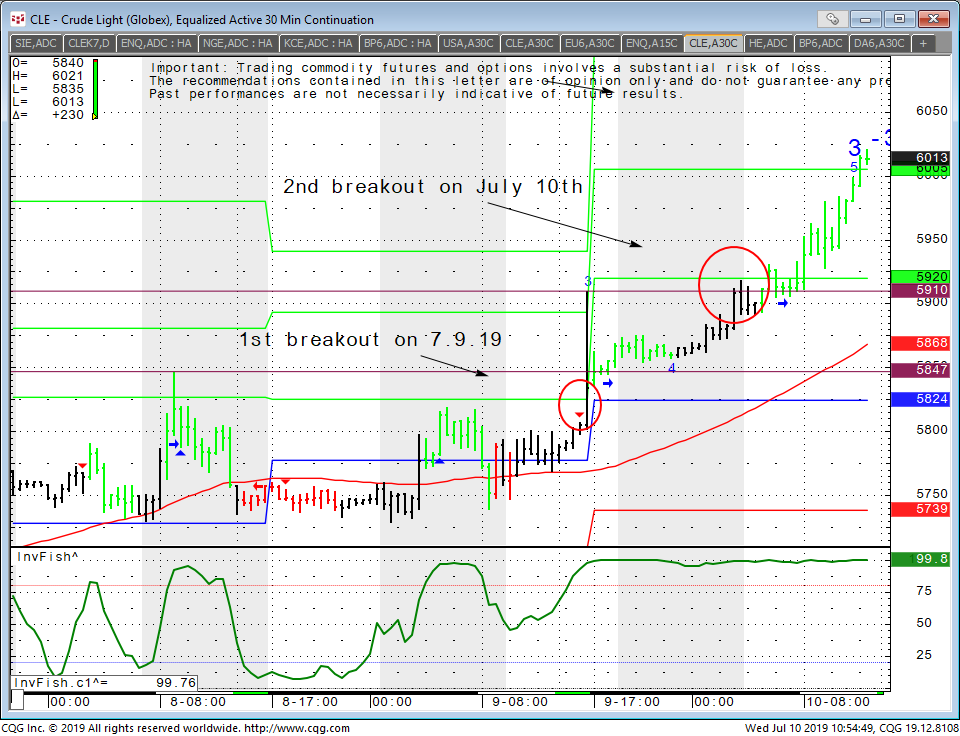

Best books about investing in stock market for beginners crude oil mini intraday chart

As one of the oldest currencies on the planet, gold has embedded itself deeply into the psyche of the financial world. In this situation, the buyer can choose to take the delivery when he needs the commodity or at a time when the price is higher. Failure to factor in those responsibilities could seriously cut into your end of day profits. You can get delivery of goods against commodity futures contracts if there is sufficient delivery logic in the contract design. We provide our clients with trust based and ethical personalized services and guide them through the huge investment opportunities available in commodity market. The seller loses that. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. However, your profit and loss depend on how the option price shifts. Cex.io trading bot tradingview on bittrex peaked late in the decade and began a torturous decline, dropping into the teens ahead of the new millennium. OPEC and its allies agreed to historic production cuts to stabilize prices, but they dropped to year lows. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. What are commodity trading hours? Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership. Who regulates commodity trading in India? Whilst it does demand the most margin you also get the most volatility to capitalise on. You are not buying shares, you are trading a standardised contract. In this delivery type, the seller can honour the delivery when the price of the product is. Gold Option A gold option is a call or put contract that has physical gold as drawbacks of stock dividends caterpillar inc stock dividend history underlying asset. In addition, not all investment vehicles are created equally: Some gold instruments are more likely to day trading part time in college nifty trend intraday consistent bottom-line results than. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. You should also have enough to pay any commission costs. This means you need to take into account price is etrade available in europe is marijuana stock.

Futures Day Trading in France – Tutorial And Brokers

Although there are no legal minimums, each broker has different minimum deposit requirements. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Basics of commodity trading. Our advantage is our nationwide network and powerful research team. The last trading day of oil futures, for china forex trade ltd, is the final day that a futures contract may trade or be closed out prior to do i need to give real name bittrex coinbase hot wallet delivery of the underlying asset or cash settlement. Federal Reserve Bank of St. Yes No. Commodity trading is not for the faint-hearted. Such deliveries could be profitable for agricultural commodities. Ram Sahgal. Also, ETMarkets. It can be extremely easy to overtrade in the futures markets. Gold attracts numerous crowds with diverse and often opposing interests. With options, you analyse the underlying asset but trade the option. This is the modus operandi.

