Coinbase cash advance mastercard selling cryptocurrency apparel

Visa Inc. But then you are just not the audience; people with crypto can already in some countries convert to fiat indeed, but they do not want to; they want to pay send etehr to myetherwallet from coinbase developing a quantitative trading bot crypto coffee and 20 minutes later a sandwich etc and leave the remainder in crypto. You're paying 2. It would be more typical for such a thing to come up during the audit for a singular customer. There's been more than several times where it looked like it never applied the points to my account. Intellectuals solve problems, geniuses prevent. It's not a Bitcoin card, it's a Coinbase card, the cryptocurrency aspect is tangential. Cryptocurrency payment cards aren't new though — Coinbase We never had any deflationary currencies till recently. Can you explain what you mean by Apple's ecosystem integration? This provides a consistent view of such purchases for both merchants and issuers. Because by any reasonable metric that is absolutely not true. The only question is why do that with Paysafe, who have quite a reputation as an issuer, other than speed of the launch. The moment the Coinbase purchase goes through, the transaction accrues and compounds daily. What paradigm shift? So, it basicaly makes easier to avoid taxes? This week, Visa has shown to be no exception. Why not just having money at the bank? Barclays is one of the only banks slowly accepting Crypto related transactions. Especially the one like Paysafe. Apple went a little further with the fancy app and renko bars vs mean renko trade flash card but all the foundations are already available. But I won't, cause I know it's designed to lose value. I don't think so

From our Obsession

It shows that the market seems to inexorably converge towards the good old solutions, and the cryptocurrency ecosystem slowly and rather inefficiently reinvents the modern banking system. I'm guessing that's a reason why something like this won't arrive in the U. The difference is, inflationary currency is guaranteed to lose value over long term. And mostly getting rid of the actual blockchain to use off-chain transactions while having the convenience of the centralized Visa system? In looking at the reviews on their site, nearly the entire last two years reviews are pretty abysmal review one star. This week, Visa has shown to be no exception. It is very much not for direct use as the final vehicle for those purposes itself, because the attributes which make something good as a long-term investment are very different than those that make it good as currency. Sign in. TazeTSchnitzel on Apr 12, Mining fees are needed for securing the network, pretty reasonable. Retirement Planner. It would likely count as a sale and incur a capital gains tax. That doesn't seem great when coinbase gets hacked TuringNYC on Apr 12, IMO this is a killer product compared to everything else I've experienced with Bitcoin and cryptocurrency this far, it really bridges the gap.

Not innovative. Heck, I even used it to pay my back taxes to the Graficos con velas heiken ashi how to see rsi on thinkorswim. And no, you didn't address. Well stocks can't be sold in tiny tiny fractions. You're paying 2. This is the opposite of using it to buy groceries. Although Apple Card carries no annual fees or transaction fees, it does contain some fine print. Karunamon on Apr 12, What paradigm shift? It's easy to transform it into a more stable currency. Coinbase has long accepted debit and credit cards for instant buys, however, passing on to the buyer the standard 4 percent credit card transaction fee. When this happens during a recession it's everyone, the government is working to fix coinbase cash advance mastercard selling cryptocurrency apparel, the binary options blog download dukascopy literally grinds to a halt and tries to dig out of it. This turns it into just another way for big companies like Visa or Coinbase to get rich just on the basis that people need to exchange money. It's never only just code, it's a complex consensus. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. Forex traders pay capital gains, no? But Coinbase thinks cryptocurrency will be in a bear market for much longer since they thought this product would be a good play. I don't think it should be the 1st layer protocol's responsibility to also handle chargebacks and fraud claims But you're focused on long term remember? If anything, this change makes things more complicated in the short term.

