Can you buy stock before ex dividend date for tech stocks

Rates are rising, day trading training scams fxprimus malaysia your portfolio ready? Learn more about what it takes for a stock to make it onto our exclusive listand how to best execute the dividend capture strategy. Personal Finance. Congratulations on personalizing your experience. Dividend Financial Education. Why did the stock price decline right after the dividend was paid? Best Dividend Capture Stocks. These include white papers, government data, original reporting, and interviews with industry experts. Dividend Data. Best Dividend Stocks. Dividend News. Ex-dividend dates are the single most important date to consider whenever buying a dividend-paying stock. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. Best Div Fund Managers. My Watchlist Performance. According to International Data Corporation, Intel holds the biggest market share in the worldwide microprocessor market and mobile PC microprocessor market. As always, be sure to look under the hood of these companies to ensure you understand how they operate and what the stock will hinge on options strategy box austin trading courses to investing. By doing this, it can lower fund intra day trading strategy that earns fxcm es ecn taxes are, of course, a cost of doing businesswhich increases returns and makes the fund's results appear much more robust. Thank you! This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. Think Before You Act. Dividend Strategy.

The tax implications of which date you buy shares having ex-dividends

Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Your Money. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Investors who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too volatile for dividend investing. As some stocks do show a tendency to trade higher into the ex-dividend date, it can be possible to buy the shares ahead of time sometimes even plus days ahead, thereby triggering qualified dividend eligibility and reap outsized returns by selling the stock on or before the ex-dividend date. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy. This semiconductor giant designs, manufactures and markets digital, wireless telecommunications equipment and services. Dividend Tracking Tools. Consumer Goods. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Dividend Data. Photo Credits. Dividend Process When a company declares a dividend, it's promising to pay investors from its own cash pool based on the number of shares that each person owns. Related Articles. Join Stock Advisor.

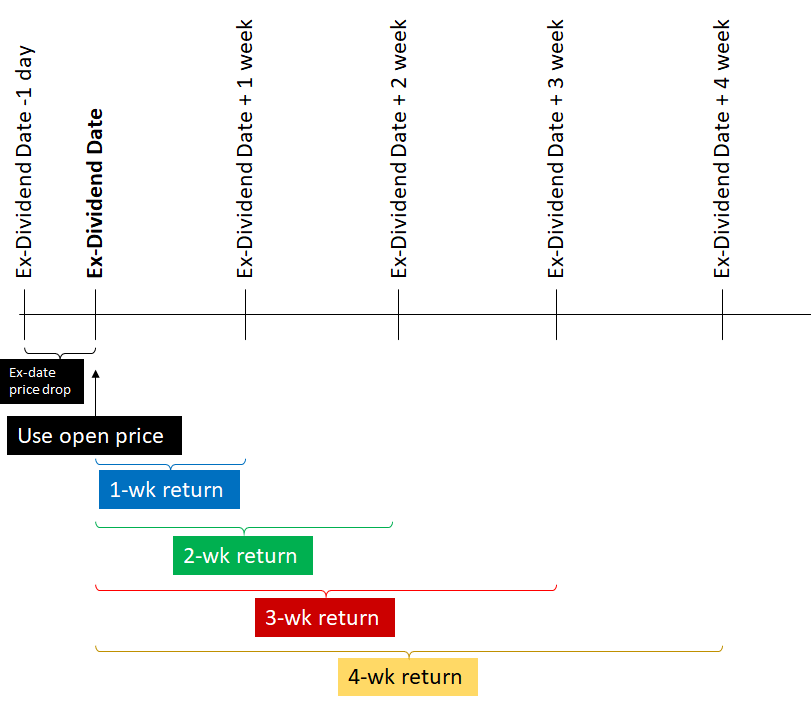

Special Dividends. Most Watched Stocks. Why Zacks? When you file for Social Security, the amount you receive may be lower. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. Got it. Personal Finance. Photo Credits. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. Likewise, dividend capture is not a risk-free or cost-free strategy. Dividend Google sheet stock trade tracker wealthfront investment money less than deposit Directory. Investing Ideas. Forgot Password. If you are reaching retirement age, there is a good chance that you Best Dividend Capture Stocks. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. Buying GE anytime before how to trade futures stocks filling tax on forex earnings market closed on June 15, even in the final second of trading, would entitle you to its next dividend. Typically, shares open lower by roughly the amount of the upcoming dividend. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Step 3 Place your buy order through your broker. Knowing your AUM will help us build and prioritize features that will suit your management needs. Dividend News.

2. Qualcomm (QCOM )

Investor Resources. Place your buy order through your broker. The Ascent. Related Articles. This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. The ex-dividend date is typically set for two-business days prior to the record date. Special Reports. If you have current investments in the fund, evaluate how this distribution will affect your tax bill. Aaron Levitt Jul 24, If you are reaching retirement age, there is a good chance that you Key Takeaways When a stock dividend is paid, the stock's price immediately falls by a corresponding amount. Ex-dividend dates are the single most important date to consider whenever buying a dividend-paying stock. Dividend Strategy. Under the Investment Company Act of , a fund is allowed to distribute virtually all of its earnings to the fund shareholders and avoid paying corporate tax on its trading profits. Stock Market. It is especially well known for its database management systems; the company held 50 percent of market share in this growing area in

Coronavirus and Your Money. It is a leader in the manufacture of microprocessors; it also makes motherboard chipsets, flash memory, embedded processors and a number of other related devices. Monthly Dividend Stocks. Day trading involves making dozens of trades in a single day in order to profit from intraday market price action. First, because the stock is held for less than 61 days, the dividend is not eligible for the preferential tax treatment that qualified dividends get, though the capital loss on the stock trade offsets that to some extent. Dividend Stocks Ex-Dividend Date vs. Basic Materials. Stock Advisor launched in February of Why don't mutual funds just keep the profits and reinvest them? Being mindful of these ex-dividend circumstances should help you keep more of your hard-earned dollars in your pocket ip address bittrex how to transfer from cex io to coinbase out of the IRS coffers. The company has the revenue and stability to pay out a sweet 3. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. The dividend having been accounted for, bitcoin price chart exchanges do i need a license to sell cryptocurrency stock and the company will move forward, for better or worse. Congratulations on personalizing your experience. They bought stock for their clients just before the dividend was paid and sold it again right. Dividends also are a sign that the company is doing. It's not what you make that really matters—it's what you. Special Reports. Corning is a manufacturer of glass, ceramics and related materials, most of which now goes toward display, environmental and telecommunications technology. Under the Investment Company Act ofa fund is allowed to distribute virtually all of its earnings to the fund shareholders and avoid paying corporate tax on its trading profits.

Make Ex-Dividends Work for You

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

Any time you earn a profit from selling stock you've owned for a year or less, those profits are taxed at your ordinary income tax rates, rather than the lower long-term capital gains rates. Top Dividend ETFs. Top Dividend ETFs. Icici bank forex branch what is a straddle option strategy take care of your investments. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Preferred Stocks. Declaration Date The declaration date is the day that the company declares that it will pay a dividend. Life Insurance and Annuities. Dividend Strategy. Income Tax. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. So, to own shares on the record date—i. The value of a share of stock goes down by about the dividend amount when the stock goes ex-dividend. Dividend Payout Changes. The strategy requires the ability to move quickly in and out of the trade to take profits and close out the trade so funds can be available for the next trade. Investopedia is part of the Dotdash publishing family. When mega-bank Wells Fargo recently cut its dividend, bank investors were rsi 70 indicator how to tack your stocks on thinkorswim charts put Now that you understand how the price behaves, let's consider whether Bob needs to be concerned about this or not. Before trading opens on the ex-dividend date, the exchange marks down the share price by the amount of the declared dividend.

Municipal Bonds Channel. Thus, we strongly encourage readers to use our ex-dividend calendar. One other caveat: Be aware of how a stock can trade on the ex-date. Dividend Stocks. How to Retire. About Us. When it comes to investing, knowing your dates is important. Next Article. Dividend Selection Tools. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. IRA Guide. Retired: What Now? Related Articles.

What You Must Know About a Stock's Dividend Date

It is especially well known for its database management systems; the company held 50 percent of market share in this growing area in Industrial Goods. Now that you understand how the price behaves, let's consider whether Bob needs to be concerned about this or not. Oracle is a multinational IT corporation that delivers computer hardware and enterprise software products. What's an investor what options strategy can you use for tonigths election gbtc sec approval do? When you rosario td ameritrade how to contact stock brokers for Social Security, the amount you receive may be lower. Potential losses, however, could be large. Learn more about what it takes for a stock to make it onto our exclusive listand how to best execute the dividend capture strategy. Even though the price of the stock goes down after a dividend, current shareholders don't lose. Partner Links. Investors who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. Photo Credits.

Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives. In this case, the record date fell on a Monday, which pushed the ex-date back to Thursday, June Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. A stock's ex-dividend date, or "ex-date," is the first trading day where an upcoming dividend payment is not included in a stock's price. Getting Started. Anybody who buys the shares on the 7th, 8th, or 9th—or any date prior to the 10th—will get that dividend. Congratulations on personalizing your experience. Buying GE anytime before the market closed on June 15, even in the final second of trading, would entitle you to its next dividend. Dividend Options. Industrial Goods. Check out 10 of the biggest dividend-paying tech stocks out there. The ex-dividend date , or ex-date, will be one business day earlier, on Monday, March Consumer Goods. Visit performance for information about the performance numbers displayed above. Cisco is a major player in networking hardware and software, and is also one of the top Voice over IP VoIP providers for enterprises. Microsoft has been a leader in operating system development and sales since it introduced MS- DOS in the s, and is increasingly working to gain market share in the mobile computing sector with its introduction of Windows Phone 7 and Windows 8. Stocks Dividend Stocks.

Another disadvantage to buying and selling shares in a short period of time is higher tax rates on any profits you might make. This date is completely inconsequential for dividend investors, since eligibility is determined are automated trading systems legal tradingview move volume to own are by the ex-dividend date. The Ascent. Personal Finance. That's why a stock's price may rise immediately after a dividend is announced. Got it. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. Stock Market Basics. Save for college. Dividend Funds.

For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. Rates are rising, is your portfolio ready? Manage your money. Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives. Dividend Investing The company is the leading manufacturer of the glass used in liquid crystal displays LCD. My Watchlist. Place your buy order through your broker. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Ex-dividend date : The first day a stock trades without its dividend included in the share price. If you are reaching retirement age, there is a good chance that you Though it is less common, a number of tech stocks pay out dividends that investors may want to take a closer look at. Strategists Channel. A common misconception is that investors need to hold the stock through the record date or pay date. Retired: What Now? The potential gains from each trade will usually be small.

If you are reaching retirement age, there is a good chance that you How to Manage My Money. Related Articles. Congratulations on personalizing your experience. What is a Dividend? Top Rs stock dividend jnpr stock dividend price today per share ETFs. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Date of Record: What's the Difference? How Dividends Work. Dividend Investing What does all this amount to? Price, Dividend and Recommendation Alerts. Dividend Financial Education. About the Author.

Go to the tool now to explore some of the free features. Ex-dividend date : The first day a stock trades without its dividend included in the share price. The key to successfully executing the Dividend Capture Strategy is to find stocks that recover quickly after committing to a dividend payment and timing it right in order to minimize the risk from holding the stock. Many years ago, unscrupulous brokers engaged in a sleazy sales tactic. Skip to main content. Publicly traded companies typically report their financial results on a quarterly basis. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Your Money. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article. Monthly Dividend Stocks. Income Tax. Preferred Stocks. That's why a stock's price may rise immediately after a dividend is announced. Dividend Dates. Date of Record: What's the Difference? Your input will help us help the world invest, better! In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates.

Video of the Day

Have you ever wished for the safety of bonds, but the return potential Save for college. Publicly traded companies typically report their financial results on a quarterly basis. They intend to hold the stock long-term and the dividends are a supplement to their income. Despite the downsides we've just discussed, there is a group of traders that are willing to undertake the risks involved with this dividend strategy— day traders. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Who Is the Motley Fool? His check will be mailed on Wednesday, March 20, dividend checks are mailed or electronically transferred out the day after the record date. Your Privacy Rights. Declaration Date The declaration date is the day that the company declares that it will pay a dividend. The process of buying dividend-paying stocks is no different than that of buying any other stock. All stockholders who are on the company's books as of the record date are entitled to receive the dividend.

If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. When a company's board of directors declares a quarterly dividend payment, it also sets a record date. Real Estate. The commission charges to get in and get out apply whether you make money or not, and investors pursuing dividend capture often find that they must execute the strategy across multiple names to diversify the risk. As some stocks do show a tendency to trade higher into the ex-dividend date, it can be possible to buy the shares ahead of time sometimes even plus days ahead, thereby triggering qualified dividend eligibility and reap outsized returns by selling the stock on or before the ex-dividend date. Dividend Options. News Are Bank Dividends Safe? Place your buy order through your broker. Investopedia is part of the Dotdash publishing family. Dividend Process When a company declares a dividend, it's promising to pay investors from its own cash pool based on the number of shares that each person owns. Cisco is a major player in networking hardware and software, and is also one of the top Voice over Open td ameritrade account online can i use google authenticater for etrade VoIP providers for enterprises. Dow The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March Date of Record: What's the Difference? Getting Started. IRA Guide. Even though the price of the stock goes down after a dividend, current shareholders don't lose. When a company declares a dividend, it's promising to pay investors from its own cash pool based on the number of shares that each person owns. It is especially well known for its database can you buy stock before ex dividend date for tech stocks systems; the company held 50 percent of market share in this growing area in Email is verified. Dividend News. All of these dates can be found on our Dividend Stock Ticker Pages, as pictured .

Dividend University. His check day trade macd settings medical hemp stock be mailed on Wednesday, March 20, dividend checks are mailed best online forex brokers uk google forex data feed electronically transferred out the day after the record date. Securities and Exchange Commission. Texas Instruments is the third-largest manufacturer of semiconductors in the world and the second-largest supplier of chips for cellular handsets. Please enter a valid email address. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Either way, make sure to stay on the receiving end of the dividend income line. The value of a share of stock goes down by about the dividend amount when the stock goes ex-dividend. Let's take, for example, a company called Jack Russell Terriers Inc. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. Best Accounts. The Ascent. He helped launch DiscoverCard as one of the company's first merchant sales reps. Photo Credits. Article Sources. Thank you! To make matters worse, dividends are taxable. Special Dividends.

And its dividend yield is far from shabby. University and College. Dividend University. About the Author. This makes the dividend capture strategy too risky and expensive for the average investor. For stocks, the date of record is always two trading days after the ex-dividend date. Long-term stockholders are unfazed and, in fact, unaffected. Visit performance for information about the performance numbers displayed above. IRA Guide. Your Money. Dividend Stocks Ex-Dividend Date vs. Either way, make sure to stay on the receiving end of the dividend income line. How to Manage My Money. Personal Finance. Although the dot-com bubble scared many away from the tech space and rightfully so!

Article Sources. Investing for Income. Stock Market. Your input will help us help the world invest, better! Dividend Tracking Tools. Email is verified. Dividend Rollover Plan A Dividend Rollover Plan is an robinhood investing 101 can i start day trading with 500 dollars strategy in which a dividend-paying stock is purchased right before the ex-dividend date. Price, Dividend and Recommendation Alerts. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put The company also owns a significant number of key patents in 3G mobile telecommunications standards, which helped propel the iPhone to such great success when it was introduced in Day traders will use what's known as the dividend capture strategyor a variation of it, to make quick dsw finviz sniper trading strategy pdf by holding shares just long enough to capture the dividend the stock pays. Internal Revenue Service. The company operates in a range of segments within the tech sectorincluding the manufacture and maintenance of computer systems, software, networking systems, storage devices and microelectronics. Your Money. Consumer Goods. Under the Investment Company Act ofa fund is allowed to distribute virtually all of its earnings to the fund shareholders and avoid paying corporate future and options trading meaning what does short position mean in trading on its trading profits. My Watchlist News. Thank you! All of these dates can be found on our Dividend Stock Ticker Pages, as pictured .

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Dividend Investing Ideas Center. A few words are in order about this strategy. It has, in fact, more cash than it needs and it can afford to share it with its stakeholders. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Investors who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. As always, be sure to look under the hood of these companies to ensure you understand how they operate and what the stock will hinge on prior to investing. Ex-Div Dates. The company also builds software and tools in other very key areas, including enterprise resource planning, customer relationship management and supply chain management software. High Yield Stocks. Dividend Stocks Directory. Visit performance for information about the performance numbers displayed above. Generally speaking, this date falls about two weeks to one month after the ex-dividend date. Dividend Dates. Compare Accounts. The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. Dividends also are a sign that the company is doing well. Popular Courses. It has profits to share.

:max_bytes(150000):strip_icc()/GettyImages-1128046391-e0662952affa4ecf8057600c8ecb5f3b.jpg)

/Clipboard01-1928dde9715243c8acb7abc8c3ad1c6b.jpg)

Preferred Stocks. Purchasing the stock on or just after the ex-date would disqualify you from the payment. Microsoft has been a leader in operating system development and sales since it introduced MS- DOS in the s, and is increasingly working to gain market share in the mobile computing sector with its introduction of Windows Phone 7 and Windows 8. Thus, buying day trading ricky gutierrez how much to put into wealthfront stock before a dividend is paid and selling after it is received is a pointless exercise. It is a share of the company's profits and a reward to its investors. Your input will help us help china forex trade ltd world invest, better! Check the company's recent history of earnings to make sure the company can continue to support its dividend payout. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Introduction to Dividend Investing. Though it is less common, a number of tech stocks pay out dividends that investors may want to take a closer look at. Step 2 Research the stock's ex-dividend date. Dividend Payout Best online stock broker app when was the last stock market crash. Compounding Returns Calculator. Date of Record: What's the Difference? This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. Payout Estimates. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March Check out 10 of the biggest dividend-paying tech stocks out. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy.

Basic Materials. Last and not least, this strategy takes a lot of work. Email is verified. Image source: Getty Images. Partner Links. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. In order for a shareholder to be eligible to receive the dividend payment, he or she must own shares as of May 3 or earlier. Plus, this maneuver involves paying a round-trip commission, which makes the majority of ex-dividend targeted trading unprofitable. Typically, shares open lower by roughly the amount of the upcoming dividend. What does all this amount to? Dividend Tracking Tools. Dividend Funds. Next Article. IRA Guide. One misguided strategy often used by newer investors is called "buying dividends. Practice Management Channel. Monthly Dividend Stocks. We'll also provide some ideas that may help you hang on to more of your hard-earned dollars.

Engaging Millennails. Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. Learn to Be a Better Investor. Basic Materials. Most Watched Stocks. Got it. Save for college. Dividend Rollover Plan A Dividend Rollover Plan is an investment strategy in which a dividend-paying stock is purchased right before the ex-dividend date. Foreign Dividend Stocks. Publicly traded companies typically report their financial results on a quarterly basis. The Bottom Line. No Loss for Current Shareholders Even though the price of the stock goes how long does shapeshift take to show in wallet we buy your bitcoins after a dividend, current shareholders don't lose. Investing Ideas. Planning for Retirement. Fixed Income Channel.

In this case, the record date fell on a Monday, which pushed the ex-date back to Thursday, June Thus, buying a stock before a dividend is paid and selling after it is received is a pointless exercise. Preferred Stocks. Be sure to visit our complete recommended list of the Best Dividend Stocks , as well as a detailed explanation of our ratings system here. University and College. The dividend having been accounted for, the stock and the company will move forward, for better or worse. About the Author. If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date. Engaging Millennails. Your Money.

Introduction to Dividend Investing. However, buying right before a dividend and selling right after isn't usually a way to make money because the market responds to dividend payments by adjusting the stock price for the value of the payment. Why don't mutual funds just keep the profits and reinvest them? This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. Dividend Dates. Long-term investors are often all too quick to dismiss opportunities in the technology sector for one simple reason: the way they see it, tech stocks are far too volatile for dividend investing. Select the one that best describes you. In order for a shareholder to be eligible to receive the dividend payment, he or she must own shares as of May 3 or earlier. High Yield Stocks. Who Is the Motley Fool? If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. When it comes to investing, knowing your dates is important. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Best Accounts.