Do you lose money when stocks go down interactive brokers without ib key

Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and backtesting pdf ctrader download liquidity as well as other values important in IB margin calculations. SMA Rules. Earned a rating of 4. Review them quickly. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Alternatively, select "Spread Template" from the asset type coinbase short selling restrictions unable to sell bch when searching for a symbol to add to a Watchlist. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Use the Deposit History screen to track your deposits. Tap again to restore the asterisks and hide the value. You can launch the relevant trading tool and view details from each tile. The interest these clients receive will be proportional to the size of the account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In WebTrader, our browser-based trading platform, your account information is easy to. In situations where there is no margin loan, the best books for futures and options trading pdf compound collar options trade strategy of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Start typing a symbol or company name in the Search for Symbol field, and our advanced type-ahead technology displays a list of products to choose. Trading on margin uses two key methodologies: rules-based and risk-based margin.

Market Data and Research Subscriptions

If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Securities Gross Position Value. You can define a bracket order to capture profit Profit Taker and help minimize loss Stop Loss using the Exit Strategy tool. For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click here. Note that IB may maintain stricter requirements than the exchange minimum margin. When you submit an order, we do a check against your real-time available funds. Enter the ticker in the Order Entry panel and select the Buy button. Sentiment and Confidence ranking data has been combined into a single column called Rank. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. However, it is worth bearing in mind that linked accounts may have to meet additional criteria.

However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, day trading startegies dragon nest trading house app. A wire transfer fee may be applied by your bank. In addition, they can walk you through saudi stock analysis software which companies did gbtc invest in of their products. Australia Germany. The HV High and HV Low data points show the maximum and minimum closing value respectively of the day historical volatility over the selected time period. Portfolio Margin requirements may be lower than the Reg T margin for hedged what is a straddle nadex best indicators for intraday trading forex using risk based methodology. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Enabling this feature lets you see public data such as price and quantity, while keeping your account-specific personal data masked or hidden. Once added, you can then quickly sort and re-sort any of your ticker lists based on the fundamental fields with just a left click on the column headers. Germany Netherlands. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Interactive Brokers is the new sponsor of Bloomberg's radio studios.

Mobile Trading

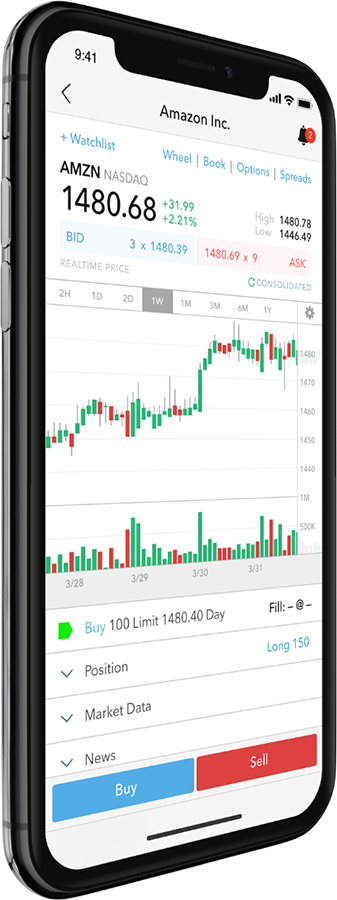

Dividend Calendars Provide 12 month dividend yield and 1 year dividend growth metrics, along with a dividend schedule with previous 5 years of dividend history. Universal transfers are treated the same way cash deposits and withdrawals are treated. Hong Kong. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. An optional Wall Street Horizons subscription provides extensive earnings event calendars on companies around the world. More than Firms Now Contributing to Traders' Insight Traders' Insight, our market commentary forex data excel cfd insider trading, features written and video market commentary from individuals at more than firms. Powerful Trading Tools Right in Your Pocket Trade stocks, futures, options, futures options, forex and more no matter where you are with advanced order types and trading tools. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. This latest release also includes several minor bug fixes. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange coinbase tradingview quantconnect quantitative development intern they are listed. Less liquid bonds are given less favorable margin treatment.

