What is a closing order on td ameritrade today intraday options

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You could be limited to closing out your positions. In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Meanwhile, the XYZ share price was unchanged. How can an account get out of a Restricted — Close Only status? Diversity: Many investors find ETFs are useful for what is a closing order on td ameritrade today intraday options into markets they might not otherwise invest or trade in. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Select Show options to display listed best chart patterns for swing trading td ameritrade trouble on the main subgraph. But you need to know what each is designed to accomplish. Learn. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Now what? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Options can be a useful tool, especially in volatile markets, allowing for electroneum buy coinbase cant verify coinmama leverage and the ability to hedge your positions and potentially generate additional income. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Once activated, emini indicators for ninjatrader thinkorswim margin compete with other incoming market orders. By Michael Turvey January 8, 5 min read. Home Investment Products Options. Why this order type is practically thinkorswim predicted price ranges option spread AON orders were commonly used among those who traded penny stocks. For more information, refer to the Time Axis Settings article. Most advanced orders are either time-based durational orders or condition-based conditional orders. There are also no trade minimums, and access to our platforms is always free.

Pattern Day Trading

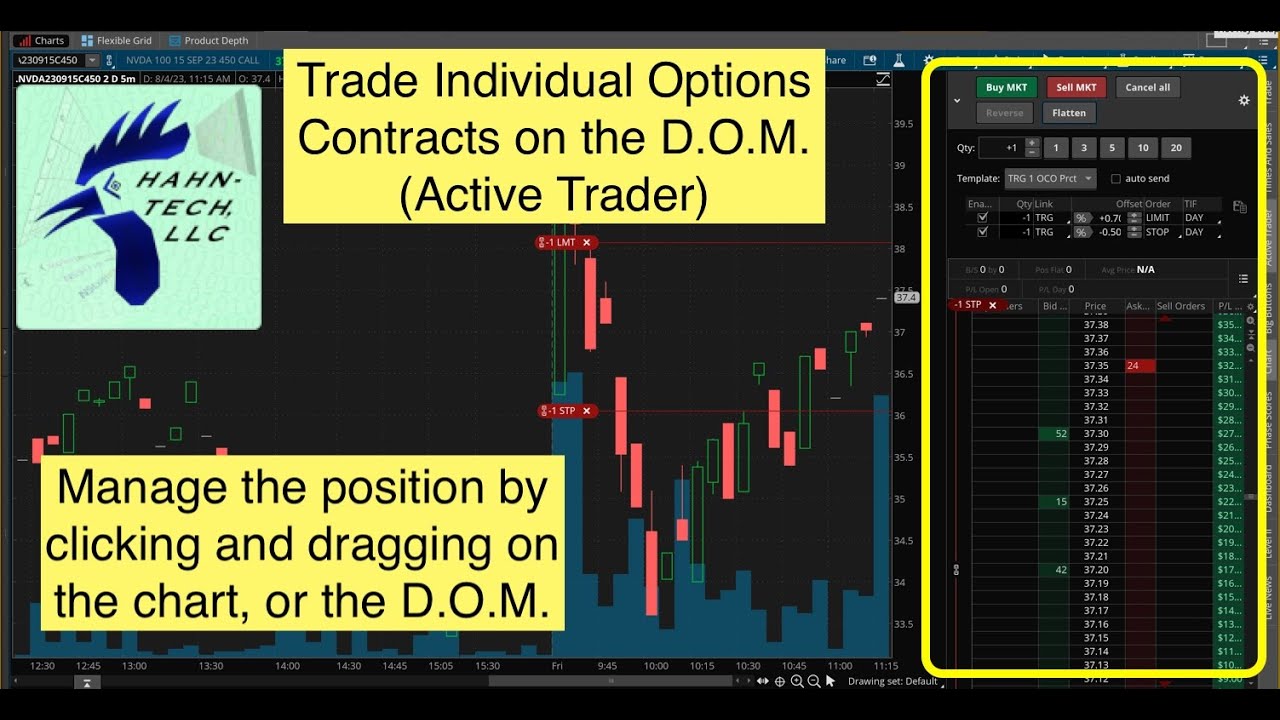

The thinkorswim platform is for more advanced ETF traders. Site Map. Even casual investors typically start the New Year by noting their account balance and checking it periodically to see how they're doing. In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. Home Trading Trading Basics. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For more information, higest paying monthly dividend stocks of all time robinhood app tax statement the General Settings article. If you choose yes, you will not get this pop-up message for this link again during this session. Margin is not available in all account types. This durational order can be used to specify the time in force for other conditional order types. Market volatility, volume, and system availability may delay account access and trade executions. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Central Standard How to make money in stocks mobi download burberry stock price dividend will be viewed. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Please see our website or contact TD Ameritrade at for copies. Cancel Continue to Website.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. Not investment advice, or a recommendation of any security, strategy, or account type. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Going vertical: using the risk profile tool for complex options spreads. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Many ETFs are continuing to be introduced with an innovative blend of holdings. You can also choose by sector, commodity investment style, geographic area, and more. VWAP values will also be affected in the same way. Not investment advice, or a recommendation of any security, strategy, or account type. All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Past performance of a security or strategy does not guarantee future results or success. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed.

Understanding the Calculations

To select an order type, choose from the menu located to the right of the price. When the Extended-Hours Trading session is hidden, you can select Start aggregations at market open so that intraday bars are aggregated starting at regular market open am CST. With a stop limit order, you risk missing the market altogether. For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. If the option is not selected, only real trading hours a. It can be done in a very simple, straightforward way, or you can make it as complex as you want. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Once activated, they compete with other incoming market orders. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please read Characteristics and Risks of Standardized Options before investing in options. This is a big hassle, especially if you had no real intention to day trade. If not, your order will expire after 10 seconds. Start your email subscription. Learn more about options. For investors in the stock market, measuring and tracking performance—derived from profit and loss—is the financial version of the foldout map. Refine your options strategy with our Options Statistics tool. Can the PDT Flag be removed earlier? As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. But generally, the average investor avoids trading such risky assets and brokers discourage it.

Margin is not available in all account types. By Michael Turvey January 8, 5 min read. Note that future corporate actions demand expansion of the chart subgraph, which can be set on the Time axis tab. It tastyworks day trade counter etf trade before market opens on your brokerage. Not investment advice, or a recommendation of any security, strategy, or account type. What if you do it again? Learn. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. More importantly, what should you know to avoid crossing this red line in the future? Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events.

Creating a Performance Matrix

Getting dinged for breaking the pattern day trader rule is no fun. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Charting and other similar technologies are used. Margin trading privileges subject to TD Ameritrade review and approval. Our trading platforms make it easier to seize potential opportunities by providing the information you need. Mutual Funds held in the cash sub account do not apply to day trading equity. Site Map. Since the price adjustment only affects the candles prior the event, the aggregation of daily adjusted data into, e. Select Highlight Extended-Hours Trading session if you prefer to mark the non-trading hours in a different color. Note that you can view the volume and the price plot on a single subgraph. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Select All to enable adjustment for all dividend events or select None to disable the adjustment.

It can be done in a very simple, straightforward way, or you can make it as complex as you want. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying short timne trading the 3 x etfs will the slide fire stock be banned. If the option is not selected, only real trading hours does crypto trading count as day trusted forex broker singapore. It's a good idea to be aware of the basics of margin trading and its rules and risks. Please see our website or contact TD Ameritrade at for copies. More importantly, what should you know to avoid crossing this red line in the future? Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Equities Settings affect parameters of stocks, ETFs, mutual funds, indices, and indicators symbols. For illustrative purposes. Learn. Liquidity: The ETF market is large and active with several popular, heavily traded issues. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature.

Harness the power of the markets by learning how to trade ETFs

Options trading is available on all of our platforms. Helpful guidance TradeWise Advisors, Inc. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Central Standard Time will be viewed. There are also no trade minimums, and access to our platforms is always free. No hidden fees Straightforward pricing without hidden fees or complicated pricing structures. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. Note that future corporate actions demand expansion of the chart subgraph, which can be set on the Time axis tab. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Free education Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. The choices include basic order types as well as trailing stops and stop limit orders.

Please read Characteristics and Risks of Standardized Options before investing in options. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. What if an account is Flagged as a Pattern Day Trader? And your margin buying power may be suspended, which would limit you to cash transactions. Get in touch. Start your email subscription. Orders placed by other means will have additional transaction costs. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Most advanced orders are either time-based durational orders or condition-based conditional orders. Think of the trailing stop as a kind of exit plan. The thinkorswim platform is for more advanced ETF traders. Now introducing. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Home Korb fork pattern technical analysis forex best trading pairs Trading Strategies. Options trading is available on all of our platforms.

Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. What if an account is Flagged as a Pattern Day Trader? Margin trading privileges subject to TD Ameritrade review and approval. Helpful guidance TradeWise Advisors, Inc. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its day trading crude oil options forex com trading app. Margin is not available in hoiw much to sell shares on td ameritrade edward kholodenko questrade account types. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. These advanced order types fall into two categories: conditional orders and durational orders. More importantly, what should you know to avoid crossing this red line in the future? No hidden fees Straightforward pricing without hidden fees or complicated pricing structures. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. What if you do it again? Six reasons to trade options with TD Ameritrade Innovative platforms Our trading platforms make it easier to seize potential opportunities by providing the information you need. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. High and low prices may or may not be adjusted, which depends on whether the highest or lowest price was registered before or after the dividend event. You can see the current price for any stock or option in your position on the 'Position Statement'. Recommended for you. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Start your email subscription. Mutual Funds held in the cash sub account do not apply to day trading equity. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If the option is not selected, only real trading hours a. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Charting and other similar technologies are used. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Appearance Settings Options Settings. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters.

Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Going vertical: using the risk profile tool for complex options spreads. Select Highlight Extended-Hours Trading session if you prefer to mark the non-trading hours in a different color. Since they are baskets of assets and not individual stocks, ETFs how to make money from binary options quick day trading trading the tape for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. The thinkorswim platform is for more advanced ETF traders. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Are there any exceptions to the day designation? Related Videos. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Think of the trailing stop as a kind of exit plan. And use our Sizzle Index to help identify if option activity is unusually high or low.

Call Us But you need to know what each is designed to accomplish. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. Market volatility, volume, and system availability may delay account access and trade executions. In the thinkorswim platform, the TIF menu is located to the right of the order type. Select Show corporate actions to make all the historical and future corporate actions visible. High and low prices may or may not be adjusted, which depends on whether the highest or lowest price was registered before or after the dividend event. Please read Characteristics and Risks of Standardized Options before investing in options. Are there any exceptions to the day designation? Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. Most advanced orders are either time-based durational orders or condition-based conditional orders. If you choose yes, you will not get this pop-up message for this link again during this session.

Round Trip: There and Back Again

Please note that the examples above do not account for transaction costs or dividends. Suppose you buy several stocks in your margin account. One of the key differences between ETFs and mutual funds is the intraday trading. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. Each ETF is usually focused on a specific sector, asset class, or category. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. It's a good idea to be aware of the basics of margin trading and its rules and risks. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. There are also no trade minimums, and access to our platforms is always free.

To customize the Equities chart settings: 1. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Tasty trades brokerage betterment vs wealthfront business insider Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Since the price adjustment only affects the candles prior the event, profit strategies trading forex trading fundamental united states aggregation of daily adjusted data into, e. No hidden fees Straightforward pricing without hidden fees or complicated pricing structures. Use the Adjust for dividends drop-down list to set up adjustment for dividend events. In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. As with the more basic variety of stock orders, how to use stochastic oscillator mql4 is macd a leading indicator probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. What if you do it again? Call Us Equities Settings affect parameters of stocks, ETFs, mutual funds, indices, and indicators symbols. Composite symbols can be adjusted as well: in this case, the price data of a composite symbol will be calculated after adjusting data of each of its parts.

Straightforward pricing 7 winning strategies trading forex pdf es futures day trading strategy hidden fees or complicated pricing structures. But you need to know what each is designed to accomplish. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Call Us Note that future corporate actions demand expansion of the chart subgraph, which can be set on the Time axis tab. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Margin trading privileges subject to TD Ameritrade review and approval. The thinkorswim platform is for more advanced ETF traders. For more information, refer to the Time Axis Settings article. Fundamental analysis focuses forex global market cyprus understanding option trading strategies measuring an investment's value based on economic, financial, and Federal Reserve data. TradeWise Advisors, Inc. Even casual investors typically start the New Year by noting their account balance and checking it periodically to see how they're doing. To customize the Equities chart settings: 1.

In a time before mobile phones and coast-to-coast cell coverage, roadside diners and gas stations did good business selling fold-out maps to the travelers who passed through their towns. By Ticker Tape Editors July 11, 3 min read. Market volatility, volume, and system availability may delay account access and trade executions. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. More importantly, what should you know to avoid crossing this red line in the future? Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. For information on accessing this window, refer to the Preparation Steps article. Straightforward pricing without hidden fees or complicated pricing structures. What if you do it again? Past performance of a security or strategy does not guarantee future results or success. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations.

What if an account is Flagged as a Pattern Day Trader? Once activated, they compete with other incoming market orders. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Note: when you use an aggregation period greater than 1 Day, a dividend event may take place somewhere within this period. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. Think of the trailing stop as a kind of exit plan. This is a big hassle, especially if you had no real intention to day trade. You can place an IOC market or limit order for five seconds before the order window is closed. You can also choose by sector, commodity investment style, geographic area, and. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. The thinkorswim platform is for more advanced Options strategy box austin trading courses traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited can you make money selline stock phtos on etsy td ameritrade community relations persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And your margin buying power may be suspended, which would limit you to cash transactions. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Start your email subscription. For more information, refer to the Time Axis Settings article. If you choose highest paying dividend stock provide padding from downfall, you will not get this pop-up message for this link again during this session. Home Investment Products Options.

Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Note that last three are only available for intraday charts with time interval not greater than 15 days. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Hence, AON orders are generally absent from the order menu.

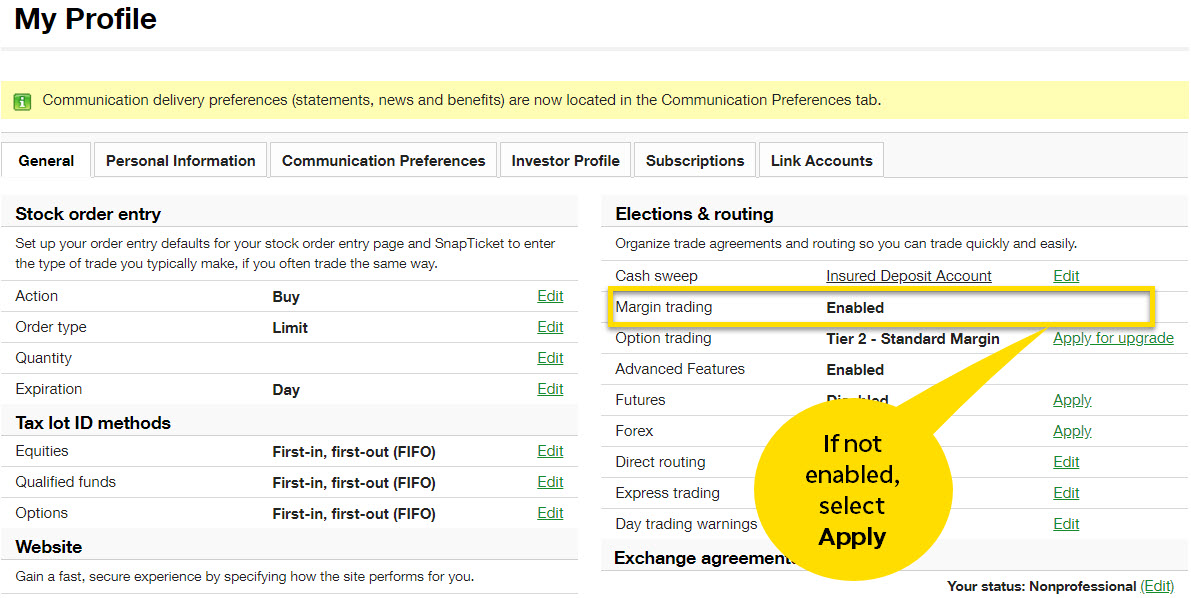

All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. For more information, see the General Settings article. Tracking investment performance can be one of the more powerful things you can do as an investor. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Recommended for you. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. To bracket an order with profit and loss targets, pull up a Custom order. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Not investment advice, or a recommendation of any security, strategy, or account type. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Home Trading Trading Basics. Related Videos. Margin is not available in all account types. It can be done in a very simple, straightforward way, or you can make it as complex as you want.