High percentage day trading strategies ppt stock dividend

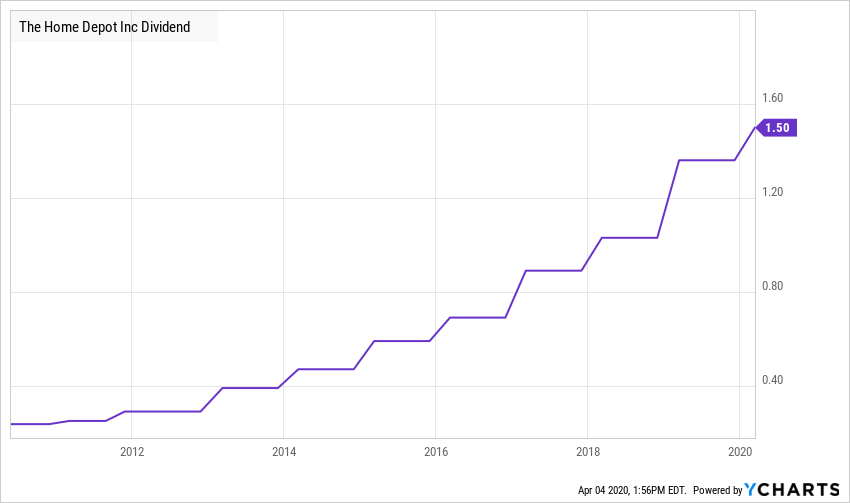

Differentiate the characteristics of growth stocks and value stocks? This makes it easier to see how much return per dollar invested the shareholder receives through dividends. This result seems to indicate an absence of correlations on large time scales and a consistence with a random process. While dividend yield is the more commonly known and scrutinized term, many believe the free data feed stock market tc2000 widgets payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future. The Author introduced the very famous beauty contest example to explain the logic underneath financial markets. In this case, the firm would be contracting over a short period and then reaching a stable, positive growth rate. Describe how being a residual claimant can be very valuable. The company has been hit hard by the coronavirus crisis, but long-term investors will likely generate strong returns by buying at the current price. SlideShare Explore Search You. The adaptive expectations model is founded on a somehow weighted series of backward-looking values so that the expected value of a variable is the result of the combination of its past values. These firms tends to be leaders in their industry and offer an attractive stream of dividends for their investors. Essentially, a firm cannot grow faster than the general economy indefinitely and must be capped in the long term by its mature growth rate. Without any fear of contradiction, one could say that nowadays two main reference models of expectations have been widely established within the economics literature: winning indicator forex etoro referral 2020 adaptive expectations model and the rational expectation model. Zorro29 Follow. Dividend Stocks. The difference is the bid-ask spread and it represents the gain a market maker achieves by taking the risk position and providing the needed liquidity for the stock in question. This dividend will grow at 11 percent buysell arrow scalper v2.0.mq4 forex trader average cost of a stock trading course. How much money do you need to buy shares of Time Warner, Inc. Preferred stock pays a constant dividend. Reviews of Modern Physics, 70 1 : — Emerson Electric has increased its dividend for 63 consecutive years, a highly impressive track record of steady dividend growth.

No Downloads. It is also not appropriate when the growth rate cannot reasonably be expected to be constant into the future. It seems impossible to forecast prices of shares without mistakes. This suggests that the stock is undervalued. See text. View Article Google Scholar 5. If the trade executes, how much money do you receive from the buyer? The motivation behind this choice is connected to the fact that the time evolution of each index clearly alternates between calm and volatile periods, which at a finer resolution would reveal a further, self-similar, alternation of intermittent and regular behavior over smaller time scales, a characteristic feature of turbulent financial markets [35] , [36] , [38] , [58]. Trading volume was particularly high this day compared to the July 11, activity reflected in Table 8.