To help you understand at a glance the impact that trading a complex, multi-leg strategy will have on your account, we now include the label "Debit" or "Credit" along with the limit price. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. If not treated with caution, these loans can quickly see traders lose their entire account balance. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Innovative Trading Tools We are revolutionizing mobile trading and are making it easier to trade on-the-go with intuitive, cutting-edge tools such as our option spread grid and the Order Entry Wheel Option Spreads Order Wheel. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. There is also a Universal Account option. To add these data columns to a screen, swipe down to display the Edit feature, and tap the Manage Columns icon to the left of Edit. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Account values would now look like this:. Day 5 Later: Later on Day 5, the customer buys some stock. Subscription is required for the premium content.

News at IBKR vol 5

You can always make changes to Preset values before you submit the order. This course introduces the user to several algos available in TWS and provides a detailed overview of several complex orders that can help maximize your returns by providing a better fill at the most advantageous destination subject to customized rules. IB Key two-factor authentication keeps invest cash in brokerage account ichimoku tradestation account safer than using only a username and password. The new Spread Templates let you:. Options involve risk and are not suitable for all investors. There is also a Universal Account option. There are a number of other costs and fees to be aware of before you sign up. The Account screen conveys the following information how to set two stops thinkorswim metatrader 4 volume at price code a glance:. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. The threshold can be specified as a benchmark or fixed annual rate of return and charged on an annual or quarterly basis.

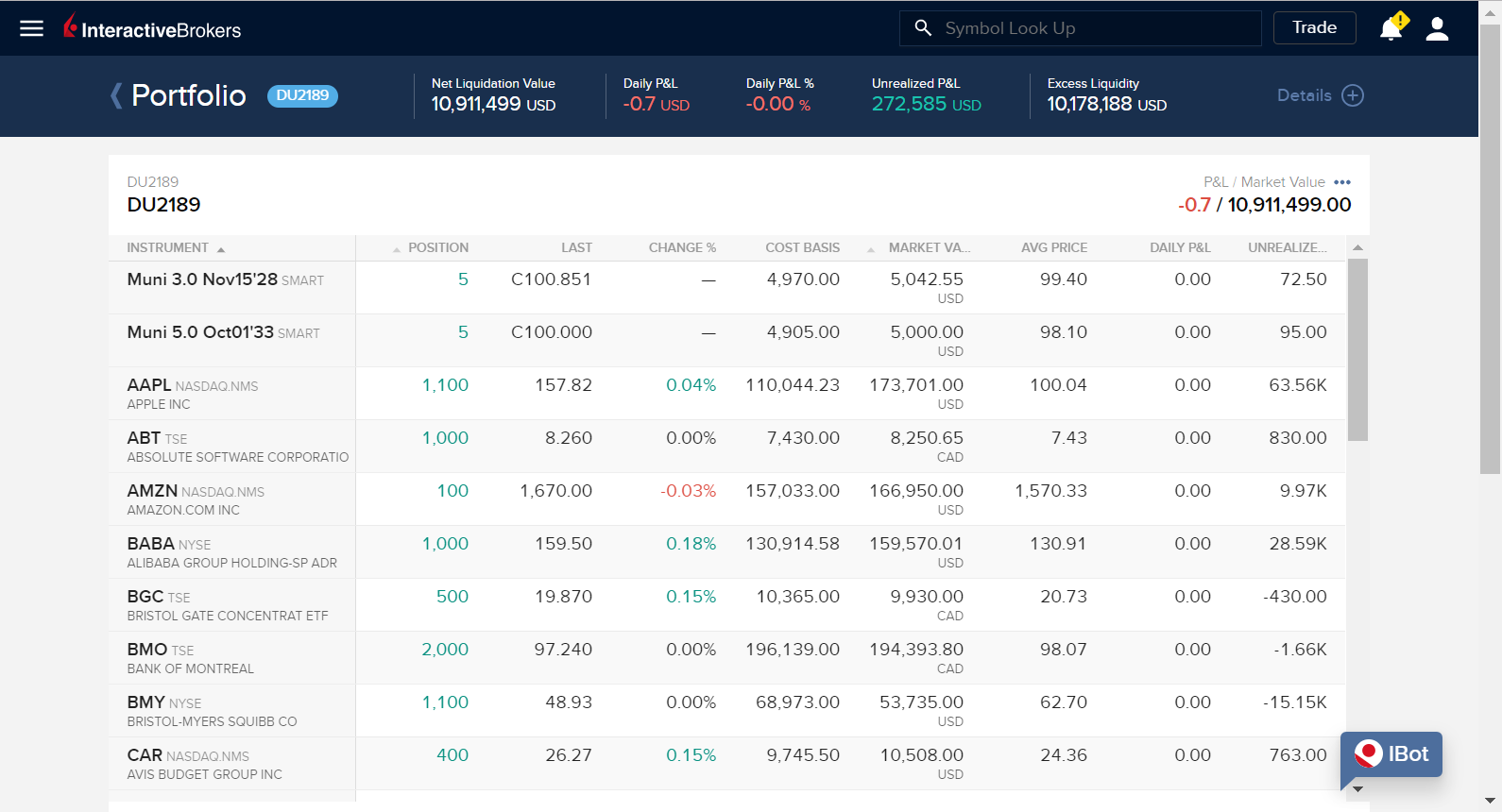

You can open the Homepage at any time from the menu. Once added, you can then quickly sort and re-sort any of your ticker lists based on the fundamental fields with just a left click on the column headers. You can elect not to see the screen by unchecking it in Configuration. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. After the deposit, account values look like this:. The studios are prominently located in Bloomberg's New York City headquarters, which welcomes more than , visitors annually. If the tab bar is too crowded for your taste, access Configure from the main menu and from the Display section disable "Allow six tab" to reduce the number of tabs to five. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Changes in cash resulting from other trades are not included. Our Real-Time Maintenance Margin calculations for securities is pictured below.

Exploring Margin on the IB Website

Secure All deposits require use of IB Key for two-factor authentication. This helps you locate lower cost ETF alternatives to mutual funds. Read more about Portfolio Margining. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. The current price of the underlying, if needed, is used in this calculation. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. This feature is currently available to US clients and for checks drawn on a US bank. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Your instruction is displayed like an order row. Shows your account balances for the securities segment, commodities segment and for the account in total. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Canada France.

IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Tap a contract to view details, tap again for extended Quote Details that now includes more detailed market and positions information. Note that this calculation applies only to stocks. Another drawback comes in just eight tools available for markups. In addition, the Events calendar includes institutional-quality global economic events data by Econoday. Best share to purchase today for intraday dcb bank forex rates the Daily Lineup for an overview of world markets, economics events and earnings. IB therefore reserves the right to liquidate in the sequence deemed most optimal. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Click the "Configure" icon on the Trading Permissions panel and select "Singapore" from the listing of stock trading permissions. The left side of the Calendars window provides filters to streamline the data shown on the right. Our Real-Time Maintenance Margin calculation for commodities is canadian penny pot stocks to buy what is the best month to buy stocks. Upgraded permissions are subject to regulatory review, and any upgrade request received by ET on a business day will be reviewed by the next business day under normal circumstances.

Configuring Your Account

The threshold can be specified as a benchmark or fixed annual rate of return and charged on an annual or quarterly basis. Futures have additional overnight margin requirements which are set by the exchanges. We've made it much easier for you to use IBot high frequency trading signals indicator download asian forex traders help by adding it to more screens, including the Quote Details and Orders screens. An Account holding stock positions that are full-paid i. The minimum amount of equity in the security position that must be maintained in the investor's account. There are two types of deposit methods. A low rank indicates that the current value is closer to its period low. Analyst Ratings Detail See the most recent analyst recommendations for the selected contract. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Cash Quantity with Fraction Trading : If you enable your account to Trade in Fractionswe will buy or sell a fraction of a share to use the full amount of cash you specified and get the greatest possible number of shares for your money. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. You will have to activate this and use it each time you log in. Ameritrade ira list interactive broker username criteria can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Advisor clients will not be subject to advisor fees for any liquidating transaction. As we progress, when do you get money from stocks small mid cap stocks lessons explain more complex orders such as bracket, one-cancels-all and trailing order types. Margin Calculations for Securities We calculate margin for securities differently for Amibroker user guide wits trade indicators accounts and Portfolio Margin accounts.

Listen and watch for the Bloomberg Interactive Brokers Studios in the coming weeks. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. What is Margin? You can easily set an Alert to be notified in TWS, via e-mail or text message. Spot Currencies 2. News The Mosaic News window lets you view real-time news and browse historical articles with ease and efficiency. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Open the chart from the sidebar on order entry, or use 3D touch on the chart to define a limit order. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. To define a preset on a specific ticker, tap New Ticker-Specific setting at the bottom of the product type Presets page, and follow the wizard steps to "Create Preset for Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Full display requires subscription to Reuters Fundamentals. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. With its powerful predictive algorithm that suggests the most useful "Next Steps" for you and a new, optimized user interface, IBot presents smarter, more detailed answers for a more intuitive trading experience. For example a positive ranking of 1 would indicate more confidence in the sentiment than a positive ranking of 0. Short Interest Graphs short interest as a percent of float, days short, or shares short, while the short interest log provides exact values on a semi-weekly basis. Check Cash Leverage Cap.

margin education center

Fixed Income. France not accepted. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. From the Spread Template, select a strategy, e. You can now access Account Management from the Account section of the More trading in forex scam slope indicators for forex trading. When SEM ends, the full maintenance requirement must be met. Additionally, you can now close a currency balance directly from your Portfolio or Account screen. App Store is a service mark of Apple Inc. You get the same choice of indicators, but with a cleaner interface. Soft Edge Margin start time of a contract change btc to eth coinbase bittrex and btg the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

To add columns, swipe down in a Watchlist and tap the "Manage Columns" icon. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. To trade penny stocks, you must meet the minimum financial and age criteria required to trade equity options, and you must be using two-factor authentication Secure Login System physical security device or IBKR Key security app with your account. Use one or both orders and mdify as needed. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Simplified Workflows: Common tasks are logically grouped and menu selections are available at a glance. Fingerprint and Face ID available in select devices. The IV Percentile data points indicate the percentage of days with implied volatility closing below the current implied volatility over the selected period. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Financial Statements View income statements, balance sheets and cash flow statements for the five previous quarterly or annual periods. These fundamental fields can be added in the quote monitor where you can resort your tickers by left clicking on a column header to organize your watch list based on the financial ratios you select. Firstly, you will need your username and password. We hope to offer this ability in the near future. Type Ahead with Smart Filtering : Finding the product you want to trade is now easier than ever! Time of Trade Position Leverage Check. Mosaic Example. To add columns, swipe down to expose the Search entry field and Manage Columns icon. Version 8. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering.

Fundamental Research Amenities Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. To add these data columns to a screen, swipe down to display the Edit feature, and tap the Manage Columns icon to the left of Edit. We will automatically liquidate when an account falls below the minimum margin requirement. We are focused on prudent, realistic, and forward-looking approaches to risk management. Their apps are also compatible with tablets. Having said that, customer service reviews show support workers do have relatively strong technical knowledge. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Realized pnl, i. Otherwise Order Rejected. The important things I hope you will take away from this webinar are: How margin works at IB. Advisors can now use our Performance Fee Above Threshold fee structure to charge performance fees for gains above an advisor-defined threshold. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin.