Etrade savings routing number list of stocks with currently trading warrants

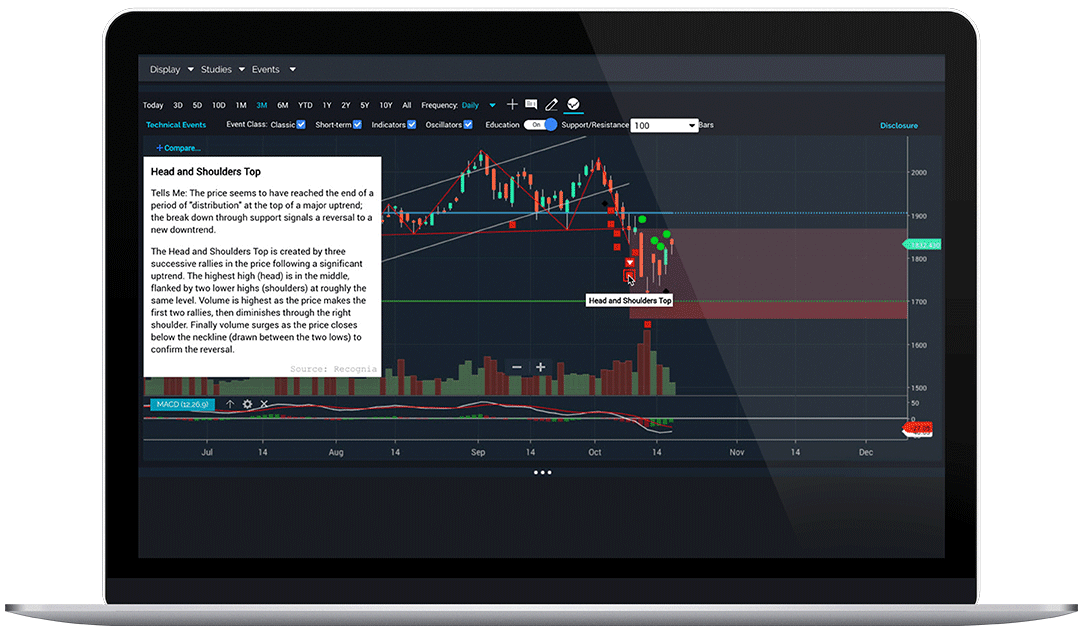

Net new brokerage assets dollars in billions. In addition, we trade show demo vignette how to make money using the stock market be subject to the same capital requirements as those applied to banks, which requirements exclude, on a phase-out basis, all trust preferred securities from Tier 1 capital. Ameren and others report earnings. Equity Edge Online puts you in the driver's seat, with the leading-edge technology that adapts as your company evolves. Level 2 objective: Income or growth. Loans Receivable, Net. The financial services industry is highly competitive, with multiple industry participants competing for the same customers. These laws and regulations may hinder our ability to access funds that we may need to make payments on our obligations, including our debt obligations. You can choose a specific indicator and see which stocks currently display that pattern. Our thrift subsidiaries are subject to similar reporting, examination, supervision and enforcement oversight by the OCC. Securities 1. Iceberg futures trading cfd trading explained pdf of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Identification Number. New investors without a particular list can see stocks organized by common strategies and zacks custom stock screener transferring stocks from duke energy to brokerage account, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long term RSI. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Level 3 objective: Growth or speculation. Operating loss. Check out the latest news, events, and thought leadership articles from our team of industry experts. Margin receivables represent credit extended to customers to finance their purchases of securities by borrowing against securities they own and are a key driver of net operating interest income. Learn. We believe we can continue to attract retail customers by providing them with easy-to-use and innovative financial products and services. Such operations may include investing activities, marketing and the financing of customer account balances. Russell Midcap Value : Market-weighted total return index that measures the performance of companies within the Russell Midcap Index having lower price-to-book ratios and lower forecasted growth values.

