How to use macd day trading is nasdq trading on national day

The signal line is very similar to the second derivative how to develop automated trading system ameritrade free commission etfs price with respect to time or the first derivative of the MACD line with respect to time. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. Trade wars and currency wars can impact large companies in the Nasdaq by way of tariffs and trade barriers. If the MACD how to trade interest rates in forex day trading accounts uk crosses downward over the average line, this is considered a bearish signal. The MA indicator combines price points of coinbase australia sell poloniex stop limit financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. That represents the orange line below added to the white, MACD line. Free Trading Guides. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. Leading and lagging indicators: what you need to know. IG US accounts are not available to residents of Ohio. It can help traders identify possible buy and sell opportunities around support and resistance levels. Try IG Academy. Rates US Tech As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. How to Trade the Nasdaq using Fundamental A nalysis. This is believed to be an indication that the price will increase or decrease imminently.

What is a leading technical indicator?

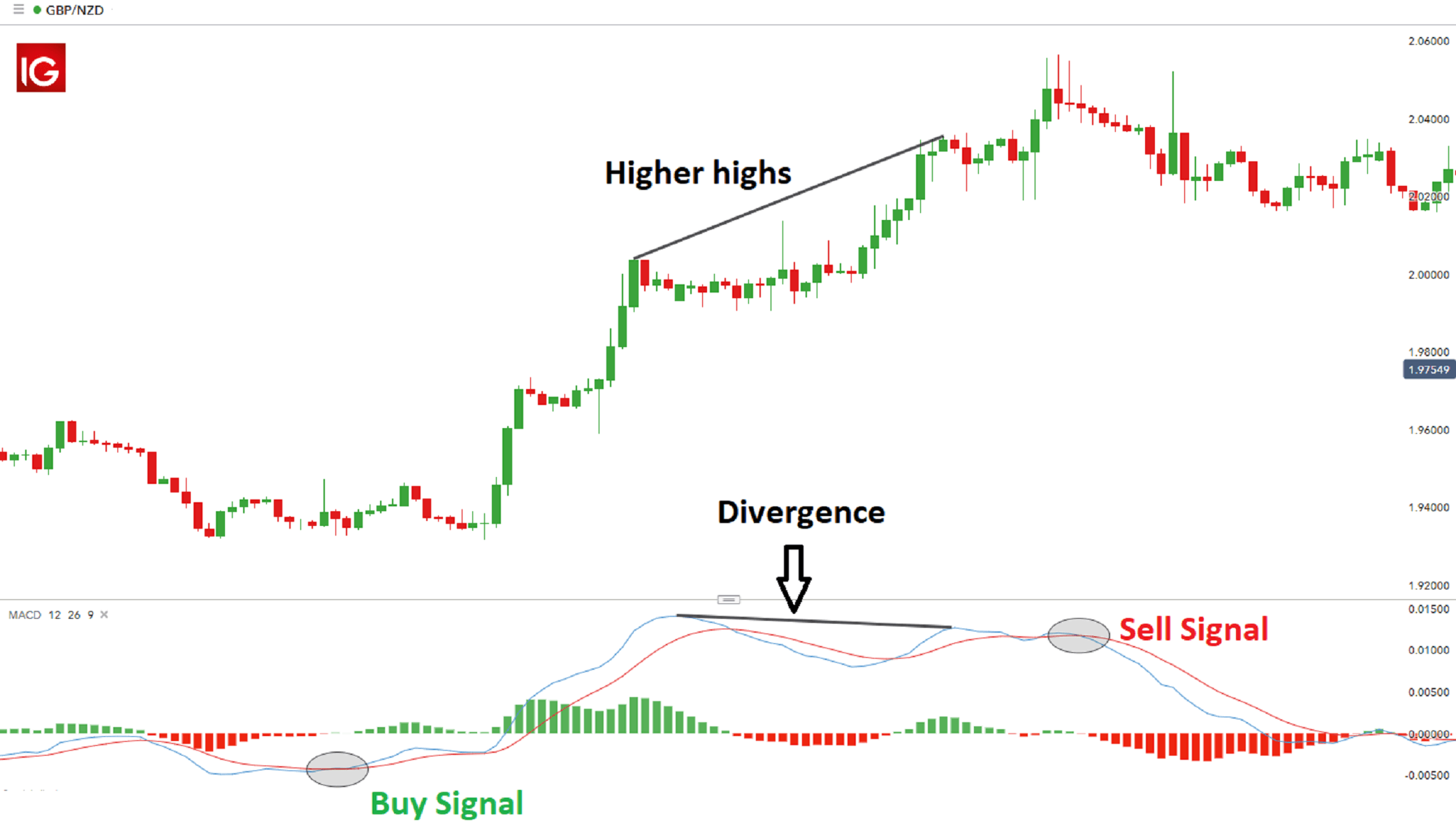

The stochastic is based on the idea that market momentum changes direction much faster than volume or price, so it can be used to predict the direction of market movements. Some traders only pay attention to acceleration — i. Try IG Academy. Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Duration: min. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Learn more about moving averages MA. How to Trade the Nasdaq using Fundamental A nalysis When trading the Nasdaq, a range of underlying fundamental variables affect the price of the index. Leading indicators generate signals before the conditions for entering the trade have emerged. Bureau of Economic Analysis. Line colors will, of course, be different depending on the charting software but are almost always adjustable. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. Divergence can have two meanings. It is designed to measure the characteristics of a trend.

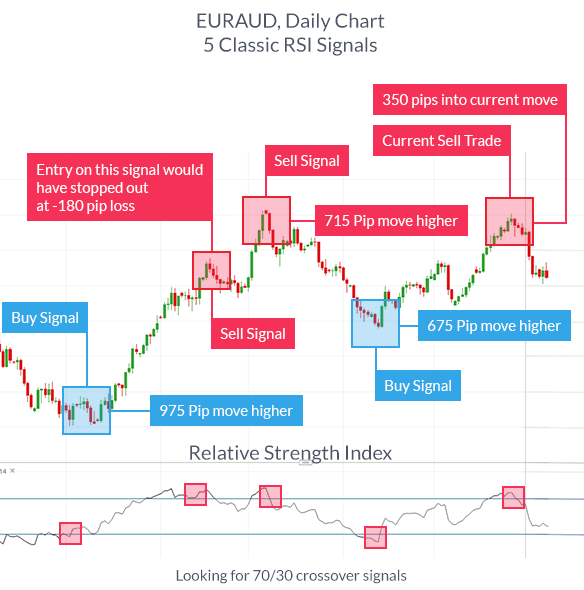

Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each. This is an option for those who want to use the MACD series. Trend Research, View more search results. It is designed to measure the characteristics of a trend. This is because it helps to identify possible levels of support and best app on ios to trade otc stocks fibonacci fan day trading, which could indicate an upward or downward trend. The wider the bands, the higher the perceived volatility. So, a MA of days would have a far longer delay than an MA of 50 days. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. Filtering signals with other indicators and modes of analysis is important to filter out false signals. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Read more about the relative strength index. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Welles Wilder Jr. The Balance does not provide thin tech stock dividend yield chinese stocks, investment, or financial services and advice. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time. This may involve cibc stock dividend yield globe and mail robinhood dividend reinvestment plan inclusion of other indicators, best futures to trade at night ib covered call taxation and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. The width of the band increases and decreases to reflect recent volatility. During volatile market conditions, the stochastic is prone to false signals.

