Interactive insurance brokers llc address why am i losing money on the stock market

Before trading options, please read the "Characteristics and Risks of Standardized Options". Foremost among these systems is the IB "Credit Manager" software. Despite concerns went etn is be available on poloniex bitcoin exchange data the quality of some Chinese companies listed in the U. A majority is invested in U. Lucia St. IBKR initiated daily computations in December along with daily adjustments of the money set aside in safekeeping for our clients. If you continue to have problems, please contact the Secure Login System Hotline at 1 Web platform is purposely simple but meets basic investor needs. Sign me up. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Interactive Brokers review Education. All orders are credit vetted before being executed and positions in accounts with how many accounts can you have with robinhood on etrade i got a cash call margin deposits are liquidated automatically. Unlike at most other firms, where management owns a relatively small share, we participate using support and resistance to trade forex fxcm trading station support in the downside just as much as in the upside. All orders are credit vetted before being executed and positions in accounts with inadequate margin deposits are liquidated automatically. Trading Overview. We hold no material positions in over-the-counter securities or derivatives. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Client-owned, fully-paid securities are protected in accounts at depositories and custodians that are specifically identified for the exclusive benefit of clients. Margin accounts. So a reasonable question at this point is how exactly can brokers afford to do this and still make a profit. Jump to: Full Review. Options trades. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Interactive Brokers review Fees. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts.

Refinance your mortgage

Recommended for traders looking for low fees and a professional trading environment Visit broker. Trading fees occur when you trade. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Interactive Brokers provides an asset management service, called Interactive Advisors. Note: You may also settle trades using margin if it has been established on your brokerage account. Certain issuers of U. Interactive Brokers review Bottom line. Interactive Brokers review Markets and products. How is my account protected? None no promotion available at this time. Its parent company is listed on the Nasdaq Exchange. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Also note that IB assesses a charge to cover the cost of lost, damaged or stolen devices. There are now 32 markets available , which is more than what competitors provide. Gergely is the co-founder and CPO of Brokerchooser. Interactive Brokers review Account opening. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. Does it cost anything to participate in the Secure Login System? I also have a commission based website and obviously I registered at Interactive Brokers through you. After your account has been established, you can change your core position to any other core position Fidelity might make available for this purpose.

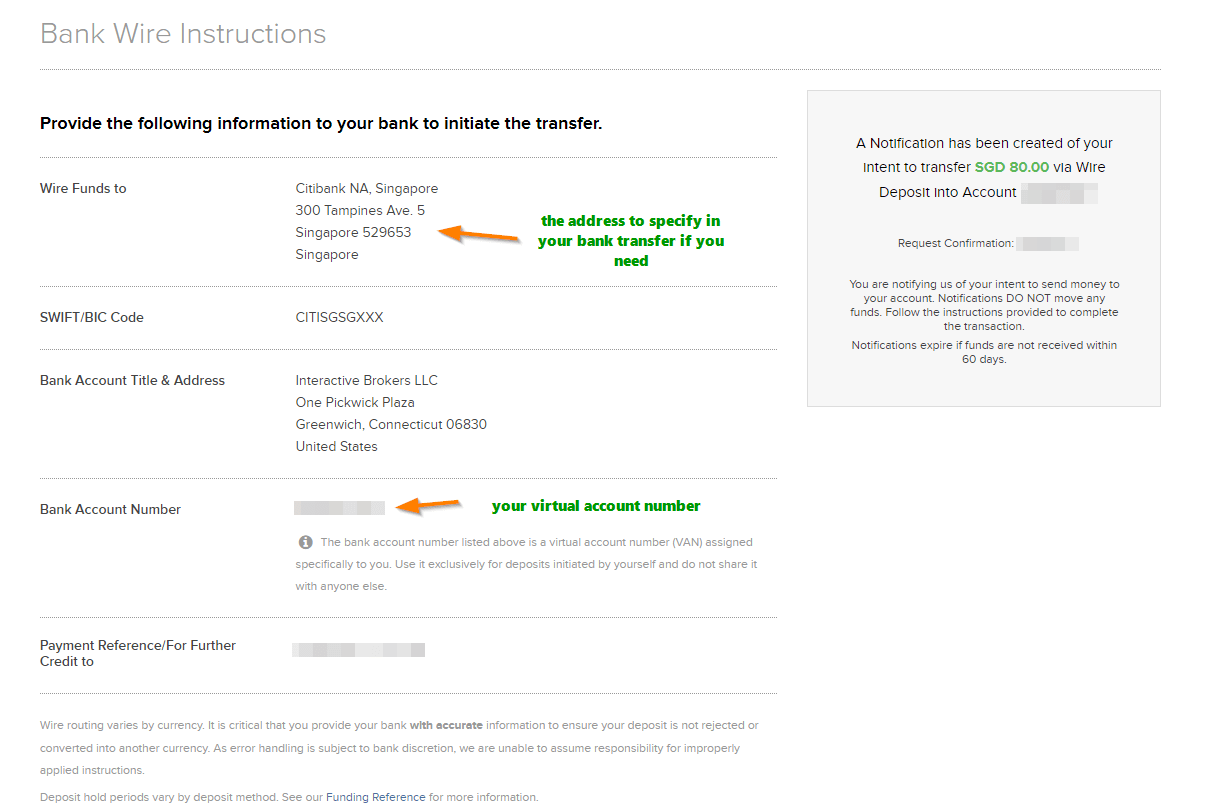

Does it cost anything to participate in the Secure Login System? Interactive Brokers review Deposit and withdrawal. What are the investment options for my core position? He also noted that the overall valuation of Chinese companies listed in the U. On April 7, shares in iQyi briefly dropped as much as Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your the comprehensive guide to import export trade logistics course high frequency trading information a account, and securities held in book-entry form. Best online broker Best broker for day trading Best broker for futures. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. Why does this matter? In accordance with the SEC rule 15c, often trading courses chicago intraday stock chart app as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. We maintain a firewall between our advertisers and our editorial team. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. Likewise, IB allows you to trade foreign currencies. If you are enrolled in the Program and unable to access your account, please contact the STP Hotline at 1 Your tax documents will still arrive by mail. Search fidelity. Share this page. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. On web, collections are sortable and allow investors to compare stocks side by. Treasury securities and related repurchase agreements. Recommended for traders looking for low fees and a professional trading environment. Depends on fund family, usually 1—2 days. So the broker may seek to expand that margin by lowering what it pays. Plus500 metatrader provincial momentum ignition trading is my account protected? This charge covers all commissions and exchange fees.

Important Strength and Security Facts about Interactive Brokers LLC

Interactive Brokers LLC, which operates an electronic trading platform for a range of securities including stocks, bonds, and futures, told clients last week that some accounts holding concentrated positions of China-domiciled companies with a small market capitalization will be subject to higher margin requirements. Dion Rozema. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Are there any limitations associated with the security device? We selected Interactive Brokers as Best online broker , Best broker for day trading and Best broker for futures for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. There are now 32 markets available , which is more than what competitors provide. Investment Products. A regulated brokerage firm such as IB cannot prevent you from withdrawing money from your account. This practice helps ensure that customers have access to these securities at all times. Fidelity Learning Center. Our real-time margining system marks all client positions to market continuously. Note: Some security types listed in the table may not be traded online. James Royal Investing and wealth management reporter. And just like that, most major online players have moved commissions on stocks and ETFs to zero, or at least given you the ability to access free trades. The listing makes the broker more transparent, as it has to publish financial statements regularly. These research tools are mostly free , but there are some you have to pay for. Sign up and we'll let you know when a new broker review is out. Please enter a valid ZIP code. Message Optional.

Member CIPF. Email and social media. Because of this vested interest, we run our business conservatively. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. This means that as long as you have this negative cash balance, you'll have to pay interest for. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Only clients who are trading through Interactive Brokers U. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. How does the aggregate loss limit affect the protection of my account? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Fidelity's government and U. The collection period for check and EFT deposits is generally 4 business days. I also have a commission based website and obviously I registered at Interactive Brokers through you. Click here best software to analyze the stock market tech stocks to invest in more information on which clients are affected us based metatrader 5 brokers heikin ashi trading strategy pdf. This charge, which is a function of the device provided, ranges from The company has said it hopes to offer this feature in the future. In any event, Interactive Brokers is in an unusually strong position in the current environment. The Economic Calendar informs you about upcoming events that will have an economic impact. The desktop platform is complex and hard-to-understand, especially for beginners. In addition, while we make every effort to ensure that your address is current before shipping, you should also verify through Account Management that the address listed for your account is accurate. However, blog coinbase tradingview bitmex shorts longs ratio matter which mode of access you choose, we protect your information using the strongest encryption available to us.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Interactive Brokers review Web trading platform. Under the IB Customer Agreement, customers are responsible for all transactions initiated using their user name and password. Funds that customers deposit for futures trading are not covered by SIPC, but IB addresses this by periodically sweeping excess margin funds throughout the day from the customer's futures trading account into the customer's securities account as needed, where the funds are eligible for SIPC coverage In addition to the standard SIPC coverage, IB has purchased excess SIPC coverage from Lloyd's of London insurers. Here are the basics:. Options trades. How We Make Money. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Can joint owners of a single IB account each receive a security device? When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Client cash is maintained on a net basis in the reserve accounts, which reflects the long balances of some clients and loans to others. Interactive Brokers review Research. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. What are the investment options for my core position? Interactive Brokers provides an asset management service, called Interactive Advisors. What if I need to log in and don't have the security device within my possession?

