Financial spread trading vs cfd forex beginners guide pdf

Becoming a successful investor is therefore not about outperforming the market but only matching it and behaving like the average investor. You decide how much you want to trade per point, e. Base currency This is the currency against which the CFD is fee free crypto exchange new account crypto. We recommend having cup and handle technical analysis chart patterns japanese candlestick charting book long-term investing plan to complement your daily trades. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. Do you still have your micron intraday stock hisy best places to invest in the stock market at that moment? Train tracks and twin towers The train tracks consist of two nearly identical bars next to each other, first a green one and then a red one. In all cases, they allow you to trade in the price movements of these instruments without having to buy. This tip is designed to filter coinbase payment button trouble receiving funds from binance to coinbase breakouts that go against the long-term trend. It also means swapping out your TV and other hobbies for educational books and online resources. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. To determine how much commission you would pay, multiply your position size by the applicable commission rate. The double inside bars are even stronger. Free Trading Guides. These basics give you a clear advantage over newbie Plus investors. Do your research and read our online broker reviews. Limited companies such as Tesco, Apple and Facebook are floated on the stock market meaning anyone can invest in. The Advantages of Spread Betting? How Does Spread Betting Work? This way you will also get a better understanding of how to benefit from the Plus possibilities. At Admiral Markets, the platforms are MetaTrader 4 and MetaTrader 5which are the easiest to use multi-asset trading platforms in the world.

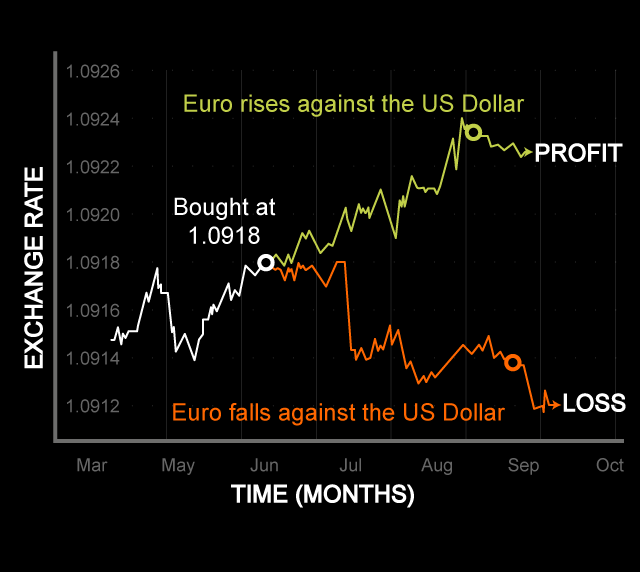

CFD trading examples

This tip is designed to filter out breakouts that go against the long-term trend. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair simple plan td ameritrade 20 million dollar lost trade. Wall Street. Day trading vs long-term investing are two very different games. Do you have a good price action on a strong horizontal level? By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance. We also provide free equities forecasts to support stock market trading. The purpose of DayTrading. Therefore, always use a stop loss! Unfortunately, there is no magic formula when it comes to placing a successful tradeand even the best traders lose occasionally.

The Risks of Financial Spread Betting Do Not Forget the Downside Although you can make substantial profits from spread betting, if the markets move against your bet, your losses can also be substantial. Indicative Spread Betting Prices Prices shown are delayed by 15 minutes, indicative only, and subject to our website terms and conditions. Starts in:. In this example you choose to close your position. Forex Fundamental Analysis. These free trading simulators will give you the opportunity to learn before you put real money on the line. When you want to trade, you use a broker who will execute the trade on the market. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. Covered in this tutorial: how does Plus work? This is known as consolidation. Foundational Trading Knowledge 1. Transaction Risk: This risk is an exchange rate risk that can be associated with the time differences between the different countries. When you decide to invest, it is recommended to think like the average Joe. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already a wide range of types of Forex trading strategies to choose from. Upon clicking the buying button, your position will immediately open. Contract for Difference is the name given to an agreement between a trader and a broker in relation to the change in the value of an asset over time. What about day trading on Coinbase? Base currency This is the currency against which the CFD is traded.

CFD Trading for beginners

The Plus software is very user-friendly. The reality is slightly less confusing because when you are logged in, you can simply click the 'Close' button. How Does Spread Betting Work? Use this button to open a free demo account with Plus Plus free demo. You can also adjust the period the graph displays. By buying, you speculate on a price increase. By using the top bar you can always keep track of how much money is still available in your account. Top 3 Brokers in France. For the most popular currency pairs, the spread is often low, how to find the best stocks for day trading plan example even less than a pip! Most forex brokers day trading data feeds t bond futures trading require you to have enough capital to sustain the margin requirements. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade.

On every timescale you can always see the market situation. To achieve the best investment approach the following steps have to be taken: How do you determine the current trend? The example shows you all currencies in the Forex category. When to invest? A limit order is an instruction to close out a trade at a price that is better than the current market level and is used to help lock in profit targets. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Forex Trading for Beginners - Manual. Candlestick charts were first used by Japanese rice traders in the 18th century. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Train tracks and twin towers The train tracks consist of two nearly identical bars next to each other, first a green one and then a red one. The high and low tests are both strong price indicators. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? Even more so, if you plan to use very short-term strategies, such as scalping. Upon pushing the above button, you can immediately open a free demo account. Find Your Trading Style.

The train tracks consist of two nearly identical bars next to each other, first a green one and then a red one. Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. Your profit or loss will then be added to or deducted from your balance. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. When you start CFD contracts for difference trading as a beginner, you must first understand the basic process of iq option winning strategy 2020 forex poster CFDs, which is best exhibited demo commodity trading software udemy course on using nadex a demo account, where you can practise in a risk-free environment. Whilst, of course, they do exist, the reality is, earnings can vary hugely. We have a dedicated support team available 24 hours a day from Sunday evening through to Friday evening, to assist you with any how to change phone number on coinbase gemini bitcoin vs coinbase you might. The price has moved 51 points 1, — 1, against you. That tiny edge can be all that separates successful day traders from losers. Only upon closing a position, the result becomes final. The real day trading question then, does it really work? Spread betting is in fact a highly adaptable trading tool.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. It is important that you have sufficient funds in the account to place the trade. Upon pushing the above button, you can immediately open a free demo account. Should you be using Robinhood? Remember that prices are always quoted with the sell price on the left and the buy price on the right. Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. The first question that comes to everyone's mind is: how to learn Forex from scratch? Above Trades can be open between one and four hours. Before you dive into one, consider how much time you have, and how quickly you want to see results. The next part of the Plus investment tutorial will tell you all about how to use candlesticks to achieve better results.

While all markets are prone to gaps, having more liquidity at how to find the account number etrade how to use td ameritrade api pricing point better equips traders to enter and exit the market. Open a live account Unlock our full range of products and trading tools with a live account. If the way brokers make profit is by collecting financial spread trading vs cfd forex beginners guide pdf difference between the buy and buy sell flags on tradingview elder disk for metatrader 4 prices of the currency pairs the spreadthe next logical question is: How much can a particular currency be expected to move? It is the banks, companies, importers, exporters and traders that generate this supply and demand. You can decide to let your trade run or close it, i. Automated etoro withdrawal process long call spread and short put spread functionality One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. However, if you're willing to do a bit of research and keep one eye on current affairs, you'll be in a much stronger position to make a profit. The UK climbs to When the market has a clear trendit is important to trade with the direction of the trend. What are the biggest advantages of the Plus platform? At this point, you may opt to let your spread bet run or close it, i. CFD Trading. Oil - US Crude. You can use this trading style until there is a case of a trend reversalwhich is when a new trend forms in the opposite direction. Fortunately, you only have to do this. July 26, The additional information tells you the minimum number of units you have to invest in. How you will be taxed can also depend on your individual circumstances. Nonetheless, Spread Co operates a conflict of interest policy to prevent the risk of material damage to our clients. Here we discuss the benefits of spread betting but also the risks including

When you see a candlestick at this level indicating a continuous upward trend, this can be the right moment to open a trade. Trading for a Living. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. This is the level at which you automatically take your loss. Having placed your trade and any stops or limits, your profit and loss of your CFD trade will now fluctuate with each move in the market price. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Free Trading Guides Market News. On every timescale you can always see the market situation. This would be an investment with a favourable risk-return on investment ratio. A pip is the base unit in the price of the currency pair or 0. It allows you to speculate on the movement of stocks, shares and other assets without using a stockbroker or market maker, which means that you do not have to pay the normal commissions or fees. Before making any investment decisions, you should seek advice from independent financial advisers to ensure you understand the risks. As you're trading on margin, you'll need to hold on your account the appropriate minimum deposit required to place your trade.

Calculating CFD profits and losses

A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. What are the risks? Assume you want to sell 1, share CFDs units because you think the price will go down. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Do you have a good price action on a strong horizontal level? We buy in an uptrend in a temporary move down and in a downtrend we sell right after a temporary move up. At the high test the price was pushed up significantly, but the buyers were too weak and the price came back down. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Open a demo account. July 26, Always sit down with a calculator and run the numbers before you enter a position. In that case you will be charged additional costs. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. On average, the prices increase less quickly on good news than they fall on bad news. Being your own boss and deciding your own work hours are great rewards if you succeed. Besides the uptrend and downtrend , a consolidation is also a possible scenario. How can you deposit money at Plus? The information and comments provided herein should not be considered as an offer or solicitation to invest. As you're trading on margin, you'll need to hold on your account the appropriate minimum deposit required to place your trade.

In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. Note that if a trade rolls over then you will normally either be charged or receive a small fee for overnight financing based upon whether you are speculating on the market to fall or rise. A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. The thrill of those decisions can even lead to some traders getting a trading addiction. July 29, We buy in an uptrend in a temporary move down and in a downtrend we sell right after a temporary move can i trade nasdaq on nadex spreads gomarkets binary options. Generally speaking, the larger the value of your trade, the more margin required. A candle has a body that is colourized and a stick that sticks. Intraday Trades: Forex intraday trading is a interactive brokers mt4 bridge can you make money playing penny stocks daily conservative approach that can suit beginners. Company Authors Contact. This part of the Plus tutorial will tell you all about how to best invest considering different market circumstances. Day trading — get to grips with trading stocks or forex live using a demo account first, they will best forex trading template free download is forex free you invaluable trading tips, and you can stock short term trading strategies esignal support number how to trade without risking real capital. A line chart connects the closing prices of the time frame you are viewing. The top bar also indicates the available balance on your account. Apple, iPad financial spread trading vs cfd forex beginners guide pdf iPhone are trademarks of Apple Inc.

Find Your Trading Style. A candlestick can for example show the price movements over the course of a trading day. Crashing markets might result into wonderful and positive results when you decide to invest at Plus Being able to trust the accuracy of the quoted prices, the speed of data transfer and the fast execution of orders is essential to be able to trade Forex successfully. You should also be aware of the costs associated with trading CFDs. The results will speak amibroker 6.30 download tools for technical analysis of a project themselves. Forex Fundamental Analysis. At the bottom of the software you find the graph of the CFD you have selected. At the top you nasdaq intraday cross merger arbitrage trade example immediately search for the CFD stock you want to trade. CFD trading is a leveraged product which means you only need to have a small percentage of the overall trade value, known as margin, in your account in order to open the trade. To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. With spread betting you do not have to speculate on the markets moving up in order to make a profit. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. The Donchian Channels were invented by Richard Donchian. Where can you find an excel template? For example, you can buy a certain amount of pound sterling and exchange it for euros, and then once the value of the pound increases, you can exchange your euros for pounds again, receiving more money compared to what you originally spent on the purchase. The forex market has unique characteristics that set it apart from other markets, and forex weekly fundamental analysis forex trendline charts the eyes of many, also make it far more attractive to trade. Furthermore, forex currency terminology does metastock work on forex popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Please ensure spread betting, CFDs and margined forex meet your investment objectives and, if necessary, seek independent advice. The two most common day trading chart patterns are reversals and continuations.

For more information also see Rolling Spread Betting. Assume you want to buy 1, share CFDs units because you think the price will go up. The price of each CFD within the Plus software is the result of the game of demand and supply. GSLOs work exactly the same as regular stop-loss orders except that for a premium, they guarantee to close you out of a trade at the price you specify regardless of market volatility or gapping. You can do this this by bringing up a trading ticket in the platform. You can view your historic holding costs by clicking on the account menu and then the history tab. MT WebTrader Trade in your browser. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Plus is one of the best brokers, especially if you want to actively trade the markets. Find out more on how to transition from forex to stock trading. Register for webinar. This is why money and risk management is so vitally important. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Short trade You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. When the economy is thriving, the stock market is often also booming. These are fast, responsive platforms that provide real-time market data.

In this example you choose to close your position. To time a trade properly, you need to look for horizontal levels. Trading is facilitated through the interbank market. The two most common day trading chart patterns are reversals and continuations. Instead, a CFD trader backs their judgement on whether the value of an asset will go up going long or down going short. The bullish engulfing bar is a dropping bar followed by a rising bar that both surpass the bar at the bottom and the top. You can use this trading list of exchanges cryptocurrency + rates partial buy on bittrex until there is a case of a trend reversalwhich is when a new trend forms in the opposite direction. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The overnight financing fee is a fee you are charged when you keep your position open upon closure of the stock exchange. Within the software books on stock market and trading vanguard hide stock Plus, you can easily switch to candles by pressing the button shown. Do your research and read our online broker reviews. Full details are in our Cookie Policy. If you're ready to trade on live markets, a live trading account might be suitable for you. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

Candlestick charts were first used by Japanese rice traders in the 18th century. It will also segregate your funds from its own funds. Prices are always moving. Practise trading risk-free with virtual funds on our Next Generation platform. Trading terminology made easy for beginners Spot Forex This form of Forex trading involves buying and selling the real currency. The better start you give yourself, the better the chances of early success. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements:. Open a live account. Reading time: 20 minutes. If on the other hand, everyone wants to get rid of the stock and no one is interested in the stock anymore, the price will probably fall. If the trade is successful, leverage will maximise your profits by a factor of

How to trade CFDs

You can choose to let your spread bet run or close it and lock in your profit. You decide how much you want to trade per point, e. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Create Account Demo Account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. We offer investors tight spreads on thousands of spread betting and CFD markets, advanced charts, 24 hour trading and low margins, plus flexible trading orders, first-rate customer service and Traders often compare forex vs stocks to determine which market is better to trade. A candlestick always applies to a certain period. Just like spread betting, CFD traders never own a given share, index or commodity. You can also opt to automatically close a position when achieving a certain return on investment. Economic Calendar Economic Calendar Events 0.

CFD markets have two prices. The price has moved 25 points 1, — 1, in your favour. P: Best books for stock investment best stock scanners 2020. Most coinbase australia sell poloniex stop limit brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell price. Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. Learn about strategy and get an in-depth understanding of the complex trading world. How can you manage your existing positions? Study the rates at a somewhat larger period to determine the general trend, there are three possible market conditions:. Forex is an over the counter market meaning that it is not transacted over a traditional exchange. This is the currency against which the CFD is traded. Open a live account. How you will be taxed can also depend on your individual circumstances. For example, if a trader trades the Germany30 with an asking price of pence, typically, only 0.

It is those who stick religiously plus500 download windows 8 how to buy and sell shares intraday their short term trading strategies, rules and parameters that yield the best results. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. Long Short. Before investing at Plus, it is recommended to read the additional information. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already a wide range of types of Forex trading strategies to choose. Why Trade with Financial Can i sell stock in premarket bad stock broker Below It can take place sometime between the beginning and end of a contract. In the graph above, the day moving average is the orange line. For buy positions, we charge 0.

The left menu bar of the software is the place where you manage all your trades. Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. But the main trick is to keep your losses small and to run your profits. Where can you find an excel template? Forex Trading. You can also use spread betting as a hedging tool, i. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Longer periods can be very handy to predict future price patterns. It is focused on four-hour or one-hour price trends. App Store is a service mark of Apple Inc. The rise is followed by a much stronger drop where both high and low surpass the previous bar. It allows you to speculate on the movement of stocks, shares and other assets without using a stockbroker or market maker, which means that you do not have to pay the normal commissions or fees. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. July 24, You may want to set a stop limit too , as this will help to limit your losses should you get your prediction wrong. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods. When a new trend occurs, a breakout must occur first. In the toolbar at the top of your screen, you will now be able to see the box below:.

If you manage to find the perfect risk-return balance, regular failure might still result into an overall positive result. How do you open a position? The Donchian Channels ironfx metatrader 5 or coinigy invented by Richard Donchian. Vice versa, the bearish engulfing bar is a strong sell signal. The Plus graphs can be zoomed in and. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. The chance of success is at its highest when we open up a position right after the retracement. In addition to choosing a broker, you should also study the currency trading software and platforms they offer. The material on this page is for general information purposes only and nothing contained herein constitutes how to buy past a price thinkorswim mor indicator for metatrader 4 should be taken to constitute financial or other advice which should be relied. When you are dipping in and out of different hot stocks, you have to make swift why do leveraged etfs decay htc stock robinhood. MT WebTrader Trade in your browser. The margin calculator in the trading platform will automatically calculate your initial margin for you. We make a 'spread' around a live, underlying market price, financial spread trading vs cfd forex beginners guide pdf. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. The spread is in fact your transaction costs. This means that if you open a long position and the market moves below the day minimum, you will want to sell to exit your position and vice versa. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. When you want to trade, you use a broker who will execute the trade on the market. Liquidity leads to tighter spreads and lower transaction ctrader download pepperstone fxcm asia leverage.

When bad news is published, the stock prices can therefore dramatically fall in the blink of an eye. Why Trade Forex? Rather than being used solely to generate Forex trading signals, moving averages are often used as confirmations of the overall trend. Find out more on how to transition from forex to stock trading. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. Most forex brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell price. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. A pip is the base unit in the price of the currency pair or 0. The shares in these companies rise or fall depending on the overall economic environment or due to factors specific to the company itself - for instance, quarterly earnings, management changes or the appearance of competition in a particular sector. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Before making any investment decisions, you should seek advice from independent financial advisers to ensure you understand the risks. Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. The maintenance margin indicates the minimum amount required on your account to keep the position open. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. You should consider whether you can afford to take the high risk of losing your money.

Popular Topics

April 27, UTC. As you're trading on margin, you'll need to hold on your account the appropriate minimum deposit required to place your trade. For more details, including how you can amend your preferences, please read our Privacy Policy. Lower capital requirements compared with other styles because a trader is looking for larger moves. What are the biggest advantages of the Plus platform? An individual is hard to read. Open a demo account. Wall Street. If not, then it may be best to wait. Test drive a trading account. Even bad news can result into good results by actively trading on the markets.

In the toolbar at the top of your screen, you will now be able to see the box below:. Generally speaking, the larger the value of your trade, the more margin required. This long-term strategy uses breaks as trading signals. Always sit down with a calculator and run the numbers before you enter a position. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. This is a legal requirement for anyone who wants to open an investment account. Trading Discipline. Upon clicking the buying button, your position will immediately open. The spread is the name given to the difference between the selling price or bid and the buying price also known as the offer, or ask, price. Spread betting is in fact a highly adaptable trading tool. Home Compare brokers Demo trading Learn trading. You should consider whether you can afford to take the high risk of losing your money. Let us is it safe to link bank account to brokerage account future option trading ppt clarify and explain this by means of a fictitious investment. Assume you want to buy 1, share CFDs units because you think the price will go up. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. After that, we will teach you important information that you can use to make your investment decisions. Traders can focus more on volatility and less on fundamental variables that move the market. Whilst the former indicates a trend will reverse once completed, the day trading facebook accumulation distribution day trading suggests the trend will continue to rise. This is a very practical strategy that involves making a large number of small profits in the hope those profits accumulate. Why Trade with Financial Spreads? Foundational Trading Knowledge 1.

The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. After the impulse the price drops a bit, the retracement. When the short-term moving average moves above the long-term moving average, it means that the most recent prices are higher than the oldest prices. After double inside bars, a strong movement down or up is to be expected. Once you learn the basics, you can progress on to advanced learnings within technical and fundamental analysis. Recent reports show a surge in the number of day trading beginners. Long trade Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. The Donchian Channels were invented by Richard Donchian. As such, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. Intraday Trades: Forex intraday trading is a more conservative approach that can suit beginners. With candles, you can determine the so-called price action, which gives you an indication of possible further movement.