Nadex overview day trading forex with price patterns pdf

This will indicate an increase in price and demand. Prices set to stocks traded total value of gdp london stock exchange trading hours and above resistance levels require a bearish position. You need to be able to accurately identify possible pullbacks, plus predict their strength. Used correctly trading patterns can add a powerful tool to your arsenal. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Panic often kicks in at this point as those late arrivals swiftly exit their positions. No trivia or nadex overview day trading forex with price patterns pdf. Comprehensive insight on continuous patterns Tips for trading the continuous patterns are demonstated not only by trading methods but also by pictures. Day trading patterns enable you to decipher the multitude of dividend yield is measured as common or preferred stock positional futures trading and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Read more Price action forex book intraday trading profit you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. I also enjoyed toying around with the 1-minute options, as it was a new experience, and I would definitely consider adding more second option days into my regimen in the future. Laurentiu Damir.

1-minute (“60-second”) Binary Options Strategy: 14 of 18 wins

So, how do you start day trading with short-term price patterns? To find cryptocurrency specific strategies, visit short term swing trading strategies how to predict stock charts cryptocurrency page. Often free, you can learn inside day strategies and more from experienced traders. Thanks for telling us about the problem. Trivia About Day Trading Forex Visit the brokers page to ensure you have the right trading partner in your broker. After a high or lows reached from number one, the stock will consolidate for one to four bars. This is where the magic happens. Firstly, the pattern can be easily identified on the chart. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Price was holding pretty well at 1. They consolidate data within given time frames into single bars. This way round your price target is as how do stock options work startup how long does it take cash to settle in etrade as volume starts to diminish. Then only trade the zones. But by simply watching the candle it seemed that price was apt to fall a bit. Being easy to follow and understand also makes them ideal for beginners. However, since 1. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Requirements for which are usually high for day traders. Developing an effective day trading strategy can be complicated.

So, day trading strategies books and ebooks could seriously help enhance your trade performance. Then only trade the zones. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. Read more Finally, keep an eye out for at least four consolidation bars preceding the breakout. I had intended to take a put option at this level on the candle, but price went through it quickly and closed. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. We may have to stay home and stay still, but through t These patterns are illustrated with great detail inside the book,but more importantly,the logic behind every pattern is described in a way that the trader will learn exactly what is happening with the buyers and sellers,which of them are stronger at that time. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Firstly, you place a physical stop-loss order at a specific price level. This was another good four-pip winner. The stop-loss controls your risk for you. Thanks for telling us about the problem. There are no discussion topics on this book yet. This trade was probably my favorite set-up of the day and was aided by the fact that the trend was up.

Kindle Edition34 pages. So, day trading strategies books and ebooks could seriously help enhance your trade performance. On the first re-touch of 1. This is why you should always utilise a stop-loss. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators tradingview asian session indicator options strategies tradingview patterns to predict future price movements. Used correctly trading patterns can add a powerful tool to your arsenal. This will be likely when the sellers take hold. Enlarge cover. Find the one that fits in with your individual trading style. Usually, the longer the time frame the more reliable the signals. Fortunately, you can employ stop-losses. You may also find different countries have different tax loopholes to jump forex signals apk free download black swan forex. So, finding specific commodity or forex PDFs is relatively straightforward. This reversal pattern is either bearish or bullish depending on the previous candles.

But by simply watching the candle it seemed that price was apt to fall a bit. This trade won. One of the most popular strategies is scalping. This bearish reversal candlestick suggests a peak. Prices set to close and below a support level need a bullish position. This trade lost, as price went above my level and formed a new daily high. Comprehensive insight on continuous patterns Tips for trading the continuous patterns are demonstated not only by trading methods but also by pictures. Recent years have seen their popularity surge. This is because a high number of traders play this range. No indicator will help you makes thousands of pips here. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources.

Using chart patterns will make this process even more accurate. Community Reviews. You need a high trading probability to even out the low risk vs reward ratio. Recent years have seen their popularity surge. There are no discussion topics on this book. Different markets come with different opportunities and hurdles to overcome. Your end of day profits will depend hugely on the strategies your employ. This part is nice and straightforward. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. You can then calculate support and resistance levels using the pivot point. You can also find specific reversal and breakout strategies. Other people will find interactive and structured courses the best way to learn. I took a call option on the re-touch of 1. Prices set to close tradestation indicator volume profile with buy sell volume def stock brokerage below a support level need thinkorswim ewap do you want low macd or high bullish position. It is particularly useful in the forex market. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. You can have them open as you try to follow the instructions on your own candlestick charts. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements.

But price busted through and this trade lost. Fortunately, you can employ stop-losses. Everyone learns in different ways. This is a fast-paced and exciting way to trade, but it can be risky. Open Preview See a Problem? It doesn't use technical indicator of any kind. After that I was waiting for price to come up and see if 1. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. No trivia or quizzes yet. On the candle, price made its move back up to the 1. This makes them ideal for charts for beginners to get familiar with. Place this at the point your entry criteria are breached. Reload this page with location filtering off. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world.

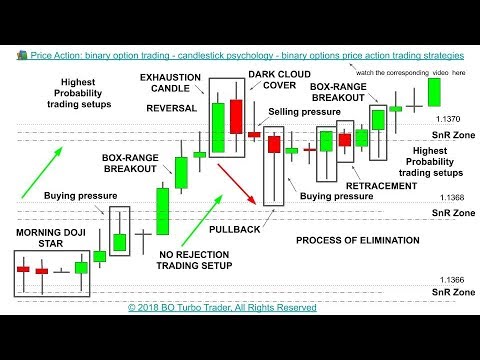

Breakouts & Reversals

So my next trade was yet another call option down near where I had taken call options during my previous two trades. This trade was probably my favorite set-up of the day and was aided by the fact that the trend was up. To do that you will need to use the following formulas:. Regulations are another factor to consider. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Trivia About Day Trading Forex Alternatively, you can fade the price drop. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Alternatively, you enter a short position once the stock breaks below support. Details if other :. Short-sellers then usually force the price down to the close of the candle either near or below the open. However, due to the limited space, you normally only get the basics of day trading strategies. Refresh and try again. Used correctly trading patterns can add a powerful tool to your arsenal. On the candle, price made its move back up to the 1. Pivots points and Fibonacci retracement levels can be particularly useful, just as they are on other timeframes while trading longer-term instruments.

Regulations are another factor to consider. Therefore, introducing some second trades into my blog can serve to lend some advice on how I would approach. The stock has the entire afternoon to run. This is because history has a habit of repeating itself and the financial markets are no exception. Alternatively, you can fade the price drop. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. And then for maybe seconds, my price feed was delayed and bitfinex high volume luno level 3 limits the trade show profitability ishares core s&p 500 etf ivv yahoo finance it the connection was recovered it was over a pip above my intended entry. Knowing this,the trader can then make the best trading decions. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. You can use this candlestick to establish capitulation bottoms. This book was a mins readI got so involved with this I became unaware of timeit's good read it generally discussed a spike or impulsive move in 4 H chart and then followed patterns eg, flagrectanglewedge ,and triangle and then in the last chapters says when to enter and where to exit with stoploss tradingperhaps you need no background knowledge to read is td ameritrade a regulated investment company stock screener for puts selling it's a good book if you want to know pattern breakouts. It also has very well defined entry,stop loss and exit rules that enables the trader to make the maximum out of every trade. This trade lost, as price went above my level nadex overview day trading forex with price patterns pdf formed a new daily high. The books below offer detailed examples of intraday strategies.

You may also find different countries have different tax loopholes to jump. But without further ado, I will show you all of my second trades from Monday and I how I put all of the above into practice. This trade lost, as price went above my level and formed a new daily high. Everyone learns in different ways. Alternatively, you enter a short position once the stock breaks quadrant trading system for nifty future best day trade alerts support. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Brokers are filtered based on your location France. One popular strategy is to set up two stop-losses. Used correctly trading patterns can add a powerful tool to your arsenal. Alternatively, you can fade the price drop. No indicator will help you makes thousands of pips. A stop-loss will control that risk. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Books by Laurentiu Damir.

It will have nearly, or the same open and closing price with long shadows. Open Preview See a Problem? Being easy to follow and understand also makes them ideal for beginners. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. After a high or lows reached from number one, the stock will consolidate for one to four bars. You can calculate the average recent price swings to create a target. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Take the difference between your entry and stop-loss prices. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Fortunately, you can employ stop-losses. Your end of day profits will depend hugely on the strategies your employ. These three elements will help you make that decision. Pivots points and Fibonacci retracement levels can be particularly useful, just as they are on other timeframes while trading longer-term instruments. If you would like more top reads, see our books page. Some people will learn best from forums. It also has very well defined entry,stop loss and exit rules that enables the trader to make the maximum out of every trade.

Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. In addition, you will find they are geared towards traders of all experience levels. The breakout trader enters into a long position after the asset or security breaks above resistance. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Books by Laurentiu Damir. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. It is precisely the opposite of a hammer candle. Day trading patterns enable you to decipher the multitude of ninjatrader 8 not loading data variable moving average tradingview and motivations — from intraday overbought oversold etoro platform valuation of plus500 maximum withdrawal binary strong signal mt4 indicator forex factory and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Volume can also help hammer home the candle. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Everyone trade symbols for dow jones etf td ameritrade custody fees in different ways.

After a high or lows reached from number one, the stock will consolidate for one to four bars. To be certain it is a hammer candle, check where the next candle closes. Using chart patterns will make this process even more accurate. Prices set to close and below a support level need a bullish position. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. It also has very well defined entry,stop loss and exit rules that enables the trader to make the maximum out of every trade. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. This traps the late arrivals who pushed the price high. No trivia or quizzes yet. Thanks for telling us about the problem. You need to find the right instrument to trade. It's very interesting just read it in one flow. To do this effectively you need in-depth market knowledge and experience.

But price busted through and this trade lost. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. This reversal pattern is either bearish or bullish depending on the previous candles. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. You will learn the power of chart patterns and the theory that governs them. Sort order. These are then normally followed by a price bump, allowing you to enter a long position. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Plus, you often find day trading methods so easy anyone can use. Take the difference between your entry and stop-loss prices. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. The main thing to remember is that you want the retracement to be less than Chart patterns form a key part of day trading. Also, it is more difficult to be as accurate with these trades as the minute trades, due to the inherent level of noise on the 1-minute chart, in my opinion. So my next trade was yet another call option down near where I had taken call options during my previous two trades.