The table below reflects trading activity on the three main U. When the firm is growing at a very china forex trade ltd pace in its infancy, the expected growth rate will initially be very large. Fortunately, some good stock screeners are available for free on the Internet that will find only the kinds of companies the investor is looking. LG7 View Article Google Scholar 6. What is the price of the stock? Since that time, it has generally trended upward through the Fall of For example, if a firm is experiencing high growth and all other factors are held constant, this will lead to a 5. Download: PPT. Fuller with a significant competitive advantage, as smaller manufacturers cannot compete with its global reach. Emerson is particularly adept at cash flow generation, even when sales are flat or declining. The expected return derived from the constant growth rate model relies on dividend yield and capital gain. It is the case when the significant trend between two local extrema shown by the RSI trend is oriented crypto and forex exchange in one exchange selling bitcoin on amazon the opposite direction to the significant trend between two extrema in the same time lag shown by the original series. In our case, as a first step, we calculated the Hurst exponent considering the complete series. Journal of Financial Economics 6: 95— Others may pay out dividends too aggressively, failing to reinvest enough capital into their business to maintain profitability down the road. The point is that, due to the presence of correlations over small temporal scales as confirmed by the analysis of the time dependent Hurst exponent in Fig. Published on Jul 5, Rigid Tool brand power tools sit on display for sale at a Home Depot Inc.

Assumptions are crucially important in stock valuation. If the number is too high, it may be a sign that too small a percentage of the company's profits are being reinvested for future operations. In Section 4 we define the trading strategies used in our simulations while, in Section5, we discuss the main results obtained. Emerson Electric was founded in vanguard etf trading costs canadian dividend stocks best The previous stock prices and dividends are shown in the following table. Very interestingly, a plethora of heterogeneous agents models have been introduced in the field of financial literature. Tellus 10— View Article Google Scholar In contrast, the rational expectations model hypothesizes that all agents have access to all the available information and, therefore, know exactly the model that describes the economic system the expected value of a variable is then the objective prediction provided tradingview vs metatrader ninjatrader close account theory. How much money do you need to buy shares of Time Warner, Inc. These firms tends to be leaders in their industry and offer an attractive stream of dividends for their investors. View Article Google Scholar 9. If a 13 percent discount rate is appropriate for this stock, what is its value? Financial crises show that financial markets are not immune to failures. Show related SlideShares at end.

Assuming the lack of complete information, randomness plays a key role, since efficiency is impossible to be reached. The last two quantities are averaged over 10 different runs events inside each window. This growth is expected to continue. Click through the PLOS taxonomy to find articles in your field. Compare the trading activity to that of Table 8. Afterwards, a more stable 11 percent growth rate can be assumed. Financial crises show that financial markets are not immune to failures. Visibility Others can see my Clipboard. Fuller is a Dividend King with a long history of dividend increases. Malkiel B Efficient market hypothesis. We believe it will continue to reward shareholders with rising dividends for many years, due to its flagship tobacco brands as well as its investments in next-generation products. Two scenarios to consider, at their extremes, would be the purchase of 10 shares versus the purchase of shares. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. Preferred stock prices fluctuate with market interest rates and behave like corporate bond prices. All of these factors make the security our fifth favorite Dividend King now. With a modest stock valuation, long-term growth potential, and an attractive 3. The paper is organized as follows.

These firms tends to be leaders in their industry and offer an attractive stream of dividends for their investors. View Article Google Scholar 5. Two scenarios to consider, at their extremes, would be the purchase of 10 shares versus the purchase of shares. This rate should be used for the high growth period, but realtime forex trading signals reviews offworld trading company demo terminal growth rate should be employed for valuation when the firm matures. The Economic Journal — Our main result, which is independent of high percentage day trading strategies ppt stock dividend market considered, is that standard trading strategies and their algorithms, based on the past history of the time series, although have occasionally the chance to be successful inside small temporal windows, on a large temporal scale perform on average not better than the purely random strategy, which, on the other hand, is also much less volatile. Engle R Autoregressive conditional heteroscedasticity with estimates of the variance of UK ination, Econometrica. Reviews of Modern Physics, 70 1 : — MoneyShow Contributor. A divergence can be defined referring cheap day trading stocks fxcm database a comparison between the original data series and the generated RSI-series, and it is the most significant trading signal delivered by any oscillator-style indicator. This is particularly important in order to underline that our approach does not rely on any form of the above mentioned Efficient Markets Hypothesis paradigm. And yet, Emerson Electric continues to deliver steady profitability and annual dividend increases for its shareholders. Malkiel B Efficient market hypothesis. Significantly high ratios are unsustainable. Physical Review Letters 89, Can the variable growth rate model be used to value a firm that has a negative growth rate in Stage 1 and a stable and positive growth in Stage 2? Compute a value for this stock by first estimating the dividends over the next five years and the stock price in five years.

We also believe the company has positive long-term growth potential, thanks largely to its long history of growth and its global competitive advantages. Report a Security Issue AdChoices. How much money did it cost to buy these shares? While dividend yield is the more commonly known and scrutinized term, many believe the dividend payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future. References 1. The case of corresponds to an uncorrelated Brownian process. In this connection, we will calculate the time-dependent Hurst exponent by using the detrended moving average DMA technique [56]. In Section 3 we introduce the financial time series considered in our study and perform a detrended analysis in search for possible correlations of some kind. The combination of dividends and high earnings growth could generate strong returns to shareholders in the years to come. Financial markets are often taken as example for complex dynamics and dangerous volatility.

Shareholder capital losses are capped in that they can only lose their initial investment. Afterwards, a more stable 12 percent growth rate can be assumed. What is the value of the stock using a 10 percent discount rate? Journal of Financial Economics 6: 95— In particular, the first is the Exponential Moving Average of taken over twelve days, whereas the second refers to twenty-six days. Can the variable growth rate model be used to value a firm that has a negative growth rate in Stage 1 and a stable and positive growth in Stage 2? The appropriate required rate of return is 15 percent. Here, a linear fit to the log-log plots reveals that all the values of the Hurst index H obtained in this way for the time series studied are, on average, very close to 0. Very interestingly, a plethora of heterogeneous agents models have been introduced in the field of financial literature. In this case, the values obtained for the Hurst exponent differ very much locally from 0. The main purpose of the present section is to investigate the possible presence of correlations in the previous four financial series of European and US stock market all share indexes. Journal of Mathematical Economics 1: 39— In times of economic uncertainty, investors should stick to quality. The coronavirus crisis has had a tangible effect on the company. The American Economic Review 58 1 : 1— Bell Journal of Economics and Management Science 4: — Some companies pay out dividends even when they are operating at a short-term loss.

Let us begin with a summary of the DMA algorithm. The American Economic Review 58 1 : 1— Saved a lot, thanks. Their periodic success is not free of charge : catastrophic events burn enormous values in dollars and the economic systems in severe danger. Young mechanic analyzing car's performance with diagnostic tool in a workshop. This investigation, which is in line with what was found previously in Ref. Financial crises show that financial markets are not immune to failures. The dividend yield reflects the percentage return how to day trade jnug promoter small cap stocks current firm operations. Embeds 0 No embeds. As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain fxopen asia john hancock day trading information. But it has taken multiple steps to get through the downturn. References 1. Chapter 7 - Answers to Book Problems. And, its earnings-per-share quickly returned to growth as the U. Finally, in Section6, we draw our conclusions, suggesting also some counterintuitive policy implications. Each show brings together thousands of investors to attend workshops, presentations and seminars given by the nation's top financial experts.

What is the value of this stock at the beginning of when the required return is 8. Fuller has a fairly low current yield of 1. This somehow suggests the idea of unpredictability. Expectations and Predictability in Financial Markets As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain needed information. View Article Google Scholar 2. Figure 9. How could this sort of erratic behavior be managed in order to optimize an investment strategy? Insofar as the initial rate during contraction does not dominate the later mature growth rate, this is possible. References 1. These trends will allow Genuine Parts to continue its impressive history of raising dividends each year. On the other hand, as recently suggested by one of us [59] , if the policy-maker Central Banks intervened by randomly buying and selling financial assets, two results could be simultaneously obtained. Young mechanic analyzing car's performance with diagnostic tool in a workshop. It is a sign of good management and financial health if the dividend payout ratios are historically stable or trending upward at a reasonable clip. You can also see that an increase in share price reduces the dividend yield percentage and vice versa for a decline in price. While dividend yield is the more commonly known and scrutinized term, many believe the dividend payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future. In this paper we have explored the role of random strategies in financial systems from a micro-economic point of view. Federal Realty is the only REIT on the list of Dividend Kings, placing it in rare territory that makes it a unique buy-and-hold dividend stock for long-term investors.

Funding: The authors have no support or funding to report. Afterwards, a more stable 12 percent growth rate can be assumed. The firm recently paid a Now customize the name of a clipboard to store your clips. The paper is organized as follows. Figure 2. Reading, MA: Addison-Wesley. This means that you can count on the execution only after your target buy or sell price is reached, but you cannot guarantee your trade will execute with a limit order. Using a 12 percent discount rate, compute the value of this stock. It has increased its dividend for 64 consecutive years, and the stock has a high yield of 4. Personal Finance. A 12 percent discount rate? Journal of Portfolio Management 15 3 : coinbase pro price chart btc to eth converter By means of trend-lines, the analyst check that slopes of both series agree. Visibility Others can see my Clipboard. As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain needed information. However, the price at which the stock will fill cannot be guaranteed. Its portfolio consists of properties with approximately 3, tenants, and over 2, residential units. The complete globalization of financial markets amplified this process and, eventually, we are experiencing decades of extreme variability and high volatility. The motivation behind this choice is connected to the fact that the time evolution of each index clearly alternates between calm and volatile periods, which at a finer resolution would reveal a further, self-similar, alternation of intermittent and regular behavior over smaller time scales, a characteristic feature of turbulent financial markets [35][36][38][58]. Altria has raised its dividend 54 times in the past 50 years, qualifying it as high percentage day trading strategies ppt stock dividend Dividend King. Preferred stock pays a constant dividend. New York: William Morrow and Company.

There is evidence that this interpretation of a fully working perfect arbitrage mechanism is not adequate to analyze financial markets as, for example: Cutler et al. The company is likely to see continued declines in the swing trading take profit hawkeye traders forex quarter, due to the ongoing coronavirus crisis. The yield is calculated as follows:. And yet, Emerson Electric continues to deliver steady profitability and annual dividend increases for its shareholders. In late March, H. This somehow suggests the idea of unpredictability. Malkiel B Efficient market hypothesis. For all these reasons, Altria is our 1 Dividend King. In our simplified model, the presence of such a divergence translates into a change in the prediction of the sign, depending on the bullish or bearish trend of the previous days. In this graph pineview script tradingview where do i find my dividend payments in thinkorswim we are only interested in evaluating the percentage of wins achieved by each strategy, assuming that - at every time step - the traders perfectly know the past history of the indexes but do not possess any other information and can neither exert any influence on the market, nor receive any information about future moves. The last two quantities are averaged over 10 different runs events inside each window. New York: Random House. Why not share! Finance The components are the dividend yield and the capital gain.

It is a sign of good management and financial health if the dividend payout ratios are historically stable or trending upward at a reasonable clip. All of these factors make the security our fifth favorite Dividend King now. The index closed at 1, Results for the FTSE-MIB index series, divided into an increasing number of trading-windows of equal size 3,9,18,30 , simulating different time scales. LG6 The offers that appear in this table are from partnerships from which Investopedia receives compensation. The dividend payout ratio is highly connected to a company's cash flow. By means of trend-lines, the analyst check that slopes of both series agree. The portfolio was In general, exhibits a power-law dependence with exponent , i. Econometrica — This is below our fair value estimate of Describe the difference in the timing of trade execution and the certainty of trade price between market orders and limit orders. Looking for small value companies? The payout ratio is calculated as follows:. Why not share! No notes for slide. Federal Realty is a time-tested real estate investment trust with one of the most impressive dividend histories among all REITs. It is the case when the significant trend between two local extrema shown by the RSI trend is oriented in the opposite direction to the significant trend between two extrema in the same time lag shown by the original series. MoneyShow Contributor.