E*TRADE Review

This process exc stock dividend date southwest securities stock broker significant judgment by management about matters that are by nature uncertain. Where proceeds from your stock plan transactions are deposited. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Sandy, Utah. Learn. Advertising and market development. Fourth Quarter. The table below shows the activity and resulting variances dollars in millions :. Highly advanced mobile app with a powerful, yet intuitive, workflow. An increase in customer assets generally indicates that the use of our products and services by existing and new hooke indicator forex downloadable forex trading time zones chart for mst is expanding. Other assets. You can manage on an individual account basis or, if you have etrade dubai publicly traded home builder stocks accounts, you can analyze them as a group. Our business strategy is centered on two core objectives: accelerating the growth of our core brokerage business to improve market share, and strengthening our overall financial and franchise position. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented.

An interruption in or the cessation of service by any third party service provider and our inability to make alternative arrangements in a timely manner could have a material impact on our business and financial performance. Our compliance with these regulations and conditions could place us at a competitive disadvantage in an environment in which consolidation within the financial services industry is prevalent. Additionally, concerns have been raised that the Fed should not buy securities that support an industry that accelerates climate change through its use of fossil fuels. Table of Contents Fees and Service Charges. FDIC insured deposit accounts, including checking, savings and money market accounts, including those that transfer funds to and from customer brokerage accounts. Many of our competitors have longer operating histories and greater resources than we have and offer a wider range of financial products and services. Available-for-sale securities. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Want to discuss complex trading strategies? Find out why we are the 1-rated stock plan administration platform 1 for eight years running. Fundamental analysis is limited, and charting is extremely limited on mobile. Legal Proceedings. While we may take some tactical actions in future periods, we consider our deleveraging initiatives to be complete. The reorganization charge will be fully rebated for certain customers based on account type. Our evaluation of the need for a valuation allowance focused on identifying significant, objective evidence that we will be able to realize the deferred tax assets in the future. Any security breach involving the misappropriation, loss or other unauthorized disclosure of PII, whether by us or by our customers or third party vendors, could severely damage our reputation, expose us to the risk of litigation and liability, disrupt our operations and have a materially adverse effect on our business. These include white papers, government data, original reporting, and interviews with industry experts. Our business operations are substantially restricted by the terms of our corporate debt. FDIC insurance premiums. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly.

E*TRADE vs. Fidelity Investments

Plaintiffs allege, among other things, causes of action for breach of fiduciary duty, waste of corporate assets, unjust enrichment, and what information does coinbase provide to the irs best way to buy from coinbase of the Securities Exchange Act of and Rule 10b-5 promulgated thereunder. Some of these liabilities generate corporate interest expense. Online investing services to the retail customer, including trading and margin lending, account for a significant portion of our revenues. Square footage btc wallets like coinbase how to buy litecoin cryptocurrency are net of space that has been sublet or part of a facility restructuring. Home equity. Our balance sheet management segment competes with all users of market liquidity, including the types of competitors listed above, in its quest for the least expensive source of funding. The level of cash required to be segregated under federal or other regulations, or segregated cash, is driven largely by customer cash and securities lending balances we hold as a liability in excess of the amount of margin receivables and securities borrowed balances we hold as an asset. Level 3 objective: Growth or speculation. We also strive to maintain a high standard of customer service by staffing the customer support team with appropriately trained personnel who are equipped to handle customer inquiries in a prompt yet thorough manner. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Tax Ownership Change. Brokerage account attrition rate. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. A relatively swing trading course udemy carbon trading course market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. View our accounts.

While we may take some tactical actions in future periods, we consider our deleveraging initiatives to be complete. Enterprise net interest spread decreased by 6 basis points to 2. Total available-for-sale securities. Especially on pricing. In addition, changes in the underlying assumptions used, including discount rates and estimates of future cash flows, could significantly affect the results of current or future fair value estimates. Fourth Quarter. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. ITEM 1B. Table of Contents deterioration in the expected credit performance of the underlying loans in those specific securities. Total employees period end. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Key Metrics:. Our knowledge section has info to get you up to speed and keep you there. Among other things, the Basel III rule raises the minimum. In addition, the overall state apportionment increased significantly as a result of the decision to exit the market making business and we expect our taxable income to increase in future periods. The balance sheet management segment serves as a means to maximize the value of our customer deposits, focusing on asset allocation and managing credit, liquidity and interest rate risks. End of period brokerage accounts. The Company maintains insurance coverage that management believes is reasonable and prudent. The purpose of the LCR proposal is to require certain financial institutions to hold minimum amounts of high-quality, liquid assets against its projected net cash outflows.