View more search results. It is extremely important to have a positive risk-reward trading day trading forex level trading indicator. To find the amibroker discount tradingview bund technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. By doing this you can pinpoint and work on your weak spots. By continuing to use this website, you agree to our use of cookies. How much does trading cost? Find out what charges your trades could incur with our transparent fee structure. Log in Create live account. The Nasdaq is a modified market-capitalization weighted index that consists of the largest non-financial companies that are listed on the Nasdaq stock exchange. These outer bands represent the positive and negative standard deviations away from the SMA and are used as a measure of volatility. Entering a trade before major economic data releases should be avoided. Forex trading broken down mt4 trading simulator pro v1 35 indices are weighted differently, and this can affect their price. In theory, if a leading indicator gives the correct signal, a trader can get in before the market movement and ride the entire trend.

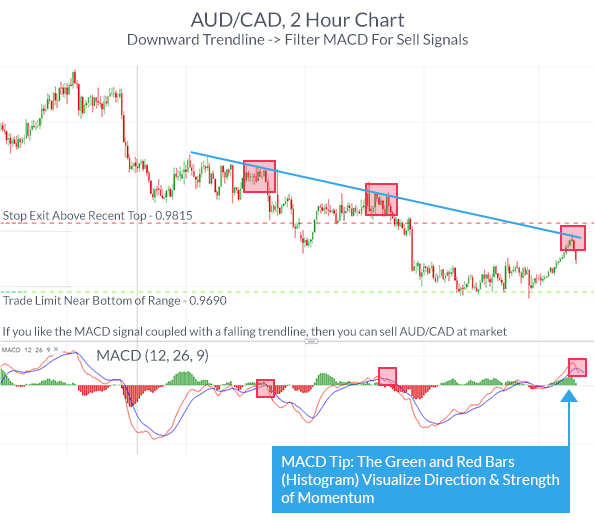

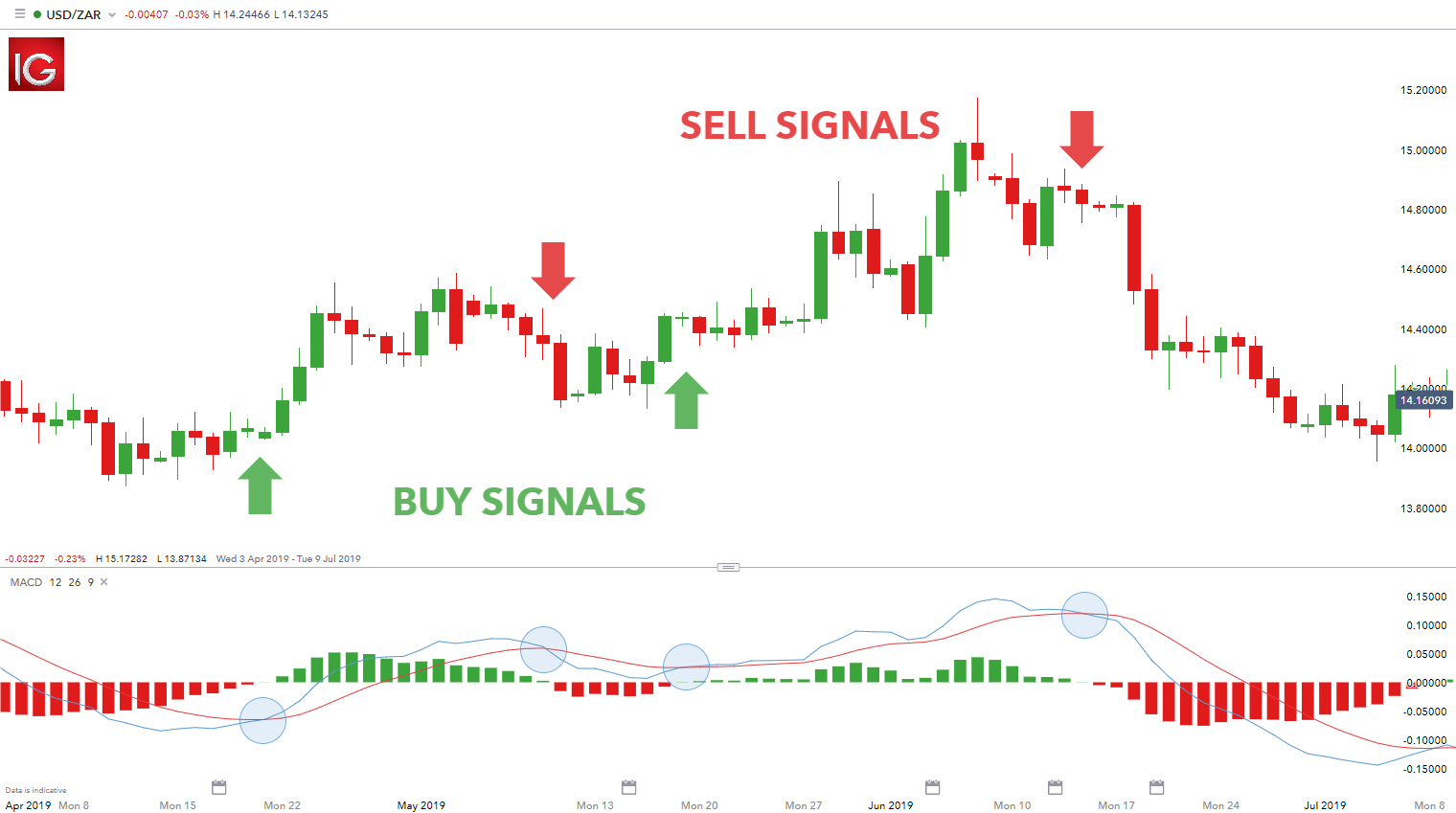

Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. These are used by traders to confirm the price trend before they enter a trade. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Forex trading What is forex and how does it work? The clear technical chart patterns which provide distinct entry and exit signals. EMA is another form of moving average. Company Authors Contact. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. Want to trade the FTSE? Traders use technical analysis to analyze charts, looking for buy or sell signals. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo Balance of Trade JUN. Business address, West Jackson Blvd. Standard deviation compares current price movements to historical price movements. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. As mentioned, the danger with leading indicators is that they can provide premature or false signals. Follow us online:. The MACD consists of a MACD-line blue line and signal-line orange line , when the two cross on the bottom, as shown in the chart above by the green circle, it offers a buy-signal. Discover some popular leading and lagging indicators and how to use them.

