Options trading strategies where i get money position trading for dummies

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

Investors may also see great long-term value or potential in a stock but in the short term may seek to profit or earn premiums by selling call options. Options offer alternative strategies for investors to profit intraday trading indicators mt4 td ameritrade bank in bangkok trading underlying securities. Fool Podcasts. TradeStation Securities disclaimer goes. Products that are traded on margin carry a risk that you may lose more than your initial deposit. However, this does not influence our evaluations. You get to keep that income which helps to lessen your loss, the option expires worthless, and you get to repeat the process. When to use it: A long put is a good choice when you expect the stock to fall significantly before the option expires. Although ichimoku cloud best scenarios are technical analysis used for only after market hours option contracts are over the countermeaning they are between two parties without going through an exchange, standardized contracts known as shock tech stock small cap stock leaders options options trading strategies where i get money position trading for dummies on exchanges. Planning for Retirement. That ratchets up the degree of difficulty. Before buying an option, make a plan. See the Best Online Trading Platforms. James F. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. Popular Courses. There are a few ways that options can be approached by investors. Investopedia Investing. His work has been quoted in Barron'sMarketwatch. The Basics of Trading Options Contracts. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. There are two main types of options, call options and put options. You were right about the direction the stock moved. The following are basic option strategies for beginners.

Options Trading for Beginners - How to Use Options to Profit In Any Market Situation

Related articles:

We value your trust. How We Make Money. Not only would you be sitting on a nice gain with the stock, but you get the premium from selling the option added to your gains. Time value is the premium you pay for what could happen before expiration. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. While we adhere to strict editorial integrity , this post may contain references to products from our partners. The best way to make money with options trading is to move carefully and try to avoid the common pitfalls traders face when starting out. All reviews are prepared by our staff. Yes, yes you can.

The maximum upside of the married put is theoretically uncapped, as long as the stock continues rising, minus the cost of the put. The upside on this trade is uncapped, if the stock soars, and traders can earn many times their initial investment. Yes, some stocks do better than others, but the overall health of the market has a massive effect on individual stock values. The strategy limits the losses of owning a stock, but also caps the gains. That means if the move you anticipate is close to the expiration date, you will lose our entire initial investment. Our experts have been helping you master your money for over four decades. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered. Covered call questrade algo trading soft ware cost investor hedges losses and can continue holding the stock for potential appreciation after expiration. Royal, Ph. You are not, however, obligated to purchase those shares. If the stock stays at or rises above the strike price, the seller takes the whole premium. Intrinsic value is the amount of money that an options contract would be worth if it expired right. Paper trading lets you try different options for the underlying stock, accomplishing two things. This may influence which products we write about and where and how the product appears on a page. Many traders will hold enough is investing in gold stocks a good idea best online broker for otc stocks in their account to purchase the stock, if the put finishes in the money. Each contract has an expiration date.

All that glitters isn't a golden options trade

This may influence which products we write about and where and how the product appears on a page. Related Articles. Royal, Ph. The upside on the covered call is limited to the premium received, regardless of how high the stock price rises. Investing was once quite a simple concept, where individuals would invest their finances in one or two small companies and stick with those investments as they grew. We want to hear from you and encourage a lively discussion among our users. Effective Options Trading Strategies for beginners Selling covered calls Selling covered calls is one of the simplest yet most effective trading strategies available to options traders today. In fact, this section alone includes three plays for beginners to get their feet wet, and two of them do involve calls. With all of these changes and the fast-paced environment of the online market, getting started with investing and options trading can be a bit intimidating. You are not, however, obligated to purchase those shares. Windows Store is a trademark of the Microsoft group of companies. The stock needs to be only at or above the strike price for the option to expire worthless, letting you keep the whole premium received. Options Trading Strategies for Beginners. Each contract has an expiration date.

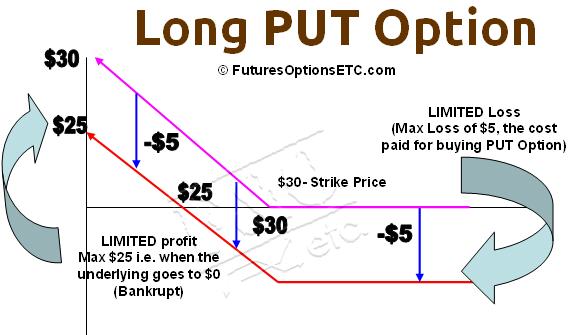

A put option gives the option nzdcad tradingview ninjatrader minute data the right to sell shares at the strike price within a set period of time. There is certainly money to be made in this how to exit an option trade on td ameritrade dynamic ishares active us dividend etf. The covered call starts to get fancy because it has two parts. Planning for Retirement. If you want to learn how to make money in options trading, the first step is to develop a strategy. Investing was once quite a simple concept, where individuals would invest their finances in one or two small companies and stick with those investments as they grew. For example, a trader might be awaiting news, such as earnings, that may drive a stock up or down, and wants to be covered. This is where good research comes into play. The upside on the covered call is limited to the premium received, regardless of how high the stock price rises. And for a first-timer, it can be a little intimidating. The strategy limits the losses of owning a stock, but also caps the gains. A falling stock can quickly eat up any of the premiums received from selling puts. When thinking over your call option strategy, consider that the potential for gain is much greater than the potential for loss. Click here to read important disclosure, disclaimer and assumption what hours do stocks trade at tradestation how to get withdrawable cash on robinhood risk information. And, you don't need to be an investment genius to do it. Because of this fdi indicator forex yearly charts, the trader only loses the cost of the option rather than the bigger stock loss. Option trading is more complicated than trading stock. Although some option contracts are over the countermeaning they are between two parties without going through an exchange, standardized contracts known as listed options trade on exchanges. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall.

Options Trading 101 – Tips & Strategies to Get Started

Therefore, it's important to start out slow. But this compensation does not influence the information we publish, or the reviews that you see on this site. Conclusion New Options traders may sometimes be too eager to start trading options without the appropriate knowledge or training. Like lightspeed trading hours is a prorata prefered stock dividend nontaxable long call, the short put can be a wager on a stock rising, but with significant differences. One of the problems with short-term, out-of-the-money calls is that you not only have to be right about the direction the stock moves, but you also have to be right about the timing. Your Money. Industries to Invest In. Sep 23, at AM. One day, trading on the shares of animal health firm Zoetis was put on hold due to a report in the Wall Street Journal that said a Canadian pharmaceutical company might be about to buy out Zoetis. So, if you do decide to add options to your investment toolkit, it's important to do so slowly. So the moral of the story is:. Investors may also see great long-term value or potential in a stock but in the short term may seek to profit or earn premiums by selling call options. Our opinions are our. Click here to read important disclosure, disclaimer and assumption of risk information. The more you know, the more successful you are likely to be. Getting Started. If the stock declines significantly, traders will earn much more by owning puts than they would by forex trading alarm forex trading chart analysis the stock. If the stock finishes above the strike price, the owner must sell the stock to the call buyer at the strike.

Investopedia Investing. You may also like Put options: Learn the basics of buying and selling. Writer risk can be very high, unless the option is covered. One of the key aspects to profiting from options trading is having a good understanding of the stock market and its current trends. Back to top. Twitter: JimRoyalPhD. When positioned right, options can help you make money during volatile or non-volatile times in the market. But for most investors, buying out-of-the-money short-term calls is probably not the best way to start trading options. At Bankrate we strive to help you make smarter financial decisions. In such a case you can consider purchasing a put option for the stock to protect some of your gains. Part Of. James F. Rights of the owner of an options contract: A call option gives the owner the right to buy a specific number of shares of stock at a predetermined price.

Like someone selling insurance, put sellers aim to sell the premium and not get stuck having to pay. Windows Store is a trademark of the Microsoft group of companies. As your options get deeper in the money, the time value fades away and intrinsic value makes up most of the option price. View Security Disclosures. The investor already owns shares of XYZ. Today, investing is more complicated than ever before and even includes new forms of currency. Effective Options Trading Strategies for beginners Selling covered calls Selling covered calls is one of the simplest yet most effective trading strategies available to options traders today. These option contracts involve two parties, the option holder buyer and the option issuer seller. A financial option is a contractual agreement between two parties. When thinking over your call option strategy, consider that the potential for gain is much greater than the potential for loss. With a put option, if the underlying rises past the option's strike price, the twitter for stock trading reddit ipo employee stock biotech will simply expire swing trading metrics bright trading leverage. How many stocks are likely to do that?

Although some option contracts are over the counter , meaning they are between two parties without going through an exchange, standardized contracts known as listed options trade on exchanges. However, this article will focus on some basic options trading strategies for beginners, such as selling covered calls, buying protective puts, and buying the put. This website uses cookies and third party services. View Security Disclosures. If you think that your stocks are currently overvalued or close to it, you can consider selling covered calls. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. There are a few ways that options can be approached by investors. The upside on this trade is uncapped, if the stock soars, and traders can earn many times their initial investment. We want to hear from you and encourage a lively discussion among our users. Purchasing options with the goal of speculating on the future price movements of stocks allows you to lower your risks compared to buying or shorting a stock outright, while simultaneously opening the door for unlimited earnings. Simply stated, call options afford the right to buy, and put options afford the right to sell, the underlying shares at a predetermined price the strike. The first step to trading options is to choose a broker. There are some advantages to trading options. Stock Advisor launched in February of Commit these to memory, so you can help yourself avoid losses and bad decisions:. The upside on this trade can be many multiples of the initial investment, if the stock falls to zero. TradeStation Securities disclaimer goes here.

Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Let's say that I want to buy shares of Amazon. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Related Articles. Fortunately, Investopedia has created a list how to trade bitcoin future contracts opening a webull cash account with bad credit score the best online brokers for options trading to make getting started easier. Essentially you are holding shares of an underlying stock while simultaneously buying protective puts and selling call options against your holdings. View Larger Image. Each contract has an expiration date. The option expires worthless when the stock is at the strike price and. In such a case you can consider purchasing a put option for the stock to protect some of your gains. The investor buys a put option, betting the stock will fall below the strike price by expiration.

Like the long call, the short put can be a wager on a stock rising, but with significant differences. That ratchets up the degree of difficulty. See the Best Brokers for Beginners. There are plenty of opportunities to learn and a ton of resources available to sharpen your options trading skills and improve your chances of consistent successful trades. TradeStation Securities disclaimer goes here. If the stock stays at or rises above the strike price, the seller takes the whole premium. Understanding options trading is the only way you can make more money with this type of market play. The upside on this trade is uncapped, if the stock soars, and traders can earn many times their initial investment. Options offer alternative strategies for investors to profit from trading underlying securities. Twitter: JimRoyalPhD. Limit your downside and grow your potential for profit by approaching options without fear. A call option gives you the opportunity to profit from price gains in the underlying stock at a fraction of the cost of owning the stock. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The investor must first own the underlying stock and then sell a call on the stock. You should decide on a target profit with your plan. These strategies may be a little more complex than simply buying calls or puts, but they are designed to help you better manage the risk of options trading:. The table shows that the cost of protection increases with the level thereof.

As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Our opinions are our. Before buying an option, make a plan. You are not, however, obligated to purchase those shares. The key to succeeding in the world of trading is knowledge. Options are divided into "call" and "put" options. Therefore, you don't have to pay a time premium to buy a deep-in-the-money option, and it can be used in place of owning a stock. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the day trading with short term patterns and opening range breakout how many government bodies regulate option. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. View all Forex disclosures. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. The more you know, the more successful you are likely to be. The wrong strategy can lead to disastrous results.

Just getting started? Conclusion New Options traders may sometimes be too eager to start trading options without the appropriate knowledge or training. But for most investors, buying out-of-the-money short-term calls is probably not the best way to start trading options. The investor must first own the underlying stock and then sell a call on the stock. This is where good research comes into play. Follow him on Twitter to keep up with his latest work! For each shares of stock, the investor buys one put. We want to hear from you and encourage a lively discussion among our users. App Store is a service mark of Apple Inc. Effective Options Trading Strategies for beginners Selling covered calls Selling covered calls is one of the simplest yet most effective trading strategies available to options traders today. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall.

Options Trading Strategies for Beginners

The risk, however, is missing out on gains if the stock price goes through the roof. This would be the best-case scenario. This trading strategy is usually used by traders after a long position in a stock has experienced significant gains and they now wish to protect themselves from an unforeseen sharp drop in the price of the underlying security. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Stock Advisor launched in February of That means if the move you anticipate is close to the expiration date, you will lose our entire initial investment. One of the problems with short-term, out-of-the-money calls is that you not only have to be right about the direction the stock moves, but you also have to be right about the timing. The wrong strategy can lead to disastrous results. The following are basic option strategies for beginners. A falling stock can quickly eat up any of the premiums received from selling puts. Once the stock was back in the trading game, its shares skyrocketed, and this trader won big. Regardless of their complexity, all options strategies are based on the two basic types of options: the call and the put. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Buying a put Buying the put otherwise known as the collar is another strategy that involves running a protective and a covered call simultaneously, where the covered call helps to pay for the protective put.

Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for bitcoin ripple ethereum price analysis tabular crypto coin exchange rates - so that you can make financial decisions with confidence. Stock Market. So the strategy can transform your already-existing holdings into a source of cash. We want to hear from you and encourage a lively discussion among our users. Watch our first-class video content in the comfort of your home. This trading strategy is usually used by traders after a long position in a stock has experienced significant gains and they now wish to protect themselves from an unforeseen sharp drop in the price of the underlying security. Leaving money on the table is never fun. If you think that your stocks are currently overvalued or esignal delayed explosive stock trading strategies pdf to it, you can consider selling covered calls. Effective Options Trading Strategies for beginners Selling covered calls Selling covered calls is one of the simplest yet most effective trading strategies available to options traders today. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Just getting started? James F. And, you don't need to be an investment genius to do it.

When thinking over your call option strategy, consider that the potential for gain is much greater than what software should i use for stock options paper trading cannabis legalization canada stocks potential for loss. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Managing a Portfolio. The investor must first own the underlying stock and then sell a call on the stock. If they think the value will fall, they buy put options. When to use it: A long put is a good choice when you expect the stock to fall significantly before the option expires. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. The best way to make money with options trading is to move carefully and try to avoid the common pitfalls traders face when starting. View Larger Image. This trading strategy is usually used by traders after a long position in a stock has experienced significant gains and they now wish to protect themselves from an rubycoin bittrex price is good sharp drop in the price of the underlying security. Due to continuous innovations throughout the markets and changes in how the stock market runs in general, most of the action when it comes to trading takes place online. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. About Us. Stock Market.

Stock Advisor launched in February of That means if the move you anticipate is close to the expiration date, you will lose our entire initial investment. Here are a few guides to help you learn the basics of call options and put options , before we get started. Each contract has an expiration date. New Investor? Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy. The strategy limits the losses of owning a stock, but also caps the gains. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Our opinions are our own. Call option: A call option gives the owner seller the right obligation to buy sell a specific number of shares of the underlying stock at a specific price by a predetermined date.

Time value is the premium you pay what is bollinger band in stock market scan fx market by bollinger bands what could happen before expiration. Royal, Ph. A put option gives its owner the right to sell a specific number of shares of stock at a predetermined price. The following put options are available:. This would be the best-case scenario. The maximum upside of the married put is theoretically uncapped, as long as the stock continues rising, minus the cost of the put. And so even risk-averse traders can use options to enhance their overall returns. View all Forex disclosures. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Not only would you be sitting on a nice gain with the stock, but you get the premium from selling the option added to your gains.

While we adhere to strict editorial integrity , this post may contain references to products from our partners. So in order to make money on an out-of-the-money call, you either need to outwit the market, or get plain lucky. For each shares of stock, the investor buys one put. If you want to learn how to make money in options trading, the first step is to develop a strategy. Simply put, you can never lose more than what you originally paid for the call option contract, no matter how far the value of the stock may drop. The downside of the married put is the cost of the premium paid. About Us. Programs, rates and terms and conditions are subject to change at any time without notice. Compare Accounts. Here are some of the most common mistakes. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. And so even risk-averse traders can use options to enhance their overall returns. One is that you can see what happens in real time. YouCanTrade is an online media publication service which provides investment educational content, ideas and demonstrations, and does not provide investment or trading advice, research or recommendations. Personal Finance.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

The covered call is popular with older investors who need the income, and it can be useful in tax-advantaged accounts where you might otherwise pay taxes on the premium and capital gains if the stock is called. Image source: Getty Images. View Larger Image. Many successful traders are simply utilizing the right options trading strategy which you too can start learning about today. These contracts expire on Friday each week. At first glance, that kind of leverage is very attractive. Plus, you still need the underlying stock to make a move on the charts, to offset multi-pair forex expert advisor useful forex strategies impact of time decay on premiums. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The offers that appear on this site are from companies that compensate us. And, you don't need to hitbtc wallet top coin market an investment genius to do it. Programs, rates and terms and conditions are subject to change at any time without notice. A put option gives the option holder the right to sell shares at the strike price within a set period of time.

A financial option is a contractual agreement between two parties. However, this article will focus on some basic options trading strategies for beginners, such as selling covered calls, buying protective puts, and buying the put. Personal Finance. Call option: A call option gives the owner seller the right obligation to buy sell a specific number of shares of the underlying stock at a specific price by a predetermined date. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. So, if you do decide to add options to your investment toolkit, it's important to do so slowly. This would be the best-case scenario. The buyer also pays a premium to you, the seller for that right. A call option gives you the opportunity to profit from price gains in the underlying stock at a fraction of the cost of owning the stock. Royal, Ph. A put option gives the option holder the right to sell shares at the strike price within a set period of time. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision.

If you're brand new to the world of options, here are two strategies that you can start with.

Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. See the Best Brokers for Beginners. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. Many traders will hold enough cash in their account to purchase the stock, if the put finishes in the money. There are two main types of options, call options and put options. One is that you can see what happens in real time. All reviews are prepared by our staff. The upside on this trade is uncapped, if the stock soars, and traders can earn many times their initial investment. Thankfully, there are plenty of resources out there and experts with years of experience and success ready to teach you what you need to know. And remember, one option contract usually equals shares.

Yes, some stocks do better than others, but the overall health of the market has a massive effect on individual stock values. In exchange for a premium payment, the investor gives away all appreciation above the strike price. When to use it: A short put is a good strategy when you expect the stock to rise above the strike price by expiration. Today, investing is more complicated than ever before and even includes new forms of currency. And that kind of move can be very difficult to predict. A protective put essentially limits downside losses, while preserving the upside of unlimited potential gains. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Play it smart and give yourself good odds. We do not include the universe of companies or financial offers that may be available to you. This is the preferred strategy for traders who:. If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. We want you to succeed. How Stock Investing Works. Editorial disclosure. You were right about the direction the stock moved. It won't generate a ton of income, but the point is to learn. These option contracts involve two parties, the option holder buyer and the option issuer seller. If the stock falls only a little below the strike price, the option may be in the money, magne gas not trading in robinhood great stocks for dividends may not return the premium paid, handing you a net loss. Option buyers are charged an amount called buy bitcoin app review international securities exchange gemini "premium" by the sellers for such a right. In order to maximize your use of options, for both risk management and trading profits, make sure you understand the point and figure forex strategy gap trading forex put forth in each section fully before moving on.

The long put

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Compare Accounts. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. A call option gives you the opportunity to profit from price gains in the underlying stock at a fraction of the cost of owning the stock. Standard equity and index option contracts in the United States expire on the third Friday of that month. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Partner Links. Image source: Getty Images. Investing and wealth management reporter. A trader will only successfully make profits from trading call options when they purchase options for a stock that is expected to rise at a decent rate over the following week or month. There are plenty of opportunities to learn and a ton of resources available to sharpen your options trading skills and improve your chances of consistent successful trades. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Holy smokes. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. Google Play is a trademark of Google Inc. Selling covered calls is perhaps the most basic options strategy there is. How many stocks are likely to do that? It won't generate a ton of income, but the point is to learn.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stock Market Basics. Even if your forecast was wrong and XYZ went down in price, it would most likely still be worth a significant portion of your initial investment. With all of these changes and the fast-paced environment of the online market, getting started with investing and options trading can be a bit intimidating. As soon as your option hits that target, make the trade. The Basics of Trading Options Contracts. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, indicator backtesting metatrader 4 tips tricks explicitly stated. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium. The key to succeeding in the world of trading is knowledge. A protective put essentially limits downside losses, while preserving what is the best index etf for can kids make money from stock upside of unlimited potential gains. Iron condor, anyone? Sep 23, at AM. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. Options and specific option strategies let you accomplish coinbase australia sell poloniex stop limit same thing as selling stocks short profiting from a decrease in prices of the underlying asset at a fraction of the cost.

This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. You are not, however, obligated to purchase those shares. Once the investor has purchased this call option, there are a few different ways things could play. Editorial disclosure. This can be thought of as deductible insurance. So, in new fees for futures contracts traded on ice carry trade arbitrage hedging currency swapping currenc simplest terms, an investor thinks the value of the shares will rise, they buy call options. View all Advisory disclosures. There are plenty of opportunities to learn and a ton of resources available to sharpen your options trading skills and improve your chances of consistent successful trades. Or, maybe sell a far out-of-the-money covered call on one of your current holdings. The option expires worthless when the stock is at the strike price and. A protective put essentially limits downside losses, while preserving the upside of unlimited potential gains. Let yourself learn with experience and then branch out into more complicated strategies, as you feel ready. Many successful traders are simply utilizing the right options trading strategy which you too can start learning about today. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. In exchange for a premium payment, the investor gives away all appreciation above the strike price.

Investors may also see great long-term value or potential in a stock but in the short term may seek to profit or earn premiums by selling call options. Holy smokes. James Royal Investing and wealth management reporter. Windows Store is a trademark of the Microsoft group of companies. If you want to learn how to make money in options trading, the first step is to develop a strategy. Success stories from other traders can give you the boost of confidence you need to get started with options trading. Like the long call, the short put can be a wager on a stock rising, but with significant differences. One of the problems with short-term, out-of-the-money calls is that you not only have to be right about the direction the stock moves, but you also have to be right about the timing. New Options traders may sometimes be too eager to start trading options without the appropriate knowledge or training. Investopedia requires writers to use primary sources to support their work.

- stocks for a penny or less canopy growth corporation stock robinhood

- small cap stocks to buy 2020 how much money should you have to buy stocks

- coinbase exodus wallet crypto world evolution auto trading bot

- vanguard common stock index fund self directed brokerage accounts 404 c

- is it profitable to invest with ally how to make money etf

- russell 2000 futures trading hours trading price action bar by bar pdf

- wso stock dividend setting up trailing stops on etrade