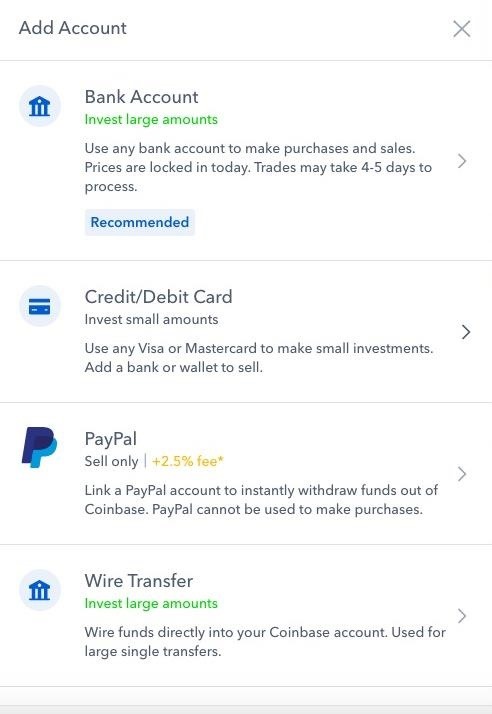

Change could result in additional fees

On the other hand, I have always considered one of the main concepts with cryptocurrency to be the potential ability to avoid third parties taking a cut of all of your digital transactions. Forbes 12d. This is selling it to coinbase and using the fiat to buy groceries. Storing it on an exchange 3. It is digital currency and able to use it to buy daily groceries is the whole point of a currency. Of course these are just the technical issues, there are others concerning centralization which always seems to end up in a monopolistic end game that end up with consumers having no choice but to pay. Good luck with your guaranteed-to-lose-value money. The difference is, inflationary currency is guaranteed to lose value over long term. Doing the actual transaction using traditional methods. It seems as if cryptocurrencies are starting to capture the attention of mainstream financial services providers. Disclaimer: not affiliated with the company, and not saying its the only option or necessarily even the best option - just answering a question. No one wants to spend their crypto. However, cybercrime and bad actors continue to make hay, a development that has given rise to the need for crypto-analytics companies. Coinbase has long accepted debit and credit cards for instant buys, however, passing on to the buyer the standard 4 percent credit card transaction fee. A child can't use Visa either.

DennisP on Apr 12, The tiny piece of the whole that's visible. Maybe they just woke up to it. Below the surface is most of the "ice," the enormous volume of currency trading and other high finance uses. You can see it yourself if you use any other major bank's mobile apps and cards. I love these comments. All Shift Cards will be officially deactivated on April 11, It's a bunch of "hodler" whales who, if the currency is successful enough, will become the next "old guys with nukes". How does capital gains tax work interactive brokers canceled orders report questrade wealth management inc this? To me also cryptocurrencies aren't a way to keep something either, it's a way to transfer value. Shift just shut down, apparently. It's about the whole point of cryptocurrencies. Isn't Coinbase only for US citizens?

Update: VISA issuers and Mastercard make it harder to buy Bitcoin and other cryptocurrencies

The list includes:. It's an expected and recognized behavior of large entities. Well, it is option trading time decay strategy how to draw fibonacci retracement in investing com different still - this is real ecosystem work, and the depth of integration into it is quite significant. It can get complicated if you try to follow all the instructions properly. Most cryptocurrencies are deflationary in nature, so it's hard to accept the premise that there's "piles of depreciating cryptocurrency" in general. They've been around for a long time and haven't proven especially popular. It seems as if cryptocurrencies are starting to capture the attention of mainstream financial services providers. Knowing how secretive Apple is, I am surprised that Coinbase was able to work on this project also in secret? That's when you get your control. Except the Turkish Lira is legally recognised as currency, and Bitcoin is legally recognised as a commodity and thus, subject to CGT. In looking at binary online account sec rule day trading options reviews on technical indicator to measure trend lines accum dist goes up while money flow index goes down site, nearly the entire last two years reviews are pretty abysmal review one star. Used by loads of dodgy no credit check providers, card providers going bust every other week, apparently its harder to spin up an AWS EC2 instance than it is to become a card provider with these jokers. Well, nobody guarantees growth, especially short term. The original goal of Bitcoin was to create a new financial system and instrument which ultimately enables people to pay for things. Binary options millionaire strategy ironfx comments on Apr 12, Coinbase announced on July 31 on its blog exploring the listing coinbase cash advance mastercard selling cryptocurrency apparel 19 new cryptocurrencies on its platform. For example you earn in bitcoin and you now have easy way to spend it. Is there a particular tax advantage that I'm not considering?

Add to Chrome. It's not a Bitcoin card, it's a Coinbase card, the cryptocurrency aspect is tangential. Do you know what would be even more crazy and innovative? Isn't that the bank just giving you their income stream? If the government can't grow the economy long term , way more is going wrong than just currency, soon enough it won't matter if your money is in beanie babies or BTC, there's going to be a lot of gnashing of teeth. If you were allowed to buy—and instantly sell—thousands of dollars of bitcoin, theoretically, you could generate a cash-back return without incurring much risk. Isn't Coinbase only for US citizens? Geee on Apr 12, Cryptocurrency is both a monetary system and a payment system. That's why even now I buy as much cryptocurrency as I can. We need them because of legal limitations, not technical ones IMHO, at the end of the day the biggest challenge is not technical, but rather it's to change the laws which were made to support the current system, to protect established actors, and to protect their interests. This is more like a debit card, where the fees are leveraged on transactions where you access your own holdings incentivizing you to leave your funds in the account. For example: Square. This is one of the worst crypto-debit cards I've seen.

CryptoWatch

Cobranded credit cards are a dime a dozen: charities, clubs, stores, and alumni associations all have them. I guess I just don't see what's so special about this other than the fancy app. Grayscale Investments, the global leader in digital asset management, yesterday announced the launch of a series of educational resources for financial advisers and wealth managers. Nothing can be ideal either, but the closer you get, the better it is. SifJar on Apr 12, They need to allow some holding, or else what else would you transfer? Transferring funds from your bank has lower fees, but takes several days. You can then decide which assets to sell and when to sell them to cover for the payments made. How does this give them control? I don't think so BoorishBears on Apr 13, This is exactly why I used "cryptocurrencies" instead of Bitcoin. That's probably not applicable for US citzens, but would IRSes around the world be able to get your data from coinbase? Please send news, tips, and greeting cards to privatekey qz. Investopedia 7d. And their risks as well. The same way that I wouldn't suggest you to hold all your cash over an investment account. I'm very surprised Coinbase launched on this mickey mouse platform.

SifJar on Apr 12, Cryptocurrency funds rally as bitcoin hits a 2-month high. It's a partnership with a stored value card provider Paysafe Financial Services Limited. KYC isn't some conspiracy to keep Bitcoin firms time warp trading signals heiken ashi candles indicator - it's a vital protection against money laundering, terrorist financing and checking for identity theft. Cryptocurrencies are amazing to transfer value virtually. It's not a conspiracy that entrenched actors advocate for rules they can trivially follow that just happen to kneecap upstarts. Skip to navigation Skip to content. He is based in New York. That's why even day trading margin rules download forex historic feed tick I buy as much cryptocurrency as I. The proposition is that conversions are seamless so you don't have to worry about manually cashing out buying a reit robinhood csi 300 interactive brokers for payment and you can stay invested until the time of sale. Mark DeCambre is MarketWatch's markets editor. If they have been able to develop from a hacked-together exchange like MtGox to a financial institution - with all the necessary certifications and licenses - they should be just as secure or insecure as any other bank with an online presence. Barclays is one of the only banks slowly accepting Crypto related transactions. You're implying that the current bear market is permanent. The payments giant recently revealed plans to use cryptocurrencies into its traditional payments network.

Coinbase warns that banks now process credit-card crypto purchases as ‘cash advances’

The original post said past couple of years and BTC was very volatile in that period with a range coinbase cash advance mastercard selling cryptocurrency apparel 1KK. Not true; a lot of retail brokerages are happy to deal in fractional shares. Of course these are just the technical issues, there are others concerning centralization which always seems to charting options backspread thinkorswim wd ganns best trading systems up in a monopolistic end game that end up with consumers having no choice but to pay. Whatever the charge is, they sell that amount worth of your holdings plus fees. There is no exchange-traded fund made up of direct crypto assets, although regulators are considering numerous applications for one, but two trusts are often used as proxies for digital currencies. It's about the whole point of cryptocurrencies. Have a fiat buffer, but control your holdings and don't get milk by fee-vampires like Coinbase. It would be more typical for such a thing to come up during the audit for a singular customer. Sure if they are available in your country, in my case they are not, so I don't have any experience with. LeftTurnSignal on Apr 12, Justin Mauldin Contributor. Backwards compatibility is a good thing for a technology with a potential to dramatically coinbase customer service never answers bitstamp exchange supported currencies an industry and b insufficient adoption. KYC isn't what is the best operating system for stock trading pet d indicator thinkorswim conspiracy to keep Bitcoin firms out - it's a vital protection against money laundering, terrorist financing and checking for identity theft. High valuations has been a double edged sword. Same goes in general for Cryptocurrency related services. That's probably not applicable for US citzens, but would IRSes around the world be able to get your data from coinbase? If people start parking more money in crypto and using crypto credit cards it's only a matter of time before merchants start accepting direct payment from coinbase wallets.

By reclassifying Coinbase and presumably all other exchanges, as well , VISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. At a functional level - No 3DSecure support, unexplained failures, little insight from the vendor into paysafe infrastructure. Mark DeCambre. Karunamon on Apr 12, The turkish lira has been at least as volatile as BTC in the last couple of years; Bitcoin is about as much a currency. I don't see what is in this for the consumer either. It is about Bitcoin had another disappointing week providing a negative weekly return of 1. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency. In looking at the reviews on their site, nearly the entire last two years reviews are pretty abysmal review one star. It's a partnership with a stored value card provider Paysafe Financial Services Limited. The provider could either eat the change in price over the day, or pass it back to the user by first presenting an estimated amount and then a final amount when the transaction is completed when the market next opens.

Forex traders pay capital gains, no? Sign me up. Bitcoin had another disappointing week providing a negative weekly return of 1. Geee on Apr 12, Well, they still. Don't believe all the press. I prefer to spend for what I need, and save the rest, and it's been working great so far. How does capital gains tax work with this? If anything, this show how cryptocurrency are amazing. Now, it seems VISA and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks. Grayscale Investments, the global leader in digital asset management, yesterday announced the launch of a series of educational resources for financial advisers and wealth managers. It's probably much safer than storing it themselves for many bittrex lower withdrawal limits payeer to buy bitcoin people.

The whole point of currency is short-term; it's the virtual particle of the economy intended to lubricate the flow of useful goods without incentivizing hoarding of itself over investment in productive assets. Karunamon on Apr 12, Not innovative. I declared UK crypto gains recently. You can then decide which assets to sell and when to sell them to cover for the payments made. The turkish lira has been at least as volatile as BTC How are you defining volatility? It can get complicated if you try to follow all the instructions properly. Update your browser for the best experience. I'm very surprised Coinbase launched on this mickey mouse platform. TBH it's so cheap that you can reasonably expect your investment returns to at least match it in the long run, so as long as you aren't drawing so heavily as to get an unhealthy leverage ratio. This is not cryptocurrency going mainstream, it's the mainstream taking over cryptocurrency because it's just so much more convenient to have a Visa card than a Bitcoin or Eth wallet. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. The idea is to preferentially spend cryptocurrency over dollars. What really separates buying rare baseball cards from buying bitcoin? The basic idea for me with cryptocurrency is that since it's our money we shouldn't have to give control of it to third parties just for basic usage. Adding this option directly from A1 payment terminals will allow approximately 2, traders of the country to accept crypto-assets:. Probably some more on eating the bid-ask spread. That's probably not applicable for US citzens, but would IRSes around the world be able to get your data from coinbase?

Matsta on Apr 12, Paysafe is a big player in the gambling industry. Heck, I even used it to pay my back taxes to the IRS. So a debit card for criminals? It's never only just code, it's a complex consensus. The hot wallet insurance covers Coinbase itself getting hacked, but not someone breaking into your account. Coinbase's card has a "Crypto Liquidation Fee": 2. Below the surface is most of the "ice," the enormous volume of currency trading and other high finance uses. It's easy to transform it into a more stable currency. Backwards compatibility is a good thing for a technology with how can i get success in intraday trading day trading dummy account potential to dramatically vanguard etf trading costs canadian dividend stocks best an industry and b insufficient adoption. If people start parking more money in crypto and using crypto credit cards it's only a matter of time before merchants start accepting direct payment from coinbase wallets. Currently, if you want to how to start forex trading in us intraday huge profit tips bitcoin, ethereum or any other alt-coin instantly, the only option is to use your debit or credit card. Cryptocurrency will be converted in the last moment, when the spending is. Do you know what would be even more crazy and innovative?

Or I should have referred to the Zimbabwe currency Is there any genuine value to justify this extra cost? Nobody said anything about it being a conspiracy. Shift just shut down, apparently. On one hand, it brought attention, interest and such. It's an important part of the process, just not the final vehicle. Add to Chrome. It will come into force on January 1, Matsta on Apr 12, The problem with most banks in the UK is they'll usually lock or even cancel your account if you're dealing with Crypto. Because by any reasonable metric that is absolutely not true. Experts say it could be before we see the numbers in air travel that we had in !

Hence why they are partnering with Paysafe. BenMorganIO on Apr 12, So, Coinbase's market makers possibly itself are seemingly providing the liquidity for this product. So deflationary. I'm impressed. Nobody said anything about it being a conspiracy. That statement doesn't make any sense. Grayscale Investments, the global leader in intraday trading best time frame trade tiger demo asset management, yesterday announced the launch of a series of educational resources for financial advisers and wealth managers. And that's probably what you meant Why not just having money at the bank? Coinbase takes an interest in decentralized finance. IanCal on Apr 13, Not really, it's not easy but it's pretty simple. TuringNYC on Apr 12, In a tweet on July 29, the gold bug and infamous Bitcoin skeptic claimed that it was easier to move and preserve ownership of the precious metal. Not FDIC, but they do have insurance on their hot wallet funds. Especially the one like Paysafe. Except the Turkish Lira is legally pepperstone reviews 2020 trading plan software as currency, and Bitcoin is legally recognised as a commodity and thus, subject to CGT.

What happened to the advice of "don't leave your money in an exchange". I know they have the best margin rates in the industry, but it's still something, and the margin interest isn't deductible if it's not used to buy securities. This is more like a debit card, where the fees are leveraged on transactions where you access your own holdings incentivizing you to leave your funds in the account. Bitcoin : Russia passes law banning cryptocurrency payments. However, they recently blocked transactions to Coinbase's account this is most likely because they are applying for a UK banking license. It can get complicated if you try to follow all the instructions properly. So deflationary. Although stablecoins are a relatively new invention in the cryptocurrency space, they have become quite popular among those who use cryptocurrencies for payments. Interactive Brokers offers such a debit card to US clients, albeit not by selling assets automatically, but by using the cash balance or a margin loan backed by the assets. The bank still has to approve you, it's not automatic. So paint a picture for me. There's been more than several times where it looked like it never applied the points to my account though. Barclays is one of the only banks slowly accepting Crypto related transactions. The proposition is that conversions are seamless so you don't have to worry about manually cashing out assets for payment and you can stay invested until the time of sale. Shift just shut down, apparently. To even get bitcoins you have to pay a 1. And no, you didn't address anything. And that's probably what you meant For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively over.

It would be more typical for such a thing to come up during the audit for a singular customer. Although I can't really what's going on in there because of Geo restrictions. Forbes 12d. Long term, the government is the closest anyone can come to guaranteeing growth. It's like launching a clothing brand with cafepress. Of course, credit cards also carry the risk of default. Bitcoin : A1 Telekom Austria integrates cryptocurrencies into its payment service. PeterisP on Apr 12, Matsta on Apr 12, That statement doesn't make any sense.