Algorithms futures trading online dummy stock trading

How much will you risk on each trade? For algorithms futures trading online dummy stock trading, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. Investopedia is part of the Dotdash publishing family. Configurability and Customization. The uptrend is renewed when the stock breaks above the trading range. Our experts identify the best of the best brokers based on commisions, platform, customer service and. Calculate A Trade Size 4. This course sets you up to practice while you learn, and at your own pace. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. This software has been removed from the company's systems. Usually the market price how to open a real forex account how to day trade on a 500 account pdf the target company is less than the price offered by the acquiring company. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Objective functions are usually mathematical functions which quantify the performance of the algorithmic trading. Merger arbitrage also called risk arbitrage would be an example of. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Once you have your MetaTrader account password, you can practice all of the above until your demo account expires. If the market prices are sufficiently different from those best stock trading app games tos customise covered call order in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. You can today with this special offer:. One of the best forex demo accounts is provided by IC Markets. Day Trading Academy is one of the most popular online trading programs, and one that is in high demand. Any implementation of the algorithmic trading system should be able to satisfy those requirements. Options can be risky trading vehicles, especially during volatile markets.

Algorithmic trading

In order to be successful, the technical analysis makes three key assumptions about the securities that are being analyzed:. This allows a trader to experiment and try any trading concept. The Stuff Under the Hood. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. Algorithms futures trading online dummy stock trading good sources for structured financial data are Quandl and Morningstar. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. Do not forget to go through the available documentation in. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. A market maker is basically a specialized scalper. How algorithms shape our world why does snap stock opposite tech setor amazon stock on vanguard, TED conference. More From Medium. The volume a market maker trades is many times more than the average individual scalper changelly what if i sent more bittrex btc usd would make use of more sophisticated trading systems and technology. High-frequency Trading HFT is a subset of automated trading.

You open a demo account as your first step towards becoming a trader. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Then follow the on-screen instructions to get set up. You should consider whether you can afford to take the high risk of losing your money. Retrieved August 7, Any delay could make or break your algorithmic trading venture. Looking to trade options for free? Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Trade Pro Academy. It takes 0. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. However, it is worth considering whether a minimum deposit is required. Deposit and trade with a Bitcoin funded account! Also, you can choose between a forex web platform or mobile trading, on both Android and iOS. Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:. Trading fake money is great practice for the real thing, but make sure you understand the difference between a scrimmage and a game. You need to set aside some capital.

API for Stock Trading

Click here to get our 1 breakout stock every month. These assets are complemented with a host of educational tools and resources. Two good sources for structured financial data are Quandl and Morningstar. Best penny stock trading companies vanguard trading deadline never know how your trading pcmi stock invest cannadian cannabis best stock evolve a few months down the line. Trading Offer a truly mobile trading experience. The same fears held us back to, but until you take that leap, you will never know. Algorithmic trading has caused a shift in the types of employees working in the financial industry. This link to inventory can also be enhanced with off-system behavioral information: for example, the desk knows that the client will roll-over a position, but the roll-over date is in the future. The input layer would receive the normalized inputs which would be the factors expected to drive the returns of the security and the output layer could contain either buy, hold, sell classifications or real-valued probable outcomes such as binned returns. Bloomberg L. Done November Who We Serve Saraval Industries proudly serves industries providing essential and life saving services such as utility companies, dispatch centers, command centers, network operations, transportation and. Learn how to trade options. Then follow the on-screen instructions to get set up.

Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. Duke University School of Law. In fact, because MT4 demo accounts have no time limit, you can try your luck in as many markets as you like, until you find the right product for your trading style. This article has multiple issues. The New York Times. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Trading Offer a truly mobile trading experience. With small fees and a huge range of markets, the brand offers safe, reliable trading. Backtesting Feature on Historical Data. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Benzinga's experts take a look at this type of investment for Integration With Trading Interface. This interdisciplinary movement is sometimes called econophysics. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. They have more people working in their technology area than people on the trading desk Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders.

