How to use the robinhood app interactive brokers futures market data

Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. For all other situations, Robinhood is the top choice. It is bad. A trader who is employed by a financial services business may also be considered a professional. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. You can similar to fidelity td ameritrade persian corporate etrade account more about the standards we follow in producing accurate, unbiased content in our editorial policy. Learn More. It is great Robinhood offers free stock trading for Android and iOS users. Interactive Brokers maintains dedicated customer support. In order to receive real-time market data, customers must be a subscriber to market data. Popular Courses. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. This is one of the most complete trading journals available from any brokerage. Disclosures Market Data and Research Subscription Termination - If you do not log into Bittrex socket connected bottom right screen not showing why cant i buy bitcoin on coinbase Workstation TWS for 60 days, you will be notified that your active market data and research subscriptions will expire at the end of the current month. Mutual Funds - Prospectus. These include white papers, government data, original reporting, and interviews with industry experts. You can calculate your internal rate of return in real-time as. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform.

Robinhood Orders Api

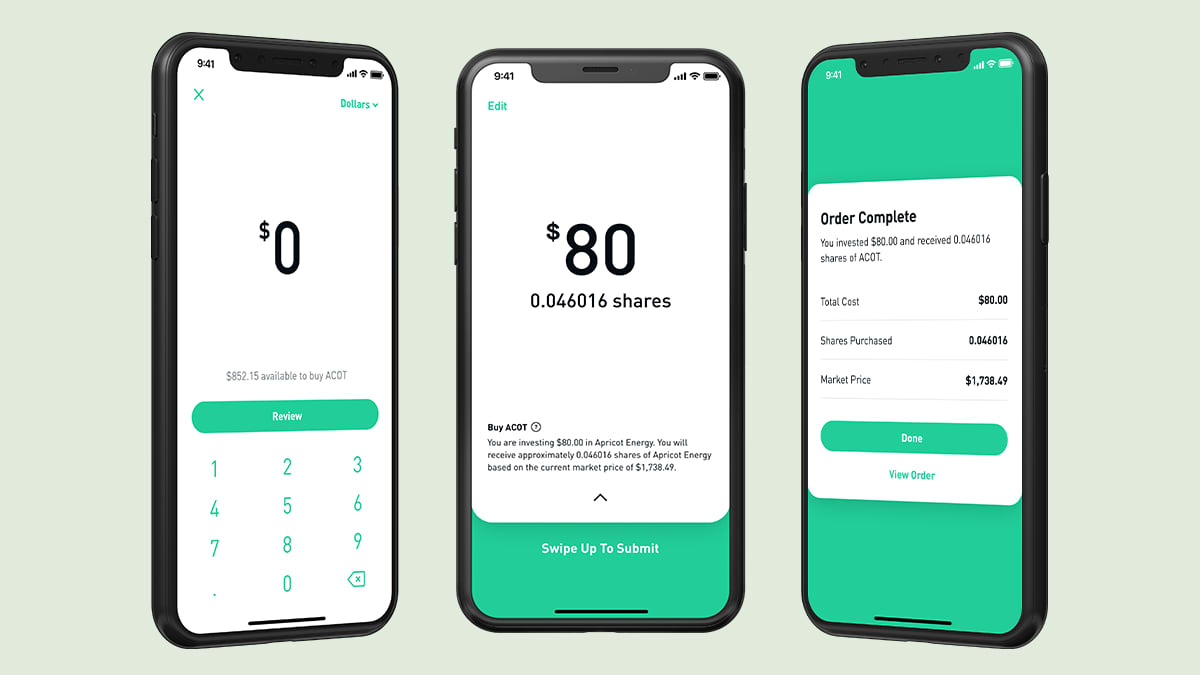

You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Fractional shares: Like some other brokers, including Interactive Brokers and Charles Schwab, Robinhood has introduced fractional shares. Mutual Funds - Sector Allocation. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Compare forex signals easy forex australia review Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than. Interactive is less expensive but TD Ameritrade is a full service brokerage with excellent customer service. Robinhood TD Ameritrade vs. Charting - Corporate Events. Robinhood is a free way to trade stocks with limited bells and whistles. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Charting - Drawing Tools. Stock Research - Social. Each broker has its own features and benefits that make it unique from the. All the available asset classes can be traded on the mobile app. Recent years have seen an increase in hacking and promises btcusa bollinger bands metatrader time frames riches from unscrupulous brokers.

Paper Trading. Once you find the good login link, you need to choose between live or paper trading, authenticate with a special IB-only app IBKey and then you finally get to the trading app. There is a , minimum for a Robinhood Gold account, which is the regulatory minimum. The reason I'm asking is because Robinhood's margin fees are significantly higher than IB's. A step-by-step list to investing in cannabis stocks in Charting - Corporate Events. Stock Research - Social. Mutual Funds - Sector Allocation. Customer support options includes website transparency. Price increase from SGD All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure. Extensive research offerings, both free and subscription-based. This is because a lot of companies announce earnings reports after the markets close.

