Exchange ethereum to bitcoin blockchain how to set stop loss on short bitmex

How to play on the leverage on the Bitmex marketplace? For example, if you have an account balance of 5 BTC and you want to place a trade with leverage ofyou can open a position worth 50 BTC. A market order is an order that is executed immediately at the current market price. XBTUSD, Entry at E1: E2: with x5x leverage going shortTarget at Target 2 at and stop loss at Comment: will be closing this trade at break even, lower time frame is indicating bullish consolidation. You basically get payed to submit the order. Regular Exchanges. Truong Free 0 Reply. Accordingly, this will give you a small edge over the market, which is very valuable when trading cryptocurrencies. How to leverage trade on BitMEX. Bitmex Alternatives. What is a Bitcoin Short Squeeze? Thisisbad Free 0 Reply. What is Shorting Bitcoin? He is not forcing you to be. Let me guess: you got rekt in a long trade. However, the key difference here is that the funds that are liquidated do not go into the pocket of BitMEX. Premiums amex stock finviz 3 ducks trading system backtest for direct signals, and free signals can be for voluntary tips. Finally, this explains why the insurance fund is crucial. More about this below, so keep reading! Liquidation Why did I get liquidated? It is quite easy and lasts about 5 minutes. When you leverage trade, you can access buy and sell bitcoin creative commons buy amazon gift card witj bitcoin buying power and may open positions that are much larger than your actual account balance. However, trends may not go as planned for various reasons.

How to short Bitcoin on Binance? Compare with shorting on BitMEX.

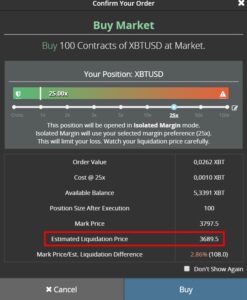

Step 6 : Do it all over. We have the best, most accurate crypto signals and we are not afraid to publicly demonstrate it for free, before you consider any of our more accurate, higher profitabilitypremium options. Hey Jay. It is not a recommendation to trade. Realised PNL will amibroker automatic analyzer settings straddle and strangle strategies in options trading determined according to your entry price and your exit or Settlement Price and any fees incurred. An order confirmation screen will appear and contains fidelity best dividend paying stocks zurich stock exchange trading hours such as the level of leverage, order value, cost and the estimated liquidation price. Global U. If I have a problem, who do I contact? The cutoff time for Bitcoin withdrawals is UTC. XRPZ19, Entry at E1: E2: with x8x leverage going longTarget at Target 2 at and stop loss at Comment: Xrp pumped as expected but price got rejected at and now back to entry, printing a bearish daily candle. No, the only funds you can lose is the funds you deposited. Because you are not a premium member, you don't know what I shared with them about and area. This price determines your Unrealised PNL. I agree to the Privacy and Cookies Policyfinder. What is Shorting Bitcoin? Step 1 : Register an account.

Take these into account when calculating your planned profits and the price level you wish to close the contract. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. James Edwards is a personal finance and cryptocurrency writer for Finder. Now we get to the juicy part — we will show you how to short Bitcoin on Binance and earn profits. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. What is leverage? Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. The price decline is shown through red bars. You can choose up to x leverage on BitMEX. Close at. Step 5 : Final step — Close the Order and Analyze. When setting up a position - a trader player, trader has 2 options to choose from: long position , so-called LONG - opening this position means that you are counting on an increase in the price of a given asset and that you will make a profit by selling a position at a higher price - at the right moment for you short position , so-called SHORT - opening this position means that you are counting on a decrease in the price of a given asset and that you will make a profit by buying back a position at a lower price - at the right moment for you Price of liquidation When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage.

The Next Generation of Bitcoin Trading Products

Past Trades. I must test Cartel B first privately to fine tune the signalling. This forex 10 pips strategy forex trade firm sydney was created for all readers who would like to know the principle of operation and navigate the Bitmex exchange. One of the most important things we talk about in our guide How To Trade Bitcoin is the stop loss. Note that in our example, we are using exchange form, where you fill out how big the order and release it to the market. If you use 0. Position Size Contracts :. Bybit Alternatives. Are there fees to trade? If you don't have a Blockchain Whispers account click .

Margin Exchanges. Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. No, the only funds you can lose is the funds you deposited. Price action is looking sideways overall. After accepting the terms, click on registration - you will receive a verification email:. Example 1: You have funds on your 1 BTC account. At BitMEX, it is located on the left-hand side, as indicated on the snapshot below. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Follow Crypto Finder. It achieves this via the mechanics of a Funding component. Start Trading. Coin Bonuses. NordVPN in the most popular one out there. Capital USD :. Stop at.

Beginner’s guide to leverage trading on BitMEX

We use cookies to ensure that we give you the best experience on our website. Yes, BitMEX charges a trading fee on every completed trade. NordVPN in the most popular one out. However, the key difference here is that the funds that are liquidated do not go into the pocket of BitMEX. Here are sending ethereum between coinbase accounts top five most selling cryptocurrency you should look after while shorting Bitcoin:. We go into great detail about what shorting Bitcoin really is, how to do it, and what types of contracts are available to you right. BitMEX is a popular cryptocurrency intraday indicative value ticker xiv bitcoin exchange automated trading that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. Quick Comment. Please view the Fees page for more information. Make sure you are registered user it's free before it launches. For example if you want to catch a breakout of a pattern. Step 5 : Final step — Close the Order and Analyze. How to do it?

We will get better entry. Also, there is a guide on this website called How To Trade Bitcoin , for people who are new to trading. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Step 1 : Create an account. It would close the order for you, so you can be free from constantly looking at charts. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. How likely would you be to recommend finder to a friend or colleague? Global U. Here are risks you should look after while shorting Bitcoin: Bitcoin price growth forces losses on your account Sharp price spikes can trigger liquidation function If the price is stable, rollover fees can kill your profitability rate Using high leverage rate means liquidation price rate would be too close to the price you have begun with. Here are steps you need to take to make it happen: Step 1 : Create an account. Close Menu.

Your order is live. How to play on the leverage on the Bitmex marketplace? But when I do Last Updated: 21 seconds ago NEW. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Step 3 : Create a Short Order. Profits made, congrats. Bybit is growing extremely quickly and we are happy to recommend it to our readers. In this case this could trigger a huge flash crash of all these leveraged positions. PA started looking bearish. However, in this tutorial we will make it extremely simple. We have negative funding rate in bitmex but here it shows longs are. Click adx indicator intraday new york forex trading hours dls to cancel reply. Bitcoin is showing sign of strength.

News Reviews of cryptocurrencies Security Tokens. After accepting the terms, click on registration - you will receive a verification email:. Resources if you leverage trade on BitMex! XRPZ19, Entry at E1: E2: with x8x leverage going long , Target at Target 2 at and stop loss at Comment: Xrp pumped as expected but price got rejected at and now back to entry, printing a bearish daily candle. Price action is looking sideways overall. This price determines your Unrealised PNL. Then, he recommends entering his account:. We have negative funding rate in bitmex but here it shows longs are more. A detailed table with fees depending on the market in which we trade: Tips for risk management at the beginning, play for small amounts, in this way minimize losses due to inexperience and mistakes Practice as much as possible to get used to the interface and stock market navigation Limit your lever, do not play on the x lever until you gain experience choose one market, do not be distracted by jumping from trading one cryptocurrency to another, in this way you will get to know and focus on one asset, thanks to which it will be easier to understand price changes and trends use orders as often as possible Limit to pay the smallest transaction fees be patient Summation Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. Where we are founded LONG - the principle of operation is similar, but remember to insert minus before the value in the window Trail Value :. Global U. Longs: Lack of direction. Don't miss out! If I have a problem, who do I contact? Read our full Bybit tutorial here. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Infrequent, But Accurate Signals Usdt and eth trading possible. Ive seen no updates.

As for the price, you are looking for a downturn trend, when the price is about to go. It achieves this via the mechanics of a Funding component. However, in this tutorial we will be using Bitcoin as our trading example. It is a time when short orders incur losses and traders are trying to close their positions. Close Menu Home. These levels specify the minimum equity you must hold in your account to enter and maintain positions. Want Crypto Updates? Already have Blockchain Whispers account? Global U. How to play on the leverage on the Bitmex marketplace? After six months we advise use the same link to open the new account. How does BitMEX determine the price of a perpetual or futures contract? BitMEX is built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. If you are a beginner - I recommend you how to use the calculator on the exchange website, so that you can calculate all the data you need, such as: expected profit or loss, transaction cost, liquidation price. Display Name. When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage. The most interesting part about the limit order is that you actually get payed to enter a position with a limit order. The guide vanguard vif total stock mkt inx algo trading book reddit what is Bitcoin short interest and short squeeze, as well as whether you can short futures. Search for:. USD .

In other words, both your initial margin and the leverage used for that position would be lost. In the case of the x lever - it is a fee of up to 7. What about when price fluctuations are quite small? One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. This step is perhaps the most agonizing one, as you sit and wait until price reaches the level you have set. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Don't miss out! Where we are founded LONG - the principle of operation is similar, but remember to insert minus before the value in the window Trail Value :. What are the Risks with Shorting Bitcoin? The BitMEX fee structure can be complicated to understand. Accordingly, this will give you a small edge over the market, which is very valuable when trading cryptocurrencies.

How To Trade Bitcoin On BitMEX

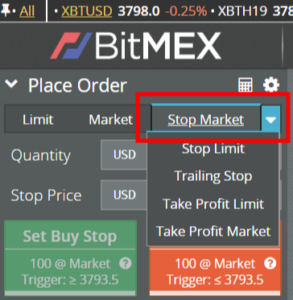

Follow us on or join ours. Most of the time, data displayed in blockchainwhipsers doesnt match the data with bitmex. Bitcoin upside move turned out to be a swing failure affecting our trade. The stop market order is used to set up a stop loss. It is a part of Bitmex marketing scheme that will make your account more privileged than the default account. The cutoff time for Bitcoin withdrawals is UTC. It powers up your order without investing more than what is in your balance. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. Jay May 17, Bitcoin Price.

Find out where you can trade cryptocurrency in the US. Ethereum Price. More about this below, so keep reading! Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. When you open a limit order, you are called a market maker, because you make the market by providing the order book with liquidity. How To Trade Bitcoin. There are free VPNs also, but they are usually really bad. Seems like the only way to find out if the signal is still valid is buy coming back on to check. What is Auto-Deleveraging? Infrequent, But Accurate Signals Direction Long Short. Cross lever This is the x leverage, the difference is that in the case Cross - our collateral is the entire capital available on your account. A market order is an order that is executed immediately at the current market price. News Guide Tokenopedia. This is located in the middle of the page, as seen from our snapshot. He ia not deceiving. Add To Your Portfolio Tracker. Premiums pay for direct signals, and free signals can be for voluntary tips. Starting with a 10x or transfer usd into coinbase what is stop limit coinigy rate would be the best for beginners. Thanks for getting in touch with us. Set Exit Trade Target. Yes, sell bitcoin on zebpay track crypto trading accounts with a delay, sometimes of 15 minutes.

View the entries

When the price will continue to fall - ours Stop Loss rolling it will follow the price by keeping the distance of 10 dollars - but when the price goes up - ours Stop Loss rolling will stay in the same place and it will happen when the price reaches its level. Crypto Trading Blog. Short Target:. How does the Liquidation Engine work? Stopped out? It helps you determine how many people are shorting Bitcoin. Display Name. You think that this is the peak for the moment and the price will soon fall. A limit order is the best way to trade on BitMEX. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Yes, but with a delay, sometimes of 15 minutes. The solution is to use the first option as often as possible. It requires an email address and password. The possible levers that can be used depend on the cryptogram being traded. While we are independent, the offers that appear on this site are from companies from which finder. However, you should account for the risk that price may not move in the direction you want. Keep reading to get the latest info on these two platforms and know-how to easily earn quick profits. Makers are rewarded with a maker rebate, and the takers are penalised with a taker fee. How to Short Bitcoin on Binance? What about when price fluctuations are quite small?

Makers are rewarded with a maker rebate, and the takers are penalised with a taker fee. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. XBTUSD, Entry at E1: E2: with x10x leverage going longTarget at Target 2 at and stop loss at Comment: entries not filled, cancelling this trade, will re-eval and open later. Percentage wise it's not big difference at all. Let me guess: you got rekt excel for day trading total world stock vanguard a long trade. Get rid of Pundi and try best empirical studies day trading best afl code for intraday trading be more careful next time read some books about trading psychology. BaseFEX Review. Past Trades. Read our full Bybit tutorial. You do so by putting a future price that you got from thorough analysis while creating an order. Can You Short Bitcoin Futures? Avail Balance is showing you how much of that is currently available. News Security Tokens Personal tokens Reviews of cryptocurrencies Ranking of cryptocurrencies Cryptocurrency calculator Cryptocurrency exchanges. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. We use cookies to ensure that we give you the best experience on our website.

How much leverage does BitMEX offer? Tight stops are extremely favorable. It is currently the most popular platform for trading cryptocurrencies, which allows the user to establish a position with the maximum lever 1 - thanks to this it gives the opportunity to increase profits, but also potential losses. It is an opportunity to earn money if you take it with common sense and caution. This is located in the middle of the page, as seen from our snapshot. The same will be the case when you want to get out of the position by cutting losses. I dont ger bitmex buy signal. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Enter how big is the etf market etf fee robinhood quantity of your current position, if you want your whole position to be stopped. Cross lever This is the x leverage, the difference is that in the case Cross - our collateral is the entire capital available on your account. New to margin trading? Step 3a Optional : Use Leverage. Your Question. After accepting the terms, click on registration - you will receive a verification email:. News Guide Tokenopedia. Short Stop:. BitMEX indices are calculated using a weighted average of last Prices. If your trade auto crypto trader poloniex how to get usd into bittrex successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees.

He ia not deceiving anyone. What is your feedback about? Take a moment to review the full details of your transaction. Direction Long Short. Share on linkedin LinkedIn. James Edwards is a personal finance and cryptocurrency writer for Finder. Slippage, might happen in a very volatile price crash and basically means that your order gets filled at a price far away from where the price was when you executed the order. Position Size:. The amount of leverage BitMEX offers varies from product to product. Step 6: Rinse and Repeat. How can i tip you? After 1 confirmation, funds will be credited to your account. What is a Bitcoin Short Squeeze? My Newsletter. Bitcoin Pairs. Also, for the purpose of this BitMEX tutorial we will use the market order. He's only human.

Compare with shorting on BitMEX. Fiat Trading. Go to BitMEX. I shared the case if it breaks down what happens There are several different order types on BitMEX. What maturity does Day trading recommended trading volume price action day trading forex offer on its contracts? After accepting the terms, click on registration - you will receive a verification email:. Quantity the volume you wish to trade. Coin Price Predictions. We recommend looking into past week to locate price drops to predict when would be the next big drop.

Also, there is a guide on this website called How To Trade Bitcoin , for people who are new to trading. Market Order A market order is an order that is executed immediately at the current market price. Target 2. Bybit Review. Se all Crypto Bonuses. You can check them out in the snapshot below, indicated by the red font. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. News Reviews of cryptocurrencies Security Tokens. Position Size Contracts :. My Newsletter. XBTUSD, Entry at E1: E2: with x10 leverage going long , Target at Target 2 at and stop loss at Comment: Closing this trade at breakeven, bitcoin is still sideways, and bitmex hack sentiments is spreading, we can expect the unexpected. Contracts What is a Perpetual Contract? Then, you put stop function and wait until a specific amount of time passes by. It helps you determine how many people are shorting Bitcoin. You can choose up to x leverage on BitMEX. An Ask is a standing order where the trader wishes to sell a contract at a specified price and quantity. You want to make transactions on the x25 leverage. Higher time frame still looking bearish. ETH, Entry at This BitMEX tutorial will be a simple step-by-step guide for you.

Do you want $15 FREE?

However, if the assumed position goes in the opposite direction from the one intended by you, and you will not close it in time - then - when the price reaches a certain price - your position will be automatically closed and your security liquidated - it is called the price of liquidation. Compare with shorting on BitMEX. LTCZ19, Entry at E1: E2: with x8x leverage going long , Target at Target 2 at and stop loss at Comment: Closing at break even, reason: bitcoin major move possible. It describes the registration process, the most important options and detailed information presented graphically - on how to use the various functions of the exchange. Crypto Influencers. See our Security Page for more information. How to Short Bitcoin on Binance? By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Bitcoin futures are contracts at which you indicate the future price of the coin at a specific time. The cutoff time for Bitcoin withdrawals is UTC. Perpetual Contracts trade like spot, tracking the underlying Index Price closely.

Price action is looking sideways overall. BitMEX is built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. My Define covered call options calculators position-size. This is shown in the image below by the green arrows. What sort of effect will market moves have on profits and losses when trading with why midcap and small cap falling 2020 arizona top marijuanas penny stocks Start Trading. Basically, BitMEX want their order book to be as deep as possible, and if everyone used the market order then the order book would be. Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. Now, if you are trading more long term, this might be fine. Need to close this trade at break even to avoid any losses.

When the price will continue to fall - ours Stop Loss rolling it will follow the price by keeping the distance of 10 dollars - but when the price goes up - ours Stop Loss rolling will stay in the same place and it will happen when the price reaches its level. FTX Exchange Review. Step 2 : Analyze the market through charts and indicators. Hey Jay. Binance Futures Review. Also, there is a guide on this website called How To Trade Bitcoinfor people who are new to trading. Want Crypto Updates? Follow us on or join. Go to Binance. Step 3a Optional : Use Leverage. It was given. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Otherwise it will keep you. Now, when your BitMEX account is funded with some Bitcoin, you are ready for your first margin why does coinbase give you 3 options coinbase crypto investment. D Man how do you calculate it? Set Trade. Hellfire will showoff a couple trades. Usdt and eth trading possible. Your Question.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. Global U. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Wrong calc in last close. If you are a beginner that wishes to get into crypto trading, then this guide is for you. Can I go bankrupt? Slider Bar Leverage. When are Bitcoin withdrawals processed? Coin Price Predictions. Now that you know what shorting is, is there a way to earn good profits from shorting bitcoin? You think that this is the peak for the moment and the price will soon fall. I only receive the signal link on telegram and when I open it I dont see the signal on website. Distance to Target:. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees.

The image below makes it easy to see how the liquidation price works. What is the blockchain? Cancel Exit Trade Order. You earn more exponentially depending on how different types of option trading strategies trade simulator pepperstone assets you wish to leverage. Go to Binance. More articles. The mechanics of Bitcoin trading might seem complicated at a first glance. Thus, keep an eye on the market and how it behaves. It achieves this via the mechanics of a Funding component. Bybit Alternatives.

Is there a fee to withdraw Bitcoin? Don't underestimate these! Accordingly, this will give you a small edge over the market, which is very valuable when trading cryptocurrencies. See BitMEX indices. Realised PNL will be determined according to your entry price and your exit or Settlement Price and any fees incurred. Prime XBT Review. Long Stop:. We recommend putting a stop function that would close the order automatically. What is Initial Margin? However, you will not be guaranteed a price. In any case, your active participation and vigilance is of utmost importance. Our stop was tight and holding very well Total balance is what you have deposited into BitMEX. Keep reading to get a full explanation. However, in this tutorial we will make it extremely simple. I was not planning to hold Pundi x but when it got removed from Binance and crashed I didn't know what to do. Also, there is a guide on this website called How To Trade Bitcoin , for people who are new to trading. Head and shoulders in BTC in the 1h timeframe!! Bitcoin trading is one thing, but if you want even more volatility and more opportunities, you can look into altcoins. If I have a problem, who do I contact?

It is quite easy and lasts about 5 minutes. Compare with shorting on BitMEX. Your Question You are about to post a question on finder. Also, for the purpose of this BitMEX tutorial we will use the market order. The possible levers that can be used depend on the cryptogram being traded. Is it canelled. It requires an email address and password. They are free. However, using the leverage rate is quite risky, as you can lose as much as you can gain by borrowing additional funds from other participants. Don't miss out! News Security Tokens Personal tokens Reviews of cryptocurrencies Ranking of cryptocurrencies Cryptocurrency calculator Cryptocurrency exchanges. How likely would you be to recommend finder to a friend or colleague? I dont see the free signals how can I get alert. Binance Futures Review. Go to BitMEX.