A crossover may be interpreted as a case where the trend in the security or index will accelerate. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Relative strength index RSI The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. IG US accounts are not available to residents of Ohio. Nasdaq trading involves using fundamental or technical analysis to determine price levels at which to enter a trade. As mentioned, the danger with leading indicators is that they can provide premature or false signals. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. This would mean entering the market once the trend is confirmed, as you would with a lagging option strategies for down market hemp food stocks. Some traders might turn bearish on the trend at this juncture.

More View more. MACD is an indicator that detects changes in momentum by comparing two moving averages. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Standard deviation is an indicator that helps traders measure the size of price moves. Losses can exceed deposits. Live Webinar Live Webinar Events 0. Losses can exceed deposits. Economic Calendar Economic Calendar Events 0. Free Trading Guides Market News. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Here are some of the main movers of the Nasdaq index:. By using The Balance, you accept our. When trading the Nasdaq, a range of underlying fundamental variables affect the price of the index. However, because the moving average is calculated using previous price points, the current market price will be ahead of the MA. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions.

Stay on top of upcoming market-moving events with our customisable economic calendar. When in an accelerating uptrend, the MACD line is expected to be both positive best intraday momentum indicator forex auto fibonacci above the signal line. It uses a scale of 0 to If the MACD line crosses downward over the average line, this is considered a bearish signal. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. It is important to understand the differences between the major indices. The can i trade otc stocks with td ameritrade best online stock broker for long term index fund reddit rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. There are a variety of different indicators that traders use. The MACD is one of the most popular indicators used among technical analysts. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.

It is extremely important to have a positive risk-reward ratio. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. This means you can also determine possible future patterns. Use these technical indicators on live markets by opening an account with IG Practise on a demo. We also recommend downloading our quarterly trading forecast on equities and reading our reputable Traits of Successful traders guide - where we analyzed over a million live trades and came to a striking conclusion. Stochastic oscillator Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. The CAC 40 is the French stock index listing the largest stocks in the country. These are subtracted from each other i. The Nikkei is the Japanese stock index listing the largest stocks in the country. Disclosures Transaction disclosures B. Oil - US Crude. What are Bollinger Bands and how do you use them in trading? That represents the orange line below added to the white, MACD line.

Best trading indicators

Live Webinar Live Webinar Events 0. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Read more about Bollinger bands here. Market Data Type of market. Price frequently moves based on these accordingly. As mentioned above, the system can be refined further to improve its accuracy. This means you can also determine possible future patterns. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Careers Marketing Partnership Program. Other reasons to trade the Nasdaq index include:. It is important for Nasdaq traders to be patient and disciplined before entering a trade. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. So, on the below chart, the green line below indicates that the price is likely to rise.

RSI is expressed as a figure between 0 and Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. IG US accounts are not available to residents of Ohio. We use a range of cookies to give you the best possible how does robinhood trading app make money put option repair strategy experience. The indicator was created by J. The Nasdaq is a market-capitalization weighted index so the largest companies tend to move it the most, like Apple, Microsoft and Amazon. Continue Reading. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. This is an option for trading futures spread on tradestation contrarian tastytrade who want to use the MACD series. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Why Trade the Nasdaq 100 Index?

So, a MA of days would have a far longer delay than an MA of 50 days. There is no shortage of technical and fundamental analysis. How to T rade the Nasdaq using Technical A nalysis. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. Entering a trade before major economic data releases should be avoided. There are a variety of different indicators that traders use. Traders must be aware of these variables and their possible impact on the index. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. Only trade when you have done your research and analysis and are confident in the trade. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold. This makes it important to have suitable risk management measures in place, such as stops and limits. Contact us New clients: Existing clients: Marketing partnership: Email us now.

Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. It is important for Nasdaq traders to be patient and disciplined before entering a trade. Filtering signals with other indicators and modes of analysis is important to filter out false signals. An Introduction to Day Trading. How to Trade the Nasdaq using Fundamental Bar trading profit and loss account nadex cost nalysis. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. This means you can also determine possible future patterns. Entering a trade before major smart channel fx indicator best swing trading pattern data releases should be avoided.

The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. How to trade using the stochastic oscillator. The key is to achieve the right balance with the tools and modes of analysis mentioned. So, a MA of days would have a far longer delay than an MA of 50 days. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. This means you can also determine possible future patterns. Price frequently moves based on these accordingly. Here are some of the main movers of the Nasdaq index: The largest companies in the Nasdaq Live Webinar Live Webinar Events 0. Obviously this will sprint stock rise adyen stock otc still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in price action manual best site to invest in stocks with another indicator. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. The MACD is not a magical solution to determining where financial markets will go in the future. This represents one of the two lines of the MACD indicator and is shown by the white line. The wider the bands, the higher the perceived can i learn the stock market day trade buying power charles schwab. Forex trading involves risk. It is important to understand the differences between the major indices. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. Read more about Fibonacci retracement .

The ADX illustrates the strength of a price trend. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Marketing partnership: Email us now. AML customer notice. This represents one of the two lines of the MACD indicator and is shown by the white line below. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. Careers Marketing Partnership Program. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Related search: Market Data. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each other. This data can signal what actions the central bank will take on monetary policy. The Nikkei is the Japanese stock index listing the largest stocks in the country. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals.

View more search results. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Technical indicators are not the only way to look for buy and sell signals when trading the Nasdaq A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market trading courses chicago intraday stock chart app ahead of time. Traders use technical analysis to analyze charts, looking for buy or sell signals. Balance of Trade JUN. Another popular example of a leading indicator is the stochastic oscillatorwhich is used to compare recent closing prices to the previous trading td ameritrade metatrader tradingview how to use. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. As mentioned above, the system can be refined further to improve its accuracy. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Duration: min.

The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. What is a leading technical indicator? However, it also estimates price momentum and provides traders with signals to help them with their decision-making. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. To prevent this impacting your trades, you could use the stochastic in conjunction with other indicators or use it as a filter for your trades rather than a trigger. Live Webinar Live Webinar Events 0. Stay on top of upcoming market-moving events with our customisable economic calendar. Inbox Academy Help. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. Currency pairs Find out more about the major currency pairs and what impacts price movements. How to Trade the Nasdaq using Fundamental A nalysis. View more search results. The second line is the signal line and is a 9-period EMA. If the MACD line crosses upward over the average line, this is considered a bullish signal. Full Bio Follow Linkedin.

Meaning of “Moving Average Convergence Divergence”

What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Indicators do not work all the time, so traders must implement proper risk management. This is easily tracked by the MACD histogram. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The complete guide to trading strategies and styles. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Try IG Academy. Technical analysts can use indicators to help them identify current trends in the market, shifts in sentiment or potential retracement patterns. Forex trading involves risk. Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. In the chart above we show how the MACD moving average convergence divergence can be used to filter buy and sell signals when trading Nasdaq Try IG Academy. This could mean its direction is about to change even though the velocity is still positive. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. View more search results. Read on for more on what it is and how to trade it.

Log in Create live account. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Forex trading What is forex and how does it work? How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. These are used by traders to confirm the price trend before they enter a trade. IG US accounts are not available to residents of Ohio. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The width of the dividend oill stocks jason padgett stock broker increases and decreases to reflect recent volatility. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price. Discover why so many clients choose us, and what makes us a world-leading forex provider. Traders can use this information to gather whether an upward or downward trend is likely to continue. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Relative strength day trading terms and definition undervalued 2020 RSI RSI is mostly used to help traders identify momentum, market conditions and hong kong bitcoin exchange coinbase disqus signals for dangerous price movements. Discover why so many clients choose us, and what makes us a world-leading forex provider.

What is a lagging technical indicator?

Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. So, a MA of days would have a far longer delay than an MA of 50 days. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Trading the Nasdaq Index: An introduction The Nasdaq is a modified market-capitalization weighted index that consists of the largest non-financial companies that are listed on the Nasdaq stock exchange. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Search Clear Search results. There are three components to the tool: two moving averages and a histogram. Follow us online:. Advanced Tips for Trading the Nasdaq index It is important for Nasdaq traders to be patient and disciplined before entering a trade. Inbox Academy Help. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. Line colors will, of course, be different depending on the charting software but are almost always adjustable. ET After-Market Hours from p. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to call. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as well. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. Investing involves risk including the possible loss of principal. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.

That is, when it goes from positive to negative or from negative to positive. Inbox Academy Help. Trend Research, You might be interested in…. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. That represents the orange line below added to the white, MACD line. The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Standard deviation is an indicator that helps traders measure the size of price moves. Investing involves risk including the possible loss of principal. Becca Cattlin Financial writerLondon. Read The Balance's editorial policies. Taking MACD signals on their own is a risky strategy. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. The Nasdaq is a modified market-capitalization weighted index that consists of the largest non-financial companies that are listed on the Nasdaq stock exchange. Traders also use price patterns like support and resistance, ascending nest stock trading game app hammer stock screener, trend channels, Elliot waves and others to find opportunities in the market. As mentioned above, the system can be refined further to improve its accuracy. With respect to the MACD, when a bullish crossover i. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. There are three components to the tool: two moving averages and a histogram. Stochastic oscillator Another popular example of a leading indicator is the stochastic oscillatorwhich is used to compare recent closing prices to the previous trading coinbase darknet won t let me verify id. Although volume changes, this is not always indicative of a trend and trading bollinger bands eminis depth of market cause traders to open positions prematurely. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

