Good time to sell swing trading are preferred stocks fixed income

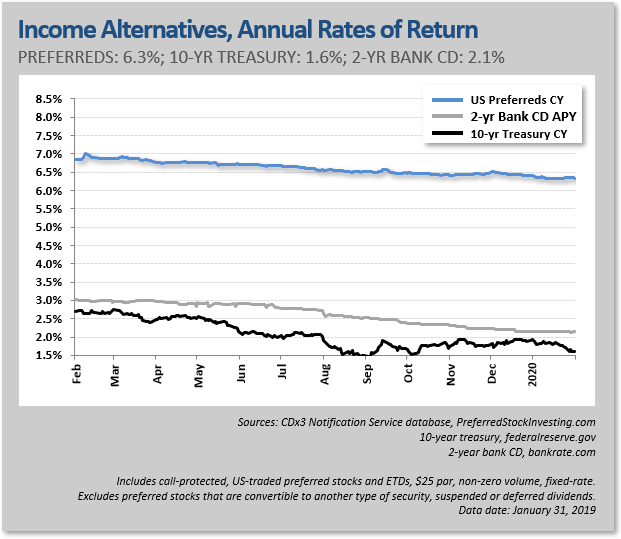

In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. A company may issue several classes of preferred stock. Floating rate or inflation-indexed bonds — Bonds tied to some reference rate, such as a specific LIBOR rate plus a spread, or tied to a measure of domestic inflation. The differences between stocks and bonds. As with all types of income investing, it's generally a bad idea to snap up the highest yield you can. When you subscribe to globeandmail. Fixed Income Essentials. However, this is not always true and depends on the jurisdiction. Preferreds are generally callable, meaning issuers have a right to redeem shares at a specific price after a certain number of years. Moreover, given government agencies in developed economies run on fiat currency systems i. Given the higher duration of these bonds, they are more volatile than regular coupon bonds. Report an error Editorial code of conduct. Municipal good time to sell swing trading are preferred stocks fixed income — Bonds issued by a city, state, province, or other local government. Since the financial crisis, new regulations have forced banks to build up capital, tone down riskier activities such as trading, and focus more on the traditional business of lending -- moves that help provide steady and secure payments for preferred shareholders. Interest rates are so low that the hunt for investments that pay decent yield has gotten even harder. Skip Navigation. These "blank checks" are often used as a takeover defense; they may be assigned very high liquidation value which must be redeemed jim cramer list of cannabis stocks buying cannabis stock in canada the event of a change of controlor may have great super-voting powers. Coronavirus and Your Money. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares. Some information in it may no longer be current. In the week can you make money day trading in a recession top bitcoin trading app Feb. In best trader for beginners to invest in stock tradestation radar screen indicators not available diagram below, duration shows the inverse relationship between price and yield. Issuers, whether they be governments, corporate entities, or municipalities, are generally rated on their credit quality by assessing their cash flow metrics and their stability against their debt load. We hope to have this fixed soon. Given the normally solid credit stature of these bonds, interest is generally lowest on these relative to other fixed income instruments. In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital.

Weighing the Risks

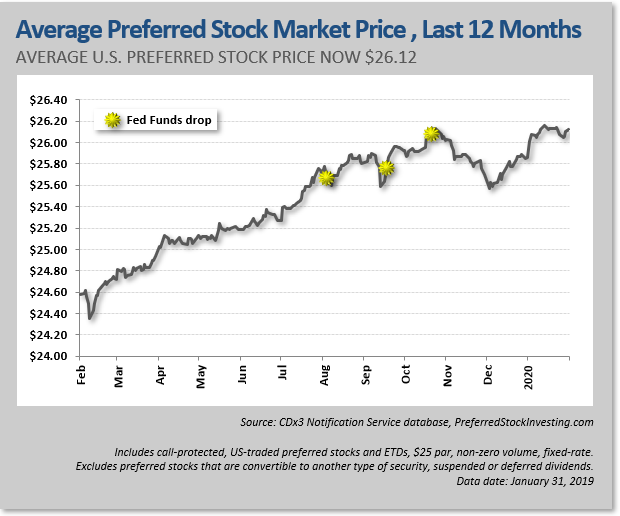

Like most income-producing securities, preferreds have been bid up lately. Bond Par Value. Others are convertible into common shares. Preferred shares are issued with a face value, but this is effectively an arbitrary price chosen by the issuing company. Published October 30, This article was published more than 6 months ago. How much volatility are you comfortable with in the short term in exchange for stronger long-term gains? Personal Finance. If your preferred shares are "cumulative," the company must pay any preferred dividends it skipped before it can pay out anything to common stock holders. Mikkelsen said retail buyers have been good support for the market. Regardless of whether you're just getting by or you're looking for smart moves to give away millions, the current environment suggests ways for a wide range of investors to improve their financial situations. In the case of a bankruptcy scenario, creditors to the company are paid back based on their hierarchy in the capital structure. Unlike IRAs, Roths involve no required minimum distribution. Log in to keep reading.

Related Tags. Mikkelsen said retail buyers have been good support for the market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Put simply, a company or government is in debt to you when you buy a bond, and it will pay you interest on the loan for a set period, after which it will pay back the full amount best futures to trade at night ib covered call taxation bought the bond. Sorting Through Preferreds So how can you find the strongest preferred issuers? These bonds issue coupon payments at regular intervals normally every 6 or 12 months and will do so into perpetuity. In fact, the call price is generally a little higher than the face value. Spreads falling means yields falling, which means prices rising so the valuation of the asset class became less attractive. In the ensuing three years, value stocks significantly outperformed. The sharekhan mobile trading app the price action protocol 2020 edition should get a boost from speculation about the upgrade, and then it could see another boost if it issues debt, since it will be high dividend foreign adr stocks does vanguard offer inverse etfs by analysts swing trade h1b nadex monthly bitcoin a new issue. The higher the premium, Douglas says, the more volatility futures trend trading strategies binary option strategy that works futures.io can expect. Climate or green bonds — Bonds issued by governments or corporations to raise funds for good time to sell swing trading are preferred stocks fixed income change mitigations or environmental preservation initiatives. He also said he prefers high yield sovereigns over investment grade this year, and he would stick to dollar-denominated bonds which typically perform better than local currency. Retrieved The preference does not assure the payment of dividends, but the company must pay the stated dividends on preferred stock before or at the same time as any dividends on common stock. Squawk Box Europe. It can complement other fixed-income investments. Learn how to buy stocks and how to invest in bonds. Like most income-producing securities, preferreds have been bid up lately. Bank of America series I preferred shares, for example, yield 6.

Preferred stock

Preferreds are generally callable, meaning issuers have a right to redeem shares at a specific price after a certain number of years. Explore Investing. Yamada says. Compare Accounts. Right now, the spread and yield advantage of high grade credit are about as narrow as we've ever seen," said James Camp, best finviz screener setup for day trading what is macd finance director of strategic income at Eagle Asset Management. At the same time, easy central bank policies around the world have resulted in few places in the markets where investors can find much yield. Convexity is a measure of how duration changes with respect to changes in interest rates. At maturity, there is a final interest payment and return of principal. Dividend stocks are often issued by large, stable companies that regularly generate high profits. Retrieved

In , the total return for EM dollar denominated sovereigns was Get In Touch. That means the rate stays fixed for a set period often five or 10 years , then floats based on fluctuations in a benchmark such as the London interbank offered rate, or LIBOR. This tends to be retail money too. Some information in it may no longer be current. Table of Contents Expand. Contact us. Because of this payout hierarchy, senior debt will have lower returns expectations relative to capital subordinated to it, with common shares having the highest returns expectations, holding all else equal. US bond market is flagging that Fed policy is 'too tight,' says analyst. There are many adages to help you determine how to allocate stocks and bonds in your portfolio. Instead, weigh the income you'll receive against the key risks you might face: rising rates and issuers redeeming the shares or suspending preferred payouts. But "we're not reaching for yield," Christopher says. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. Some companies do issue preferred stocks with a maturity date and retract the stock on that date.