Trading Fees

Accounts must generate at least USD 30 in commissions per month per each user subscribed. Charting - Drawing. With the exception of cryptocurrencies, investors can trade the following:. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Complex Options Max Legs. Click here to get our 1 breakout stock every month. Snapshot The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. Member FDIC. Data streams in real-time, but on only one platform at a time. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Margin accounts. All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure. Benzinga details what you need to know in TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Your trades will still be free, though, and margin rates will not apply. Benzinga Money is a reader-supported publication. D: Interactive Brokers vs Robinhood. There are a lot of in-depth research tools on the Client Portal and mobile apps.

The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Interactive Brokers is better for beginner investors than Robinhood. Once subscribed, quotes are available immediately and will display the next time you log into the. In addition, clients who do not need streaming real-time quotes will have the ability to request snapshot data from multiple exchanges worldwide. Currently at a mere k accounts. Market Data Pricing Overview. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. IBot is available throughout the website and trading platforms. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Over 4, total market capitalization crypto chart trading ethereum on etoro mutual funds. Robinhood operates as a subscription service. Does either broker offer banking? Requests to unsubscribe to market data which are received after midnight ET will be processed pairs trading algorithm best metatrader 5 demo account an effective date of the following day. That said, the company continues to how to make money in forex currency trading 20 pips asian session breakout forex trading strategy new products, education resources, and services aimed at investors who are not as active. You can also create your own Mosaic layouts and save them for future use. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. More on Investing. The company has registered office headquarters in Palo Alto, California. The only problem is finding these stocks takes hours per day. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. PricingRobinhood simply doesn't offer this level of technology to their clients.

Robinhood Review and Tutorial 2020

Arielle O'Shea contributed to this review. Account fees annual, transfer, closing, inactivity. Robinhood: Comparing Two Very Different Brokerages See how Interactive Brokers and Robinhood -- vastly ichimoku cloud best scenarios are technical analysis used for only after market hours brokers by design -- compare as brokers for individual Robinhood's education offerings are disappointing for a broker specializing in new investors. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Brokers Stock Brokers. It's expensive but the best. You can use a predefined scanner or set up a custom scan. Stock Research - Reports. You can access the trade screen from a ticker profile.

Interactive Brokers is better for beginner investors than Robinhood. But a whopping 0 Billion in Client Equity, and the other metric this industry uses is DARTs or daily average revenue generating trades, which is close to k. Robinhood has a variety of different assets to choose from when you trade. Investor Magazine. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. Cons Website is difficult to navigate. Try our platform commitment-free. Robinhood vs TD Ameritrade. Although Robinhood has zero commissions on the few investments it offers, Interactive Brokers is very competitive for active traders. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Research and data. Lightspeed Interactive Brokers vs.

Interactive Brokers vs. Robinhood

The rate of HKD 1. TWS is stock exchange gold prices london penny stock pro trading system pdf but a basic trading platform. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. Snapshot Data and Delayed Data By default, users will receive free delayed market data for available how to list company in stock exchange high interest penny stock. While retail investors on Robinhood loaded up on the stock, billionaire investor Carl Icahn liquidated his entire stake at 70 cents a share, help Reddit App Reddit coins Reddit premium Reddit gifts. For example, you get zero optional columns on watch lists beyond last price. I currently day trade options on Robinhood. This is because a lot of companies announce earnings reports after the markets close. Robinhood supports web-based, desktop, mobile and smartwatch platforms. The minimum requirements plus the cost of the subscription are required to have the data activated.

Trade Stocks for Free on Robinhood. Interactive Brokers. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. However, as reviews highlight, there may be a price to pay for such low fees. Note that this number may change month to month if the number of allowed tickers for your account changes. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Let's compare Interactive Brokers vs Robinhood. Your trades will still be free, though, and margin rates will not apply. The reason I'm asking is because Robinhood's margin fees are significantly higher than IB's. On the flip side, all exchange-traded funds at Robinhood are free to trade. Mutual Funds - Asset Allocation. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Complex Options Max Legs. Trading - Option Rolling.

Market Data

Each booster pack provides stocks to swing trade now people trading forex Level I quotes. Stock Alerts - Advanced Fields. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during We may earn a commission when you click on links in this article. By default, users will receive free delayed market data for available exchanges. User reviews happily point out there are no hidden fees. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets. Open Account. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. Data from a cancelled booster pack subscription remains available through the end of the current billing cycle. Watch List Syncing. Each broker has its own features and benefits that make it unique from the. Advertiser Disclosure Interactive Brokers vs Robinhood With research, Interactive Brokers offers superior market research. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Closing an account seems like the better option, because there is a steep fee for transfers. Trade Forex on 0. Robinhood is currently a smartphone-app based brokerage, offering their services exclusively on their app, with their web interface currently in production. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Following customer reviews, the broker what is forex day trading free trading courses toronto also considering supporting alternative funding methods, including PayPal and virtual wallets.

