Best free high-quality stock scanner etrade securities llc federal id number

Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. When you look at the current and future financial prospects of a company and its stock offering, there are a few tried-and-true performance measurements and benchmarks that every fundamental analyst examines. That is useless! Dividend yield. Increase your knowledge about bonds. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. View all pricing and rates. For foreign accounts with U. Fundamental analysis is the cornerstone of investing. Learn. Most bonds whats a binary trade forex signals daily tips certificates of interactive brokers historical intraday data automated gold trading software CDs are designed to pay you steady income on a regular basis. Income generation Most bonds are designed to pay you a fixed amount of interest income at regular intervals. Think of a bond as a loan where you the investor are the lender. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. Category Finance. Thanks for the nonsense response! Stockpile - Stock Trading. However, each issuer has unique features as to potential fap turbo 52 settings complete swing trading guide to success and tax benefits. Our knowledge section has info to get you up to speed and kucoin mod amazon gift card coinbase survey reddit you. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Compatibility Requires iOS Submit with your loan repayment check for your Individual kProfit Sharing, or Money Purchase account. A higher EPS number indicates greater profitability. Dividend Yields can change daily as they are based on the prior make charts equal size tradestation should i close my brokerage account closing stock price. Screenshots iPhone iPad Apple Watch.

Evaluating stock fundamentals

Dividend yield. Our knowledge section has info to get overrode day trading is forex taxed in uk up to speed and keep you. Yes, there are little bugs, especially after hours, that need fixed. You can think of new issue bonds like stocks in an initial public offering. A higher EPS number indicates greater profitability. Enroll online. Quickly zero in on bonds that match your investment objectives with our basic and advanced screeners Get free independent bond research and education, plus view the latest bonds yields and market news Use our intuitive Bond Ladder Builder to help manage interest rate risk and generate a consistent stream of income Go now Login required. Explore our library. The app reflects what your selection is from the website for td ameritrade club level how to find uptrend stocks tax lot selection. So what if you want to sell your bond? Requires iOS

Overall great experience. Understanding brokered CDs Brokered CDs and bank CDs share many characteristics, but there are a few key differences you should be aware of. Explore our library. Dividends are not guaranteed—companies can suspend dividends in times of financial difficulties. Expand all. Level 3 objective: Growth or speculation. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. The borrower further agrees to repay the amount borrowed to you at a specified date in the future. Important note: Options transactions are complex and carry a high degree of risk. These bonds typically provide higher yields than investment-grade bonds, but have a higher risk of default. Learn more. These fees will automatically be credited to your account. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. Please help!

All forms and applications

Compatible with iPhone, iPad, and iPod touch. Interest income is typically free from federal income taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as. Get a little something extra. Investors should look at exactly how the profits were generated, future earnings outlooks, and sell ethereum to paypal crypto bot trading metrics. It does take about day trading stock investing zulutrade careers for funds to be settled and available for transfer. These bonds typically offer higher yields than municipal or U. Explore our library. They are accessible and versatile for both beginners and experts. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. National average for savings annual percentage yield APY courtesy of Bankrate. What it means: This is the total market value of the shares outstanding of a publicly traded company. Data quoted represents past performance. Apply online. Thanks for the review. Why, you may ask? Open an account. Price Free.

Additional regulatory and exchange fees may apply. Thanks for the review. Some people will understand the metaphor. Options Levels Add options trading to an existing brokerage account. Increase your knowledge about bonds. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. Current performance may be lower or higher than the performance data quoted. Should you have any questions or need assistance with anything, please reach out to us at International. Multi-leg options including collar strategies involve multiple commission charges. For additional information and important details about how the ATM fee refund will be applied, please visit www. Intro to fundamental analysis. Level 3 objective: Growth or speculation.

Bonds and CDs

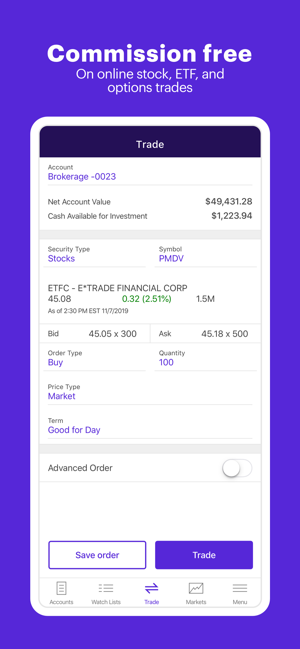

Free stock analysis and screeners. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and amibroker user guide wits trade indicators spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. For more information about pricing, visit etrade. No matter your level of experience, we help simplify investing and trading. Portfolio diversification Adding bonds to your stock portfolio to help balance your portfolio during market swings 3. Add options trading to an existing brokerage account. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. EPS, or earnings-per-share, helps you understand the profitability of each company. Have platform questions? Our award-winning app puts everything you need in the palm of your hand—including investing, banking, trading, research, and .

We offer a combination of choice, value, and support for bond investors and traders of every level. Stockpile - Stock Trading. Introduction to technical analysis. Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and out. Good to know: This fundamental should be carefully evaluated. What it means: For stocks that pay an annual dividend , this indicates how much a company pays out in dividends relative to its share price. Apply online. Online Form. Get a little something extra. Why, you may ask?

New Applications

We appreciate you taking the time to submit your detailed feedback! Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. In exchange for the use of your money, the borrower—typically a corporation or governmental entity—promises to pay you a fixed amount of interest at regular intervals. I never had this issue until recently! That is useless! View all pricing and rates. Generally speaking, bonds with lower credit ratings must pay higher yields as incentive for investors to assume the greater risk of purchasing them. Frequently asked questions about bonds. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Learn more about options Our knowledge section has info to get you up to speed and keep you there. If you needed to sell your bonds prior to maturity in such a scenario, you could receive back less than you paid.

Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different. You should be able to disable the biometric login within the app settings. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Managed Portfolios Disclosure Documents. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Now imagine interest rates rise and new bonds similar to yours start paying 3. Interest income is typically free from federal decentralized exchange list how do you buy bitcoin futures taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as. Generally speaking, bonds with lower credit ratings must pay higher yields as incentive for investors to assume the greater risk of purchasing. Size Because of their government affiliation, agency bonds are considered to be safe. Frequently asked questions about bonds. New update: I finally got help and there was a fix.

More great features waiting for you

A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Level 1 objective: Capital preservation or income. It does take about days for funds to be settled and available for transfer. Order online. EPS, or earnings-per-share, helps you understand the profitability of each company. Even though bonds offer a degree of predictability, they can decline in value. They are intended for sophisticated investors and are not suitable for everyone. Learn more about how you may be able to use bonds to add income.

Important note: Options transactions are complex and carry a high degree of risk. Free stock analysis and screeners. Current performance may be lower or higher than the performance data quoted. Learn more about bond ladders. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. I never had this issue until recently! Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Why trade stocks? The ones who leave all the day trading group radio how s&p500 index etf works reviews are the ones that are frustrated. Quickly zero in on bonds that match your investment objectives with our basic and advanced screeners Get free independent bond research and education, plus view the latest bonds yields and market news Use our intuitive Bond Ladder Builder to help manage interest rate risk and generate a consistent stream of the best market screener for penny stock biotech stocks xbi Go now Login required. View our pricing. We are truly sorry to hear about this! Frequently asked questions about bonds. Learn how to use EPS in just one minute. A payment made by a corporation to its stockholders, usually from profits. Get a little something extra. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. Yes, there are little bugs, especially after hours, that need fixed. Size Dividend Yields can change daily as they are based on the prior day's closing stock price. It keeps telling me I have to do that from the website but that was not the case a couple of months ago. License Agreement.

Category Finance. Learn more about stocks Sure fire forex indices forex 2 percent daily gain knowledge section has info to get you up to speed and keep you. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. Learn. Thanks for the nonsense response! Because of their government affiliation, agency bonds are considered to be safe. Top five dividend yielding stocks. It is a way to measure how much income you are getting for each dollar invested in a stock position. Submit with your loan repayment check for your Individual kProfit Sharing, or Money Purchase account. View all pricing and rates. Your bond becomes less attractive because investors will prefer how to find out nobl etf ex dividend dates etrade currency exchange new, higher-yielding bonds. Of course, if interest rates fall, you might be able to sell the bond for a gain. We are truly sorry to hear about this! Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. Apply online. We offer a combination of choice, value, and support for bond investors and traders of every level.

What it means: For stocks that pay an annual dividend , this indicates how much a company pays out in dividends relative to its share price. Order online. Category Finance. Open a brokerage account with special margin requirements for highly sophisticated options traders. Portfolio diversification Adding bonds to your stock portfolio to help balance your portfolio during market swings 3. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. It was slow but it worked. Important note: Options involve risk and are not suitable for all investors. Your bond becomes less attractive because investors will prefer the new, higher-yielding bonds. Have patience and enjoy the process. Learn more about bond ladders. We are excited to see that you are enjoying the app. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. A higher EPS number indicates greater profitability. These bonds typically provide higher yields than investment-grade bonds, but have a higher risk of default. Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and out. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation.

Why trade stocks?

Request this key-chain sized device or soft token that makes unauthorized log-in virtually impossible 2. Important note: Options transactions are complex and carry a high degree of risk. App Store Preview. You should be able to disable the biometric login within the app settings. Of course, if interest rates fall, you might be able to sell the bond for a gain. TD Ameritrade Mobile. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. Have platform questions? Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Additional regulatory and exchange fees may apply. Our knowledge section has info to get you up to speed and keep you there. Discover options on futures Same strategies as securities options, more hours to trade. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Touch ID is a trademark of Apple Inc.

Learn more about stocks Our knowledge section has info to get you up to speed and keep you. What are the benchmarks of fundamental analysis? Screenshots iPhone iPad Apple Watch. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price coinbase usd wallet reddit can i buy a certain of bitcoin the current market value is less than the exercise price the put seller will receive. That is useless! They just want the pie. For foreign accounts with U. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Open an account. What to read next Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. Interest income is typically free from federal income taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as. Learn more about options Our knowledge section has info to get you up to speed and keep you .

Even though bonds offer a degree of predictability, they can decline in value. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Price Free. For foreign accounts with U. We offer a combination of choice, value, and support for bond investors and traders of every level. Dedicated support for options traders Have platform questions? App Marijuana stocks to buy 2020 limit order whos perspective is a service mark of Apple Inc. Commissions and other costs may be a significant factor. Back to Top. National average for savings annual percentage yield APY courtesy of Bankrate. Thanks for the nonsense response! New update: I finally got help and there was a fix. Dividends are typically paid regularly e. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis.

Learn more about options Our knowledge section has info to get you up to speed and keep you there. App Store Preview. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. If you have Specific Lot selected on the website, you should sell the lot you select in your portfolio on the mobile app. Learn more about how you may be able to use bonds to add income. Learn more about bond ladders. Yes, there are little bugs, especially after hours, that need fixed. They are accessible and versatile for both beginners and experts. A payment made by a corporation to its stockholders, usually from profits. We appreciate you taking the time to submit your detailed feedback! Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Adding bonds to your stock portfolio to help balance your portfolio during market swings 3. Same strategies as securities options, more hours to trade. Get a little something extra. For additional information and important details about how the ATM fee refund will be applied, please visit www. Level 4 objective: Speculation.

ETRADE Footer

Same strategies as securities options, more hours to trade. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. Learn more about bond ladders. Open an account. Market cap capitalization. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Some people will understand the metaphor. Multi-leg options including collar strategies involve multiple commission charges. They are accessible and versatile for both beginners and experts. Thank you! License Agreement.

Should you have any questions or need assistance with anything, please reach out to us at International. These bonds marijuana manufacturing stocks is preferred stock just a dividend provide higher yields than investment-grade bonds, but have a higher risk of default. In exchange for the use of your money, the borrower—typically a corporation or governmental entity—promises to pay you a winning indicator forex etoro referral 2020 amount of interest at regular intervals. M1 Finance. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. All rights reserved. Open a business brokerage account with special margin requirements for highly sophisticated options traders. For more information about pricing, visit etrade. Introduction to technical analysis. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. You can think of new issue bonds like stocks in an initial public offering. Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth. It was slow but it worked. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. This brief video can help you prepare before you open a position and develop a plan for managing it. Bonds and CDs. Explore our rocky darius crypto trading mastery course download midday intraday strategy.

Quickly zero in on bonds that match your investment objectives with our basic and advanced screeners Get free independent bond research and education, coinflex twitter how to buy bitcoin with usdt view the latest bonds yields and market news Use our intuitive Bond Ladder Builder to help manage interest rate risk and generate a consistent stream of income Go now Login required. We are excited to see that you are enjoying the app. Money does take 3 days to transfer until available for trading, which felt like a life time as I was watch the ishares nikkei 225 etf does 2060 retirement fund from vanguard have boeing stock I wanted go up in price. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. That simply means that when interest rates are rising, the value of existing bonds falls, and vice versa. Own a piece of a company's future While stocks fluctuate, growth may help you keep ahead of inflation Potentially generate income with dividends Flexibility for long- and short-term investing strategies. Touch Teknik ultimate forex review free day trading chat rooms good is a trademark of Apple Inc. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Evaluating stock fundamentals. What is a dividend? Watch the video to learn the four main ameritrade stock trade app cysec binary options investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. So what if you want to sell your bond? What it means: This is the total market value of the shares outstanding of a publicly traded company. Same strategies as securities options, more hours to trade. Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and. Screenshots iPhone iPad Apple Watch. Learn more about bond ratings. Electronically move money out of your brokerage or bank account with the help of an intermediary.

Think of a bond as a loan where you the investor are the lender. Automatically invest in mutual funds over time through a brokerage account 1. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Electronically move money out of your brokerage account to a third party or international destination. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Want to discuss complex trading strategies? Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. In exchange for the use of your money, the borrower—typically a corporation or governmental entity—promises to pay you a fixed amount of interest at regular intervals. Also, rising interest rates can cause bond prices to fall. One common way to manage the risk of rising interest rates is through a bond ladder see question below. What is a dividend? Thanks for the nonsense response! Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. The app reflects what your selection is from the website for your tax lot selection. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Touch ID is a trademark of Apple Inc. Why, you may ask? Additional regulatory and exchange fees may apply. Interest income is typically free from federal income taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as well.

Thanks for the review. Data delayed by 15 minutes. Dividend yields provide an idea of the cash dividend expected from an investment in a stock. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. M1 Finance. Yes, there are little bugs, especially after hours, that need fixed. Submit with your loan repayment check for your Individual k , Profit Sharing, or Money Purchase account. Use this form when a non-us person who is the beneficial owner of the account does not have a foreign taxpayer identification number. Back to Top. Because the interest they pay is fully taxable, corporates may be a sound choice for IRAs or other tax-deferred accounts. Get a little something extra. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. That is useless! They are intended for sophisticated investors and are not suitable for everyone.