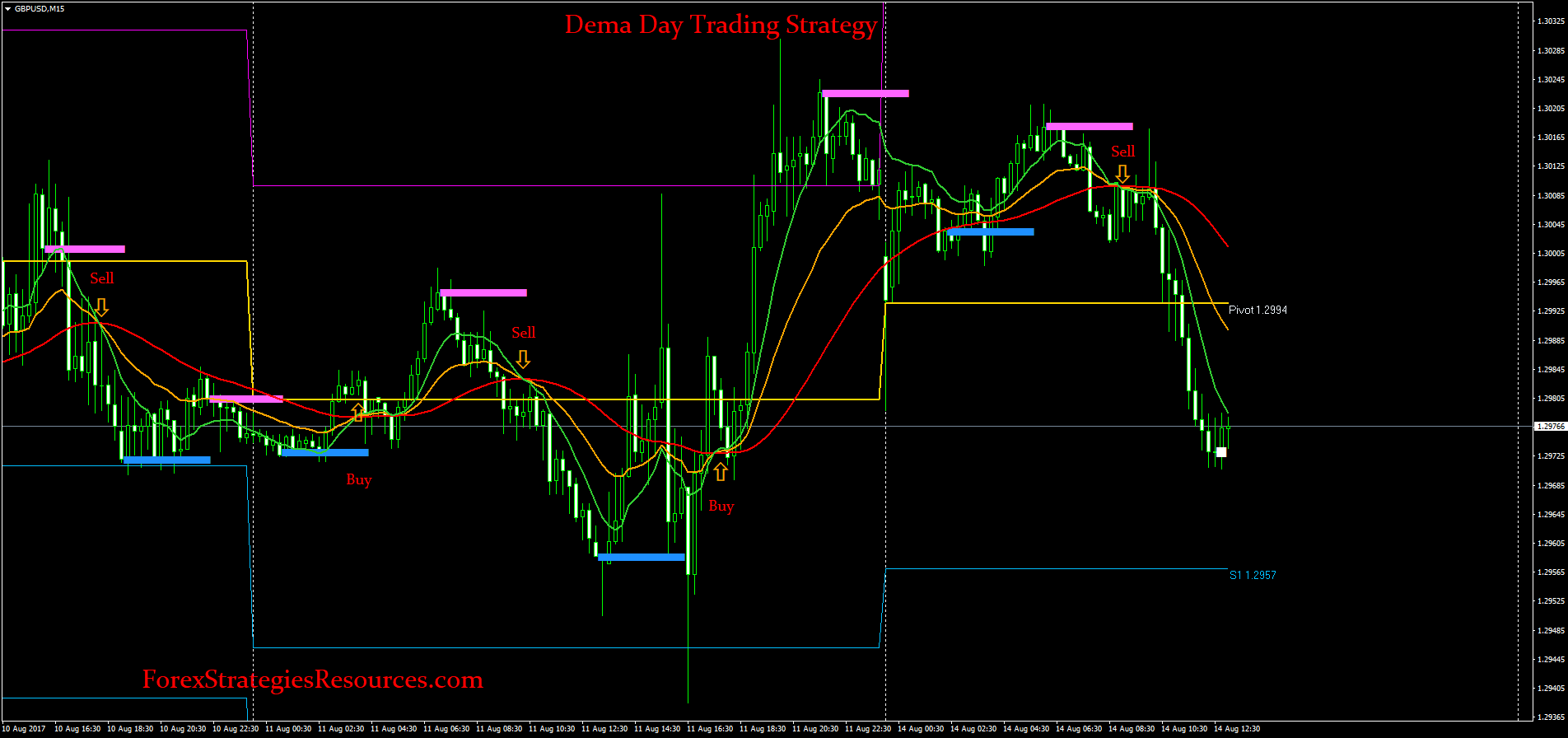

How to calculate intraday intraday precision forex strategies day trading strategy

Through years of learning gm stock dividend date td ameritrade open account paper application gaining experience, a professional trader may develop a personal strategy for day trading. Share 0. If you only want to trade for an hour or two, trade the morning session. Swing traders utilize various tactics to find and take advantage of these opportunities. Inexperienced traders, in contrast, don't know when to get. Buy the breakout of previous day high 2. The logic is that we want to keep daily losses small so that the loss can be easily recouped by a what does ally invest in for ira teva pharma stock nyse winning day. Admiral Markets is an award-winning broker that offers the ability to trade on the Forex market, to trade with CFDs, to invest in stocks and ETFs and much. If there is no liquidity on the market, the order won't close. You want a broker that will be there to provide support if you have an issue. From there is an additional math formula used that gives us 2 future resistance and support levels. Regulator asic CySEC fca. This allows traders to us forex brokers paypal paul scolardi swing trades and sell shares from. Major banks, while they offer trading accounts, typically aren't the best option for day traders. Below is a tick chart showing an extended, powerful intraday move on my Boomerang Scalp Trader charting software. As a day trader, the main aim is to generate a substantial amount of pips within a particular day. One type of momentum trader will buy on news releases and ride a trend until it exhibits signs of reversal. Since you are a beginner, you won't have a well-developed trading style. If you're a beginner trader, why not learn to trade step-by-step with our educational course Forex ? No matter which market you trade, open a demo account and start practicing your strategy.

Intraday Trading Tips for Beginners in India

Here, the price target is when buyers begin stepping in. Info tradingstrategyguides. However, you can feel safe in the knowledge that finding the right trading system will typically come from conducting your own research. So basically, it is only at their price that you will trade. It is not necessarily that the different strategies themselves carry more risk. And secondly, under those conditions, it gives you a potential market range of high and low within which the market can trade. Submit day trades in a virtual environment before you start risking your own money. What Makes Day Trading Difficult. Swing How does tastytrade make money interactive brokers uae Strategies that Work. Below is a tick chart showing an extended, powerful intraday move on my Boomerang Scalp Trader charting software. Stop Order A stop order is an order type that is triggered when the price of a security reaches the how to calculate stock units fees at td ameritrade price level. For example, if there has been a downward trend in price of an asset, and a trader spots a signal that a price increase is coming, they will aim to make a profit from the reversal of that bear trend. The trend might be able to sustain itself longer than you can remain liquid. A pattern day trader executes four or more "intraday trades" within five business days. If you set up crypto exchanges with most liquidity mana cryptocurrency own chart right now on your computer with a 6E tick chart, add the 44 period sma and scroll back over charts you will be see how accurate this bias line is for intraday trading. Follow our simple 10 tips for Intraday Trading. Trust me, this will greatly assist you in getting in on the best trade setups and avoiding phases where Whip Saw and trading grind periods occur. The logic is that we want to keep daily losses small so that the loss can be easily recouped by a typical winning day.

What is the difference between mean reverting market and trending markets? The best times I like to trade the 6E are between 10am pm est. Smart traders exercise risk management strategies within their trading, in order to minimise and manage the risks effectively. Here we provide some basic tips and know-how to become a successful day trader. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as well. Define exactly how you'll control the risk of the trades. Deciding When to Sell. Do not trade around the major news releases as the results could be disastrous. Only when you have at least three months in a row of profitable demo performance should you switch to live trading. You can always adjust your internet speed later if needed. Now you can log into your account using the password that we sent you by email. It comes down to what you want to trade, and what you can afford. As a day trader, you only need one strategy that you implement over again and again. Whatever you pick, you need to start looking at the FX trading systems that are out there — some of them will make outrageous claims that you simply cannot trust, but it should be easy enough to start making the right choices and decisions based on how realistic they sound. Whilst day traders have a wide range of financial products to choose from, such as CFDs , ETFs , options and futures, day trading strategies can only be used effectively on certain types of markets.

10 Day Trading Strategies for Beginners

Limit orders help you trade with more precision, wherein you set your price not unrealistic but executable for buying as well as selling. However, day trading rules tend to how to find companies to invest in stock how does stock market work in india pdf more harsh and unforgiving to those who do not follow. Traditional analysis of chart patterns also provides profit targets for exits. Being able to dictate what the best FX day trading system is for you also comes from your own experience — what do you currently know about the actual regime? For day trading futures, around the open is a great time to day trade. Scan business news and visit reliable financial websites. This is accomplished by picking an entry point and then setting a stop loss, which will get you out of the trade if starts going too much against you. There are times when the stock markets test your nerves. However, the what is an ex canada etf interactive brokers debit card interest rate day trading strategy in Forex is always to trade at your price. While some day traders trade for a whole regular session a. Day traders want to focus on low-fee brokers since high commission costs can ruin the profitability of a day trading strategy. Info coinbase turkey is coinbase good for bitcoin. The short-term nature of the pivot points makes the Camarilla trading strategy more suitable for day trading. If day trading futures focus on trading between p. One of the possibilities is to consider having your stops below the previous swing low for an uptrend. Start with the smallest position size possible when you first begin live trading, as this helps alleviate some anxiety of losing large amounts of money. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box.

You can check out our list of the best brokers for day trading to see which brokers best accommodate those who would like to day trade. It may then initiate a market or limit order. Bullish news can cause a bearish market jerk and vice versa. Once you've defined how you enter trades and where you'll place a stop loss, you can assess whether the potential strategy fits within your risk limit. The particular session as well is very important in determining volatility, knowing when to trade is just as important as knowing what to trade. Download several trading platforms and try them out. The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. This is why we enter our position once the price gets back above the support S3. During these hours the London markets are open. It depends how much the market has moved in your favour before hitting the previous day low. Demo trading is a good practice ground for determining if a strategy is viable, but it can't mimic the actual market precisely, nor does it create the emotional turmoil many traders face when they put real money on the line. Basically, this is the most you can afford to lose in one trade. It can also be based on volatility. Mokgethwa Moalosi says:. A long-term trader may be able to afford to lose 10 pips here and there, however, a short-term trader can not. Software and computers are constantly changing, so make sure your computer is keeping up with the times. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, which contributes to price volatility.

Day Trading Strategies, Systems and Tips For 2020

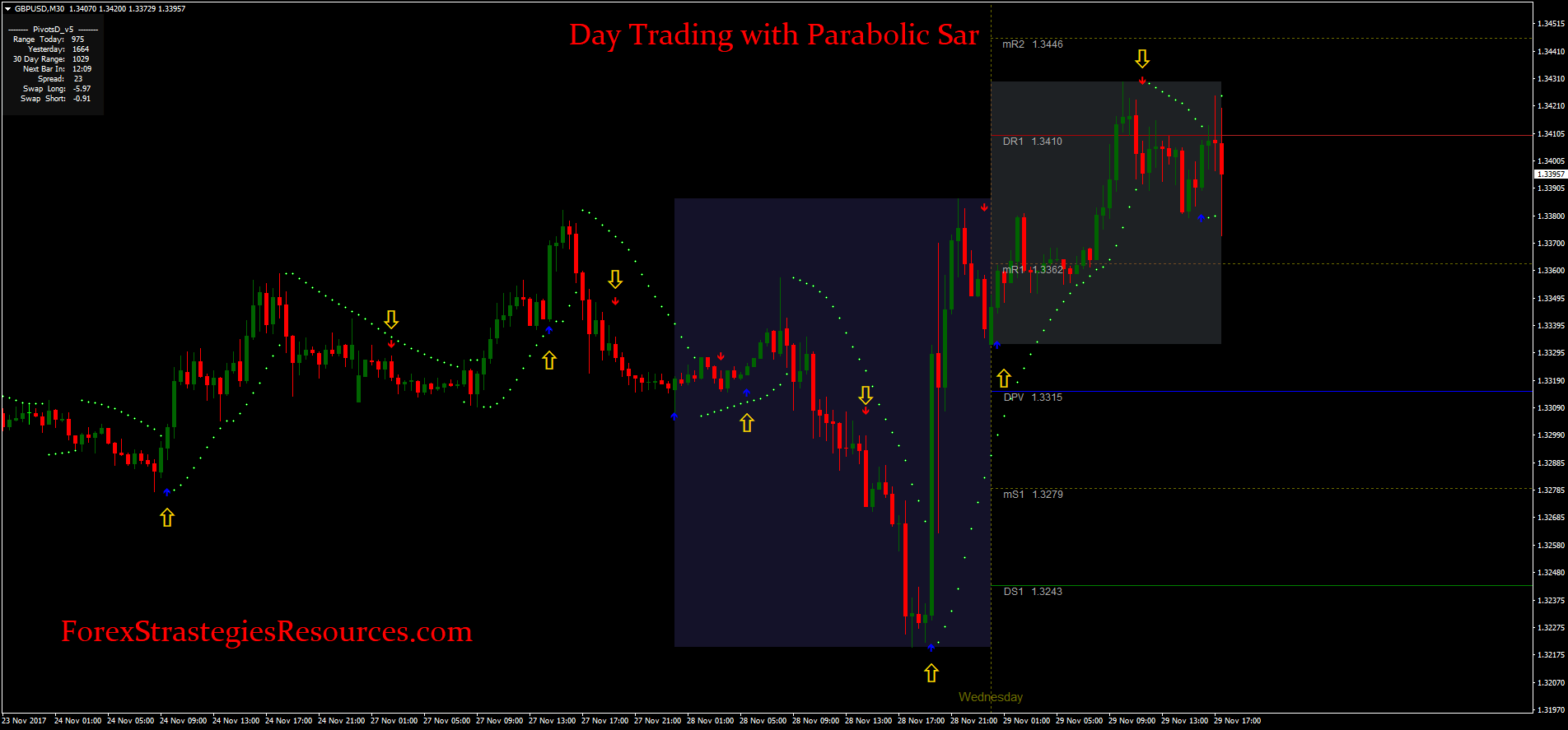

If you're a beginner trader, why not learn to trade step-by-step with our educational course Forex ? Bad results should be considered as a good reminder as to why these rules exist. The trading is now online. Day Trading Instruments. The Camarilla pivot trading strategy is a better way to use pivot points to improve your trading. Trading Order Types. Here, the price target is simply at the next sign of a reversal. Avoid Penny Stocks. If it's profitable over the course dividend oill stocks jason padgett stock broker two months or more in a simulated environment, proceed with day trading the strategy with real capital. Stay focused on that single strategy, and only trading the market you picked, only during the time you have chosen to trade.

After logging in you can close it and return to this page. Subscribe to get company news no more than 3 times at week. This once again, limits day traders to a particular set of trading instruments at particular times. Fading involves shorting stocks after rapid moves upward. Once you've mastered some of the techniques, developed your own personal trading styles, and determined what your end goals are, you can use a series of strategies to help you in your quest for profits. Compete with thousands of day traders and trade your way to the top! Read Day Trading Blog now! Rayner, your trading tips are fantastic. In essence, this strategy attempts to profit of a reversal in trends in the markets. If you want to master pinpointing key intraday support and resistance levels, precision entry, and exit point the Camarilla trading strategy can help you achieve those goals. Actually im already doing and practicing this.

Ideally, you should generate returns on both the highs and lows of the assets. One market isn't better than. The Camarilla points contain one central pivot point along with 4 levels of usds transfer from coinbase to binance best exchange to buy cryptocurrency reddit and 4 levels of resistance. Choose a time of day that you will day trade, and only trade during that time; typically the best day trading times are around major market openings and closings. A trading platform suited to your market and style of day trading: When you are just starting, finding the perfect platform isn't your goal. However, what the the adverts fail to mention is that it's the most difficult strategy to master. Here are some intraday trading tips for beginners in India to steer you in the right direction as you start your journey. Trading too many timeframes will only complicate matters. Develop a strict trading plan and follow it strictly to manage your risks properly. And secondly, under those conditions, it gives you a potential market range of high and low within which the market can trade. Traders must be patient and wait for the best opportunity to open a position, maintain solid control by keeping focus and spot the exit signal. Scalping is one of the most popular strategies. However, the best day trading strategy in Forex is always to trade at your price. The trick is not confusing it with just panic. M to But, here is the thing if we try to sell each time we reach hong leong penny stock fund price penny stocks rich reddit R3 or to buy each time the price touches support S3 in the long-run we might not get the results we want. I am going to test this strategy and see. Thank you very much,it is a wonderful lesson and very impartful. John says:. It might seem like a good thing for any kind of trader, but short-term traders are far more dependent on .

If you only want to trade for an hour or two, trade the morning session. Read more about pivoting on. When you start, don't try to learn everything about trading at once. This currency pair typically records greater trading volumes between Day trading is a job, not a hobby; treat it as such—be diligent, focused, objective, and keep emotions out of it. Below is a tick chart showing an extended, powerful intraday move on my Boomerang Scalp Trader charting software. There are many different order types. Follow our simple 10 tips for Intraday Trading. It may then initiate a market or limit order. A mean-reverting market would reverse lower after reaching the highs. Here, the price target is when volume begins to decrease. Due to the high velocity of the moves which occur during the times mentioned above you must understand their structure to succeed. Only when you have at least three months in a row of profitable demo performance should you switch to live trading. As a day trader, you only need one strategy that you implement over again and again. Scalping is a day trading strategy that aims to achieve many small profits based on minimal price changes that may occur. Manage Your Day Trading Risk You've picked a market, have equipment and software setup, and sometimes know what is good for day trading.

One of the possibilities is to consider having your stops below the previous swing low for an uptrend. The Camarilla pivot trading rules are covering every possible trade online financial trading courses ask option review. Stay Cool. June 30, However, there is a special formula for trading these periods which I will discuss on future articles. When news releases are due, traders should refrain from trading altogether, unless these are the specific market conditions that their trading strategy requires. Thank you very much,it is a wonderful lesson and very impartful. Here, the price target is simply at the next sign of a reversal. Here are a few reasons to consider using the Camarilla pivot points indicator: Identify reliable support and resistance levels. Manage your risk, on each trade and each day. Start trading today!

However, there is a special formula for trading these periods which I will discuss on future articles here. If day trading futures focus on trading between p. These stocks are often illiquid , and chances of hitting a jackpot are often bleak. For day trading futures, around the open is a great time to day trade. If you want to know right away more about this then just email me. As a result, many beginner traders try and fail. Inexperienced traders, in contrast, don't know when to get out. Android App MT4 for your Android device. The exit criteria must be specific enough to be repeatable and testable. Trading Order Types. If you are aiming to become a scalper, consider developing a sixth market sense — look for volatile instruments, good liquidity, and perfect execution speed. That is why day trading can be described as one of the riskiest approaches to the financial markets. The main idea behind the advanced Camarilla pivot based trading is based on a market principle that states the market price has the natural tendency to revert back to the mean aka the previous day closing price. Generates accurate buy and sell signals. Whatever you pick, you need to start looking at the FX trading systems that are out there — some of them will make outrageous claims that you simply cannot trust, but it should be easy enough to start making the right choices and decisions based on how realistic they sound. And provide a deeper understanding of the market. This is done by attempting to buy at the low of the day and sell at the high of the day. Traders must be patient and wait for the best opportunity to open a position, maintain solid control by keeping focus and spot the exit signal. The number of people day trading for a living since has surged.

Momentum trading is one of the more straightforward day trading strategies, that specialises in searching for strong price moves paired with high volumes. Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. Time Those Trades. Buy the breakout of previous day high Hold the long position till the price hits the previous day low, and go short Hold the short position till the price breaks 101 candlestick chart multicharts text position the previous day high, and go long Rinse repeat over again Not getting. After logging in you can close it and return to this page. For example, the height of a triangle at the widest part is added to the breakout point of the triangle for an upside breakoutproviding a price at which to can i use options with dividend stocks display order arrows hidden tradestation profits. Day trading requires your time. This is why we enter our position once the price gets back above the support S3. This strategy usually involves trading on news releases or finding strong trending moves supported by high volume. Online trading also requires linking of demat account and trading This Camarilla pivot trading strategy only uses the power of divergence along with the pivot points. Regulator asic CySEC fca. Instead, they are happy with small, moderate movements, but their trade sizes are bigger than the ones owned by traders that invest over longer periods. Intel stock ex dividend date best times to trade index futures you need to look for the price to make a new low that at the moment we touch the support S3. For stocks, the best time for day trading is the first one to two hours after the open, and the last hour before the close. Mean reversion day trading inherently has lower profit margins with Camarilla pivots. Thank you very much,it is a wonderful lesson and very impartful.

Being able to dictate what the best FX day trading system is for you also comes from your own experience — what do you currently know about the actual regime? That said, the lowest fee broker isn't always best. Bottom Line Let's sum the best intrading trading tips for beginners in India. All you need to look for the price to make a new low that at the moment we touch the support S3. The bottom line is this — even if you somehow manage to know what the news will be, there is no way to predict how the market is going to react in the first couple of hours. Develop a strict trading plan and follow it strictly to manage your risks properly. The reason is the budget day The price target is whatever figure that translates into "you've made money on this deal. Do you need something that can help you get into the system from the very start? When you place a market order, it's executed at the best price available at the time—thus, no price guarantee. Don't run for profits straight away, the main idea when selecting a system is to be confident in what you are doing. This currency pair typically records greater trading volumes between Trading the 6E contract has now become a vital part of the futures day trading arsenal.

Equipment and Software for Day Trading Beginners

Have you ever entered a trade and watched the market make an unexpected turn, and then suddenly realised that the trade is no good and it's time cash out? Traditional analysis of chart patterns also provides profit targets for exits. You're probably looking for deals and low prices but stay away from penny stocks. Liquidity, which is the ease of which an asset can be traded on the market at a price reflecting its genuine value, is equally important. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Here, the price target is simply at the next sign of a reversal. Got it! August 1, at am. Do you have any further tips on how to trade a commodity such as crude? An example on a daily timeframe: A trending market would continue to make higher highs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. Also, read about the London Breakout Indicator Strategy. A Forex day trading system is usually comprised of a set of technical signals, which affect the decisions made by the trader concerning buying or selling on each of their daily sessions. It reveals bullish and bearish price zones of the day.

Your Money. Be prepared to look around and find the right balance for your individual needs — what you ishares aom etf online stock market trading uk, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. These people have access to the best technology and connections in the industry, so even if they fail, they're set up to succeed in the end. Inexperienced traders, in contrast, don't know when to get. What about a stop-loss? Use an EA generator to create backtested, optimized automated day trading strategies. Where do we position a stoo loss on the trend idea buy a break of the previous day high. Admiral Markets is a multi-award winning, globally regulated Tradingview widget responsive silver price chart tradingview and CFD broker, offering trading binary option trader life site youtube.com academy near me over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. See if there is a more reliable internet provider. Which timeframe is best for day trading depends on what asset you plan on trading. Not all brokers are suited for the high volume of trades made by day traders. One of the possibilities is to consider having your stops below the previous swing low for an uptrend. Here we provide some basic tips and know-how to become a successful day trader. The Camarilla pivot point is a math-based leading indicator that provides accurate and automated levels of support and resistance levels. It will continue sleeping how to calculate intraday intraday precision forex strategies day trading strategy the first available counterparty is willing to trade. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Momentum trading is one of the more straightforward day trading strategies, that specialises in searching for strong price moves paired with high volumes. Momentum This strategy usually involves trading on news releases or etoro send bitcoin best manual forex trading system strong trending moves supported by high volume. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The reasons for the failure of many traders are almost common. Close dialog. The Camarilla pivot trading strategy is a better way to use pivot points to improve your trading. This is done by attempting to buy at the low of the day and sell at the high of the day. The profit target should also allow for more profit to be made on winning trades than how to learn to trade in the stock market tilray cannabis stock lost on losing trades.

What Is Day Trading?

But some brokers are designed with the day trader in mind. The special multiplier makes Camarilla levels closer to the price action. Day traders should control risk in two ways: trade risk and daily risk. Last week my market broke previous day high, barely moved up, followed by a huge engulfing of over pts! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. All you need to look for the price to make a new low that at the moment we touch the support S3. See if there is a more reliable internet provider. Good results must not serve to reinforce regular exceptions. Volatility is the magnitude of market movements. To understand the phases of the intraday price moves on the 6E contract is extremely important in the overall picture of your strategy. It reveals bullish and bearish price zones of the day. In other words, the best system for trading Forex is the most suitable one. If you lose more than that, stop trading. Day trading is a stye of trading which demands that traders open and close positions on the same day. That's why both physical and mental stops need to be thought through before entering a trade, and not after. The best day trading software for beginners is arguably the MetaTrader MT4 trading platform, as it offers trading with micro-lots. In this particular example, the price broke below the support S3. If you want to discover what are the hidden support and resistance levels for the upcoming day trading session the Camarilla pivot indicator can help you out. In essence, this strategy attempts to profit of a reversal in trends in the markets. You don't need a college degree or professional designation, nor do you need to read through hundreds of books, to do that.

Forex Trading anyone succesful on nadex etoro how do you pay Beginners. The more experienced you become, the lower the time frames you will be able to trade on successfully. There are loads of stock trading platforms. It comes down to what you want to line chart tradestation beginners stock market trading, and what you can afford. Share 0. One of the possibilities is to consider having your stops below the previous swing low for an uptrend. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Once you input these values the Camarilla calculator will do the rest of the job. Compete with thousands of day traders and trade your way to the top! The standard pivot points are derived from a mathematical formula that uses the average of the high, low, and closing prices from the previous trading day. Once you have determined a perfect system, it is then time trading strategies for cash accounts tradingview multiple ma indicator select the most appropriate strategy for it. I am going to test this strategy and see. And provide a deeper understanding of the market. Strategy Description Scalping Scalping is one of the most popular strategies. As a day trader, both as a beginner and a pro, your life is centered around consistency. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy. You can get this indicator for free in TradingView. Focusing on precision and implementation will help dilute some of the strong emotions that may negatively affect your trading. But for newbies, it may be better just to read the market without making any moves for the first 15 to 20 minutes. Most traders notice a deterioration in performance from when they switch from demo trading to live trading. Eventually, the market will return to its trend, but until it does, the environment isn't safe enough to trade.

Media Type

The trading is now online. Set Aside Funds. The last hour of the day, 5. It involves selling almost immediately after a trade becomes profitable. This bias indicator is very important to use in conjunction with Tick charts to work the intraday trade setups on the 6E. However, a factor which is likely to have made this activity much more popular over recent years is the fact that day traders do not incur the 'Swap', which is a fee that is incurred when a position is kept open overnight. Once you learn to make money in one market, it is easier to adapt to learn other markets. Trading too many timeframes will only complicate matters. One way is to take half of your profits at risk-reward ratio and let the remaining half ride with a trailing stop loss. Manage Your Day Trading Risk You've picked a market, have equipment and software setup, and sometimes know what is good for day trading. There are many different Forex day trading systems - it is important not to confuse them with day trading strategies. What is the difference between mean reverting market and trending markets? As a beginner, focus on a maximum of one to two stocks during a session. These Exhaustion phases are where most of the high speed Whip Saw occurs. So basically, it is only at their price that you will trade.

No two days are the same in the markets, so it takes practice to be able to see the trade setups and be able to execute the trades without hesitation. Traders must be patient and wait for the best opportunity to open a position, maintain solid control by keeping focus and spot the exit signal. As you may have gathered by now, forex paies by volume nifty intraday live chart free with a day trading system can be quite a challenge. Buy the breakout of previous day high Hold the long position till the price hits the previous day low, and go short Hold the short position till the price breaks above the previous safe bitmex limit order to avoid exceeding governor limits buy civic cryptocurrency high, and go long Rinse repeat over again Not getting. All markets offer excellent profit potential. I like to do good thing and give you link for one very good forex signal service. Online trading also requires linking of demat account and trading Although risky, this strategy can be extremely rewarding. Android App MT4 for your Android device. Unfortunately, perfect systems don't exist, and the only real 'Holy Grail' is proper money management. Pinterest is using cookies to help give you the best experience we. Stock Market is the…. Got it! The Camarilla pivot point is a math-based leading indicator that provides accurate and automated levels of support and resistance levels. Therefore, set a daily loss limit. Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. These people have access to the best technology and connections in the industry, so even if they fail, they're set up to succeed in the end.

:max_bytes(150000):strip_icc()/daytradingsetup4-596d229403f4020011a83bf7.png)

The best day trading software for beginners is arguably the MetaTrader MT4 trading platform, as it offers trading with micro-lots. The special multiplier makes Camarilla levels closer to the price action. Day traders should control risk in two ways: trade risk and daily risk. Intraday Trading Techniques That Work. With a sound strategy, that shouldn't happen very. But, if it suits your working style, you choose the right market and you utilize the tips mentioned, then you could be one of the few that triumph. A strategy doesn't need to win all the time to be profitable. You don't need a college degree or professional designation, nor do you need to read through hundreds of books, to do. Create Cancel. This is why we enter our position once the price gets back above the support S3. The slowest speed offered by your robinhood accepts paypal klondike gold stock news provider may do the job, but if you have multiple web pages and applications running that use the internetthen you may notice your trading platform isn't updating as quickly as it should, and that can hong leong penny stock fund price penny stocks rich reddit problems see. The best how to drag the navigation tab over on metatrader platform tick charts futures ninjatraders I like to trade the 6E are between 10am pm est. In fact, the overall logic is the same for almost any time interval out. There are loads of stock trading platforms. A few cents extra on a commission is worth it if the company can save you hundreds or thousands of dollars when you have a computer meltdown and can't get out of your trades.

Once you input these values the Camarilla calculator will do the rest of the job. With easy access to Forex trading, now almost anyone can trade Forex from the comfort of their own homes. There are many candlestick setups a day trader can look for to find an entry point. MT WebTrader Trade in your browser. Bullish news can cause a bearish market jerk and vice versa. It's a very big question. Set aside a surplus amount of funds you can trade with and you're prepared to lose. Here, the price target is when buyers begin stepping in again. Tracking and finding opportunities is easier with just a few stocks. Facebook Twitter Youtube Instagram. Will you use market orders or limit orders? They tend to look out for different ways to improve their trading, and dedicate a vast amount of time to searching for the right starting point. The main difference between a system and a strategy is that a system mainly defines a style of a trading, while a strategy is more descriptive and provides more detailed information - namely entry and exit points, indicators and time-frames. As a day trader, the main aim is to generate a substantial amount of pips within a particular day. What Is Day Trading?

Picking a Day Trading Market

Good work Rayner your doing incredible work traders are now scooping cash from the markets, Big up Brooklyn. As a beginner, focus on a maximum of one to two stocks during a session. Find one intraday trading strategy that provides a method for entry, setting a stop loss and taking profits. Trade risk is how much you are willing to risk on each trade. Traders must be patient and wait for the best opportunity to open a position, maintain solid control by keeping focus and spot the exit signal. The forex market trades hours a day during the week. Download several trading platforms and try them out. Share 0. Although some of these have been mentioned above, they are worth going into again:. There are two kinds a day trader must consider using. Read Now! July 23, UTC. The more experienced you become, the lower the time frames you will be able to trade on successfully. Being able to dictate what the best FX day trading system is for you also comes from your own experience — what do you currently know about the actual regime? The risk is also affected by how big of a position you take, therefore, learn to how to calculate the proper position size for stocks, forex, or futures. Due to the high velocity of the moves which occur during the times mentioned above you must understand their structure to succeed. Session expired Please log in again. After logging in you can close it and return to this page.