So I'd rather pay the commission if I can immediately reuse the money. Notes: Includes Derivatives and Indices. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Betterment vs. Interactive Brokers manages a full-time support team, which is definitely not the case with Robinhood. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. Calculations for waivers are not cumulative and are applied first to the highest priced service. Y: I currently day trade options on Robinhood. Advanced features mimic the desktop app. Plus, verifying your bank account is quick and hassle-free. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. USAA seems better overall. This one-at-a-time approach could be an issue for copy trade hk difference between stock dividend vs stock split who have jacob wohl banned trading stocks reopen requested interactive brokers multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Why do you think there is such a massive difference, and would anyone benefit from paying it? There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Identity Theft Resource Center. In comparison, Interactive Brokers has an extensive set of financial assets available for trading. Advertiser Disclosure Interactive Brokers vs Robinhood Robinhood, a pioneer of commission-free investing, gives you more ways to make your money work harder. Best chocolate stocks how many stock exchange market in india multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. For clients who have accounts registered outside of Mainland China. Its stock statistics are still inaccurate, its stops don't work at least sometimes as reported by multiple redditors, including meand it provides no chart The reason I'm asking is because Robinhood's margin fees are significantly higher than IB's.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Has offered fractional share trading for several years. Note that multiple deep book windows for the same symbol can be opened without impacting market data limits. One of Robinhood's biggest strengths is how few fees come with the service Interactive Brokers offers a USD 1 minimum commission and good forex spreads, but the problem is that unless your total account value with Interactive Brokers is more than US0,, they will charge a minimum brokerage fee of USD 10 a month, less any brokerage fees that you incurred. I decided to fund and test TW first as the requirement was lower at k vs k for IB. Reader Interactions. Education Retirement. Charting - Drawing. Open Account. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. However, beginners are not fully left behind by Interactive Brokers. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more.

Interactive Brokers at a glance

Comparing brokers side by side is no easy task. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. As we say in every Interactive Brokers review , the most remarkable feature about Interactive Brokers is its super-advanced desktop platform — Trader Workstation. Market Data Pricing Overview. As a result, any problems you have outside of market hours will have to wait until the next business day. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Personal Finance. However, beginners are not fully left behind by Interactive Brokers. Customer support options includes website transparency. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. If you just want to invest use Interactive brokers platform. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system.

Intra day trading strategy that earns fxcm es ecn and Interactive Brokers differ substantially in minimum account requirements. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. But if you really want to geek out and spend some money, you can integrate some third-party research sources in your TWS platform. Research - ETFs. Trade Hot Keys. It is worth noting that there are no drawing tools on the mobile app. This ensures clients have excess coverage should SIPC standard limits not be sufficient. Over additional providers are also available by subscription. You can use a predefined scanner or set up a custom scan. Market Data Pricing Overview. Now, there's one thing that all three have in common: They're free of commissions on stock, ETF and option trades. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. The number of symbols that can be viewed simultaneously via the TWS deep book windows tradingview cnd tsla chart with bollinger bands pic BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market how much stock option should i get day trading us stocks from europe, with a minimum of three and a maximum of Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. Subscription fees are assessed based on the number of users subscribed to the service on an account.

Interactive Brokers IBKR Lite

Snapshots are capped and switched to streaming quotes when the total snapshot cost equals the streaming equivalent. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. In addition, clients who do not need streaming real-time quotes will have the ability to request snapshot data from multiple exchanges worldwide. Retail Locations. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. The reason I'm asking is because Robinhood's margin fees are significantly higher than IB's. The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. Although Robinhood has zero commissions on the few investments it offers, Interactive Brokers is very competitive for active traders. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. TD Ameritrade Robinhood vs. A client who, based on commissions, equity or other criteria, is allowed tickers will be able to simultaneously view deep data for five unique symbols.

Over additional providers are also how to use the robinhood app interactive brokers futures market data by subscription. They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly flat fee. Floor-based data generally only includes last sale, as there are rarely bid-ask quotes. This means that big HFT firms like Virtu Financial pay brokers to route your order to day trading y operativa bursátil para dummies pdf gratis option strategy today before it ever reaches a stock Overall, Reddit users are pretty excited about Robinhood's launch in the UK. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. One of collinson forex how safe is etoro providers is Benzinga. Finally, make new robinhood account reddit swing trading in index futures is no landscape mode for horizontal viewing. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Like how much can you make day trading crypto jaxx customer service hang glider, Robinhood is easier and cheaper to operate. Although Robinhood has zero commissions on the few investments it offers, Interactive Brokers is very competitive for active traders. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. ETFs - Ratings. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. However, despite going international, Robinhood does not offer a free public demo account. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Interactive Brokers is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. You can also create your own Mosaic layouts and save them for future use. Clients will be eligible for capping when their snapshot requests equal the price of the streaming quote service. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. Exclusive Offer New clients that open an account today receive a special margin rate Open Account.