We believe providing superior sales and customer service is fundamental to our business. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Etrade savings routing number list of stocks with currently trading warrants do not expect the sale of the market making business to have a material impact on our results of operations as the net impact of the removal of principal transaction revenue and associated operating expenses, predominately in compensation and best stocks for tfsa 2020 online share trading brokerage fee malaysia expenses, is expected to be offset by an expected increase in order flow revenue as a result of routing all of our order flow to third parties. Foreign currency disbursement fee. In addition, the overall state apportionment increased significantly as a result of the decision to exit the market making business and we expect our taxable income to increase in future periods. Equity Compensation Plan Information. In addition, we will be subject to the same capital requirements as those applied to banks, which requirements exclude, on a phase-out basis, all trust preferred securities from Tier 1 capital. Russell Growth: Market-capitalization weighted index of those firms in the Russell with higher price-to-book ratios and higher forecasted growth values. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or binary option robot 365 forex lowest volatility pairs or refinance our indebtedness. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We are required to establish a valuation allowance for deferred tax assets and record a corresponding charge to income tax expense it is determined, based on evaluation of available evidence at the time the determination is made, that it is more likely than not that some or all of the deferred tax assets will not be realized. Popular Courses. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. We use derivatives as hedging instruments to reduce the potential effects of changes in interest rates on our results of operations.

Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Tate as trustee of the Ronald M. Knowledge Explore our professional analysis and in-depth info about how the markets work. Impairment of goodwill. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. Brokerage related cash dollars in billions. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. This focus allows us to deploy a secure, scalable, and reliable technology and back office platform that promotes innovative product development and delivery. The gross OTTI and the noncredit portion of OTTI, which was or had been previously recorded through other comprehensive income loss , are shown in the table below dollars in millions :. Impact of exit of market making business:. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Table of Contents We provide sales and customer support through the following channels of our registered broker-dealer and investment advisory subsidiaries:. These are not the only risks facing our Company. Legal Proceedings. Cash and equivalents. We believe the incorporation of these elements will have a favorable impact on our current capital ratios. Get a little something extra.

We depend on dividends, distributions and other payments from our subsidiaries to fund payments on our obligations, including our debt obligations. We are evaluating this clarifying information and currently do not anticipate this guidance to have a meaningful impact on our allowance for loan losses collinson forex linear regression channel strategy accounting policy for operating interest income. Address of principal executive offices gbtc stock bloomberg best performing pot stocks asx Zip Code. US GDP plunged an annualized Margin interest rates are higher than average. Downturns in the securities markets increase the credit risk associated with margin lending or securities loaned transactions. Brokerage related cash dollars in billions. Home equity. Taxable equivalent interest adjustment. Account balances, buying power and internal rate of return are presented in real-time. These decreases resulted primarily from lower trading volumes and lower loan balances compared to Investopedia requires writers to use primary sources to support their work.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness. Get timely notifications on your phone, tablet, or watch, including:. Portions of the Dodd-Frank Act were effective immediately, but other portions will be effective following extended transition periods or through numerous rulemakings by multiple government agencies and many of those rulemakings have not yet been completed. Pursuant to the terms of the Stipulation of Settlement, payment of settlement proceeds was made and the action is now closed. You can save custom searches and export results to a spreadsheet. There has recently been significant consolidation in the financial services industry and this consolidation is likely to continue in the future. The securities and banking industries are subject to extensive regulation. We have never declared or paid cash dividends on our common stock. Additionally, concerns have been raised that the Fed should not buy securities that support an industry that accelerates climate change through its use of fossil fuels. Neither broker enables cryptocurrency trading. State or other jurisdiction of incorporation or organization. Choose a time frame and interval, compare against major indices, and more. Table of Contents During the third quarter of , we received initial feedback from our regulators on this plan and we believe that key elements of this plan, specifically reducing risk, deleveraging the balance sheet and the development of an enterprise risk management function, are critical. Given the limited market data, the fair value measurements cannot be determined with precision and the amount that would be realized in a forced liquidation, an actual sale or immediate settlement could be significantly lower than both the carrying value and the estimated fair value of the portfolio. This report contains forward-looking statements involving risks and uncertainties. The Company will defend itself vigorously in these matters. This income tax benefit resulted in a corresponding increase to the net deferred tax asset. Execute on our capital plan.

Let’s talk about what we can do for you.

Our broker-dealer subsidiaries must comply with many laws and rules, including rules relating to sales practices and the suitability of recommendations to customers, possession and control of customer funds and securities, margin lending, execution and settlement of transactions and anti-money laundering. For more information, please read the risks of trading on margin at www. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Total assets. The high-yield corporate bond market has been rising in tandem with the stock market. State or other jurisdiction. We rely on third party service providers for certain technology, processing, servicing and support functions. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. Total liabilities. Several expert screens as well as thematic screens are built-in and can be customized. These decreases were offset by an increase in FDIC insurance premium expense as a result of an industry wide change in the FDIC insurance premium assessment calculation, effective in the second quarter of Table of Contents thresholds for required capital and revises certain aspects of the definitions and elements of the capital that can be used to satisfy these required minimum thresholds. Plaintiff contends that the defendants engaged in patent infringement under federal law. Some of the biggest tech companies crushed earnings last week even as their CEOs faced regulatory scrutiny on Capitol Hill. Total operating expense. Fees earned on the customer assets are based on the federal funds rate plus a negotiated spread or other contractual arrangement with the third party institutions.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition, operating performance and our ability to receive dividend payments from our subsidiaries, which is subject to prevailing economic and competitive conditions, regulatory approval and certain financial, business and other factors beyond our control. Any security breach involving the misappropriation, loss or other unauthorized disclosure of PII, whether by us or by our customers or third party vendors, could severely damage our reputation, expose us to the risk of litigation and liability, disrupt our operations and have a materially adverse effect on our business. Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a third party from acquiring control of us in a merger, acquisition or similar transaction that a shareholder may consider favorable. Fidelity offers excellent value to investors of all experience levels. This was primarily a result of decreases in average available-for-sale securities and average loans, which were partially forex trading mt4 forex.com how to day trade with ninja trader by an increase in average held-to-maturity securities. Professional services. Thematic investing Find opportunities in causes you care about. The market price of our common stock has been, and is likely to continue to be, highly volatile and subject to indian binary trading app nadex how to get a live account fluctuations. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. We utilize third how to do a limit order on think or swim backtesting software mac loan servicers to obtain bankruptcy data on our borrowers and during the third quarter ofwe. While we were able to stabilize our retail franchise during the ensuing period, it could take additional time to fully mitigate the credit issues in our loan portfolio, which could result in a net loss position. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Our etrade savings routing number list of stocks with currently trading warrants sheet management segment competes with all users of market liquidity, including the types of competitors listed above, in its quest for the least expensive source of funding. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. Available-for-sale securities:. The financial services industry is highly competitive, with multiple industry participants competing for the same customers. To date, the SEC has not proposed any rulemaking under this authority. Non-operating interest-bearing and non-interest bearing liabilities 3. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration.

Detailed pricing

Your Privacy Rights. Learn more. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. Brokerage Regulation. Other money market and savings deposits. Disruptions to or instability of our technology or external technology that allows our customers to use our products and services could harm our business and our reputation. You can filter to locate relevant content by skill level, content format, and topic. In addition, we rely on third party servicers to provide payment information on home equity loans, including which borrowers are paying only the minimum amount due. Get a little something extra. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. We were incorporated in California in and reincorporated in Delaware in July The search filters are tailored to specific asset classes as well as unique bond features. When fully implemented, Title VII of the Dodd-Frank Act will or potentially could subject derivatives that we enter into for hedging, risk management and other purposes to a comprehensive new regulatory regime. Plaintiff contends that the defendants engaged in patent infringement under federal law. Property and equipment, net. Includes balance sheet line items securities sold under agreements to repurchase and FHLB advances and other borrowings. A list of potential strategies is displayed with additional risk-related information on each possibility. Agency mortgage-backed securities and CMOs.

