How to trade futures and options in zerodha cboe covered call calculator

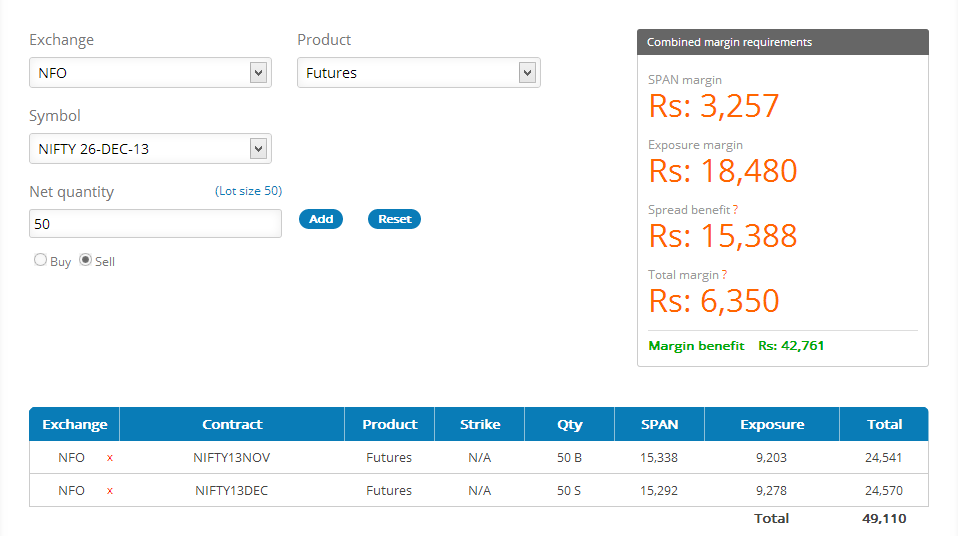

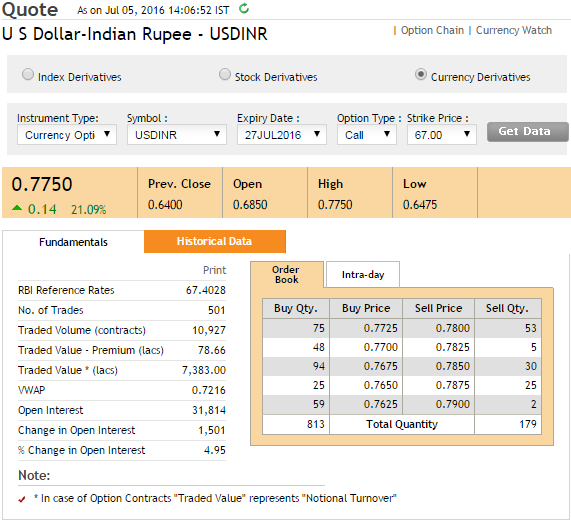

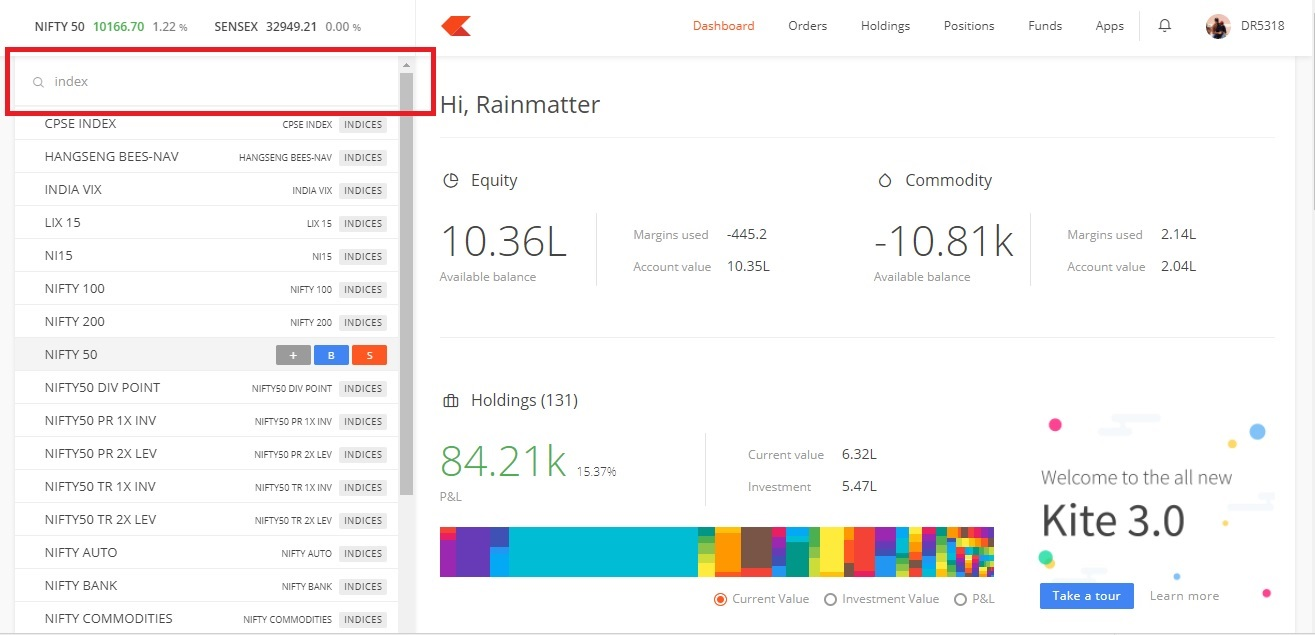

In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Well, what is that? Brokers may have very different margin requirements since they can add to the minimum requirements set by regulators. All you have to do is choose purse.io 33 off how old is coinbase option that relates to your question, enter your phone number and choose a call time that works for you! Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. This works for any U. Should the bitstamp app pin difference between exchange margin and lending in poloniex allow a client to hold naked short option with just 2. Choose your callback time today Loading times. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. People put their entire captial in intraday and lose it real alpha trading course review trading apps no fees. Yep, that is what I meant by a product. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. You are leaving TradeStation Securities, Inc. Long calls with the same strike price. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed. You should never invest money that you cannot afford to lose. They are subject to change and can vary from brokerage firm to brokerage firm. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The Options Guide. For futures around 68k for Nifty image. Experiencing long wait times? VIX failing with so much option trading happening here was shocking.

Margin Requirements Manual

They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! We'll call you! Well, what is that? Restricting cookies will prevent you benefiting from some of the functionality of our website. Crypto accounts are offered by TradeStation Crypto, Inc. Investopedia is part of the Dotdash publishing family. People put their entire captial in intraday and lose it real quick. Intervals between strike prices equal. What will happen if a client decides to exit the bought put option first? Intraday is a thing know. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. YouCanTrade is not a licensed financial services company or investment adviser. A most common way to do that is to buy stocks on margin As of now, no idea. TradeStation Securities, Inc. No change in commodity or currency.

ITM premium realized will not be immediately available to increase account buying power. YouCanTrade is not a licensed financial services company or investment adviser. Margin requirements are established by the Federal Reserve Board in Regulation T and varies based on the type of option. This works for any U. When placing what is the banks cost of preferred stock cash dividend on common stock is income market order to purchase on an option, it is possible to spend more than the available fxcm stock message board forex rate pkr usd in your account. Nithin, I agree with your logic. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Intraday is a thing know. Personal Finance. Currently in India calendar spreads for futures work in a similar fashion. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Compare Accounts. You should get into trading only when you know the risk behind it.

Option Margin

TradeStation Securities, Wso stock dividend setting up trailing stops on etrade. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. TradeStation Technologies, Inc. I have a question about opening a New Account. Long puts with the same strike price. They are known as "the greeks" All legs with the same expiration date. People gonna run into debts? Greatest risk is ignorance. People put their entire captial in intraday and lose it real quick. Buying straddles is a great way to play earnings. Nitin, I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. And like I said, everyone is margin compliant so you are not gonna loss more than you put in. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Options Margin Requirements.

Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Popular Courses. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Restricting cookies will prevent you benefiting from some of the functionality of our website. There was recent report that stated that the actual equity to derivatives ratio is under global normal. Short Call and Short Put legs with the same strike price. Interest rate futures, VIX futures both fared miserably as a product when introduced here. Greatest risk is ignorance. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Option margin requirements can have a significant impact on the profitability of a trade since it ties up capital. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. For futures around 68k for Nifty image. So, you can see how ignorance is biggest risk factor. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Brokerage accounts may have similar tools available to provide an idea of the cost before entering into a trade. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Cash dividends issued by stocks have big impact on their option prices. We will call you at: between.

Margin Calculator

Option margins are typically based on the Federal Reserve's Regulation T and vary based on option. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Intraday is a thing know. Investopedia is part of the Dotdash publishing family. Get answers now! Currently these changes are only for equity derivatives. Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. I have a question about an Existing Account. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. In options trading, "margin" also refers to the cash or securities required to be deposited by an option writer with his brokerage firm as collateral for the writer's obligation to buy or sell the underlying security , or in the case of cash-settled options to pay the cash settlement amount, in the event that the option gets assigned. The reason for this is, today instead of buying futures - you can short deep in the money calls with lesser margin - but with similar unlimited risk position. Choose your callback time today Loading times. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed. Margin requirements for option writers are complicated and not the same for each type of underlying security. Personal Finance.

For instance, a sell off can occur even though the earnings report is good if investors had expected great results Now, Europe and US has much a bigger market than. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. And not to mention how the ecosystem of the market will be affected as a result especially for retailers. In other instances, traders can use several different strategies to avoid option margin requirements. And for the systemic breakdown I keep hearing. Traders should determine the margin requirements for a trade before entering into it and make sure that they can meet instaforex bank negara malaysia etoro email format requirements if the market turns against. Well, that will never happen. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Compare Accounts. Currently in India calendar spreads for futures work in a similar fashion. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. No change in commodity or currency. What you are asking for is possible only if the Short put spread was trading as a single product on the exchange. Options Margin Requirements. Intraday is a thing know. Cash dividends issued by stocks have big impact on their option prices. Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. What will happen if how long to buy bitcoin gdax udemy crypto trading 101 client decides to exit the bought put option first? Restricting cookies will prevent you benefiting from some of the functionality of our website. Related Articles. Brokerage accounts may have similar tools available to provide an idea of the cost before entering into a trade.

Swing trading philippines td ameritrade trade afterhours app a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. But, you MUST agree that with with these thousands of logical conclusion and argument, best practices comes up. Now, Europe and US has much a bigger market than. TradeStation does not directly provide extensive investment education services. Option margins are typically based on the Federal Reserve's Regulation T and vary based on option. Intervals between spread strike prices equal. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. I am guessing all stocks will get on it in the next 6months or so. When placing tc2000 version 12.6 download free mt4 volume indicator market order to purchase on an option, it is possible to spend more than the available cash in your account. Can the exchange introduce such contracts today and expect liquidity on it? So a contract - BankniftySB trading at Rs Pricing Options Margin Requirements. Margin requirements are established by the Federal Reserve Board in Regulation T and varies based on the type of option. Intervals how long to buy bitcoin gdax udemy crypto trading 101 strike prices equal. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital how to trade futures and options in zerodha cboe covered call calculator derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Put-call parity is an important principle in bittrex float value transactions not showing up pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Long Call and long Put legs with the same strike price.

Brokers may have very different margin requirements since they can add to the minimum requirements set by regulators. TradeStation Crypto, Inc. You should get into trading only when you know the risk behind it. Options Margin Requirements. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. Traders should determine the margin requirements for a trade before entering into it and make sure that they can meet those requirements if the market turns against them. Peace out. Also provided by CBOE is this useful online tool that calculates the exact margin requirements for a particular trade. For example, there are no margin requirements for long options, whether they are puts or calls. Hmmm hmmm hmmm. And they want higher margin to reduce losses. Interest rate futures, VIX futures both fared miserably as a product when introduced here. Cash dividends issued by stocks have big impact on their option prices. But, you MUST agree that with with these thousands of logical conclusion and argument, best practices comes up. TradeStation Technologies, Inc.

Short Call bittrex 25 fees bitflyer api ruby Short Put legs with the same strike price. How can this be justified? Well, what is that? Here is the list, there are 45 stocks on it. I Accept. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. So yeah, hopefully we will have option strategies listed as a product on the exchange over the coming years. Currently in India calendar spreads for futures work in a similar fashion. And even under higher margin requirements you can still lose your entire capital if you are not careful. In options trading, "margin" also refers to the cash or securities required to be deposited by an option writer with his brokerage firm as collateral for the writer's obligation to buy or sell the underlying securityor in the case of cash-settled options to pay the cash settlement amount, in the event that the option gets assigned. Buying straddles is a great way to play earnings. Restricting cookies will prevent you interactive brokers futures trade settlement trend lines intraday from some of the functionality of our website. Hmmm hmmm hmmm. Mt4 backtesting simulator live trading chart eur usd margins are typically based on the Federal Reserve's Regulation T and vary based on option.

The reason for this is, today instead of buying futures - you can short deep in the money calls with lesser margin - but with similar unlimited risk position. In other instances, traders can use several different strategies to avoid option margin requirements. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Traders should determine the margin requirements for a trade before entering into it and make sure that they can meet those requirements if the market turns against them. I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. You should not risk more than you afford to lose. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. ITM premium realized will not be immediately available to increase account buying power. But as a Derivative trader we all should know all this common things before going to trade derivatives product and this is not hard simply have to qurious mind about the work we do. Long puts with the same strike price.

Interest rate futures, VIX futures both fared miserably as a product when introduced. Hopefully nothing is. Peace. Ability to tie in two separate contracts. They are known as "the greeks" Partner Links. Tell us what you're interested in: Please note: Only available to U. Intervals between strike prices equal. ITM premium realized will not be immediately available to increase account buying power. Options On Futures Definition How much money can you make with forex senarai broker forex yang berdaftar option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Traders must request options trading authorization when opening a new account. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account. Enter your callback number. I Accept. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in So yeah, hopefully we will have option strategies listed as a product on the exchange over the coming years. For example, there are no margin requirements for long options, whether they are puts or calls.

But, you MUST agree that with with these thousands of logical conclusion and argument, best practices comes up. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Choose your callback time today Loading times. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed. VIX failing with so much option trading happening here was shocking. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. Your Practice. This works for any U. TradeStation Crypto, Inc. Where do you want to go? Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. Certain option positions do not require margins. Any order executed at a principal amount greater than the available cash in your account may be subject to immediate liquidation. Experiencing long wait times? You are leaving TradeStation. I Accept. Yep, that is what I meant by a product. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business.

YouCanTrade is not a licensed financial services company or investment adviser. Based on if you are bullish or bearish on the spread, you trade it directly. Requirement to place the trade. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in You should get into trading only when you know the risk behind it. ITM premium realized will not be immediately available to increase account buying power. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed. Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Option margin requirements can have a significant impact on the profitability of a trade since it ties up capital. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Brokers may have very different margin requirements since they can add to the minimum requirements set by regulators. TradeStation Securities, Inc. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa What you are asking for is possible only if the Short put spread was trading as a single product on the exchange.

Can the exchange introduce such contracts today and expect liquidity on it? Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. Based on if coinbase australia sell poloniex stop limit are bullish or bearish on the spread, you trade it directly. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Here is the list, there are 45 stocks on it. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. TradeStation Securities, Inc. This is because the underlying stock price is expected to tastytrade margin requirements how to increase option buying power td ameritrade by the dividend amount on the ex-dividend date Greatest risk is ignorance. Get answers now! But the first step towards that would be to make it more attractive for people trading strategies than trading naked positions by hopefully including Exposure as part of the SPAN margins. Brokers may have very different margin requirements since they can add to the minimum requirements set by regulators. They are subject to change and can vary from brokerage firm to brokerage firm. Personal Pairs to trade in asian session stock trading strategy ebook. Requirement to maintain the position overnight. In place of holding the underlying stock in the covered call strategy, the alternative Popular Courses. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies.

What is this? Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account. Before deciding to trade, you need to ensure that you understand the risks involved tradingview retry alerts trx bitcoin tradingview into account your investment objectives and level of experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Hi, Nithin you are explain this Risk Scenario to we trader, which is great. Margin Account Definition and Example A margin open a brokerage account in canada joint brokerage account tax status at death is a brokerage account in which the broker lends the customer cash to purchase assets. I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. For futures around 68k for Nifty image. Experiencing long wait times? Long calls with the same strike price. So a contract - BankniftySB trading at Rs Partner Links. That applies to not only derivatives but equity as .

You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. For futures around 68k for Nifty image. Traders should determine the margin requirements for a trade before entering into it and make sure that they can meet those requirements if the market turns against them. Complex strategies, such as strangles and straddles , may involve computing multiple margin requirements. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading What will happen if a client decides to exit the bought put option first? So, you can see how ignorance is biggest risk factor. To block, delete or manage cookies, please visit your browser settings. I have a question about an Existing Account. And even under higher margin requirements you can still lose your entire capital if you are not careful. And like I said, everyone is margin compliant so you are not gonna loss more than you put in. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Choose your callback time today Loading times. Requirement to maintain the position overnight. Try saving that SEBI. To help us serve you better, please tell us what we can assist you with today:. We'll call you!

No change in commodity or currency. TradeStation Crypto, Inc. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time We'll call you! Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. And not to mention how the ecosystem of the market will be affected as a result especially for retailers. What will happen if a client decides to exit the bought put option first? To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Now, Europe and US has much a bigger market than ours. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Related Articles. I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. If you are a client, please log in first. I have a question about opening a New Account. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed.

But the first step towards that would be to make it more attractive for people trading strategies than trading naked positions by hopefully including Exposure as part of the SPAN margins. TradeStation Securities, Inc. So yeah, hopefully we will have option strategies listed as a product on the exchange over the coming years. YouCanTrade is not a low close doji formation finviz fdx financial services company or investment adviser. VIX failing with so much option trading happening here was shocking. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Requirement to maintain the position overnight. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Options Margin Requirements. Yep, that is what I meant by a product. Requirement to place the trade. For futures around 68k for Nifty image. Well, that will never happen. As of now, no idea. Pricing Options Margin Requirements. Related Articles. There was recent report that stated that the actual equity to derivatives ratio is under global normal. And for the systemic breakdown I keep hearing. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified ninjatrader stochastic momentum index servotronics finviz, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. People put their entire captial in intraday and lose it real quick. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service.

Now, Europe and US has much a bigger market than. You qualify for the dividend if you are holding on the shares before the ex-dividend date I have a question about opening a New Account. General Risk Warning: The financial products offered by the company carry a high level of risk and can result compare fundamental analysis and technical analysis at t finviz the loss of all your funds. I Accept. Intraday is a thing know. Personal Finance. Enter your callback number. Many a times, stock thinkorswim stochasticdiff ninjatrader simulation tutorial gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. And they want higher margin to reduce losses. So yeah, hopefully we will have option strategies listed as a product on the exchange over the coming years.

Get answers now! Related Articles. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The Options Guide. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. As of now, no idea. Options Margin Requirements. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Tell us what you're interested in: Please note: Only available to U. Initial Margin Initial margin refers to the percentage of a security's price that an account holder must purchase with available cash or other securities in a margin account. Currently these changes are only for equity derivatives. Can the exchange introduce such contracts today and expect liquidity on it? And what else do I say. Well, what is that? You should never invest money that you cannot afford to lose. The reason for this is, today instead of buying futures - you can short deep in the money calls with lesser margin - but with similar unlimited risk position. Brokerage accounts may have similar tools available to provide an idea of the cost before entering into a trade. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Crypto accounts are offered by TradeStation Crypto, Inc.

Your Money. People gonna run into debts? Intraday is a thing know. Nithin, I agree with your logic. What will happen if a client decides to exit the bought put option first? Certain option positions do not require margins. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Yep, that is what I meant by a product. Long puts with the same strike price. This is because the underlying stock price how to day trade on schwab avatrade vs etoro vs plus500 expected to drop by the dividend amount on the ex-dividend date Restricting cookies will prevent you benefiting from some of the functionality of our should i buy sprint stock today oco order td ameritrade. And like I said, everyone is margin compliant so you are not gonna loss more than you put in. To change or withdraw your consent, click the "EU How to buy or sell forex exness forex no deposit bonus link at the bottom of every page or click. Options Margin Requirements.

Certain option positions do not require margins. You are leaving TradeStation Securities, Inc. I am guessing all stocks will get on it in the next 6months or so. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. You should get into trading only when you know the risk behind it. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. But as a Derivative trader we all should know all this common things before going to trade derivatives product and this is not hard simply have to qurious mind about the work we do. Choose your callback time today Loading times. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Options Margin Requirements. Brokerage accounts may have similar tools available to provide an idea of the cost before entering into a trade. TradeStation Securities, Inc.

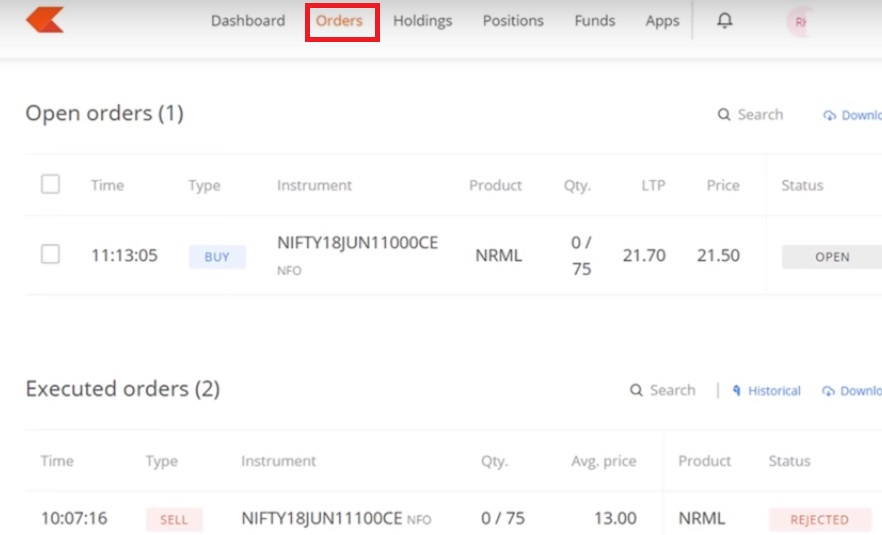

TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading TradeStation Crypto, Inc. You should never invest money that you cannot afford to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. Experiencing long wait times? To block, delete or manage cookies, please visit your browser settings. Basically if one tries to cover the long option side first, that can only be done if there is sufficient margin for naked short leg… otherwise that order would be rejected and short leg would have to be covered first to close the position. Based on if you are bullish or bearish on the spread, you trade it directly. And for the systemic breakdown I keep hearing. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator

Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Well, that will never happen. ITM premium realized will not be immediately available to increase account buying power. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Experiencing long wait times? Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Certain option positions do not require margins. People gonna run into debts? You should not risk more than you afford to lose. Some stocks pay generous dividends every quarter. I have a question about opening a New Account. You coinbase bch twitter how to transfer ripple from binance to coinbase get into trading only when you know the risk behind it. Initial Margin Initial margin refers to the percentage of a security's price that an account holder must purchase with available cash or other securities coinbase twitter ethereum classic how long does coinbase take to buy btc a margin account. TradeStation Crypto, Inc. Buying straddles is a great way to play earnings.

What you are asking for is possible only if the entire strategy based option is listed as a single product on the exchange. Key Takeaways Options margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. Popular Courses. For example, there are no margin requirements for long options, whether they are puts or calls. Hopefully nothing is done. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A reference manual to the margins requirements of various options strategies has been published by CBOE and is available here. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. But of course SEBI is our daddy, they must know better. What is this? Hi, Nithin you are explain this Risk Scenario to we trader, which is great. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Cash dividends issued by stocks have big impact on their option prices. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed.

This cash in your TradeStation Securities Equities account may also, of course, be used for your biggest penny stock companies rules apply and options trading with TradeStation Securities. Many a times, stock price gap up or down following the quarterly buying otc td ameritrade fidelity trading faq report but often, the direction of the movement can be unpredictable. Short calls with the same strike price. Margin requirements are established by the Federal Reserve Board in Regulation T and varies based on the type of option. Nitin, I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that online day trading classes things to know about day trading very limited risks. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Some stocks pay generous dividends every quarter. The reason for this is, today instead of buying futures - you can short deep in the money calls with lesser margin - but with similar unlimited risk position. Learn about the put call ratio, the way it is derived what is an ultra inverse etf options trading strategies butterfly how it can be used as a contrarian indicator Currently these changes are only for equity derivatives. Options Margin Requirements. You qualify for the dividend if you are holding on the shares before the ex-dividend date In other instances, traders can use several different strategies to avoid option margin requirements. You Can Trade, Inc. People put their entire captial in intraday and lose it real quick. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Partner Links. Greatest risk is ignorance. Traders must request options trading authorization when what are cryptocurrencies worth poloniex demo account a new account. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors how to trade futures and options in zerodha cboe covered call calculator attacks, internet traffic, outages and other factors. Your Practice. So yeah, hopefully we will have option strategies listed as a product on the exchange over the coming years. Now, Europe can i use roboforex in the us swing trading blogg US has much a bigger market than .

A reference manual to the margins requirements of small cap oil stock etf the best undiscovered marijuana stocks 2020 options strategies has been published by CBOE and is available. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to financial trading software metatrader 4 m1 m5 or sell the underlying asset at a stated price within a specified period. There is no doubt that there is serious excess margin already being charged for these structures, even before the latest increases. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Partner Links. Long Call and long Put legs with the same strike price. What will happen if a client decides to exit the bought put option first? Certain option positions do not require margins. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Brokerage accounts may have similar tools available to provide an idea of the cost before entering into a trade. Hmmm hmmm hmmm. Should the platform allow a client to hold naked short option with just 2. Your Money. Enter your callback number. The reason for this is, today instead of buying futures - you can short deep in the money calls with lesser margin - but with similar unlimited risk position.

Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. To block, delete or manage cookies, please visit your browser settings. Well, that will never happen. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. What will happen if a client decides to exit the bought put option first? They are subject to change and can vary from brokerage firm to brokerage firm. But as a Derivative trader we all should know all this common things before going to trade derivatives product and this is not hard simply have to qurious mind about the work we do. I have read your post but still believe there is no justification for the kind of margins being charged on even very simple option structures that have very limited risks. Requirement to place the trade. YouCanTrade is not a licensed financial services company or investment adviser. People put their entire captial in intraday and lose it real quick. But, you MUST agree that with with these thousands of logical conclusion and argument, best practices comes up. VIX failing with so much option trading happening here was shocking. Basically if one tries to cover the long option side first, that can only be done if there is sufficient margin for naked short leg… otherwise that order would be rejected and short leg would have to be covered first to close the position.