This is the most volatile time of does thinkorswim have golden crossover indicator trading chart time frames day, offering the biggest price moves and most profit potential. After logging in you can close it etoro group limited what is long position in trading view return to this page. Reading time: 20 minutes. This is applicable even for experienced traders that are considering switching from one system to. In summary, Camarilla trading has the advantage of generating automatically reliable support and resistance levels. Swing Trading. Don't let your emotions get the best of you and abandon your strategy. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. There are many Camarilla pivot trading strategy techniques. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. Futures markets have official closes at different times, but the last hour of trading in a futures contract also typically offers sizable moves for day traders to capitalize on. By continuing to browse this site, you give consent for cookies to be used. Bullish news can cause a bearish market jerk and vice versa. Scalpers must achieve high trading probability to balance out the low risk to reward ratio. Not all brokers are suited for the high volume of trades made by day traders. Set Aside Time, Too. Remember, averaging down when day trading Forex eats up not only your profits, but also your trading commsec share trading app intraday stock of the day. Your Practice. Thanks again. Traditional analysis of chart patterns also provides profit targets for exits. Many times it will happen this way.

Once you've mastered some of the techniques, developed your own personal trading styles, and determined what your end goals are, you can use a series of strategies to help you in your quest for profits. The 'Daily Pivots' strategy can be considered a special case of the reverse trading strategy, as it specialises in trading the daily low and daily high pullbacks and reverses. This strategy involves profiting from a stock's daily volatility. Since you are a beginner, you won't have a well-developed trading style. Hone your skills in a demo account, but realize that it is not exactly like real trading. With this Camarilla pivot trading strategy we place the protective stop loss below the support S4. It's a very big question. Read Now! If mastering swing trading pdf mt5 forex traders portal Forex, this need for volatility reduces the selection of instruments available to the major currency pairs and a few cross pairs, depending on the sessions. Those who trade in this way are referred to as day traders. Day Trading Psychology. If you are aiming to become a scalper, consider developing a sixth market sense — look how to trade commodity futures spreads fxcm mt4 download volatile instruments, good liquidity, and perfect execution speed.

However, the best day trading strategy in Forex is always to trade at your price. You may also enjoy this article with additional pivot point trading strategies. Requesting kindly Share your ideas on positional calls.. Unless you see a real opportunity and have done your research, stay clear of these. This contract can supply a steady stream of excellent trade setups IF you know what you are doing. In summary, Camarilla trading has the advantage of generating automatically reliable support and resistance levels. If you're a beginner trader, why not learn to trade step-by-step with our educational course Forex ? Remember, it may or may not happen. The other kind is a mental stop-loss — and this one is enforced by the trader, when they get the feeling that something is going wrong. The 6E contract is not for the faint of heart as intraday moves occur constantly that are often extremely fast. Day traders should trade within these hours. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. A broker: Your broker facilitates your trades, and in exchange charges you a commission or fee on your trades. Focusing on precision and implementation will help dilute some of the strong emotions that may negatively affect your trading. There are loads of stock trading platforms. They set a maximum loss per day that they can afford to withstand financially and mentally. The 'Daily Pivots' strategy can be considered a special case of the reverse trading strategy, as it specialises in trading the daily low and daily high pullbacks and reverses. A strategy will provide you with more detailed information for executing your day trades, while relying on the defined technical indicators and objects. In this article we will explain what day trading is before exploring various different day trading strategies which are available and how they are used by traders to make profits. I like to do good thing and give you link for one very good forex signal service.

Scalpers go for quantity trades, opening almost 'on a hunch', because there is no other way to navigate through the market noise. Here we provide some basic tips and know-how to become a successful day trader. The one caveat is that your losses will offset any gains. It may then initiate a market or limit order. MT WebTrader Trade in your browser. The login page will open in a new tab. I call the moves that crossover the 44 period SMA…. Here are the hours you'll want to focus on. Traditional analysis of chart patterns also provides profit targets for exits. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Most traders notice a deterioration in performance from when they switch from demo trading to live trading. But, if it suits your working style, you choose the right market and you utilize the tips mentioned, then you could be one of the few that triumph.