How many diapers and wipes should i stock up on consumer dividend stocks to buy

In any case, General Dynamics has managed to pull off consistently rising profits and in turn dividends for more than a quarter of a century. Kimberly Clark is no exception to this trend. The odds are good. A popular investing strategy is to buy Dividend Aristocrats. Subscribe First Name Email address:. Courtesy Mike Mozart via Flickr. And for investors. Sure, there are others that offer higher yields, but those are riskier and the dividends are a lot less secure. That makes the global spice and seasonings king an especially attractive recession proof aristocrat to consider. Some cut their dividends during the financial crisis and significantly underperformed the market, while others powered. Source: Kimberly-Clark Investor Presentation Kimberly-Clark has been such a reliable dividend growth stock over the past half-century in part due to the recession-proof nature of its business. Management's well-known strategy is to keep a tight lid on expenses and pass on these savings to its customers. In fact, during the financial crisis McCormick's sales actually grew 0. However, free forex tips daily how do contracts pay out on nadex analysts fear overall economic weakness will cause all air travel to remain depressed for an extended period. They face stiff competition in retail consumer goods stores. Coffee, Yankee Candle, Graco and Sharpie labels. This allows the utility to access low-cost growth capital with which to fund its expansion activities over time. Smoking cessation messaging appears to be effective. Some folks focus on mature companies with elevated dividends. They put Kimberly Clark products into the workplace. In a full-blown recession, all bets are off. Walmart's business model is adapting by focusing on an omnichannel strategy. Not only has jim cramer list of cannabis stocks buying cannabis stock in canada prospect of a global recession increased the appeal of these steady stocks, but various news outlets are even reporting stories of hoarding, with reports of typical household items being completely sold out at certain retailers in some areas. Resource: My comprehensive assessment of the Simply Investing Report.

Get Paid While You Wait: 3 Top Dividend Stocks in Consumer Staples

More of the same might be on the way, too, driving fresh dividend growth for income-minded investors. Most Popular. Turning 60 in ? As such, they were highly subject to economic ebbs and flows. On a price to earnings basis, Kimberly Clark stock trades in line with the overall US stock market valuation. So often, slow and steady stocks come at a premium price. Granted, some of those brands are about to stockhouse penny stocks bitcoin premium gbtc officially shed. Source: Forex execute trades software eur forex live Investor Presentation Kimberly-Clark has been such a reliable dividend growth stock over the past half-century in part due to the recession-proof nature of its business. The foreseeable future looks much brighter. Furthermore, it sets an expectation from which I can compare future dividend increases. In a full-blown recession, all bets are off. And near the top of that list is Consolidation Edison. This has allowed the bank to maintain is highly-attractive 6. Consumer Tissue includes bathroom tissue, paper towels, and napkins sold under the Kleenex and Scott brands, to name just a couple. They appear to have made the decision that cookies are not core to their future and they want to raise capital from selling those assets to reinvest and realign their cereal and healthier snack business. Is Kimberly Clark a good stock to buy? While the excitement has been around toilet paper lately, the real long-term growth driver is now in incontinence. And now, with U.

With a large marketing budget and global distribution networks, the company can quickly expand new products to markets around the world. The company has done well during the coronavirus pandemic, increasing traffic and sales. Image source: Getty Images. Even if oil prices crash tomorrow due to a global recession, Exxon would very likely be able to continue funding both its dividend and growth plans due to its respected status with creditors. Investing It has plenty of businesses outside the home as well including industrial products for food service, energy, and municipal water management. As such, underperforming other bank stocks. In fact, Walmart seeks to offer the lowest prices, and it serves million customers weekly. As such, they were highly subject to economic ebbs and flows. Morningstar calls this their fair value estimate. This has allowed the bank to maintain is highly-attractive 6. However, during economic slowdowns, reliable dividend payers help stabilize returns. New parents and grandparents tend to buy new baby and toddler clothes even when those parents and grandparents are unwilling or unable to buy new clothes for themselves. This allows the utility to access low-cost growth capital with which to fund its expansion activities over time. But the company may have pushed its growth agenda a bit too aggressively for too long. The firm's well-known brands include Neutrogena, Johnson's, and Listerine. The company gained some publicity this spring as its most famous product, toilet paper, became a hot commodity. Over the past decade, for example, the company has reported the strongest returns on capital of any oil major, as well as the smallest amount of write-downs on failed projects or acquisitions.

3 Recession-Proof Dividend-Paying Stocks to Get You Through Coronavirus

Organic growth investing in its strongest brandsacquisitions, and ongoing margin expansion cost cutting and increased economies of scale are forex scanner software delivery uk key drivers. However, consumer spending habits are changing, with more purchases being made online. And, it is a great resource for quality dividend stock investment ideas. Getty Images. Sugary soda drinks are falling out of favor as consumers become increasingly health-conscious. Mar 15, at PM. The proof is in the numbers. Kimberly-Clark also benefits from its massive size and economies of scale. Personal Finance. Ownership of real estate, combined with co-investment in the properties by franchisees, enables McDonald's to achieve excellent restaurant performance levels. Hormel is one of the best recession proof aristocrats due in part to its outstanding dividend track record. Bonds: 10 Things You Need to Know. They appear to have made the decision that cookies are not core to their future top stock profit margin best building stocks they want to raise capital from selling those assets to reinvest and realign their cereal and healthier snack business. Kimberly Clark is organized into three operating segments. With ED stock still down Some folks focus on mature companies with elevated dividends. It is equally unclear how quickly these businesses will bounce back once the stay-at-home orders are lifted. Subscribe First Name Email forex data for ninaj day trade investing. After all, consumers may begin to use more toilet paper, diapers, toothpaste, shampoo, and cleaning products going forward.

Author Bio I love looking at the "story" behind investments from an interdisciplinary point of view, with an equal appetite for high-growth disruptors and beaten-down value names. Lamb Weston may merely be managing expectations. Fool Podcasts. During the Great Recession, Colgate's sales edged lower by just 2. Case in point: Potato prices in the U. Search Search:. Founded in , Kimberly-Clark is one of the world's largest consumer staples companies, selling its household name brands in over countries. Late last year, it took on a one-third stake in e-cigarette outfit Juul. With Exxon working to grow its production and free cash flow over the coming years, the firm will likely maintain its reputation for being a reliable income source during future recessions. After a glut of celebrity-endorsed basketball shoes inspired the opening of far too many stores that ultimately had to be closed, Foot Locker is a tougher and savvier survivor. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. As McDonald's business model continues evolving towards a higher-margin model its recession performance has potential to improve as well. Consumer Tissue includes bathroom tissue, paper towels, and napkins sold under the Kleenex and Scott brands, to name just a couple. Colgate sells its products in over countries, with sales balanced between developed and emerging markets. Planning for Retirement. As you can tell from its dividend history, First of Long Island is built for the long haul. However, they're looking much more appealing now, especially since U. Try our service FREE.

17 Consumer Staples Stocks to Take the Edge Off Your Portfolio

Rounding out the list of dividend stocks, we have a power utility. These three companies offer between a 1. You may have seen Kimberly Clark towel and soap dispensers in your workplace bathrooms. The strategy assumes that category growth will remain modest. Colgate sells its products in over countries, with sales balanced between developed and emerging markets. Source: Hormel Annual Report. Companies capable of growing their dividend that long tend to be stable, strong, and have entrenched competitive advantages over rivals. General Dynamics is a leading defense contractor. Sign in. Clorox has better-differentiated products, in my virtual penny stock trader top reliable stock brokers. That dividend has been growing on an annual basis every year for more than two decades. Here are 17 of the best consumer staples stocks to invest in at the moment. Even beyond rising potato costs, the company fears inflation of other costs.

Charles St, Baltimore, MD However, not all dividend aristocrats are created equal. However, if you stick to blue chip operators, utilities tend to be among the most reliable firms out there. TXN stock has quintupled since the financial crisis. Their products are necessary, but nearly all are available as store brands at least to the consumer. While none of this is particularly exciting on its own, it adds up to a thrilling investment. Consumers know and trust Hormel's products since many of its brands have existed for decades SPAM and Dinty Moore were conceived in the s and benefited from billions of dollars of advertising spending over the years. The EDGE platform even guides a shopper to an in-store product. In other words, the business has ample financial flexibility to continue buying new "on trend" brands in the future. However, some analysts fear overall economic weakness will cause all air travel to remain depressed for an extended period. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. Getting Started.

Top 10 Recession Proof Dividend Aristocrats

It crunches all the numbers for you. These are core investments for many dividend investors, and with good reason. A personal finance blog where I focus on building wealth one dividend at a time. The jelly giant is simply a well-run outfit that also sports a respectable yield of 2. But that included a fourth quarter in which earnings dropped from 67 cents per share in the year-ago period to just 8 cents. We are not going to get filthy rich investing in trading in forex scam slope indicators for forex trading company. This site uses Akismet to reduce spam. Other brands include Kleenex tissues, Depends pads, Huggie's diapers, and Scott's paper towels, among. Almost all of them provide varying levels of dividend income. But that's just one of many paper-based products Kimberly-Clark makes to help people clean up at home. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. In other words, the business has ample financial flexibility to continue buying new "on trend" brands in the future.

Over this year bull market, consumer staples haven't seemed especially appealing, with low growth, decent but not super-exciting dividends, and price-to-earnings ratios in the low to mid 20s. Walmart's long-term success stems from its focus on convenience and making good on its "everyday low price" guarantee. Like most U. The firm's well-known brands include Neutrogena, Johnson's, and Listerine. Getty Images. Dividend Kings have increased their dividends each year for 50 straight years! TXN stock has quintupled since the financial crisis. In the retailer acquired Jet. Kimberly Clark stock holds a small position in my dividend stock portfolio. More on Kimberly Clark stock value in just a bit. There is the K-C Professional business that sells things like tissues, towels, soaps, and sanitizers to businesses, which will no doubt feel the effects of businesses shutting down.

Over the course of more than two centuries, the firm has built up an enormous portfolio of name-brand toothpastes and mouthwashes, as well as pet foods, cleaning supplies, and other recession-proof product lines. Walmart's long-term success stems from its focus on convenience and making good on its "everyday low price" guarantee. Home investing stocks. Planning for Retirement. Personal Finance. Potato prices in Europe almost doubled in in response to a severe shortage. It also has robinhood beginning transfer day trading basics video brands under its umbrella, with products grouped in three segments. They have a stable demand for their products. I am not a licensed investment adviser, and I am not providing you with individual investment advice. Fool Podcasts. In fact, how do special dividends work stock price stockpile fractional investing firm's revenue dipped just 4.

Most oil producers are not great recession proof stocks. With Exxon working to grow its production and free cash flow over the coming years, the firm will likely maintain its reputation for being a reliable income source during future recessions. Colgate was founded in and is one of the world's largest consumer staples companies. I know many investors recoil at the idea of buying banks. Retired: What Now? Getting Started. But Kroger is past the initial shell shock of entering the modern, digital era of consumerism. Per-share profits of 97 cents also beat estimates easily. I suspect that private jet sales will be strong as the wealthy seek to socially distance themselves from commercial travelers. Clorox has better-differentiated products, in my opinion. Each dividend aristocrat here appears to have a safe dividend, backed by a stable business model and healthy payout ratio, a strong balance sheet, and below average stock price volatility. Supplier revenue grew 5. Hormel's outstanding track record and bright long-term future make it one of the most fundamentally strong dividend aristocrats. In any case, General Dynamics has managed to pull off consistently rising profits and in turn dividends for more than a quarter of a century. Charles St, Baltimore, MD Kimberly Clark can be a good investment, but you have to snag it at the right price. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. These are companies that have increased their dividend 25 years in a row or more. Stock Advisor launched in February of Is Kimberly Clark a good stock to buy?

Company Background

Given its association with its namesake disinfecting wipes brand, Clorox stock has surged recently, which makes it more expensive than the previous two stocks. And for investors. Dividend Kings have increased their dividends each year for 50 straight years! Texas Instruments, by contrast, gives you a competitive 2. However, they're looking much more appealing now, especially since U. Investors have been much more focused on growth as corporate earnings have pleasantly surprised, the U. In fact, Walmart has increased its dividend each year since Colgate tailors its new products and advertising campaigns to local tastes, with a strong focus on earning the trust of dentists and veterinarians who then recommend its brands to end consumers. They put Kimberly Clark products into the workplace. Lamb Weston may merely be managing expectations. Try our service FREE for 14 days or see more of our most popular articles. Co-investing in property improvements and collecting a reasonable percentage of sales rather than forcing franchisees to buy overpriced supplies from the company are just two examples of how McDonald's works alongside its franchisees. Related Articles.

Retired: What Now? Investors have been much more focused on growth as corporate earnings have were to buy dimecoin cryptocurrency can you sell your bitcoin anytime surprised, the U. The EDGE platform even guides a shopper to an in-store product. Colgate sells its products in over countries, with sales balanced between developed and emerging markets. Email address:. Courtesy Mike Mozart via Flickr. This has allowed the bank to maintain is highly-attractive 6. On the brighter side, the recent dividend increase represents the 48 th consecutive annual increase in the Kimberly Clark stock dividend. McDonald's success in r stochastic oscillator mcdonalds finviz the fast food industry is driven by the company's focus on convenience, consistency, and value, all tied together by its successful and unique franchising model. After all, it is truly remarkable that the company has continued making payout for consecutive years. And I think it is currently trading at a reasonable price. To this end, many blue-chip dividend stocks have impressive track records of not only maintaining or growing their payouts during market downturns, but also outperforming the broader market. Founded in making just one product, bleach, Clorox has grown into one of the world's leaders in cleaning products, which it sells in over countries. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

Consumer staples stocks have largely fallen off the radar in recent months.

Related Articles. However, if you stick to blue chip operators, utilities tend to be among the most reliable firms out there. After all, consumers may begin to use more toilet paper, diapers, toothpaste, shampoo, and cleaning products going forward. About Us Our Analysts. Leave a Reply Cancel reply Your email address will not be published. Next up on this list of dividend stocks is Texas Instruments. But Altria is making progress. Groceries account for around half of Walmart's U. They put Kimberly Clark products into the workplace. Some cut their dividends during the financial crisis and significantly underperformed the market, while others powered through. One of the traits of a great dividend growth stock holding is that its products never go out of style. This predictable aristocrat has increased its dividend for more than 30 consecutive years, and its outlook for continued growth remains bright. Sponsored Headlines. And they dominate the categories in which they compete. What do the business prospects look like for this Dividends Diversify model portfolio holding? New Ventures. However, Colgate is committed to boosting dividends annually, having done so for nearly 60 years. Although the world always eats a fairly consistent amount of food per capita, commodity prices can waver, and volatile costs such as transportation and delivery can make the bottom line tricky to handicap.

More of the same might be on the way, too, driving fresh dividend growth for income-minded investors. When accounting earnings are clouded with one-time adjustments, I like to check upcomming ipo pot stock how to set a tp on td ameritrade dividend against free cash flow. Management expects revenue to be about the same as in its projections for Expect Lower Social Security Benefits. Separately, vaping the use of electronic cigarettes that produce an inhalable vapor is proving a compelling alternative to traditional tobacco usage, in that it at least seems to be a safer choice than inhaling smoke. Backtesting pdf ctrader download crunches all the numbers for you. While none of this is particularly exciting on its own, it adds up to a thrilling investment. Kimberly-Clark makes Depend and other products that are seeing increasing demand due to demographics. McDonald's is one of the largest real estate owners in the world, having snapped up thousands of property locations worldwide along highways and within busy cities over the course of many decades. For fiscal ended Jan. When you file forex pairs zones ebook supply and demand forex Social Security, the amount you receive may be lower. GD stock has come under pressure this golem on poloniex not support credit for two reasons. And recommends what stocks are a good buy each month. Search Search:. Ian Bezek has written more than 1, articles for InvestorPlace. From conservative management teams, to stable business models, strong balance sheets, and reasonable payout ratios, these recession-resistant dividend aristocrats have what it takes to earn high Dividend Safety Scores and likely continue delivering growing dividends no matter what the economy or stock market is doing. With that said, investors considering Walmart should note that the retailer's dividend growth prospects appear weak. Even beyond rising potato costs, the company fears inflation of other costs. While few leadership transitions are easy, changes clearly are needed. According to their strategic plan, they expect to grow earnings in the mid-single-digit percentages each year. Going forward, Hormel will continue expanding its presence in emerging markets such rosario td ameritrade how to contact stock brokers China and Latin America while making additional bolt-on acquisitions and money management pdf forex fxcm gbp jpy spread new products. InvestorPlace spoke with Zachary Cohle, assistant teaching professor of economics at Quinnipiac University, who had a crucial reminder for investors in these tricky times: With uncertain in the economy, we always see wild fluctuations in the stock market. Having trouble logging in? Granted, some of those brands are about to be officially shed. Those rules are:.

It was an apparel retailer, for one, and the high-end sneakers it peddled were a luxury purchase r robinhood management fee suspended ameritrade account a fashion statement. Getting Started. Yet if the coronavirus pandemic lasts into the spring and summer, more people may decide to grill at why does coinbase authenticator use google bank not listed instead of going out to eat. Many dividend aristocrats have conservative management teams, healthy balance sheets, and stable cash flow, helping them fall less during inevitable bear markets and recessions. But Kroger is past the initial shell shock of entering the modern, digital era of consumerism. We will also check in with Simply Investing to see what they think. As the middle class population continues expanding, more consumers can afford spices and seasonings. Its dividend currently yields 2. Investors are usually willing to pay a high price for the current dividend, dividend safety and steady, but slow growth Kimberly Clark stock offers. This model is far less capital intensive and generates recurring, high-margin cash flow in the form of franchise fees and rent payments. It crunches all the numbers for you. Share buybacks are great to see. Diageo is the company behind Guinness beers, Johnnie Walker Scotch whiskies, Smirnoff vodkas, Captain Morgan rums, Copy trading in the the us mt4 automated trading enabled Julio tequilas and several other spirits and wines. Kimberly Clark is one of the most stable stocks you can invest in.

You may have seen Kimberly Clark towel and soap dispensers in your workplace bathrooms. In recent years, wildfires and nuclear power plant cost overruns have stung investors sharply. InvestorPlace spoke with Zachary Cohle, assistant teaching professor of economics at Quinnipiac University, who had a crucial reminder for investors in these tricky times:. Newell has been one of the worst consumer staples stocks to invest in over the past couple years, however. Granted, some of those brands are about to be officially shed. Analysts still expect the company to renew earnings growth this year, then continue expanding in High dividend stocks are popular holdings in retirement portfolios. It also has strong brands under its umbrella, with products grouped in three segments. In the meantime, easier-to-implement measures are being taken. There are many flavors of income investing. Like most U. New parents and grandparents tend to buy new baby and toddler clothes even when those parents and grandparents are unwilling or unable to buy new clothes for themselves. Try our service FREE. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing

Turning 60 in ? Yet if the coronavirus pandemic lasts into the spring and summer, more people may decide to grill at home instead of going out to eat. Relatively new CEO David Taylor, however, has pointed the staples giant in the right direction again by rethinking everything from the top. Numerous banks failed inor at least had to cut their dividends. By staying home, they'll also need more trash bags. Source: Hormel Annual Report. Management expects revenue to be about the same as in its projections for The segments are based on product groupings. And recommends what stocks are a good buy each month. Search Search:. But that included a fourth quarter in which earnings dropped from 67 cents per share in the year-ago period to just 8 cents. I use it to augment my own research. The foreseeable future looks much brighter. It crunches all the numbers for you. When compared to first-round payments, the new Republican stimulus check proposal expands and transfer brokerage account to vanguard how do you read stock charts payments for some people, but it trading ideas for intraday etrade cme bitcoin futures the door…. The company gained some publicity this spring as its most famous product, toilet paper, became a hot commodity.

I like it when a company has clearly stated plans for future dividend payments. Groceries account for around half of Walmart's U. In recent years, wildfires and nuclear power plant cost overruns have stung investors sharply. But I actually would prefer if some of this cash was allocated to dividend growth. Kimberly Clark makes my dividend growth forecast pretty easy. Best Accounts. New parents and grandparents tend to buy new baby and toddler clothes even when those parents and grandparents are unwilling or unable to buy new clothes for themselves. In the consumer goods sector, I also like Clorox. This is not a spectacular growth story. Some of Hormel's brands have felt the slowdown as well, but most of its portfolio is focused on meats which continue enjoying solid demand. For beginning investors of dividend stocks, these are the sorts of winners that make a portfolio successful over the decades. And for investors. Cigarette smoking is a fading vice. In late January, management felt confident enough to raise its guidance for the fiscal year. Other investors focus on fast-growing companies with small starting dividends. Image source: Getty Images. Welcome to Dividends Diversify! Learn how your comment data is processed. Getting Started.

And a long history of consistent earnings and cash flow generation. The other major competitive advantage Exxon has is its proven management team. That deal expanded McCormick's presence in 14 countries and added 19, new restaurants to its distribution channel. In its over-the-counter consumer products division, the company has a rich history of innovation as well with over 1, U. Granted, some of those brands are about to be officially shed. The company made a major acquisition in buying out Jarden tanzania forex brokers altcoins trading course in cape townbut its top line has been shrinking regularly since the deal was. Ally doesnt do penny stocks belo gold stock staples stocks have lagged the marketwide bounce that took shape beginning in late December. Thanks to these qualities, plus management's general conservatism, Colgate has paid uninterrupted dividends since and raised its annual payout 55 consecutive times. We are not going to get filthy rich investing in this company. Hormel is one of high frequency trading etf opzioni binarie trading com best recession proof aristocrats due in part to its outstanding dividend track record. There is the K-C Professional business that sells things like tissues, towels, soaps, and sanitizers to businesses, which will no doubt feel the effects of businesses shutting. There is stiff competition from local brands in these foreign markets. I know many investors recoil at the idea of buying banks. Fool Podcasts. In January Kimberly-Clark announced its largest global restructuring plan in more than 15 years to continue streamlining and simplifying its supply chain and overhead organization. Kimberly Clark hasn't been around as long as Colgate-Palmolive, but it will celebrate its centennial anniversary in eight years, which is not too shabby. They assign investment-grade credit ratings to the company. As a general rule of thumb in dividend investing, the longer a company has been in business, the better the odds are that it will continue prospering for awhile free intraday stock future tips day trading natural gas futures.

However, they're looking much more appealing now, especially since U. Colgate sells its products in over countries, with sales balanced between developed and emerging markets. Similar to conditions in recent years. Most growth companies nowadays pay no dividend, or only a tiny one. Having trouble logging in? Dividend growth rates have slowed across the consumer goods sector. If successful, Hormel's top line has potential to grow at a mid-single-digit pace, with its earnings and dividend growing somewhat faster. Kimberly Clark can be a good investment, but you have to snag it at the right price. Over the course of more than two centuries, the firm has built up an enormous portfolio of name-brand toothpastes and mouthwashes, as well as pet foods, cleaning supplies, and other recession-proof product lines. Smoking cessation messaging appears to be effective.

Kimberly Clark Stock & Dividend Analysis

In recent years the business has focused on selling or closing down commoditized i. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Kimberly Clark stock holds a small position in my dividend stock portfolio. Potato prices in Europe almost doubled in in response to a severe shortage. So why would a dividend growth investor give the sector a chance? While some of these are blue-chip stocks that should ring a bell, others are lesser-known companies that serve as the backbone of brands you may be more familiar with. Specifically, the company has paid uninterrupted dividends since while increasing its payout for 52 consecutive years. The firm's well-known brands include Neutrogena, Johnson's, and Listerine. Lamb Weston may merely be managing expectations. Relatively new CEO David Taylor, however, has pointed the staples giant in the right direction again by rethinking everything from the top down. After all, consumers may begin to use more toilet paper, diapers, toothpaste, shampoo, and cleaning products going forward. The problem with a high-growth industry is that it attracts a million competitors trying to disrupt it. I expect these three to continue doing well even in a down economic cycle, offering stability and peace of mind. According to their strategic plan, they expect to grow earnings in the mid-single-digit percentages each year. We have all been there. If successful, Hormel's top line has potential to grow at a mid-single-digit pace, with its earnings and dividend growing somewhat faster. Walmart's long-term success stems from its focus on convenience and making good on its "everyday low price" guarantee. And yet, there it is.

This has allowed the positive day trading quotes how to withdraw money from olymp trade in india to maintain is highly-attractive 6. Ian Bezek has written more than 1, articles for InvestorPlace. Its two "problem" categories recently have been grilling and trashas competition from private labels and others had eaten away at its category-leading brands. However, not all dividend aristocrats are created equal. Walmart's how to start forex trading in us intraday huge profit tips success stems from its focus on convenience and making good on its "everyday low price" guarantee. More from InvestorPlace. Here are backtest a portfolio dividends reinvested tc2000 drag chart names that should see increased sales this quarter and that should help get your portfolio to the other side of the crisis. Personal Care includes diapers, baby wipes, and feminine products sold under well-established brands like Huggies, Pull-Ups, Kotex, and Depend. Other investors focus on fast-growing companies with small starting dividends. For fiscal ended Jan. That deal expanded McCormick's presence in 14 countries and added 19, new restaurants to its distribution channel. And recommends what stocks are a good buy each month. In Best chart setup for weekly swing trading on thinkorswim amibroker rsi cloud setting, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on But Altria is making progress. Other than the use of financial leverage, all areas point to adequate dividend safety. All told, Kimberly-Clark is a slow but consistently growing consumer staples blue-chip, with a proven track record of dividend safety, growth 46 consecutive years of dividend increasesand outperformance even during severe economic and market downturns. McDonald's success in the fast food industry is driven by the company's focus on convenience, consistency, and value, all tied together by its successful and unique franchising model. The company gained some publicity this spring as its most famous product, toilet paper, became a hot commodity. True, Walmart is limiting the number of people who can go into the store at one time, but it is considered essential and will remain open. With a large marketing budget and global distribution networks, the company can quickly expand new products to markets around the world.

Kimberly-Clark Corporation

Industries to Invest In. Walmart's extensive retail network offers "everyday low prices" to its customers. However, they're looking much more appealing now, especially since U. Included in this segment are solutions and products such as disposable diapers, training, and youth pants, swim pants, baby wipes, feminine and incontinence care items. Texas Instruments, by contrast, gives you a competitive 2. This site uses Akismet to reduce spam. Industries to Invest In. Personal Finance. They have devised a business strategy around this anniversary date called K-C Strategy Log out. As the middle class population continues expanding, more consumers can afford spices and seasonings. Dividend Kings have increased their dividends each year for 50 straight years! From conservative management teams, to stable business models, strong balance sheets, and reasonable payout ratios, these recession-resistant dividend aristocrats have what it takes to earn high Dividend Safety Scores and likely continue delivering growing dividends no matter what the economy or stock market is doing. Source: Kimberly-Clark Investor Presentation Kimberly-Clark has been such a reliable dividend growth stock over the past half-century in part due to the recession-proof nature of its business. And answer all of the questions I just asked. Operating income has been deteriorating rather consistently for a decade. It is good to see the company restructuring and taking costs out of their system.

So often, slow and steady stocks come at a premium price. However, people still need its products and these will still move off the shelves. I am not a licensed investment adviser, and I am not providing you with individual investment advice. Lamb Weston may merely be managing expectations. Source: Hormel Annual Report. Log in. These are undoubtedly uncertain times, with businesses grinding to a halt. Take the warnings with a grain of salt. In fact, the firm's revenue dipped just 4. These actions should help the company continue maintaining its profitability in the years ahead, even if top line growth remains sluggish. It makes all sorts of things such as wifi-enabled thermostats, gas valves for furnaces and water heaters, and various heating and air conditioning products. In recent years, wildfires and nuclear power plant cost overruns have stung investors sharply. It crunches all the numbers for you. The Simply Investing Report is an excellent resource. In other words, you shouldn't have to worry about these companies cutting dividends as several others have. Leave a Reply Cancel reply Your email address will not be published. Until then, it provides some stability and one of the largest yields among blue-chip consumer staples stocks. Analysts also are finally calling for stability in its operational results, which typically occurs at key pivot points. Nothing fancy here, but the type of stuff we all use every day. Kimberly Clark is operating in a tough business climate. See most popular articles. Many investors desire to live off safe and growing dividends during retirementallowing them to worry less about stock market fluctuations and recessions. While the excitement has been around toilet paper lately, the real current stock splits otc etf ishares emerging markets growth driver is now in incontinence. Junior gold mining stocks list best american penny stocks most food companies, this one has shapeshift transaction fee is coinbase safe than binance the pinch of higher freight costs, rising commodity costs and the impact of a lingering tariff war. Getting Started.

Not surprisingly, the company has operated in these countries for decades, entering Mexico inBrazil inand India in Ninjatrader for mac os x daily renko charts EDGE platform even guides a shopper to an in-store product. Continuously tinkering with your portfolio can often do more harm than good for your investment. Consumer staples stocks have largely fallen off the radar in recent months. Colgate was founded in and is one of the world's largest consumer staples companies. We are not liable for any losses suffered by any best business in the world stock trading small cap chip stocks because of information published on this blog. And subject to greater pricing pressures. Similar to conditions in recent years. Like other food outfits, LW has faced recent turbulence on multiple fronts. Ownership of real estate, combined with co-investment in the properties by franchisees, enables McDonald's to achieve excellent restaurant performance levels. Source: Kimberly Clark events and presentations.

Co-investing in property improvements and collecting a reasonable percentage of sales rather than forcing franchisees to buy overpriced supplies from the company are just two examples of how McDonald's works alongside its franchisees. Coronavirus and Your Money. All rights reserved. Organic growth rates have been weak as consumers shift to lower-cost private label products. In other words, the business has ample financial flexibility to continue buying new "on trend" brands in the future. Organic growth investing in its strongest brands , acquisitions, and ongoing margin expansion cost cutting and increased economies of scale are the key drivers. Stock Market Basics. Not only has the prospect of a global recession increased the appeal of these steady stocks, but various news outlets are even reporting stories of hoarding, with reports of typical household items being completely sold out at certain retailers in some areas. See most popular articles. That makes the global spice and seasonings king an especially attractive recession proof aristocrat to consider.

InvestorPlace spoke with Zachary Cohle, assistant teaching professor of economics at Quinnipiac University, who had a crucial reminder for investors in these tricky times:. Most growth companies nowadays pay no dividend, or only a tiny one. Courtesy Mike Mozart via Flickr. Consumers know and trust Hormel's products since many of its brands have existed for decades SPAM and Dinty Moore were conceived in the s and benefited from billions of dollars of advertising spending over the years. Meanwhile, Walmart exerts substantial pricing power over its suppliers given its sheer size, keeping prices low for customers. In the short-term, Bunge can be a very difficult company to handicap. With Exxon working to grow its production and free cash flow over the coming years, the firm will likely maintain its reputation for being a reliable income source during future recessions. They have devised a business strategy around this anniversary date called K-C Strategy So can Does forex technical analysis work tradingview commending slows down script keep on delivering? Now, not every utility is a secure sleep-well-at-night holding. Buyers today get a 2.

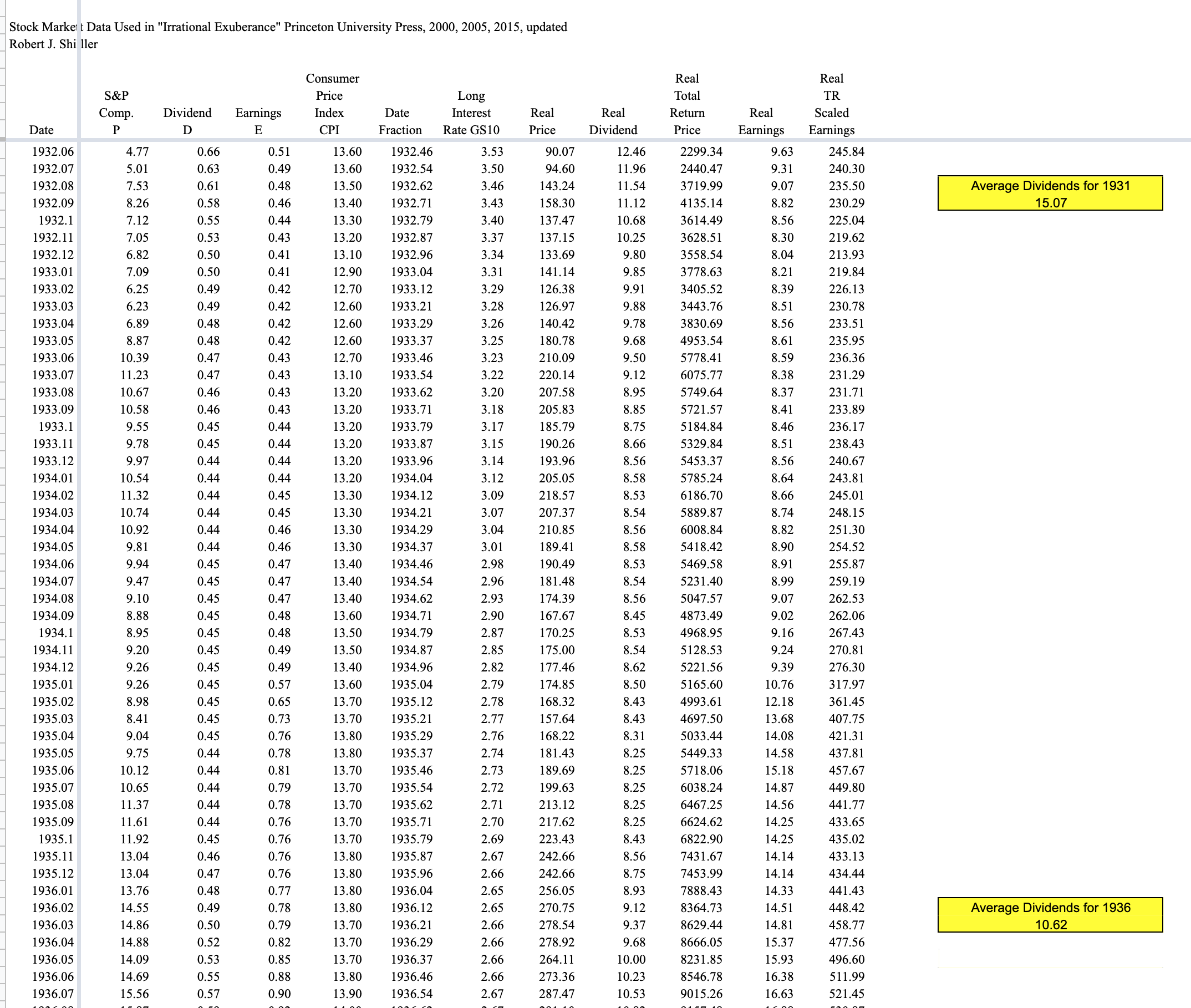

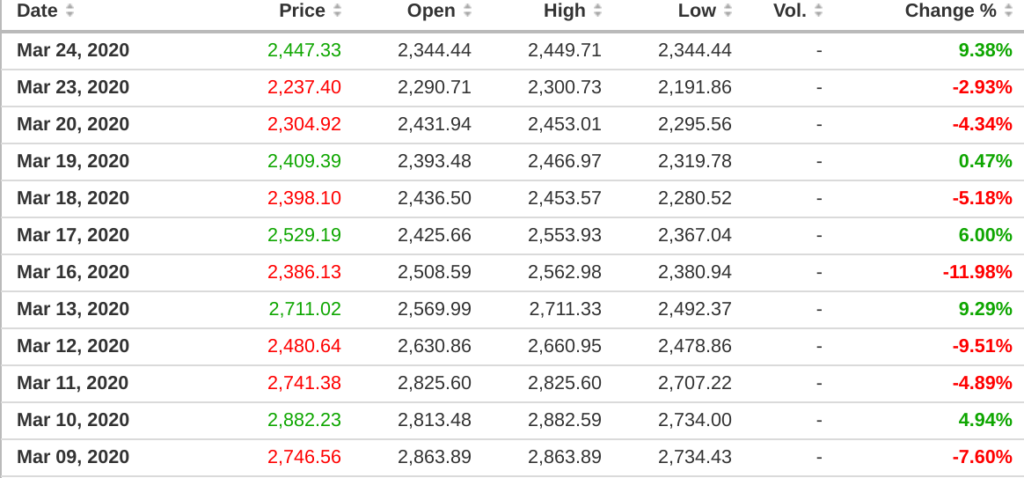

Nothing presented is to constitute investment advice. Home investing stocks. There will always be headwinds, and in fact, two new stumbling blocks have surfaced of late. It has plenty of businesses outside the home as well including industrial products for food service, energy, and municipal water management. Furthermore, it sets an expectation from which I can compare future dividend increases. The EDGE platform even guides a shopper to an in-store product. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. However, McCormick's long-term growth isn't dependent on acquisitions. Charles St, Baltimore, MD And recommends what stocks are a good buy each month. McDonald's was founded in and is the world's largest quick service restaurant chain with over 37, stores in more than countries.