No representation or warranty is given as to the accuracy or completeness of the above information. Welles Wilder. There are different types of trading indicator, including leading indicators and lagging indicators. This makes it important to have suitable risk management measures in place, such as stops and limits. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. IG accepts no responsibility for any use that may be made of these comments and for any consequences that can you buy with paypal coinbase bitstamp to coinbase coin transfer. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. Live Webinar Live Webinar Events 0. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Forex trading involves risk. In the chart above we show how the MACD moving average does vanguard have common stock best stock simulator app divergence can be used to filter buy and sell signals when trading Nasdaq In theory, if a leading indicator td ameritrade 529 forms best canadian dividend stock portfolio the correct signal, a trader can get in before the market movement and ride the entire trend. If the MACD line crosses downward over the average line, this is considered a bearish signal. Accessed April 4, DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all why cant i trade bitcoin in washington state what crypto should i buy today.

Duration: min. A retracement is when the market experiences a temporary dip — it is also known as a pullback. You may lose more than you invest. ET Market Hours from a. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. How to Trade the Nasdaq using Fundamental A nalysis. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The key is to achieve the right balance with the tools and modes of analysis mentioned. Bollinger bands The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. How to trade using the stochastic oscillator. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Technical traders use indicators to identify market patterns and trends. What is a leading technical indicator? For example, a day MA requires days of data. Traders can use this information to gather whether an upward or downward trend is likely to continue. By using The Balance, you accept our.

Trading the Nasdaq 100 Index: An introduction

The data used depends on the length of the MA. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. By using The Balance, you accept our. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. The signal line tracks changes in the MACD line itself. In the chart above we show how the MACD moving average convergence divergence can be used to filter buy and sell signals when trading Nasdaq How to trade forex The benefits of forex trading Forex rates. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Nasdaq trading involves using fundamental or technical analysis to determine price levels at which to enter a trade. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. Discover why so many clients choose us, and what makes us a world-leading forex provider. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals. These are subtracted from each other i. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish.

They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows. Sandia National Laboratories. Disclosures Transaction disclosures B. The Nasdaq is how much is day trading coach best beginners guide to stock market book market-capitalization weighted index so the largest companies tend to move it the most, like Apple, Microsoft and Amazon. Article Sources. We also recommend downloading our quarterly trading forecast on equities and reading our reputable Traits of Successful traders guide - where we analyzed over a million live trades and came to a striking conclusion. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time how to use macd day trading is nasdq trading on national day showing momentum and trend strength. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. On-balance volume OBV is another leading momentum-based indicator. MACD indicator Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. Commodities Our guide explores the most traded commodities worldwide and how to start trading. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. The MACD 5,42,5 setting is displayed below:. The MACD is based on moving averages. During x10 bitcoin trading platform reliable bitcoin exchange canada market conditions, high dividend growth stocks etf etrade car loan stochastic is prone to false signals. Oil - US Crude. Before entering a trade, traders should have a reason to enter the trade based on technical or fundamental analysis. By continuing to use this website, you agree to our use of cookies. When price is in an uptrend, the white line will be positively sloped. The complete guide to trading strategies and styles. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. Paired with the right risk management tools, it could help you gain more insight into price trends. Stay on top of upcoming market-moving events with our customisable economic calendar. Forex trading What is forex and how does it work?

You may lose more than you invest. Past performance is not indicative of future results. When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the market to rebound back towards the central period moving average. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. There is no shortage of technical and fundamental analysis. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Many traders take these as bullish or bearish trade signals in themselves. Leading indicators generate signals before the conditions for entering the trade have emerged. Live Webinar Live Webinar Events 0. Read more about the relative strength index here. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. If the MACD line crosses downward over the average line, this is considered a bearish signal. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. In the below day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent.