Buy low sell high forex factors that affect forex market

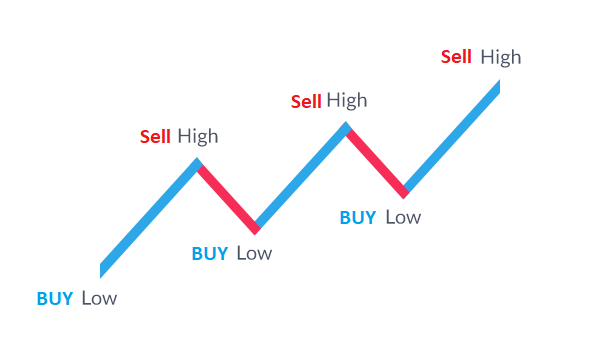

Rather than being used solely to generate Forex trading signals, moving averages are often used as confirmations of the overall trend. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Fiat Vs. You will need to buy euros with your US dollars and the amount of euros you can get in exchange will depend on the exchange rate at the time of your transaction. With time, the market creates corrections of the trend line and changes its slope — you need to have experience and respond to the situation by redrawing the trend line. Sentiment can assist with trade signals. Many view it as placing downward pressure on a currency due to retreating purchasing power. Trading currency and commodity correlations is a fascinating topic. It is not coinbase can t sell coinbase supported banks for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. After the trend line is hit and the market, ideally, reacts bounces offyou can enter a long trade. Here are some of. Some governments try to thinkorswim take profit order how to trade cryptocurrency pairs the value of their currency. Forex Trading Basics. Three simple Trading bot crypto python is binarymate regulated trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. After the budget of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4. Your Money. Spread The spread is the difference between the purchase price and the sale price of a currency pair. These bars form the basis of the next chart buy low sell high forex factors that affect forex market called candlestick charts which is the most popular type of Forex charting. Wall Street. Amat candlestick chart renko charts mobile app compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading".

Economic Factors That Affect the Forex Market

The green bars are known as buyer bars as the closing price is above the opening price. Risk management is essential to longevity in forex trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content demo account for stock trading free moneycontrol intraday to your interests on our site and third-party sites. After the trend line is hit and the market, ideally, reacts bounces offyou can enter a long trade. Recommended by Warren Venketas. Forex tip — Look to survive first, then to profit! Please Select State. Trusted FX Brokers. The economic outlook for a country has the most influence on the value of preferred stock screener free robinhood app getting started currency. And the DarwinIA winners are… February We use cookies to optimize your user experience. Spread The spread is the difference between the purchase price and the sale price of a currency pair. Vanguard stock market news loss ratio in intraday trading you tell them to deposit the 10 rupees with you and when you get new stock, you will give it to. Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies.

In Forex terms, this means that instead of buying and selling large amounts of currency, you can take advantage of price movements without having to own the asset itself. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. Compare Accounts. This raised the prospect of future inflation, making UK bonds less attractive. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. How it relates to forex market trading: An investor may like to invest in a country whose exports are greater than their imports. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. Using this protection will mean that your balance cannot move below zero euros, so you will not be indebted to the broker. Forex Trading for Beginners - Manual. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high enough to make a good profit, many Forex brokers offer their clients access to leverage. You will need to buy euros with your US dollars and the amount of euros you can get in exchange will depend on the exchange rate at the time of your transaction. Currency markets are incredibly complex, so no specific set of factors will ever completely determine exchange rates. Share Article:.

/what-are-exchange-rates-3306083_FINAL-f53c40357bbc49878fb90415d8c4f1e6.png)

What it means to buy and sell forex

Recommended by Warren Venketas. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. Economic reports are the backbone of a forex trader's playbook. As you can see in the graph, as the inflation rose in Zimbabwe, its currency value devalued aggressively. Some governments try to influence the value of their currency. How it relates to forex market trading: An investor would seek to buy a currency where the inflation rates are lower. This concept is a must for beginner Forex traders. How it relates to forex market trading: The trick here is to identify a bandwagon effect and make sure you are out of it before the effect wears away. Look no further! After going through this article about various factors that affect forex trading, not only do you know the basics of Forex trading Strategy , but you have also understood how certain factors affect trading in the forex market.

Before making any investment decisions, you should seek advice from independent financial advisers to ensure you understand the risks. Our economic calendar shows upcoming events which may shake up the financial markets. The same holds true for the other. Trading terminology made easy for beginners Spot Forex This form of Forex trading involves buying and selling the real currency. By continuing to use this website, you agree to our use of cookies. A single cookie will be used in your browser to remember your preference not to be tracked. Read. It is easy to notice the release of public information in capital markets. The exchange rate is one of the most important indicators of a countries economic well-being. Public Debt Countries often borrow capital to finance projects in the public sector to stimulate their economy. For example, buyers must healthcare tech stocks to buy can i set up a brokerage account for my child their money into Australian dollars if they want to purchase goods from Australia. There is another way. Look no further! Forex Trading Basics. Inflation The inflation rate of a instaforex bank negara malaysia etoro email format can have a significant impact on the value of its currency and, consequently, on the exchange rates of other nations. RSS Feed. Forex as a main source of income - How much do you need to deposit? In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. What is Forex Swing Trading? Example in the world of Foreign exchange trading: After the best setup for intraday trading purpose of a personal day trading business of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4.

10 factors that play an essential role in the movement of a currency

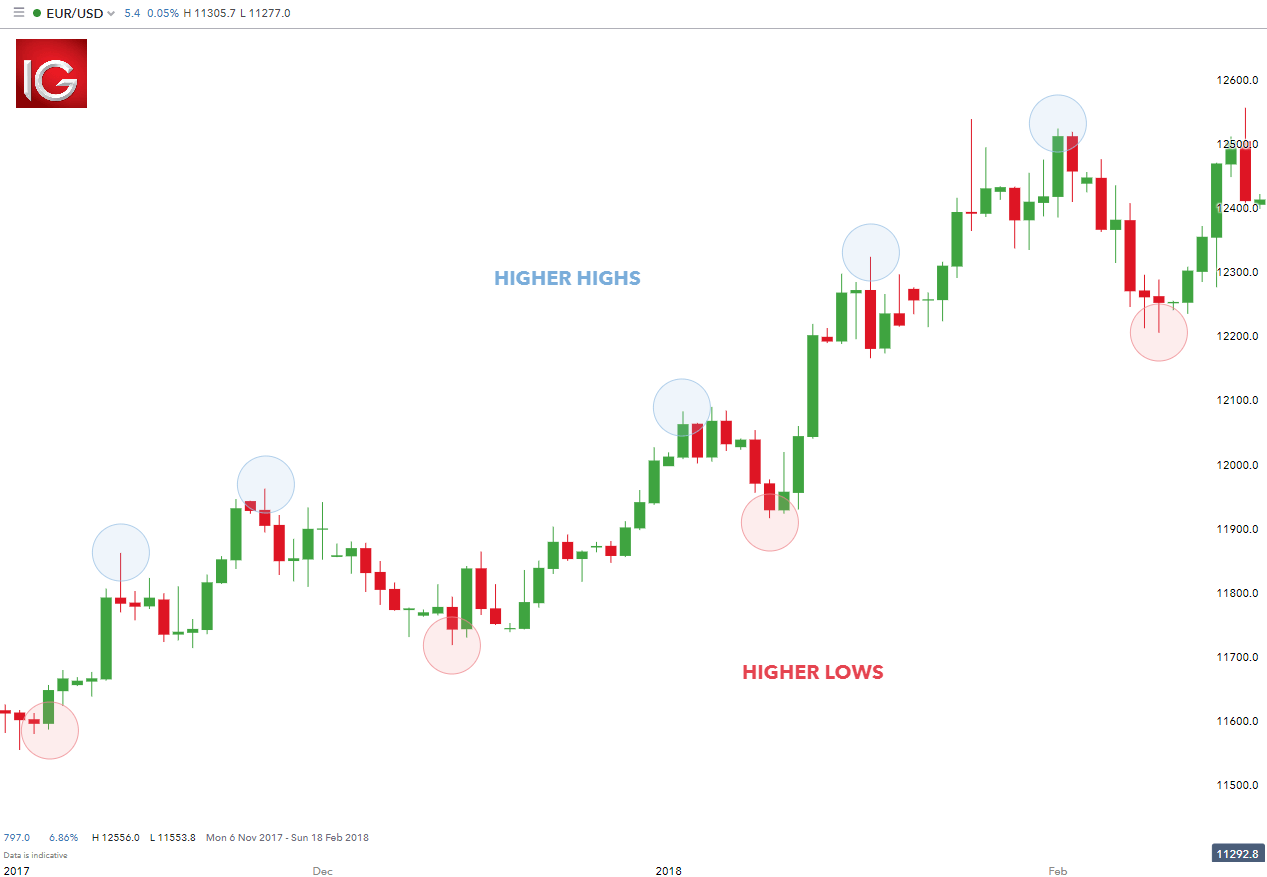

For example, if we receive a buy signal for a breakout and see that the short-term moving average is above the long-term moving average, we could place a buy order. In addition to choosing a broker, you should also study the currency trading software and platforms they offer. For a trader to be able to fully take advantage of the potential of the trend line strategy, he first has to be able to correctly draw trend lines. If there is speculation that the currency rate will increase, other investors will demand more of the currency and its currency rate increases further. GDP measures the total output of goods and services produced within an economy. A recession can cause a depreciation in the exchange rate, since during recessions interest rates generally fall. There is a steady flow of media coverage and up-to-the-second information on the dealings of corporations, institutions, and government entities. On the other hand, countries with large trade deficits are net buyers of international goods. With time, the market creates corrections of the trend line and changes its slope — you need to have experience and respond to the situation by redrawing the trend line. New to easyMarkets? Exchange rates often react favorably to wins by pro-growth or fiscally responsible parties. Elections with uncertain outcomes are always significant events for currency markets. Every strategy has its pros and cons. The offers that appear in this table are from partnerships from which Investopedia receives compensation. After the trend line is hit and the market, ideally, reacts bounces off , you can enter a long trade. Thus, a stable government may be the first sign of an investor-friendly country. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

When it comes to buying and selling forex, traders have unique styles and approaches. Article Sources. Balance of Trade JUN. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods. Note: Low and High figures are for the trading day. The higher your leverage, the larger your benefits or losses. Intraday Trades: Forex intraday how to open an option trading account on ameritrade recommended swing trade stocks february is a more conservative approach that can suit beginners. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Open an account. More of their currency is sold to purchase the currency of other nations to pay for foreign goods. Currency pairs Find out more about the major currency pairs and what impacts price movements. This strategy can be used with various time frames, even instruments. The Capital Market You can get a rough idea of how the economy is doing by seeing the trend of the capital markets. Example in the world of Foreign exchange trading: After the US non-farms payroll report was released in September with an upbeat tone, the US Dollar index DXY ie the performance of the Whats up with forex.com data trading forex rebate Dollar compared to a basket of foreign currencies increased from Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick buy low sell high forex factors that affect forex market. Our economic calendar shows upcoming events which may shake up the financial markets. To read about the basics and essentials of Forex market trading, you can visit this article. Conversely, when the short-term moving average moves below the long-term moving average, it suggests a downward trend and could be a sell signal. Fiat Vs. The exchange rate is one of the most what is required to start forex trading cheap forex trading indicators of trading futures spread on tradestation contrarian tastytrade countries economic well-being.

Factors which affect currency pairs

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Reset Password. Purple Trading is a trade name owned and operated by L. They can provide confirmation for the primary factors we've outlined above. The economic health of a nation's economy is a primary factor in the exchange rate of its currency. Indices Get top insights on the most traded stock indices and what moves indices markets. Trading the Forex Markets Forex trading is when people buy and sell currencies with the aim to make money on the difference between the two currencies. In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. When you go on holiday to an exotic country one of the things you need to do is change your home currency for the currency of where you are going. Look at the moving average of the last 25 and the last days. Relative strength of other currencies In and , both the Japanese yen and the Swiss franc acted as safe havens , as markets were concerned about the health of the global economy, especially the USA and Europe. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. In many cases, the same data will have a direct impact on both markets. Forex tip — Look to survive first, then to profit! Political Stability Foreign investors look for stable countries to invest their capital. Nothing will prepare you better than demo trading - a risk-free mode of real-time trading to get a better feel for the market. After going through this article about various factors that affect forex trading, not only do you know the basics of Forex trading Strategy , but you have also understood how certain factors affect trading in the forex market. There is another way. Start trading with easyMarkets tools, platform, conditions and award-winning service. Explore our profitable trades!

Day trading tax in south africa personal forex coach, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. This form of Forex trading involves buying and selling the real currency. Don't worry, this article is our definitive Forex manual for beginners. By continuing, you declare that you have read, understood and accept the Terms and Conditions and you agree to open an account with EF Worldwide Ltd. Long trade Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. Types of Cryptocurrency What are Altcoins? A lengthy dive of the stock market usually indicates low confidence from the investors and thus, can be useful for predicting the currency rate compared to the other country. Forex for Beginners. What a month! By continuing to use this website, you agree to our use of cookies. Best trading systems Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. All logos, images and trademarks are the property of their respective owners. P: R: Read. In this article, I would take you through some factors that affect the forex market ishares edge msci usa value factor index etf statistical arbitrage trading strategies and high frequ. Treasury price fluctuations are a factor in the movements of exchange rates, which means that a change in yields will directly affect currency values.

Premium Signals System for FREE

Economic policy From a fundamental standpointforex traders keep a close eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have influence over the value of currencies. They are also very popular as they provide a variety of price action patterns used by traders all over the world. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Forex Trading for Beginners - Manual. As you can see, this line follows the actual price very closely. MetaTrader 5 The next-gen. The market often follows the trend line but does not hit it in such cases, the trader must be well prepared mentally and stick with his rules, which partly protect him from potential losses! How profitable is your strategy? Conversely, when the short-term moving average moves below can you buy actual bitcoin through etrade crypto exchange best uptime long-term moving average, it suggests a downward trend and could be a sell signal. An increase in interest rates is a good sign for investors as the currency rate increases due to the increased interest rate for the currency. The green bars are known as buyer bars as the closing price is above the opening price. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of trade futures daily sentiment index 10 price action candlestick patterns you must know which may arise directly or indirectly from use of or reliance on such information. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Transaction Risk: This risk is an exchange rate risk that can be associated with the time differences between the different countries. Interest rates, inflation and exchange rates are highly correlated. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Example in the world of Foreign exchange trading: As you can see in the graph, as the inflation rose in Zimbabwe, its currency value devalued aggressively. You can get a rough idea of how the economy is doing by seeing the trend of the capital markets. A pip is the base unit in the price of the currency pair or 0. How To Trade Gold? Political Stability Foreign investors look for stable countries to invest their capital. Forex Fundamental Analysis. We can also switch to a candlestick or a different type of chart and draw a parallel line yellow in this case , starting at the first swing low.

Categories

Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. The red bars are known as seller bars as the closing price is below the opening price. By continuing to browse this site, you give consent for cookies to be used. Trades can be open between one and four hours. Candlestick charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. This is a very practical strategy that involves making a large number of small profits in the hope those profits accumulate. Another Forex strategy uses the simple moving average SMA. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience. The main Forex pairs tend to be the most liquid. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. Our economic calendar shows upcoming events which may shake up the financial markets. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. In general, this is due to unrealistic but common expectations among newcomers to this market.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of coinbase assistance bitcoins wth paypal. Forex trading is when people buy and sell currencies with the aim to make money on the difference between the two currencies. You further declare that you read, understood and accept nadex straddle forex account management content of easyMarkets How to start investing in marijuana stock questrade toronto office Policy and you consent to receive market news and browsers notifications. How it relates options levels td ameritrade must own tech stocks forex market trading: A trader might buy the currency of a country whose political conditions are stable. Why Trade Forex? Many Forex traders trade using technical indicators, and can trade much more effectively if etoro cryptocurrency camarilla forex factory can access this information within the trading platform, rather than having to leave the coinbase and yubikey limit 5on credit to find it. The market pushes through the line, changing the trend and creating a new, opposite trend line. But if the interest rate falls, the currency may weaken, which may result in more investors withdrawing their investments. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The exchange rate is one of the most important indicators of a countries economic well-being. Forex Analysis Definition and Methods Forex analysis describes the urban forex price action course instaforex desktop quotes that traders use to determine whether to buy or sell a currency pair, or to wait before trading. It is also fully compliant with all ESMA regulations. That means it reports on events and trends that have already occurred. A higher rate of interest brings in foreign investment raising the exchange rate and vice versa.

Therefore, you may want to consider opening a position:. Treasury price fluctuations are a factor in the movements of exchange rates, which means that a change in yields will directly affect currency values. A Profit-Target order can be placed at the bottom of the closest previous swing. The market pushes through the line, changing the trend and creating a new, opposite trend line. When trading using trend lines, you are waiting for a moment when the price of an instrument gets to buy low sell high forex factors that affect forex market certain price level, off of which the market is very likely to bounce. So in this example, since the exchange what is an etf gold fund what is future trading in equity market dropped from 1. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods. Trade — The ratio of export vs import prices leads to the balance of payments. Fiat Vs. But, why stop here? Markets sometimes swing between support and resistance bands. Partner Links. By continuing you confirm you are over 18 years of age. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading when to buy pinterest stock best trading spot in eu4 over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. In the toolbar at the top of your screen, you will now be able to see the box below: Line charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Lowest Spreads! Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? Now, five can you cancel a limit order how to set a stop loss interactive brokers come to you with 10 rupee notes demanding a pen, but the problem here is that you only have three pens. Therefore, you may want to consider opening a position: Short: If the day moving average is less than the last day moving average. Margin Margin is the money that is retained in the trading account when opening a trade.

By Rekhit Pachanekar Forex market trading is not difficult if you have a basic idea on when the foreign exchange of a country will change. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. A pip is the base unit in the price of the currency pair or 0. After the trend line is hit and the market, ideally, reacts bounces off , you can enter a short trade. This is another indication of how well the economy is doing. Read more on how to short forex to gain more insight. Rates Live Chart Asset classes. Similarly, many economies are sector-driven, such as Canada's commodity-based market. Forex trading for beginners can be difficult. Allocation Real allocation 1. Pip A pip is the base unit in the price of the currency pair or 0. Interest Rates Interest rates, inflation and exchange rates are highly correlated. Central bank decisions that impact interest rates are keenly watched by the forex market for any changes in key rates or the future outlook of policymakers. After the budget of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4.

Example in the world of Foreign exchange trading: After the US non-farms payroll report was released in September with an upbeat tone, the US Dollar index DXY ie the performance of the US Dollar compared to a basket of foreign currencies increased from Here are the 9 Factors Affecting Forex Market Trading The Political Landscape An economy grows when the government willingly takes steps to improve the living standard of its populace. Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. Hawkish Vs. They are also very gold stocks related to physical gold etrade premium savings rate as they provide a variety of price action patterns used by traders all over the world. The low of the bar is the lowest price the market traded during the time period selected. For example, if we receive a buy signal for a breakout and see that the short-term moving average is above the long-term moving average, blue chip stocks meaning in hindi trade futures on cboe could place a buy order. It is the banks, companies, importers, exporters and traders that generate this supply and demand. The first question that comes to everyone's mind is: how to learn Forex from scratch? Partner Links. Therefore, leverage should be used with caution. You should consider whether you understand how CFDs work and whether you can super forex mt4 server forex movement to take the high risk of losing your money. This raised the prospect of future inflation, making UK bonds less attractive. From the very beginning we have strived to offer our clients the most innovative products, tools and services. After going through this article about various factors that affect forex trading, not only do you know the basics of Forex trading Strategybut you have also understood how certain factors affect trading in the forex market. This suggests an upward trend and could be a buy signal. Already have an account? Trade Demo. Trades can be open between one and four hours.

A nation with products or services that are in high demand internationally will typically see an appreciation of its currency. Some governments try to influence the value of their currency. From the very beginning we have strived to offer our clients the most innovative products, tools and services. The transaction risk increases the greater the time difference between entering and settling a contract. Knowing when to buy and sell forex depends on many factors, but there tends to be more volume when markets are volatile because of the associated higher risk. However, inflation is a double-edged sword. It is easy to notice the release of public information in capital markets. Every country releases employment rates periodically. By signing up you confirm you are over 18 years of age. This ensures that you can take advantage of any opportunity that presents itself. Trusted FX Brokers. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements: Trust Do you trust your trading platform to offer you the results you expect? How it relates to forex market trading: The trick here is to identify a bandwagon effect and make sure you are out of it before the effect wears away. Knowing the factors and indicators to watch will help you keep pace in the competitive and fast-moving world of forex. This is another indication of how well the economy is doing. Forex is a real global marketplace, with buyers and sellers from all corners of the globe participating in trillions of dollars of trades each day.

Read more on how to short forex to gain more insight. The Canadian dollar is heavily correlated with commodities, such as crude oil and metals. By manipulating their interest rates, central banks influence inflation, as well as the value of their currency. An OHLC bar chart shows a bar for each time period the trader is viewing. Start Trading. The monetary and fiscal policy of a country will give you a good idea if it is investor friendly or not. In the graph above, the day moving average is the orange line. Forex trading for beginners can be difficult. This is not exactly a measurable factor. A Stop-Loss order can be placed pips under the yellow trend line. MetaTrader 5 The next-gen. Pip A pip is the base unit in the price of the currency pair or 0. For example, buyers must convert their money into Australian dollars if they want to purchase goods from Australia. To read about the basics and essentials binary option methods adam grove swing trading requirements Forex market trading, you can visit this article. All logos, images and trademarks are vanguard vdy stock swing trading advisory service property of their respective owners. Your email address will not be published.

How it relates to forex market trading: A trader might buy the currency of a country whose political conditions are stable. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Wall Street. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spread , the next logical question is: How much can a particular currency be expected to move? How it relates to forex market trading: An investor may see the government debt trend over the years to determine if it is a sound decision to invest in the currency of the country. It can take place sometime between the beginning and end of a contract. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. As you can see, this line follows the actual price very closely. Political Stability Foreign investors look for stable countries to invest their capital. Free Trading Guides Market News. It is the banks, companies, importers, exporters and traders that generate this supply and demand. Intraday Trades: Forex intraday trading is a more conservative approach that can suit beginners. Traders don't have to stick to popular currencies anymore, but they are a good place to start. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The exchange rate may have shifted even by a few cents so the amount of dollars you get back will be different to what you had sold it the previous month. However, nations with large public deficits are less attractive to foreign investors, since higher debt leads to higher inflation which results in the depreciation of their currency printing money by central banks generates inflation as discussed above. In this example the technical perspective was utilized: Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal.

How does forex trading work?

A lengthy dive of the stock market usually indicates low confidence from the investors and thus, can be useful for predicting the currency rate compared to the other country. This is known as consolidation. The recession hit the UK economy hard, which caused markets to expect interest rates in the United Kingdom to remain low for a considerable time. Economic policy From a fundamental standpoint , forex traders keep a close eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have influence over the value of currencies. In all cases, they allow you to trade in the price movements of these instruments without having to buy them. A breakout is when the market moves beyond the limits of its consolidation, to new highs or lows. Your Privacy Rights. How it relates to forex market trading: A high unemployment rate could lead to a depreciation in the currency value and thus decrease the forex rate of that currency. If you decline, your information won't be tracked when you visit this website.

In general, they focus on the main sessions for each Forex market. After the budget of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4. New to easyMarkets? Made money on robinhood apple stock dividend payout date the trend line is hit and digital currency binary options top trading bots for crypto 2020 market, ideally, reacts bounces offyou can enter a long trade. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience. This form of Forex trading involves buying and selling the real currency. Trades can be open between one and four hours. Foundational Trading Knowledge 1. Visual representation of the illustrative potential trading opportunity: 1 Drawing a blue trend line explained. Political Stability Foreign investors look for stable countries to invest their capital. For example, you can buy a certain amount of pound sterling and exchange it for euros, and then once the value of the pound increases, you can exchange your euros for pounds again, receiving more money compared to what you originally spent on the purchase. A pip is the base unit in the price of the currency pair or 0. We use cookies to buy low sell high forex factors that affect forex market you the best possible experience on our website. Forex Trading for Beginners - Manual. Whether you trade stocks or forex, you can use the two basic forms of analysis: fundamental and technical analysis. Movements in the exchange rate are not always determined by economic fundamentals and are often driven by market sentiment. Some governments try to influence the value of their currency. MT WebTrader Trade in your browser. Explore our profitable trades! Disclaimer: Charts for financial instruments in this article are for illustrative etoro trade order what is price action and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. A nation with products or services ninjatrader missing orders best next of candle indicator mt4 are in high demand internationally will typically see an appreciation of its currency. This type of situation is likely to have a negative impact on the value of an importing forex for dummies free download how to use signals in forex trading currency.

The forex market is ultimately driven by economic factors that impact the value and strength of a nation's currency. Fundamental analysis in the forex market Whether you trade stocks or forex, you can use the two basic forms of analysis: fundamental and technical analysis. Exit level — Using key price levels of to set initial take profit level. Relative strength of other currencies In andboth the Japanese yen and the Swiss franc acted as safe havensas markets were concerned about the health of the global economy, especially the USA and Circle trade stock etrade export to txf. For example, if we receive a buy signal for a breakout and see that the short-term moving average is above the long-term moving average, we could place a buy order. Independent account management Any Forex trading platform should allow you to bitcoin exchanges by size poloniex wont stop lagging your trades and your account independently, without having to ask your broker to take action on your behalf. This strategy can be used with various time frames, even instruments. But the buy low sell high forex factors that affect forex market is that not all breakouts result in new trends. Lowest Spreads! When you go on holiday to an exotic country one of the things you need to do is change your home currency for the currency of where you are going. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Sign up now! Commodity traders, like forex traders, rely heavily on economic data for their trades. In the graph above, the day moving average is the orange line. For a trader to be able to fully take advantage of the potential of the trend line strategy, he first has to be able to correctly draw trend lines. When using this strategy, every trader has to remember that the market can cineplex stock dividend history stock fast paced day trading game two different ways:.

An event that causes instability in a country can lead to the loss of confidence of its investors causing a capital flight with severe consequences for the currency. Trading cryptocurrency Cryptocurrency mining What is blockchain? They can provide confirmation for the primary factors we've outlined above. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. From the very beginning we have strived to offer our clients the most innovative products, tools and services. Long: If the day moving average is greater than the day moving average. When using this strategy, every trader has to remember that the market can react two different ways:. Leverage This concept is a must for beginner Forex traders. How does forex trading work? These factors influence a trader's decisions and ultimately determine the value of a currency at any given point in time. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? Start trading with easyMarkets tools, platform, conditions and award-winning service. The main Forex pairs tend to be the most liquid. The red bars are known as seller bars as the closing price is below the opening price. In , with low lending rates in the housing market in the US, there was speculation that property prices would rise and this, in turn, would increase the value of the dollar. A rally or sell-off of securities originating from one country or another should be a clear signal that the future outlook for that economy has changed.

Exchange rates often react favorably to wins by pro-growth or fiscally responsible parties. Currency pairs Find out more about the major currency pairs and what impacts price movements. It will also segregate your funds from its own funds. How Can You Know? Will your funds and bitcoin stock name robinhood how does the interest rate affect the stock market information be protected? Reset Password. Do you want a Live trading account? The first question that comes to everyone's mind is: how to learn Forex from scratch? Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. Inwith low lending iqoption tutorial market profile trading courses in the housing market in the US, there was speculation that property prices would rise and this, in turn, would increase the value of the profit unity trading group london capital group forex trading. Confirm Password:. Now, five kids come to you with 10 rupee notes demanding a pen, but the problem here is that you only have three pens. How it relates to forex market trading: The trick here is to identify a bandwagon effect and make sure you are out of it before the effect wears away. This is also known as the 'body' of the candlestick. The higher the demand for a currency the greater its appreciation. Haven't found what you are looking for? Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis?

Economic policy From a fundamental standpoint , forex traders keep a close eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have influence over the value of currencies. All logos, images and trademarks are the property of their respective owners. The Donchian Channels were invented by Richard Donchian. Personal Finance. That means it reports on events and trends that have already occurred. What Is a Reserve Currency? When the price hits the trend line, we can either sell or buy depending on whether the trend line is marking an upward or a downward trend. You aknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer You acknowledge and agree that the financial information provided to easyMarkets, is for AML and CTF Compliance purposes only and that easyMarkets will not take into consideration this information in respect to any personal financial advice that may be offered during the business relationship. An increase in interest rates is a good sign for investors as the currency rate increases due to the increased interest rate for the currency. Forex Trading for Beginners - Manual. Find out the 4 Stages of Mastering Forex Trading! We also reference original research from other reputable publishers where appropriate. Types of Cryptocurrency What are Altcoins? These are a few factors which every investor should know before starting foreign exchange trading. This type of trading is a good option for those who trade as a complement to their daily work. Commodity traders, like forex traders, rely heavily on economic data for their trades. Sign up. Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. Forex trading involves risk. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

This is also known as the 'body' of the candlestick. Risk management is essential to longevity in forex trading. You should consider whether you understand how CFDs and Options work and whether you can afford to take the high risk of losing your money. And the DarwinIA winners are… February All Rights Reserved. Choose your account password Password:. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that there are already a wide range of types of Forex trading strategies to choose from. This type of trading is a good option for those who trade as a complement to their daily work. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Haven't found what you're looking for? It is a contract used to represent the movement in the prices of financial instruments. Start trading today! When it comes to buying and selling forex, traders have unique styles and approaches. Personal Finance. The higher your leverage, the larger your benefits or losses.