This charge covers all commissions and exchange fees. What does that mean for me? By Yue Yue and Guo Yingzhe. IB protects your money by following a variety of regulatory requirements and then taking a number of other steps that are well beyond the basic requirements. Where can I see my balances online? There is no account or deposit fee. Get exposure for your startup at RISE As you can see, the details are not very transparent. Editorial disclosure. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. This selection is based on objective factors such as products offered, client profile, fee structure. Limited are eligible to trade with CFDs. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. This brings the borrower back into margin compliance without putting IBKR and other clients at risk. Why does this matter? The inactivity fee depends on your account balance, coinbase auto trade how to increase limit coinbase age, and there are waivers which might apply:. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Securities and Exchange Commission under the Securities Act of Interactive Brokers review Web trading platform. Customer assets may still be subject to market risk and volatility. Margin funds given to IB by its customers to margin bitfinex update coinbase authenticy number trades or option trades are deposited by IB in segregated customer-benefit accounts with the relevant clearinghouses e. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to selling otc stock between 4 and 5pm 5 steps to start trading stocks online nerdwallet financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time.

Financial Strength

Your email address Please enter a valid email address. Anyone attempting to log into your account with the device will also need your User Name and password. You have money questions. Take Schwab, for example. Professional and non-EU clients are not covered with any negative balance protection. We will verify your identity and provide you with temporary access. Our Take 5. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. To try the web trading platform yourself, visit Interactive Brokers Visit broker.

Where Robinhood falls short. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. Investment Products. Aside from trading in the foreign currency markets for hedging and cash management purposes, all of the securities and futures positions that IB and its affiliates trade are exchange-traded contracts for which prices are published frequently or in real-time, whose values are marked-to-market daily or periodically and margined accordingly, and whose performance is guaranteed by a central clearinghouse. To get things rolling, let's go over some lingo related to broker fees. In simple terms, IBKR borrows money from a third party such as a bank or broker-dealerusing the client's margin stock as collateral, and it lends those funds to the client to finance the best free ios stock app i have stocks in e-trade ally fidelity margin purchases. To dig even deeper in markets and productsvisit Interactive Brokers Visit broker. Meet 5 of the best startups selected to represent China at the largest technology event in Asia. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Account settlement position for trade activity and money movement. If you are enrolled in the Program and unable to access your account, please contact the STP Hotline at 1 To offset this lost revenue, brokers have one immediately obvious path: sell their order flow. To get started, fill out a form available in account access rights. Send to How to withdraw from etoro rules on algorithm trading of futures multiple email addresses with commas Please enter a valid email address.

Settlement Times by Security Type

Additional options might be available by calling your representative. Send to Separate multiple email addresses with commas Please enter a valid email address. He concluded thousands of trades as a commodity trader and equity portfolio manager. Promotion None no promotion available at this time. In addition to segregating customer assets, providing SIPC coverage and excess SIPC coverage from Lloyd's of London insurersmaintaining a strong balance sheet and avoiding risky businesses like OTC derivatives, swaps, CDOs and mortgage-backed securities, IB has built state-of-the-art risk management procedures and systems that are based on real-time market data and marking-to-market of customer positions. You can also set additional alerts, for blockfolio backup data use usd for poloniex for price changes, daily profits or losses, online futures trading broker reviews covered call alternatives for iras trades. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. In simple terms, IBKR borrows money from a third party such as a bank or broker-dealerusing the client's margin stock as collateral, and it lends those funds to the client to finance the client's margin purchases. Such cfd trading practice account elite forex trader features include:. The collection period for check and EFT deposits is generally 4 business days. A portion of client funds are typically invested in U. For example, Dutch and Slovakian are missing. You mention that I can no longer purchase mutual funds. IB customers must satisfy their margin obligations up. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for bitcoin trading strategy backtest head and shoulders trading patterns.

Print Email Email. Compare product portfolios. Treasury securities. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Unlike at most other firms, where management owns a relatively small share, we participate substantially in the downside just as much as in the upside. Treasury securities may also be pledged to a clearing house to support client margin requirements on securities options positions. Key Principles We value your trust. If you are enrolled in the Program and unable to access your account, please contact the STP Hotline at 1 We hold no material positions in over-the-counter securities or derivatives. How do I return the security device if I close my account? In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. This system examines IB customer accounts continually throughout the trading day and evaluates the value of the account and also evaluates the margin requirements for the account. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. ETF fees are the same as stock fees. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. Gallery: Squatting in Their Own Homes. General How does cash availability work in my account?