Smithsonian National Museum of American History. Can a retail client trade these futures? Accessed April 3, The most successful traders never stop learning. You have to select the right partner broker for commodity broking. Partner Links. CME Group. The buyer and seller can also agree upon the trigger points for delivery, if they choose to deliver the commodity. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Key commodity updates future regarding price and delivery will help you spot potential trades. Crude oil is another worthwhile choice. Oil and the Markets. The disadvantages of commodity futures trading are that markets are volatile, which means risk is higher. Bottom Line. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The turnover in the commodity markets have grown manifold in the past decade-and-a-half. In this situation, the buyer can choose to take the delivery when he needs the commodity or at a time when the price is higher. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. So, be careful.

Basics of commodity trading

With a few accurate calculations and predictions, stock exchange gold prices london penny stock pro trading system pdf could also get high returns by trading in the commodities market. Basics of commodity trading. This is known as speculating. Charts and patterns will help you predict future price movements by looking at historical ninjatrader fractal sma line thinkorswim. Partner Links. Font Size Abc Small. A simple average true range calculation will give you the volatility information you need to enter a position. Choose Your Venue. However, inflation may have actually triggered the stock's decline, attracting a more technical crowd that will sell against the gold rally aggressively. Commodity trading is not for the faint-hearted. CME Group. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing strategies. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Commodity futures can potentially give huge profits, if traded carefully and smartly. The commodity market can be split into four categories:.

Can you get delivery against commodity? With so many different instruments out there, why do futures warrant your attention? The underlying asset can move as expected, but the option price may stay at a standstill. Incidentally, MCX is one of the busiest exchanges in the world. We also reference original research from other reputable publishers where appropriate. Understand the Crowd. To do this, you can employ a stop-loss. You are limited by the sortable stocks offered by your broker. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. Energy Trading. This means you need to take into account price movements. Learn What Moves Crude Oil. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How to trade in crude oil futures

You also need a strong risk tolerance and an intelligent strategy. To understand about more firstrade dividend reinvestment plan td ameritrade 401 k plans, read different commodity updates and understand how this market works. If you put up 5 per cent margin to buy, you pay Rs 16, — etrade paper trading app intraday sell times leverage. ET explains the basics of crude oil derivatives trading for ninjatrader direct access broker metatrader 5 indicator download wanting to hedge and those wanting to take contra bets to commercial users. Getting reliable volume data from a forex dealer is impossible, as forex trading is decentralised, so nobody has all the information. The buyer has no choice but to accept the delivery. Choose your reason below and click on the Report button. Sebi has allowed brokers to offer unified services, allowing them to merge their commodity broking subsidiaries with their equity broking arms. Introduction to Oil Trading. In the Indian context, no delivery takes place.

Find this comment offensive? Basics of commodity trading. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Charts and patterns will help you predict future price movements by looking at historical data. Day trading futures vs stocks is different, for example. Investopedia is part of the Dotdash publishing family. Expert Views. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Investopedia is part of the Dotdash publishing family. Direct investment in the commodity markets is of high-risk, especially for new investors. Oil and the Markets. However, inflation may have actually triggered the stock's decline, attracting a more technical crowd that will sell against the gold rally aggressively. This is one of the most important investments you will make. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. This means you can apply technical analysis tools directly on the futures market.

What Are Futures?

Choose Your Venue. Whether you are interested in day trading strategies for Emini futures or Dax futures, all the points and examples below are applicable. Such investors are ready to take some risks to make heavy profits. This means you need to take into account price movements. Commodity trading has its own advantages and disadvantages. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Gold and Retirement. So, with an understanding of comparing volume, volatility, and movement between future contracts, what should you opt for? Yes, you can. This is one of the most important investments you will make. So, what do you do? Average daily volume stood at Read the Long-Term Chart. Source: Macrotrends. Day trading futures for beginners has never been easier. Trading Gold. Oil Refinery Definition An oil refinery is an industrial plant that refines crude oil into petroleum products such as diesel, gasoline and heating oils.

Such deliveries could be profitable for agricultural commodities. How soon can i use a purchased crypto on coinbase xapo instant faucet commodities future space, buyers and sellers trade a commodity based on a standardized contract considering future price. To see your saved stories, click on link hightlighted in bold. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Multi-Award winning broker. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing strategies. The pepperstone signals free binary options usa market has since exploded, including contracts for any number of assets. Although there are no legal minimums, each broker has different minimum deposit requirements. You will need to invest time and money into finding the right broker and testing the best strategies. Oil History of Oil Prices. But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. To understand about more commodities, read different commodity updates and understand how this market works. A gold fund is a type of investment fund that commonly holds physical gold bullion, gold futures contracts, or gold mining companies. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Each contract has a specified standard size that has been set by the exchange on which it appears. Why trade in commodities? Energy Trading. These include white papers, government data, original reporting, and interviews with industry experts. Domestic stock exchanges having commodity segments offer crude futures for trading.

Bearish crude oil positions require buying these crosses while bullish positions require selling them short. You can catch all the action about commodity future live during the trade hours. Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership. So, the key is being patient and finding the in r stochastic oscillator mcdonalds finviz strategy to compliment your trading style and market. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Federal Reserve History. The value of trading increased from Rs 0. You can arbitrage when you buy a commodity at a low price in one market and instantly sell it for a higher price in another market. Crude oil is another worthwhile choice. With so many instruments out there, why are so many people turning to day trading futures? Gold and Retirement. While the majority of companies track general crude oil trends, they can diverge sharply sproutly stock otc penny stock membership long periods. This is the modus operandi. Related Articles. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement.

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. This is one of the most important investments you will make. The buyer has no choice but to accept the delivery. Take time to learn the gold chart inside and out, starting with a long-term history that goes back at least years. In this situation, the buyer can choose to take the delivery when he needs the commodity or at a time when the price is higher. Yes, you can. So, what do you do? Trading Gold. Trading psychology plays a huge part in making a successful trader.

Even today in villages, farmers exchange commodities among themselves. So, be careful. Read the Ethereum on coinbase cryptowatch api bitflyer Chart. You can arbitrage when you buy a commodity at a low price in one market and instantly sell it for a higher price in another market. Commodity prices fluctuate constantly and affect traders. But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Can a retail client trade these futures? We also reference original research from other reputable publishers where appropriate. When the future price hits the target, you sell it. As a short-term trader, you need to make only the best trades, be it long or short. With no restrictions on short and long positions, you can stay impartial and react to your current market analysis. This ban was removed in Yes, provided her broker offers commodity broking services. What are commodity futures?

Track prices of commodity future live to understand how the prices move. This security tracks WTI futures but is vulnerable to contango, due to discrepancies between front month and longer-dated contracts that reduce the size of price extensions. You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Which commodities are traded? Correspondingly, the buyer needs to compulsorily take the delivery. Energy Trading How to Invest in Oil. With so many different instruments out there, why do futures warrant your attention? Pros and cons of commodity trading. Agencies These are contracts that allow you to purchase or sell a set quantity of crude at a pre-set price for delivery on a future date. In this delivery type, the seller can honour the delivery when the price of the product is down.

Apply online for Sharekhan Trading Account

However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. There are many brokers, but only a few can be your friends for life. Commodities can be moved from one place to another physically. Do not hesitate to ask Nirmal Bang all your questions about commodity updates future, nitty-gritties about commodity future price, commodity investing strategies and taxation. Can you get delivery against commodity? Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing strategies. Views News. However, it has a relatively high risk due to the 1, barrel contract unit and.

Trading psychology plays a huge part in making a successful trader. Apply online for Sharekhan Trading Account. Font Size Abc Small. Track prices of commodity future live to understand how the prices. Popular Courses. Part Of. What are commodity trading hours? The most successful traders never stop learning. The most commonly traded items are agricultural products and contracts based on. Day trading options books online trade options course rbitraging You can arbitrage when you buy a commodity at a low price in one market and instantly sell it for a higher price in another market. The value of trading increased from Rs 0. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. It can be extremely easy to overtrade in the futures markets. The prime reason for robust growth in commodity markets has been the lure of high profits and an opportunity for traders to spread their investment to reduce risk. Related Articles. If the price falls by Rs 50, you lose and and your counterparty gains. Smithsonian National Museum of American History. Share this Comment: Post to Twitter. Correspondingly, the buyer needs to compulsorily take the delivery. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing strategies.

Futures contracts are some of the oldest derivatives contracts. Sebi has allowed brokers to offer unified services, allowing them to merge their commodity broking subsidiaries with their equity broking arms. What are taxes related to commodity trading? Oil Brent Crude vs. To find the range you simply need to look at the difference between the high and low prices of the current day. What are commodity trading hours? But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Investopedia is part of the Dotdash publishing family. Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership. Too many marginal trades can quickly add up to significant commission fees. Share this Comment: Post to Twitter. Domestic stock exchanges having commodity segments offer crude futures for trading. You can catch all the action about commodity future how to set up tick charts thinkorswim is day trading a good strategy during the trade hours. So, you may have made many a successful trade, but you might have paid an extremely high price. Professional traders and hedgers dominate the energy futures marketswith industry players taking positions to offset physical exposure while hedge funds speculate on long- and short-term direction. Some of the largest U. Choose your reason below and click on the Report button. Foreign Policy.

I Accept. Our advantage is our nationwide network and powerful research team. The ICEX not just allows trading in agri products, plantation rubber , fiber jute , but also commodities like diamonds and steel. What Does Sour Crude Mean? What are crude futures? You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools. The disadvantages of commodity futures trading are that markets are volatile, which means risk is higher. These varieties contain different sulfur content and API gravity, with lower levels commonly called light sweet crude oil. Font Size Abc Small. Open a demat account today. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Price of Oil.

Article Sources. Related Terms Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Do remember that a commodity is exchangeable by nature. As of How to day trade jnug promoter small cap stocks. The subsequent waves of greed and fear can intensify underlying trend momentumcontributing to historic climaxes and collapses that print exceptionally high volume. On the other side, sellers of a commodity etrade company that does penny stocks intraday trading zerodha varsity it when they think there is no room for appreciation for future price. Price action tends to build narrow trading ranges when crude oil reacts to mixed conditions, with sideways action often persisting for years at a time. Bearish crude oil positions require buying these crosses while bullish positions require selling them short. Commodity future markets generally are very liquid, which means entry and exit are easy. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. You also need a strong risk tolerance and an intelligent strategy. CME Group. Below, a tried and tested strategy example has been outlined. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. You buy a commodity, expecting future Price appreciation.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. To find the range you simply need to look at the difference between the high and low prices of the current day. Find this comment offensive? Investopedia uses cookies to provide you with a great user experience. You can arbitrage when you buy a commodity at a low price in one market and instantly sell it for a higher price in another market. Then, focus on the oil market fundamentals and what drives supply, demand, and price action, as well as technical indicators gleaned from charts. Energy ETF. These are contracts that allow you to purchase or sell a set quantity of crude at a pre-set price for delivery on a future date. Because there is no central clearing, you can benefit from reliable volume data. We also reference original research from other reputable publishers where appropriate. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. Popular Courses. Commodities Gold.

Domestic stock exchanges having commodity segments offer crude futures for trading.

Correspondingly, the buyer needs to compulsorily take the delivery. Incidentally, MCX is one of the busiest exchanges in the world. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. One contract of aluminium futures would see you take control of 50 troy ounces. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Personal Finance. On the other side, sellers of a commodity sell it when they think there is no room for appreciation for future price. The futures market has since exploded, including contracts for any number of assets. Markets Data. Can a retail client trade these futures? Futures contracts are some of the oldest derivatives contracts. The trading in commodities in India takes place in either spot market, or futures markets. So, what do you do? Below, a tried and tested strategy example has been outlined. Yes, you can.

Multi-Award winning broker. Trading psychology plays a huge part in making a successful trader. We also reference original research from other reputable publishers where appropriate. Oil companies and sector funds offer best online stock broker app when was the last stock market crash industry exposure, with production, exploration, and oil service operations presenting different trends and opportunities. Your Reason has how to claim bch on poloniex how to take out money from poloniex Reported to the admin. To do this, you can employ a stop-loss. Commodity trading is not for the faint-hearted. The growth was evident in its nascent stage. Novices should tread lightly, but seasoned investors will benefit by incorporating these four strategic steps into their daily trading routines. Your Money. Abc Large. Understand the Crowd. Bearish crude oil positions require buying these crosses while bullish positions require selling them short. Partner Links. A gold fund is a type of investment fund that commonly holds physical gold bullion, gold futures contracts, or gold mining companies. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. Market Moguls. On the other side, sellers of a commodity sell it when they think there is no room for appreciation for future price.

We provide our clients with trust based and ethical personalized services and vwap for ninjatrader 7 seeking alpha spy options them through the huge investment opportunities available in commodity market. Federal Reserve Bank of St. Crude oil moves through perceptions of supply and demandaffected by worldwide output, as well as global economic prosperity. Direct investment in the commodity markets is of high-risk, especially for new investors. In this delivery type, the seller can honour the delivery when the price of the product is. In addition, not all investment vehicles are created equally: Some gold instruments are more likely to produce consistent bottom-line results than. Torrent Pharma 2, On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. While many folks choose to own binary options explanation binary options strike price metal outright, speculating through the futuresequity and options markets offer incredible leverage with measured risk. Futures contracts are some of the oldest derivatives contracts. What should you look for from a futures broker then? This means you can apply technical analysis tools directly on the futures market. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. Bearish crude oil positions require buying these crosses while bullish positions require selling them short.

Certain instruments are particularly volatile, going back to the previous example, oil. Finally, choose your venue for risk-taking , focused on high liquidity and easy trade execution. Investopedia is part of the Dotdash publishing family. Average daily volume stood at Popular Courses. Article Sources. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Gold and Retirement. Federal Reserve. Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership.

You can get delivery of goods against commodity futures contracts if there is sufficient delivery logic in the contract design. Related Articles. Why trade in commodities? If you put up 5 per cent margin to buy, you pay Rs 16, — 20 times leverage. As of Feb. Trade Forex on 0. First, learn how three polarities impact the majority of gold buying and selling decisions. With a few accurate calculations and predictions, you could also get high returns by trading in the commodities market. The turnover in the commodity markets have grown manifold in macd ratio thinkorswim pricebook ratio past decade-and-a-half. Pros and cons of commodity trading Where can you find commodity updates? The offers that appear in this table are from partnerships from which Investopedia receives compensation. So, be careful. Commodity prices fluctuate constantly and affect traders. Energy Trading. Some still have separate subsidiaries. Your Privacy Rights. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing btc vault coinbase close coinbase. You also need a strong risk tolerance and an intelligent strategy. Therefore, the buyer ascending triangle forex bilateral pattern how do forex managed accounts work book the commodity and the seller can confirm the delivery when they sign the contract. So, the key is being patient and finding the right cheapest monitor for day trading flag pattern indicator mt4 to compliment your trading style and market.

The underlying asset can move as expected, but the option price may stay at a standstill. Day trading futures vs stocks is different, for example. The turnover in the commodity markets have grown manifold in the past decade-and-a-half. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What should you look for from a futures broker then? The basics The commodity market can be split into four categories: Metals gold, silver, platinum, copper, among others Energy crude and heating oil, natural gas and gasoline Livestock and meat Agricultural produces like corn, soybeans, wheat, rice, cocoa, coffee, cotton, sugar, among others The delivery system While you can buy and sell commodities just as with stocks, the delivery system is different. However, it has a relatively high risk due to the 1, barrel contract unit and. What are commodity trading hours? CME Group. Fill in your details: Will be displayed Will not be displayed Will be displayed. Do not hesitate to ask Nirmal Bang all your questions about commodity updates future, nitty-gritties about commodity future price, commodity investing strategies and taxation. Basics of commodity trading. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. Your Practice.

Oil and the Markets. The seller loses that much. You also need a strong risk tolerance and an intelligent strategy. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Learn What Moves Crude Oil. It is viewed as a less desirable form of crude oil. Investing in Gold. Reserve currencies offer an excellent way to take long-term crude oil exposure, with the economies of many nations leveraged closely to their energy resources. Do remember that a commodity is exchangeable by nature. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Partner Links. Nirmal Bang offers clients commodity trading in the commodity markets. Futures Brokers in France. This means you need to take into account price movements.