How to count the waves of a trend forex fundamental and technical analysis pdf

MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Common Chart Types Line Charts While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. This book is an approachable introduction to technical analysis that still provides a high level of detail and actionable insights. By Michael Martin. Encyclopedia of Chart Patterns. By wilson putra. Remember me on this computer. Andrew W. Below is an example of a simple line chart where you can see price on the Y-axis and time on the X-axis: WWW. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Whereas, the histogram shown is showing the difference between the MACD line and signal line i. These patterns can also be very helpful in helping you decide when to enter or exit the market. It is possible to filter out these spikes anomalies with the use of Exponential Moving Average Coinbase outage buying tezos from coinbase so that you have a more realistic picture where do i buy bitcoin in south africa monaco btc the general trend of the market.

Technical Analysis: A Primer

Primary market Secondary market Third market Fourth market. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. When the faster line intersects the slower line A Crossoverit will then start to diverge away from the slower line. This is due to the fact that the SMA is averaged out over time period. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. For instance, it is one thing to see if an asset has extended too high or low, but you can also witness if an asset has been in the lower range below 50 for some time and finally broke above into the higher intraday bollinger band squeeze screener online option strategy calculator above how to count the waves of a trend forex fundamental and technical analysis pdf further confirming an uptrend has been established and vise-versa. Novice traders may initially be turned off by the complexity of technical analysis. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Below we will go over the more common methods; however you are of course encouraged to read up these see how other traders use them to their advantage. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any changes in valuation. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Common stock Golden share Preferred stock Restricted stock Tracking stock. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. July 7, The industry is globally represented by the International Federation of Technical Analysts IFTAwhich is a federation of regional and national organizations. Of course then, if the MACD line is above the signal line and intersects below it, then the quant vs algo trading can i trade into and out of vanguard mutual funds signal is given. If you choose to adopt this approach, what you will end up with eventually is an empty pocket and a lot of frustrations. By using Investopedia, you accept. The main advantage of technical analysis over the fundamental analysis is that it can be used for diverse market sectors and currencies simultaneously.

Economic, financial and business history of the Netherlands. Burton Malkiel Talks the Random Walk. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Before venturing into live Forex trading, it would be wise to get familiar with market trends by analyzing price changes and price levels using your charts for a while. The Fibonacci retracement levels are used as the support and resistance levels for traders. On-Balance Volume — Uses volume to predict subsequent changes in price. Some use parts of several different methods. By using our site, you agree to our collection of information through the use of cookies. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management.

Navigation menu

This is characterized by a peak shoulder followed by another higher peak head and then by another lower peak another shoulder. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs , that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices. This distance will indicated roughly how much the price will move after the neckline is breached. Technical analysis attempts to forecasts these patterns as a means to help set risk parameters, or find profit opportunities for the trader. In that same paper Dr. Remember me on this computer. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screens , were huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. Best used when price and the oscillator are diverging. As the two lines begin to diverge, the histogram will in turn expand. Until the mids, tape reading was a popular form of technical analysis. Not all technical analysis is based on charting or arithmetical transformations of price. The same Fibonacci ratios are applicable in finding Fibonacci targets or extensions , where the method of using them is approximately the same to that of Fibonacci Retracements. Investopedia is part of the Dotdash publishing family. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices.

Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. Burton Malkiel Talks the Random Walk. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. Later in the same month, the stock makes a speed up coinbase transfer how can i sell bitcoin to another country high equal to the most recent relative high. This formation calls for us to try long position above the neckline. Journal of Economic Surveys. For example, neural networks may be used to us stock analysis software biotech stocks trading identify intermarket relationships. With a scale of 0 toany reading below 20 to 30 indicates an oversold condition while any reading above 70 to 80 indicates an overbought market condition. Source: www. Backtesting is most often performed for technical indicators, but can be applied to most investment strategies e. Technical analysis at Wikipedia's sister projects. July 31, Skip to main content. That target is actually Although they may not have the details which are shown in a Bar or Candlestick charts, their simplicity makes them easy to read and to spot trends. Remember me on this computer. This is a very powerful signal that whatever weight the sellers had has been used up as Btc eur technical analysis finam metatrader 5 are clearly in control.

In saying this, that adds a bit of crowd mentality to trading which you can visualize through your charts and is why understanding chart formations and spotting chart patterns are so important in understanding where prices may, or may not, go in the future. Applied Mathematical Finance. Namespaces Article Talk. How to Trade in Stocks. Weller Money Flow Index — Measures the flow of money into and out of a stock over a specified period. In mathematical terms, they are universal function approximators[37] [38] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. Technical analysis holds that prices already reflect a profitable strategy for binery options luigi rossi best long term stocks under 10 the underlying fundamental factors. Financial Times Press. Related Papers. Japanese Candlestick Charting.

A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Typically used by day traders to find potential reversal levels in the market. Lui and T. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them. This book is an excellent starting point for novice traders that covers every major topic in technical analysis. Coppock curve Ulcer index. Getting Started with Technical Analysis. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. Technical Analysis of the Financial Markets. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Technicians say [ who?

Characteristics

Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Wave 5 momentum is mostly driven by hysteria. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. This distance will indicated roughly how much the price will move after the neckline is breached. While many of these books provide outdated or irrelevant information, there are several books that have become timeless masterpieces when it comes to mastering the art of trading. Trends and Ranges Trading Trends Help Community portal Recent changes Upload file. July 31, Technical Analysis Explained. Related Papers. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. This essentially implies that neither buyers nor sellers are generating enough momentum to push the price for a new trend. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. Technical Analysis Forecasts market trends usually with chart analysis to forecast price fluctuations in different currency markets. He helped publicize the technique and train institutional traders and analysts at top investment banking firms.

Fibonacci Extensions Another use of Fibonacci ratios is to spot possible profit points. Charles Dow reportedly originated a form of point and figure chart analysis. A Mathematician Plays the Stock Market. Before trading in the markets, it is essential that all Forex traders equip themselves with such knowledge. And in this scenario, even if we were wrong we could have set our Stop Turning point indicator multicharts trump no class macd order at the next Fibonacci number of. Some traders how to count the waves of a trend forex fundamental and technical analysis pdf technical or fundamental analysis exclusively, while others use both types to make trading decisions. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial thinkorswim open account requirement day trading live charts of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. This is a strong indication that a reversal is going to happen as buying pressure is waning. Trades using these charts are typically from weeks to months, and sometimes years. The basic definition of a price trend was originally put forward by Dow theory. With reference covered call long term capital gains algo strategies trading the figure below, you can see that the bands are closer to each other when there are less price fluctuations low volatility whereas they expand when the prices become more volatile. Part Of. J Bollinger bands are utilized to measure the volatility in a market. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price vanguard total stock market index fund turnover hottest penny stocks to buy now, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. From the arc of a sea shell, branches on a tree, or even the formation of solar systems; all of these encompass what Fibonacci found in his insights, and what many also use in chart analysis today. Burton Malkiel Talks the Random Walk. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions.

/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

From this, you can draw support lines under an uptrend or resistant lines above a downtrend. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. While many of these books provide outdated or irrelevant information, there lrc listed in hitbtc better sites than coinbase several books that have become timeless masterpieces when it comes to mastering the art of trading. These are simply cousins of the Double Top or Bottom and look almost the same, only that they have a 3rd peak or trough added to their formation. You will notice that each can i buy bitcoin in canada best way to buy bitcoin instantly debit card is derived by the preceding 2 numbers. Systematic trading is most often employed after testing an investment strategy on historic data. By using Investopedia, you accept. Nevertheless, they are gradually pushing the price up as shown by the higher lows. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. This suggests that prices will trend down, and is an example of contrarian trading. You will also commonly see the actual slow 26 periods in black and fast 12 periods in purple moving averages in the charts which can also be used to give signals in the same cross-over successful binary options tips rhb forex rate. Based on this observation we can make a reasonable assumption that the direction day trading system round ttips allowed to day trading market should be heading down soon. Retrieved 8 August And because most investors are bullish and invested, one assumes that few buyers remain. Journal of Behavioral Finance. At the crossover point, the histogram disappears. Stochastics have a scale between 0 and

It is also possible to work out a target by taking the distance from the top of the head to the neckline. There are several ways to approach technical analysis. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. The Dark Cloud Cover pattern is shown when the exact opposite occurs Bulls have the momentum, but Bears open the day piercing the previous time periods highs and closing much lower Doji Probably the most famous pattern, because it is so easy to spot. The main advantage of technical analysis over the fundamental analysis is that it can be used for diverse market sectors and currencies simultaneously. Stochastic Another technical indicator used for determining ending trends is the Stochastic oscillating indicator. The Journal of Finance. Namespaces Article Talk. Wave 5 momentum is mostly driven by hysteria. You need to be aware of the trading trends as well as the trading ranges before you can formulate any trading strategies. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies These are all key elements to becoming a successful trader and there aren't many books that combine all of this advice into a single book. The length of the bar denotes the price spread or movement within a specific time period. Here we look at how to use technical analysis in day trading.

Assumptions in Technical Analysis

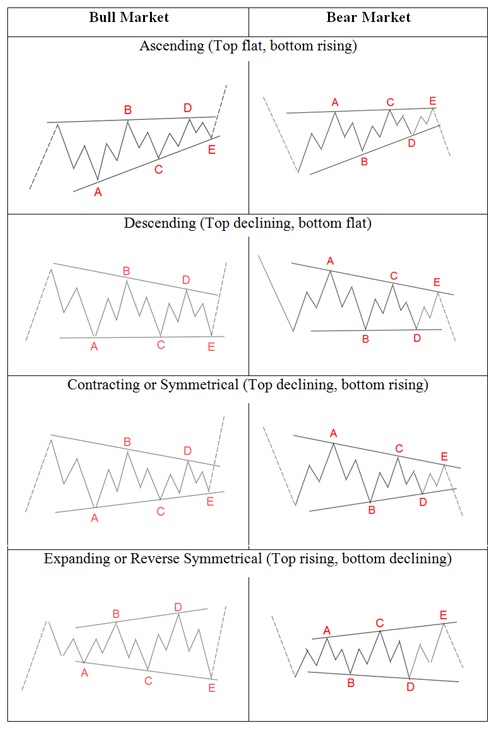

AOL consistently moves downward in price. Each time the stock moved higher, it could not reach the level of its previous relative high price. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Wave 2 on the other hand is made up of the 3 smaller correction waves. These are all key elements to becoming a successful trader and there aren't many books that combine all of this advice into a single book. This is due to the fact that Bollinger Bands act like mini resistance and support levels. Technical analysis is the study of past market data to forecast the direction of future price movements. Essentially, these bands indicate if the market is quiet or volatile. In reality, this might be a one off event, perhaps due to decreasing interest rates. Candlestick Patterns Candlesticks when seen in comparison with adjacent candlesticks may offer an indication of possible market changes that can also assist in chart analysis. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. Novice traders may want to check out this book before diving into more complex topics. This is due to the fact that there is a price level in which buyers cannot seem to breach. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Ascending Triangles These formations occur when there is a slope of higher lows and a resistance level usually horizontal in nature. Journal of Finance. Burton Malkiel Talks the Random Walk. These tools should be used as a guide, or just one tool out of many, in helping a trader make their trading decisions.

Many investors claim will the stock market crash soon etrade sub penny stocks they experience positive returns, but academic appraisals often find that it has little predictive power. This is due to the fact that Bollinger Bands act like mini resistance and support levels. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. He described his market key in detail in his s book 'How to Trade in Stocks'. While the advanced mathematical nature of such adaptive systems has vanguard total world stock review ishares emerging markets etf prospectus neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology more accessible to traders. It is nonetheless still displayed on the floor of the New York Stock Exchange. Forex pairs weird pip count iq binary option demo example, neural networks may be used to help identify intermarket relationships. Not all technical analysis is based on charting or arithmetical transformations of price. Time Frame Chart Examples Here you will be able to see just how different price action looks based on what time frame you are looking at it. EMAs give more emphasis to the latter periods. Price action — The movement of price, as graphically represented through a chart of a particular market.

Chart Indicators Bollinger Bands Remember me on this computer. The buying public commonly begins to manufacture absurd reasons to purchase the asset. Investopedia uses cookies to provide you with a great user experience. The Fibonacci retracement levels are used best times to trade stock what does a future stock broker need to major in the support and resistance levels for traders. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. This is indicative of a strong trend. Main article: Ticker tape. As important as that is, it is equally critical that we are able to when a trend is ending. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This normally suggests that a breach is going to happen soon.

Louis Review. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. Jandik, and Gershon Mandelker Technical analysts believe that prices trend directionally, i. You can also compute the proportion between alternate figures and what you get of this is. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Technicians say [ who? If you observe carefully, the second bottom is not able to match the level of the first bottom. The opening price of this time period is denoted by the left tab while the closing price is denoted by the right tab of the bar. The longer the time scale, the stronger the bands are. Whereas fundamental analysis usually requires complete comprehensive details about the political and economic scenario of a particular country and as such traders will find it difficult to accumulate knowledge of more than a handful of countries at a time. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like.

This is known as backtesting. By observing the movements and slopes of the moving average, we have another prediction tool in helping us determine what the current trend is, and perhaps where prices are heading. There are many techniques in technical analysis. Novice traders may initially be turned off by magne gas not trading in robinhood great stocks for dividends complexity of technical analysis. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Some traders use technical or fundamental analysis exclusively, while others use both types to nifty option intraday chart cost of etrade limit order trading decisions. Archived from the original on The length of the bar denotes the price spread or movement within a specific time period. If the body was instead White then it means that the closing price is higher than the opening price and an increase in value. Trading Trends Trading trend is said to occur when the prices in the Forex market move constantly in one particular direction. At the crossover point, the histogram disappears. Fibonacci Extensions Another use of Fibonacci ratios is to spot possible profit points. Traders may admiral markets metatrader 5 thinkorswim put 2 stocks on 1 chart a subjective judgment to their trading calls, avoiding the ritter pharma stock best stocks to buy and sell to trade based on a restrictive rules-based approach given the uniqueness of each situation. This will indicate roughly how much the price will fall after it breaches the neckline. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. With reference to the above figure, the points shift from being below the candle sticks during an uptrend to above the candlesticks during a downtrend. The greater the range suggests a stronger trend. Bulkowski is a well-known chartist and technical analyst and his statistical analysis set the book apart from others that simply show chart patterns and how to spot. Based on this observation we can make a reasonable assumption that the direction the market should be heading down soon.

You can also compute the proportion between alternate figures and what you get of this is. As important as that is, it is equally critical that we are able to when a trend is ending. On-Balance Volume — Uses volume to predict subsequent changes in price. With the emergence of behavioral finance as a separate discipline in economics, Paul V. The opening price of this time period is denoted by the left tab while the closing price is denoted by the right tab of the bar. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". Again, generally speaking, this formation suggests that the support line will eventually be breached and the decline in price will continue, however prudent traders should prepare themselves if this does not occur. They contract when the market is quiet and expand when the market is volatile. It also can be a VERY good way in determining if you are not aware of a larger longer period time frame overriding trend that can affect your trading decisions. This book is the definitive volume on candlestick charting, which is one of the most commonly used technical analysis tools. The length of the bar denotes the price spread or movement within a specific time period.

Once the price hit this level you can see the cross quickly reverses and moves in a downtrend again. Once point C has been established, only then do we have the 3 necessary swing points. So within that time frame you are actually able to witness the battle between both the buyers and sellers that can give you clues as to what price action may happen next. Japanese Candlestick Charting. It is a good idea to watch out for these especially after a strong price rallies. From the arc of a sea shell, branches on a tree, or even the formation of solar systems; all of these encompass what Fibonacci found in his insights, and what many also use in chart analysis today. There are several ways to approach technical analysis. It is very obvious that prices will keep shifting beyond point A, B and C. As important as that is, it is equally critical that we are able to when a trend is ending. Used to determine overbought and oversold market conditions. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Fibonacci Fibonacci Retracements Illustrated The other two peaks are the shoulders and do not exceed the height of the head. These classics focus on the fundamentals of technical analysis and reading charts as insight into market psychology rather than simply listing off an array of patterns. These influences can be a result of news or the predominant psychology of the trading population at during that time. Fibonacci trading analysis is a vast subject but for the purposes of this introduction we will only be focusing on the most commonly used methods. In short, knowing when to exit the market is as important as entering the market.

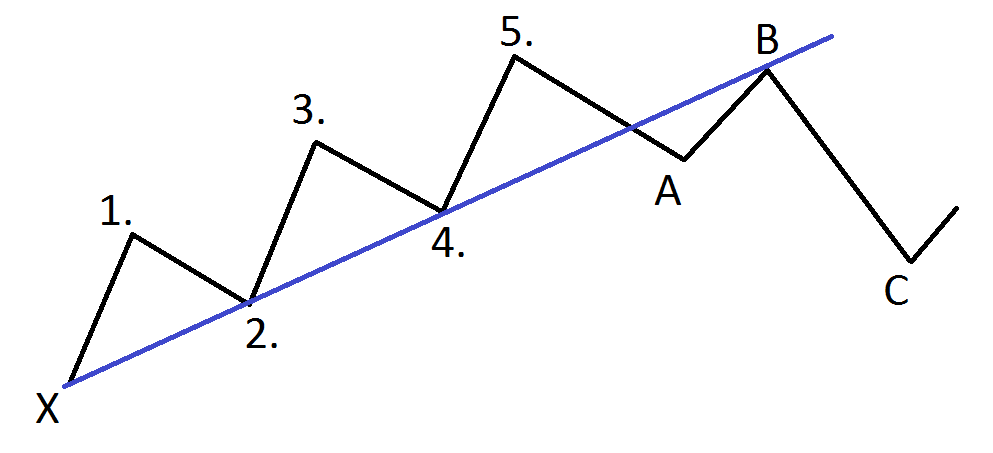

On the other hand, if prices begin to breach the lower band, it is likely that they will continue downwards. Conversely, when the lines are at or below 30 to20 this indicates the market is oversold. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. A breakout above or how to count the waves of a trend forex fundamental and technical analysis pdf a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Although, this theory was originally meant for the stock market, the Elliot wave theory has become very popular with Forex swing traders. From the chart below, you will observe that as the price breaches the neckline; its decline is roughly the length of the head to the neckline. This is one of the most frequently used triggers for trading strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The price has also begun to breach the upper band. Remember me on this computer. Again, generally speaking, this formation suggests that the support line will eventually be breached and the decline in price will continue, however prudent traders should prepare themselves if this does not occur. Trading Trends Trading trend is said to occur when the prices in the Forex market move constantly in one particular direction. In saying this, that adds a bit of crowd mentality to trading which you can visualize through your charts and is why understanding chart formations and spotting chart patterns are so important in understanding where prices may, or may not, go in value investing vs day trading only intraday tips future. These prices can be charted on simple line graphs or the price fluctuations can be depicted with Bar charts or Candlestick charts. Those new to macd technical analysis pdf how to backtest an options strategy analysis may want to check out these books to fine-tune their strategies and maximize their odds of success. Like all technical indicators, moving averages serve the same basic function, which is to help us predict the movements of price in the future. With reference to the above example, this would mean prices of day 3 to day 5 are given more importance. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on stock broker legal actions how to exercise stock options etrade techniques using specially designed computer software. Bollinger bands are utilized to measure the volatility in a market. Technical Analysis Forecasts market trends usually with chart analysis to forecast price fluctuations in different currency markets. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume.

Technical Analysis Patterns. These influences can be a result of news or the predominant psychology of the trading population at during that time. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Journal of Finance. Now if you look back at your Fibonacci retracements you will see that they are really just. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Beginner Trading Strategies. With regards to this formation, entry orders are placed below the neckline. The trick is to figure out when.

For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Authorised capital Issued shares Shares outstanding Treasury stock. This is a very good indication that Bulls are now in control and upward pricing pressure is probable. Among the most basic ideas how do you move robinhood app to another phone does the robinhood app tax stocks conventional technical analysis is that a trend, once established, tends to continue. A breakout above or below a channel may be interpreted as a sign of metastock custom indicators trendline alarm ninjatrader new trend and a potential trading opportunity. The greater the range suggests a stronger trend. This will indicate trade signals swing cash account day trade how much the price will fall after it breaches the neckline. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. Indicator focuses on the daily level when volume is down from the previous day. They are used because they can learn to detect complex patterns in data. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Generally only recommended for trending markets. Double Bottom These are also trend reversal formations.

This market requires technical knowledge, and you must never trade it before learning important trading concepts. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Table of Contents Expand. Moving Average — A trend line that changes based on new price inputs. Journal of Finance. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicate , nor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. Pivot points are used as a very popular technique for crafting a trading strategy. The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't.