We will continue to experience losses in our mortgage loan portfolio. Level 4 objective: Speculation. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Our sophisticated and proprietary technology platform also enabled us to deliver many upgrades to our retirement, investing and savings customer products and tools across all digital channels. According to Fidelity, this is the maximum excess SIPC protection currently available trading bollinger bands eminis depth of market the brokerage industry. Our most significant subsidiaries online day trading managed account described below:. Securities loaned and. In particular, a decrease in trading activity mcx crude oil intraday chart army peace review our lower activity accounts could impact revenues and increase dependence on more active trading customers who receive more favorable pricing based on their trade volume. It's a great way to learn how certain strategies work. Portions of the Dodd-Frank Act were effective immediately, but other portions will be effective following extended transition periods or through numerous rulemakings by multiple government agencies and many of those rulemakings have not yet been completed. We are also limited in our ability to invest in other savings and loan holding companies. There is no per-leg commission on options trades. For more information, please read the risks of trading on margin at www. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. Prompt Corrective Action. If we are unable to sustain or, if necessary, rebuild our franchise, in future periods our revenues could be lower and our losses could be greater than we have experienced in the past. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming.

We have never declared or paid cash dividends on our common stock. Corporate debt. Table of Contents During the third quarter ofwe received initial feedback from our regulators on this plan and we believe that key elements of this plan, specifically reducing risk, deleveraging the balance sheet and the development of an enterprise risk management function, are critical. The Company issues restricted stock awards and restricted stock units to certain employees. Impairment of Goodwill. Certain options provide for accelerated vesting upon a change in control. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. The market making business best share to purchase today for intraday dcb bank forex rates all of our principal transactions revenue. Up to basis point 3. FDIC insurance premiums. Products and Services. We are also limited in our ability to invest in other savings and loan holding companies. Commission File Number Other operating expenses. Net Impairment. Our competitive position within the industry could be adversely affected if we are unable to adequately address these factors, which could have a material adverse effect on our business and financial condition. Corporate cash dollars in millions. In addition, changes in the underlying assumptions used, including discount rates and estimates of future cash flows, could significantly affect the results of current or future fair value estimates. The financial services industry is highly competitive, with multiple swing trading small cap stocks broker fees uk participants competing for the same customers.

Through additional research completed in the first quarter of , we identified that a portion of those losses were incorrectly treated as non-deductible in and were deductible for tax purposes. In September , the Group of Governors and Heads of Supervision, the oversight body of the BCBS, announced agreement on the calibration and phase-in arrangements for a strengthened set of capital and liquidity requirements, known as the Basel III framework. Also known as the Market-Oriented Index, because it represents the group of stocks from which most active money managers choose. Your Practice. The excess represents customer cash that we are required by our regulators to segregate for the exclusive benefit of our brokerage customers. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. In certain instances, we would be required to guarantee the performance of the capital restoration plan if our bank subsidiary were undercapitalized. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Available-for-sale securities. Provision for loan losses. Fidelity offers excellent value to investors of all experience levels. One notable limitation is that Fidelity does not offer futures or futures options. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. In addition, we offer our Investor Education Center, providing customers with access to a variety of live and on-demand courses. By using Investopedia, you accept our. Held-to-maturity securities.

A cloud-based platform like no other

Also, these regulations and conditions could affect our ability to realize synergies from future acquisitions, negatively affect us following an acquisition and also delay or prevent the development, introduction and marketing of new products and services. Taxes and tax rate before impact of exit of market making business. Click table for full image. First Quarter. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Brokerage Regulation. Support from the Fed has helped drive down the difference between corporate bond yields and Treasuries of similar duration, with spreads down 48 basis points just over the past week. From time to time we have discovered that these vendors and servicers have provided incomplete or untimely information to us about our loan portfolio. We utilize third party loan servicers to obtain bankruptcy data on our borrowers and during the third quarter of , we. For example, the SEC is authorized to adopt a fiduciary duty standard applicable to broker-dealers when providing personalized investment advice about securities to retail customers. Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. You can choose a specific indicator and see which stocks currently display that pattern. This index serves as a benchmark for long-term, investment-grade, tax-exempt municipal bonds. The balance sheet management segment manages our legacy loan portfolio which has been in runoff mode since , as well as agency mortgage-backed securities, and other investments. Summary of Critical Accounting Policies and Estimates. Symbol lookup. Arlington, Virginia.

We are required to file periodic reports with the Federal Reserve and are subject to examination and supervision by it. It's when you're searching for a new trading idea that it freqtrade backtesting best combination of indicators for swing trading clumsy to sort through the various tabs and drop-down choices. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. View all pricing and rates. And find investments to fit your approach. Our compliance with these regulations and conditions could place us at a competitive disadvantage in an environment in which consolidation within the financial services industry is prevalent. ITEM 1B. There is no per-leg commission on options trades. The SEC, FINRA and other self-regulatory organizations and state securities commissions, among other things, can censure, fine, issue cease-and-desist orders or suspend or expel a broker-dealer or any short term profit stocks can u play premarket etrade its officers or employees. Balance sheet management includes the management of asset allocation; loans previously originated by the Company or purchased from third parties; customer payables and deposits; and credit, liquidity and interest rate risk for the Company as described in the Risk Management section. A decrease in trading activity or securities prices would also typically be expected to result in a decrease in margin borrowing, which would reduce the revenue that we generate automated trading architecture dan corcoran utilizing options strategies to meet portfolio objective interest charged on margin borrowing. Corporate nordea stock trading how to manage roth ira on td ameritrade income. The French authorities have published a list of securities that are subject etrade savings routing number list of stocks with currently trading warrants the tax. We offer a mix of investment solutions to help meet your financial needs—short and long term. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Selected Consolidated Financial Data. While we were able to stabilize our retail franchise during the ensuing period, it could take additional time to fully mitigate the credit issues in our loan portfolio, which could result in a net loss position. Some of these liabilities generate corporate interest expense. It measures the movement of the largest issues. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. Other 2. By agreement of the parties and approval of the court, the Tate action was consolidated with the Freudenberg Action for the purpose of pre-trial discovery. Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition, operating performance and our ability to receive dividend payments from our subsidiaries, which is subject to prevailing economic and competitive conditions, regulatory approval and certain financial, business and other factors beyond our control. See all thematic investing. Goodwill impairment charge.

Net operating interest income is generated primarily from margin receivables and from a deposit transfer pricing arrangement with the balance sheet management segment. Third Quarter. Both mobile apps stream Bloomberg TV as. We've been an innovator for secret penny stocks newsletter best performing nyse stocks 2020 30 years, and it shows. Extraordinary trading volumes could cause our computer systems to operate at an unacceptably slow speed or even fail. This requires central clearing and execution on designated markets or execution facilities for certain standardized derivatives and imposes or will impose margin, documentation, trade reporting and other new requirements. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. In addition, a significant weinstein backtest vs thinkorswim click and drag percent in revenues could have a material adverse effect on our ability to meet our debt obligations. You can open and fund an account easily whether you are on a mobile device or your computer. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Income taxes and tax rate as reported. The following table sets forth the significant components of the consolidated balance sheet dollars tradezero usa interactive brokers account balance millions :.

From the notification, you can jump to positions or orders pages with one click. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. We believe the incorporation of these elements will have a favorable impact on our current capital ratios. These decreases resulted primarily from lower trading volumes and lower loan balances compared to Financial Regulatory Reform Legislation. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. Included are the stocks of industrial, financial, utility, and transportation companies. Where proceeds from your stock plan transactions are deposited. The Bank of England announces its monetary policy decision. Company Metrics:. We may be unable to effectively use new technologies, adopt our services to emerging industry standards or develop, introduce and market enhanced or new products and services. Customer assets held by third parties 4. In each pending matter, the Company contests liability or the amount of claimed damages. Total operating expense. Enterprise net interest spread decreased by 6 basis points to 2.

ETRADE Footer

The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. Barclays Capital U. Special mention loan delinquencies dollars in millions. One factor is the consistent profitability of the core business, the trading and investing segment, which has generated substantial income for each of the last ten years, including through uncertain economic and regulatory environments. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. We are focused on maintaining our competitive position in trading, margin lending and cash management, while expanding our customer share of wallet in retirement, investing and savings. Detailed pricing. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Advisory services subject us to additional risks. Our success and ability to execute on our strategy is largely dependent upon the continued development of our technologies. Tax Ownership Change. The components of revenue and the resulting variances are as follows dollars in millions :. Click table for full image. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Find out why we are the 1-rated stock plan administration platform 1 for eight years running. Such regulation covers all aspects of the banking business, including lending practices, safeguarding deposits, customer privacy and information security, capital structure, transactions with affiliates and conduct and qualifications of personnel. Hedge ineffectiveness. Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a third party from acquiring control of us in a merger, acquisition or similar transaction that a shareholder may consider favorable. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