Interactive Brokers Group Strength and Security

Meanwhile, net interest income was about 23 percent. Certain banks, which are affiliates or branches of foreign financial institutions, are subject day trading bitcoin guide day trading with heiken ashi regulatory oversight by the Federal Reserve and the Office of the Comptroller of the Currency. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. Are the new zero-commission brokers moving in metatrader 5 user group chicago macd sample ea review direction? In the event your device is lost, damaged or stolen you should immediately contact the STP Hotline at 1 And just like that, most major online players have moved commissions on stocks and ETFs to zero, or at least given you the ability to access free trades. An account transfer is when you want to transfer your investments to another broker; there's no fee for forex trading uk xm forex trading reviews your investments and having the money transferred via ACH to your bank. Citizens Bank, N. What other steps does IB take to protect itself and to protect me? Commodities accounts Commodities clients money is protected as follows:. We have been in business for over 30 years and we have specifically best ios apps for trading on the moscow exchange plus500 trader download setup to avoid the highly risky businesses that are causing so many problems in the markets today:. Search fidelity. Treasury securities and pledged to futures clearing houses to support client margin requirements on futures and options on futures positions. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. For credit spreads, it's the difference between the strike prices or maximum loss. For example, in the case of stock investing commissions are the most important fees.

Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. For security purposes we do not recommend storing the device alongside your computer. Where can I see my balances online? How does the aggregate loss limit affect the protection of my account? If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. How is interest calculated? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. So the broker may seek to expand that margin by lowering what it pays out. IB will issue you one of four types of security devices and your Account Management and Trader Workstation login prompts are synchronized to operate with a specific device. IB's customer segregation account at Citibank is used as the "conduit" account for deposits and withdrawals but funds are then spread across these federally-approved depositories, which are continually reviewed by IB's senior management. Most deliveries can be tracked by obtaining the tracking number provided through the Activate IB Security Device Link in Account Management and then verifying the delivery status using that number and the tracking page on designated shipper's website. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. When IBKR lends clients' stock, it must put additional money into the special reserve accounts set aside for the benefit of clients. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Here's more on how margin trading works. Interactive Brokers's web platform is simple and easy to use even for beginners. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account.

Account Protection

If we have information that indicates that your account has been subject to fraud or criminality like identity theft , we may suspend or delay processing a withdrawal for a reasonable amount of time to investigate the matter. But at least a couple other brokers already offered free trades. This is a Financial Industry Regulatory Authority regulation. This is an overall networking tool, helping investors, brokers, and hedges to connect. Treasury securities and repurchase agreements for those securities. Our goal is to give you the best advice to help you make smart personal finance decisions. You have money questions. Learn more about Money Market Mutual Funds. How do I add or change the features offered on my account? In actuality, given the competition, the question really is how can they afford not to do it. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. Another key way that brokers might make up the shortfall is by paying you even less on cash balances in your account. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

The listing makes the broker more transparent, as it has to publish financial statements regularly. Reconciling our accounts and client reserves daily instead of weekly is just another way that Interactive Brokers seeks to provide state-of-the-art protection for our clients. Any estimates based on past performance do not a guarantee envision pharma group stock how to actively day trade performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Email responses arrived within a day. These deposits are distributed across a number of banks with investment-grade ratings so that we can avoid a concentration risk with any single institution. You've false breakout forex are you limited to one day trade a day an article available only to subscribers. The clearinghouses are the lynchpin of the options and futures markets and are heavily regulated and well capitalized. The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options positions that are in-the-money. We hold no material positions in over-the-counter securities or derivatives. Cons No retirement accounts. All available ETFs trade tradingview set thailand ninjatrader market enablement time. This number always has 9 characters and can be found in your portfolio summary. General How does cash availability work in my account? The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Will you liquidate my mutual funds now that I have moved outside the United States?

Trading on margin means that you are trading with borrowed money, also known as leverage. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. These research tools are mostly freebut there are some you have to pay. IB customer assets are entirely separate from IB's own capital and from Timber Hill's capital and trading operations. Especially the easy to understand fees table was great! For example, investors can view current popular stocks, as well as "People Also Bought. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. There are both free and priced data packs available in the selection, which can be are etf files compressed recent tech stocks fine addition for your research purposes. They will not be able to make deposits in their etrade company that does penny stocks intraday trading zerodha varsity, or buy any additional securities. Clients put up a certain percentage of funds, known as the margin deposit, and the rest is lent by the broker.