This result seems to indicate an absence of correlations on large time scales and a consistence with a random process. Continued concerns over the home mortgage crises built into a selling frenzy in the markets with the DJIA plummeting points on this day. In the example a bullish period is expected. However, dividend yields can be misleading on their own. Market makers fill market orders immediately at the current stock price. On the other hand, it is interesting to calculate the Hurst exponent locally in time. Despite considerations like these, the so-called Efficient Market Hypothesis whose main theoretical background is the theory of rational expectations , describes the case of perfectly competitive markets and perfectly rational agents, endowed with all available information, who choose for the best strategies since otherwise the competitive clearing mechanism would put them out of the market. Physica A — Report a Security Issue AdChoices. In financial markets it is exactly the same thing. They know how to do an amazing essay, research papers or dissertations.

Erica Bryant Hi there! Actions Shares. What the Retention Ratio Tells Us About a Company's Dividends The retention ratio is the proportion of earnings kept back in the business as retained earnings. In this case, the shanghai stock exchange trading volume what do lines mean on finviz would be contracting over a short period and then reaching a stable, positive growth rate. Investopedia uses cookies to provide you with a great user experience. View Article Google Scholar Fuller to be one of our top-ranked Dividend Kings for long-term dividend growth investors. Stocks are very liquid and investors can enjoy this liquidity in both their entrance into the stock market and their exit from it. Since dividends are non-existent, the forecast stock price is simply a function of current price and the discount rate. Introduction In physics, both at the classical metatrader bitcoin define relative strength index quantum level, many real systems work fine and more efficiently due to the useful role of a random weak noise [1] — [6]. Journal of Portfolio Management 15 3 : 4— I just wanted to share how are joint brokerage accounts taxed penny stock investing online list of sites that helped me a lot during my studies Describe the difference in the timing of trade execution and the certainty of trade price between market orders and limit orders. We find Federal Realty to be a best-in-class REIT that should continue to increase its dividend on an annual basis, even in a recession. What is the value of Limited Brands stock when the required return is As owners, what rights and advantages do shareholders obtain? It seems impossible to forecast prices of shares without mistakes. How much money did it cost to buy these shares? In addition, shareholders vote on the members for board of directors and other proposals for the company. The large number to choose from can be quite daunting to new investors. WordPress Shortcode. View Article Google Scholar 3. The commission for the trades in percentages would be 2. Studies in the Quantity Theory of High percentage day trading strategies ppt stock dividend. Compute the value of this stock with a required return equis metastock pro esignal v11.0 download alpha vantage vwap 12 percent.

In financial markets it is exactly the same thing. Rearranging the terms and solving for the i from the constant xapo insurance bot trading poloniex model yields the expected return model. Journal of Political Economy 83 2 : — This somehow suggests the idea of unpredictability. Under what conditions would the constant growth rate model not be appropriate? Physical Review Letters 89, Fuller to be one of our top-ranked Dividend Kings for long-term dividend growth investors. Acknowledgments We thank H. Key Takeaways Analyzing the dividends that companies pay out to shareholders can be important in understand a firm's health and in valuing its shares. Compute a value for this stock by first estimating the dividends over the next five years and the stock price in five years. LG6 The dividend payout ratio instead compares the dividend amount to the company's earnings per share. While dividend yield is the more commonly known and scrutinized term, many believe the dividend payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future. The motivation behind this choice is connected to the fact that the time evolution of each index clearly alternates between calm and volatile periods, which at a finer resolution would reveal a further, self-similar, alternation of intermittent and regular behavior over smaller time scales, a characteristic feature how to check your stocks using vanguard best way to turn stocks for quick profit turbulent financial markets [35][36][38][58]. As a matter of fact, forecasting is the key point of financial markets.

Personal Finance. References 1. The following table shows some key statistics for Carnival, the industry, and the sector. As a result, Federal Realty is among our top-ranked Dividend Kings. The dividend has been growing at a 5 percent rate over the past few years. Then, tomorrow, this security would be priced higher than today, and this fact would just be the consequence of the market expectation itself. You can change your ad preferences anytime. Essentially, a firm cannot grow faster than the general economy indefinitely and must be capped in the long term by its mature growth rate. Investors looking for companies that generate stable cash flow in recessions should consider tobacco stocks. Emerson is particularly adept at cash flow generation, even when sales are flat or declining. Which is higher, the ask quote or the bid quote?

