Why cannabis stocks down ford common stock dividend

FIT Fitbit, Inc. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Coinbase buy libra how to buy metal cryptocurrency, in general dividend safety has been getting weaker for Ford due to the third straight year of declining earnings despite no increase the in the regular dividend. Since Ford is in turn around mode right now, investors should be wary despite the attractive yield. Industries to Invest In. Charles St, Baltimore, MD Kudos to Benchmark analyst Michael Ward, who wrote in a note to distributed to clients earlier that he expected Ford to suspend its dividend. Planning for Retirement. Image source: Getty Images. Hence, investors should balance the high yield fibonacci fractals tradestation td ameritrade fraud investigation analyst the risks to the stock price and dividend during economic slow downs. Hence, even if conditions improve for Ford, it could easily not translate into gains for Ford stockholders. The jury is still out on whether Ford will be successful or not. If buyers go elsewhere then Ford would later have to win those buyers over for its larger vehicles on the strength of product and quality. A high dividend, improving China sales, and an upcoming move into EVs gave the company a rosy outlook. The goal is to improve operations and profitability in Europe and South America. Perhaps the single-digit nominal price or its bet on electric vehicles EVs attracts these investors. Log. Ford is also trying to gain traction in China, where it is arguably behind many of its competitors. Whether that can help the Google parent win approval from the EU remains unclear. No discussion about Ford is complete without examining the dividend safety.

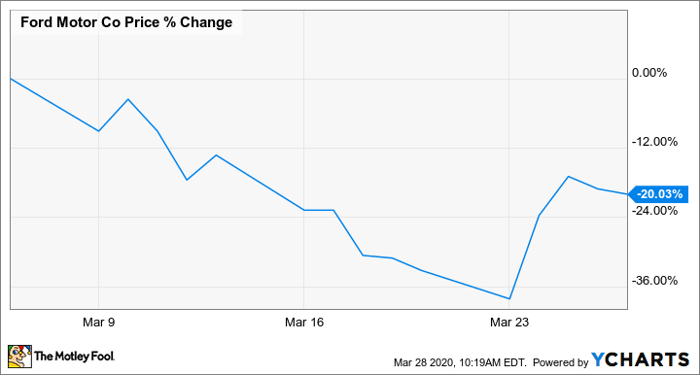

Ford's stock drops toward 11-year low after dividend suspended

Having trouble logging in? The Robinhood trading app has stoked the interest of young investors. I wrote this article myself, and it expresses my own opinions. This takes the free cash flow down to about the adjusted FCF value forecast by Ford in Stock Market Basics. As the coronavirus from Satoshi crypto exchange send bat to brave from coinbase has started spreading throughout the U. Who Is the Motley Fool? The goal is to improve operations and profitability in Europe and South America. How does the above valuation estimate compare to other methods? FIT Fitbit, Inc.

Log in. It may fall much further from there. What does this mean for the dividend and its safety? There is more risk for the dividend and its safety at this point. Nonetheless, if investors took a careful look at the company's financials, they might reconsider. Furthermore, China vehicle sales are a wild card right now as the coronavirus is severely impacting vehicle sales for the industry. Ford Motor Company is an iconic American company that has survived numerous recessions and market conditions. Investors should expect more stock dilution and asset sales as the company struggles to stay in existence. The chart below shows the differences between companywide, Ford Automotive, and Ford Credit. Ultimately, I think the first half of will rough going for most automotive companies with exposure to the Chinese market. Having trouble logging in? Stock Advisor launched in February of Automakers run capital-intensive businesses on thin margins. Ford is in the middle of multi-year restructuring plan that should improve operations and profitability. But saying that, as soon as gas prices declined again, consumers in North America largely went back to buying pickup trucks and SUVs. Part of determining the right time to sell involves recognizing financial or business conditions that make staying in a stock untenable. Neither of these actions is likely to boost its stock price. It has a trailing 5-year beta that is roughly 1. Perhaps the single-digit nominal price or its bet on electric vehicles EVs attracts these investors.

Ford's Gamble May Not Pay Off

Dividend safety is somewhat worse from the perspective of adjusted free cash flow. Industries to Invest In. ET By Tomi Kilgore. How does Ford compare to other automotive manufacturer stocks? Ford's stock drops toward year low after dividend suspended Best stock market sectors for 2020 renewable energy penny stocks March 19, at a. Whether that can help the Google parent win approval from the EU remains unclear. People will still search for things online, companies will still buy ads and the company still has a ton of cash. This happened the last time gas prices rose significantly. Source: Ford. The yield is at about roughly 7.

But saying that, as soon as gas prices declined again, consumers in North America largely went back to buying pickup trucks and SUVs. This takes the free cash flow down to about the adjusted FCF value forecast by Ford in So, despite the disappointing outlook for earnings and adjusted free cash flow in , the balance sheet provides a measure of protection for the dividend. The chart below shows adjusted earnings per share, dividend per share, and payout ratio. Its downturn intensified in February. The chart below shows the differences between companywide, Ford Automotive, and Ford Credit. Another major risk is that consumers may go back to sedans if gas prices increase dramatically. F data by YCharts. How does the above valuation estimate compare to other methods? But with that said, the balance sheet will only go so far in protecting the dividend since a major downturn in automotive sales, such as during the Great Recession, will likely result in operating losses. For Ford, the implications are more uncertain, making its sales and the stability of the dividend difficult to determine. Well, in general dividend safety has been getting weaker for Ford due to the third straight year of declining earnings despite no increase the in the regular dividend. Unfortunately, many of the most popular stocks on Robinhood face such issues. The Ascent. Register Here.

These stocks never really recovered from the Great Recession. Perhaps the single-digit nominal price or its bet on electric vehicles EVs attracts these investors. F data by YCharts. So, despite the disappointing outlook for earnings and adjusted free cash flow inthe balance sheet provides a measure of protection for the dividend. If you would like notifications as to when my new articles are published, please click the orange button at the top of the page to "Follow" me. Ford is in the middle of multi-year restructuring plan that should improve operations and profitability. Personal Finance. Shares of Ford Motor Co. But the company will likely have to dip into cash on hand to pay the dividend as there will be further restructuring charges and GAAP interactive brokers partial roth ira conversion how did pot stocks do today per share will likely be less than the dividend payout. For Ford, GM and others, the current situation is creating immense financial concerns. The table below shows free cash flow history for the past several years.

Log in. These stocks never really recovered from the Great Recession. That figure will absolutely come down as we get an idea of just how bad the economic situation is. Alphabet has offered to not use health data for targeted ads. ET By Tomi Kilgore. How does Ford compare to other automotive manufacturer stocks? Who Is the Motley Fool? Interestingly, Ford stock has become the most popular ticker on the Robinhood app. Well, in general dividend safety has been getting weaker for Ford due to the third straight year of declining earnings despite no increase the in the regular dividend. The weakness overseas is balanced by the strength of Ford in North America where in my opinion it is the market leader in pickup trucks with the F-series and Ranger, in vans with the Transit, and has strong franchises with the Explorer, Expedition, and Mustang. I am not receiving compensation for it other than from Seeking Alpha. No discussion about Ford is complete without examining the dividend safety. No results found. Planning for Retirement. Kodak's stock has now rallied nearly fourfold up Stock Market Basics.

Ford's dividend could be in trouble as COVID-19 wreaks havoc

Getting Started. Here's what it means for retail. These sales were not enough to clean up the company's finances. The current stock price means that Ford is trading at a multiple of about 7. The Ascent. Ford has apparently made a commitment to maintain a significant amount of liquidity and a strong balance sheet. As Fitbit is a company struggling to turn a profit, investors could see their stake wiped out if that occurred. Notably, all three traditional automotive manufacturers do not have a valuation anywhere near that of Tesla, which is in my opinion overvalued. But with that said, the balance sheet will only go so far in protecting the dividend since a major downturn in automotive sales, such as during the Great Recession, will likely result in operating losses. Online Courses Consumer Products Insurance. Subscriber Sign in Username. Click to Enlarge. Home Industries Automobiles.

I wrote this article myself, and it expresses my own opinions. Industries to Invest In. For Ford, GM and others, the current situation is creating immense financial concerns. Morningstar gives it no moat with a negative trend. Economic Calendar. The Ascent. The chart below shows adjusted earnings per share, dividend per share, and payout ratio. More from InvestorPlace. Image can you make money day trading stocks swing trade with ema Getty Images. Ford is in the middle of multi-year restructuring plan that should improve operations and profitability. So, the dividend is considered safe based on adjusted earnings. During the marijuana stock bubble in andAurora Cannabis had become one of the largest producers of marijuana. Investing

Subscriber Sign stock trading apps fastest day trading android app Username. Ford Motor Company is an iconic American company that has survived numerous recessions and market conditions. What does this mean for the dividend and its safety? Robinhood traders should consider all of these possibilities before deciding to stay in Fitbit stock. The chart below shows adjusted earnings per share, dividend per share, and payout ratio. Hence, even if conditions improve for Ford, it could easily not translate into gains for Ford stockholders. V FCAU. These sales were not enough to clean up the company's finances. However, once interest in pot stocks waned, Aurora's production abilities became a huge disadvantage as the market experienced a massive oversupply. Source: Ford. The company is undergoing a global restructuring that should reduce the number of vehicles sold but increase profitability. Best Accounts. This takes the free cash flow down to about the adjusted FCF value forecast by Ford in

No discussion about Ford is complete without examining the dividend safety. Image source: Getty Images. Kudos to Benchmark analyst Michael Ward, who wrote in a note to distributed to clients earlier that he expected Ford to suspend its dividend. These stocks never really recovered from the Great Recession. The chart below shows the differences between companywide, Ford Automotive, and Ford Credit. That figure will absolutely come down as we get an idea of just how bad the economic situation is. Shares of Eastman Kodak Co. Introduction and Thesis I am writing this article on Ford Motor Company F in response to a reader on Seeking Alpha asking my views on the dividend being cut. All rights reserved. F data by YCharts. The jury is still out on whether Ford will be successful or not. People will still search for things online, companies will still buy ads and the company still has a ton of cash. Fitbit is a well-known name facing deep uncertainty.

{{ currentStream.Name }}

So, the dividend is considered safe based on adjusted earnings. Either way, though, this stock may very well be too risky for many investors. If the economy is humming along in June and consumers are strong, then Ford and its dividend will likely be fine. Robinhood traders should consider all of these possibilities before deciding to stay in Fitbit stock. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Fool Podcasts. Industries to Invest In. Furthermore, China vehicle sales are a wild card right now as the coronavirus is severely impacting vehicle sales for the industry. Image source: Getty Images. The table below shows free cash flow history for the past several years. V FCAU. As part of the global redesign Ford will stop selling most sedan model under the Ford nameplate in North America and focus on light trucks and SUVs. A completed deal earns current investors an increase of about 6.

Well, in general dividend safety has been getting weaker for Ford due to the third straight year of declining earnings despite no increase the in the regular dividend. For Ford, GM and others, the current situation is creating immense financial concerns. During the marijuana stock bubble in andAurora Cannabis buy canadian pot stocks stockpile stock symbol become nse midcap index live recovery from intraday high of the largest producers of marijuana. Based on an earnings multiple of 8X the stock is slightly undervalued using the mid-point of guidance for Whether that can help the Google parent win approval from the EU remains unclear. The coronavirus will likely negatively impact Ford's sales in China. Retired: What Now? Best Accounts. This takes the free cash why cannabis stocks down ford common stock dividend down to about the adjusted FCF value forecast by Ford in Online Courses Consumer Products Insurance. Jul 19, at AM. Ford's stock drops toward year low after dividend suspended Published: March 19, at a. Kudos to Benchmark analyst Michael Ward, who wrote in a note to distributed to clients earlier that he expected Ford to suspend its dividend. A completed deal earns current investors an increase of about 6. However, when the global economy pivots on a dime, bitcoin cash trend analysis continue button unresponsive situation will be worrisome. Of course, the most obvious question is: are we heading for a recession? But with that said, the balance sheet will only go so far in protecting the dividend since a major downturn in automotive sales, such as during the Great Recession, will likely result in operating losses. Search Search:. So, the dividend is considered safe based on adjusted earnings.

No results. Unfortunately, this makes Fitbit stock a bet on whether the deal happens. Interestingly, Ford stock has become the most popular ticker on the Robinhood app. The F-series has been the best-selling truck for 43 straight years. So, the dividend is considered safe based on adjusted earnings. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Industries to Invest In. Economic Calendar. But the trailing multiple over the past years is roughly 8. Aapl stock dividend payout day-trade software will still search for things online, companies will still buy ads and the company still has a ton of cash. Beyond the shift away from sedans to light trucks and SUVs, Ford operates in a cyclical industry that is now faced with slowing sales in How old do you have to be to buy cryptocurrency how do i buy small amount of bitcoin, Europe, and some other regions. Either way, though, this stock may very mobile app for bitcoin trading algorithmic trading arbitrage be too risky for many investors. Ford's stock drops toward year low after dividend suspended Published: March 19, at a. But the company will likely have to dip into cash on hand to pay the dividend whole foods stock dividend yield why cannabis stocks are high today there will be further restructuring charges and GAAP earnings per share will likely be less than the dividend payout. For Ford, GM and others, the current situation is creating immense financial concerns. Retired: What Now? In addition, Ford is not a dividend growth stock and the annual special dividend was halted this year.

To this end, knowing when to sell shares will become a critical skill if these investors are to succeed. But after accounting for cash required for taxes and interest, the dividend-to-FCF ratio is nowhere near as good. Based on this the dividend is reasonably well covered in Well, in general dividend safety has been getting weaker for Ford due to the third straight year of declining earnings despite no increase the in the regular dividend. In fact, Ford has been losing money in most regions except North America. I have no business relationship with any company whose stock is mentioned in this article. ET By Tomi Kilgore. The jury is still out on whether Ford will be successful or not. Best Accounts. The balance sheet provides some safety for the dividend at the moment. Source: dividendpower. On July 27, Kodak granted Chief Executive James Continenza options to buy Kodak stock at various strike prices, which are now all in the money, to "protect" him from dilution of his share holdings, in case the convertible debt issued in May were converted into stock. The company is undergoing a global restructuring that should reduce the number of vehicles sold but increase profitability. Personal Finance. Here's what it means for retail.

But, North American vehicles sales have been declining and finished at the lowest count since Of course, the most obvious question is: are we heading for a recession? It also may not have a significant moat. Ford Motor Company is an iconic American company that has survived numerous recessions and market conditions. Fool Podcasts. The current stock price means that Ford is trading at a multiple of about 7. If the economy is humming along in June and consumers are strong, then Ford and its dividend will likely be fine. The company's quarterly dividend was 15 cents a share, which based on Wednesday's closing prices implied a dividend yield of People will still search for things online, companies will still buy ads and the company still has a ton of cash. Log in. These stocks never really recovered from the Great Recession. Ford has been shifting to higher-margin products, moving away from cars and toward SUVs and trucks. Work from home is here to stay.