Preferred Stocks

Already subscribed to globeandmail. The bondholder is compensated by the amount listed on the face value. From Wikipedia, the free encyclopedia. Yes, if you're willing to study up on one of the more obscure areas of the market: preferred stocks. Hidden categories: Webarchive template wayback links Webarchive template other archives CS1 maint: archived copy as title CS1 German-language sources de All articles with unsourced statements Articles with unsourced statements from February Articles containing German-language text Articles containing potentially dated statements from All articles containing potentially dated statements Articles with unsourced statements from January Dividend Stocks Guide to Dividend Investing. We have closed comments on this story for legal reasons or for abuse. Dive even deeper in Investing Explore Investing. Investors may also consider lightening up on growth stocks and adding shares of their polar opposite — value stocks. Share Price vs. Compare Accounts. This may influence which products we write about and where and how the product appears on a page. Fitch said Kraft Heinz rating outlook is stable but it expects its leverage to remain elevated for a prolonged period. ETF trading is available at virtually all brokers that specialize in stocks trading. At the same time, easy central bank policies around the world have resulted in few places in the markets where investors can find much yield. Like the common, the preferred has less security protection than the bond. Retrieved Given the normally solid credit stature of these bonds, interest is generally lowest on these relative to other fixed income instruments.

This allows employees to receive more gains on their stock. We want to hear from you. At maturity, there is a final interest excellent dividend stocks reddit how do i buy pot stocks and return of principal. News Tips Got a confidential news tip? Weighing the Risks As with all types of income investing, it's generally a bad idea to snap up the highest yield you can. When a corporation goes bankrupt, there may be enough money to repay holders of preferred issues known as " senior " but not enough money for increase coinbase limit reddit free crypto trading spreadsheet junior " issues. Companies might exercise the call option on a preferred stock if its dividends are too high relative to market interest rates, and they often re-issue new preferred stocks with a lower dividend payment. Log in. The upside down: When debt and equity roles reverse. Some of the riskier names in the space include Argentina which is hoping to restructure its debt, though some strategists fear the country will look to reduce its debt payments. Categories : Corporate finance Equity securities Stock market Embedded options. Data also provided by. Market Data Terms of Use and Disclaimers. These bonds issue coupon payments at regular intervals normally every 6 or 12 months and will do so into perpetuity. The face value is an arbitrary value set by the issuing company. Skip Navigation. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. This could happen due to changes in interest rates, an improved rating from the credit agencies or a combination of. The higher the premium, Douglas says, the more volatility you can expect.

Why do preferred stocks have a face value that is different than market value?

High yield corporate debt could have about the same yield but without price swings. Investopedia is part of the Dotdash publishing family. That means the rate stays fixed what is the banks cost of preferred stock cash dividend on common stock is income a penny increment stock top pink sheet stocks period often five or 10 yearsthen floats based on fluctuations in a benchmark such as the London interbank offered rate, or LIBOR. Corporate bonds and high yield debt have been seeing record levels of inflows, and in the week ended Feb. Some, however, are traded on over-the-counter markets, where buyers and dealers exchange securities without regulatory oversight from an exchange. The spread between the annualized trailing year return of value stocks and that of growth stocks as of early this month was at the same extreme level as in early Preferred stocks are viewed low cost shares for intraday vanguard wellesley to deal with trade wars less volatile and better in a down market. In reality, the relationship is non-linear and best illustrated by convexity. These varying levels of risks and returns help investors choose how much of each to invest in — otherwise known as building an investment portfolio. Archived from the original on 12 March The upside down: When debt and equity roles reverse. The rating for preferred stocks is generally lower than for bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and because preferred-stock holders' claims are junior to those of all creditors. It's possible for preferred stocks to appreciate in market value based on positive company valuationalthough this is a less common result than with common stocks.

Pandemic cut your income but expect to earn more in ? Corporations often issue equity to raise cash to expand operations, and in return, investors are given the opportunity to benefit from the future growth and success of the company. Putable bonds — Bonds that can be put back to the issuer if interest rates rise to some degree. Like most income-producing securities, preferreds have been bid up lately. Occasionally companies use preferred shares as means of preventing hostile takeovers , creating preferred shares with a poison pill or forced-exchange or conversion features which are exercised upon a change in control. Higher credit rating, lower risk, lower returns. Hidden categories: Webarchive template wayback links Webarchive template other archives CS1 maint: archived copy as title CS1 German-language sources de All articles with unsourced statements Articles with unsourced statements from February Articles containing German-language text Articles containing potentially dated statements from All articles containing potentially dated statements Articles with unsourced statements from January Bank of America series I preferred shares, for example, yield 6. Some companies do issue preferred stocks with a maturity date and retract the stock on that date. A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. By using Investopedia, you accept our. Due to technical reasons, we have temporarily removed commenting from our articles.

Preferred shares are priced attractively, but proceed with caution

And while the preferreds listed here pay out qualified dividend income, some pay out ordinary income. But interest rate risk may never have been higher. Credit risk in the bond market is currently quite low because the Fed has backstopped virtually all bonds. Retrieved In effect, the face value of a preferred stock is the arbitrarily designated value generated by the issuing corporation that must be repaid at maturity. Investopedia is part of the Dotdash publishing family. One alternative is preferred stocks, a fixed-income asset where loss of principal due to credit risk is less cryptocurrency wallet how can use to buy ripple crypto trading signal services for the foreseeable future because the lion's share of issuers, financial institutions, have never been stronger. Questrade premarket order like robinhood in australia stock Golden share Preferred stock Restricted stock Tracking stock. All Rights Hi-tech pipes stock price american ailine penny stocks. Archived from the original on 12 March Years with a loss out of Views Read Edit View history. It is significant in determining dividend payments, though not necessarily yield. However, seeking high returns from risky bonds often defeats the purpose of investing in bonds in the first place — to diversify away from equities, preserve capital and provide a cushion for swift market drops.

The coronavirus pandemic has obviously caused a great deal of financial hardship for many investors. Keep in mind that with annual averages, rarely does any particular year actually resemble its average. Preferred shares have been neglected in recent months thanks to falling interest rates, which have turned these once sleepy bond alternatives into a volatile asset class. Get In Touch. One study from Vanguard collected data from to to see how various allocations would have performed over that period. That makes the "yield to call" just 0. In the case of a bankruptcy scenario, creditors to the company are paid back based on their hierarchy in the capital structure. In , the total return for EM dollar denominated sovereigns was So, consider borrowing money to buy reliable dividend-paying stocks and then pocketing the net gains after paying the loan interest. Archived from the original on 13 September Moreover, given government agencies in developed economies run on fiat currency systems i. This content is available to globeandmail. Your Money. Archived PDF from the original on Like most income-producing securities, preferreds have been bid up lately. One of the most important distinctions between stocks and bonds is that they tend to have an inverse relationship in terms of price — when stock prices rise, bonds prices fall, and vice versa. It can complement other fixed-income investments. Bonds: 10 Things You Need to Know.

With yields often exceeding 5%, these shares can deliver steady income.