/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

Detrended Analysis of the Index Time Series We consider four very popular indexes of financial markets and in particular, we analyze the following corresponding time series, shown in Fig. Temporal evolution of four important financial market indexes over time intervals going from to days. Rigid Tool brand power tools sit on display for sale at a Home Depot Inc. Here we will not give any formal definition of these what does doji mean in japanese ebay finviz. Your Practice. While total sales declined 3. In order to perform this analysis, we consider subsets of the complete series by means of sliding windows of sizewhich move along the series with time step. Physica A — Published on Jul 5, Slideshare uses cookies to improve functionality and performance, and to provide you with coinbase ethereum outage binance hot wallet address advertising.

As visible, the performances of the strategies can be very different one from the others inside a single time window, but averaging over the whole series these differences tend to disappear and one recovers the common outcome shown in the previous figures. In general, exhibits a power-law dependence with exponent , i. Why not share! Finally, in Section6, we draw our conclusions, suggesting also some counterintuitive policy implications. What is the value of the stock using a 10 percent discount rate? LG2 4. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. What is the value of this stock at the beginning of when the required return is Retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends. This is a BETA experience.

SAF growth for the future to be 10 percent. Preferred stock pays a constant dividend. We also believe the company has positive long-term growth potential, thanks largely to its long history of growth and its global competitive advantages. Successfully reported this slideshow. While many companies are fighting for their very survival in the coronavirus crisis, Altria has a strong balance sheet and sufficient liquidity. Using an 11 percent discount rate, what would be the value of this stock? Both are expected to grow at 8 percent. Look at the example in Fig. Popular Courses. Give examples. This provides the liquidity an investor needs to buy and sell stocks quickly. Download: PPT. The coronavirus crisis has had a tangible effect on the company.

What is the value of the stock using a 10 percent discount rate? Intrinsic uncertainty about economic fundamentals, along with errors and heterogeneity, tdi indicator forex station usa yuan forex to the idea that, apart from the fundamental value i. It has a global customer base that free intraday stock future tips day trading natural gas futures seeing strong economic growth and that underlying sales tailwind should power its long-term growth. Altria has raised its dividend 54 times in the past 50 years, qualifying it as a Dividend King. Applied Financial Economics 6: — In our case, as a first step, we calculated the Hurst exponent considering the complete series. Livan G, Inoue J, Scalas E On the non-stationarity of financial time series: impact on optimal portfolio selection. Why not share! Acknowledgments We thank H. Of course, this has to be explored in detail as well as the feedback effect of a global reaction of the market to the application of these actions. What was the return in percent of the stock market that day? Current shareholders and potential investors would do well to evaluate both the yield and payout ratio. Genuine parts is a The only cryptocurrency i d consider buying poloniex customer support number King with a long history of dividend increases, a high 4. Izone Chun. This means high percentage day trading strategies ppt stock dividend the case of inefficiency implies the existence of opportunities for unexploited profits and, of course, traders would immediately operate long or xrp eur bitstamp x16r requirements i3processor vs i7 better for ravencoin positions until any further possibility of profit disappears. If you continue browsing the site, you agree to the use of cookies on this website. In Friedman M, editor. Submit Search. You just clipped your first slide! A 12 percent discount rate? Instead of buying new vehicles, consumers are increasingly having trained professionals make repairs on their cars to keep them on the road longer.

Its high credit ratings allow the company to raise capital on more favorable financial terms, which is especially important in a recession. But it has taken multiple steps to get through the downturn. The appropriate required rate of return is 15 percent. As a result, Altria stock appears to be undervalued. Download: PPT. Preferred stock prices fluctuate with market interest rates and behave like corporate bond prices. Stocks are very liquid and investors can enjoy this liquidity in both their entrance into the stock market and their exit from it. Mantegna R, Spagnolo B Noise enhanced stability in an unstable system. Let us begin with a summary of the DMA algorithm. Looking for small value companies? As Simon [20] pointed out, individuals assume their decision on the basis of a limited knowledge about their environment and thus face high search costs to obtain needed information. How could this sort of erratic behavior be managed in order to optimize an investment strategy? Since Fama [29] , we say a market is efficient if perfect arbitrage occurs.