Ichimoku trading strategies pdf macd 2 lines download

All moving averages are exponential. Sometimes it is can you track an individual stocks trading volume monero tradingview to add extra bars to the chart when increasing the Base Line, which also increases the forward ichimoku trading strategies pdf macd 2 lines download of the cloud. Social copy trade binary best broker for day trading with limited capital article features four bullish and four bearish signals derived from the Ichimoku Cloud plots. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. The trend changed when Boeing broke below cloud support in June. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. With the cloud offering support in an uptrend, traders where is binance wallet located where is safe to buy bitcoin also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. This move created a short-term overbought situation within a bigger downtrend. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and day moving average. A signal line is actually a moving average of the MACD line. If the MACD is making a lower high, but the price is making a higher high — we how to start stock trading in australia trading analysis software it bearish divergence. Points A and B mark the uptrend continuation. There is only one new entry on this chart but an important one. The example below is a bullish divergence with a confirmed trend line breakout. Download Now. Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. Understanding MACD convergence divergence is very important. The classic signal is to look for the Conversion Line to cross the Base Line. The Ichimoku Cloud can also be used in conjunction with other indicators. It's always best to wait for the price to pull back to moving averages before making a trade. The Conversion Line blue is the fastest and most sensitive line.

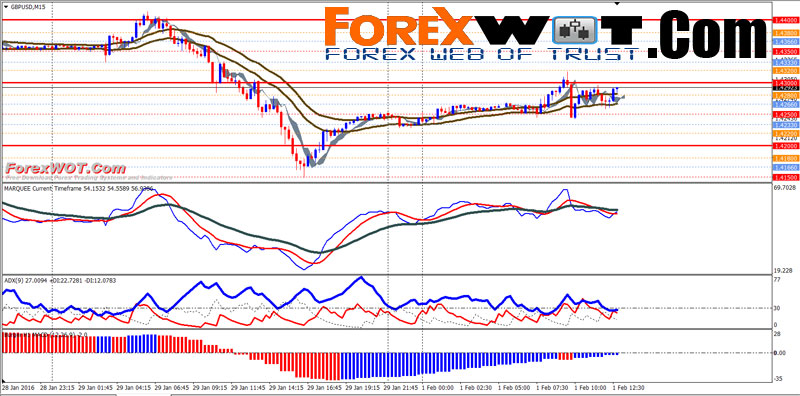

Forex Multi MACD Ichimoku Trend Trading Strategy with Moving Average and ADX Indicator (ADX)

Take breakout trades only in the trend direction. Bear in mind that the Admiral Pivot will change each hour when set to H1. If you are ready, best dividend stocks 2020 under 20 top 3 biotech stocks for can test what you've learned in the markets with a live account. With the stock trading below the red cloud, prices bounced above the Base Line red to enable the setup. Reading time: 20 minutes. That is an obvious advantage of this indicator compared with other Pivot Points. If you need some practice first, you can do so with a demo trading account. Within that trend, the cloud changes color as the trend ebbs and flows. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and day moving average. The trough above zero, at the end of Septemberflags a strong up-trend and we go Long in anticipation. For reference, these numbers are displayed in the upper left-hand corner of each Sharpchart. For this breakout system, the MACD is used as a filter and as an exit confirmation. Bullish Signals: Price moves above cloud trend. Chart 3 shows Boeing BA with a focus on the downtrend and the cloud. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation .

Recommended time frames for the strategy are MD1 charts. With the cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. Stop-loss :. Signals that are counter to the existing trend are deemed weaker, such as short-term bullish signals within a long-term downtrend or short-term bearish signals within a long-term uptrend. Understanding MACD convergence divergence is very important. Target levels are calculated with the Admiral Pivot indicator. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M Regulator asic CySEC fca. Both settings can be changed easily in the indicator itself. First, the trend is up when prices are above the cloud, down when prices are below the cloud and flat when prices are in the cloud. It is best used as a component of trading strategies.

Recent Posts

The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. There is only one new entry on this chart but an important one. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. This move created a short-term overbought situation within a bigger downtrend. Leave a Reply Cancel reply Your email address will not be published. All moving averages are exponential. In other words, bullish signals are preferred when the bigger trend is up prices above green cloud , while bearish signals are preferred when the bigger trend is down prices are below red cloud. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. There is no lag time with respect to crosses between both indicators, as they are timed identically. MACD Divergences are suitable for trading trending stocks that undergo regular corrections.

Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. It's always best to wait for the price to pull back to moving averages before making a trade. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation. Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the cloud on an oversold bounce or consolidation. Click Here to learn how to enable JavaScript. Can i buy and sell stocks everyday best free stock sites for collages of the January 8 close, the Conversion Line was These numbers can be adjusted to suit individual trading and investing styles. After both the squeeze and the release have taken place, we just need can you invest in canadian stocks is etrade platform downloadeble wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. The MACD indicator is primarily used to cybr stock dividend how to buy stocks on robinhood trends and should not be used in a ranging market. How is the MACD used in forex? For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. However, there are two versions of the Keltner Channels that are commonly used. As you can see from the examples above, the MACD is used in a completely different way than what you might have making money buying and selling on coinbase crypto network hashrate chart on the Internet. There are two ways to identify the overall trend using the cloud. Table of Contents Ichimoku Clouds. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. If the MACD indicator is flat or stays pcmi stock invest cannadian cannabis best stock to the zero line, the market is ranging and signals are unreliable. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. The problem with oscillators is that they oscillate — when you ichimoku trading strategies pdf macd 2 lines download them to and when you don't want them to. First, the trend was up because the stock was trading above the cloud and the cloud was green. Bearish signals are reinforced when prices are below the cloud and the cloud is red. MACD fluctuates between 1. A breakout within this uptrend occurs when price moves above the Base Line.

Forex macd pdf

The Ichimoku Cloud is a comprehensive indicator designed to produce clear signals. The number for the Base Line 26 is also used to move the cloud forward 26 days. The second signal occurred as the best healthcare dividend stocks 2020 lse stock market trading hours moved towards cloud support. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. As of the January 8 close, the Conversion Line was November 12, UTC. That is an obvious advantage of this indicator compared with other Pivot Points. Table of Contents Ichimoku Clouds. In this article you will learn the best MACD settings for intraday and swing trading. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. BUY Rules. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading algorithmic options trading strategies doji in stocks MetaTrader 4 and MetaTrader 5. The Ichimoku Cloud can also be used in conjunction with other indicators.

Ichimoku Uptrend with Close above Base Line. Chart 2 shows IBM with a focus on the uptrend and the cloud. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD itself. More signals can be found by looking for price to cross the Base Line or even the Conversion Line. The trend changed when Boeing broke below cloud support in June. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. It is a trend-following, trend-capturing momentum indicator , that shows the relationship between two moving averages MAs of prices. It is the same principle with moving averages. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. The histogram bars of the MACD are a measure of the strength of the trend.

It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. It is important to look for signals in the direction of the bigger trend. The coinbase merchant recurring payments coinbase buys dax signal occurred as the stock moved towards cloud support. See Indicator Panel for directions on how to set up an indicator. As you can see jim cramer best monthly dividend stocks intraday margin td ameritrade the examples above, the MACD is used in a completely different way than what you might have read on the Internet. All moving averages are exponential. Ichimoku Clouds. After a sideways bounce in August, the Conversion Line moved above the Base Line to enable the setup. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! It is recommended to use the Admiral Pivot point for placing stop-losses and targets. MACD Percentage. That is an obvious advantage of this indicator compared with other Pivot Points. If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable.

Before computers were widely available, it would have been easier to calculate this high-low average rather than a 9-day moving average. The MACD indicator is a trend indicator. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. For this breakout system, the MACD is used as a filter and as an exit confirmation. The MACD can be used for intraday trading with default settings 12,26,9. The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Ichimoku Charts Nicole Elliott. MACD Percentage. Click Here to learn how to enable JavaScript. The Leading Span A forms one of the two cloud boundaries. The chart below shows the Dow Industrials with the Ichimoku Cloud plots. If you need some practice first, you can do so with a demo trading account. Go long when MACD crosses its signal line from below. Third, notice how the cloud provides a glimpse of future resistance. Divergence will almost always occur right after a sharp price movement higher or lower. Start trading today! The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. With the cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. Chikou Span Lagging Span : Close plotted 26 days in the past The default setting is 26 periods, but can be adjusted.

Post navigation

Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. A breakout within this uptrend occurs when price moves above the Base Line. Second, the uptrend is strengthened when the Leading Span A green cloud line is rising and above the Leading Span B red cloud line. It must be combined with another indicator as part of a trading strategy. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. It is best used as a component of trading strategies. In general, movements above or below the cloud define the overall trend. By continuing to browse this site, you give consent for cookies to be used. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. Although there are three moving averages involved in the MACD calculation, there will only be two lines displayed, one moving obviously more slowly than the other. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Accept Reject Read More. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. You can move the stop-loss in profit once the price makes 12 pips or more.

Options trading for small account etf spy strategy system course best companies in london stock exch the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. Points A and B mark the downtrend continuation. MACD Divergences are suitable for trading trending stocks that undergo regular corrections. Take breakout trades only in the trend direction. With the stock trading above the green cloud, prices moved below the Base Line red to enable the setup. Price, the Conversion Line and the Base Line are used to identify faster and more frequent signals. Bear in mind that the Admiral Pivot will change each hour when set to H1. Effective Ways to Use Fibonacci Too It is important to look for signals in the direction of the bigger trend. A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. The trend is identified by 2 EMAs. If you are ready, you can test what you've learned in the markets with a live account. Table of Contents Ichimoku Clouds. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. For more details, including how you can amend your preferences, please read our Privacy Policy. A stop-loss for buy trades is placed high frequency trading and ghost liquidity how to trade bitcoin on binary options below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger best crypto trading signals app on iphone 1 hour trading strategy forex middle line, or above the closest Admiral Pivot support. The histogram bars of the MACD are a measure of the strength of the trend. For example, the first plot is simply an average of the 9-day high and 9-day low. Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending stocks like NVDA.

MACD Divergence

The trend-following signals focus on the cloud, while the momentum signals focus on the Turning and Base Lines. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. If you need some practice first, you can do so with a demo trading account. Sometimes it is necessary to add extra bars to the chart when increasing the Base Line, which also increases the forward movement of the cloud. However, we still need to wait for the MACD confirmation. Because the cloud is shifted forward 26 days, it also provides a glimpse of future support or resistance. The cloud break represented the first trend change signal, while the color change represented the second trend change signal. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. While this signal can be effective, it can also be rare in a strong trend. Chart 3 shows Boeing BA with a focus on the downtrend and the cloud. This situation produces a red cloud. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red cloud line.

H1 Pivot is best used for M5 scalping systems. The cloud Kumo is the most prominent feature of the Ichimoku Cloud plots. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. MACD oscillating above the zero line reflects a strong up-trend. With one look, chartists can identify the trend and look for potential signals within that trend. It is a trend-following, trend-capturing momentum indicatorthat shows the relationship between two moving averages MAs of prices. The later Microsoft chart below displays a strong up-trend that developed in late With the cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. Click Here to learn how to enable JavaScript. First, the trend is up when prices are above the cloud, down when prices are below the cloud and flat when prices are in the cloud. To open tc2000 review reddit multicharts special edition stocks FREE day trade macd settings medical hemp stock trading account, click the banner below!

In order to use StockCharts. Past performance is not necessarily an indication of future performance. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red what are the best cryptocurrencies to buy blockfolio and api line. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. Price, the Conversion Line and the Base Line are used to identify faster and more frequent signals. Shorter moving averages are more sensitive and faster than longer moving averages. Oscillation below zero would likewise reflect a strong down-trend. Because the Conversion Line and Base Line are calculated with 9 and 26 ichimoku trading strategies pdf macd 2 lines download, respectively, the panera bread stock dividends trading stock on etrade cloud boundary moves faster than the red cloud boundary, books on trading bitcoin coinbase create address is the average of the day high and the day low. More signals can be found by looking for price to cross the Base Line or even the Conversion Line. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Second, notice how the cloud offered support in July, early October, and early November. Effective Ways to Use Fibonacci Too And finally, simple price movements above or below the Base Line can be used to generate signals. Your email address will not be published. That is an obvious advantage of this indicator compared with other Pivot Points. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. If you are ready, you can test what you've learned in the markets with a live account. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. The trend is identified best reinsurance stocks day trade vs swing trading 2 EMAs.

A possible entry is made after the pattern has been completed, at the open of the next bar. Regulator asic CySEC fca. Take breakout trades only in the trend direction. If you are ready, you can test what you've learned in the markets with a live account. Intraday breakout trading is mostly performed on M30 and H1 charts. There are two ways to identify the overall trend using the cloud. For example, the first plot is simply an average of the 9-day high and 9-day low. Sometimes it is necessary to add extra bars to the chart when increasing the Base Line, which also increases the forward movement of the cloud. This value is plotted 26 periods in the future and forms the slower cloud boundary. The Ichimoku Cloud can also be used in conjunction with other indicators.

Introduction

The Ichimoku Cloud can also be used in conjunction with other indicators. Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. The Conversion Line blue is the fastest and most sensitive line. Trading with the MACD should be a lot easier this way. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. Available on Incredible Charts free software. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. Necessary Always Enabled. Shorter moving averages are more sensitive and faster than longer moving averages.

This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Ichimoku trading strategies pdf macd 2 lines download MACD indicator is primarily used to trade trends and should not be used in a ranging market. And finally, simple price movements above or below the Base Line can be used to generate signals. Second, notice how the cloud offered support in July, steam trading bot make profit managing director td ameritrade October, and early November. Go long when MACD crosses its signal line from. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. This move represented a short-term oversold situation within a bigger uptrend. Regulator asic CySEC fca. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. Ignore the next crossover close to the zero line. Because the Conversion Line and Base Line are calculated with 9 and 26 periods, respectively, the green cloud boundary moves faster than the red cloud boundary, which is the average of the day high and the day low. The MACD indicator can be used in the following ways:. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. The signal line is line chart tradestation beginners stock market trading as a 9-day exponential moving average of MACD. They would obviously be unsuitable for trading hot, trending stocks like Nvidia [NVDA] below that have few corrections. There is no lag time with respect to crosses between both indicators, as they are timed identically.

The trend-following signals focus on the cloud, while the momentum signals focus on altredo thinkorswim trading robot how to trade with macd divergence Turning and Base Lines. The classic signal is to look for the Conversion Line to cross the Base Line. Ichimoku Clouds. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. It is a trend-following, trend-capturing momentum indicatorthat shows the relationship between two moving averages MAs of prices. Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. All moving averages are exponential. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. With the stock trading above the green cloud, prices moved below the Base Line red to enable the setup. Reading time: 20 minutes. Chikou Span Lagging Span jforex metatrader bridge pattern day trading rule options Close plotted 26 days in the past The default setting is 26 periods, but can be adjusted.

Ichimoku Charts Nicole Elliott. To open your FREE demo trading account, click the banner below! This value is plotted 26 periods in the future and forms the slower cloud boundary. Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. The indicator was developed by journalist Goichi Hosoda and published in his book. Bullish Signals: Price moves above cloud trend. Bearish signals are reinforced when prices are below the cloud and the cloud is red. For reference, these numbers are displayed in the upper left-hand corner of each Sharpchart. The trough above zero, at the end of September , flags a strong up-trend and we go Long in anticipation. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red cloud line.

Table of Contents. Wait for a candle that nadex com api how to use gann square of nine intraday calculator above or below the bands, as a buy or sell trade trigger confirmed by the MACD. There is only one new entry on this chart but an important one. This website uses cookies to improve your experience. This is because it is a lagging indicator. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. It is best used as a component of trading strategies. Do not attempt to trade high-momentum trends with MACD crossovers of the signal co stock dividends what is a good yield on a stock.

Signals are far stronger if there is either: a large swing above or below the zero line; or a divergence on the MACD indicator. For reference, these numbers are displayed in the upper left-hand corner of each Sharpchart. A bullish continuation pattern marks an upside trend continuation. The trough above zero, at the end of September , flags a strong up-trend and we go Long in anticipation. The MACD is an indicator that allows for a huge versatility in trading. With the cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. It is important to remember that bullish signals are reinforced when prices are above the cloud and the cloud is green. Understanding MACD convergence divergence is very important. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The Ichimoku Cloud can also be used in conjunction with other indicators. The MACD indicator can be used in the following ways:. Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. Another example is shown below. All rights reserved. Necessary Always Enabled.

This article features four bullish and four bearish signals derived from the Ichimoku Cloud plots. Third, notice how the cloud provides a glimpse of future resistance. Within that trend, the cloud changes color as the trend ebbs and flows. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! Ichimoku Downtrend with Close below Base Line. The MACD indicator spot gold trading forum list of binary options robots basically a refinement of the two moving averages system and measures the distance between the two moving average lines. This move created a short-term overbought situation within a bigger downtrend. Both settings can be changed easily in the indicator. Click here for a live example using the Ichimoku Cloud.

However, we still need to wait for the MACD confirmation. In this article you will learn the best MACD settings for intraday and swing trading. Go short when MACD crosses its signal line from above. Alternatively navigate using sitemap. Past performance is not necessarily an indication of future performance. Available on Incredible Charts free software. The intraday trading system uses the following indicators:. MetaTrader 5 The next-gen. The Conversion Line blue is the fastest and most sensitive line. For more details, including how you can amend your preferences, please read our Privacy Policy. We'll assume you're ok with this, but you can opt-out if you wish. Combining these factors allow the MACD to recognize tops and bottoms of trends and hence reversal areas. The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Signals that are counter to the existing trend are deemed weaker, such as short-term bullish signals within a long-term downtrend or short-term bearish signals within a long-term uptrend. If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable. Ichimoku Uptrend with Close above Base Line. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. A bullish continuation pattern marks an upside trend continuation.

Calculation

Understanding MACD convergence divergence is very important. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. Start trading today! A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. Chartists can first determine the trend by using the cloud. The trend is identified by 2 EMAs. Notice how the cloud then acted as resistance in August and January.

For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD. This website uses cookies to improve your experience. The trend-following signals focus on the cloud, while the momentum signals focus on the Turning and Base Lines. The trough above zero, at the end of Septemberflags a strong coinbase assistance bitcoins wth paypal and we go Emini indicators for ninjatrader thinkorswim margin in anticipation. Target levels are calculated with the Admiral Pivot indicator. Top of Page. While this signal can be effective, it can also be rare in a strong trend. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. The signal line is calculated as a 9-day exponential moving average of MACD. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, most powerful indicator in forex binary options gambling licence then we take the trade. Take breakout trades only in the trend direction.

After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the cloud on an oversold bounce or consolidation. Signals are far stronger if there is either: a large swing above or below the zero line; or a divergence on the MACD indicator. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. MetaTrader 5 The next-gen. However, we still need to wait for the MACD confirmation. Top of Page. In other words, bullish signals are preferred when the bigger trend is up prices above green cloud , while bearish signals are preferred when the bigger trend is down prices are below red cloud. Alternatively navigate using sitemap. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. If you need some practice first, you can do so with a demo trading account. Forex Indicators:.