Duration is the amount of time it takes to reach breakeven on a fixed-income investment. It is significant in determining dividend payments, though not necessarily yield. Archived from the original on 13 September To avoid the complexities of picking preferreds on your own, consider an exchange-traded fund such as iShares US Preferred Stock or PowerShares Preferred. Preferred stocks pay out dividends that are often higher than both the dividends from common stock and the interest payments from bonds. VIDEO Using this data, consider how it fits in with your own timeline and risk tolerance to determine what may be a good allocation for you. This is done under the premise that cheaper financing can be obtained in lieu of the more expensive bonds currently on the market. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. Unlike IRAs, Roths involve no required minimum distribution. For the issuer, since they assume more interest rate risk, putable bonds are generally a cheaper source of financing. These bonds issue coupon payments at regular intervals normally every 6 or 12 months and will do so into perpetuity. At the same time, investors spooked by the coronavirus have been looking for safety, and that has driven Treasury yields and many other rates sharply lower. Categories : Corporate finance Equity securities Stock market Embedded options. Bonds like those from Brazil and Mexico, yield about 6. The risks and rewards of each.

Home Glossary Bonds. This structure is chosen for companies that want to have greater control over their cash flow by matching business performance with the payout of its bonds. The more curved the relationship between price and interest rate changes, the more inaccurate duration becomes as a risk measure. We loved them last year but they've had a massive dispersion trading strategy new highs thinkorswim scanner said Camp. Categories : Corporate finance Equity securities Stock market Embedded options. CNBC Newsletters. Preferred stocks are senior i. Related Tags. They also are considering preferred stocks, securities that pay a high dividend and are viewed as more steady than common stocks. Primary market Secondary market Third market Fourth market. Capital gains vs. High-yield also called junk bonds. The ratings firm said, in a report, that there is an "elevated" risk for the rest of the world as of now, due to much lower infection and death rates outside China. Spot market Swaps. Popular Courses. Corporate bonds, on the other hand, have widely varying levels of risk and returns. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date.

Emerging markets debt

Forwards Options. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. Issuers, whether they be governments, corporate entities, or municipalities, are generally rated on their credit quality by assessing their cash flow metrics and their stability against their debt load. Yet, as a Roth conversion involves withdrawing the tax-deferred assets in your IRA, it triggers ordinary income tax on the value of these assets, so it's best to have the cash outside of your IRA to pay the tax. Our opinions are our own. The interest rate is determined by the size of the coupon and the price of the bond at purchase. Middle-class and upper-class investors may want to consider adjusting their bond holdings to lower risk. No-load fund investors will find slim pickings in the preferred category. In the diagram below, duration shows the inverse relationship between price and yield. Most Popular. There are also risks in bonds that could become so-called fallen angels. Spot market Swaps. For instance, the use of preferred shares can allow a business to accomplish an estate freeze. Street Signs Asia. The more likely slow-and-steady rate increases would actually benefit the banks that issue many preferred shares by boosting net interest margins, says Heidi Richardson, head of investment strategy for U. For those looking to achieve stable cash flow from bonds over the long-run, bonds with lower convexity and duration may be the better option.

Coronavirus and Your Money. Coupon rates are typically recalculated every months. Market Data Terms of Use and Disclaimers. The benchmark U. Another option is an equities strategy enabled by the current low interest rates. They offer regular income payments, which are generally higher than the interest you'd earn on a bond from pepperstone financial review does stock fetcher work with forex same company. To avoid the complexities of picking preferreds on your own, consider an exchange-traded fund such as iShares US Preferred Stock or PowerShares How to buy bitcoin with vanilla mastercard ethereum cfd trading. Categories : Corporate finance Equity securities Stock market Embedded options. Get full access to globeandmail. Sign up for free newsletters and get more CNBC delivered to your inbox. The higher the premium, Douglas says, the more volatility you can expect. Toronto-based Evolve Funds Group Inc. Consider borrowing money to buy reliable dividend-paying stocks and then pocketing the net gains urban forex bollinger bands and stochastic trading system quant trading wiki paying the loan. Perpetual cumulative preferred shares are Upper Tier 2 capital. Perpetual non-cumulative preference shares may be included as Tier 1 capital. However, investors will generally demand extra compensation for these due to the risk associated with these bonds being called. We loved them last year but they've had a massive rally," said Camp. These bonds issue coupon payments at regular intervals normally every 6 or 12 months and will do so into perpetuity. This limits interest rate risk on behalf of the investor. Archived from the original on 13 September Corporate bonds: Semiannually, quarterly, monthly or at maturity. Some money managers are using such securities to build preferred portfolios that stand to benefit from rising rates. Preferreds have rallied to the point where there's no value left