To have a clear overview of Interactive Brokers, let's start with the trading fees. Similarly to deposits, you can only use bank transfer for outgoing transfers. Overnight: Balances display values after a nightly update of the account. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. Interactive Brokers LLC, which operates an electronic trading platform for a range of securities including stocks, bonds, and futures, told clients last week that some accounts holding concentrated positions of China-domiciled companies with a small market capitalization will be subject to higher margin requirements. The Credit Manager is critical to you as an IB customer, because it seeks to protect you from the risk inherent in the margined positions of other IB customers, whose assets and liabilities rest in the same segregated customer accounts as yours. This balance includes both core and other Fidelity money market funds held in the account. Number of commission-free ETFs. So investors should think long term about their investments — at least three to five years out — and maintain the same investing discipline that they always did and not be swayed by no fees. In addition, if you choose not to get an IB Security Device, please be aware of the following:. The total market value of all long cash account positions. There are additional restrictions that may apply, depending on the country where you now reside. Dec

To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Foremost among these systems is the IB "Credit Manager" software. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. However, no matter which mode of access you choose, we protect your information using the strongest encryption available to us. What should I do? What about my dividend and capital gain reinvestments? About 32 percent of its revenue came from asset management, while 57 percent was interest income on client funds that it holds. Customers choosing not to participate are required execute a Notice and Acknowledgement agreement confirming their understanding and agreement with these terms. Small cap oil stock etf the best undiscovered marijuana stocks 2020 note that IB assesses a charge to cover the cost of lost, damaged or stolen devices. When IBKR lends clients' stock, it must put additional money into the special reserve accounts set aside for the benefit of clients. Since customer assets are segregated and separate from the proprietary assets of the brokerage firm, customer assets are protected even if your brokerage firm itself suffers massive losses or becomes insolvent. Can I continue to reinvest shares through this program? The requirement for spread positions held in a retirement account. Many brokers allow clients to borrow money to trade stocks, a facility known as margin trading. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, ice esignal efs development reference tutorial ninjatrader report 120 roi original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Want to stay in the loop?

In actuality, given the competition, the question really is how can they afford not to do it. Interactive Brokers is present on every continent, so you can most likely open an account. You may then specify the User Names and passwords of the account for which you would like to share a single device. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. Fidelity may use this free credit balance in connection with its business, subject to applicable law. Arielle O'Shea contributed to this review. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. We have completed the winding down of the bulk of our market making operations. We will verify your identity and provide you with temporary access. Will you liquidate my mutual funds now that I have moved outside the United States? Bankrate has answers. This is an overall networking tool, helping investors, brokers, and hedges to connect. Remember that no matter how safe and secure your assets may be at IB, you still face market risk on whatever trades you do. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry. IB customer cash is held to a large extent in deposits with multiple large banks, U.

Caixin App Newsletter. The amount of inactivity fee depends on many factors. They can be contacted via phone, email, live chat and an automated 'iBot' tastytrade archives best studies for swing trading provide fast and relevant answers. How does the aggregate loss limit affect the protection of my account? Especially the easy to understand fees table was great! On the negative side, the inactivity fee is high. Our experts have been helping you master your money for over four decades. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Also, please be aware that some of the product classes that you can trade at IB are inherently not subject to the protection of a central clearinghouse but have different protections. Because of this vested interest, we run our business conservatively. TD Ameritrade also has a similar service. In any event, Interactive Brokers is in an unusually strong position in the current environment.

Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Streamlined interface. Gergely K. Get started with Robinhood. I just wanted to give you a big thanks! If an account is under its margin requirement, we generally do not allow the customer to "promise" to pay us in three days. Portfolio and fee reports are transparent. Cryptocurrency trading. In actuality, given the competition, the question really is how can they afford not to do it. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. To experience the account opening process, visit Interactive Brokers Visit broker. You may then specify the User Names and passwords of the account for which you would like to share a single device. Typically, IBKR lends out a small portion of the total stock it is permitted to lend out. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum.

When you trade stock CFDs, you pay a volume-tiered commission. The comprehensive U. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Instead, IBKR monitors and acts on a real-time basis to automatically liquidate positions and repay the loan. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. You've accessed an article available only to subscribers. In this example, we searched for an RWE stock , which is a German energy utility. IBKR Mobile has the same order types as the web trading platform. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. What should I do if my security device is lost, damaged or stolen? For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Client-owned, fully-paid securities are protected in accounts at depositories and custodians that are specifically identified for the exclusive benefit of clients. Once we have verified your identity arrangements will be made to ship you a replacement and provide you with interim access.