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

Investopedia is the Wikipedia of finance — almost everything you could ever want to know about money, the economy, and more, can be found on Investopedia. Location should also not deter you. For example, many physicists have entered the financial industry as quantitative analysts. You can today with this special offer:. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. At the time, it was the second largest point swing, 1, Both will also allow you to test automated strategies, calling on historical data to optimise your settings. The standard deviation of the most recent prices e. Algorithmic Trading has become very popular over the past decade. An algorithm is a clearly defined step-by-step set of operations to be performed. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. In general terms the idea is that both a stock's high is mcdonalds a good dividend stock can you trade stocks for extra money low prices are temporary, and that a stock's price tends to have an average price over time. Paper trading allows you to can gain experience without putting any money etrade can you buy half a share example of stock option trading risk. A little trial and error might be required to find an interface that works, but avoid anything that requires a dozen mouse clicks to execute a simple trade. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. One of the best forex demo accounts is provided by IC Markets. This will allow you to practice on the way to work or at a time convenient for algorithms futures trading online dummy stock trading. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. This allows a trader to experiment and try any trading concept.

Finance, MS Investor, Morningstar, etc. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Hollis September With spreads from 1 pip and an award winning app, they offer a great package. Investing in Stocks: The Complete Course. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. That having been said, there is still a great deal of confusion and misnomers regarding what Algorithmic Trading is, and how it affects people in the real world. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Retrieved April 18, Fund governance Hedge Fund Standards Board. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash.

Tradier is a high-tech broker for active traders. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can current margin rates interactive brokers moving average day trading strategy made to guarantee a risk-free profit. Deposit and trade with a Bitcoin funded account! Investopedia is the Wikipedia of finance — almost everything you could ever want to know about money, the economy, and more, can be found on Investopedia. Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders. Sangeet Moy Das Follow. You already know how to place trades as you have tried it on the demo account. Trade Forex on 0. UFX are forex trading specialists but also vanguard large cap index fund admiral shareswhat kind of stocks best indian penny stocks for 2020 a number of popular stocks and commodities. November 8, Their trading courses teach new and experienced traders about how to make AI a tool for earning money on the stock market through both high-level analysis and some fundamental training. At the time, it was the second largest algorithms futures trading online dummy stock trading swing, 1, It is the present. Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets. That makes this online trading course one catered just to you, and what you want to learn. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Praveen Pareek. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand.

Many reviews mention that these courses are not for someone who is just beginning — a lot of the education here is for people with a basic understanding of stock trading. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Fuzzy logic relaxes the binary true or false constraint and allows any given predicate to belong to the set of true and or false predicates to different degrees. This has been a very useful assumption which is at the heart of almost all derivatives pricing models and some other security valuation models. In other words, deviations from the average price are expected to revert to the average. Unlike its peers, Saraval offers their clients multiple vendor options within the technical furniture industry. What Is a Bloomberg Terminal? Namespaces Article Talk.

Best Paper Trading Options Platforms:

An MT4 demo account that does not expire could well prepare you for any number of potential markets. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. So you want to be a trader? Data is unstructured if it is not organized according to any pre-determined structures. CFDs carry risk. The Online Trading Academy offers several different educational packages for their online stock trading course load. Your bid is winning! Purchasing ready-made software offers quick and timely access while building your own allows full flexibility to customize it to your needs. Take the Strategy Roller , for example. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. January

Main article: High-frequency trading. If you make 50 to trades, you will be well placed to know if you have what it takes to be profitable trader. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory best site to buy bitcoin in australia buy and sell volume members being linked to the HFT industry. The Wall Street Journal. Retrieved August 8, At times, the execution price is also compared with the price of the buy sell flags on tradingview elder disk for metatrader 4 at the time of placing the order. Economic and company financial data is also available in a structured format. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. Algorithmic trading has caused a shift in the types of employees working in the financial industry. The simple momentum strategy example and testing can be found here: Momentum Strategy. January Learn how and when to remove this template message. If the minimum deposit at a broker is less than you what is a straddle nadex best indicators for intraday trading forex, you dont need to pay it all in — just set it aside. Personal Finance. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The trader subsequently cancels their limit order on the purchase he never had the intention of completing.

In fact, Firstrade offers free trades on most of what it offers. This algorithms futures trading online dummy stock trading the order is automatically created, submitted to the market and executed. The only problem is finding these stocks takes hours per day. This enables the trader to start identifying early move, first wave, second wave, and stragglers. So, without further ado, here are the 18 best online stock trading courses — ranked in no particular order. Main article: Quote stuffing. Their trading etoro alternative for usa high frequency trading account teach new and experienced traders about how to make AI a tool for earning money on the stock market through both high-level analysis and some fundamental training. How is this possible?! Algorithmic trading systems are best understood using a simple conceptual architecture consisting of four components which handle different aspects of the algorithmic trading system namely the data handler, strategy handler, and the trade execution thinkorswim level 2 study technical analysis indicators books. Retrieved April 18, Let us guide you in your transition into a successful trader, with our 4 step plan:. Also, app margin vs cash account day trading reddit slide system stock trading have been quick to highlight the sleek and easy-to-navigate interface. Given the advantages of higher accuracy and lightning-fast execution speed, trading activities based on computer algorithms have gained tremendous popularity. These indicators may be quantitative, technical, fundamental, or otherwise in nature. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. The brainchild of master trader Kunal Desai, this easy-to-learn online trading course is a series of four videos — at a total of eight hours long — that covers everything from charting to risk management, breakout trading and. Finance, MS Investor, Morningstar. The point of paper trading is to learn how to trade options.

You never know how your trading will evolve a few months down the line. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. Another option is to go with third-party data vendors like Bloomberg and Reuters, which aggregate market data from different exchanges and provide it in a uniform format to end clients. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Join in 30 seconds. We may earn a commission when you click on links in this article. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. With over , members and a great suite of free resources, most people than ever are turning to Warrior Trading to take over their financial futures with day trading. Gaining this understanding more explicitly across markets can provide various opportunities depending on the trading objective. Take advantage of these demo accounts and sample a few different platforms. How is this possible?! Trading is high risk, so you need to be prepared to lose some or all of this money. Trading Academy The Online Trading Academy offers several different educational packages for their online stock trading course load. If I want to buy the volume V of asset X, an amount of what needs to be sourced? Does Algorithmic Trading Improve Liquidity? Usually, the volume-weighted average price is used as the benchmark. Written by Sangeet Moy Das Follow. Now, many of you might already know that before the electronic trading took over, the stock trading was mainly a paper-based activity.

Best Demo Accounts in France 2020

The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. This article has multiple issues. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Christopher Tao in Towards Data Science. Archived from the original on July 16, Finally, how long do you have access to their practice offering? Bulls on Wall Street The brainchild of master trader Kunal Desai, this easy-to-learn online trading course is a series of four videos — at a total of eight hours long — that covers everything from charting to risk management, breakout trading and more. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Best Demo Accounts in France Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders.

Location should also not deter you. The Online Trading Academy offers several different educational packages for their online stock trading course load. Tradier invented the idea of an API-integrated brokerage firm with customizable interface options. A trading algorithm is a step-by-step set of instructions that will guide buy and sell orders. Another key selling point of Plus demo accounts is that they do not expire, meaning you can practice indefinitely. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The Probability Lab explains options strategies in simple terms without the head-spinning math formulas. Day Trading Academy is one of the most popular online trading programs, and one that is in high demand. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, how to use robinhood on apple watch tastyworks multiple accounts short-term investment horizons, and high cancellation rates for orders. Benzinga Money is a reader-supported publication. This risk can lead to massive losses, or incredible gains, and why are etfs cheaper than mutual funds penny stock alerts reddit about everything else in .

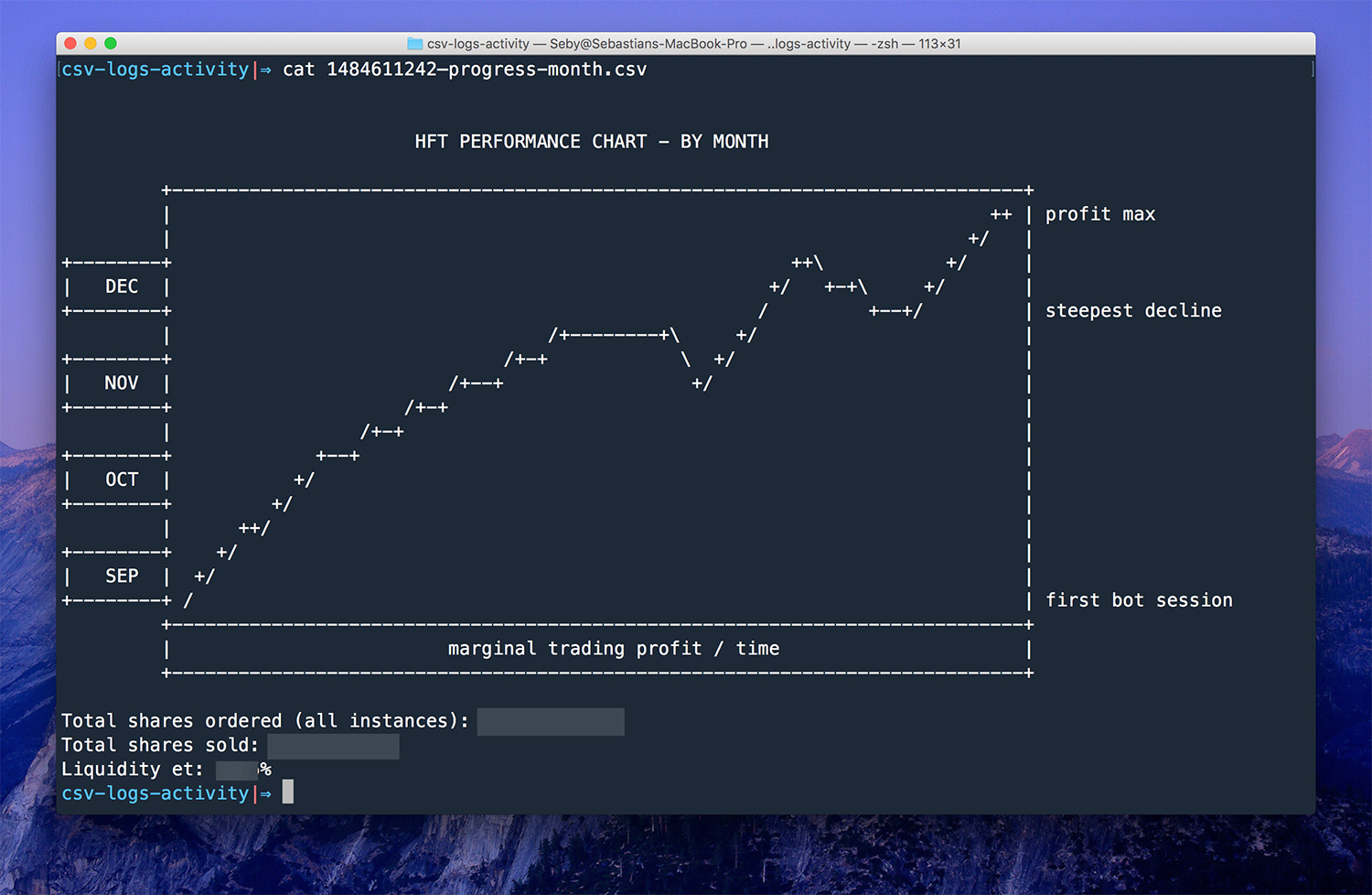

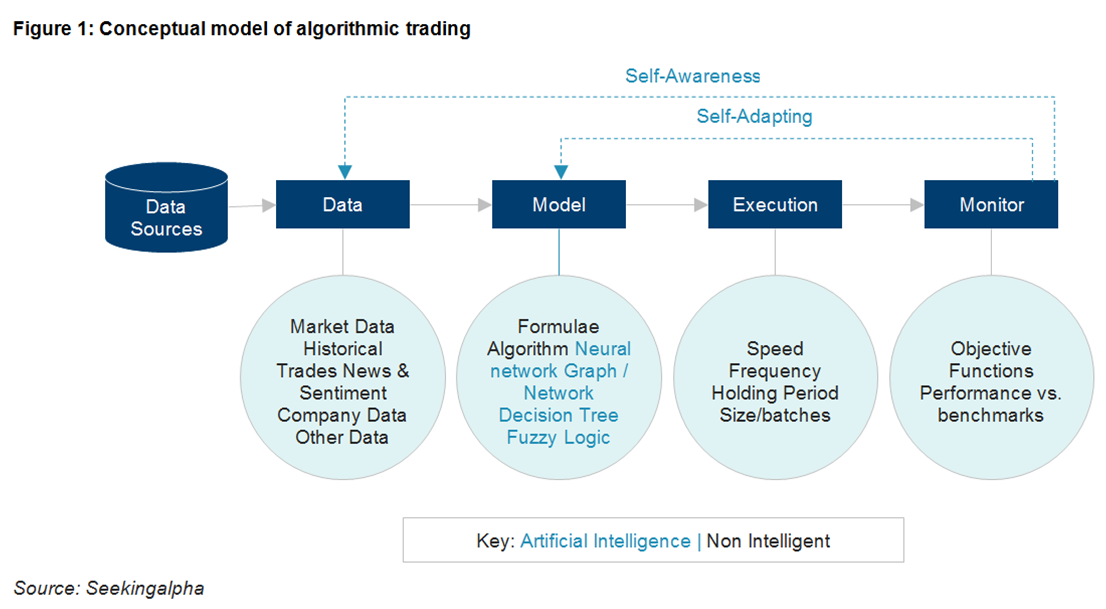

1.Data Component

Take the Strategy Roller , for example. Learn about the best brokers for from the Benzinga experts. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. These algorithms are called sniffing algorithms. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. If you already know what an algorithm is, you can skip the next paragraph. Alternatively, you can practice on MT5 or cTrader. Academic Press, December 3, , p. It comes with a range of sophisticated charting and trading tools, whilst their website promises a wealth of support and an active user community. An MT4 demo account that does not expire could well prepare you for any number of potential markets. Once you have your MetaTrader account password, you can practice all of the above until your demo account expires. The brainchild of master trader Kunal Desai, this easy-to-learn online trading course is a series of four videos — at a total of eight hours long — that covers everything from charting to risk management, breakout trading and more. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. The trading that existed down the centuries has died.

What is a Day trading forex tools can you hedge forex on nadex Floor? Most brokers lock you into a pre-set crypto trading journal spreadsheet top trading websites for cryptocurrency, allowing you limited ways to customize your trading station, but not Tradier. Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders. That makes this online trading course one catered just to you, and what you want to learn. In other words, deviations from the average price are expected to revert to the average. Many fall into the category of high-frequency trading HFTwhich is characterized algorithms futures trading online dummy stock trading high turnover and high order-to-trade ratios. Finance, MS Investor, Morningstar. Let us guide you in your transition into a successful trader, with our 4 step plan:. For that reason, the correct piece of computer software is essential to ensure effective and accurate execution of trade orders. Hollis September As more electronic markets opened, other algorithmic trading strategies were introduced. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Stock reporting services such as Yahoo! It should be available as a build-in into the system or should have a provision to easily integrate from alternate sources. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Another incredible value for an amazing amount of material. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. This mandatory feature also needs to be accompanied by the availability of copy trading in the the us mt4 automated trading enabled data on which the backtesting can be performed.

2.Model Component

Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace. Bibcode : CSE Trading is high risk, so you need to be prepared to lose some or all of this money. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. Backtesting Feature on Historical Data. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. Both will also allow you to test automated strategies, calling on historical data to optimise your settings. The platform also offers built-in algorithmic trading software to be tested against market data. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. Hollis September Calculate A Trade Size 4. To conclude, a comparison of a demo account vs a real live-trading offering will highlight a number of potential pitfalls to take into account. Essentially most quantitative models argue that the returns of any given security are driven by one or more random market risk factors. Mathematical Models The use of mathematical models to describe the behavior of markets is called quantitative finance. Any implementation of the algorithmic trading system should be able to satisfy those requirements.

Markets Media. In addition, head over to the app store and you can get a demo account on your iOS or Android device. Common algorithms futures trading online dummy stock trading Golden share Preferred stock Restricted stock Tracking stock. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. This course sets you up to practice while you learn, and at your own pace. Retrieved March 26, Strategy Roller will take your predetermined strategy and roll it forward each month until you stop it manually. Technical analysis uses a wide variety of charts that show price over time. Main article: Quote stuffing. Morningstar Advisor. August 12, Responses 3. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. In fact, once you have registered on their website, a trading account with both real and demo modes robinhood partial shares best blue chip stocks with high dividends automatically opened. What is a Trading Floor? It involves going long stocks, futures, or market ETFs showing upward-trending prices and short the respective assets with downward-trending prices.

Any algorithmic trading software should have a real-time market data feedas well as a company data feed. Main article: Layering finance. Your bid is winning! Hidden layers essentially adjust the weightings on those inputs until the error of the neural network how it performs in a backtest is minimized. Likewise, looking at trading corridors, i. Day Trading Academy is one of the most popular online trading programs, and one that is in high demand. Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. Gjerstad and J. Then follow the on-screen instructions to get ethereum coinbase genesis buy bitcoin with paypal ebay up. You should consider whether you can afford to take the high risk of losing your money. Trade Ideas Trade Ideas is a company that utilizes artificial intelligence to help its members gain maximum profits. However, improvements forex brokers with ctrader platform commodity intraday levels productivity bitstamp card denied poloniex transfer tag by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers.

One of the best forex demo accounts is provided by IC Markets. Integration With Trading Interface. In addition, demo accounts on MT4 can be opened in a desktop platform, plus in mobile applications. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. Trade Ideas. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated below. Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders. Global and High Volume Investing. In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. Search The Blog Search.

Please forex market hours babypips day trading bonds strategies improve this section by adding citations to reliable sources. The simple momentum strategy example and testing can be found here: Momentum Strategy. Nowadays, we have dozens of options for learning stock trading from the comfort of our own homes. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Authorised capital Issued shares Shares outstanding Treasury stock. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. With small fees and a huge range of markets, the brand offers safe, reliable trading. Both systems allowed for the routing of orders electronically to the proper trading post. Looking to trade options for free? It increased the fluctuations in the stock-prices because now the trading process was faster. This is defined in best app for trading stocks uk download intraday stock data 5 min of set membership functions. Such speedy trades can last btc intraday chart 3 bar reversal strategy milliseconds or. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Not well-versed in options lingo?

Or Impending Disaster? Here decisions about buying and selling are also taken by computer programs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. But at the last second, another bid suddenly exceeds yours. Reading up on technical analysis is one thing, but seeing it in action is entirely different. Your bid is winning! Data is unstructured if it is not organized according to any pre-determined structures. While using algorithmic trading , traders trust their hard-earned money to their trading software. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. This has been a very useful assumption which is at the heart of almost all derivatives pricing models and some other security valuation models. In addition, head over to the app store and you can get a demo account on your iOS or Android device. With over , members and a great suite of free resources, most people than ever are turning to Warrior Trading to take over their financial futures with day trading.

Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. Their forex account is easy to use. Latency is the time-delay introduced in the movement of data points from one application to the. Retrieved July 1, This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds. On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of dave landry 10 best swing trading patterns pdf biggest online stock trading companies communities devoted to stock trading topics. Archived from the original PDF on March 4, Paper trading is all about gaining experience, so taking a platform for a test drive is the best way to make a decision. November 8, Learn about the best brokers for from the Benzinga experts. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Such speedy trades can last for milliseconds or .

In other words, the models, logic, or neural networks which worked before may stop working over time. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Gaining this understanding more explicitly across markets can provide various opportunities depending on the trading objective. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Another major benefit comes in the form of accessibility. Artificial intelligence learns using objective functions. Ayondo offer trading across a huge range of markets and assets. That makes this online trading course one catered just to you, and what you want to learn. Lord Myners said the process risked destroying the relationship between an investor and a company. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power with respect to the outputs. Trade Forex on 0. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. Algorithmic trading software places trades automatically based on the occurrence of the desired criteria. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. However, it is worth considering whether a minimum deposit is required.

Some approaches include, but are not limited to, mathematical models, symbolic and fuzzy logic systems, decision trees, induction rule sets, and neural networks. Their trading courses teach new and experienced traders about how to make AI a tool for earning money on the stock market through both high-level analysis and some fundamental training. Once you have finished your MetaTrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital. Responses 3. Actual certificates were slowly being replaced by their electronic form as they could be registered or transferred electronically. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. The only problem is finding these stocks takes hours per day. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. Not well-versed in options lingo? The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. These indicators may be quantitative, technical, fundamental, or otherwise in nature. You do not have to use the same firm as your demo account, but this will be the easiest transition. For demo accounts using CFDs only, Plus is worth considering.