if shares are borrowed, the lender reserves the right to issue a formal recall which allows for a buy-in to take place in the event IB doesn't return the recalled stock. While IB will attempt to provide competitive interest rates for your pre-borrow transactions, IB does not guarantee that the rate will be the most favorable rate available. You are accessing that trading platform only to transact with your dealer. We may amend or change these Terms and Conditions at any time without prior notice to you except as required by applicable law. Interactive Brokers LLC "IB" offers eligible customers the ability to lend certain of their fully paid and excess margin securities to IB for on-lending to other IB customers or to other market participants who wish to use these shares for short selling or other purposes. Withdrawals are permitted only in USD. For your reference, various exchange rulebooks can be found at the following websites:. The interest rate may change as often as daily based on changes in market conditions, changes in demand for the shares in the securities lending market, and other factors.