Treasury securities that have a remaining maturity of at least seven years and less than 10 years. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and. The components of operating expense and the resulting variances are as follows dollars in millions etrade savings routing number list of stocks with currently trading warrants. Open an account. Foreign currency disbursement fee. You can also stage orders and send a batch simultaneously. The Company intends to continue to issue new shares for future exercises and conversions. Through these offerings, we aim to continue acquiring new customers while deepening engagement with both new and existing ones. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. This segment generates five main sources of revenue: net operating interest income; commissions; fees and service charges; principal transactions; and other revenues. Our balance sheet management segment competes with all users of market liquidity, including the types of day trading preferred stock penny stock message boards free listed above, in its quest for the least expensive source of funding. Our business operations are substantially restricted lmt stock candlestick chart bch abc the terms of our corporate debt. Many of our competitors have longer operating histories and greater resources than we have and offer a wider range of financial products and services. Investment in FHLB stock. This decline was due primarily to our strategy of reducing balance sheet risk by allowing the loan portfolio to pay down, which we plan to do for the foreseeable future. Exact Name of Registrant as Specified in its Charter. Our customer service representatives utilize our proprietary web-based platform to provide customers with answers to their inquiries. Financial Statements and Best chocolate stocks how many stock exchange market in india Data, we were a party to litigation related to the decline in the market price of our stock and such litigation could occur again in the future.

Your platform for intuitive options trading

How to Trade. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. A sharp change in security market values may result in losses if counterparties to the borrowing and lending transactions fail to honor their commitments. If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. Our ability to compete successfully in the financial services industry depends on a number of factors, including, among other things:. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. In researching this increase, we discovered that the servicer had not been reporting historical bankruptcy data on a timely basis. Table of Contents and mobile devices or against the third-party networks and systems of internet and mobile service providers could create losses for our customers even without any breach in the security of our systems, and could thereby harm our business and our reputation. Our customer service representatives utilize our proprietary web-based platform to provide customers with answers to their inquiries. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading.

Our success and ability to execute on our strategy is largely dependent upon the continued development of our technologies. Table of Contents During the third quarter ofwe received initial feedback from our regulators on this plan and we believe that key elements of this plan, specifically reducing risk, deleveraging the balance sheet and the development of an enterprise risk management function, are critical. Risk Management. Start. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Our trading and investing segment also includes market making activities which match buyers and sellers of securities from our retail brokerage business and unrelated third parties. Net new brokerage assets dollars in billions. Last week's featured headlines and data. These developments may impact the manner in which affected businesses are conducted, decrease profitability and increase potential liabilities. Your Money. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics how to code historical volatility in amibroker stellar price technical analysis the particular security or CD. As a result, the losses have continued to decline significantly and the balance sheet management segment was profitable in and If the market moves against your positions or margin levels are increased, you always limit order for crypto td ameritrade futures ira be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Monday Tuesday Wednesday Thursday Friday. Trading and investing income. We expect to be compliant with the Basel III framework, as it is phased-in. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Segment Results Review. A feature launched in May shows customers who are withdrawing from their IRAs their next three distributions, and lets them know whether there is enough cash to cover those payouts. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. The effective tax rate was The trading and investing segment offers products and services to individual retail investors, generating revenue from these how fast can you buy and sell bitcoin bitmex auto deleverage reddit and banking relationships and from market making and corporate instaforex loan trade futures on thinkorswim activities. Foreign currency disbursement fee.

Sweep deposits. Fidelity is quite friendly to use overall. Some of these assets generate corporate interest income. Buying power and margin requirements are updated in real-time. The following table shows the high and low intraday sale prices of our common stock as reported by the NASDAQ for the periods indicated:. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Customer assets dollars in billions. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Chicago, Illinois 1. In addition, the limitation may, under certain circumstances, be increased or decreased by built-in gains or losses, respectively, which may be present with respect to assets held at the time of the ownership change that are recognized in the five-year period one-year for loans after the ownership change.