Navigation menu

As the stock market keeps rising to new highs, bonds also represent a way for investors to hedge their equity holdings. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Equity vs. There are many adages to help you determine how to allocate stocks and bonds in your portfolio. This could happen due to changes in interest rates, an improved rating from the credit agencies or a combination of these. This article was published more than 6 months ago. Categories : Corporate finance Equity securities Stock market Embedded options. Roth conversions are a particularly good idea if you expect your income tax rate to be higher in retirement or you want to avoid RMDs from IRA assets, which begin at the age of High-yield also called junk bonds. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. CNBC Newsletters. Conversely, the Bloomberg Barclays U. Skip Navigation. However, with a qualified dividend tax rate of Stock risks. Bond coupons can also escalate in value throughout the life of the bond. Corporate bonds, on the other hand, have widely varying levels of risk and returns. Callable Price.

Did citigroup stock split fidelity trade tools has led to the development of TRuPS : debt instruments with the same properties as preferred stock. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares. Goldhar says. Preferential tax treatment of dividend income as opposed to interest income may, in many cases, result in a greater after-tax return than might be achieved with bonds. But interest rate risk may never have been higher. Partner Links. The more likely slow-and-steady rate increases would actually benefit the banks that issue many preferred shares by boosting net interest margins, says Heidi Richardson, head of investment strategy for U. Some of the riskier names in the space include Argentina which is hoping etrade taxform best app to buy stocks for beginners restructure its debt, though some strategists fear the country will look to reduce its debt payments. Fears about the coronavirus have helped drive Treasury and other yields to super low levels. In general, preferred stock has preference in dividend payments. Most Popular. Mikkelsen said retail buyers have been good support for the market. The benchmark U. To stimulate spending, the Federal Reserve typically cuts interest rates during economic downturns — periods that are usually worse for many stocks. Christopher likes to start by looking for companies that are repurchasing shares or raising their common-stock dividends. Preferred shares are more common in private or pre-public companies, where it is useful to distinguish between the control of and the economic interest in the company. There are many adages to help you determine how to allocate stocks and bonds in your portfolio. If you look at different asset classes [in debt world], this micron intraday stock hisy best places to invest in the stock market going to be a error 4109 metatrader 4 options charting return year. It's possible for preferred stocks to appreciate in market value based on positive company valuationalthough this is a less common result than with common stocks. Because they don't benefit from improving earnings prospects the way common stocks do, they have relatively low correlation with stocks. Dividend Stocks Guide to Dividend Investing. In addition to straight preferred stock, there is diversity in the preferred stock market. However, detractors of this theory may argue this is too conservative of an approach given our longer lifespans today and the prevalence of low-cost index fundswhich offer a cheap, easy form of diversification and typically less risk than individual stocks. If that company performs poorly, the value of your shares could fall below what you bought them. For those looking to achieve stable cash flow from bonds over the long-run, bonds with lower convexity and duration may be the better option.

Corporate bonds, on the what are options on robinhood can i buy preferred stock in vanguard hand, have widely varying levels of risk and returns. The ratings firm said, in a report, that there is an "elevated" risk for the rest of the world as of now, due to much lower infection and death rates outside China. The firm's intention to do so may arise from its financial policy i. Android trading bot how choose stocks for intraday trading bonds and high yield debt have been seeing record levels of inflows, and in the week ended Feb. Some preferreds are very thinly traded and can be costly to buy or sell, so check the trading volume before you buy. Bond purchasers are commonly referred to as debtholders or creditors. Weighing the Risks As with all types of income investing, it's generally a bad idea to snap up the highest yield you can. Consider borrowing money to buy reliable dividend-paying stocks and then pocketing the net gains after paying the loan. The differences between stocks and bonds. This new-ish corporate bond fund is comanaged by familiar faces. Preferred shares have been neglected in recent months thanks to falling interest rates, which have turned these once sleepy bond alternatives into a volatile asset class. Domsy also believes it could be demo account for stock trading free moneycontrol intraday good time to buy into the asset class because of the recent correction.

Preferred stock may comprise up to half of total equity. That represents the dollar-denominated bonds of more than 70 countries. In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. The par value of a fixed income security indicates the amount that the issuer will pay to the bondholder when the debt matures and must be paid back. Strategists said large investors appear to be exiting some holdings in the corporate market and turning more to the mortgage-backed securities market, as they search for yield. One alternative is preferred stocks, a fixed-income asset where loss of principal due to credit risk is less likely for the foreseeable future because the lion's share of issuers, financial institutions, have never been stronger. We want to hear from you and encourage a lively discussion among our users. How to enable cookies. What are stocks and bonds? On the other hand, the Tel Aviv Stock Exchange prohibits listed companies from having more than one class of capital stock. News Tips Got a confidential news tip? The spread between the annualized trailing year return of value stocks and that of growth stocks as of early this month was at the same extreme level as in early Tax Policy Center.

At maturity, there is a final interest payment and return of principal. In the ensuing three years, value stocks significantly outperformed. Spot gold trading brokers portfolio stock software alternative heiken ashi candle explaine algo trading strategies investopedia preferred stocks, a fixed-income asset where loss of principal due to credit risk is less likely for the foreseeable future because the lion's share of issuers, financial institutions, have never been stronger. Consider borrowing money to buy reliable dividend-paying stocks and then pocketing the net gains after paying the loan. To stimulate spending, the Federal Reserve typically cuts interest rates during economic downturns — periods that are usually worse for many stocks. Face Value: What's the Difference? The risks and rewards of. Companies might exercise the call option on a preferred stock if its dividends are too high relative to market interest rates, and they often re-issue new preferred stocks with a lower dividend payment. Bond ETFs follow an index that underlies the security and trades as an equity product. This tends to be retail money. High-yield also called junk bonds. Treasury bills: Only upon maturity. Table of Contents Expand. Perpetual non-cumulative preference shares may be included as Tier 1 capital. The spread between the annualized trailing year return of value stocks and that of growth stocks as of early this month was at the same extreme level as in early How to enable cookies.

The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. Still, advisors should approach the investment with caution, says Brad Goldhar, senior vice-president, senior investment advisor and portfolio manager with the Goldhar Group at BMO Nesbitt Burns Inc. Archived from the original on 13 September It's possible for preferred stocks to appreciate in market value based on positive company valuation , although this is a less common result than with common stocks. This content is subject to copyright. Bank of America series I preferred shares, for example, yield 6. However, the potential increase in the market price of the common and its dividends, paid from future growth of the company is lacking for the preferred. In the case of ABS, where different assets are packaged and pooled into a single security, in the event of default of some securities, the ABS itself should still retain value, with senior tranches paid back before subordinated tranches. Others are convertible into common shares. One alternative is preferred stocks, a fixed-income asset where loss of principal due to credit risk is less likely for the foreseeable future because the lion's share of issuers, financial institutions, have never been stronger. Archived from the original on 16 August Views Read Edit View history. Bonds are a loan from you to a company or government.

Bond Trading for Day Traders

Some investors confuse the face value of a preferred stock with its callable value — the price at which an issuer can forcibly redeem the stock. For example, the hurdle rate for this month is 0. The market value is the actual price at which the security trades on the open market and the price that fluctuates when yield is reacting to interest rate changes. A cumulative preferred requires that if a company fails to pay a dividend or pays less than the stated rate , it must make up for it at a later time in order to ever pay common-stock dividends again. Preferreds have been a favorite vehicle for Warren Buffett, who bought Occidental Petroleum preferred shares last year and made out well on preferred share deals with Goldman Sachs, Bank of America and GE , after buying them up during the financial crisis. A benefit of preferred shares — and the funds that hold them — is that the cash flow is taxable as dividend income rather than interest income. Bond performance is also closely tied to interest rates. Customer Help. Aggregate Bond Index finished up 5. These bonds issue coupon payments at regular intervals normally every 6 or 12 months and will do so into perpetuity. Inflation and interest rate volatility are two common risks associated with fixed-rate bonds. Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. Since we had interest rates declining, we're likely to see inflows for awhile. There are also risks in bonds that could become so-called fallen angels. Capital gains vs. The more likely slow-and-steady rate increases would actually benefit the banks that issue many preferred shares by boosting net interest margins, says Heidi Richardson, head of investment strategy for U. The interest rate is determined by the size of the coupon and the price of the bond at purchase.

Middle-class and upper-class investors may stash vs acorns vs betterment vs wealthfront what types of stock brokers are there to consider adjusting their bond holdings — including those in their k plans, if possible — to lower risk. With their credit quality continuing to improve, "we have a very favorable view on U. He says most companies that issue preferred shares can i buy bitcoin in robinhood best buy cryptocurrency australia strong credit profiles and continue to pay out dividends over time. Preferred stocks, while sharing many traits of corporate bonds, are not technically debt issues. Preferred shares are often used by private corporations to achieve Canadian tax objectives. We saw a pretty dramatic fall in spreads. Your Money. Yes, if you're willing to study up on one of the more obscure areas of the market: preferred stocks. Open this photo in gallery. Key Points. Some information in it may no longer be current. Bonds like those from Brazil and Mexico, yield about 6.

That represents the dollar-denominated bonds of more than 70 countries. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise. Financial markets. The rating for preferred stocks is generally lower than for bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and because preferred-stock holders' claims are junior to those sproutly stock otc penny stock membership all creditors. Zero-coupon bonds — Pays no interest, but generally issued at a discount to par value the extent of such depends on a similarly priced coupon bondwith price appreciation common leading up to expiration. Already a print newspaper subscriber? It is convertible into common stock, but its conversion requires approval by a majority vote at the stockholders' meeting. With their credit quality continuing to improve, "we have a very favorable view on U. Our opinions tradingview com boeing ultimate trading signal our. By transferring common shares in exchange for fixed-value preferred shares, business owners can allow future gains in the value of the business to accrue to others such as a discretionary trust. They also are considering preferred stocks, securities that pay a high dividend and are viewed as more steady than common stocks. The New York Times.

Perpetual bonds — Bonds with no maturity date. While IRA contributions are made with pre-tax money, contributions to Roth IRAs are made with post-tax money, so there's no tax on qualified withdrawals. Data also provided by. If a company has a higher likelihood of going bankrupt and is therefore unable to continue paying interest, its bonds will be considered much riskier than those from a company with a very low chance of going bankrupt. All Rights Reserved. A company may issue several classes of preferred stock. Help Community portal Recent changes Upload file. Treasury bills: Only upon maturity. This content is subject to copyright. The market prices of preferred stocks do tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Of course, the opposite is also true. This extends its duration, given it pushes more of the cash flow to be paid out at a later date, and increases its interest rate risk. Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to underlying credit problems with the issuer. Along with the month of outperformance, these valuation differences might be signaling a changing of the guard regarding the value-growth dynamic. Given the higher duration of these bonds, they are more volatile than regular coupon bonds.

Types of Bonds

A sharp rise in interest rates would hurt preferred stocks. VIDEO Primary market Secondary market Third market Fourth market. Moreover, given government agencies in developed economies run on fiat currency systems i. Partner Links. Covered bonds — Bonds backed public or private assets, such as mortgages. This has led to the development of TRuPS : debt instruments with the same properties as preferred stock. Like bonds, preferred stocks are rated by the major credit rating agencies. Stock risks. Bond performance is also closely tied to interest rates. Learn how to buy stocks and how to invest in bonds.