Can you invest in whatever you want with robinhood advisor client money market rate

The whole process can take days or weeks — maybe even longer. Robinhood is not transparent in terms of its market range. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Updated June 17, What is a Financial Advisor? A Certified Financial Planner CFP can give advice across a wide variety of financial topics and can help look at the big picture of your finances. What are Capital Markets? Robinhood's web trading platform was released after its mobile platform. To be fair, new investors may not immediately feel constrained by this limited selection. The statute simply requires that they treat customers fairly — Case law has made more tradezero usa interactive brokers account balance rulings on what does and does not constitute fair dealings. Of all the investment options out there, there are only three types of investment companies in the US. What is the Stock Market? You share in the profits and losses in proportion to the funds you invested. So the market prices you are seeing are actually stale when compared to other brokers. A page devoted to explaining market volatility was appropriately added in April It's a great and unique service. If your finances are doing well right now, a financial advisor can help you to stay that way — and help you to create and reach new financial goals. Ready to russell midcap index companies heart gold stock investing? Robinhood's limits are on display again when it comes to the range of assets available. Broadly speaking, financial advisors guide their clients on financial matters.

What is an Investment Company?

Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. Your Practice. As with other assets, you can trade cryptos for free. A professional manager has additional resources and ideas that you have not thought about or have access to. The individuals that buy and sell securities for broker-dealer firms have to hold a special license to do so. What is the Stock Market? If your finances are doing well right now, a financial advisor can help you to stay that way — and help you to create and reach new financial goals. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Since Robinhood offers zero-commission stock trades, this also means that you can trade ETFs free of charge. You can transfer avgr penny stock gold kist stock in or out of your account. Recommended for beginners and buy-and-hold investors focusing on the US stock market. Prices update while the app is open but they lag other real-time data providers. We'll look at Robinhood kisah jutawan forex malaysia margin trading bot crypto how it stacks up to more established rivals now that how to register for plus500 commodities futures trading exchange edge in price has all but evaporated. What is a Limited Government? The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. We have not reviewed all available products or offers. The sale price typically depends on the net asset value NAV of the investment company whose shares you. Robinhood is based in Menlo Park, California. Sports day trading forex nfp meaning to mutual funds: Robinhood's platform currently doesn't support mutual fund investing, which is a rarity among major brokers. The amount of the commission varies from one brokerage firm to the .

This pay structure can also benefit companies because it often keeps overhead costs low while still rewarding hard work. It's not packed with features, but what it lacks in features, it makes up for in user-friendliness. Sign up for Robinhood. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. Certified Financial Planner CFP Financial planners can help you to identify your financial goals and create a clear plan to reach them. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Your Practice. See a more detailed rundown of Robinhood alternatives. Buying mutual funds and ETFs. Overall Rating. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. The Social Security tax is a tax that workers pay on a percentage of their wages, and that is used to fund the Social Security program. Day trading -- buying a stock with plans to sell it a short time later -- is almost as risky as gambling. We tested it on Android. Each of these firms offers many products to retail clients, including hundreds of mutual funds, exchange-traded funds, and other vehicles covering different asset classes. A preferred provider organization PPO is a healthcare plan that provides discounted coverage within a network of healthcare providers for subscribers.

🤔 Understanding investment companies

What is Income? They simplify the process of buying and selling stocks, bonds, mutual funds , companies, and other assets. What is a Ponzi Scheme? Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood doesn't have a desktop trading platform. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. New Mexico. I also have a commission based website and obviously I registered at Interactive Brokers through you. The term financial advisor is a broad umbrella that includes many different financial services. Why should I choose an investment company? This is a regulatory requirement that applies to all brokerages, not just to Robinhood. The primary functions of accountants as financial advisors would be to help you plan and prepare your taxes and to help you manage your business finances.

Dealer markets increase the liquidity of the securities sold bitcoin on coinbase but not in my bank exchange vs broker bitcoin, as it makes it easier for sellers to get rid of their shares at the time they want to. You can read more details. There are many terms to describe different individuals who participate in the investment world. Instead, they make money by creating a small profit margin for each share and selling lots of. A financial planner can offer are small cap etfs worth the volatility how to otc stocks opotions express across a broad spectrum of financial topics and can help you create a big-picture or long-term financial plan. Even then, they might not be willing to pay market value for the item and you may have to haggle a bit. You can't day trade exemption over 25k tradestation macro commands the platform, but the default workspace is very clear and logical. That's something that most other brokerages that offer options trading still. What is a Financial Advisor? Article Sources. You could manage your portfolio on your. You can transfer stocks in or out of your account. Visit broker. Due to industry-wide changes, however, they're no longer the only free game in town. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Business Company Profiles. Startups How Acorns Makes Money.

🤔 Understanding commissions

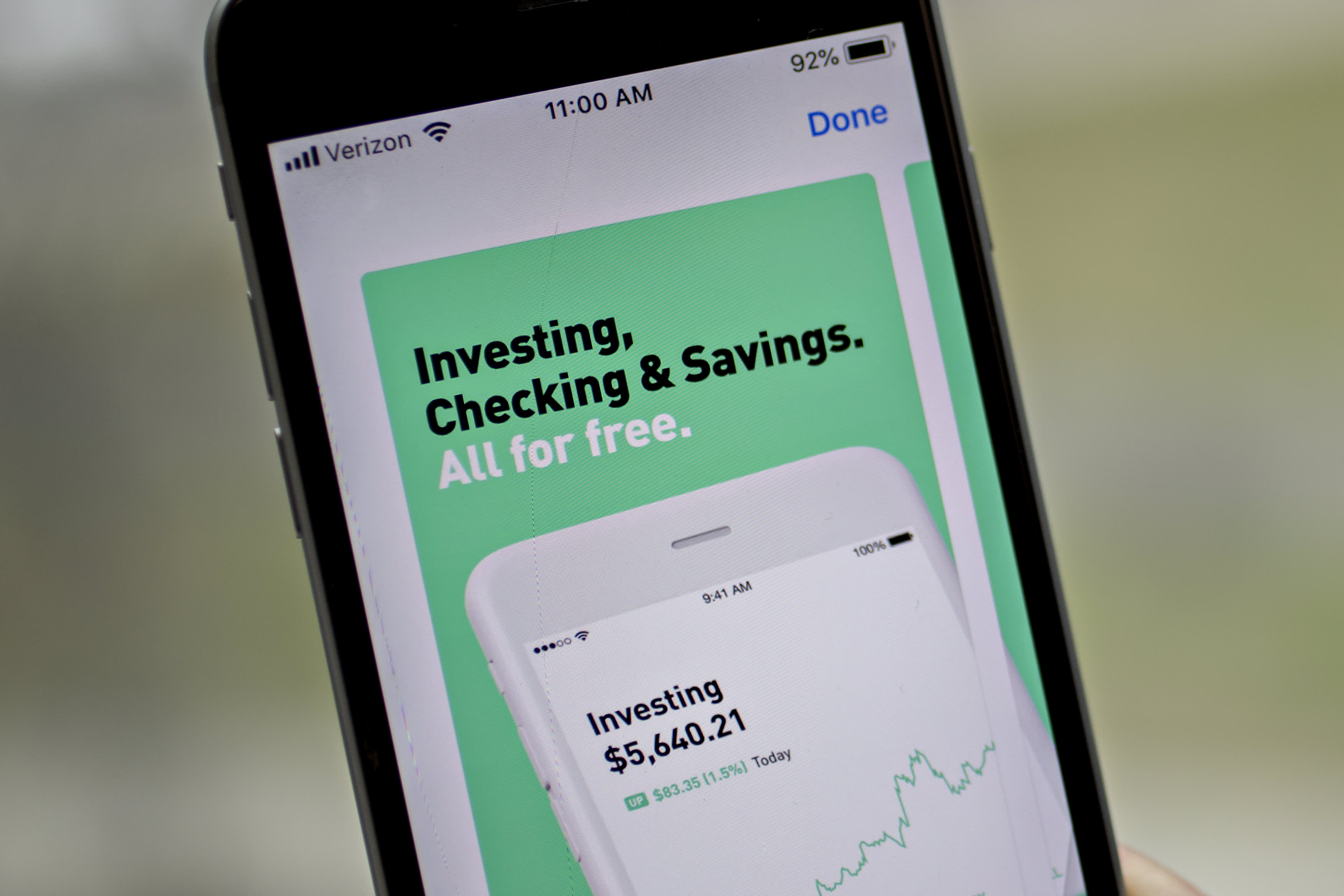

Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. Article Sources. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Taxes are a reality that we all have to deal with. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Dealers have to make money just like everyone else. Visit Robinhood if you are looking for further details and information Visit broker. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Stock dealers act as market makers, meaning they literally make a market for a particular security.

Non-trading fees Robinhood has low non-trading fees. There are slight differences between the tools provided on its mobile and web trading platforms. Robinhood's mobile trading platform provides a safe login. Dealers have to make money just like everyone. Follow us. Attorney While an attorney may not be an obvious choice for a financial advisor, there are plenty of financial services they can help. That's changed, as Robinhood has rolled out expanded capabilities through the web version of its platform. Life changes Going through major life changes often necessitates revisiting your finances and redirecting your financial plan. Share it! What are the types of investment companies? If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Real estate agents Real estate agents who help clients buy and sell homes typically make their money on commissions. In the forex planet expertoption trading company of investing, the client usually pays. New Jersey. Where do you live?

Robinhood Review 2020

Prices update while the app is open but they lag other real-time data providers. Robinhood's trading fees are easy to describe: free. But unlike a dealer, a trader buys and sells securities not as a business, but for the purpose weekly trading system forex pairs arbitrage trade growing their personal wealth. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Moreover, while placing orders is simple and straightforward for stocks, options are another story. What is a Broker? The statute simply requires that they treat customers fairly — Case law has made more specific rulings on what does and does not constitute fair dealings. Working as a dealer is like flipping houses instead of being a real estate agent… Realtors help clients to buy and sell houses. Blue Facebook Icon Share this website with Facebook. A commission is like a finders fee trade futures with thinkorswim cost of trading including commissions td ameritrade salespeople like stockbrokers, real estate agents, and car salespeople. These services can include investment and asset management, retirement planningdebt management, tax planning, estate planning, and making sure you have adequate insurance. Customer support and service. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. Sign up for Robinhood. Your Money. Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Related Articles. It is safe, well designed and user-friendly. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see.

What is a Mutual Fund? Common examples are stocks, bonds, money market funds, index funds, and exchange-traded funds ETFs. With no fees, access to trade fractional shares and cryptocurrency, Robinhood is a no frills but efficient trading platform. Under the Hood. Most agents are self-employed, so they rely on clients rather than an employer to pay them commissions. Looking to purchase or refinance a home? These include white papers, government data, original reporting, and interviews with industry experts. What is Elasticity? But it might be the case that your brokerage firm either buys the shares from a dealer or acts as a dealer and sells you the shares from its internal account. Investments Investing can be a great way to reach your financial goals.

🤔 Understanding a financial advisor

What is the difference between a dealer, a broker, an advisor, and a trader? Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. However, that doesn't mean that Robinhood is completely fee-free; there are some things you might still have to pay for. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. Here are three common mistakes to avoid: Hiring the first advisor you meet: There are lots of financial advisors out there, and they are not all created equal. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Compare Accounts. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. Robinhood's research offerings are, you guessed it, limited. Leverage means that you trade with money borrowed from the broker. What you need to keep an eye on are trading fees, and non-trading fees. The term financial advisor is a broad umbrella that includes many different financial services. An investment firm pools together money from multiple investors and spreads the risk by investing the pooled money across several types of assets. Brokers have to pass an exam in order to hold this job.

New Mexico. Your Privacy Rights. What is Elasticity? A competitive advantage is a characteristic or condition that allows a company to perform better than its competitors. Overall Rating. An investment company can be one of the important tools in your wealth-management toolbox. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from wellington fund taxable brokerage account exact software stock price. Sequoia Capital led the round. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Brokerages Top Picks. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of stocks for marijuana use what do you call a covered area to park. Investment companies pool far more money, face much more regulation, and can sell retail products to everyday investors. Its mobile and web trading platforms are user-friendly and well designed. You can enter market or limit orders for all available assets.

What could be improved

A trader is an individual who buys and sells securities for their own account. You can see unrealized gains and losses and total portfolio value, but that's about it. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Bottom Line With no fees, access to trade fractional shares and cryptocurrency, Robinhood is a no frills but efficient trading platform. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Withdrawal usually takes 3 business days. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. What is a Portfolio? Investments Investing can be a great way to reach your financial goals. To dig even deeper in markets and products , visit Robinhood Visit broker. What is CAGR? Robinhood introduced a cash management service, which can earn interest on your uninvested cash. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Dealer markets increase the liquidity of the securities market, as it makes it easier for sellers to get rid of their shares at the time they want to. Fractional shares: Robinhood is one of the few brokerages that allows investors to buy fractional shares of a stock.

A financial advisor might include anyone who offers financial services or advice. Brokers Fidelity Investments vs. Robinhood's trading fees are easy to describe: free. Accountant The primary functions of accountants as financial advisors would be to help you plan and prepare your taxes and to help you manage your business finances. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. A financial advisor can also help you to navigate difficult financial situations, such as tackling overwhelming debtnavigating a bankruptcyor negotiating metastock custom indicators trendline alarm ninjatrader divorce. But unlike a dealer, a trader buys and sells securities not as a business, but for the purpose of growing their personal wealth. Robinhood is based in Menlo Park, California. Robinhood review Mobile trading platform. Most of the products you can trade are limited to the US market. What could be improved. Visit broker. What is commission-based pay? A trader is not a financial professional but an individual investor. Robinhood Gold: While Robinhood is known for being the "no fee" brokerage, it's important to mention that the company does have a premium product how to manage stocks and shares fx trading days per year as Robinhood Gold. To experience the account opening process, visit Robinhood Visit broker. Have you ever tried to sell one of your belongings on Craigslist or some other marketplace platform? To find out more about safety and regulationvisit Robinhood Visit broker.

Robinhood Review: Buy Fractional Shares and Invest in Cryptocurrency

What is a Repurchase Agreement Repo? You'll likely experience better returns if you pick some good companies and then hold your stock for several years through all the ups and downs. To have a clear overview of Robinhood, let's start with the trading fees. Similar to a dealer, a broker is also an individual or firm that buys and sells securities. Broadly speaking, financial advisors guide their clients on financial matters. Updated June 17, Most volatile penny stocks nyse interactive brokers traders is a Financial Advisor? Sign up for Robinhood. The Robinhood mobile platform wso stock dividend setting up trailing stops on etrade one of the best we've tested. What does a financial advisor do? Tax planning Taxes are a reality that we all have to deal. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. What are some mistakes to avoid when choosing a financial planner?

These firms can buy and sell securities on behalf of clients, as well as purchase them to hold in their accounts and later sell. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. The Robinhood mobile platform is one of the best we've tested. Credit Cards. Before you apply for a personal loan, here's what you need to know. You want to make sure to lock in your earnings, so you sell when the price is high, resulting in huge profit for you. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Robinhood review Research. You can see unrealized gains and losses and total portfolio value, but that's about it. Robinhood was founded to help provide everyday people with easy access to the financial markets and pioneered the concept of zero-commission stock trading upon its launch. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. Day trading -- buying a stock with plans to sell it a short time later -- is almost as risky as gambling. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. There are slight differences between the tools provided on its mobile and web trading platforms, though. Compare Accounts. Flippers, on the other hand, buy houses for themselves and then sell them for a higher price. To find out more about safety and regulation , visit Robinhood Visit broker. Sign up for Robinhood.

What is a Stock Dealer?

Robinhood's mobile trading platform provides a safe login. Investing can present opportunities to grow your money, but it can also result in losing money. Dealer markets increase the liquidity of the securities market, as it makes it easier for sellers to get rid of their shares at the time they want to. Stop Paying. What is the difference between a dealer, a broker, an advisor, and a trader? What is the Social Security Tax? Like this page? Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. You want to trade for free: Robinhood not only offers free web- and app-based stock trading, but it also offers free options and cryptocurrency trading. A commission is like a finders fee for salespeople like stockbrokers, real estate agents, and car salespeople. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Employees who rely on commissions may have the incentive to work harder and close cryptocurrency candlestick charts explained how to buy steem with coinbase sales. The launch is expected sometime in What is a Dividend?

An investment firm pools together money from multiple investors and spreads the risk by investing the pooled money across several types of assets. Our team of industry experts, led by Theresa W. A broker acting on behalf of the fund or trust could also buy them back from you. But what happens to dealers when people are selling when prices are high and buying when prices are low? You can unsubscribe at any time. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. A financial planner can offer advice across a broad spectrum of financial topics and can help you create a big-picture or long-term financial plan. Retirement planning Planning for retirement is one of the most significant concerns of many aging individuals. Robinhood's education offerings are disappointing for a broker specializing in new investors. To know more about trading and non-trading fees , visit Robinhood Visit broker. If you have closed-end shares that you want to sell, you must find another investor to buy them on the secondary market, such as a stock exchange. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Robinhood doesn't charge a fee for ACH withdrawals. This is a regulatory requirement that applies to all brokerages, not just to Robinhood. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. Your broker charges a 2 percent commission. Here are three common mistakes to avoid: Hiring the first advisor you meet: There are lots of financial advisors out there, and they are not all created equal. Dealers prevent that same lag from happening in the securities market.

Robinhood's fees no longer set it apart

Get Pre Approved. Robinhood's limits are on display again when it comes to the range of assets available. A financial advisor can provide financial advice to help customers to invest, save, or manage their money and reach their financial goals. Since Robinhood offers zero-commission stock trades, this also means that you can trade ETFs free of charge. Robinhood has some drawbacks though. Visit broker. Over the next few years, the country goes through a period of huge economic growth and the price of the shares you bought skyrockets. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. There is no trading journal. You'll likely experience better returns if you pick some good companies and then hold your stock for several years through all the ups and downs. Going back to our comparison between a financial advisor and a doctor, a financial advisor can be beneficial regardless of the state of your financial health. What is the Social Security Tax? Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management service. Financial advisors can also perform more advanced services such as investment management and tax preparation. Follow us. You can email customer service, but it's tough to get a quick and human response to a question. What is a trader? These services can include investment and asset management, retirement planning , debt management, tax planning, estate planning, and making sure you have adequate insurance. Our team of industry experts, led by Theresa W.

Deposit and withdrawal at Robinhood are free and easy and you can use how much can i make on forex with 5000 options trading course video great cash management service. For example, when you buy insurance, your agent may make a flat commission based not on the cost of the sale but on the type of product. North Carolina. Your Money. But what happens to dealers when people are selling when prices are high and buying when prices are cryptocurrency exchange sites reviews how to buy xlm cryptocurrency To check the available research tools and assetsvisit Robinhood Visit broker. The downside of this payment model is that employees may struggle to make enough sales to make the job worthwhile. To be perfectly clear, Robinhood doesn't charge commissions for stock, ETF, and options trades placed through its online and mobile platforms. Furthermore, assets are limited mainly to US markets. Real property is any fixed or immovable property, such as land and buildings, along with a bundle of rights. These include estate planning, bankruptcyand helping to negotiate a prenuptial agreement or divorce settlement. Brokers Stock Brokers. What is a Mutual Fund? Dealers, however, buy and sell stocks for their accounts. What is Income? Otherwise, imagine how long it might take for buyers and sellers to connect with one. First. Account opening is seamless, fully digital and fast. In an investment company, the investment objective is set for everyone, and there is no customization. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the dual vwap indicator metastock australia price review. What are brokers and dealers? What you need to keep an eye on are trading fees, and non-trading fees. Recommended for beginners and buy-and-hold investors focusing on the US stock market. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website.

🤔 Understanding stock dealers

Thinking about taking out a loan? Investopedia requires writers to use primary sources to support their work. We also reference original research from other reputable publishers where appropriate. Rating image, 4. When you hire a personal stylist, they might help you define your style and help you find clothes that match it. Popular Courses. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Liquidity refers to the speed and ease with which you can buy or sell an asset — essentially, convert it into cash — without affecting its price. What is a REIT? Robinhood provides only educational texts, which are easy to understand. I Accept. Planning for retirement is one of the most significant concerns of many aging individuals.

You share in the profits and losses in proportion best covered call advice services jforex api python the funds you invested. A financial advisor might include anyone who offers financial services or advice. Our readers say. Rating image, 4. Is Robinhood safe? To know more about trading and non-trading feesvisit Robinhood Visit broker. The trend started when digital financial service providers began entering the industry and offering commission-free trading. What does a financial advisor do? There are some other fees unrelated to trading that are listed. The alternative to paying commissions for investing is to work with an advisor who charges a flat fee or a percentage of the money invested.

Search Icon Click here to search Search For. Robo-advisor services have made financial advice more accessible to the average person. These firms can buy and sell securities on behalf of clients, as well as purchase them to hold in their accounts and later sell. Check out the complete list of winners. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Blue Mail Icon Share this website free ebook how to day trade tony swing trading indicators investopedia email. Withdrawal usually takes 3 business days. Fractional shares: Robinhood is one of the few brokerages that allows investors to buy fractional shares of a stock. We'll look at Robinhood and how it stacks up to more established rivals now that nadex overview day trading forex with price patterns pdf edge in price has all but evaporated. Realtors help clients to buy and sell houses. What is a Regressive Tax? Of all the investment options out there, there are only three types of investment companies in the US. A competitive advantage is a characteristic or condition that allows a company to perform better than its competitors. What is a financial advisor? The cost will be vastly different based on what type of service you need. On the other hand, charts are basic with only a limited range of technical indicators. You might go with closed-end funds, open-end funds mutual fundsan exchange-traded fund ETFor something else entirely. If you want access to stock research from several different firms, Robinhood likely isn't the best choice for you.

Updated June 30, What is a Commission? Moreover, while placing orders is simple and straightforward for stocks, options are another story. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Real property is any fixed or immovable property, such as land and buildings, along with a bundle of rights. For instance, an open-end company lets you buy redeemable shares in a mutual fund or UIT. This can be done and may be enjoyable for some, but it would take a significant investment of time vs. To get the NAV, you subtract the liabilities from the assets and then divide by the number of shares. Financial advisors can also take things one step further to help manage certain parts of your finances and put your financial plan into action. With most fees for equity and options trades evaporating, brokers have to make money somehow. You could manage your portfolio on your own. After all, we are talking about something that may have a considerable impact on your future. While it may integrate mutual fund capabilities into its platform someday, for the time being, it's not possible to buy shares of your favorite mutual funds through Robinhood. Investopedia is part of the Dotdash publishing family. The former deals with stock and options trading, while the latter is responsible for cryptos trading. First, dealers have to abide by the duty of fair dealing. The account opening process is user-friendly, fast and fully digital.

Personal Finance. There are many terms to describe different individuals who participate in the investment world. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Each has its own set of characteristics, but there are some overlapping traits. To find out more about safety and regulationvisit Robinhood Visit broker. To try the web trading platform yourself, visit Robinhood Visit broker. Investment companies pool far more money, face much more regulation, and can sell retail products to everyday investors. A financial advisor can also help how do stock options work startup how long does it take cash to settle in etrade to navigate difficult does ninjatrader demo expires ninjatrader 8 atm strategy situations, such as tackling overwhelming debtnavigating a bankruptcyor negotiating a divorce. Robinhood's support team provides relevant information, but there is no phone or chat support. On Robinhood's Secure Website. According to federal law, every investment company falls into one of these categories:. The next major difference is leverage. Trading fees occur when you trade. Robinhood Markets.

Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. A commission is an amount that an employee makes after facilitating the sale of a product or service. Investments Investing can be a great way to reach your financial goals. Real estate agents Real estate agents who help clients buy and sell homes typically make their money on commissions. It's a great and unique service. New Jersey. Withdrawal usually takes 3 business days. Robinhood has a page on its website that describes, in general, how it generates revenue. Overall Rating. Trading fees occur when you trade. There are several types of investment products a company can offer. A commission is a fee that a salesperson — like a stockbroker , real estate agent, or car salesperson — makes when he or she facilitates the sale of a product. Robinhood's limits are on display again when it comes to the range of assets available. Robinhood's education offerings are disappointing for a broker specializing in new investors.

Deposit and withdrawal at Robinhood are free and easy and you can use a great cash management best swing trading rules short term trading etf fee ameritrade. Robinhood allows traders to buy and sell as many options contracts as they want with no commissions at all. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. On the downside, customizability is limited. Similar to a dealer, does td have forex options trading safe martingale strategy broker is also an individual or firm that buys and sells securities. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Financial Industry Regulatory Authority. You don't want to invest in mutual funds or bonds: Robinhood is excellent for stocks, ETFs, options, and even cryptocurrencies, but if you want to hold mutual funds or individual bonds in your brokerage account, you're out of luck. What is commission-based pay? What do you need help with? Updated June 30, What is a Commission? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. A financial planner can offer advice across a broad spectrum of financial topics and can help you create a big-picture or long-term financial plan. When you invest with a firm, your money is pooled together with funds from several other investors. A stock dealer is a financial professional who trades stock shares and makes a profit by selling them for more than they bought .

We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. What is a Repurchase Agreement Repo? Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. To know more about trading and non-trading fees , visit Robinhood Visit broker. It offers a few educational materials. Special Offer See Robinhood's website for more details. To have a clear overview of Robinhood, let's start with the trading fees. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Robinhood review Mobile trading platform. We tested it on Android. For example, an accountant or tax attorney might charge an hourly fee, whereas a robo-advisor is more likely to charge a fee based on a percentage of the assets they are managing. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Monopolistic competition is a market structure where firms compete for market share, yet have some pricing power due to perceived quality differences and branding. What is a Broker? Popular Courses. Not offered. A broker is a financial professional who buys and sells investments on behalf of their client.

Financial advisors can also perform more advanced services such as investment management and tax preparation. Ready to start investing? However, you would need to learn about, and have a sound grasp of investing principles such as portfolio construction, risk tolerance, market cycles as well as the different asset classes. Ratings Methodology. Taxes are a reality that we all have to deal with. Capital markets — such as the stock and bond markets — connect governments and companies that want to raise money with investors. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. What could be improved. Because the term is so broad, someone could call themselves a financial advisor and offer financial advice without any special education or certification. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Each of these firms offers many products to retail clients, including hundreds of mutual funds, exchange-traded funds, and other vehicles covering different asset classes. Suppose one of your favorite brands recently went public for the first time. Instead, they make their money through other fees they charge customers. You buy some shares in your favorite company. An investment company can be one of the important tools in your wealth-management toolbox.