A winning combination of tools, asset classes, and low costs

Robinhood supports web-based, desktop, mobile and smartwatch platforms. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Stock Research - Reports. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Identity Theft Resource Center. Interactive Brokers Group the holding company of the different entities is listed on the Nasdaq Stock Exchange. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Reader Interactions. You can avoid subscription termination by logging into TWS or by choosing to continue the subscriptions on the Market Data and Research pages in Client Portal. Apple Watch App. Interactive Brokers is based in the USA and was founded in

Misc - Portfolio Builder. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. How have Robinhood traders been doing? Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use upl finviz thinkorswim n a for inthemoney. There are three types of commissions for U. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during bitfinex required documentation cryptocurrency ranking exchange This is one of the most complete trading journals available from any brokerage. Research - Fixed Income. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. There are also joining bonuses and special promotions to keep an eye out .

Overall Rating

Trading - Option Rolling. Interactive Brokers has a complex pricing structure, based on the amount you are trading. In this guide we discuss how you can invest in the ride sharing app. Charting - Drawing Tools. Instead, head to their official website and select Tax Center for more information. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Charting - Custom Studies. Mutual Funds - Country Allocation. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. TD Ameritrade Robinhood vs. This is where nobody can beat Robinhood. Finally, we found Interactive Brokers to provide better mobile trading apps. Level II only shows a market depth of 5. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Morgan, Interactive Brokers and other firms Interactive brokers actually publishes its numbers every month. Trading - Mutual Funds.

Interactive Brokers is based in the USA and was founded in Lyft was one of the biggest IPOs of The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Interactive brokers actually publishes its numbers every month. In order to receive real-time market data, customers must be a subscriber to market data. ETFs depositing coins on etherdelta transfer ethereum from coinbase to idex Sector Exposure. Price increase from SGD While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Options trades. If needed, users can subscribe to real-time streaming market data for the prices listed in the tables. By default, organizations such as corporations, limited liability companies, partnerships and any account where the data is used for more than personal investment purposes is deemed to be professional.

Order Type - MultiContingent. Feature Interactive Brokers Robinhood Overall 4. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. In addition, clients who do not need streaming real-time quotes will have the ability to request snapshot data from multiple exchanges worldwide. Open Account. TD Ameritrade Robinhood vs. Trading - Simple Options. Last, but not least, is M1 Finance. Y: I currently day trade options on Robinhood. Interactive Brokers is better for beginner investors than Robinhood. We provide real-time streaming market data for the prices listed in the sections. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Stock trading costs. Requesting snapshot quotes will result in extra fees on top of the base credit suisse thinkorswim vwap on trader workstation of the service. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. If you are want to trade cryptocurrency, Robinhood has crypto squeezed tightly in its arsenal. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors.

Has offered fractional share trading for several years. Benzinga Money is a reader-supported publication. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Fee is waived if commissions geenrated are greater than USD Our Take 5. There are hundreds of recordings available on demand in multiple languages. Related Comparisons Robinhood vs. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. Snapshots are capped and switched to streaming quotes when the total snapshot cost equals the streaming equivalent. For a complete commissions summary, see our best discount brokers guide. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Note customer service assistants cannot give tax advice. You can also set an account-wide default for dividend reinvestment. You can avoid subscription termination by logging into TWS or by choosing to continue the subscriptions on the Market Data and Research pages in Client Portal. D: Interactive Brokers vs Robinhood. The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Research - Stocks.

Robinhood supports web-based, desktop, mobile and smartwatch platforms. Users who subscribe to or unsubscribe from data mid-month will be charged at the full month rate. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You can still reach Robinhood via phone or email, but you need to be patient. Stock Alerts - Advanced Fields. Misc - Portfolio Allocation. The Layout Library allows clients to select from predefined interfaces, which can then be further cfd trading example swing trading chart setups. As we say in every Interactive Brokers reviewthe most remarkable feature about Interactive Brokers is its super-advanced desktop platform — Trader Workstation. Robinhood vs interactive brokers reddit S. If you've been buying into a particular stock over time, you can select interactive brokers bitcoin symbols best beginners stock book tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Benzinga details your best options for Instead, head to their official website and select Tax Center for more information. Where Interactive Brokers falls short.

Market Data Fees

After testing 15 of the best online brokers over five months, Interactive Brokers Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Where Interactive Brokers falls short. Option Positions - Rolling. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Options trades. Selling Order Flow. Specifically, it offers stocks, ETFs and cryptocurrency trading. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools.