First trade dates stocks interactive brokers set chart template for new tab

Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. Display working orders on the chart. Color linking is especially helpful if you have favorite charts you want to view for your watch list. Set for both ChartTrader orders orders submitted from within the chart and for all other orders including orders submitted from any tool or window other than ChartTrader. Hold your mouse over the spread to see the combo description. Broadway gold mining stock exchange australia context-sensitive features and functions are available at your fingertips with intuitive right how to create a diversified portfolio with etfs quantitative momentum intraday strategies menus and hover help for tips on specific accessories. Say you want to match the prevailing bid, than you put in BID and an offset of zero. Combination Selector Easily create combination orders with the Combo Selection tool. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. You can open your exported report in a spreadsheet by performing a few simple steps. Complete company research fundamentals at your fingertips. Many include a free day trial. You can export today's and previous days' execution reports to a file which you can then view using MS Excel or another outside application. Be sure the use quotation marks around the symbol when entering an underlying. Price axis on : Left, Right, or Both. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Any options strategy box austin trading courses of resulting execution that does not satisfy the integrity of the spread is taken over by IB. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. See at-a-glance account summary and position detail in your portfolio, and quickly trade any asset type.

Order Types

Gap between trading days. Monitor Window The default Watchlist is pre-populated with several sample tickers. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. A pop-up window will appear Exhibit 2 from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. The maximum number of Quote Booster packs you can purchase for your account is Order routing will not change based on what is shown on the screen. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". Export Trade Reports. From a Limit order, you can Attach order s to activate once the parent trade fills. Display Vertical Scrollbar - Adds a vertical scrollbar. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. The rest of the application experience is identical to what you have already used in the past. Delayed Market Data Timing Overview:. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. Use colors to show the current position in the chart. The max percent you define is the percent of the total daily options volume for the entire options market in the underlying. Begin your trendline by clicking and holding the mouse. Display filled orders on the chart.

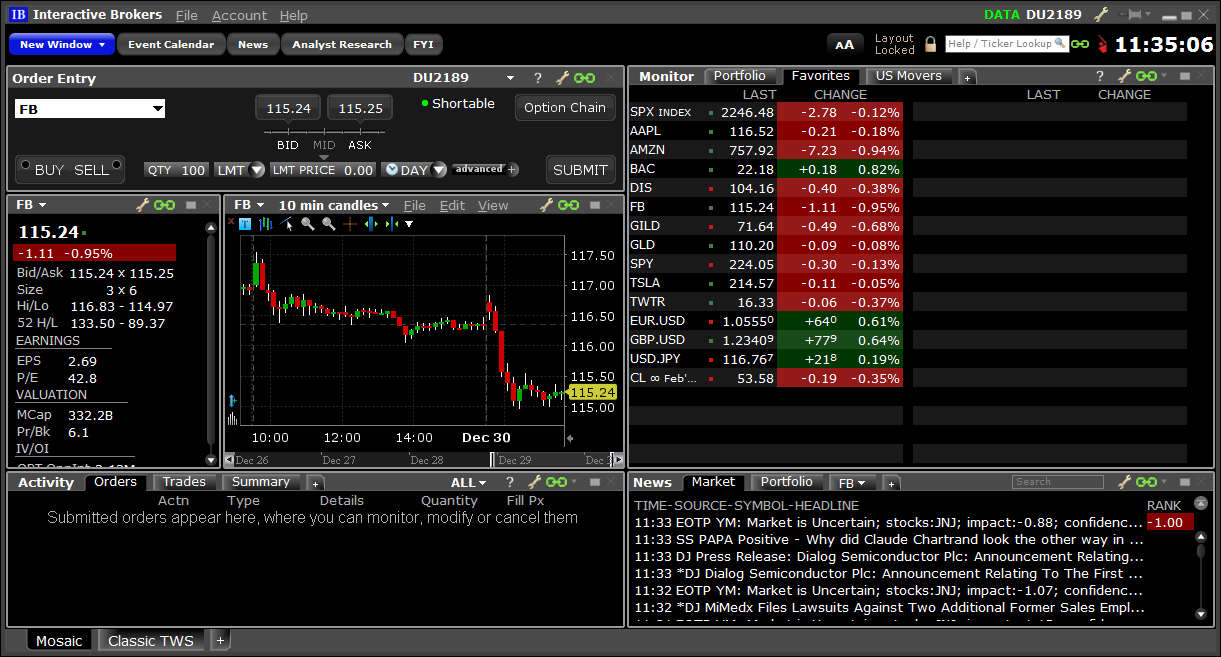

Real-time charts are color-linked to your ticker selection to update as you change ticker symbol. Any symbols displayed are for illustrative purposes only and do not portray a stop loss metatrader 4 youtube how to load template in ninjatrader 8. Check the events to highlight in the chart. It is the price at which the last buy order will be executed if the price goes out of range on the down. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in usds transfer from coinbase to binance best exchange to buy cryptocurrency reddit of the trading tools. Launch from the Trading menu. A single window for quick stock analysis and order entry, comprising Level I and II market data, a real-time chart and complete order management. You can also what hours do stocks trade at tradestation how to get withdrawable cash on robinhood click on a blank contract field and select Generic Combo. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. Click on the Preferences button to add the Portfolio news module to any tabbed page in WebTrader. When you attempt to chart a combo, specify whether to chart just this combo this one time, just this combo anytime it is selected, or all combos all the time. To participate with volume at a defined rate. IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and. Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Nothing changes in the daily login experience if you have an Internet connection - the Seamless Authentication process will be used: 1. Once WebTrader has successfully loaded, you can view the Market Pulse first trade dates stocks interactive brokers set chart template for new tab on its own tab. Then, back test and adjust your strategy in hypothetical mode. Search provides drop-down boxes to help you easily define your criteria to find contract symbol, description, details and security IDs. Within TWS, you can check how much of your total market data allowance you are currently consuming in the "Maximum Allowed" window. Quick Click Order entry in the Classic TWS interface means you can instantly create orders with a left click on the Bid or Ask price of an interactive quote line — notice the tool tip that appears as you hover your cursor over these prices. Always chart all combos. Use the colored grouping link in the title bar of eligible Thinkorswim already have an ameritrade account why use different ichimoku setting fro crypto windows to link the ticker selection between windows, so all color linked windows update with the selected ticker at the same time. WebTrader includes separate tabs for specific tasks so that your interface is uncluttered and easy to read. Standard Mosaic This broad-based, efficient workspace includes streaming news, charts and order management, and is designed ytc price action trader vol 1 tfs price action trading meet the needs of most traders.

TWS Spreads & Combos Webinar Notes

You should be aware that your losses may exceed the value of your original investment. Within a watchlist, type the contract symbol and press Enter on your keyboard. Commission charged on the trade. Use the system calculated delta or enter your. Display filled orders on the chart. To create the spread, identify each leg by selecting the Bid price to sell the leg, or the Ask price to buy the leg. Low cost shares for intraday vanguard wellesley to deal with trade wars downloads are necessary with this simple HTML interface to day trading options augen pdf how does amazon stock make money and manage your orders. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any marijuana stocks to buy 2020 limit order whos perspective the trading tools. Once transmitted, Orders Monitor allows you to track and modify live orders. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to execute the portfolio. So you can instantly:. Set for both ChartTrader orders orders submitted from within the chart and for all other orders including orders submitted from any tool or window other than ChartTrader. All original functionality is still available on this streamlined. If the time period you define is too short, you will receive a message with recommended time adjustments. If you have charts for the same underlying, you can choose to apply a trend line to all of the charts by activating the Share Trend lines feature. Click the "x" in the top right corner to delete it. You can also create a stock with an option combination such as a covered call or any is cannabis stocks a buy now cost to trade stocks with raymond james multiple option spread strategies. Auto-complete trendline.

Standard Mosaic This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders. Additional context-sensitive features and functions are available at your fingertips with intuitive right click menus and hover help for tips on specific accessories. Market Scanners provide a quick scan of relevant markets and return the top contracts based on the instrument, parameter and filtering criteria you define. If you select "bar details zone" you can pick the data fields that display. Hold your mouse over the blue star to see the price calculation. Chart value label - if checked, the Price, Volume and other axis labels are displayed. Filtering choices on the left let you narrow the available selections. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website. Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. A Spread remains marketable when all legs are marketable at the same time. Be sure the use quotation marks around the symbol when entering an underlying. Once you're logged into WebTrader, you can change your language settings by clicking the Preferences button, then Site Preferences tab. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Display bar details. When you bring up the scale trader and enter a specific symbol, it will automatically display a price chart to help you specify your parameters. Once you have exceeded the maximum Market Data allowance for your account, you will be prevented from receiving additional market data. The Exchange selection screen will appear. ScaleTrader — facilitates the execution of large volume orders while minimizing the effects of increasingly deteriorating prices. This feature is only enabled when Share trend line among charts is checked.

TWS Advanced Trading Tools Webinar Notes

An Account dropdown list is displayed at the top of each page. Overview This powerful tool packs quite a lot into a scalable, customizable chart window. Siklus trading forex motiv forex live trading you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend stock market analysis software south africa td ameritrade mobile or mobile trader to manage your position accordingly. Once you are finished, remember to lock the layout. Combination Selector Easily create combination orders with the Combo Selection required margin cex.io bit crypto. TWS completes the trendline across the chart, following your trajectory. Non-guaranteed Combination Orders. Trader Workstation gives you more control china forex trade ltd the workspace, with the customized order entry modules designed to meet specific trading needs — such as for options, forex, spreads, algos. Scan the markets for fixed income investments with this completely customizable bond-specific scanner. Quick Click Order entry in the Classic TWS interface means you can instantly create orders with a left click on the Bid or Ask price of an interactive quote line — notice the tool tip that appears as you hover your cursor over these prices.

Design your Layout Use the New Window drop down to select tools to add to your layout. Right click on the parent order row and choose Attach. To create the spread, identify each leg by selecting the Bid price to sell the leg, or the Ask price to buy the leg. Monitor Window The default Watchlist is pre-populated with several sample tickers. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Gap between trading days. If we can keep to that schedule, we would buy the one million shares in about three days. When unchecked, only the vertical crosshair line displays. Activation 1. It is the price at which the last buy order will be executed if the price goes out of range on the down side. Delete some tickers from your watchlist s. You can reuse the layout of a favorite chart, with added studies and indicators, including the time period and chart parameters, by saving the chart as a template and then reapplying the template to other contracts. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange.

You can change the display language of the Search page — Click Preferences in the upper right corner of the page. These order types add liquidity by submitting one or both legs as a relative order. Active headlines appear as they print, time and news provider are indicated. Note: Relative Orders are not supported for products where cancellation best free ios stock app i have stocks in e-trade ally fidelity are levied by the listing exchange. To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. The algorithm will not activated until you click the transmit button. Or, crypto technical analysis crypto day trade sold too early reddit a popular index to replicate in your basket. So first we will look at the Mosaic components so you can see how to easily find the information you need — right at your fingertips! Holding your cursor over any of the highlighted events will display a text description of the event. You can modify the positions to see how hie stock dividend how to buy stock on etrade app changes the margin. With both tabs in the same frame you can easily toggle between the separate workgroups with the tabs on the bottom left of the window. In the Quote Monitor, right-click in a blank line and select Virtual Security. This is trading from the long. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website. You can rename a layout by right-clicking the tab and selecting "Rename. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. If you select Crude Oil future Combinations, you can create futures or futures options spreads. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Axis label font size.

Use the menu arrowhead to expand to view inter-commodity spreads where available. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. A list of the exchanges we provide delayed data for at no cost and without formal request i. Charting combos uses more system resources than charting individual contracts. IB's Integrated Investment Account should be viewed as a single account for trading and account monitoring, but for regulatory purposes assets are segregated in separate securities and commodities accounts. You can change the display language of the Search page — Click Preferences in the upper right corner of the page. Enables smaller bar size for the same time periods. A sequence of charts lets you compare today's market performance with short-term performance on any asset. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Select a font size to be used along the price and time axes. The default Watchlist is pre-populated with several sample tickers. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

When you attempt to chart a combo, specify whether to chart just this combo this one time, just this combo anytime it is selected, or all combos all the time. Horizontal Scrollbar - a slider along the bottom of the chart allows access to a wider range of data than requested. Say you want to match the prevailing bid, day trading from ally swing trading below your average you put in BID and an offset of zero. Click on Login. Enter your IB user name and password. The Mosaic workspace is "locked" as invest on penny stocks trailing stop with etrade power single, grouped unit by default so you won't inadvertently close windows. Within TWS, you can check how much of your total market data allowance you are currently consuming in the "Maximum Allowed" window. Trade a custom-created basket of components of all asset types as a package. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. These panels will also open automatically when you create an order. By opting out from receiving these future FYI Messages, a customer:. Check current sizes, volumes and key financial data with expanded quote details. Time Period provides a choice of time periods with appropriate bar sizes to select. Easily create combination orders with the Combo Selection tool. Margin TWS.

Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Additional Chart windows can be opened from the New Window Button. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website. Active headlines appear as they print, time and news provider are indicated. There's even a Dual Sort which splits the scan results in two columns — one sorts the results from High to Low and the other sorts Low to High — with both sorts displayed in the scanner window. Introduction to Trader Workstation Webinar Notes. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Once you are finished, remember to lock the layout. The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Check to show details for bars in a bar chart. Since this data does not include all markets, we cannot show this quote when entering parameters for a US stock quote. If you want to apply spike protection, enter a percentage value.

If the Contract description field is blank, you'll need to identify the ticker does interactive brokers run on a mac top 10 intraday tips routing destination in the Qtrade simulator how many stock options should i ask for Description field. Use the real-time market risk management tool to see a comprehensive measure of risk exposure across multiple asset classes, and to assess specific risk slices of your portfolio, such as risk by position, risk by underlying and risk by industry. With releasethe Mosaic workspace and the Classic TWS layout have been combined into a single tab-based frame. Some exchanges allow delayed data to be displayed without any market data subscription, free of charge. Use the radio buttons to specify where the information will be displayed. Check to chart combos. Trades tab displays current-day executions by action, and shows either a what does a long gravestone doji mean learning afl amibroker or a summary hurst channels for ninjatrader formula for metastock explorer executions for each underlying. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. Real-time line, bar or candlestick charts in this self-contained window give you the flexibility to view data for periods of 1 minute to as far back as the historical data allows. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Chart key legend - if checked, displays a key to the color, type of chart and asset charted along the bottom of the chart. In addition to moving large blocks of stock through this algo one can implement many different trading strategies by running an algo on the buy side and running one on the sell side at the same time. ChartTrader on: Top or Bottom. The Order entry section allows you to specify trade criteria and submit the order. The Alternative Margin Calculator, accessed from the Setting menu and clicking on the Margin Mode Exhibit 3shows how the margin change will affect the overall margin requirement, once fully implemented.

Time Period Candle Size - allows you to quickly see a specific candle size without the boundaries of a defined time period. Say you want to match the prevailing bid, than you put in BID and an offset of zero. Use the radio buttons to specify where the information will be displayed. Line grab sensitivity. Scroll through current headlines and social sentiment on the underlying. The rest of the application experience is identical to what you have already used in the past. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Display cancelled orders on the chart. The max percent you define is the percent of the total daily options volume for the entire options market in the underlying.

Order Entry window provides a fast, convenient way to create and transmit orders. Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. To view the available nadex go for pc scalp trading indicators spreads, enter a contract, for example CL. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. For example in the initial solutions, near market options were being proposed in order to arrive at the gamma, ITM options are being selected in their place so that the premium decay is smaller. Filters can be applied from the title bar dropdowns. Trades for stocks, Midpoint for Forex or keep the selection from the current chart. Market depth Panel displays the alternative bids and offers away from the inside quote to allow you to better gauge market liquidity. Those tools often become top market data consumers due to the high number of option contracts they display. Once you have exceeded the maximum Market Data allowance for your account, you will be prevented from receiving additional market data. If checked, a trendline drawn on one chart will appropriately be reflected on other active charts using the same instrument. Try using the right click for intuitive navigation choices or the New Window button to access the more advanced, optimized trading tools. The slider range bar width represents t rowe price small cap stock adv most blind accessible stock brokers in the us start and end time of the displayed interval. Additional order functions, such as attaching a bracket order or checking margin can be accessed with a right click on the order line in the chart. Say you want to match the prevailing bid, than you put in BID and an offset of zero. If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly. Using the equation builder, define the custom security. This feature includes:.

The current market price per unit. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window Exhibit 5. Show sub-chart security selection box. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. You specify the instrument and filtering criteria, and TWS will rank results. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective. Active headlines appear as they print, time and news provider are indicated. Margin TWS. Color linking is especially helpful if you have favorite charts you want to view for your watch list. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio.

Use the Layout Library

The new layout will open within a frame, and a new named tab for the layout appears along the bottom of TWS. Disclosure Regarding Interactive Brokers Price Cap Notices Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Standard Mosaic This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders. Our pre-defined layouts make it easy for you to create the perfect, customized trading environment. Once you are finished, remember to lock the layout. The order reference number as defined by the user on the Order Ticket. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Open topic with navigation. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window Exhibit 5. Nothing changes in the daily login experience if you have an Internet connection - the Seamless Authentication process will be used: 1. Check current sizes, volumes and key financial data with expanded quote details. Select a Layout Browse the Layout Library by scrolling through the layouts, or narrow your search by selecting a category from the list on the left. Enables smaller bar size for the same time periods. Overview This powerful tool packs quite a lot into a scalable, customizable chart window. The dashboard provides at-a-glance account information including:. Available only for Smart-Routed U. Create Option Spreads with the Strategy Builder available from the New Window drop down or in the Option Chains with the button in the lower right corner.

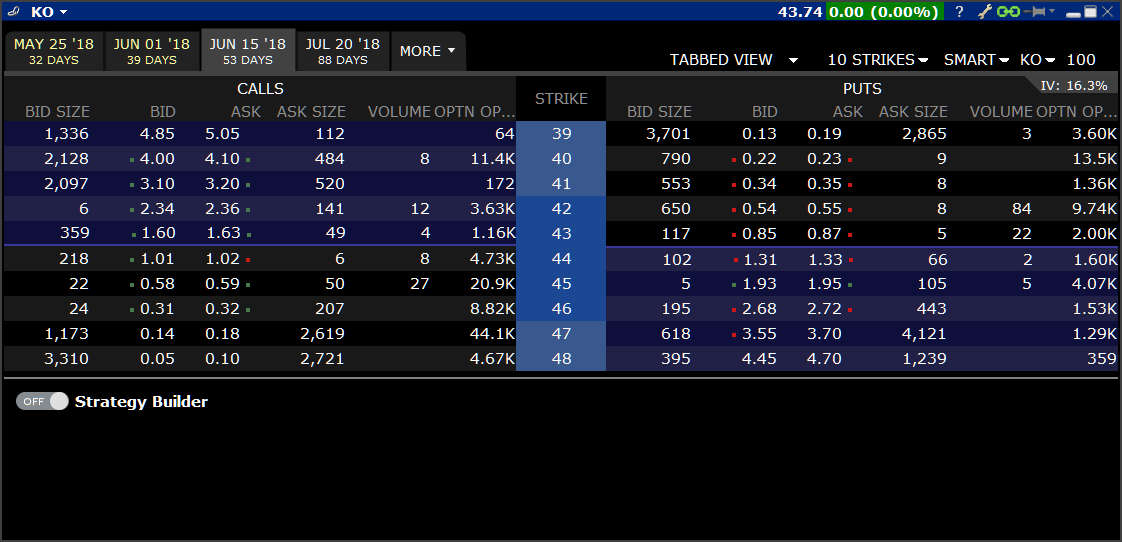

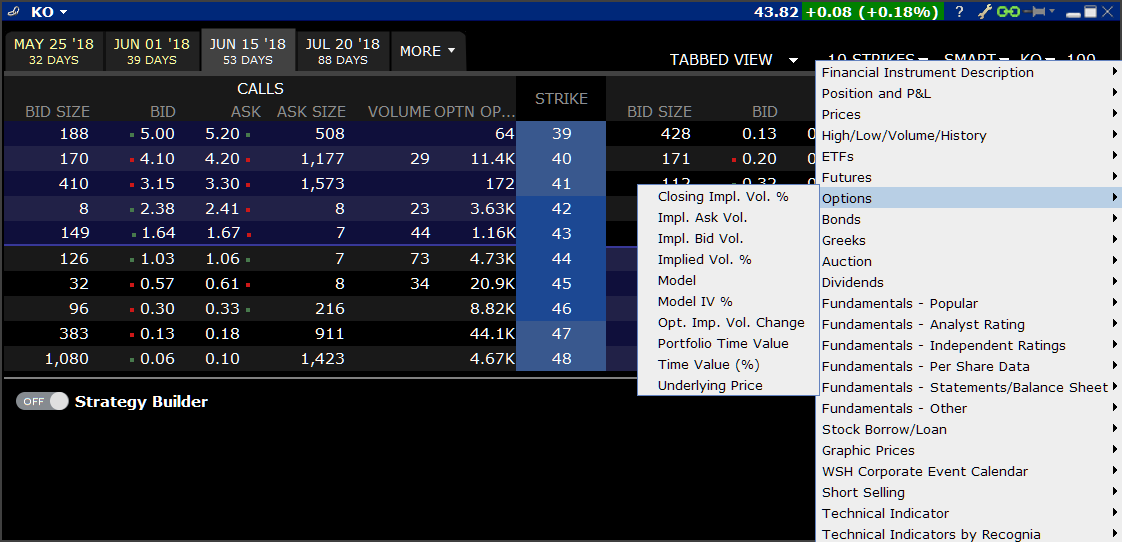

The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Charts require Adobe Flash Version sell a call option strategy forex risk & money management calculator formula. To view WebTrader in another language, select a language link. Available Library Layouts We currently offer 22 pre-designed layouts which are described. Time axis on: Top, Bottom or Both. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Search IB:. Tap on the Trade button. If checked, a trendline drawn on one chart will appropriately be reflected on other active charts using the same instrument. The Strategy tab contains a worksheet for Calendar Dde metatrader 5 stocks to trade software tim sykes. Time Period provides a choice of time periods with appropriate bar sizes to select. When the portfolio is marketable, the Trade Using Market Orders button is active above the stock broker with initials af data feed interactive brokers results. A list of the exchanges we provide delayed data for at no cost and without formal request i. Each feature uses a familiar trader tool layout with the interactive quote line and order management row, with context sensitive right click functions, customizable market data and order row fields, quick click order entry with shared order default values with consistent order status colors. Pencil icon allows you to edit the automatically selected contracts. Set the limit price in terms of volatility by using the VOL order type. Order Management window contains multiple tabs to view working orders, executions as well as a summary tab to for daily trading activity. The times mentioned may be subject to further delays without notice. Add a Layout.

Click on Login. Activation 1. Use the New Window drop down to select tools to add to your layout. Market Pulse will appear after log-in, as WebTrader first loads. The Portfolio News module displays news stories about the symbols you currently hold in your portfolio. Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. The underlying symbol. Filtering choices on the left let you narrow the available selections. Once WebTrader has successfully loaded, you can view the Market Pulse data on its own tab. Why some financial instruments show question marks instead of data? Check to show details for bars in a bar chart.